(CUSIP NOS. 03965U AC4 / G0457F AC1; ISINs

US03965UAC45 / USG0457FAC17)

Arcos Dorados Holdings Inc. (NYSE: ARCO) (“Arcos Dorados” or the

“Company”) today announced that it has extended the expiration

deadline of its previously announced offer to purchase for cash any

and all of its outstanding 5.875% Notes due 2027 (the “Notes”) (the

“Offer”).

The Offer was previously scheduled to expire at 8:00 a.m., New

York City time, on January 23, 2025 and will instead expire at 5:00

p.m., New York City time, on January 23, 2025 (the “Expiration

Time”), unless further extended or early terminated by Arcos

Dorados. If a holder of a Note has already validly tendered and not

validly withdrawn Notes pursuant to the original Offer, such holder

of Notes is not required to take any further action with respect to

such Notes and such tender constitutes a valid tender for purposes

of the Offer, as amended by this press release.

As of 8:00 a.m., New York City time, on January 23, 2025,

$130,115,000 in aggregate principal amount of Notes outstanding

have been validly tendered and not validly withdrawn pursuant to

the Offer.

Holders of Notes who have not already done so may validly tender

their Notes until the Expiration Time (as extended by this

announcement). The Withdrawal Deadline was previously scheduled to

expire at 8:00 a.m. New York City time, on January 23, 2025, and

will instead expire at 5:00 p.m. New York City time, on January 23,

2025. Holders of Notes who validly tender their Notes on or before

the Expiration Time are eligible to receive the Consideration in

connection with any such Notes accepted for tender.

The obligation of Arcos Dorados to purchase Notes in the Offer

is conditioned on the satisfaction or waiver of certain conditions,

including, without limitation, the Financing Condition, described

in the Offer Documents. Arcos Dorados reserves the right, in its

sole discretion, to amend or terminate the Offer at any time.

The Offer is being made in connection with a proposed offering

of U.S. dollar denominated senior notes (the “New Notes”) to be

issued by Arcos Dorados B.V., a subsidiary of Arcos Dorados (the

“Proposed New Notes Offering”). The Proposed New Notes Offering

will be exempt from the registration requirements of the U.S.

Securities Act of 1933, as amended.

The offering of New Notes was announced on January 17, 2025.

Tendering Holders who wish to tender their Notes for cash and also

subscribe for the New Notes should quote a unique identifier code

corresponding to the New Notes being subscribed (“Unique Identifier

Code”), which can be obtained by contacting any of the Dealer

Managers, in their acceptance to DTC through the DTC Automated

Offer Program (“ATOP”) or Electronic Acceptance Instruction. A

Unique Identifier Code is not required for a Holder to tender its

Notes, but if a tendering Holder wishes to subscribe for the New

Notes, such Holder should obtain a Unique Identifier Code from a

Dealer Manager and enter the Unique Identifier Code in its

ATOP.

Arcos Dorados will review tender instructions received on or

prior to the pricing date of the New Notes, and may give priority

to those investors tendering with Unique Identifier Codes in

connection with the allocation of New Notes. However, no assurances

can be given that any Holder that tenders its Notes will be given

an allocation of New Notes at the levels it may subscribe for, or

at all.

The Company reserves the right, in its sole and absolute

discretion, to extend, withdraw, terminate or amend the terms and

conditions of the Offer at any time for any reason.

The information and tender agent for the Offer is Global

Bondholder Services Corporation. To contact the information and

tender agent, banks and brokers may call +1 (212) 430-3774, and

others may call U.S. toll-free: +1 (855)-654-2015 or email

contact@gbsc-usa.com. Additional contact information is set forth

below.

