false000091901200009190122024-12-042024-12-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 04, 2024 |

AMERICAN EAGLE OUTFITTERS INC

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

1-33338 |

13-2721761 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

77 Hot Metal Street |

|

Pittsburgh, Pennsylvania |

|

15203-2329 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (412) 432-3300 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.01 par value |

|

AEO |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On December 4, 2024, American Eagle Outfitters, Inc. (the “Company”) issued a press release announcing, among other things, the Company’s financial results for the third quarter ended November 2, 2024. A copy of this press release is attached hereto as Exhibit 99.1.

The information in this Item 2.02, including the accompanying Exhibits, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

This Current Report on Form 8-K (including the Exhibits hereto) contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of the Company’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in our Annual Report on Form 10-K for the year ended February 3, 2024, and in any subsequently-filed quarterly reports on Form 10-Q, which have been filed with the Securities and Exchange Commission and are available on our website and on the Securities and Exchange Commission’s website (www.sec.gov). The Company does not undertake to update the forward-looking statements to reflect the impact of circumstances or events that may arise after the date of the forward-looking statements.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

AMERICAN EAGLE OUTFITTERS, INC. |

|

|

|

(Registrant) |

Date: |

December 4, 2024 |

By: |

/s/ Michael A. Mathias |

|

|

|

Michael A. Mathias

Executive Vice President, Chief Financial Officer |

Exhibit 99.1

AEO Inc. Reports Third Quarter Growth Across Brands Reflecting Strong Execution on Powering Profitable Growth Plan

•Aerie achieved all-time high third quarter revenue with comps up 5%, following 12% reported comp growth last year

•American Eagle comps increased 3%, following 2% reported comp growth last year

•Operating Income was $106 million. Adjusted Operating Income of $124 million reflected an Adjusted Operating Margin of 9.6%

•Annual outlook updated; Remain on track to deliver mid-teen adjusted operating income growth, in line with long-term targets

December 4, 2024

PITTSBURGH -- (BUSINESS WIRE) – American Eagle Outfitters, Inc. (NYSE: AEO) today announced financial results for the third quarter fiscal 2024 ended November 2, 2024.

“Building on our positive performance in the first half of the year, third quarter results provide another proof point of the effectiveness of our Powering Profitable Growth Plan. Led by a strong back-to-school season, we achieved comparable sales growth across brands and channels, and delivered adjusted operating income at the high end of our guidance range,” commented Jay Schottenstein, AEO’s Executive Chairman of the Board and Chief Executive Officer.

“We have entered the holiday season well positioned, with our leading brands offering high-quality merchandise, great gifts and an outstanding shopping experience across channels. Key selling periods have seen a positive customer response, yet we remain cognizant of potential choppiness during non-peak periods. The teams are focused on delivering the quarter and with our strong year-to-date performance, we remain confident in achieving our long-term strategic objectives,” he concluded.

Third Quarter 2024 Results:

•Third quarter 2024 results are presented for the 13 weeks ended November 2, 2024 compared to the 13 weeks ended October 28, 2023. Comparable sales metrics are

presented for the 13 weeks ended November 2, 2024 compared to the 13 weeks ended November 4, 2023.

•Total comparable sales increased 3%, following 5% reported comp growth last year.

•Total net revenue of $1.3 billion declined 1%. This included approximately $45 million of adverse impact from the retail calendar shift.

•Aerie comparable sales increased 5% on a 12% increase last year. American Eagle comparable sales grew 3% following 2% growth last year.

•Gross profit of $527 million decreased 3%. Gross margin of 40.9% compared to 41.8% last year, reflecting increased markdowns and expense deleverage related to the retail calendar shift.

•Selling, general and administrative expense of $351 million decreased 3% and leveraged 50 basis points. The improvement was due to lower compensation, including incentive costs, as well as lower professional fees and services and maintenance costs, partially offset by higher advertising.

