Form N-CSRS - Certified Shareholder Report, Semi-Annual

08 Julio 2024 - 3:52PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: |

811-21980 |

| |

|

| Exact name of registrant as specified in charter: |

abrdn Total Dynamic Dividend

Fund |

| |

|

| Address of principal executive offices: |

1900 Market Street, Suite 200 |

| |

Philadelphia, PA 19103 |

| |

|

| Name and address of agent for service: |

Sharon Ferrari |

| |

abrdn Inc. |

| |

1900 Market Street, Suite 200 |

| |

Philadelphia, PA 19103 |

| |

|

| Registrant’s telephone number, including area code: |

1-800-522-5465 |

| |

|

| Date of fiscal year end: |

October 31 |

| |

|

| Date of reporting period: |

April 30, 2024 |

Item 1. Reports to Stockholders.

(a) A copy of the report transmitted to shareholders

pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”) is filed herewith.

abrdn Global Dynamic Dividend Fund

(AGD)

abrdn Total Dynamic Dividend Fund

(AOD)

Semi-Annual Report

April 30, 2024

Letter to Shareholders (unaudited)

Dear Shareholder,

We present the Semi-Annual

Report, which covers the activities of abrdn Global Dynamic Dividend Fund ("AGD") and abrdn Total Dynamic Dividend Fund ("AOD") (collectively, the "Funds" and each a "Fund"), for the six-month period ended April 30,

2024. The primary investment objective for AGD is to seek high current dividend income, more than 50% of which qualifies for the reduced federal income tax rate, as created by the Jobs and Growth Tax Relief

Reconciliation Act of 2003. The primary investment objective for AOD is to seek high current dividend income. The Funds also focus on long-term growth of capital as a secondary investment objective.

Total Investment Return1

For the six-month period

ended April 30, 2024, the total return to shareholders of the Funds based on the net asset value (“NAV”) and market price of the Funds, respectively, is as follows:

|

| AGD

| AOD

|

| NAV2,3

| 14.14%

| 14.40%

|

| Market Price2

| 15.53%

| 14.29%

|

| MSCI AC World Index (Net DTR)4

| 19.77%

| 19.77%

|

For more information about

AGD or AOD performance, please visit the Funds on the web at www.abrdnagd.com (AGD) and www.abrdnaod.com (AOD), respectively. On the web you can view quarterly commentary on the Funds' performance, monthly fact

sheets, distribution and performance information, and other Fund literature.

NAV, Market Price and Premium(+)/Discount(-)

The below tables represent

comparison from current six-month period end to prior fiscal year end of market price to NAV and associated Premium(+) and Discount(-).

|

| AGD

|

|

|

|

| NAV

| Closing

Market

Price

| Premium(+)/

Discount(-)

|

| 4/30/2024

| $10.84

| $9.31

| -14.11%

|

| 10/31/2023

| $9.90

| $8.40

| -15.15%

|

During the six-month period

ended April 30, 2024, AGD’s NAV was within a range of $9.98 to $11.26 and AGD’s market price traded within a range of $8.46 to $9.71. During the six-month period ended April 30, 2024, AGD’s shares

traded within a range of a premium(+)/discount(-) of -15.98% to -13.59%.

|

| AOD

|

|

|

|

| NAV

| Closing

Market

Price

| Premium(+)/

Discount(-)

|

| 4/30/2024

| $9.36

| $7.95

| -15.06%

|

| 10/31/2023

| $8.54

| $7.26

| -14.99%

|

During the six-month period

ended April 30, 2024, AOD's NAV was within a range of $8.61 to $9.74 and AOD's market price traded within a range of $7.31 to $8.29. During the six-month period ended April 30, 2024, the AOD's shares traded within a

range of a premium(+)/discount(-) of -16.39% to -14.16%.

{foots1}

| 1

| Past performance is no guarantee of future results. Investment returns and principal value will fluctuate and shares, when sold, may be worth more or less than original cost. Current performance may be

lower or higher than the performance quoted. NAV return data includes investment management fees, custodial charges and administrative fees (such as Trustee and legal fees) and assumes the reinvestment of all

distributions.

|

{foots1}

| 2

| Assuming the reinvestment of dividends and distributions.

|

{foots1}

| 3

| The Funds' total return is based on the reported NAV for each financial reporting period end and may differ from what is reported on the Financial Highlights due to financial statement rounding or adjustments.

|

{foots1}

| 4

| The Morgan Stanley Capital International (MSCI) All Country (AC) World Index Net DailyTotal Return (DTR) is an unmanaged index considered representative of developed and emerging market stock

markets.The index is calculated net of withholding taxes to which the Funds are generally subject. Indexes are unmanaged and have been provided for comparison purposes only. No fees or expenses are reflected. You

cannot invest directly in an index.

|

| 2024 Semi-Annual Report

| 1

|

Letter to Shareholders (unaudited) (continued)

Distribution Policy

The Funds' distributions to

common shareholders and the annualized distribution rates based on market price and NAV, respectively, for the six-month period ended April 30, 2024 are shown in the table below:

| Fund

| Distribution

per share

| NAV annualized

distribution rate

| Market Price

annualized

distribution rate

|

| AGD

| $0.39

| 7.20%

| 8.38%

|

| AOD

| $0.35

| 7.37%

| 8.68%

|

Since all distributions are

paid after deducting applicable withholding taxes, the effective distribution rate may be higher for those U.S. investors who are able to claim a tax credit.

On May 9, 2024 and June 11,

2024, AOD and AGD announced that they will pay on May 31, 2024 and June 28, 2024, respectively, a distribution per share to all shareholders of record as of May 23, 2024 and June 21, 2024, respectively. AGD and AOD

will pay a distribution of $0.065 and $0.0575 per share, respectively.

The Funds' policy is to

provide investors with a stable monthly distribution out of current income, supplemented by realized capital gains and, to the extent necessary, paid-in capital, which is a nontaxable return of capital. This policy is

subject to an annual review as well as regular review at the quarterly meetings of each Fund's Board of Trustees (each, a "Board" and collectively, the "Boards") unless market conditions require an earlier

evaluation.

Unclaimed Share Accounts

Please be advised that

abandoned or unclaimed property laws for certain states require financial organizations to transfer (escheat) unclaimed property (including Fund shares) to the state. Each state has its own definition of unclaimed

property, and a Fund's shares could be considered “unclaimed property” due to account inactivity (e.g., no owner-generated activity for a certain period), returned mail (e.g., when mail sent to

a shareholder is returned to the Funds' transfer agent as undeliverable), or a combination of both. If your Fund shares are categorized as unclaimed, your financial advisor or the Funds' transfer agent will

follow the applicable state’s statutory requirements to contact you, but if unsuccessful, laws may require that the shares be escheated to the appropriate state. If this happens, you will have to contact the

state to recover your property, which may involve time and expense. For more information on unclaimed property and how to maintain an active account, please contact your financial adviser or the Funds' transfer

agent.

Open Market Repurchase Program

The Boards approved an open

market repurchase and discount management policy (the “Program”). The Program allows the Funds to purchase, in the open market, their outstanding common shares,

with the amount and timing of any repurchase

determined at the discretion of the Funds' investment adviser. Such purchases may be made opportunistically at certain discounts to NAV per share in the reasonable judgment of management based on historical discount

levels and current market conditions. If shares are repurchased, a Fund will report repurchase activity on its website on a monthly basis. For the six-month period ended April 30, 2024, the Funds did not

repurchase any shares through the Program.

On a quarterly basis, the

Boards will receive information on any transactions made pursuant to this policy during the prior quarter and management will post the number of shares repurchased on each respective Fund's website on a monthly

basis. Under the terms of the Program, each Fund is permitted to repurchase up to 10% of its outstanding shares of common stock in the open market during any 12 month period.

Portfolio Holdings Disclosure

The Funds' complete schedule

of portfolio holdings for the second and fourth quarters of each fiscal year are included in the Funds' semi-annual and annual reports to shareholders. Each Fund files its complete schedule of portfolio holdings with

the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. These reports are available on the SEC’s website

at http://www.sec.gov. The Funds make the information available to shareholders upon request and without charge by calling Investor Relations toll-free at 1-800-522-5465.

Proxy Voting

A description of the policies

and procedures that the Funds use to determine how to vote proxies relating to portfolio securities and information regarding how the Funds voted proxies relating to portfolio securities during the most recent 12

month period ended June 30 is available by August 31 of the relevant year: (1) upon request without charge by calling Investor Relations toll-free at 1-800-522-5465; and (2) on the SEC’s website at

http://www.sec.gov.

