Axos Financial, Inc. Investor Presentation NYSE: AXMay 7, 2024

2 Safe Harbor This presentation contains forward-looking statements that involve risks and uncertainties, including without limitation statements relating to Axos Financial, Inc.’s (“Axos”) financial prospects and other projections of its performance and asset quality, Axos’ deposit balances and capital ratios, Axos’ ability to continue to grow profitably and increase its business, Axos’ ability to continue to diversify its lending and deposit franchises, the anticipated timing and financial performance of other offerings, initiatives, and acquisitions, expectations of the environment in which Axos operates and projections of future performance. These forward- looking statements are made on the basis of the views and assumptions of management regarding future events and performance as of the date of this presentation. Actual results and the timing of events could differ materially from those expressed or implied in such forward-looking statements as a result of risks and uncertainties, including without limitation Axos’ ability to successfully integrate acquisitions and realize the anticipated benefits of the transactions, changes in the interest rate environment, monetary policy, inflation, government regulation, general economic conditions, changes in the competitive marketplace, conditions in the real estate markets in which we operate, risks associated with credit quality, our ability to attract and retain deposits and access other sources of liquidity, and the outcome and effects of litigation and other factors beyond our control. These and other risks and uncertainties detailed in Axos’ periodic reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended June 30, 2023, Form 10-Q for the quarter ended March 31, 2024 and its last earnings press release, could cause actual results to differ materially from those expressed or implied in any forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Axos undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. All written and oral forward-looking statements made in connection with this presentation, which are attributable to us or persons acting on Axos’ behalf are expressly qualified in their entirety by the foregoing information.

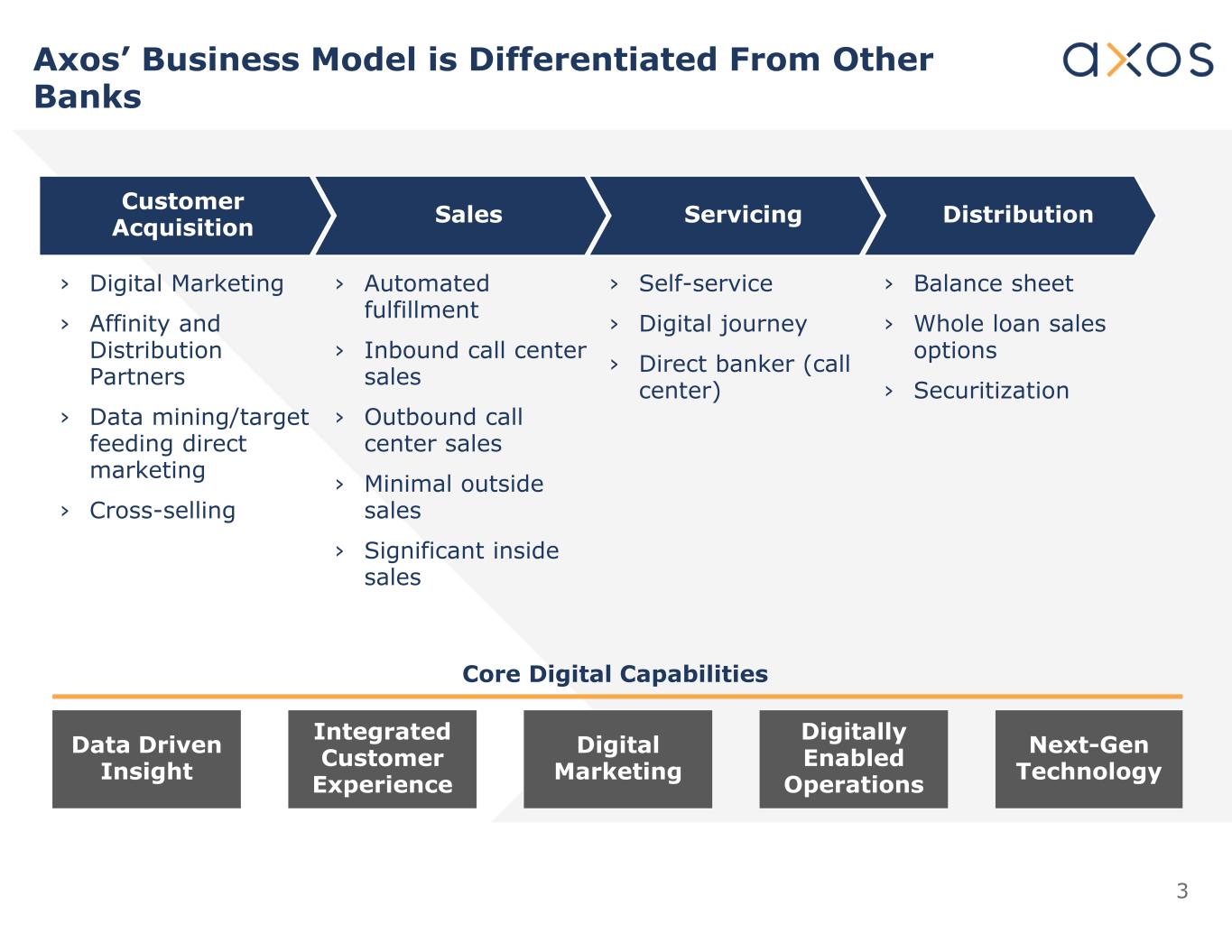

3 Customer Acquisition Sales Servicing Distribution › Digital Marketing › Affinity and Distribution Partners › Data mining/target feeding direct marketing › Cross-selling › Automated fulfillment › Inbound call center sales › Outbound call center sales › Minimal outside sales › Significant inside sales › Self-service › Digital journey › Direct banker (call center) › Balance sheet › Whole loan sales options › Securitization Data Driven Insight Integrated Customer Experience Digital Marketing Digitally Enabled Operations Next-Gen Technology Core Digital Capabilities Axos’ Business Model is Differentiated From Other Banks

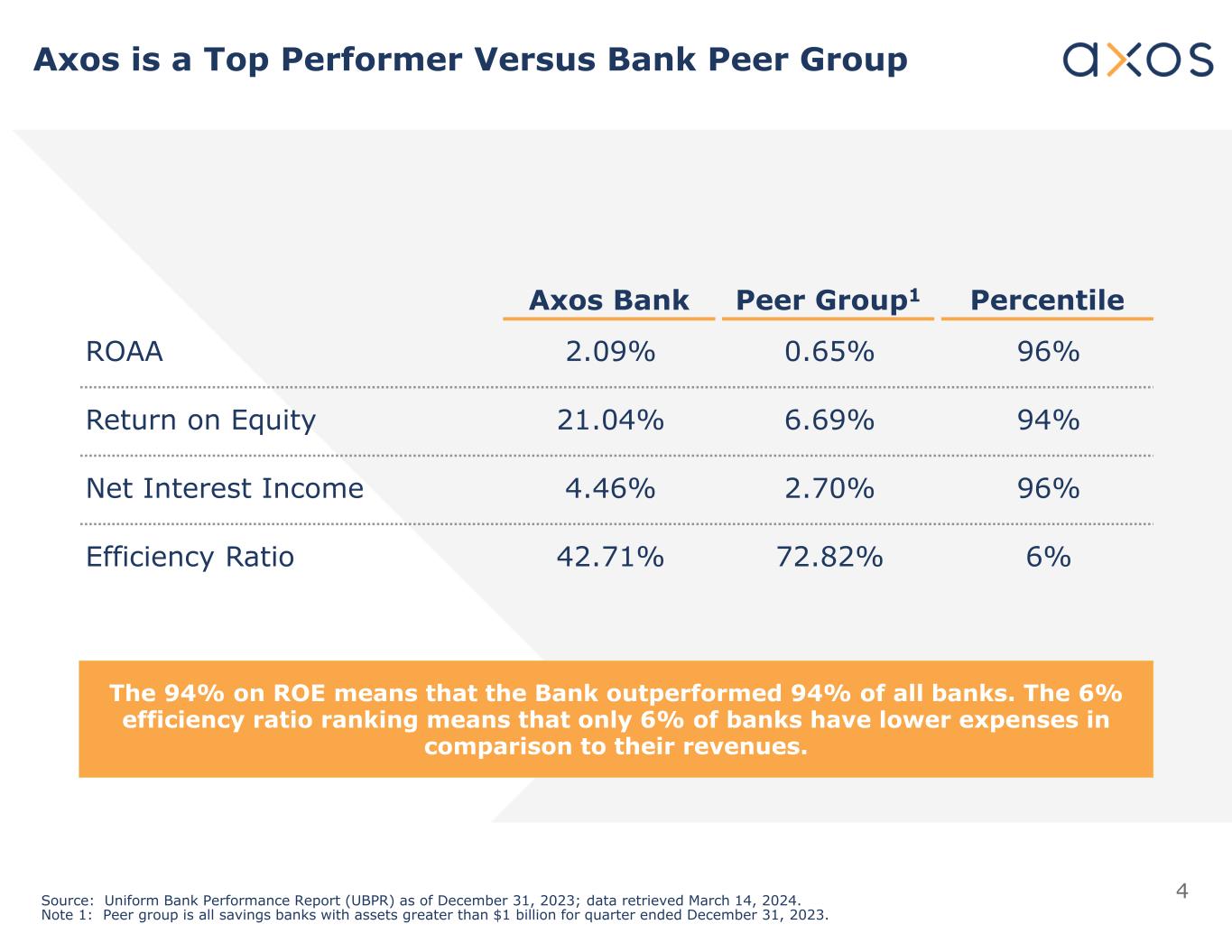

4 PercentilePeer Group1Axos Bank 96%0.65%2.09%ROAA 94%6.69%21.04%Return on Equity 96%2.70%4.46%Net Interest Income 6%72.82%42.71%Efficiency Ratio Source: Uniform Bank Performance Report (UBPR) as of December 31, 2023; data retrieved March 14, 2024. Note 1: Peer group is all savings banks with assets greater than $1 billion for quarter ended December 31, 2023. The 94% on ROE means that the Bank outperformed 94% of all banks. The 6% efficiency ratio ranking means that only 6% of banks have lower expenses in comparison to their revenues. Axos is a Top Performer Versus Bank Peer Group

