Form 8-K - Current report

03 Diciembre 2024 - 5:04AM

Edgar (US Regulatory)

false

0001232582

0001232582

2024-12-03

2024-12-03

0001232582

us-gaap:CommonStockMember

2024-12-03

2024-12-03

0001232582

us-gaap:SeriesDPreferredStockMember

2024-12-03

2024-12-03

0001232582

us-gaap:SeriesFPreferredStockMember

2024-12-03

2024-12-03

0001232582

us-gaap:SeriesGPreferredStockMember

2024-12-03

2024-12-03

0001232582

us-gaap:SeriesHPreferredStockMember

2024-12-03

2024-12-03

0001232582

aht:PreferredStockSeriesIMember

2024-12-03

2024-12-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of

earliest event reported): December 3, 2024

ASHFORD HOSPITALITY TRUST, INC.

(Exact name of registrant

as specified in its charter)

| Maryland |

001-31775 |

86-1062192 |

(State or other jurisdiction of

incorporation or organization) |

(Commission file number) |

(I.R.S. Employer Identification

Number) |

| 14185 Dallas Parkway, Suite 1200, Dallas, Texas |

|

75254 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (972) 490-9600

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of

this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

AHT |

|

New York Stock Exchange |

| Preferred Stock, Series D |

|

AHT-PD |

|

New York Stock Exchange |

| Preferred Stock, Series F |

|

AHT-PF |

|

New York Stock Exchange |

| Preferred Stock, Series G |

|

AHT-PG |

|

New York Stock Exchange |

| Preferred Stock, Series H |

|

AHT-PH |

|

New York Stock Exchange |

| Preferred Stock, Series I |

|

AHT-PI |

|

New York Stock Exchange |

| ITEM 7.01. |

REGULATION FD DISCLOSURE. |

On December 3, 2024, Ashford Hospitality Trust,

Inc. (the “Company”) issued a press release announcing the closing on March 31, 2025, of its Series J and Series K non-traded

preferred stock offering.

A copy of the press release is attached hereto

as Exhibit 99.1 and is incorporated herein by reference. The information in this Form 8-K and Exhibits attached hereto shall not

be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by

reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

| ITEM 9.01. |

FINANCIAL STATEMENTS AND EXHIBITS. |

(d) Exhibit

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

Date: December 3, 2024

|

ASHFORD HOSPITALITY TRUST, INC.

|

| |

By: |

/s/ Deric S. Eubanks |

| |

|

Deric S. Eubanks |

| |

|

Chief Financial Officer |

Exhibit 99.1

Issuer Free Writing

Prospectus

Dated December 3,

2024

Filed Pursuant to

Rule 433

Registration Statement

No. 333-263323

NEWS RELEASE

| Contact: |

Deric

Eubanks |

Laken

Avonne Rapier |

Joseph

Calabrese |

| |

Chief

Financial Officer |

Media

Contact |

Financial

Relations Board |

| |

(972)

490-9600 |

LRapier@ashfordinc.com |

(212)

827-3772 |

ASHFORD HOSPITALITY

TRUST ANNOUNCES CLOSING OF NON-TRADED PREFERRED STOCK OFFERING

DALLAS –

December 3, 2024 – Ashford Hospitality Trust, Inc. (NYSE: AHT) (“Ashford Trust” or the “Company”)

announced today that it plans to close its offering of Series J and Series K non-traded preferred stock on March 31, 2025.

Since launching the offering in 2022, the Company raised approximately $180.0 million of gross proceeds from the sale of its Series J

and Series K non-traded preferred stock.

“Our non-traded

preferred stock offering has allowed us to raise substantial capital during a challenging time in the capital markets,” commented

Stephen Zsigray, Ashford Trust’s President and Chief Executive Officer. “Given the success of this offering to date and our

improved financial condition, we are pleased to announce the upcoming closing of the offering.”

Ashford Hospitality

Trust is a real estate investment trust (REIT) focused on investing predominantly in upper upscale, full-service hotels.

