Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

30 Mayo 2024 - 7:39AM

Edgar (US Regulatory)

March 31, 2024

(unaudited)

| |

|

|

Shares

|

|

|

Value (a)

|

|

| Common Stocks — 99.5% |

|

|

Communication Services — 9.0%

|

|

|

Alphabet Inc. Class A (b)

|

|

|

|

|

709,600 |

|

|

|

|

$ |

107,099,928 |

|

|

|

Meta Platforms, Inc. Class A

|

|

|

|

|

158,100 |

|

|

|

|

|

76,770,198 |

|

|

|

Netflix, Inc. (b)

|

|

|

|

|

52,422 |

|

|

|

|

|

31,837,453 |

|

|

|

Verizon Communications Inc.

|

|

|

|

|

617,000 |

|

|

|

|

|

25,889,320 |

|

|

|

Walt Disney Company

|

|

|

|

|

118,900 |

|

|

|

|

|

14,548,604 |

|

|

| |

|

|

|

|

256,145,503 |

|

|

|

Consumer Discretionary — 10.8%

|

|

|

Amazon.com, Inc. (b)

|

|

|

|

|

684,600 |

|

|

|

|

|

123,488,148 |

|

|

|

Booking Holdings Inc.

|

|

|

|

|

7,000 |

|

|

|

|

|

25,395,160 |

|

|

|

Home Depot, Inc.

|

|

|

|

|

41,500 |

|

|

|

|

|

15,919,400 |

|

|

|

McDonald’s Corporation

|

|

|

|

|

93,400 |

|

|

|

|

|

26,334,130 |

|

|

|

NIKE, Inc. Class B

|

|

|

|

|

211,100 |

|

|

|

|

|

19,839,178 |

|

|

|

O’Reilly Automotive, Inc. (b)

|

|

|

|

|

22,800 |

|

|

|

|

|

25,738,464 |

|

|

|

Tesla, Inc. (b)

|

|

|

|

|

134,700 |

|

|

|

|

|

23,678,913 |

|

|

|

Uber Technologies, Inc. (b)

|

|

|

|

|

357,200 |

|

|

|

|

|

27,500,828 |

|

|

|

Ulta Beauty, Inc. (b)

|

|

|

|

|

31,900 |

|

|

|

|

|

16,679,872 |

|

|

| |

|

|

|

|

304,574,093 |

|

|

|

Consumer Staples — 5.8%

|

|

|

Coca-Cola Company

|

|

|

|

|

144,000 |

|

|

|

|

|

8,809,920 |

|

|

|

Colgate-Palmolive Company

|

|

|

|

|

255,200 |

|

|

|

|

|

22,980,760 |

|

|

|

Monster Beverage Corporation (b)

|

|

|

|

|

242,668 |

|

|

|

|

|

14,385,359 |

|

|

|

PepsiCo, Inc.

|

|

|

|

|

47,800 |

|

|

|

|

|

8,365,478 |

|

|

|

Philip Morris International Inc.

|

|

|

|

|

259,935 |

|

|

|

|

|

23,815,245 |

|

|

|

Procter & Gamble Company

|

|

|

|

|

226,849 |

|

|

|

|

|

36,806,250 |

|

|

|

Target Corporation

|

|

|

|

|

112,500 |

|

|

|

|

|

19,936,125 |

|

|

|

Walmart Inc.

|

|

|

|

|

506,943 |

|

|

|

|

|

30,502,760 |

|

|

| |

|

|

|

|

165,601,897 |

|

|

|

Energy — 4.1%

|

|

|

Adams Natural Resources Fund, Inc. (c)(g)

|

|

|

|

|

2,186,774 |

|

|

|

|

|

50,427,008 |

|

|

|

Chevron Corporation

|

|

|

|

|

89,500 |

|

|

|

|

|

14,117,730 |

|

|

|

Diamondback Energy, Inc.

|

|

|

|

|

90,600 |

|

|

|

|

|

17,954,202 |

|

|

|

Hess Corporation

|

|

|

|

|

92,600 |

|

|

|

|

|

14,134,464 |

|

|

|

Marathon Petroleum Corporation

|

|

|

|

|

99,837 |

|

|

|

|

|

20,117,156 |

|

|

|

|

|

|

|

116,750,560 |

|

|

Schedule of Investments (continued)

March 31, 2024

(unaudited)

| |

|

|

Shares

|

|

|

Value (a)

|

|

|

Financials — 12.8%

|

|

|

American International Group, Inc.

|

|

|

|

|

367,000 |

|

|

|

|

$ |

28,688,390 |

|

|

|

Bank of America Corp.

