0001232582false00012325822024-11-062024-11-060001232582us-gaap:CommonStockMember2024-11-062024-11-060001232582us-gaap:SeriesDPreferredStockMember2024-11-062024-11-060001232582us-gaap:SeriesFPreferredStockMember2024-11-062024-11-060001232582us-gaap:SeriesGPreferredStockMember2024-11-062024-11-060001232582us-gaap:SeriesHPreferredStockMember2024-11-062024-11-060001232582aht:SeriesIPreferredStockMember2024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): November 6, 2024

ASHFORD HOSPITALITY TRUST, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-31775 | | 86-1062192 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (IRS employer identification number) |

| | | | |

| 14185 Dallas Parkway, Suite 1200 | | | | |

| Dallas | | | | |

| Texas | | | | 75254 |

| (Address of principal executive offices) | | | | (Zip code) |

Registrant’s telephone number, including area code: (972) 490-9600

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock | | AHT | | New York Stock Exchange |

| Preferred Stock, Series D | | AHT-PD | | New York Stock Exchange |

| Preferred Stock, Series F | | AHT-PF | | New York Stock Exchange |

| Preferred Stock, Series G | | AHT-PG | | New York Stock Exchange |

| Preferred Stock, Series H | | AHT-PH | | New York Stock Exchange |

| Preferred Stock, Series I | | AHT-PI | | New York Stock Exchange |

ITEM 7.01 REGULATION FD DISCLOSURE

On November 6, 2024, Ashford Hospitality Trust, Inc. (the “Company”) held an earnings conference call for its third quarter ended September 30, 2024. A copy of the conference call transcript is attached hereto as Exhibit 99.1. On November 5, 2024, the Company filed a Form 8-K that included the actual earnings release text and supplemental tables.

The information in this Form 8-K and Exhibits attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

Exhibit Number Description

104 Cover Page Interactive Data File (formatted in Inline XBRL and contained in Exhibit 101)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ASHFORD HOSPITALITY TRUST, INC. |

| | |

| Dated: November 6, 2024 | By: | /s/ Alex Rose |

| | Alex Rose |

| | Executive Vice President, General Counsel & Secretary |

ASHFORD HOSPITALITY TRUST

Third Quarter 2024 Conference Call

November 6, 2024

10 a.m. CT

Introductory Comments – Deric Eubanks

Good day everyone and welcome to today’s conference call to review results for Ashford Hospitality Trust for the third quarter of 2024 and to update you on recent developments. On the call today will also be: Stephen Zsigray, President and Chief Executive Officer; and Chris Nixon, Executive Vice President and Head of Asset Management. The results as well as notice of the accessibility of this conference call on a listen-only basis over the Internet were distributed yesterday afternoon in a press release.

At this time, let me remind you that certain statements and assumptions in this conference call contain or are based upon “forward-looking” information and are being made pursuant to the safe harbor provisions of the federal securities regulations. Such forward-looking statements are subject to numerous assumptions, uncertainties and known or unknown risks, which could cause actual results to differ materially from those anticipated. These factors are more fully discussed in the Company’s filings with the Securities and Exchange Commission. The forward-looking statements included in this conference call are only made as of the date of this call, and the Company is not obligated to publicly update or revise them. Statements made during this call do not constitute an offer to sell or a solicitation of an offer to buy any securities. Securities will be offered only by means of a registration statement and prospectus which can be found at www.sec.gov.

In addition, certain terms used in this call are non-GAAP financial measures, reconciliations of which are provided in the Company’s earnings release and accompanying tables or schedules, which have been filed on Form 8-K with the SEC on November 5, 2024, and may also be accessed through the Company’s website at www.ahtreit.com. Each listener is encouraged to review those reconciliations provided in the earnings release together with all other information provided in the release. Also, unless otherwise stated, all reported results discussed in this call compare the third quarter ended September 30, 2024 with the third quarter ended September 30, 2023.

I will now turn the call over to Stephen Zsigray. Please go ahead.

Introduction – Stephen Zsigray

Good morning, and welcome to our call.