Investor Relations Information

As part of abrdn’s

commitment to shareholders, we invite you to visit the Funds on the web at www.abrdnagd.com (AGD) and www.abrdnaod.com (AOD). On the web you can view monthly fact sheets, quarterly commentary, distribution and

performance information, and other Fund literature.

Enroll in abrdn’s email

services and be among the first to receive the latest closed-end fund news, announcements, videos, and other information. In addition, you can receive electronic versions of

| 2

| 2024 Semi-Annual Report

|

Letter to Shareholders (unaudited) (concluded)

important Fund documents, including annual

reports, semi-annual reports, prospectuses and proxy statements. Sign up today at https://www.abrdn.com/en-us/cefinvestorcenter/contact-us/preferences

Contact Us:

| •

| Visit: https://www.abrdn.com/en-us/cefinvestorcenter

|

| •

| Email: Investor.Relations@abrdn.com; or

|

| •

| Call: 1-800-522-5465 (toll free in the U.S.).

|

Yours sincerely,

/s/ Christian Pittard

Christian Pittard

President

{foots1}

All amounts are U.S. Dollars

unless otherwise stated.

| 2024 Semi-Annual Report

| 3

|

abrdn Global Dynamic Dividend Fund

Total Investment Return (unaudited)

The following table summarizes

the average annual Fund performance compared to the Fund’s primary benchmark for the six-month (not annualized), 1-year, 3-year, 5-year and 10-year periods ended April 30, 2024.

| AGD

| 6 Months

| 1 Year

| 3 Years

| 5 Years

| 10 Years

|

| Net Asset Value (NAV)

| 14.14%

| 7.00%

| 2.02%

| 7.80%

| 7.84%

|

| Market Price

| 15.53%

| 6.27%

| 0.44%

| 7.33%

| 7.43%

|

| MSCI AC World Index (Net DTR)

| 19.77%

| 17.46%

| 4.27%

| 9.44%

| 8.19%

|

Performance of a $10,000

Investment for AGD (as of April 30, 2024)

This graph shows the change in

value of a hypothetical investment of $10,000 in the Fund for the periods indicated. For comparison, the same investment is shown in the indicated index.

abrdn Investments Limited (the

"Adviser") assumed responsibility for the management of the Fund as investment adviser on May 7, 2018. Performance prior to this date reflects the performance of an unaffiliated investment adviser.

The Adviser entered into a

written contract with the Fund to waive fees or limit expenses. This contract may not be terminated before June 30, 2024. Absent such waivers and/or reimbursements, the Fund's returns would be lower. Additionally,

abrdn Inc. has entered into an agreement with the Fund to limit investor relations services fees, without which performance would be lower if the Fund's investor services fees exceeded such limit during the relevant

period. This agreement aligns with the term of the advisory agreement and may not be terminated prior to the end of the current term of the advisory agreement. See Note 3 in the Notes to Financial Statements.

Returns represent past

performance. Total investment return at NAV is based on changes in the NAV of Fund shares and assumes reinvestment of dividends and distributions, if any, at market prices pursuant to the dividend reinvestment program

sponsored by the Fund’s transfer agent. All return data at NAV includes fees charged to the Fund, which are listed in the Fund’s Statement of Operations under “Expenses.” Total investment

return at market value is based on changes in the market price at which the Fund’s shares traded on the NYSE during the period and assumes reinvestment of dividends and distributions, if any, at market prices

pursuant to the dividend reinvestment program sponsored by the Fund’s transfer agent. The Fund’s total investment return is based on the reported NAV as of the financial reporting period end date of April

30, 2024. Because the Fund’s shares trade in the stock market based on investor demand, the Fund may trade at a price higher or lower than its NAV. Therefore, returns are calculated based on both market price

and NAV. Past performance is no guarantee of future results. The performance information provided does not reflect the deduction of taxes that a shareholder would pay on distributions received

from the Fund. The current performance of the Fund may be lower or higher than the figures shown. The Fund’s yield, return, market price and NAV will fluctuate. Performance information current to the most recent

month-end is available at www.abrdnagd.com or by calling 800-522-5465.

The annualized net operating

expense ratio, excluding fee waivers, based on the six-month period ended April 30, 2024, was 1.28%. The annualized net operating expense ratio net of fee waivers based on the six-month period ended April 30, 2024 was

1.17%. The annualized net operating expense ratio, net of fee waivers and excluding interest expense based on the six-month period ended April 30, 2024, was 1.16%.

| 4

| 2024 Semi-Annual Report

|

abrdn Global Dynamic Dividend Fund

Portfolio Summary (as a percentage of net assets) (unaudited)

As of April 30, 2024

The following table summarizes

the sector composition of the Fund’s portfolio, in S&P Global Inc.’s Global Industry Classification Standard (“GICS”) Sectors. Industry allocation is shown below for any sector representing

more than 25% of net assets.

| Sectors-AGD

|

|

| Information Technology

| 20.1%

|

| Financials

| 17.8%

|

| Health Care

| 11.5%

|

| Industrials

| 9.8%

|

| Consumer Staples

| 9.5%

|

| Consumer Discretionary

| 9.1%

|

| Utilities

| 7.2%

|

| Energy

| 4.8%

|

| Materials

| 4.7%

|

| Communication Services

| 4.1%

|

| Real Estate

| 2.2%

|

| Short-Term Investment

| 0.6%

|

| Liabilities in Excess of Other Assets

| (1.4%)

|

|

| 100.0%

|

The

following table summarizes the composition of the Fund’s portfolio by geographic classification.

| Countries-AGD

|

|

| United States

| 61.4%

|

| France

| 10.0%

|

| United Kingdom

| 4.2%

|

| Netherlands

| 4.0%

|

| Germany

| 3.0%

|

| South Korea

| 2.1%

|

| Other, less than 2% each

| 16.1%

|

| Short-Term Investment

| 0.6%

|

| Liabilities in Excess of Other Assets

| (1.4%)

|

|

| 100.0%

|

The following were the

Fund’s top ten holdings as of April 30, 2024:

| Top Ten Holdings-AGD

|

|

| Microsoft Corp.

| 3.7%

|

| Apple, Inc.

| 3.4%

|

| Engie SA

| 3.0%

|

| Broadcom, Inc.

| 2.3%

|

| Danone SA

| 2.2%

|

| Alphabet, Inc.

| 2.2%

|

| Eli Lilly & Co.

| 1.6%

|

| Target Corp.

| 1.6%

|

| Coca-Cola Co.

| 1.6%

|

| Taiwan Semiconductor Manufacturing Co. Ltd.

| 1.5%

|

| 2024 Semi-Annual Report

| 5

|

Portfolio of Investments (unaudited)

As of April 30, 2024

abrdn Global Dynamic Dividend Fund

|

| Shares or

Principal

Amount

| Value

|

| COMMON STOCKS—99.5%

|

|

| AUSTRALIA—0.8%

|

| Materials—0.8%

|

|

|

|

| Rio Tinto PLC, ADR

|

| 32,500

| $ 2,204,475

|

| BRAZIL—1.6%

|

| Industrials—0.9%

|

|

|

|

| CCR SA

|

| 969,000

| 2,300,922

|

| Materials—0.7%

|

|

|

|

| Vale SA, ADR

|

| 161,500

| 1,965,455

|

| Total Brazil

|

| 4,266,377

|

| CANADA—1.4%

|

| Energy—1.4%

|

|

|

|

| Enbridge, Inc.(a)

|

| 107,300

| 3,813,442

|

| CHINA—1.7%

|

| Communication Services—0.9%

|

|

|

|

| Tencent Holdings Ltd.