|

|

|

|

|

1,105,368 |

|

|

|

|

|

41,915,555 |

|

|

|

Berkshire Hathaway Inc. Class B (b)

|

|

|

|

|

82,643 |

|

|

|

|

|

34,753,034 |

|

|

|

Blackstone Inc.

|

|

|

|

|

153,600 |

|

|

|

|

|

20,178,432 |

|

|

|

Cboe Global Markets, Inc.

|

|

|

|

|

124,800 |

|

|

|

|

|

22,929,504 |

|

|

|

JPMorgan Chase & Co.

|

|

|

|

|

304,363 |

|

|

|

|

|

60,963,909 |

|

|

|

Marsh & McLennan Companies, Inc.

|

|

|

|

|

100,100 |

|

|

|

|

|

20,618,598 |

|

|

|

Mastercard Incorporated Class A

|

|

|

|

|

30,562 |

|

|

|

|

|

14,717,742 |

|

|

|

MetLife, Inc.

|

|

|

|

|

220,200 |

|

|

|

|

|

16,319,022 |

|

|

|

Morgan Stanley

|

|

|

|

|

302,269 |

|

|

|

|

|

28,461,649 |

|

|

|

S&P Global, Inc.

|

|

|

|

|

39,600 |

|

|

|

|

|

16,847,820 |

|

|

|

Visa Inc. Class A

|

|

|

|

|

195,161 |

|

|

|

|

|

54,465,532 |

|

|

| |

|

|

|

|

360,859,187 |

|

|

|

Health Care — 12.3%

|

|

|

AbbVie, Inc.

|

|

|

|

|

180,000 |

|

|

|

|

|

32,778,000 |

|

|

|

Cencora, Inc.

|

|

|

|

|

140,500 |

|

|

|

|

|

34,140,095 |

|

|

|

DexCom, Inc. (b)

|

|

|

|

|

194,957 |

|

|

|

|

|

27,040,536 |

|

|

|

Eli Lilly and Company

|

|

|

|

|

63,568 |

|

|

|

|

|

49,453,361 |

|

|

|

Health Care Select Sector SPDR Fund

|

|

|

|

|

218,500 |

|

|

|

|

|

32,279,005 |

|

|

|

IDEXX Laboratories, Inc. (b)

|

|

|

|

|

26,100 |

|

|

|

|

|

14,092,173 |

|

|

|

Johnson & Johnson

|

|

|

|

|

101,200 |

|

|

|

|

|

16,008,828 |

|

|

|

Merck & Co., Inc.

|

|

|

|

|

86,400 |

|

|

|

|

|

11,400,480 |

|

|

|

Regeneron Pharmaceuticals, Inc. (b)

|

|

|

|

|

32,300 |

|

|

|

|

|

31,088,427 |

|

|

|

Thermo Fisher Scientific Inc.

|

|

|

|

|

40,700 |

|

|

|

|

|

23,655,247 |

|

|

|

UnitedHealth Group Incorporated

|

|

|

|

|

107,700 |

|

|

|

|

|

53,279,190 |

|

|

|

Zoetis, Inc. Class A

|

|

|

|

|

135,900 |

|

|

|

|

|

22,995,639 |

|

|

| |

|

|

|

|

348,210,981 |

|

|

|

Industrials — 8.3%

|

|

|

Boeing Company (b)

|

|

|

|

|

34,777 |

|

|

|

|

|

6,711,613 |

|

|

|

Generac Holdings Inc. (b)

|

|

|

|

|

103,400 |

|

|

|

|

|

13,042,876 |

|

|

|

Hubbell Incorporated

|

|

|

|

|

55,400 |

|

|

|

|

|

22,993,770 |

|

|

|

Ingersoll Rand Inc.

|

|

|

|

|

267,300 |

|

|

|

|

|

25,380,135 |

|

|

|

Leidos Holdings, Inc.

|

|

|

|

|

195,900 |

|

|

|

|

|

25,680,531 |

|

|

|

Pentair plc

|

|

|

|

|

272,900 |

|

|

|

|

|

23,316,576 |

|

|

|

Republic Services, Inc.

|

|

|

|

|

132,500 |

|

|

|

|

|

25,365,800 |

|

|

|

Trane Technologies plc

|

|

|

|

|

97,000 |

|

|

|

|

|

29,119,400 |

|

|

|

TransDigm Group Incorporated

|

|

|

|

|

22,600 |

|

|

|

|

|

27,834,160 |

|

|

|

Union Pacific Corporation

|

|

|

|

|

142,400 |

|

|

|

|

|

35,020,432 |

|

|

| |

|

|

|

|

234,465,293 |

|

|

Schedule of Investments (continued)