After my introductory comments, Deric will review our third quarter financial results and then Chris will provide an operational update on our portfolio.

I’ll begin by reiterating how pleased I am with the significant progress that we’ve made executing on our plan to pay off our strategic financing. We announced this plan back in January, and since then we’ve done exactly what we said we would do. We’ve sold over $310 million of hotels, we’ve completed a refinancing of our Renaissance Nashville that generated significant excess proceeds, and we’ve now raised approximately $173 million of gross proceeds from the sale of our non-traded preferred stock. We’ve used some of the proceeds from each of these efforts to pay down our strategic

financing by more than $100 million since the beginning of the year to approximately $82 million today.

Additionally, we announced this morning that we’ve agreed to an amendment to the strategic financing. This amendment provides the Company with an opportunity for a discounted exit fee if the financing is fully paid off by December 15th, provided that the outstanding balance has been reduced to $50 million or less by next Friday, November 15th. We are currently working on a couple of transactions that we hope to close in the near term, and we continue to believe we have a viable path to paying off this financing entirely before the end of the year.

Operationally, in light of underwhelming revenue growth across the lodging industry through the first three quarters, our property managers are aggressively driving sales and managing expenses. We are pleased to announce that October saw our highest monthly top line growth of any month this year, with RevPAR growth of 4.6% versus October 2023. We believe we will also begin to see the benefits of additional expense management initiatives in the fourth quarter and more fully throughout 2025. We are also excited about the imminent conversions at our La Concha Hotel in Key West and Le Pavillon Hotel in New Orleans, as well as our newest addition to the portfolio, the Le Meridien Fort Worth Downtown.

Regarding the La Concha Hotel in Key West, we are on track to convert this hotel by the end of the year to Marriott’s Autograph Collection. Upon conversion, it will be rebranded to Autograph La Concha, and we’re creating a distinctive theme and style for the hotel that is commensurate with the upper-upscale/luxury Autograph product. This includes transforming the lobby, bar, and restaurant, as well as upgrading the exterior, guestrooms, guest bathrooms, corridors, pool, and meeting space. Ideally located in Old Town Key West, the transformation is expected to elevate the property into a desirable niche in the high-barrier-to-entry, high-RevPAR Key West market. Post conversion we believe the new Autograph property should realize a 20% to 30% RevPAR premium compared to pre-conversion.

We’re also on track to convert our Le Pavillon Hotel in New Orleans to Marriott’s Tribute Portfolio by the end of 2024. This upbranding includes renovations to guestrooms, guest bathrooms, restaurant, lobby bar as well as extensive exterior work. Located on historic Poydras Street, it has a prime location and proximity to major demand generators in downtown New Orleans. Post conversion, we believe the new Tribute Portfolio property should realize a 10% to 20% RevPAR premium compared to pre-conversion.

Additionally, we have also recently opened the Le Méridien Fort Worth Downtown, following a redevelopment of the 13-story historic building. Situated in downtown Fort Worth, Texas, the 188-room hotel is located within easy walking distance of the Fort Worth Convention Center and close to local landmarks such as Trinity Park and Sundance Square. The property features a rooftop lounge, French-inspired cuisine, over 5,000 square feet of function space, and floor-to-ceiling windows designed to offer scenic views of the city’s downtown. It’s a great addition to our portfolio, it’s already running well ahead of expectations, and we’re very excited about the prospects for this property.

As we look forward, completing the repayment of our strategic financing will allow the Company to finally turn the page on the COVID era. As mentioned, we are keenly focused on maximizing the performance, profitability, and value of our hotels. Perhaps equally importantly, the Company’s advisor, Ashford Inc., has also provided an unwavering commitment to substantially improve the profitability of Ashford Hospitality Trust over the coming year through corporate cost reductions,

strategic portfolio turnover, and continued deleveraging. We will have more information to share regarding those efforts in the coming months, and we are excited about the future of the Company especially given increasingly attractive industry fundamentals, several coming years of limited supply growth, and improving transaction and financing markets.

I will now turn the call over to Deric to review our third quarter financial performance.

Financial Review – Deric Eubanks

Thanks, Stephen.