|

| 56,700

| 2,488,177

|

| Financials—0.8%

|

|

|

|

| Ping An Insurance Group Co. of China Ltd., H Shares

|

| 435,700

| 1,974,627

|

| Total China

|

| 4,462,804

|

| DENMARK—1.1%

|

| Financials—1.1%

|

|

|

|

| Tryg AS

|

| 156,000

| 3,087,588

|

| FRANCE—10.0%

|

| Consumer Discretionary—1.0%

|

|

|

|

| LVMH Moet Hennessy Louis Vuitton SE

|

| 3,200

| 2,628,595

|

| Consumer Staples—3.1%

|

|

|

|

| Danone SA

|

| 95,700

| 5,989,608

|

| Pernod Ricard SA

|

| 15,600

| 2,359,377

|

|

|

|

| 8,348,985

|

| Energy—1.4%

|

|

|

|

| TotalEnergies SE, ADR(a)

|

| 50,900

| 3,688,723

|

| Financials—0.5%

|

|

|

|

| AXA SA

|

| 37,350

| 1,290,502

|

| Industrials—1.0%

|

|

|

|

| Bouygues SA

|

| 46,400

| 1,710,085

|

| Teleperformance SE(b)

|

| 11,800

| 1,068,900

|

|

|

|

| 2,778,985

|

| Utilities—3.0%

|

|

|

|

| Engie SA(b)

|

| 475,500

| 8,254,970

|

| Total France

|

| 26,990,760

|

| GERMANY—3.0%

|

| Consumer Discretionary—1.0%

|

|

|

|

| Mercedes-Benz Group AG

|

| 34,200

| 2,586,918

|

| Financials—1.0%

|

|

|

|

| Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen

|

| 6,300

| 2,770,794

|

| Utilities—1.0%

|

|

|

|

| RWE AG

|

| 81,900

| 2,853,030

|

| Total Germany

|

| 8,210,742

|

|

| Shares or

Principal

Amount

| Value

|

|

|

|

| HONG KONG—0.8%

|

| Financials—0.8%

|

|

|

|

| Hong Kong Exchanges & Clearing Ltd.

|

| 70,600

| $ 2,243,273

|

| ISRAEL—0.8%

|

| Energy—0.8%

|

|

|

|

| Energean PLC

|

| 154,400

| 2,129,953

|

| JAPAN—1.8%

|

| Financials—1.2%

|

|

|

|

| Mitsubishi UFJ Financial Group, Inc.

|

| 319,000

| 3,177,671

|

| Real Estate—0.6%

|

|

|

|

| GLP J-Reit

|

| 2,000

| 1,626,624

|

| Total Japan

|

| 4,804,295

|

| NETHERLANDS—4.0%

|

| Financials—1.2%

|

|

|

|

| ING Groep NV, Series N

|

| 208,000

| 3,288,535

|

| Information Technology—2.8%

|

|

|

|

| ASML Holding NV

|

| 4,600

| 4,006,659

|

| BE Semiconductor Industries NV

|

| 26,100

| 3,462,792

|

|

|

|

| 7,469,451

|

| Total Netherlands

|

| 10,757,986

|

| NORWAY—1.7%

|

| Communication Services—1.0%

|

|

|

|

| Telenor ASA

|

| 224,700

| 2,587,130

|

| Financials—0.7%

|

|

|

|

| DNB Bank ASA

|

| 109,425

| 1,907,184

|

| Total Norway

|

| 4,494,314

|

| SINGAPORE—1.3%

|

| Financials—1.3%

|

|

|

|

| Oversea-Chinese Banking Corp. Ltd.

|

| 342,000

| 3,550,495

|

| SOUTH KOREA—0.8%

|

| Materials—0.8%

|

|

|

|

| LG Chem Ltd.

|

| 7,100

| 2,040,172

|

| SPAIN—0.9%

|

| Consumer Discretionary—0.9%

|

|

|

|

| Amadeus IT Group SA

|

| 36,660

| 2,326,954

|

| SWEDEN—0.7%

|

| Industrials—0.7%

|

|

|

|

| Atlas Copco AB, A Shares

|

| 105,900

| 1,854,953

|

| TAIWAN—1.5%

|

| Information Technology—1.5%

|

|

|

|

| Taiwan Semiconductor Manufacturing Co. Ltd.

|

| 170,200

| 4,075,227

|

| UNITED KINGDOM—4.2%

|

| Consumer Discretionary—1.0%

|

|

|

|

| Taylor Wimpey PLC

|

| 1,585,300

| 2,597,708

|

| Financials—1.0%

|

|

|

|

| London Stock Exchange Group PLC

|

| 25,700

| 2,833,170

|

| Health Care—1.4%

|

|

|

|

| AstraZeneca PLC, ADR(a)

|

| 49,900

| 3,786,412

|

| Industrials—0.8%

|

|

|

|

| Melrose Industries PLC

|

| 260,200

| 2,044,217

|

| Total United Kingdom

|

| 11,261,507

|

See accompanying Notes to

Financial Statements.

| 6

| 2024 Semi-Annual Report

|

Portfolio of Investments (unaudited) (continued)

As of April 30, 2024

abrdn Global Dynamic Dividend Fund

|

| Shares or

Principal

Amount

| Value

|

| COMMON STOCKS (continued)

|

|

| UNITED STATES—61.4%

|

| Communication Services—2.2%

|

|

|

|

| Alphabet, Inc., Class C(a)(b)

|

| 36,000

| $ 5,927,040

|

| Consumer Discretionary—5.2%

|

|

|

|

| Aptiv PLC(a)(b)

|

| 24,400

| 1,732,400

|

| Genuine Parts Co.(a)

|

| 22,500

| 3,537,225

|

| Las Vegas Sands Corp.

|

| 35,400

| 1,570,344

|

| Lowe's Cos., Inc.(a)

|

| 16,100

| 3,670,639

|

| TJX Cos., Inc.(a)

|

| 37,400

| 3,518,966

|

|

|

|

| 14,029,574

|

| Consumer Staples—6.4%

|

|

|

|

| Coca-Cola Co.(a)

|

| 67,800

| 4,188,006

|

| Keurig Dr Pepper, Inc.

|

| 81,100

| 2,733,070

|

| Mondelez International, Inc., Class A(a)

|

| 43,000

| 3,093,420

|

| Nestle SA

|

| 28,810

| 2,892,528

|

| Target Corp.(a)

|

| 26,500

| 4,265,970

|

|

|

|

| 17,172,994

|

| Energy—1.2%

|

|

|

|

| Williams Cos., Inc.(a)

|

| 82,285

| 3,156,453

|

| Financials—8.2%

|

|

|

|

| Bank of America Corp.(a)

|

| 80,700

| 2,986,707

|

| Blackstone, Inc.

|

| 25,154

| 2,933,208

|

| CME Group, Inc.(a)

|

| 13,300

| 2,788,212

|

| Fidelity National Information Services, Inc.

|

| 43,339

| 2,943,585

|

| Goldman Sachs Group, Inc.

|

| 9,500

| 4,053,745

|

| JPMorgan Chase & Co.

|

| 20,900

| 4,007,366

|

| MetLife, Inc.

|

| 31,700

| 2,253,236

|

|

|

|

| 21,966,059

|

| Health Care—10.1%

|

|

|

|

| AbbVie, Inc.(a)

|

| 24,212

| 3,937,840

|

| Bristol-Myers Squibb Co.(a)

|

| 42,408

| 1,863,408

|

| CVS Health Corp.

|

| 37,100

| 2,512,041

|

| Eli Lilly & Co.(a)

|

| 5,700

| 4,452,270

|

| Medtronic PLC(a)

|

| 29,000

| 2,326,960

|

| Merck & Co., Inc.

|

| 29,100

| 3,760,302

|

| Roche Holding AG

|

| 11,010

| 2,638,152

|

| Sanofi SA

|

| 30,900

| 3,052,705

|

| UnitedHealth Group, Inc.(a)

|

| 5,592

| 2,704,850

|

|

|

|

| 27,248,528

|

| Industrials—6.4%

|

|

|

|

| FedEx Corp.(a)

|

| 13,500

| 3,534,030

|

| Ferrovial SE

|

| 76,000

| 2,733,368

|

| Norfolk Southern Corp.

|

| 11,200

| 2,579,584

|

| Schneider Electric SE

|

| 15,800

| 3,602,611

|

| Stanley Black & Decker, Inc.

|

| 22,800

| 2,083,920

|

| Waste Management, Inc.

|

| 13,400

| 2,787,468

|

|

|

|

| 17,320,981

|

| Information Technology—14.5%

|

|

|

|

| Accenture PLC, Class A

|

| 7,400

| 2,226,734

|

| Amdocs Ltd.

|

| 36,500

| 3,065,635

|

| Analog Devices, Inc.

|

| 18,100

| 3,631,041

|

| Apple, Inc.(a)

|

| 54,000

| 9,197,820

|

| Broadcom, Inc.(a)

|

| 4,726

| 6,145,076

|

| Cisco Systems, Inc.

|

| 63,600

| 2,987,928

|

|

| Shares or

Principal

Amount

| Value

|

|

|

|

|

|

| Microsoft Corp.(a)

|

| 25,626

| $ 9,976,971

|

| Oracle Corp.

|

| 16,800

| 1,911,000

|

|

|

|

| 39,142,205

|

| Materials—2.4%

|

|

|

|

| Linde PLC

|

| 8,300

| 3,659,995

|

| Newmont Corp.