•Operating income was $106 million, reflecting an operating margin of 8.2%. This included an approximately $20 million adverse impact from the retail calendar shift. Adjusted operating income of $124 million excluded $18 million of impairment and restructuring costs. The adjusted operating margin of 9.6% was flat to last year.

•Diluted earnings per share was $0.41. Adjusted diluted earnings per share was $0.48. Average diluted shares outstanding were 196 million.

Inventory

Total ending inventory increased 5% to $804 million. Inventory is healthy and well positioned for the holiday season.

Shareholder Returns

In the third quarter, the company returned approximately $24 million in cash to shareholders through the quarterly cash dividend of $0.125 per share bringing year-to-date cash dividends to $73 million.

Additionally, during the first half of the year, the company repurchased 6 million shares for $131 million. The company continues to have 24 million shares remaining for repurchase under the current authorization.

Capital Expenditures

Capital expenditures totaled $61 million in the third quarter and $158 million year-to-date. For fiscal 2024, management expects capital expenditures in the range of $225 to $245 million.

Restructuring and Impairment Charges

In the third quarter, the company recorded an $18 million impairment and restructuring charge, of which $6 million was non-cash. As part of its ongoing profit improvement initiatives, the company took additional actions to streamline its corporate cost structure. The company also changed its Hong Kong retail operation from company-owned to a licensed model.

Outlook

Fourth quarter comparable sales are expected to be up approximately 1%, with total revenue down 4% including a roughly $85 million impact from the combination of the retail calendar shift and one less selling week, as previously discussed. Operating income is expected to be in the range of $125 to $130 million. This incorporates currency pressure from the recent strengthening in the U.S. dollar, in addition to a $20 million drag from the retail calendar shift. SG&A is expected to leverage reflecting the company’s continued focus on driving efficiencies across key focus areas.

For the year, this implies comparable sales growth of approximately 3%, with total revenue up 1%, including the impact of one less selling week. Adjusted operating income is expected to be in the range of $428 to $433 million compared to adjusted operating income of $375 million in 2023, representing growth in the mid-teens.

FY24 Quarterly Impact of Retail Calendar

|

|

|

|

|

|

|

1Q |

2Q |

3Q |

4Q |

FY24 |

Revenue Impact |

+$15M |

+$55M |

-$45M |

-$85M |

-$60M |

Webcast and Supplemental Financial Information

Management will host a conference call and real time webcast today at 4:30pm Eastern Time. To listen to the call, dial 1-877-407-0789 or internationally dial 1-201-689-8562 or go to www.aeo-inc.com to access the webcast and audio replay. Additionally, a financial results presentation is posted on the company’s website.

* * * *

About American Eagle Outfitters, Inc.

American Eagle Outfitters, Inc. (NYSE: AEO) is a leading global specialty retailer with a portfolio of beloved apparel brands including American Eagle, Aerie, OFFL/NE by Aerie, Todd Snyder and Unsubscribed. Rooted in optimism, inclusivity and authenticity, AEO’s brands empower every customer to celebrate their unique personal style by offering casual, comfortable, timeless outfitting and high-quality products that are made to last.

AEO Inc. operates stores in the United States, Canada and Mexico, with merchandise available in more than 30 countries through a global network of license partners. Additionally, the company operates a robust e-commerce business across its brands. For more information, visit aeo-inc.com.