March 31, 2024

(unaudited)

| |

|

|

Shares

|

|

|

Value (a)

|

|

|

Information Technology — 29.8%

|

|

|

Accenture plc Class A

|

|

|

|

|

38,319 |

|

|

|

|

$ |

13,281,749 |

|

|

|

Adobe Inc. (b)

|

|

|

|

|

58,300 |

|

|

|

|

|

29,418,180 |

|

|

|

Advanced Micro Devices, Inc. (b)

|

|

|

|

|

197,100 |

|

|

|

|

|

35,574,579 |

|

|

|

Analog Devices, Inc.

|

|

|

|

|

112,000 |

|

|

|

|

|

22,152,480 |

|

|

|

Apple Inc.

|

|

|

|

|

874,100 |

|

|

|

|

|

149,890,668 |

|

|

|

Arista Networks, Inc. (b)

|

|

|

|

|

70,391 |

|

|

|

|

|

20,411,982 |

|

|

|

Broadcom Inc.

|

|

|

|

|

8,800 |

|

|

|

|

|

11,663,608 |

|

|

|

Cisco Systems, Inc.

|

|

|

|

|

359,400 |

|

|

|

|

|

17,937,654 |

|

|

|

Intuit Inc.

|

|

|

|

|

47,600 |

|

|

|

|

|

30,940,000 |

|

|

|

Lam Research Corporation

|

|

|

|

|

37,500 |

|

|

|

|

|

36,433,875 |

|

|

|

Micron Technology, Inc.

|

|

|

|

|

260,700 |

|

|

|

|

|

30,733,923 |

|

|

|

Microsoft Corporation

|

|

|

|

|

531,800 |

|

|

|

|

|

223,738,896 |

|

|

|

NVIDIA Corporation

|

|

|

|

|

161,100 |

|

|

|

|

|

145,563,516 |

|

|

|

Oracle Corporation

|

|

|

|

|

48,800 |

|

|

|

|

|

6,129,768 |

|

|

|

Salesforce, Inc.

|

|

|

|

|

135,700 |

|

|

|

|

|

40,870,126 |

|

|

|

Synopsys, Inc. (b)

|

|

|

|

|

50,100 |

|

|

|

|

|

28,632,150 |

|

|

| |

|

|

|

|

843,373,154 |

|

|

|

Materials — 2.2%

|

|

|

Avery Dennison Corporation

|

|

|

|

|

25,900 |

|

|

|

|

|

5,782,175 |

|

|

|

Freeport-McMoRan, Inc.

|

|

|

|

|

404,100 |

|

|

|

|

|

19,000,782 |

|

|

|

Linde plc

|

|

|

|

|

61,400 |

|

|

|

|

|

28,509,248 |

|

|

|

PPG Industries, Inc.

|

|

|

|

|

64,900 |

|

|

|

|

|

9,404,010 |

|

|

| |

|

|

|

|

62,696,215 |

|

|

|

Real Estate — 2.2%

|

|

|

CBRE Group, Inc. Class A (b)

|

|

|

|

|

118,700 |

|

|

|

|

|

11,542,388 |

|

|

|

Equinix, Inc.

|

|

|

|

|

19,500 |

|

|

|

|

|

16,093,935 |

|

|

|

Prologis, Inc.

|

|

|

|

|

174,800 |

|

|

|

|

|

22,762,456 |

|

|

|

Public Storage

|

|

|

|

|

43,300 |

|

|

|

|

|

12,559,598 |

|

|

|

|

|

|

|

62,958,377 |

|

|

| |

Schedule of Investments (continued)

March 31, 2024

(unaudited)

| |

|

|

Shares

|

|

|

Value (a)

|

|

|

S&P 500 Index — 0.3%

|

|

|

SPDR S&P 500 ETF Trust

|

|

|

|

|

16,200 |

|

|

|

|

$ |

8,473,734 |

|

|

|

|

|

Utilities — 1.9%

|

|

|

Atmos Energy Corporation

|

|

|

|

|

97,300 |

|

|

|

|

|

11,566,051 |

|

|

DTE Energy Company

|

|

|

|

|

137,400 |

|

|

|

|

|

15,408,036 |

|

|

NextEra Energy, Inc.