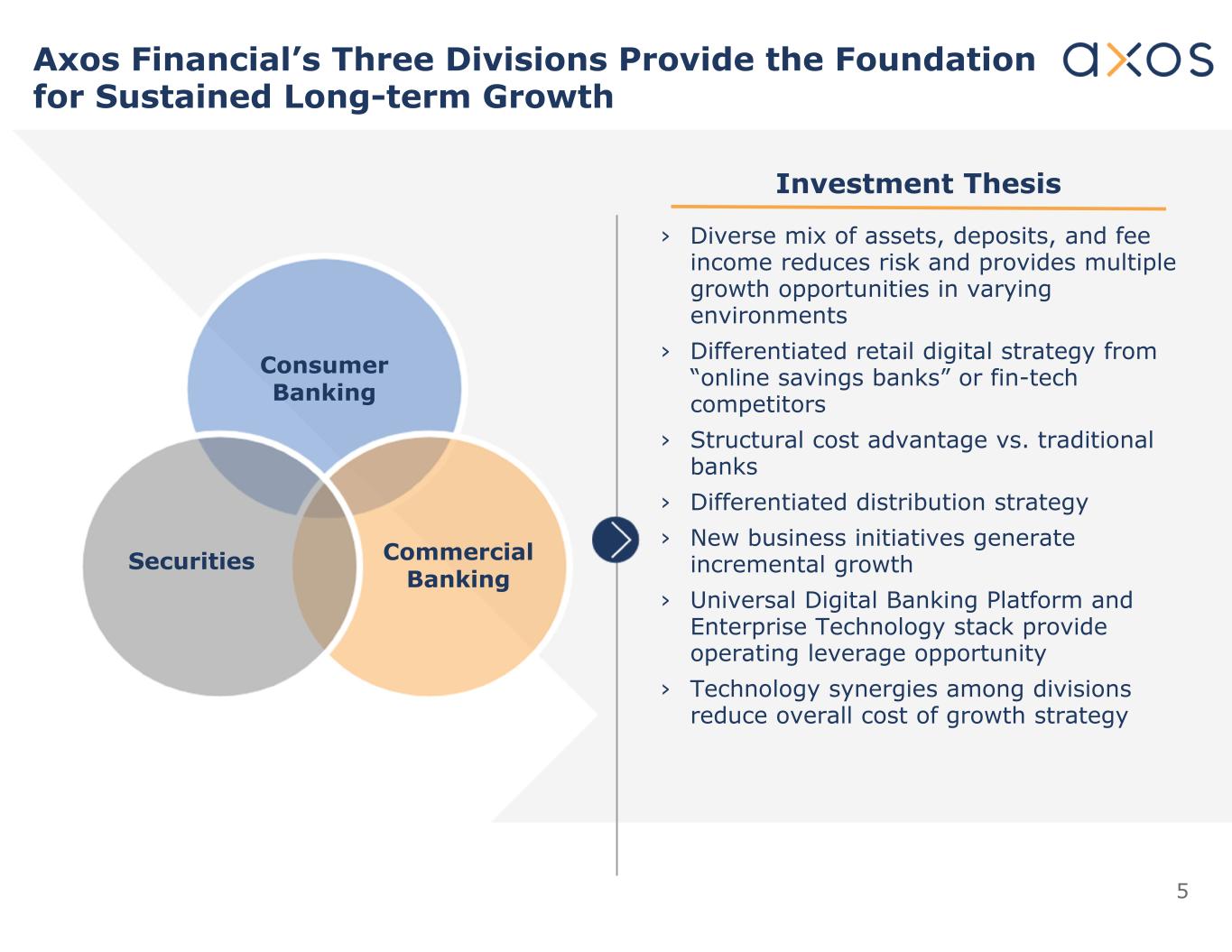

5 › Diverse mix of assets, deposits, and fee income reduces risk and provides multiple growth opportunities in varying environments › Differentiated retail digital strategy from “online savings banks” or fin-tech competitors › Structural cost advantage vs. traditional banks › Differentiated distribution strategy › New business initiatives generate incremental growth › Universal Digital Banking Platform and Enterprise Technology stack provide operating leverage opportunity › Technology synergies among divisions reduce overall cost of growth strategy Investment Thesis Axos Financial’s Three Divisions Provide the Foundation for Sustained Long-term Growth Consumer Banking Commercial Banking Securities

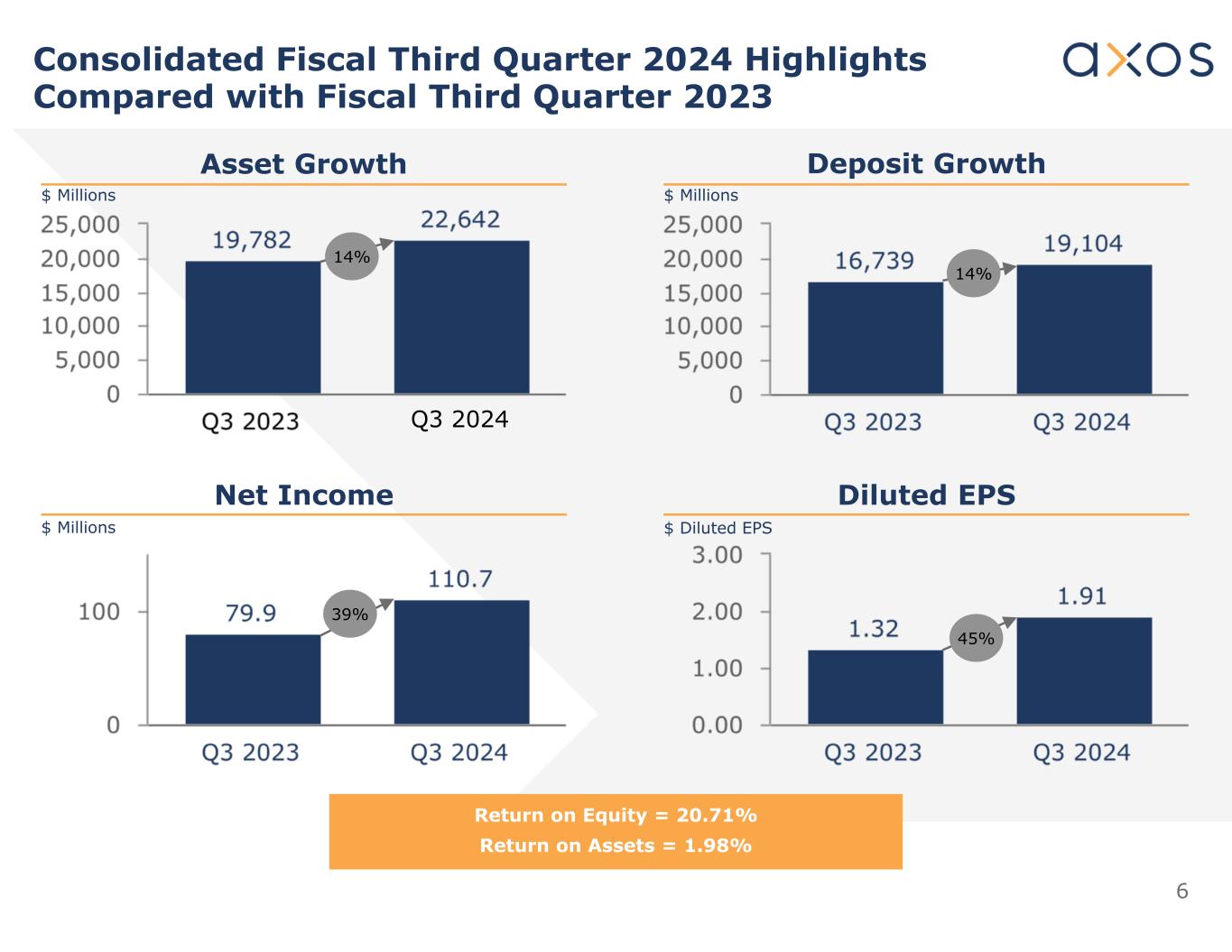

6 Return on Equity = 20.71% Return on Assets = 1.98% Consolidated Fiscal Third Quarter 2024 Highlights Compared with Fiscal Third Quarter 2023 14% 14% 39% 45% Asset Growth Deposit Growth Net Income Diluted EPS $ Millions $ Millions $ Millions $ Diluted EPS Q3 2024