Non-GAAP Measures

This press release includes operating income and net income and net income per diluted share presented on an adjusted or non-GAAP basis, which are non-GAAP financial measures. These financial measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similar measures presented by other companies. Non-GAAP information is provided as a supplement to, not as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP. We believe that this non-GAAP information is useful as an additional means for investors to evaluate our operating performance when reviewed in conjunction with our GAAP Consolidated Financial Statements and provides a higher degree of transparency. These amounts are not determined in accordance with GAAP and, therefore, should not be used exclusively in evaluating our business and operations. The tables included in this release reconcile the GAAP financial measures to the non-GAAP financial measures discussed above for the 13 weeks and 39 weeks ended November 2, 2024, Fiscal 2024 and Fiscal 2023.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This release and related statements by management contain forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995), which represent management’s expectations or beliefs concerning future events, including, without limitation, fourth fiscal quarter and annual fiscal 2024 results. Words such as “outlook,” "estimate," "project," "plan," "believe," "expect," "anticipate," "intend," “may,” “potential,” and similar expressions may identify forward-looking statements, although not all forward-looking statements contain these identifying words. All forward-looking statements made by the company are inherently uncertain because they are based on assumptions and expectations concerning future events and are subject to change based on many important factors, some of which may be beyond the company’s control. Except as may be required by applicable law, we undertake no obligation to publicly update or revise any forward-looking statements whether as a result of new information, future events or otherwise and even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized. The following factors, in addition to the risks disclosed in Item 1A., Risk Factors, of our Annual Report on Form 10-K for the fiscal year ended February 3, 2024 and in any other filings that we may make with the Securities and Exchange Commission, in some cases have affected, and in the future could affect, the company's financial performance and could cause actual results to differ materially from those expressed or implied in any of the forward-looking statements included in this release or otherwise made by management: the risk that the company’s operating, financial and capital plans may not be achieved; our inability to anticipate customer demand and changing fashion trends and to manage our inventory commensurately;

seasonality of our business; our inability to achieve planned store financial performance; our inability to react to raw material cost, labor and energy cost increases; our inability to gain market share in the face of declining shopping center traffic; our inability to respond to changes in e-commerce and leverage omni-channel demands; our inability to expand internationally; difficulty with our international merchandise sourcing strategies; challenges with information technology systems, including safeguarding against security breaches; and global economic, public health, social, political and financial conditions, and the resulting impact on consumer confidence and consumer spending, as well as other changes in consumer discretionary spending habits, which could have a material adverse effect on our business, results of operations and liquidity.

The use of the “company,” “AEO,” “we,” "us," and “our” in this release refers to American Eagle Outfitters, Inc.

CONTACT:

Line Media

412-432-3300

LineMedia@ae.com

|

|

|

|

|

|

|

|

|

AMERICAN EAGLE OUTFITTERS, INC. |

|

CONSOLIDATED BALANCE SHEETS |

|

(Unaudited; Dollars in thousands) |

|

|

|

November 2, 2024 |

|

|

October 28, 2023 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

160,195 |

|

|

$ |

240,940 |

|

Merchandise inventory |

|

|

804,256 |

|

|

|

769,315 |

|

Accounts receivable, net |

|

|

214,114 |

|

|

|

239,374 |

|

Prepaid expenses |

|

|

118,773 |

|

|

|

81,423 |

|

Other current assets |

|

|

38,810 |

|

|

|

22,366 |

|

Total current assets |

|

|

1,336,148 |

|

|

|

1,353,418 |

|

Operating lease right-of-use assets |

|

|

1,237,741 |

|

|

|

995,023 |

|

Property and equipment, at cost, net of accumulated depreciation |

|

|

745,988 |

|

|

|

742,793 |

|

Goodwill, net |

|

|

225,196 |

|

|

|

264,825 |

|

Non-current deferred income taxes |

|

|

88,092 |

|

|

|

20,791 |

|

Intangible assets, net |

|

|

43,371 |

|

|

|

88,201 |

|

Other assets |

|

|

59,596 |

|

|

|

55,735 |

|

Total assets |

|

$ |

3,736,132 |

|

|

$ |

3,520,786 |

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

283,471 |

|

|

$ |

300,031 |

|

Current portion of operating lease liabilities |

|

|

293,006 |

|

|

|

294,898 |

|

Accrued compensation and payroll taxes |

|

|

90,289 |

|

|

|

96,484 |

|

Unredeemed gift cards and gift certificates |

|

|

50,161 |

|

|

|

47,676 |

|

Accrued income and other taxes |

|

|

38,468 |

|

|

|

19,255 |

|

Other current liabilities and accrued expenses |

|

|

95,620 |

|

|

|

72,887 |

|

Total current liabilities |

|

|

851,015 |

|

|

|

831,231 |

|

Non-current liabilities: |

|

|

|

|

|

|

Non-current operating lease liabilities |

|

|

1,098,197 |

|

|

|

927,019 |

|

Other non-current liabilities |

|

|

40,322 |

|

|

|

24,247 |

|

Total non-current liabilities |

|

|

1,138,519 |

|

|

|

951,266 |

|

Commitments and contingencies |

|

|

— |

|

|

|

— |

|

Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock |

|

|

— |

|

|

|

— |

|

Common stock |

|

|

2,496 |

|

|

|

2,496 |

|

Contributed capital |

|

|

359,348 |

|

|

|

343,695 |

|

Accumulated other comprehensive loss |

|

|

(49,872 |

) |

|

|

(32,865 |

) |

Retained earnings |

|

|

2,376,077 |

|

|

|

2,234,761 |

|

Treasury stock |

|

|

(941,451 |

) |

|

|

(809,798 |

) |

Total stockholders’ equity |

|

|

1,746,598 |

|

|

|

1,738,289 |

|

Total liabilities and stockholders’ equity |

|

$ |

3,736,132 |

|

|

$ |

3,520,786 |

|

|

|

|

|

|

|

|

Current Ratio |

|

|

1.57 |

|

|

|

1.63 |

|

|

|

|

|

|

|

|

|

|

|

|

|

AMERICAN EAGLE OUTFITTERS, INC. |

CONSOLIDATED STATEMENTS OF OPERATIONS |

(Unaudited; Dollars and shares in thousands, except per share amounts) |

|

|

GAAP Basis |

|

|

|

|

13 Weeks Ended |

|

|

|

|

November 2, 2024 |

|

|

October 28, 2023 |

|

|

|

|

(In thousands) |

|

(Percentage of revenue) |

|

|

(In thousands) |

|

(Percentage of revenue) |

|

|

Total net revenue |

|

$1,289,094 |

|

100.0 |

% |

|

$1,301,055 |

|

100.0 |

% |

|

Cost of sales, including certain buying, occupancy and warehouse expenses |

|

762,470 |

|

59.1 |

|

|

757,258 |

|

58.2 |

|

|

Gross profit |

|

526,624 |

|

40.9 |

|

|

543,797 |

|

41.8 |

|

|

Selling, general and administrative expenses |

|

351,380 |

|

27.3 |

|

|

361,992 |

|

27.8 |

|

|

Impairment, restructuring and other charges |

|

17,561 |

|

1.4 |

|

|

— |

|

0.0 |

|

|

Depreciation and amortization expense |

|

51,594 |

|

4.0 |

|

|

56,444 |

|

4.4 |

|

|

Operating income |

|

106,089 |

|

8.2 |

|

|

125,361 |

|

9.6 |

|

|

Interest (income), net |

|

(1,246) |

|

(0.1) |

|

|

(2,871) |

|

(0.2) |

|

|

Other (income), net |

|

(895) |

|

(0.1) |

|

|

(3,984) |

|

(0.3) |

|

|

Income before income taxes |

|

$108,230 |

|

8.4 |

|

|

$132,216 |

|

10.1 |

|

|

Provision for income taxes |

|

28,211 |

|

2.2 |

|

|

35,516 |

|

2.7 |

|

|

Net income |

|

$80,019 |

|

6.2 |

% |

|

$96,700 |

|

7.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per basic share |

|

$0.42 |

|

|

|

|

$0.50 |

|

|

|

|

Net income per diluted share |

|

$0.41 |

|

|

|

|

$0.49 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - basic |

|

191,630 |

|

|

|

|

195,343 |

|

|

|

|

Weighted average common shares outstanding - diluted |

|

195,782 |

|

|

|

|

198,367 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMERICAN EAGLE OUTFITTERS, INC. |