For the third quarter, we reported a net loss attributable to common stockholders of $63.2 million, or $(12.39) per diluted share.

For the quarter, we reported AFFO per diluted share of negative $(1.71).

Adjusted EBITDAre for the quarter was $52.4 million.

At the end of the third quarter, we had $2.7 billion of loans with a blended average interest rate of 8.0%, taking into account in-the-money interest rate caps. Considering the current level of SOFR and the corresponding interest rate caps, approximately 83% of our debt is now effectively fixed and 17% is effectively floating.

We ended the quarter with cash and cash equivalents of $119.7 million and restricted cash of $114.3 million. The vast majority of that restricted cash is comprised of lender and manager-held reserve accounts, and $2.4 million related to trapped cash held by lenders. At the end of the quarter, we also had $26.7 million due from third-party hotel managers. This primarily represents cash held by one of our property managers, which is also available to fund hotel operating costs. We ended the quarter with net working capital of approximately $160.0 million.

As of September 30, 2024, our consolidated portfolio consisted of 73 hotels with 17,644 rooms.

After taking into account our recently completed 1-for-10 reverse stock split, our share count at the end of the quarter consisted of approximately 5.6 million fully diluted shares outstanding, which is comprised of 5.4 million shares of common stock and 0.2 million OP units.

While we are currently paying our preferred dividends quarterly or monthly, we do not anticipate reinstating a common dividend in 2024.

This concludes our financial review, and I would now like to turn it over to Chris to discuss our asset management activities for the quarter.

Asset Management – Chris Nixon

Thank you, Deric.

For the third quarter, Comparable Hotel RevPAR for our portfolio decreased 1% over the prior year quarter. While achieving growth in RevPAR has been challenging, our team has been actively working with our property managers to roll out several initiatives to grow ancillary revenue, which increased 15% per occupied room compared to the prior year quarter. Corporate transient is improving with year-to-date corporate revenue up 9% compared to the prior year period. Additionally, we are seeing an acceleration in attendance at major events and decreased price sensitivity around those events. We

have also benefitted from non-annual events. For example, in August, when Chicago hosted the Democratic National Convention, our Silversmith hotel experienced an 85% increase in group room revenue and a 58% increase in group ADR. I will now go into more detail on some of the achievements completed throughout the quarter.

Many of our historically group-dominant markets are operating at full steam, significantly surpassing levels seen in 2019. Group room revenue for the full year 2024 is pacing ahead of last year by 2%, and group room revenue for the full year 2025 is pacing ahead by 8% with all quarters pacing ahead to prior year. We are pleased with the positive outlook and continue to build momentum, as evidenced by our group lead volume, which increased by 4% compared to the prior year quarter. Our revenue optimization team has worked diligently with the hotel teams to capitalize on the positive 2025 group outlook seen across the industry, to grow group block sizes and extend the booking window. Additionally, our team has set optimal group mix targets across the portfolio for sales teams and has meticulously audited spending for digital channels and event space demand generators. This process has positioned our two largest hotels in favorable positions, with Marriott Crystal Gateway and Renaissance Nashville group room revenue pacing ahead by 14% and 7%, respectively, for 2025.

As Stephen mentioned, we opened the Le Méridien Ft. Worth during the last week of August. The 14-story, 188-room full-service hotel is well situated near local demand generators and attractions. As background, we completed a comprehensive redevelopment of a property that was abandoned since the mid-2000’s. The redevelopment features two Food and Beverage outlets, including an upscale lobby-level restaurant and a stunning rooftop lounge with views of Fort Worth’s downtown skyline. Situated adjacent to our Hilton Fort Worth property, the historically registered hotel is also managed by Remington resulting in operational synergies. The initial performance of this upscale boutique property has been strong out of the gate. Total revenue for the first full month of operations was more than double that of our underwriting. This performance was bolstered in part from a local university’s parents’ weekend that drove market compression. Although the hotel had only been open for a few weeks, the property team was able to push a $20 ADR premium over the market during that weekend.