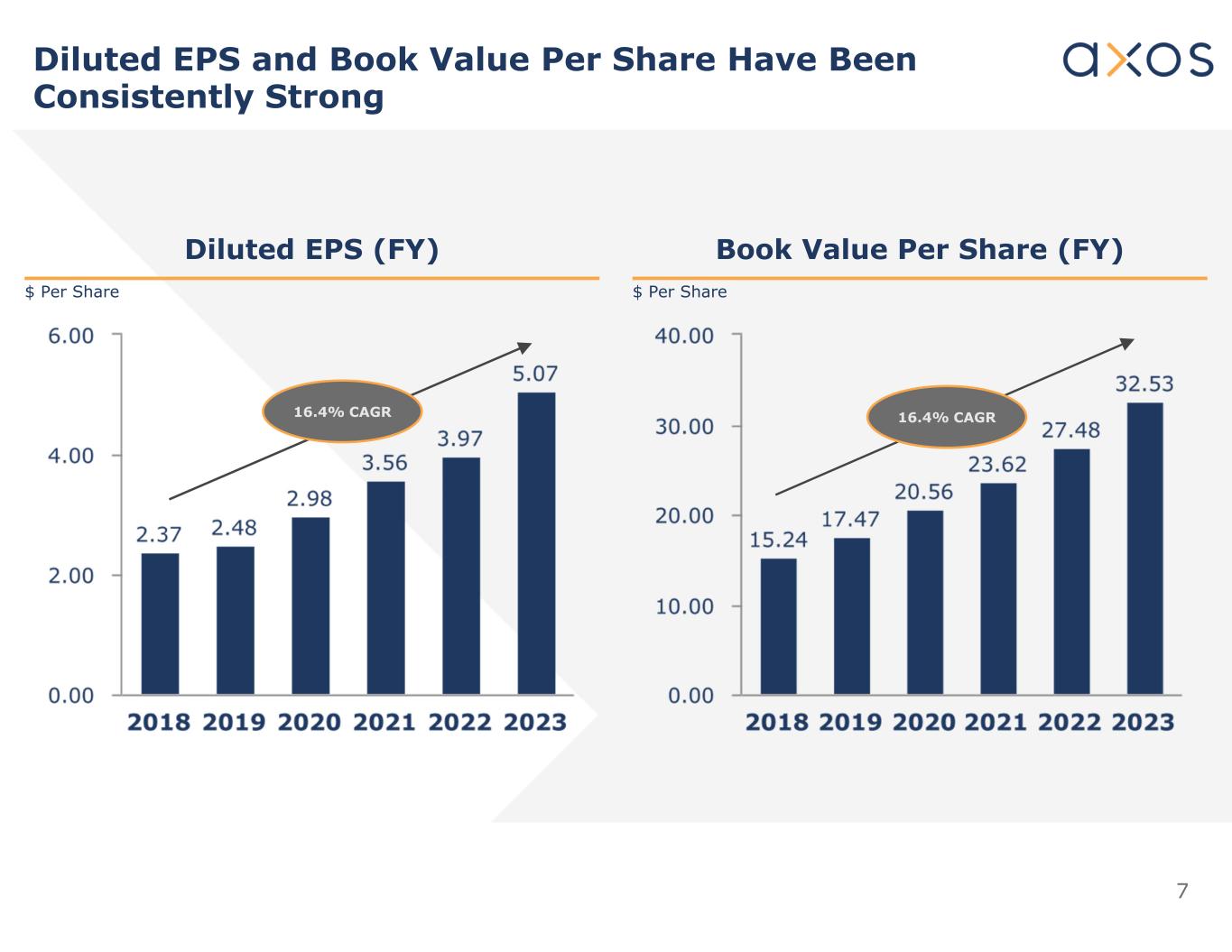

7 Diluted EPS and Book Value Per Share Have Been Consistently Strong 16.4% CAGR 16.4% CAGR Diluted EPS (FY) Book Value Per Share (FY) $ Per Share $ Per Share

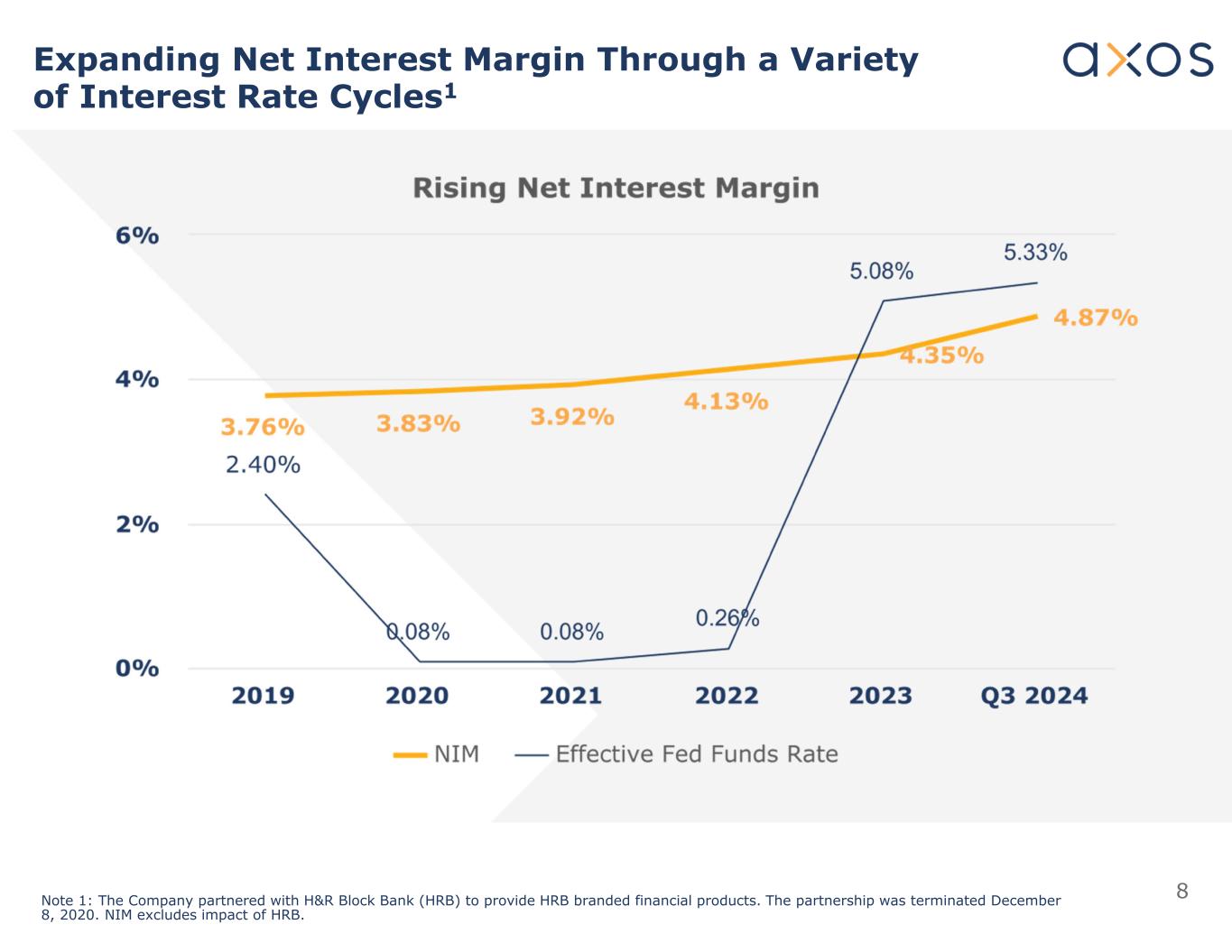

8 Expanding Net Interest Margin Through a Variety of Interest Rate Cycles1 Note 1: The Company partnered with H&R Block Bank (HRB) to provide HRB branded financial products. The partnership was terminated December 8, 2020. NIM excludes impact of HRB.