|

|

|

|

|

288,300 |

|

|

|

|

|

18,425,253 |

|

|

Utilities Select Sector SPDR Fund

|

|

|

|

|

110,000 |

|

|

|

|

|

7,221,500 |

|

| |

|

|

|

|

52,620,840 |

|

| Total Common Stocks |

|

|

(Cost $1,562,365,399)

|

|

|

|

|

|

|

|

|

|

|

2,816,729,834 |

|

| Other Investments — 0.0% |

|

|

Financials — 0.0%

|

|

|

Adams Funds Advisers, LLC (b)(d)(g)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Cost $150,000)

|

|

|

|

|

|

|

|

|

|

|

466,000 |

|

| Short-Term Investments — 0.4% |

|

|

Money Market Funds — 0.4%

|

|

|

Morgan Stanley Institutional Liquidity Funds

Prime Portfolio, 5.38% (e)

|

|

|

|

|

9,999,709 |

|

|

|

|

|

10,000,709 |

|

|

Northern Institutional Treasury Premier

Portfolio, 5.15% (e)

|

|

|

|

|

759,579 |

|

|

|

|

|

759,579 |

|

| Total Short-Term Investments |

|

|

(Cost $10,761,838)

|

|

|

|

|

|

|

|

|

|

|

10,760,288 |

|

| Total — 99.9% |

|

|

(Cost $1,573,277,237)

|

|

|

|

|

|

|

|

|

|

|

2,827,956,122 |

|

| Other Assets Less Liabilities — 0.1% |

|

|

|

|

|

|

|

|

|

|

1,528,372 |

|

|

Net Assets — 100.0%

|

|

|

|

|

|

|

|

|

|

$ |

2,829,484,494 |

|

| |

Schedule of Investments (continued)

March 31, 2024

(unaudited)

Total Return Swap Agreements — 0.0%

|

Description

|

|

|

|

|

|

|

|

|

|

|

Value and

Unrealized

Appreciation

(Assets)

|

|

|

Value and

Unrealized

Depreciation

(Liabilities)

|

|

|

Terms

|

|

|

Contract

Type

|

|

|

Underlying

Security

|

|

|

Termination

Date

|

|

|

Notional

Amount

|

|

|

Receive total return on underlying

security and pay financing

amount based on notional

amount and daily U.S. Federal

Funds rate plus 0.55%.

|

|

|

Long

|

|

|

Deere & Company

(37,000 shares) |

|

|

4/15/2025

|

|

|

|

$ |

13,858,354 |

|

|

|

|

$ |

1,348,143 |

|

|

|

|

$ |

— |

|

|

|

Pay total return on underlying security and receive financing amount based on notional amount and daily U.S. Federal Funds rate less 0.45%.

|

|

|

Short

|

|

|

Industrial Select

Sector SPDR Fund

(113,700 shares)

|

|

|

4/15/2025

|

|

|

|

|

(13,815,596) |

|

|

|

|

|

— |

|

|

|

|

|

(511,377) |

|

|

| Gross unrealized gain (loss) on open total return swap agreements |

|

|

|

$ |

1,348,143 |

|

|

|

|

$ |

(511,377) |

|

|

| Net unrealized gain on open total return swap agreements (f) |

|

|

|

$ |

836,766 |

|

|

|

(a)

Common stocks are listed on the New York Stock Exchange or NASDAQ and are valued at the last reported sale price on the day of valuation.

(b)

Presently non-dividend paying.

(c)

Non-controlled affiliate, a closed-end sector fund, registered as an investment company under the Investment Company Act of 1940.

(d)

Controlled affiliate valued using fair value procedures.

(e)

Rate presented is as of period-end and represents the annualized yield earned over the previous seven days.

(f)

Counterparty for all open total return swap agreements is Morgan Stanley. At March 31, 2024, $790,000 in cash collateral was held by the fund.

(g)

During the three months ended March 31, 2024, investments in affiliates were as follows:

| |

Affiliate

|

|

|

Shares held

|

|

|

Net realized gain

(loss) and

long-term capital

gain distributions

|

|

|

Dividend income

|

|

|

Change in

unrealized

appreciation

|

|

|

Value

|

|

| |

Adams Funds Advisers, LLC (controlled) |

|

|

|

|

n/a |

|

|

|

|

$ |

— |

|

|

|

|

$ |

— |

|

|

|

|

$ |

— |

|

|

|

|

$ |

466,000 |

|

|

| |

Adams Natural Resources Funds, Inc.

(non-controlled) |

|

|

|

|

2,186,774 |

|

|

|

|

|

21,868 |

|

|

|

|

|

196,810 |

|

|

|

|

|

5,313,861 |

|

|

|

|

|

50,427,008 |

|

|

| |

Total |

|

|

|

|

|

|

|

|

|

$ |

21,868 |

|

|

|

|

$ |

196,810 |

|

|

|

|

$ |

5,313,861 |

|

|

|

|

$ |

50,893,008 |

|

|

Information regarding transactions in equity securities during the quarter can be found on our website at: www.adamsfunds.com.

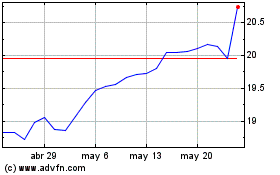

Adams Diversified Equity (NYSE:ADX)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Adams Diversified Equity (NYSE:ADX)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024