Turning to property taxes, during the third quarter, we had successful appeals at several locations and have reduced total real estate assessments by over $100 million, with total estimated tax payment savings of $1.7 million. The largest reduction and subsequent savings were generated from our appeal of our current assessment on the Marriott Sugar Land. The Appraisal Review Board agreed to reduce the assessment by over $31 million, which resulted in an estimated tax savings of approximately $600,000. Also, during the quarter, we successfully resolved prior litigation on the Marriott DFW Airport, which will generate refunds of approximately $120,000.

In late September and early October, a number of markets and hotels were impacted by Hurricanes Helene and Milton in the southeastern United States. As always, we believe it’s important for our hotels to stay open as a place of refuge and service the communities during these storms. We have a lot of experience here, and we prioritize the safety and well-being of the hotel employees and guests. We’ve seen time and time again, that keeping our hotels open not only provides a safe haven for the local community, hotel staff, and disaster relief crew members, but positions the properties to be able to quickly mitigate any damage and capitalize on demand. During the third quarter, we are pleased to say that all of our hotels remained open. Our risk management team proactively handles hurricane procedures by identifying and notifying potentially impacted hotels, allowing them ample time to prepare. We then preemptively align with the hotels on preparation procedures such as identifying low spots, adding sandbags, removing debris, and strapping down equipment. We ensure that all hotels

have access to generators in case of a power outage. These procedures have helped us to forge strong relationships with disaster-relief companies, who provide quick aid to our hotels with cleanup. Overall, despite minor damage occurring at some of the hotels, our approach towards the hurricanes resulted in minimal operation impact and positive financial results during the quarter.

Moving on to capital expenditures, during the third quarter of 2024, we completed both the guestroom and public space renovations for two strategic conversions: the $35 million transformation of La Concha Key West into an Autograph Collection Hotel and the $19 million renovation of Le Pavillon New Orleans into a Tribute Portfolio Hotel. We anticipate both properties to fully convert to their respective brand by year-end. Once finalized, both hotels will benefit significantly from Marriott’s extensive sales, distribution, and loyalty platforms. We have also made significant progress on the extensive renovation of both guestrooms and public spaces at the Embassy Suites Dallas, with the project slated for completion later this year. Additionally, we initiated a comprehensive guestroom renovation at the Embassy Suites West Palm Beach. For 2024, we anticipate spending between $80 and $100 million on capital expenditures as we continue to invest in key renovations and strategic upgrades across our portfolio.

As mentioned earlier, group business has continued to show growth. We are experiencing strong demand in various markets, and our ancillary revenue initiatives have performed well. We remain optimistic about the outlook for this portfolio and will now open the call up for Q&A.

Stephen Zsigray

Thank you for joining today’s call, and we look forward to speaking with you all again next quarter.

v3.24.3

Document and Entity Information

|

Nov. 06, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 06, 2024

|

| Entity Registrant Name |

ASHFORD HOSPITALITY TRUST, INC.

|

| Entity Central Index Key |

0001232582

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-31775

|

| Entity Tax Identification Number |

86-1062192

|

| Entity Address, Address Line One |

14185 Dallas Parkway, Suite 1200

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75254

|

| City Area Code |

972

|

| Local Phone Number |

490-9600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AHT

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series D |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series D

|

| Trading Symbol |

AHT-PD

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series F |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series F

|

| Trading Symbol |

AHT-PF

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series G |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series G

|

| Trading Symbol |

AHT-PG

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series H |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series H

|

| Trading Symbol |

AHT-PH

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series I |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series I

|

| Trading Symbol |

AHT-PI

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesDPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesFPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesGPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesHPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=aht_SeriesIPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

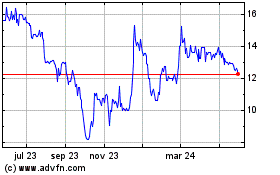

Ashford Hospitality (NYSE:AHT-I)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

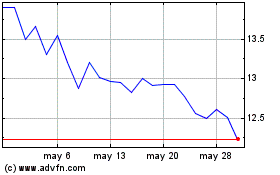

Ashford Hospitality (NYSE:AHT-I)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025