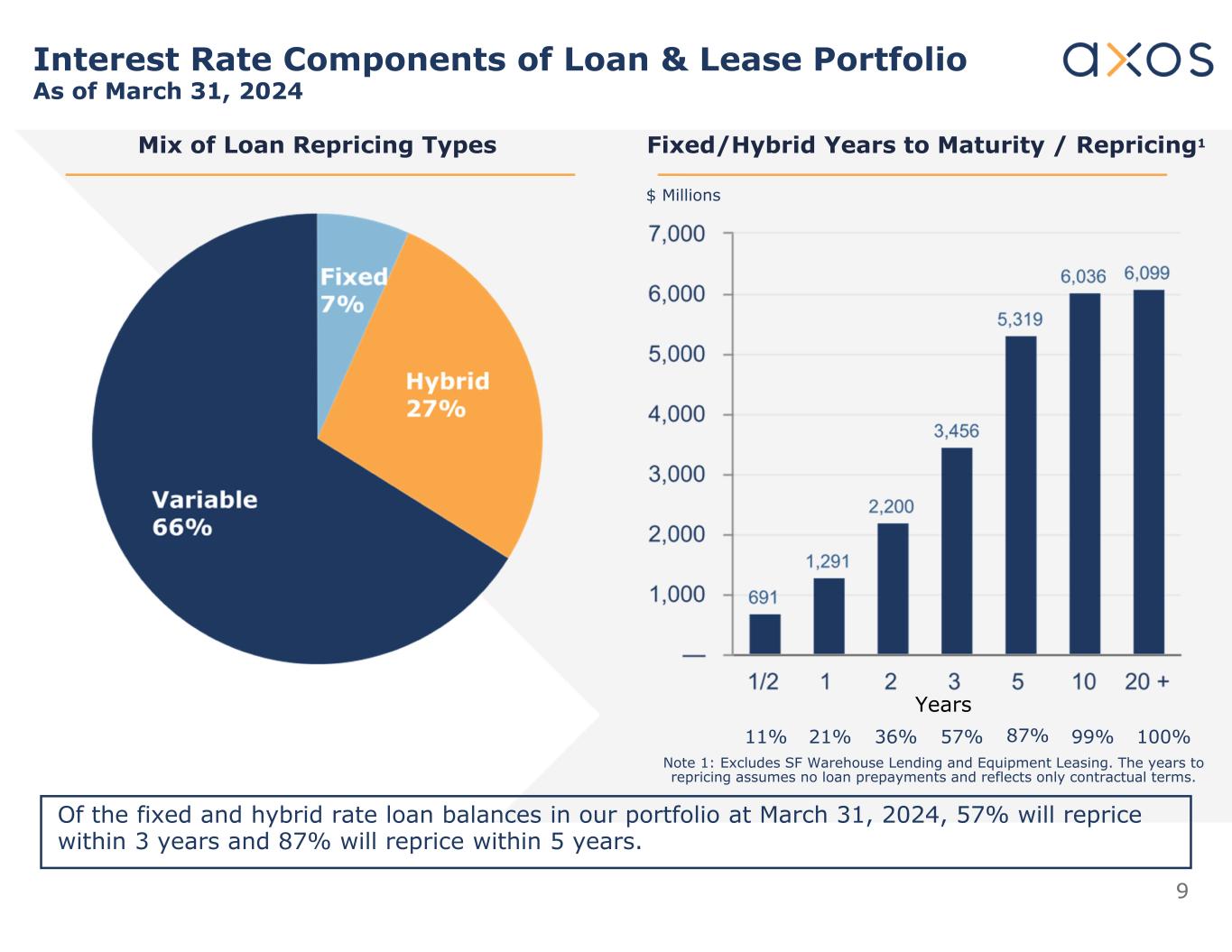

9 Fixed/Hybrid Years to Maturity / Repricing1Mix of Loan Repricing Types Of the fixed and hybrid rate loan balances in our portfolio at March 31, 2024, 57% will reprice within 3 years and 87% will reprice within 5 years. Interest Rate Components of Loan & Lease Portfolio As of March 31, 2024 100%99%87%57%36%21%11% Note 1: Excludes SF Warehouse Lending and Equipment Leasing. The years to repricing assumes no loan prepayments and reflects only contractual terms. $ Millions Years

10 Loan Growth by Category $ Millions SF Warehouse Lending Multifamily Small Balance Commercial Jumbo Mortgage Asset-Based and Cash Flow Lending Lender Finance Non-RE Capital Call Facilities Auto Unsecured/OD Single Family Mortgage & Warehouse Multifamily & Commercial Mortgage Commercial Real Estate Commercial & Industrial Non-RE Auto & Consumer Other Loans Inc (Dec)Q2 FY24Q3 FY24 $ (29)$ 3,993$ 3,964 6099159 (45)2,7082,663 (19)1,3571,338 (180)5,4005,220 50643693 852,2352,320 4281,1891,617 138753891 (20)419399 (8)5951 (3)52 $ 457$ 18,860$ 19,317 Lender Finance RE CRE Specialty

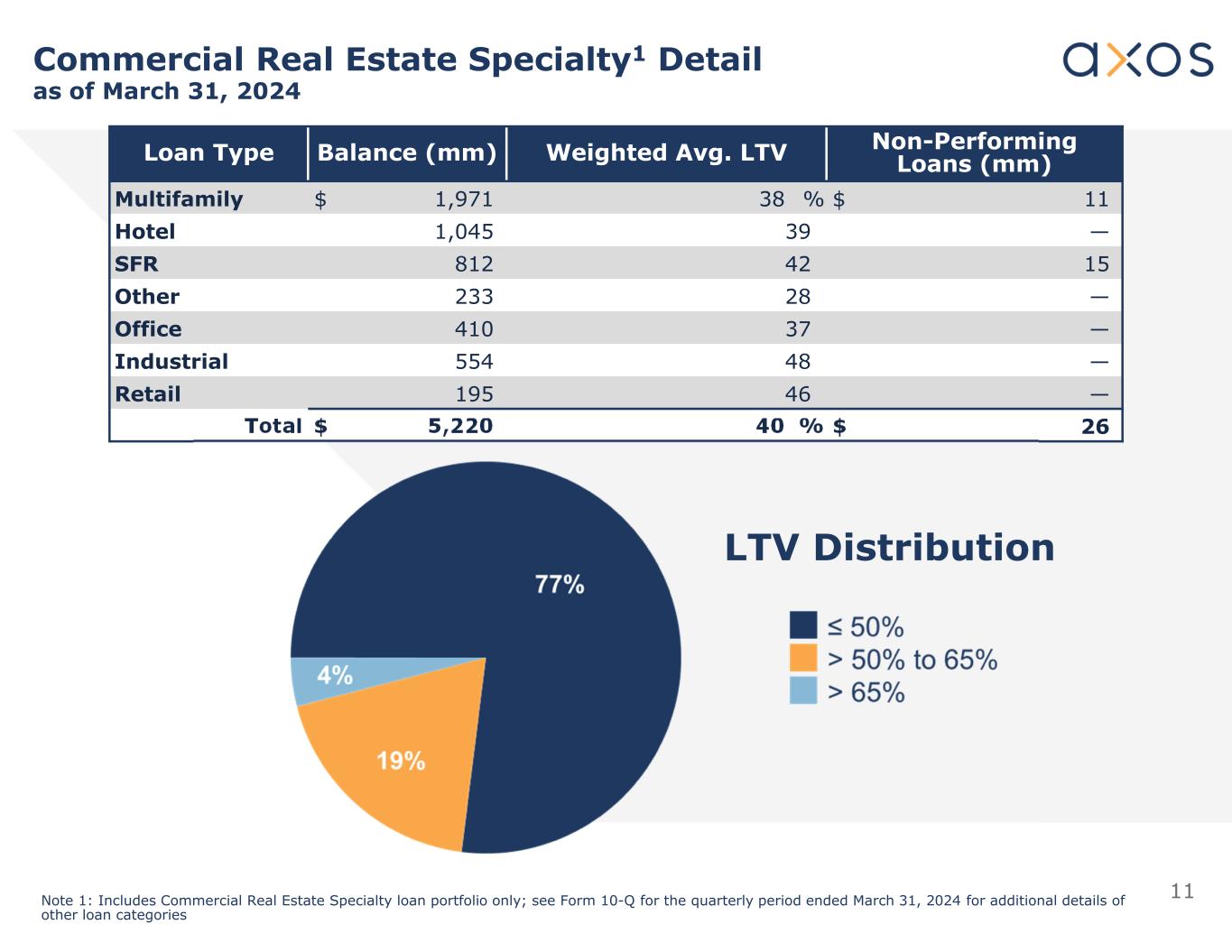

11 Commercial Real Estate Specialty1 Detail as of March 31, 2024 Non-Performing Loans (mm)Weighted Avg. LTVBalance (mm)Loan Type $ 1138 %$ 1,971Multifamily —391,045Hotel 1542812SFR —28233Other —37410Office —48554Industrial —46195Retail $ 2640 %$ 5,220Total LTV Distribution Note 1: Includes Commercial Real Estate Specialty loan portfolio only; see Form 10-Q for the quarterly period ended March 31, 2024 for additional details of other loan categories