The issuer has

filed a registration statement (including a prospectus) with the Securities and Exchange Commission (the “SEC”) for the offering

to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents

the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents

for free by visiting EDGAR on the SEC’s web site at www.sec.gov. Alternatively, the issuer, the dealer manager or any dealer participating

in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-877-787-9239.

The final prospectus

and prospectus supplement no. 1 for the Offering, dated May 4, 2022 and September 14, 2022, respectively, can be accessed through

the following links:

| |

· |

https://www.sec.gov/Archives/edgar/data/1232582/000110465922056200/tm2213690-3_424b3.htm |

| |

· |

https://www.sec.gov/Archives/edgar/data/1232582/000110465922100064/tm2225818-1_424b3.htm |

Forward-Looking

Statements

Certain statements

and assumptions in this press release contain or are based upon “forward-looking” information and are being made pursuant

to the safe harbor provisions of the federal securities regulations. Forward-looking statements are generally identifiable by use of

forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,”

“expect,” “anticipate,” “estimate,” “approximately,” “believe,” “could,”

“project,” “predict,” or other similar words or expressions. Additionally, statements regarding the following

subjects, among others, are forward-looking by their nature: our business and investment strategy; anticipated or expected purchases,

sales or dispositions of assets; our projected operating results; completion of any pending transactions; our plan to pay off strategic

financing; our ability to restructure existing property-level indebtedness; our ability to secure additional financing to enable us to

operate our business; our understanding of our competition; projected capital expenditures; and the impact of technology on our operations

and business.. Such forward-looking statements are based on our beliefs, assumptions, and expectations of our future performance taking

into account all information currently known to us. These beliefs, assumptions, and expectations can change as a result of many potential

events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity, results of operations,

plans, and other objectives may vary materially from those expressed in our forward-looking statements. You should carefully consider

this risk when you make an investment decision concerning our securities. These and other risk factors are more fully discussed in the

Company's filings with the SEC.

The forward-looking

statements included in this press release are only made as of the date of this press release. Investors should not place undue reliance

on these forward-looking statements. We will not publicly update or revise any forward-looking statements, whether as a result of new

information, future events or circumstances, changes in expectations or otherwise except to the extent required by law.

v3.24.3

Cover

|

Dec. 03, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 03, 2024

|

| Entity File Number |

001-31775

|

| Entity Registrant Name |

ASHFORD HOSPITALITY TRUST, INC.

|

| Entity Central Index Key |

0001232582

|

| Entity Tax Identification Number |

86-1062192

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

14185 Dallas Parkway

|

| Entity Address, Address Line Two |

Suite 1200

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75254

|

| City Area Code |

972

|

| Local Phone Number |

490-9600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AHT

|

| Security Exchange Name |

NYSE

|

| Series D Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series D

|

| Trading Symbol |

AHT-PD

|

| Security Exchange Name |

NYSE

|

| Series F Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series F

|

| Trading Symbol |

AHT-PF

|

| Security Exchange Name |

NYSE

|

| Series G Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series G

|

| Trading Symbol |

AHT-PG

|

| Security Exchange Name |

NYSE

|

| Series H Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series H

|

| Trading Symbol |

AHT-PH

|

| Security Exchange Name |

NYSE

|

| Preferred Stock Series I [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series I

|

| Trading Symbol |

AHT-PI

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesDPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesFPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesGPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesHPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=aht_PreferredStockSeriesIMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

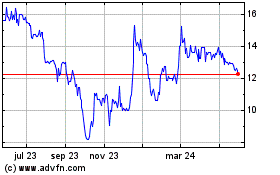

Ashford Hospitality (NYSE:AHT-I)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

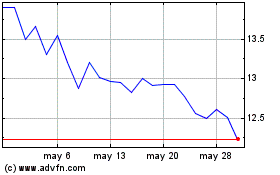

Ashford Hospitality (NYSE:AHT-I)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025