CONSOLIDATED STATEMENTS OF OPERATIONS |

(Unaudited; Dollars and shares in thousands, except per share amounts) |

|

|

GAAP Basis |

|

|

|

|

|

39 Weeks Ended |

|

|

|

|

|

November 2, 2024 |

|

|

|

October 28, 2023 |

|

|

|

|

|

(In thousands) |

|

|

(Percentage of revenue) |

|

|

|

(In thousands) |

|

|

(Percentage of revenue) |

|

|

|

Total net revenue |

|

$ |

3,724,019 |

|

|

100.0 |

|

% |

|

$ |

3,582,859 |

|

|

|

100.0 |

|

% |

|

Cost of sales, including certain buying, occupancy and warehouse expenses |

|

|

2,234,260 |

|

|

|

60.0 |

|

|

|

|

2,172,867 |

|

|

|

60.6 |

|

|

|

Gross profit |

|

|

1,489,759 |

|

|

|

40.0 |

|

|

|

|

1,409,992 |

|

|

|

39.4 |

|

|

|

Selling, general and administrative expenses |

|

|

1,030,186 |

|

|

|

27.7 |

|

|

|

|

1,006,210 |

|

|

|

28.1 |

|

|

|

Impairment, restructuring, and other charges |

|

|

17,561 |

|

|

|

0.4 |

|

|

|

|

21,275 |

|

|

|

0.6 |

|

|

|

Depreciation and amortization expense |

|

|

156,978 |

|

|

|

4.2 |

|

|

|

|

169,026 |

|

|

|

4.7 |

|

|

|

Operating income |

|

|

285,034 |

|

|

|

7.7 |

|

|

|

|

213,481 |

|

|

|

6.0 |

|

|

|

Interest (income), net |

|

|

(5,414 |

) |

|

|

(0.1 |

) |

|

|

|

(1,229 |

) |

|

|

0.0 |

|

|

|

Other (income), net |

|

|

(4,006 |

) |

|

|

(0.1 |

) |

|

|

|

(9,446 |

) |

|

|

(0.3 |

) |

|

|

Income before income taxes |

|

$ |

294,454 |

|

|

|

7.9 |

|

|

|

$ |

224,156 |

|

|

|

6.3 |

|

|

|

Provision for income taxes |

|

|

69,420 |

|

|

|

1.9 |

|

|

|

|

60,434 |

|

|

|

1.7 |

|

|

|

Net income |

|

$ |

225,034 |

|

|

|

6.0 |

|

% |

|

$ |

163,722 |

|

|

|

4.6 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per basic share |

|

$ |

1.16 |

|

|

|

|

|

|

$ |

0.84 |

|

|

|

|

|

|

Net income per diluted share |

|

$ |

1.14 |

|

|

|

|

|

|

$ |

0.83 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - basic |

|

|

193,908 |

|

|

|

|

|

|

|

195,467 |

|

|

|

|

|

|

Weighted average common shares outstanding - diluted |

|

|

198,201 |

|

|

|

|

|

|

|

197,969 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMERICAN EAGLE OUTFITTERS, INC. |