12 Commercial Real Estate Specialty1 Detail as of March 31, 2024 76% of total Commercial Real Estate Specialty balance at March 31, 2024 is indirect note structures where Axos has first payment priority; these loans carry a weighted-average LTV of 39%. Note 1: Includes Commercial Real Estate Specialty loan portfolio only; see Form 10-Q for the quarterly period ended March 31, 2024 for additional details of other loan categories Weighted Avg. LTVBalance (mm)Loan Type 35 %$ 1,951Construction 441,815Bridge 37507Pre-development 45947Stabilized 40 %$ 5,220Total

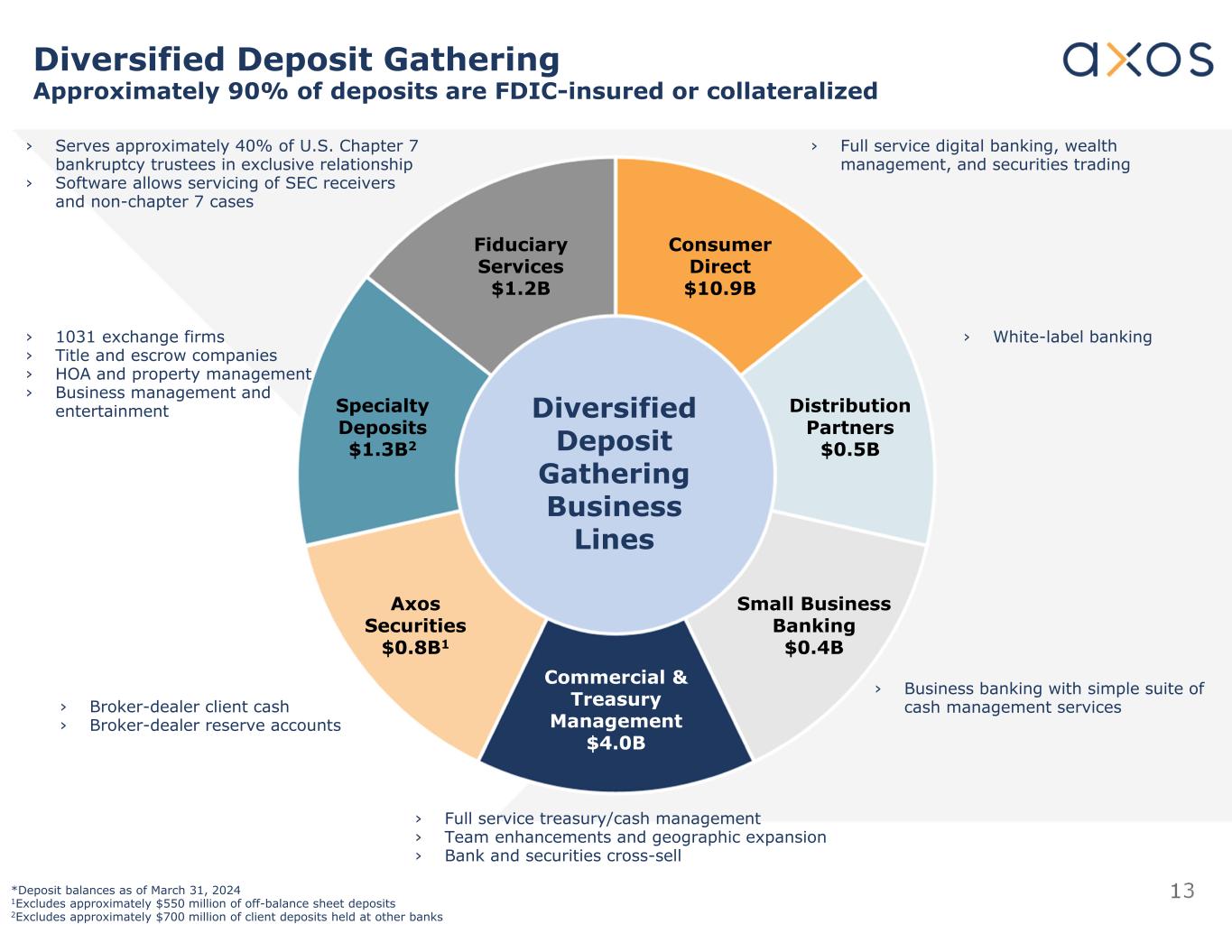

13 Diversified Deposit Gathering Approximately 90% of deposits are FDIC-insured or collateralized *Deposit balances as of March 31, 2024 1Excludes approximately $550 million of off-balance sheet deposits 2Excludes approximately $700 million of client deposits held at other banks › Serves approximately 40% of U.S. Chapter 7 bankruptcy trustees in exclusive relationship › Software allows servicing of SEC receivers and non-chapter 7 cases › Full service digital banking, wealth management, and securities trading › White-label banking › Business banking with simple suite of cash management services › 1031 exchange firms › Title and escrow companies › HOA and property management › Business management and entertainment › Broker-dealer client cash › Broker-dealer reserve accounts › Full service treasury/cash management › Team enhancements and geographic expansion › Bank and securities cross-sell Fiduciary Services $1.2B Consumer Direct $10.9B Specialty Deposits $1.3B2 Distribution Partners $0.5B Axos Securities $0.8B1 Small Business Banking $0.4B Commercial & Treasury Management $4.0B Diversified Deposit Gathering Business Lines

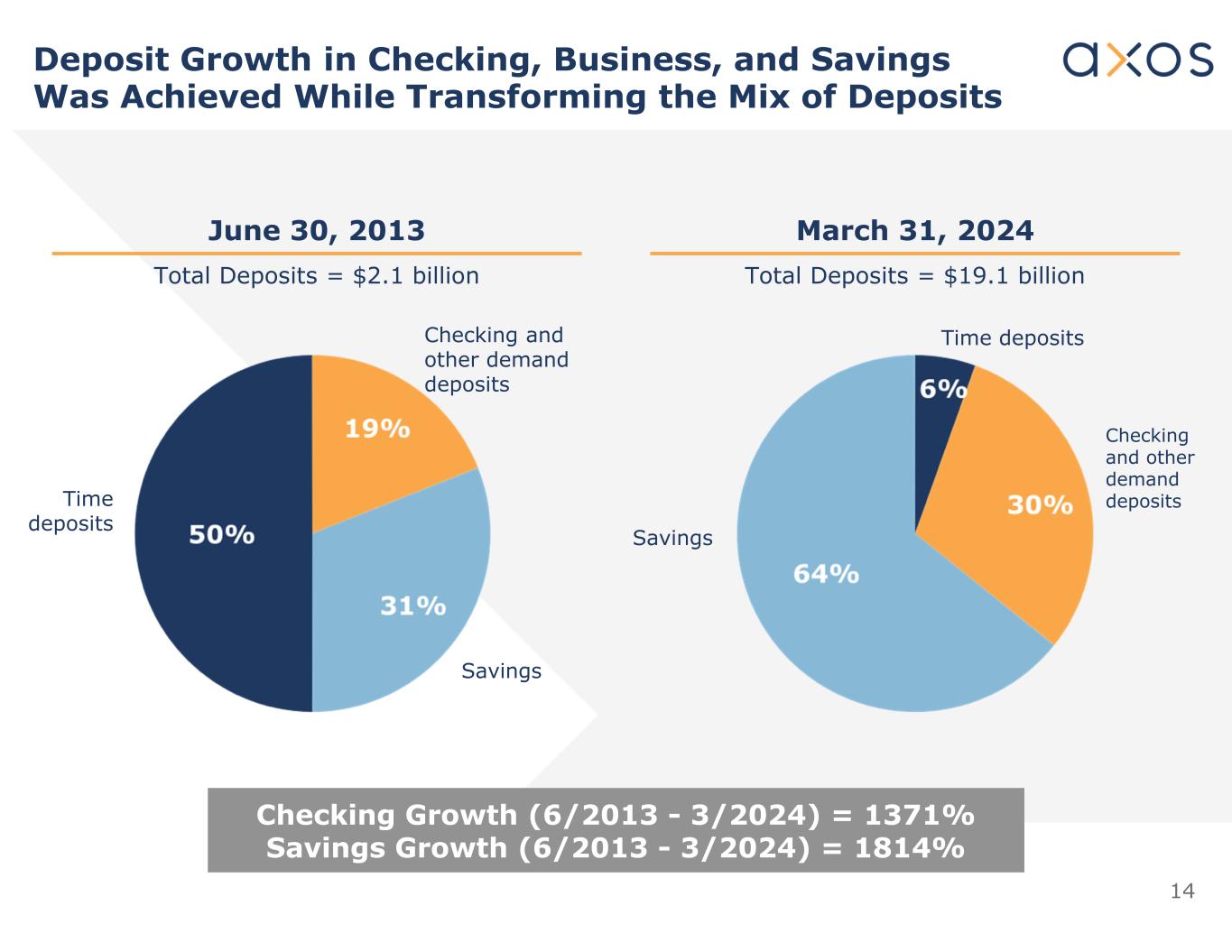

14 Deposit Growth in Checking, Business, and Savings Was Achieved While Transforming the Mix of Deposits June 30, 2013 Total Deposits = $2.1 billion March 31, 2024 Total Deposits = $19.1 billion Checking and other demand deposits Savings Time deposits Checking Growth (6/2013 - 3/2024) = 1371% Savings Growth (6/2013 - 3/2024) = 1814% Checking and other demand deposits Savings Time deposits