|

| 67,800

| 2,755,392

|

|

|

|

| 6,415,387

|

| Real Estate—1.6%

|

|

|

|

| American Tower Corp., REIT

|

| 11,500

| 1,972,940

|

| Gaming & Leisure Properties, Inc., REIT(a)

|

| 53,991

| 2,307,035

|

|

|

|

| 4,279,975

|

| Utilities—3.2%

|

|

|

|

| CMS Energy Corp.

|

| 43,800

| 2,654,718

|

| FirstEnergy Corp.

|

| 59,600

| 2,285,064

|

| NextEra Energy Partners LP

|

| 46,300

| 1,313,068

|

| NextEra Energy, Inc.(a)

|

| 37,100

| 2,484,587

|

|

|

|

| 8,737,437

|

| Total United States

|

| 165,396,633

|

| Total Common Stocks

|

| 267,971,950

|

| CORPORATE BONDS—0.0%

|

|

| UNITED STATES—0.0%

|

| Diversified Financial Services—0.0%

|

|

|

|

| Fixed Income Pass-Through Trust, Class B, Series 2007 -C 0.00%, 01/15/2087(c)(d)

| $

| 500,000

| 500

|

| Total Corporate Bonds

|

| 500

|

| PREFERRED STOCKS—1.3%

|

|

| SOUTH KOREA—1.3%

|

| Information Technology—1.3%

|

|

|

|

| Samsung Electronics Co. Ltd.

|

| 75,400

| 3,520,509

|

| Total Preferred Stocks

|

| 3,520,509

|

| SHORT-TERM INVESTMENT—0.6%

|

|

| State Street Institutional U.S. Government Money Market Fund, Premier Class, 5.25%(e)

|

| 1,616,230

| 1,616,230

|

| Total Short-Term Investment

|

| 1,616,230

|

Total Investments

(Cost $232,818,458)(f)—101.4%

| 273,109,189

|

| Liabilities in Excess of Other Assets—(1.4%)

| (3,670,940)

|

| Net Assets—100.0%

| $269,438,249

|

| (a)

| All or a portion of the security has been designated as collateral for the line of credit.

|

| (b)

| Non-income producing security.

|

| (c)

| Denotes a security issued under Regulation S or Rule 144A.

|

| (d)

| Variable or Floating Rate security. Rate disclosed is as of April 30, 2024.

|

| (e)

| Registered investment company advised by State Street Global Advisors. The rate shown is the 7 day yield as of April 30, 2024.

|

| (f)

| See accompanying Notes to Financial Statements for tax unrealized appreciation/(depreciation) of securities.

|

| ADR

| American Depositary Receipt

|

| EUR

| Euro Currency

|

| PLC

| Public Limited Company

|

| REIT

| Real Estate Investment Trust

|

| USD

| U.S. Dollar

|

See Accompanying Notes to Financial

Statements.

| 2024 Semi-Annual Report

| 7

|

Portfolio of Investments (unaudited) (concluded)

As of April 30, 2024

abrdn Global Dynamic Dividend Fund

| At April 30, 2024, the Fund held the following forward foreign currency contracts:

|

Sale Contracts

Settlement Date

| Counterparty

| Currency

Purchased

| Amount

Purchased

| Currency

Sold

| Amount

Sold

| Fair Value

| Unrealized

Appreciation/

(Depreciation)

|

| United States Dollar/Euro

|

|

|

|

|

|

| 07/12/2024

| Citibank N.A.

| USD

| 21,155,099

| EUR

| 19,400,000

| $20,765,530

| $389,569

|

See Accompanying Notes to Financial

Statements.

| 8

| 2024 Semi-Annual Report

|

abrdn Total Dynamic Dividend Fund

Total Investment Return (unaudited)

The following table summarizes

the average annual Fund performance compared to the Fund’s primary benchmark for the six-month (not annualized), 1-year, 3-year, 5-year and 10-year periods ended April 30, 2024.

| AOD

| 6 Months

| 1 Year

| 3 Years

| 5 Years

| 10 Years

|

| Net Asset Value (NAV)

| 14.40%

| 6.86%

| 2.81%

| 8.01%

| 7.85%

|

| Market Price

| 14.29%

| 4.93%

| 1.06%

| 6.99%

| 7.78%

|

| MSCI AC World Index (Net DTR)

| 19.77%

| 17.46%

| 4.27%

| 9.44%

| 8.19%

|

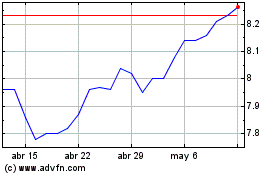

Performance of a $10,000

Investment for AOD (as of April 30, 2024)

This graph shows the change in

value of a hypothetical investment of $10,000 in the Fund for the periods indicated. For comparison, the same investment is shown in the indicated index.

abrdn Investments Limited (the

"Adviser") assumed responsibility for the management of the Fund as investment adviser on May 7, 2018. Performance prior to this date reflects the performance of an unaffiliated investment adviser.

The Adviser entered into a

written contract with the Fund to waive fees or limit expenses. This contract may not be terminated before June 30, 2024. Absent such waivers and/or reimbursements, the Fund's returns would be lower. Additionally,

abrdn Inc. has entered into an agreement with the Fund to limit investor relations services fees, without which performance would be lower if the Fund's investor services fees exceeded such limit during the relevant

period. This agreement aligns with the term of the advisory agreement and may not be terminated prior to the end of the current term of the advisory agreement. See Note 3 in the Notes to Financial Statements.

Returns represent past

performance. Total investment return at NAV is based on changes in the NAV of Fund shares and assumes reinvestment of dividends and distributions, if any, at market prices pursuant to the dividend reinvestment program

sponsored by the Fund’s transfer agent. All return data at NAV includes fees charged to the Fund, which are listed in the Fund’s Statement of Operations under “Expenses.” Total investment

return at market value is based on changes in the market price at which the Fund’s shares traded on the NYSE during the period and assumes reinvestment of dividends and distributions, if any, at market prices

pursuant to the dividend reinvestment program sponsored by the Fund’s transfer agent. The Fund’s total investment return is based on the reported NAV as of the financial reporting period end date of April

30, 2024. Because the Fund’s shares trade in the stock market based on investor demand, the Fund may trade at a price higher or lower than its NAV. Therefore, returns are calculated based on both market price

and NAV. Past performance is no guarantee of future results. The performance information provided does not reflect the deduction of taxes that a shareholder would pay on distributions received

from the Fund. The current performance of the Fund may be lower or higher than the figures shown. The Fund’s yield, return, market price and NAV will fluctuate. Performance information current to the most recent

month-end is available at www.abrdnaod.com or by calling 800-522-5465.

The annualized net operating

expense ratio, excluding fee waivers, based on the six-month period ended April 30, 2024, was 1.44%. The annualized net operating expense ratio net of fee waivers based on the six-month period ended April 30, 2024 was

1.34%. The annualized net operating expense ratio, net of fee waivers and excluding interest expense based on the six-month period ended April 30, 2024, was 1.14%.

| 2024 Semi-Annual Report

| 9

|

abrdn Total Dynamic Dividend Fund

Portfolio Summary (as a percentage of net assets) (unaudited)

As of April 30, 2024

The following table summarizes

the sector composition of the Fund’s portfolio, in S&P Global Inc.’s Global Industry Classification Standard (“GICS”) Sectors. Industry allocation is shown below for any sector representing

more than 25% of net assets.

| Sectors-AOD

|

|

| Information Technology

| 20.5%

|

| Financials

| 18.3%

|

| Health Care

| 11.9%

|

| Industrials

| 10.1%

|

| Consumer Staples

| 9.7%

|

| Consumer Discretionary

| 9.5%

|

| Utilities

| 7.7%

|

| Communication Services

| 5.2%

|

| Materials

| 4.7%

|

| Energy

| 4.2%

|

| Real Estate

| 2.3%

|

| Short-Term Investment

| 0.6%

|

| Liabilities in Excess of Other Assets

| (4.7%)

|

|

| 100.0%

|

The

following table summarizes the composition of the Fund’s portfolio by geographic classification.

| Countries-AOD

|

|

| United States

| 62.7%

|

| France

| 10.8%

|

| United Kingdom

| 4.3%

|

| Netherlands

| 4.1%

|

| Germany

| 3.2%

|

| South Korea

| 2.2%

|

| Other, less than 2% each

| 16.8%

|

| Short-Term Investment

| 0.6%

|

| Liabilities in Excess of Other Assets

| (4.7%)

|

|

| 100.0%

|

The following were the

Fund’s top ten holdings as of April 30, 2024:

| Top Ten Holdings-AOD

|

|

| Microsoft Corp.