NET REVENUE BY SEGMENT |

(Unaudited; Dollars in thousands) |

|

13 Weeks Ended |

|

|

39 Weeks Ended |

|

|

|

November 2, 2024 |

|

|

October 28, 2023 |

|

|

November 2, 2024 |

|

|

October 28, 2023 |

|

|

Net Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

American Eagle |

$ |

831,914 |

|

|

$ |

857,378 |

|

|

$ |

2,384,295 |

|

|

$ |

2,295,487 |

|

|

Aerie |

|

410,442 |

|

|

|

393,042 |

|

|

|

1,198,741 |

|

|

|

1,132,537 |

|

|

Other |

|

56,562 |

|

|

|

111,805 |

|

|

|

169,002 |

|

|

|

329,480 |

|

|

Intersegment Elimination |

|

(9,824 |

) |

|

|

(61,170 |

) |

|

|

(28,019 |

) |

|

|

(174,645 |

) |

|

Total Net Revenue |

$ |

1,289,094 |

|

|

$ |

1,301,055 |

|

|

$ |

3,724,019 |

|

|

$ |

3,582,859 |

|

|

|

|

|

|

|

|

|

|

AMERICAN EAGLE OUTFITTERS, INC. |

|

STORE INFORMATION |

|

(Unaudited) |

|

|

13 Weeks Ended |

|

|

39 Weeks Ended |

|

|

November 2, 2024 |

|

|

November 2, 2024 |

|

Consolidated stores at beginning of period |

|

1,178 |

|

|

|

1,182 |

|

Consolidated stores opened during the period |

|

|

|

|

|

AE Brand (1) |

|

8 |

|

|

|

14 |

|

Aerie (incl. OFFL/NE) (2) |

|

7 |

|

|

|

17 |

|

Todd Snyder |

|

2 |

|

|

|

4 |

|

Consolidated stores closed during the period |

|

|

|

|

|

AE Brand (1) |

|

(6 |

) |

|

|

(20 |

) |

Aerie (incl. OFFL/NE) (2) |

|

(3 |

) |

|

|

(10 |

) |

Unsubscribed |

|

— |

|

|

|

(1 |

) |

Total consolidated stores at end of period |

|

1,186 |

|

|

|

1,186 |

|

|

|

|

|

|

|

Stores by Brand |

|

|

|

|

|

AE Brand (1) |

|

845 |

|

|

|

|

Aerie (incl. OFFL/NE) (2) |

|

317 |

|

|

|

|

Todd Snyder |

|

19 |

|

|

|

|

Unsubscribed |

|

5 |

|

|

|

|

Total consolidated stores at end of period |

|

1,186 |

|

|

|

|

|

|

|

|

|

|

Total gross square footage at end of period (in '000) |

|

7,282 |

|

|

|

7,282 |

|

|

|

|

|

|

|

International license locations at end of period (3) |

|

310 |

|

|

|

310 |

|

|

|

|

|

|

|

(1) AE Brand includes AE stand alone locations, AE/Aerie side-by side locations, AE/OFFL/NE side-by-side locations, and AE/Aerie/OFFL/NE side-by-side locations. |

|

|

|

|

(2) Aerie (incl. OFFL/NE) includes Aerie stand alone locations, OFFL/NE stand alone locations, and Aerie/OFFL/NE side-by-side locations. |

|

|

|

|

(3) International license locations (retail stores and concessions) are not included in the consolidated store data or the total gross square footage calculation. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP to Non-GAAP Reconciliation |

|

(Dollars in thousands, except per share amounts) |

|

|

|

13 Weeks Ended |

|

|

|

November 2, 2024 |

|

|

|

Operating Income |

|

|

Provision for Income Taxes |

|

|

Net Income |

|

|

Earnings per Diluted Share |

|

GAAP Basis |

|

$ |

106,089 |

|

|

$ |

28,211 |

|

|

$ |

80,019 |

|

|

$ |

0.41 |

|

% of Revenue |

|

|

8.2 |

% |

|

|

|

|

|

6.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add: Impairment, restructuring and other charges (1) |

|

$ |

17,561 |

|

|

|

|

|

$ |

12,983 |

|

|

$ |

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax effect of the above (2) |

|

|

|

|

$ |

4,578 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Basis |

|

$ |

123,650 |

|

|

$ |

32,789 |

|

|

$ |

93,002 |

|

|

$ |

0.48 |

|

% of Revenue |

|

|

9.6 |

% |

|

|

|

|

|

7.3 |

% |

|

|

|

The following footnotes relate to the impairment, restructuring, and other charges recorded in the 13 weeks ended November 2, 2024:

(1) The Company recorded restructuring costs of $10.7 million related to employee severance, as well as impairment and restructuring costs of $6.8 million related to the pending sale of its Hong Kong retail operations to a third party buyer.