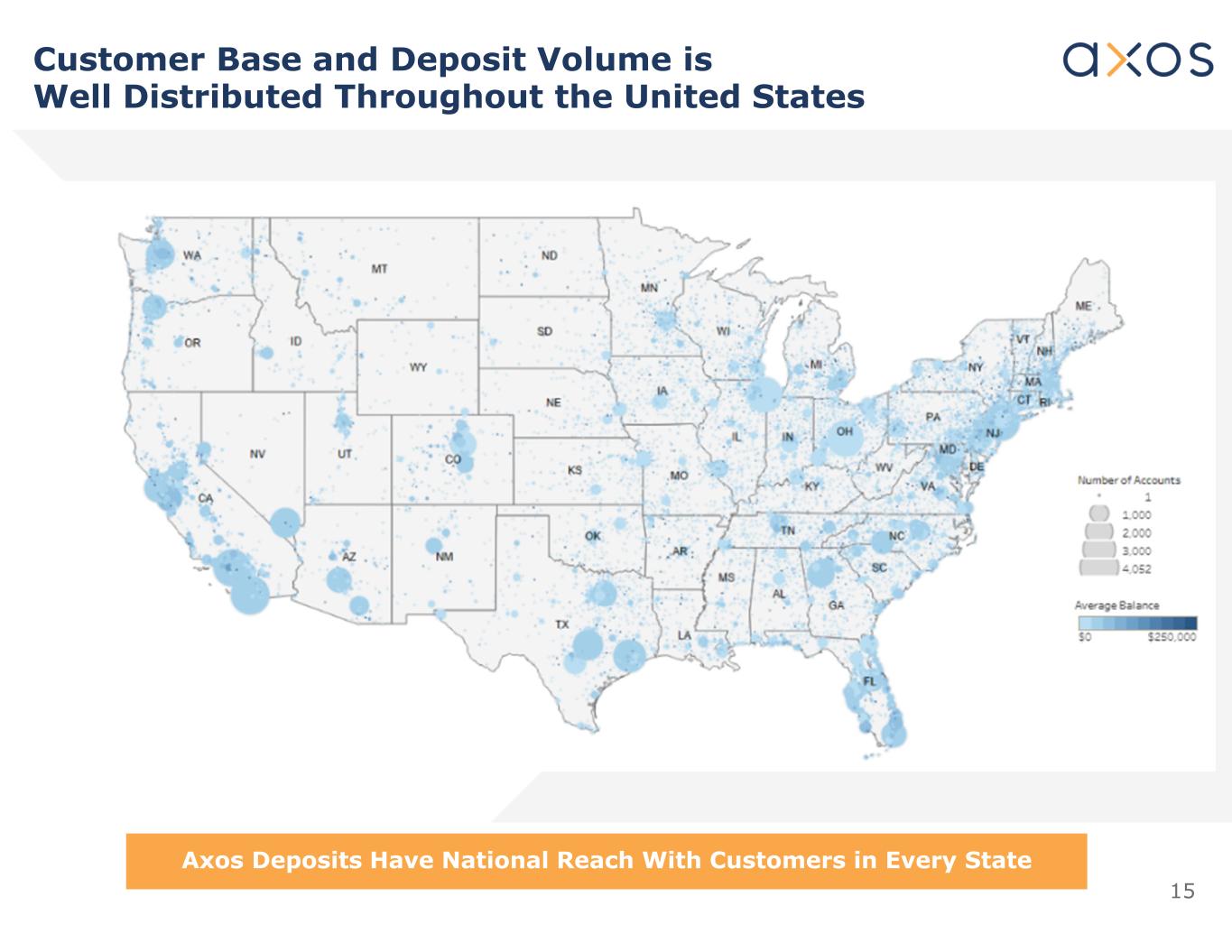

15 Axos Deposits Have National Reach With Customers in Every State Customer Base and Deposit Volume is Well Distributed Throughout the United States

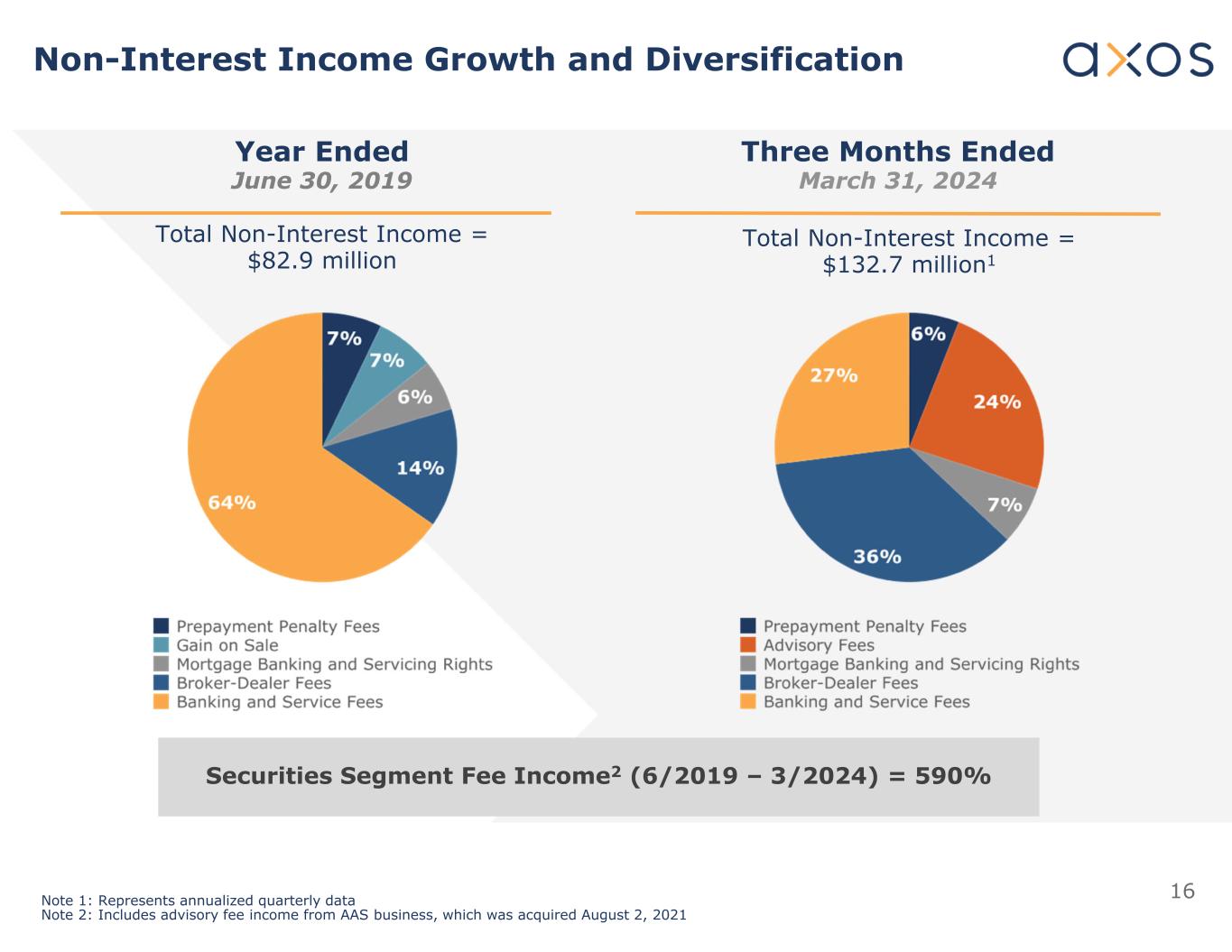

16 Non-Interest Income Growth and Diversification Year Ended June 30, 2019 Three Months Ended March 31, 2024 Securities Segment Fee Income2 (6/2019 – 3/2024) = 590% Total Non-Interest Income = $82.9 million Total Non-Interest Income = $132.7 million1 Note 1: Represents annualized quarterly data Note 2: Includes advisory fee income from AAS business, which was acquired August 2, 2021