| 3.6%

|

| Apple, Inc.

| 3.4%

|

| Engie SA

| 3.2%

|

| Broadcom, Inc.

| 2.3%

|

| Danone SA

| 2.3%

|

| Alphabet, Inc.

| 2.3%

|

| Eli Lilly & Co.

| 1.7%

|

| Taiwan Semiconductor Manufacturing Co. Ltd.

| 1.7%

|

| Coca-Cola Co.

| 1.6%

|

| Target Corp.

| 1.6%

|

| 10

| 2024 Semi-Annual Report

|

Portfolio of Investments (unaudited)

As of April 30, 2024

abrdn Total Dynamic Dividend Fund

|

| Shares

| Value

|

| COMMON STOCKS—102.7%

|

|

| AUSTRALIA—0.8%

|

| Materials—0.8%

|

|

|

|

| Rio Tinto PLC, ADR

|

| 119,900

| $ 8,132,817

|

| BRAZIL—1.6%

|

| Industrials—0.9%

|

|

|

|

| CCR SA

|

| 3,650,100

| 8,667,283

|

| Materials—0.7%

|

|

|

|

| Vale SA, ADR

|

| 608,400

| 7,404,228

|

| Total Brazil

|

| 16,071,511

|

| CANADA—1.5%

|

| Energy—1.5%

|

|

|

|

| Enbridge, Inc.(a)

|

| 414,500

| 14,731,330

|

| CHINA—1.7%

|

| Communication Services—1.0%

|

|

|

|

| Tencent Holdings Ltd.

|

| 220,200

| 9,663,077

|

| Financials—0.7%

|

|

|

|

| Ping An Insurance Group Co. of China Ltd., H Shares

|

| 1,652,900

| 7,491,074

|

| Total China

|

| 17,154,151

|

| DENMARK—1.2%

|

| Financials—1.2%

|

|

|

|

| Tryg AS

|

| 584,900

| 11,576,474

|

| FRANCE—10.8%

|

| Consumer Discretionary—1.1%

|

|

|

|

| LVMH Moet Hennessy Louis Vuitton SE

|

| 12,900

| 10,596,525

|

| Consumer Staples—3.2%

|

|

|

|

| Danone SA

|

| 363,300

| 22,737,979

|

| Pernod Ricard SA

|

| 62,000

| 9,377,011

|

|

|

|

| 32,114,990

|

| Energy—1.5%

|

|

|

|

| TotalEnergies SE, ADR(a)

|

| 204,200

| 14,798,374

|

| Financials—0.7%

|

|

|

|

| AXA SA

|

| 212,550

| 7,343,937

|

| Industrials—1.1%

|

|

|

|

| Bouygues SA

|

| 176,133

| 6,491,433

|

| Teleperformance SE(b)

|

| 44,600

| 4,040,079

|

|

|

|

| 10,531,512

|

| Utilities—3.2%

|

|

|

|

| Engie SA(b)

|

| 1,805,300

| 31,341,108

|

| Total France

|

| 106,726,446

|

| GERMANY—3.2%

|

| Consumer Discretionary—1.0%

|

|

|

|

| Mercedes-Benz Group AG

|

| 126,400

| 9,561,008

|

| Financials—1.1%

|

|

|

|

| Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen

|

| 24,000

| 10,555,406

|

| Utilities—1.1%

|

|

|

|

| RWE AG

|

| 323,500

| 11,269,295

|

| Total Germany

|

| 31,385,709

|

| HONG KONG—0.9%

|

| Financials—0.9%

|

|

|

|

| Hong Kong Exchanges & Clearing Ltd.

|

| 266,500

| 8,467,880

|

|

| Shares

| Value

|

|

|

|

| JAPAN—1.8%

|

| Financials—1.2%

|

|

|

|

| Mitsubishi UFJ Financial Group, Inc.

|

| 1,169,700

| $ 11,651,792

|

| Real Estate—0.6%

|

|

|

|

| GLP J-Reit

|

| 7,600

| 6,181,172

|

| Total Japan

|

| 17,832,964

|

| NETHERLANDS—4.1%

|

| Financials—1.3%

|

|

|

|

| ING Groep NV, Series N

|

| 789,100

| 12,475,880

|

| Information Technology—2.8%

|

|

|

|

| ASML Holding NV

|

| 16,800

| 14,633,014

|

| BE Semiconductor Industries NV

|

| 102,500

| 13,599,087

|

|

|

|

| 28,232,101

|

| Total Netherlands

|

| 40,707,981

|

| NORWAY—1.8%

|

| Communication Services—1.1%

|

|

|

|

| Telenor ASA

|

| 890,530

| 10,253,301

|

| Financials—0.7%

|

|

|

|

| DNB Bank ASA

|

| 415,125

| 7,235,273

|

| Total Norway

|

| 17,488,574

|

| SINGAPORE—1.4%

|

| Financials—1.4%

|

|

|

|

| Oversea-Chinese Banking Corp. Ltd.

|

| 1,298,471

| 13,480,160

|

| SOUTH KOREA—0.8%

|

| Materials—0.8%

|

|

|

|

| LG Chem Ltd.

|

| 27,100

| 7,787,136

|

| SPAIN—1.7%

|

| Communication Services—0.8%

|

|

|

|

| Cellnex Telecom SA(b)(c)

|

| 241,800

| 7,992,626

|

| Consumer Discretionary—0.9%

|

|

|

|

| Amadeus IT Group SA

|

| 138,600

| 8,797,486

|

| Total Spain

|

| 16,790,112

|

| SWEDEN—0.7%

|

| Industrials—0.7%

|

|

|

|

| Atlas Copco AB, A Shares

|

| 404,400

| 7,083,504

|

| TAIWAN—1.7%

|

| Information Technology—1.7%

|

|

|

|

| Taiwan Semiconductor Manufacturing Co. Ltd.

|

| 676,600

| 16,200,344

|

| UNITED KINGDOM—4.3%

|

| Consumer Discretionary—1.0%

|

|

|

|

| Taylor Wimpey PLC

|

| 5,888,400

| 9,648,865

|

| Financials—1.1%

|

|

|

|

| London Stock Exchange Group PLC

|

| 98,400

| 10,847,624

|

| Health Care—1.5%

|

|

|

|

| AstraZeneca PLC, ADR

|

| 192,300

| 14,591,724

|

| Industrials—0.7%

|

|

|

|

| Melrose Industries PLC

|

| 968,800

| 7,611,212

|

| Total United Kingdom

|

| 42,699,425

|

| UNITED STATES—62.7%

|

| Communication Services—2.3%

|

|

|

|

| Alphabet, Inc., Class C(a)(b)

|

| 136,200

| 22,423,968

|

| Consumer Discretionary—5.5%

|

|

|

|

| Aptiv PLC(a)(b)

|

| 91,100

| 6,468,100

|

See accompanying Notes to

Financial Statements.

| 2024 Semi-Annual Report

| 11

|

Portfolio of Investments (unaudited) (continued)

As of April 30, 2024

abrdn Total Dynamic Dividend Fund

|

| Shares

| Value

|

| COMMON STOCKS (continued)

|

|

| UNITED STATES (continued)

|

| Genuine Parts Co.(a)

|

| 86,200

| $ 13,551,502

|

| Las Vegas Sands Corp.

|

| 138,600

| 6,148,296

|

| Lowe's Cos., Inc.(a)

|

| 63,100

| 14,386,169

|

| TJX Cos., Inc.(a)

|

| 143,600

| 13,511,324

|

|

|

|

| 54,065,391

|

| Consumer Staples—6.5%

|

|

|

|

| Coca-Cola Co.

|

| 260,700

| 16,103,439

|

| Keurig Dr Pepper, Inc.

|

| 303,500

| 10,227,950

|

| Mondelez International, Inc., Class A(a)

|

| 154,200

| 11,093,148

|

| Nestle SA

|

| 104,800

| 10,521,937

|

| Target Corp.(a)

|

| 99,800

| 16,065,804

|

|

|

|

| 64,012,278

|

| Energy—1.2%

|

|

|

|

| Williams Cos., Inc.

|

| 304,000

| 11,661,440

|

| Financials—8.0%

|

|

|

|

| Bank of America Corp.(a)

|

| 306,700

| 11,350,967

|

| Blackstone, Inc.

|

| 97,800

| 11,404,458

|

| CME Group, Inc.

