Ares Management and Lone Star Partner on £755 million Preferred Equity Investment to Wembley’s Quintain

30 Julio 2024 - 3:05PM

Business Wire

Ares Management Corporation (NYSE: ARES) (“Ares”) announced

today that funds managed by its Alternative Credit strategy have

led a £755 million preferred equity commitment in Quintain, the

award-winning development and asset management company which owns

and manages the iconic 85-acre Wembley Park estate in London.

Quintain is owned by funds managed by Lone Star Funds (“Lone

Star”), which will be contributing £337 million to the preferred

equity instrument.

With over £2.8 billion of investment to date, Quintain has

transformed the Wembley Park estate into a premier mixed-use

development, with leading retail, modern office space, acres of

parks and pedestrianized public realm, and around 5,000 homes.

“Lone Star and Quintain have built Wembley Park into one of

London’s leading neighbourhoods, delivering a high-quality and

sustainable real estate for thousands of residents and millions of

visitors. We are excited to partner with their outstanding teams,

and to provide significant new capital for Quintain to continue its

journey and cement its position as a leader in London’s critically

undersupplied residential rental market,” said Stefano Questa,

Partner and European Co-Head of Ares Alternative Credit, who will

be joining the Quintain Board of Directors as part of the

transaction.

“Our team is an established leader in providing bespoke and

creative capital solutions to asset-focused investment

opportunities,” said Joel Holsinger, Partner and Co-Head of Ares

Alternative Credit. “We believe our scale, coupled with our

flexible mandate, makes Ares an ideal partner for private equity

sponsors, as they seek to grow and optimize the balance sheets of

their highest quality assets. We are delighted to be partnering

with Lone Star in this landmark transaction for the UK market.”

“This is a significant next step in the evolution of Quintain’s

development of Wembley Park under Lone Star’s ownership. Wembley

Park is one of the largest build-to-rent schemes in the UK and a

great example of ambitious place-making. In Ares, we have found a

like-minded partner, and together we look forward to taking this

iconic asset to its next exciting phase,” said James Riddell,

Co-Head of European Real Estate at Lone Star.

“Quintain is delighted to have Ares’ backing as a new partner,

whilst maintaining our longstanding partnership with Lone Star, to

continue to develop the world-class Wembley Park estate which

already is home to the largest multifamily/build-to-rent community

in the UK,” said James Saunders, CEO of Quintain.

The Ares Alternative Credit strategy is one of the largest

investors in asset-based credit managing approximately $36.5

billion in assets under management as of March 31, 2024. The team

invests across the capital structure and seeks opportunities in

specialty finance, lender finance, loan portfolios, equipment

leasing, structured products, net lease, cash flow streams

(royalties, licensing, management fees) and other asset-focused

investments. Aligning Ares' investment activities with its societal

impact, Ares and Ares Alternative Credit portfolio managers have

committed to donate a portion of the performance fees earned from

Ares Alternative Credit flagship funds to support global health and

education charities.

About Ares Management Corporation

Ares Management Corporation (NYSE: ARES) is a leading global

alternative investment manager offering clients complementary

primary and secondary investment solutions across the credit,

private equity, real estate and infrastructure asset classes. We

seek to provide flexible capital to support businesses and create

value for our stakeholders and within our communities. By

collaborating across our investment groups, we aim to generate

consistent and attractive investment returns throughout market

cycles. As of March 31, 2024, Ares Management Corporation's global

platform had approximately $428 billion of assets under management,

with approximately 2,900 employees operating across North America,

Europe, Asia Pacific and the Middle East. For more information,

please visit www.aresmgmt.com.

About Lone Star

Lone Star is a leading private equity firm advising funds that

invest globally in corporate equity, credit, real estate and other

financial assets. Since the establishment of its first fund in

1995, Lone Star has organized 24 private equity funds with

aggregate capital commitments totaling approximately $92 billion.

The firm organizes its funds in three series: the Opportunity Fund

series; the Commercial Real Estate Fund series; and the U.S.

Residential Mortgage Fund series. Lone Star invests on behalf of

its limited partners, which include institutional investors such as

pension funds and sovereign wealth funds, as well as foundations

and endowments that support medical research, higher education, and

other philanthropic causes. For more information regarding Lone

Star Funds, go to www.lonestarfunds.com.

About Quintain

Quintain is the award-winning development and asset management

company behind Wembley Park, one of London's most exciting new

neighbourhoods.

Quintain celebrated its 30th anniversary in 2022, with 20 years

since acquiring its interest in Wembley Park. To date, the 85-acre

development has seen over £2.8bn invested and welcomes on average

16 million visitors a year.

Quintain’s award-winning residential management business,

Quintain Living, focuses on the management of Quintain's

institutional quality, Build-to-Rent (BTR) property management

platform and pipeline. In 2022 Quintain Living was named Estate

Gazette’s BTR Specialist and RESI’s Property Manager of the

Year.

More information can be found at: www.quintain.co.uk

www.quintainliving.com www.wembleypark.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730461916/en/

Media: media.europe@aresmgmt.com

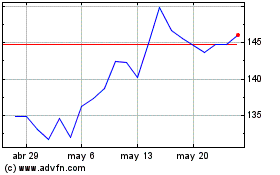

Ares Management (NYSE:ARES)

Gráfica de Acción Histórica

De Jul 2024 a Jul 2024

Ares Management (NYSE:ARES)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024