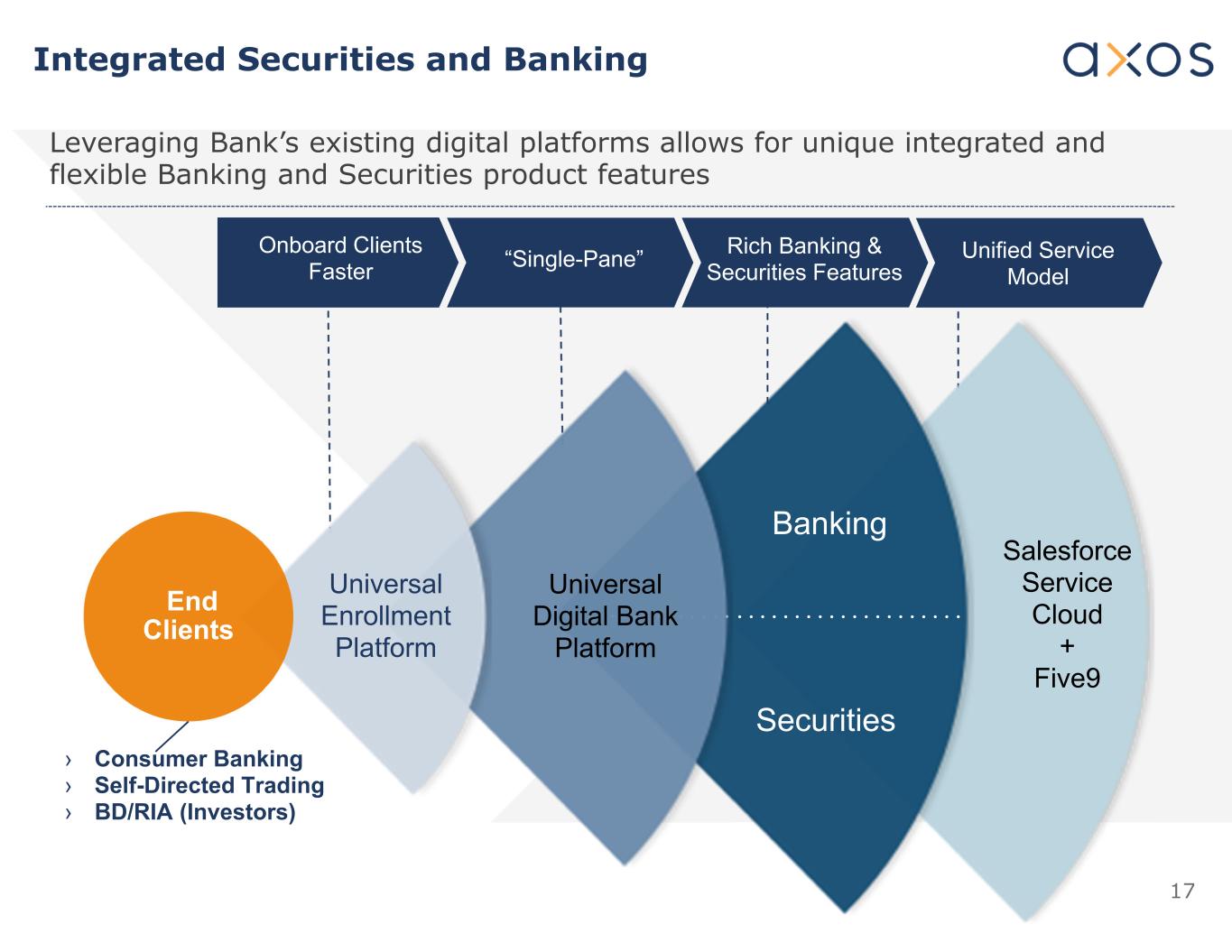

17 Integrated Securities and Banking Leveraging Bank’s existing digital platforms allows for unique integrated and flexible Banking and Securities product features End Clients Securities Banking Universal Enrollment Platform Universal Digital Bank Platform Onboard Clients Faster “Single-Pane” Rich Banking & Securities Features › Consumer Banking › Self-Directed Trading › BD/RIA (Investors) Unified Service Model Salesforce Service Cloud + Five9

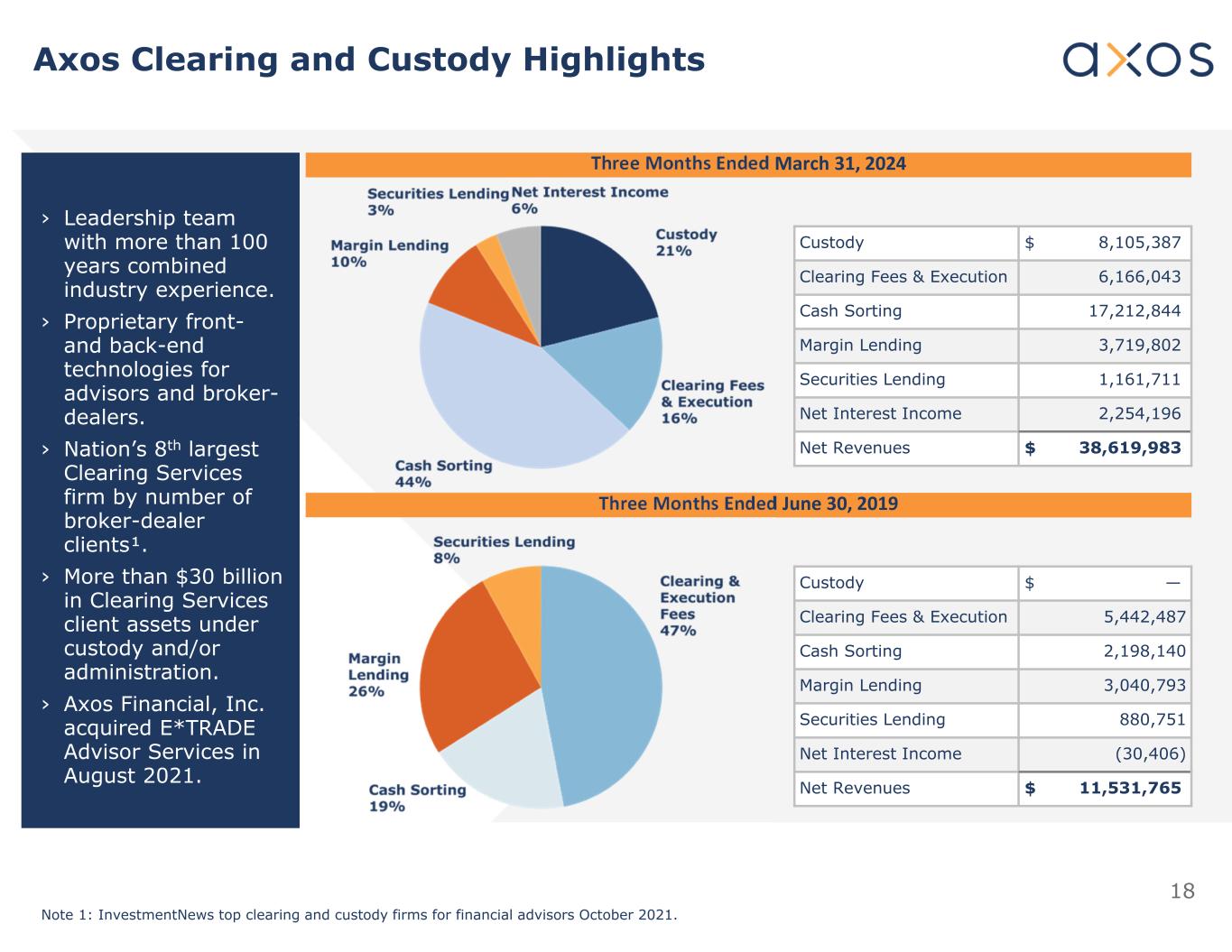

18 › Leadership team with more than 100 years combined industry experience. › Proprietary front- and back-end technologies for advisors and broker- dealers. › Nation’s 8th largest Clearing Services firm by number of broker-dealer clients¹. › More than $30 billion in Clearing Services client assets under custody and/or administration. › Axos Financial, Inc. acquired E*TRADE Advisor Services in August 2021. Three Months Ended March 31, 2024 Three Months Ended June 30, 2019 Axos Clearing and Custody Highlights $ —Custody 5,442,487 Clearing Fees & Execution 2,198,140Cash Sorting 3,040,793Margin Lending 880,751Securities Lending (30,406)Net Interest Income $ 11,531,765Net Revenues Note 1: InvestmentNews top clearing and custody firms for financial advisors October 2021. $ 8,105,387Custody 6,166,043Clearing Fees & Execution 17,212,844Cash Sorting 3,719,802Margin Lending 1,161,711Securities Lending 2,254,196Net Interest Income $ 38,619,983Net Revenues

19 Secular Industry Trends Provide Opportunities for Axos › RIAs need to reduce costs and streamline back-office ops › Automation frees up time/resources for client interactions › Axos to provide bundled securities clearing, custody and banking services › Target small & medium-sized RIAs and IBDs that large custodians do not serve well › Axos to provide succession-based and M&A financing to RIAs and IBDs › Nationwide footprint and industry focus are competitive advantages › Axos will offer direct-to-consumer and private label robo-advisory solutions to individuals and independent RIAs Fee Compression for Active and Passive Investment Managers Digitization of Wealth Management Aging Advisor Population is Driving Consolidation and Succession Planning Advisors are Leaving Wirehouses to Become Independent Advisors