|

| 50,700

| 10,628,748

|

| Fidelity National Information Services, Inc.

|

| 148,900

| 10,113,288

|

| Goldman Sachs Group, Inc.

|

| 34,800

| 14,849,508

|

| JPMorgan Chase & Co.

|

| 77,300

| 14,821,502

|

| MetLife, Inc.

|

| 81,000

| 5,757,480

|

|

|

|

| 78,925,951

|

| Health Care—10.4%

|

|

|

|

| AbbVie, Inc.(a)

|

| 88,200

| 14,344,848

|

| Bristol-Myers Squibb Co.(a)

|

| 162,900

| 7,157,826

|

| CVS Health Corp.

|

| 139,300

| 9,432,003

|

| Eli Lilly & Co.

|

| 21,600

| 16,871,760

|

| Medtronic PLC(a)

|

| 118,900

| 9,540,536

|

| Merck & Co., Inc.

|

| 110,900

| 14,330,498

|

| Roche Holding AG

|

| 41,400

| 9,920,027

|

| Sanofi SA

|

| 118,593

| 11,716,165

|

| UnitedHealth Group, Inc.(a)

|

| 20,300

| 9,819,110

|

|

|

|

| 103,132,773

|

| Industrials—6.7%

|

|

|

|

| FedEx Corp.(a)

|

| 51,800

| 13,560,204

|

| Ferrovial SE

|

| 292,000

| 10,501,886

|

| Norfolk Southern Corp.(a)

|

| 39,400

| 9,074,608

|

| Schneider Electric SE

|

| 62,800

| 14,319,240

|

| Stanley Black & Decker, Inc.

|

| 87,400

| 7,988,360

|

| Waste Management, Inc.

|

| 50,300

| 10,463,406

|

|

|

|

| 65,907,704

|

| Information Technology—14.6%

|

|

|

|

| Accenture PLC, Class A

|

| 27,500

| 8,275,025

|

| Amdocs Ltd.

|

| 142,100

| 11,934,979

|

| Analog Devices, Inc.

|

| 68,600

| 13,761,846

|

| Apple, Inc.(a)

|

| 196,600

| 33,486,878

|

|

| Shares

| Value

|

|

|

|

|

|

| Broadcom, Inc.(a)

|

| 17,500

| $ 22,754,725

|

| Cisco Systems, Inc.(a)

|

| 245,300

| 11,524,194

|

| Microsoft Corp.(a)

|

| 90,900

| 35,390,097

|

| Oracle Corp.

|

| 63,200

| 7,189,000

|

|

|

|

| 144,316,744

|

| Materials—2.4%

|

|

|

|

| Linde PLC

|

| 30,800

| 13,581,667

|

| Newmont Corp.

|

| 262,300

| 10,659,872

|

|

|

|

| 24,241,539

|

| Real Estate—1.7%

|

|

|

|

| American Tower Corp., REIT

|

| 46,400

| 7,960,384

|

| Gaming & Leisure Properties, Inc., REIT

|

| 206,800

| 8,836,564

|

|

|

|

| 16,796,948

|

| Utilities—3.4%

|

|

|

|

| CMS Energy Corp.(a)

|

| 156,000

| 9,455,160

|

| FirstEnergy Corp.(a)

|

| 238,000

| 9,124,920

|

| NextEra Energy Partners LP

|

| 177,800

| 5,042,408

|

| NextEra Energy, Inc.(a)

|

| 146,000

| 9,777,620

|

|

|

|

| 33,400,108

|

| Total United States

|

| 618,884,844

|

| Total Common Stocks

|

| 1,013,201,362

|

| PREFERRED STOCKS—1.4%

|

|

| SOUTH KOREA—1.4%

|

| Information Technology—1.4%

|

|

|

|

| Samsung Electronics Co. Ltd.

|

| 288,800

| 13,484,389

|

| Total Preferred Stocks

|

| 13,484,389

|

| SHORT-TERM INVESTMENT—0.6%

|

|

| State Street Institutional U.S. Government Money Market Fund, Premier Class, 5.25%(d)

|

| 6,062,282

| 6,062,282

|

| Total Short-Term Investment

|

| 6,062,282

|

Total Investments

(Cost $807,106,433)(e)—104.7%

| 1,032,748,033

|

| Liabilities in Excess of Other Assets—(4.7%)

| (46,235,092)

|

| Net Assets—100.0%

| $986,512,941

|

| (a)

| All or a portion of the security has been designated as collateral for the line of credit.

|

| (b)

| Non-income producing security.

|

| (c)

| Denotes a security issued under Regulation S or Rule 144A.

|

| (d)

| Registered investment company advised by State Street Global Advisors. The rate shown is the 7 day yield as of April 30, 2024.

|

| (e)

| See accompanying Notes to Financial Statements for tax unrealized appreciation/(depreciation) of securities.

|

| ADR

| American Depositary Receipt

|

| PLC

| Public Limited Company

|

| REIT

| Real Estate Investment Trust

|

See Accompanying Notes to Financial

Statements.

| 12

| 2024 Semi-Annual Report

|

Portfolio of Investments (unaudited) (concluded)

As of April 30, 2024

abrdn Total Dynamic Dividend Fund

| At April 30, 2024, the Fund held the following forward foreign currency contracts:

|

Sale Contracts

Settlement Date

| Counterparty

| Currency

Purchased

| Amount

Purchased

| Currency

Sold

| Amount

Sold

| Fair Value

| Unrealized

Appreciation/

(Depreciation)

|

| United States Dollar/Euro

|

|

|

|

|

|

| 07/12/2024

| Citibank N.A.

| USD

| 80,149,472

| EUR

| 73,500,000

| $78,673,529

| $1,475,943

|

See Accompanying Notes to Financial

Statements.

| 2024 Semi-Annual Report

| 13

|

Statement of Assets and Liabilities (unaudited)

April 30, 2024

| Assets

| abrdn

Global Dynamic

Dividend Fund

| abrdn

Total Dynamic

Dividend Fund

|

| Investments, at value

| $ 271,492,959

| $ 1,026,685,751

|

| Short-term investments, at value

| 1,616,230

| 6,062,282

|

| Foreign currency, at value

| 966,437

| 4,114,618

|

| Receivable for investments sold

| 7,692,658

| 31,681,896

|

| Interest and dividends receivable

| 2,234,225

| 8,412,161

|

| Unrealized appreciation on forward foreign currency exchange contracts

| 389,569

| 1,475,943

|

| Tax reclaim receivable

| 1,281,187

| 4,905,047

|

| Prepaid expenses

| 13,196

| 53,301

|

| Other assets

| 42,701

| —

|

| Total assets

| 285,729,162

| 1,083,390,999

|

| Liabilities

|

|

|

| Payable for investments purchased

| 7,933,393

| 32,303,367

|

| Line of credit payable (Note 7)

| 7,908,278

| 63,133,712

|

| Investment management fees payable (Note 3)

| 199,805

| 757,449

|

| Investor relations fees payable (Note 3)

| 30,753

| 81,176

|

| Administration fees payable (Note 3)

| 17,872

| 65,475

|

| Interest payable on line of credit

| 12,819

| 198,248

|

| Due to custodian

| 938

| 84,394

|

| Other accrued expenses

| 187,055

| 254,237

|

| Total liabilities

| 16,290,913

| 96,878,058

|

|

|

| Net Assets

| $269,438,249

| $986,512,941

|

| Cost:

|

|

|

| Investments

| 231,202,228

| 801,044,151

|

| Short-Term Investments

| 1,616,230

| 6,062,282

|

| Foreign currency, at cost

| 969,362

| 4,121,236

|

| Composition of Net Assets

|

|

|

| Paid-in capital in excess of par

| 270,690,204

| 990,459,099

|

| Distributable accumulated loss

| (1,251,955)

| (3,946,158)

|

| Net Assets

| $269,438,249

| $986,512,941

|

| Net asset value per share

| $10.84

| $9.36

|

| Shares issued and outstanding

| 24,865,081

| 105,430,999

|

Amounts listed as

“–” are $0 or round to $0.