(2) The tax effect of excluded items is the difference between the tax provision calculated on a GAAP basis and an adjusted non-GAAP basis.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP to Non-GAAP Reconciliation |

|

(Dollars in thousands, except per share amounts) |

|

|

|

39 Weeks Ended |

|

|

|

November 2, 2024 |

|

|

|

Operating Income |

|

|

Provision for Income Taxes |

|

|

Net Income |

|

|

Earnings per Diluted Share |

|

GAAP Basis |

|

$ |

285,034 |

|

|

$ |

69,420 |

|

|

$ |

225,034 |

|

|

$ |

1.14 |

|

% of Revenue |

|

|

7.7 |

% |

|

|

|

|

|

6.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add: Impairment, restructuring and other charges (1) |

|

$ |

17,561 |

|

|

|

|

|

$ |

12,983 |

|

|

$ |

0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax effect of the above (2) |

|

|

|

|

$ |

4,578 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Basis |

|

$ |

302,595 |

|

|

$ |

73,998 |

|

|

$ |

238,017 |

|

|

$ |

1.20 |

|

% of Revenue |

|

|

8.1 |

% |

|

|

|

|

|

6.4 |

% |

|

|

|

The following footnotes relate to the impairment, restructuring, and other charges recorded in the 39 weeks ended November 2, 2024:

(1) The Company recorded restructuring costs of $10.7 million related to employee severance, as well as impairment and restructuring costs of $6.8 million related to the pending sale of its Hong Kong retail operations to a third party buyer.

(2) The tax effect of excluded items is the difference between the tax provision calculated on a GAAP basis and an adjusted non-GAAP basis.

|

|

|

|

|

|

|

GAAP to Non-GAAP Reconciliation |

|

Fiscal 2024 Guidance |

|

(Dollars in millions) |

|

|

Operating |

|

|

Income |

|

|

Low End |

|

High End |

|

GAAP Basis |

$ |

410 |

|

$ |

415 |

|

Add: Impairment, Restructuring and Other Charges(1) |

$ |

18 |

|

$ |

18 |

|

Non-GAAP Basis |

$ |

428 |

|

$ |

433 |

|

(1) During the 13 weeks ended November 2, 2024, the Company recorded restructuring costs of $10.7 million related to employee severance, as well as impairment and restructuring costs of $6.8 million related to the pending sale of its Hong Kong retail operations to a third party buyer.

|

|

|

|

|

GAAP to Non-GAAP Reconciliation |

|

53 Weeks Ended February 3, 2024 |

|

(Dollars in thousands) |

|

|

|

Operating |

|

|

|

Income |

|

GAAP Basis |

|

$ |

222,717 |

|

% of Revenue |

|

|

4.2 |

% |

|

|

|

|

Add: Impairment, Restructuring and Other Charges |

|

$ |

152,645 |

|

|

|

|

|

Non-GAAP Basis |

|

$ |

375,362 |

|

% of Revenue |

|

|

7.1 |

% |

The Fiscal 2023 adjustments relate to certain inventory provisions, asset impairments, restructuring and other charges recognized in relation to Quiet Platforms, as well as the company’s international and corporate operations. Please refer to Note 16. “Impairment, Restructuring and Other Charges,” to the Consolidated Financial Statements included in the Company's Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 15, 2024 for further information on the nature of these amounts.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

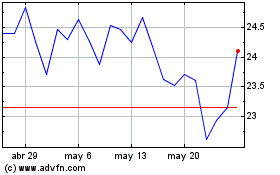

American Eagle Outfitters (NYSE:AEO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

American Eagle Outfitters (NYSE:AEO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024