By Mail, Hand or Overnight

Courier

65 Broadway – Suite 404

New York, NY 10006

Attention: Corporate Actions

By Facsimile

Transmission

+1 (212) 430-3775/3779

Attention: Corporate Actions

Confirmation by

Telephone

+1 (212) 430-3774

Toll free: +1 (855) 654-2015

E-mail

contact@gbsc-usa.com

Copies of each of the Offer Documents are available at the

following web address: https://www.gbsc-usa.com/arcos/

Any questions or requests for assistance or for additional

copies of this notice may be directed to the Dealer Managers at

their respective telephone numbers set forth below or, if by any

Holder, to such Holder’s broker, dealer, commercial bank, trust

company or other nominee for assistance concerning the Offer.

The Dealer Managers for the Offer are:

BBVA Securities Inc.

Citigroup Global Markets

Inc.

Itau BBA USA Securities,

Inc.

J.P. Morgan Securities

LLC

Santander US Capital Markets

LLC

Two Manhattan West,

375 9th Ave, 9th Floor,

New York, NY 10001

United States

388 Greenwich Street,

Trading 4th Floor

New York, NY 10013

United States

599 Lexington Avenue, 34th

Floor,

New York, NY 10022

United States

383 Madison Avenue, 6th Floor New

York, NY 10179

United States

437 Madison Avenue

New York, NY 10022

United States

Attn: Liability Management

Attn: Liability Management

Group

Attn: Debt Capital Markets

Attn: Latin America Debt Capital

Markets

Attn: Liability Management

E-mail:

liabilitymanagement@bbva.com

E-mail:

ny.liabilitymanagement@citi.com

E-mail:

AmericasLM@santander.us

Collect: (212) 728-2446

Toll-Free: +1 (800) 422-8692

Collect: +1 (212)-723-6106

Toll-Free: +1 (800) 558-3745

Collect: +1 (212) 710-6749

Toll Free: +1 (888) 770-4828

Collect: +1 (212) 834-7279

Toll Free: +1 (866) 846-2874

Collect: +1(212) 350-0660

Toll Free: +1(855) 404-3636

This notice does not constitute or form part of any offer or

invitation to purchase, or any solicitation of any offer to sell,

the Notes or any other securities in the United States or any other

country, nor shall it or any part of it, or the fact of its

release, form the basis of, or be relied on or in connection with,

any contract therefor. The Offer is made only by and pursuant to

the terms of the Offer Documents, and the information in this

notice is qualified by reference to the Offer and the Notice of

Guaranteed Delivery. None of Arcos Dorados, the Dealer Managers or

the information and tender agent makes any recommendation as to

whether Holders should tender their Notes pursuant to the

Offer.

Follow us on: LinkedIn Instagram X YouTube

About Arcos Dorados

Arcos Dorados is the world’s largest independent McDonald’s

franchisee, operating in Latin America and the Caribbean. It has

the exclusive right to own, operate and grant franchises of

McDonald’s restaurants in 20 Latin American and Caribbean countries

and territories with more than 2,400 restaurants, operated or

franchised by the Company or by its sub-franchisees, that together

employ more than 100,000 people (as of 09/30/2024). The Company is

also committed to the development of the communities in which it

operates, to providing young people their first formal job

opportunities and to utilize its Recipe for the Future to achieve a

positive environmental impact. Arcos Dorados is listed for trading

on the New York Stock Exchange (NYSE: ARCO). To learn more about

the Company, please visit the Investors section of our website:

www.arcosdorados.com/ir.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250123424847/en/

Investor Relations Contact Dan Schleiniger VP of Investor

Relations Arcos Dorados daniel.schleiniger@mcd.com.uy

Media Contact David Grinberg VP of Corporate

Communications Arcos Dorados david.grinberg@mcd.com.uy

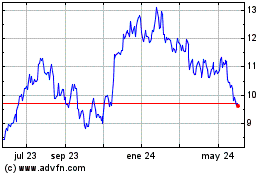

Arcos Dorados (NYSE:ARCO)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

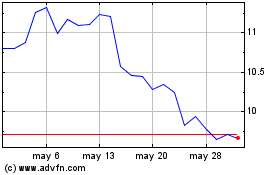

Arcos Dorados (NYSE:ARCO)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025