See Accompanying Notes to Financial

Statements.

| 14

| 2024 Semi-Annual Report

|

Statement of Operations (unaudited)

For the Six-Months Ended April 30, 2024

|

| abrdn

Global Dynamic

Dividend Fund

| abrdn

Total Dynamic

Dividend Fund

|

| Net Investment Income

|

|

|

| Investment Income:

|

|

|

| Dividends

| $ 9,891,170

| $ 36,959,776

|

| Interest and other income

| 44,570

| —

|

| Foreign taxes withheld

| (860,925)

| (3,240,387)

|

| Total investment income

| 9,074,815

| 33,719,389

|

| Expenses:

|

|

|

| Investment management fee (Note 3)

| 1,344,369

| 5,081,964

|

| Administration fee (Note 3)

| 107,549

| 394,530

|

| Reports to shareholders and proxy solicitation

| 43,557

| 87,654

|

| Investor relations fees and expenses (Note 3)

| 38,153

| 123,054

|

| Custodian’s fees and expenses

| 37,877

| 71,479

|

| Trustees' fees and expenses

| 34,028

| 64,530

|

| Legal fees and expenses

| 28,350

| 109,716

|

| Independent auditors’ fees and tax expenses

| 22,929

| 38,593

|

| Transfer agent’s fees and expenses

| 8,776

| 8,523

|

| Miscellaneous

| 37,013

| 106,150

|

| Total operating expenses, excluding interest expense

| 1,702,601

| 6,086,193

|

| Interest expense (Note 7)

| 16,858

| 993,219

|

| Total operating expenses before reimbursed/waived expenses

| 1,719,459

| 7,079,412

|

| Expenses waived (Note 3)

| (143,132)

| (464,137)

|

| Net expenses

| 1,576,327

| 6,615,275

|

|

|

| Net Investment Income

| 7,498,488

| 27,104,114

|

| Net Realized/Unrealized Gain/(Loss) from Investments and Foreign Currency Related Transactions:

|

|

|

| Net realized gain/(loss) from:

|

|

|

| Investments (Note 2h)

| (6,274,058)

| (16,829,772)

|

| Forward foreign currency exchange contracts

| (335,795)

| (1,271,193)

|

| Foreign currency transactions

| (6,502)

| (16,046)

|

|

| (6,616,355)

| (18,117,011)

|

| Net change in unrealized appreciation/(depreciation) on:

|

|

|

| Investments (Note 2h)

| 31,713,449

| 112,377,902

|

| Forward foreign currency exchange contracts

| 326,752

| 1,236,467

|

| Foreign currency translation

| (5,071)

| 20,739

|

|

| 32,035,130

| 113,635,108

|

| Net realized and unrealized gain from investments, forward foreign currency exchange

contracts and foreign currencies

| 25,418,775

| 95,518,097

|

| Change in Net Assets Resulting from Operations

| $32,917,263

| $122,622,211

|

Amounts listed as

“–” are $0 or round to $0.

See Accompanying Notes to Financial

Statements.

| 2024 Semi-Annual Report

| 15

|

Statements of Changes in Net Assets

|

| abrdn Global Dynamic Dividend Fund

| abrdn Total Dynamic Dividend Fund

|

|

| For the

Six-Month

Period Ended

April 30, 2024

(unaudited)

| For the

Year Ended

October 31, 2023

| For the

Six-Month

Period Ended

April 30, 2024

(unaudited)

| For the

Year Ended

October 31, 2023

|

| Increase/(Decrease) in Net Assets:

|

|

|

|

|

| Operations:

|

|

|

|

|

| Net investment income

| $7,498,488

| $15,320,734

| $27,104,114

| $61,514,810

|

| Net realized gain from investments, forward foreign currency exchange contracts and foreign currency transactions

| (6,616,355)

| (7,510,274)

| (18,117,011)

| (28,051,167)

|

| Net change in unrealized appreciation on investments, forward foreign currency

exchange contracts and foreign currency translation

| 32,035,130

| (855,823)

| 113,635,108

| 31,509,278

|

| Net increase in net assets resulting from operations

| 32,917,263

| 6,954,637

| 122,622,211

| 64,972,921

|

| Distributions to Shareholders From:

|

|

|

|

|

| Distributable earnings

| (9,697,382)

| (15,666,124)

| (36,373,695)

| (63,774,379)

|

| Return of capital

| –

| (526,610)

| –

| (8,973,011)

|

| Net increase in net assets from distributions

| (9,697,382)

| (16,192,734)

| (36,373,695)

| (72,747,390)

|

| Proceeds from shares issued from the reorganization resulting in the addition of 0,

12,315,499, 0 and 0 shares of common stock, respectively (Note 11)

| –

| 129,362,047

| –

| –

|

| Change in net assets

| 23,219,881

| 120,123,950

| 86,248,516

| (7,774,469)

|

| Net Assets:

|

|

|

|

|

| Beginning of period

| 246,218,368

| 126,094,418

| 900,264,425

| 908,038,894

|

| End of period

| $269,438,249

| $246,218,368

| $986,512,941

| $900,264,425

|

Amounts listed as

“–” are $0 or round to $0.

See Accompanying Notes to Financial

Statements.

| 16

| 2024 Semi-Annual Report

|

abrdn Global Dynamic Dividend

Fund

|

| For the

Six-Month

Period Ended

April 30,

| For the Fiscal Years Ended October 31,

|

|

| 2024

(unaudited)

| 2023

| 2022

| 2021

| 2020

| 2019

|

| PER SHARE OPERATING PERFORMANCE(a):

|

|

|

|

|

|

|

| Net asset value, beginning of period

| $9.90

| $10.05

| $12.95

| $10.16

| $11.14

| $10.80

|

| Net investment income

| 0.30

| 0.75

| 0.68

| 0.82

| 0.70

| 0.76

|

| Net realized and unrealized gains/(losses) on investments, forward

foreign currency exchange contracts and foreign currency transactions

| 1.03

| (0.12)

| (2.80)

| 2.75

| (0.90)

| 0.36

|

| Total from investment operations

| 1.33

| 0.63

| (2.12)

| 3.57

| (0.20)

| 1.12

|

| Distributions to common shareholders from:

|

|

|

|

|

|

|

| Net investment income

| (0.39)

| (0.75)

| (0.73)

| (0.78)

| (0.76)

| (0.78)

|

| Return of capital

| –

| (0.03)

| (0.05)

| –

| (0.02)

| –

|

| Total distributions

| (0.39)

| (0.78)

| (0.78)

| (0.78)

| (0.78)

| (0.78)

|

| Net asset value, end of period

| $10.84

| $9.90

| $10.05

| $12.95

| $10.16

| $11.14

|

| Market price, end of period

| $9.31

| $8.40

| $8.92

| $12.01

| $8.58

| $9.78

|

| Total Investment Return Based on(b):

|

|

|

|

|

|

|

| Market price

| 15.53%

| 2.29%

| (19.88%)

| 49.84%

| (4.43%)

| 14.71%

|

| Net asset value

| 14.14%

| 7.00%

| (16.28%)

| 36.44%

| (0.65%)

| 11.91%

|

| Ratio to Average Net Assets Applicable to Common Shareholders/Supplementary Data:

|

|

|

|

|

|

|

| Net assets applicable to common shareholders, end of period (000 omitted)

| $269,438

| $246,218

| $126,094

| $162,528

| $127,512

| $139,776

|

| Average net assets applicable to common shareholders (000 omitted)

| $270,351

| $219,791

| $146,601

| $157,694

| $132,667

| $134,835

|

| Net operating expenses, net of fee waivers

| 1.17%(c)

| 1.19%

| 1.18%

| 1.18%

| 1.18%

| 1.21%

|

| Net operating expenses, excluding fee waivers

| 1.28%(c)

| 1.34%

| 1.37%

| 1.31%

| 1.36%

| 1.34%

|

Net operating expenses, net of fee waivers and

excluding interest expense

| 1.16%(c)

| 1.19%

| 1.16%

| 1.17%

| 1.17%

| 1.16%

|

| Net Investment income

| 5.58%(c)

| 6.97%

| 5.86%

| 6.56%

| 6.59%

| 7.06%

|

| Portfolio turnover

| 47%(d)

| 78%(e)

| 81%

| 71%

| 105%

| 119%

|

| Line of credit payable outstanding (000 omitted)

| $7,908

| $1,537

| $–

| $311

| $–

| $211

|

| Asset coverage ratio on revolving credit facility at period end(f)

| 3,507%

| 16,121%

| –

| 52,338%

| –

| 66,335%

|

| Asset coverage per $1,000 on line of credit payable at period end

| $35,070

| $161,213

| $–

| $523,384

| $–

| $663,350

|

| (a)

| Based on average shares outstanding.Amounts listed as “–” are $0 or round to $0.

|

| 2024 Semi-Annual Report

| 17

|

Financial Highlights (concluded)

abrdn Global Dynamic Dividend

Fund (concluded)

| (b)

| Total investment return is calculated assuming a purchase of common stock on the first day and a sale on the last day of each reporting period. Dividends and distributions, if any, are assumed, for

purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment return does not reflect brokerage commissions.

|

| (c)

| Annualized.

|

| (d)

| Not annualized.

|

| (e)

| The portfolio turnover calculation excludes $100,050,254 and $90,865,012 of proceeds received and cost of investments related to rebalancing the portfolio after the

fund reorganization which occurred on March 10, 2023.

|

| (f)

| Asset coverage ratio is calculated by dividing net assets plus the amount of any borrowings for investment purposes by the amount of the Line of Credit.

|

Amounts listed as

“–” are $0 or round to $0.

| 18

| 2024 Semi-Annual Report

|

abrdn Total Dynamic Dividend

Fund

|

| For the

Six-Month

Period Ended

April 30,

| For the Fiscal Years Ended October 31,

|

|

| 2024

(unaudited)

| 2023

| 2022

| 2021

| 2020

| 2019

|

| PER SHARE OPERATING PERFORMANCE(a):

|

|

|

|

|

|

|

| Net asset value, beginning of period

| $8.54

| $8.61

| $10.98

| $8.76

| $9.56

| $9.33

|

| Net investment income

| 0.26

| 0.58

| 0.63

| 0.66

| 0.63

| 0.64

|

| Net realized and unrealized gains/(losses) on investments, forward

foreign currency exchange contracts and foreign currency transactions

| 0.91

| 0.04

| (2.31)

| 2.25

| (0.74)

| 0.27

|

| Total from investment operations

| 1.17

| 0.62

| (1.68)

| 2.91

| (0.11)

| 0.91

|

| Distributions to common shareholders from:

|

|

|

|

|

|

|

| Net investment income

| (0.35)

| (0.60)

| (0.69)

| (0.69)

| (0.67)

| (0.65)

|

| Return of capital

| –

| (0.09)

| –

| –

| (0.02)

| (0.04)

|

| Total distributions

| (0.35)

| (0.69)

| (0.69)

| (0.69)

| (0.69)

| (0.69)

|

| Capital Share Transactions:

|

|

|

|

|

|

|

| Anti-Dilutive effect of share repurchase program

| –

| –

| –

| –

| –

| 0.01

|

| Net asset value, end of period

| $9.36

| $8.54

| $8.61

| $10.98

| $8.76

| $9.56

|

| Market price, end of period

| $7.95

| $7.26

| $7.50

| $10.05

| $7.31

| $8.44

|

| Total Investment Return Based on(b):

|

|

|

|

|

|

|

| Market price

| 14.29%

| 5.41%

| (19.25%)

| 47.64%

| (5.47%)

| 15.55%

|

| Net asset value

| 14.40%

| 8.01%

| (15.15%)

| 34.60%(c)

| 0.00%(c)

| 11.39%

|

| Ratio to Average Net Assets Applicable to Common Shareholders/Supplementary Data:

|

|

|

|

|

|

|

| Net assets applicable to common shareholders, end of period (000 omitted)

| $986,513

| $900,264

| $908,039

| $1,157,523

| $924,011

| $1,007,850

|

| Average net assets applicable to common shareholders (000 omitted)

| $991,745

| $977,703

| $1,049,849

| $1,129,413

| $964,667

| $981,093

|

| Net operating expenses, net of fee waivers

| 1.34%(d)

| 1.27%

| 1.16%

| 1.16%

| 1.15%

| 1.22%

|

| Net operating expenses, excluding fee waivers

| 1.44%(d)

| 1.36%

| 1.21%

| 1.20%

| 1.18%

| 1.24%

|

Net operating expenses, net of fee waivers and

excluding interest expense

| 1.14%(d)

| 1.15%

| 1.14%

| 1.14%

| 1.14%

| 1.18%

|

| Net Investment income

| 5.50%(d)

| 6.29%

| 6.36%

| 6.14%

| 6.93%

| 6.94%

|

| Portfolio turnover

| 47%(e)

| 79%

| 83%

| 72%

| 115%

| 135%

|

| Line of credit payable outstanding (000 omitted)

| $63,134

| $49,052

| $12,250

| $4,092

| $–

| $–

|

| Asset coverage ratio on line of credit payable at period end(f)

| 1,663%

| 1,935%

| 7,512%

| 28,385%

| –

| –

Amounts listed as “–” are $0 or round to $0.

|

| 2024 Semi-Annual Report

| 19

|

Financial Highlights (concluded)

abrdn Total Dynamic Dividend

Fund (concluded)

|

| For the

Six-Month

Period Ended

April 30,

| For the Fiscal Years Ended October 31,

|

|

| 2024

(unaudited)

| 2023

| 2022

| 2021

| 2020

| 2019

|

| Asset coverage per $1,000 on line of credit payable at period end

| $16,626

| $19,353

| $75,124

| $283,852

| $–

| $–

|

| (a)

| Based on average shares outstanding.

|

| (b)

| Total investment return is calculated assuming a purchase of common stock on the first day and a sale on the last day of each reporting period. Dividends and distributions, if any, are assumed, for

purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment return does not reflect brokerage commissions.

|

| (c)

| The total return shown above includes the impact of financial statement rounding of the NAV per share and/or financial statement adjustments.

|

| (d)

| Annualized.

|

| (e)

| Not annualized.

|

| (f)

| Asset coverage ratio is calculated by dividing net assets plus the amount of any borrowings for investment purposes by the amount of the Line of Credit.

|

Amounts listed as

“–” are $0 or round to $0.

| 20

| 2024 Semi-Annual Report

|

Notes to Financial Statements (unaudited)

April 30, 2024

abrdn Global Dynamic

Dividend Fund ("AGD") and abrdn Global Total Dynamic Dividend Fund ("AOD") (collectively, the “Funds" and each a "Fund") are diversified, closed-end management investment companies. AGD and AOD were organized as

a Delaware statutory trusts on May 11, 2006 and October 27, 2006, and commenced operations on July 26, 2006 and January 26, 2007, respectively. The primary investment objective for AGD is to seek high current dividend

income, more than 50% of which qualifies for the reduced federal income tax rates created by the Jobs and Growth Tax Relief Reconciliation Act of 2003. The primary investment objective for AOD is to seek high

current dividend income. The Funds also focus on long-term growth of capital as a secondary investment objective. The Board of Trustees of each Fund (each a "Board" and collectively, the "Boards") authorized an

unlimited number of shares with no par value.

On March 10, 2023, AGD

acquired the assets and assumed the liabilities of Delaware Enhanced Global Dividend and Income Fund ("DEX") and Delaware Investments® Dividend and Income Fund, Inc. ("DDF") pursuant to plans of reorganization

approved by the Board of AGD on August 11, 2022 ("Reorganizations"). In the Reorganizations, common shareholders of DEX and DDF received an amount of AGD common shares with a net asset value equal to the aggregate net

asset value of their holdings of DEX and DDF common shares, as determined at the close of regular business on March 10, 2023. Any applicable fractional shares were paid as cash-in-lieu to the applicable holder. The

Reorganizations were each structured as a tax-free transaction. The Fund is considered the tax survivor and accounting survivor of the Reorganizations.

The following is a summary of

the net asset value (“NAV”) per share issued as of March 10, 2023.

| Acquired Fund

| AGD NAV per

Share ($) March 10, 2023

| Conversion Ratio

| Shares Issued

|

Delaware Enhanced Global Dividend

and Income Fund (“DEX”)

| 10.5040

| 0.835659

| 6,212,854

|

Delaware Investments® Dividend and

Income Fund, Inc. (“DDF”)

| 10.5040

| 0.801802

| 6,102,645

|

2. Summary of Significant

Accounting Policies

The Funds are investment companies and

accordingly follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board ("FASB") Accounting Standards Codification Topic 946 Financial Services-Investment Companies. The

following is a summary of significant accounting policies followed by the Funds in the preparation of their financial statements. The policies conform to generally accepted accounting principles ("GAAP") in the United

States of America. The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and

liabilities at the date of the financial statements, and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The accounting records of the Funds are maintained

in U.S. Dollars and the U.S. Dollar is used as both the functional and reporting currency.

a. Security Valuation:

The Funds value their

securities at current market value or fair value, consistent with regulatory requirements. "Fair value" is defined in the Funds' Valuation and Liquidity Procedures as the price that could be received to sell an asset

or paid to transfer a liability in an orderly transaction between willing market participants without a compulsion to transact at the measurement date. Pursuant to Rule 2a-5 under the Investment Company Act of 1940,

as amended (the "1940 Act"), the

Board designated abrdn Investments Limited