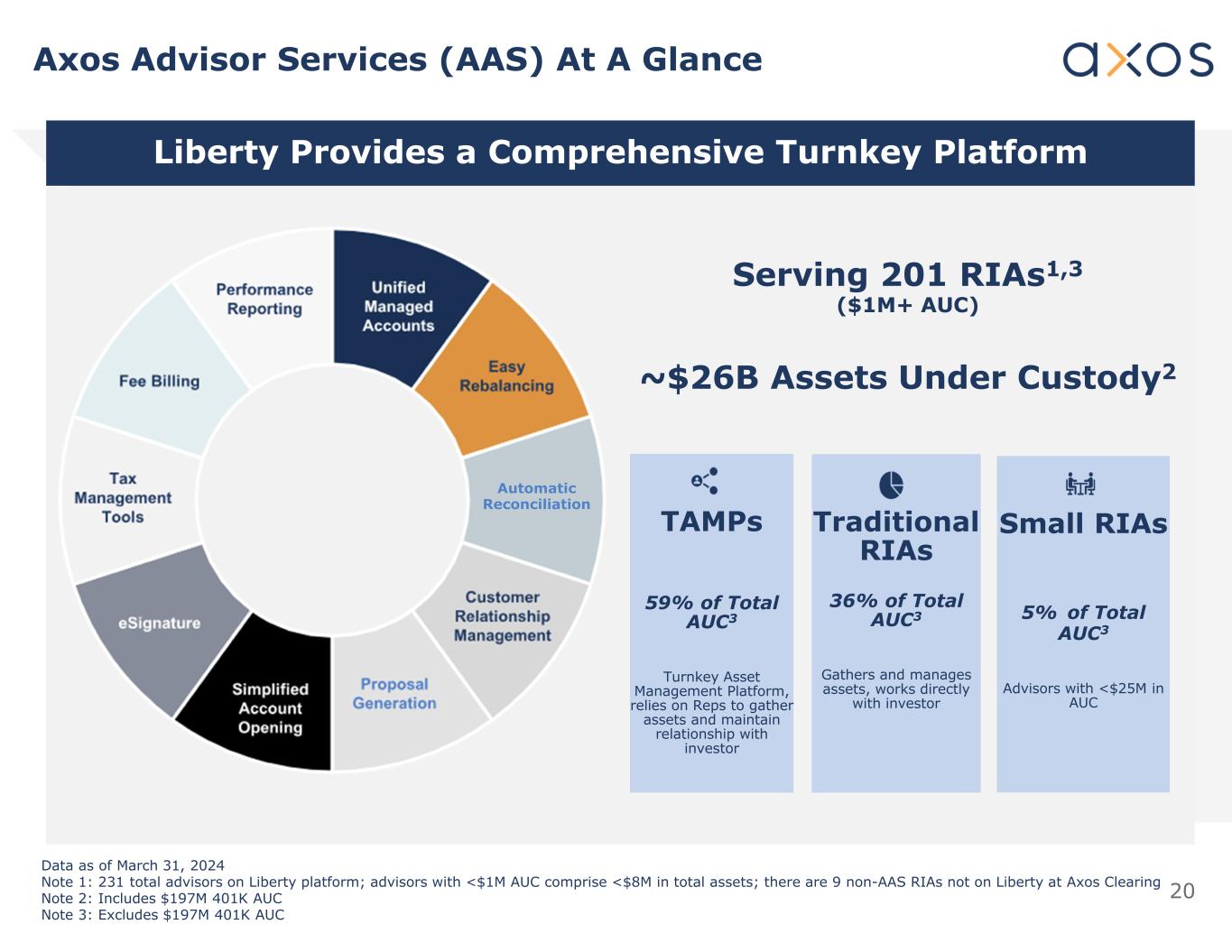

20 Axos Advisor Services (AAS) At A Glance Liberty Provides a Comprehensive Turnkey Platform Automatic Reconciliation Serving 201 RIAs1,3 ($1M+ AUC) ~$26B Assets Under Custody2 Small RIAs 5% of Total AUC3 Advisors with <$25M in AUC Traditional RIAs 36% of Total AUC3 Gathers and manages assets, works directly with investor TAMPs 59% of Total AUC3 Turnkey Asset Management Platform, relies on Reps to gather assets and maintain relationship with investor Data as of March 31, 2024 Note 1: 231 total advisors on Liberty platform; advisors with <$1M AUC comprise <$8M in total assets; there are 9 non-AAS RIAs not on Liberty at Axos Clearing Note 2: Includes $197M 401K AUC Note 3: Excludes $197M 401K AUC

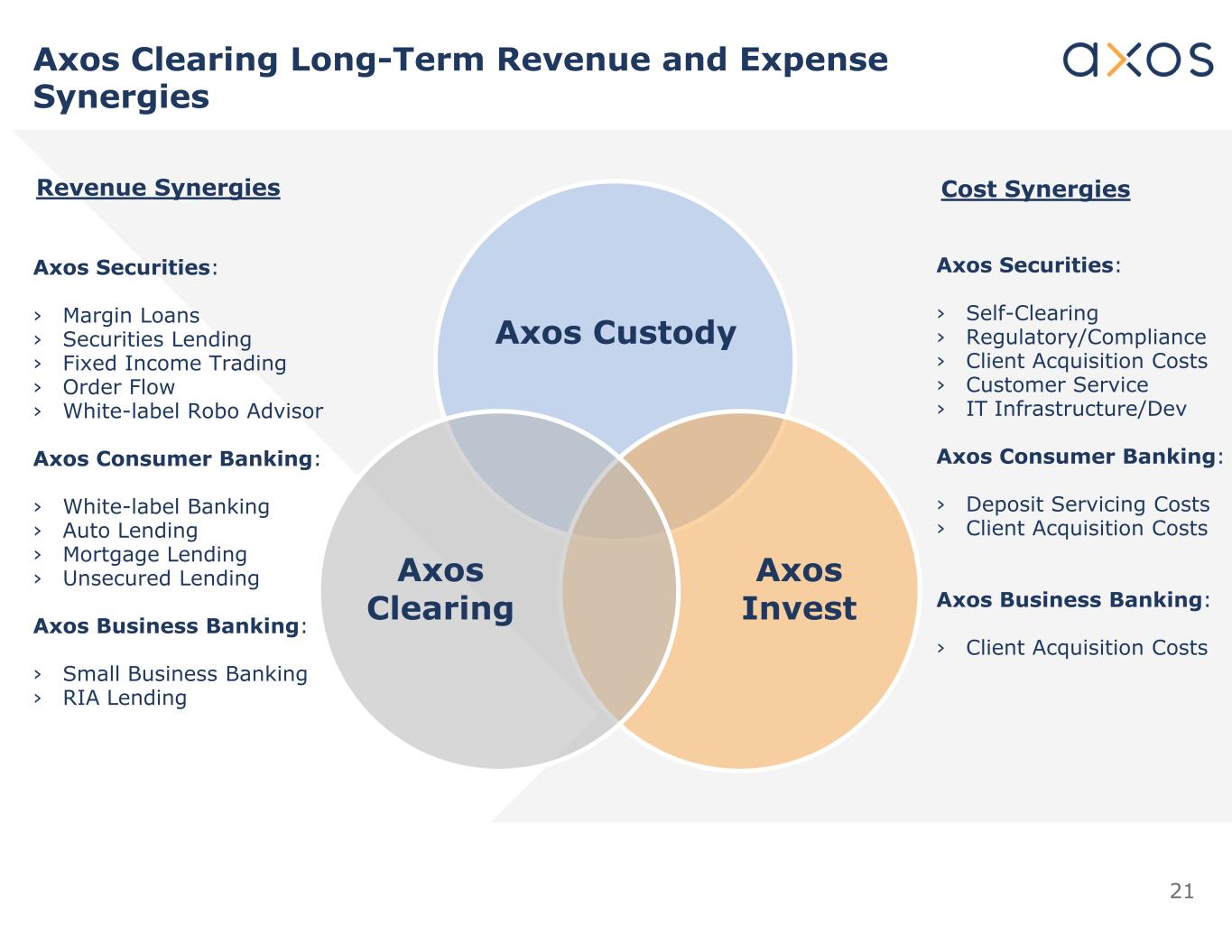

21 Axos Clearing Long-Term Revenue and Expense Synergies Revenue Synergies Cost Synergies Axos Securities: › Margin Loans › Securities Lending › Fixed Income Trading › Order Flow › White-label Robo Advisor Axos Consumer Banking: › White-label Banking › Auto Lending › Mortgage Lending › Unsecured Lending Axos Business Banking: › Small Business Banking › RIA Lending Axos Securities: › Self-Clearing › Regulatory/Compliance › Client Acquisition Costs › Customer Service › IT Infrastructure/Dev Axos Consumer Banking: › Deposit Servicing Costs › Client Acquisition Costs Axos Business Banking: › Client Acquisition Costs Axos Custody Axos Clearing Axos Invest

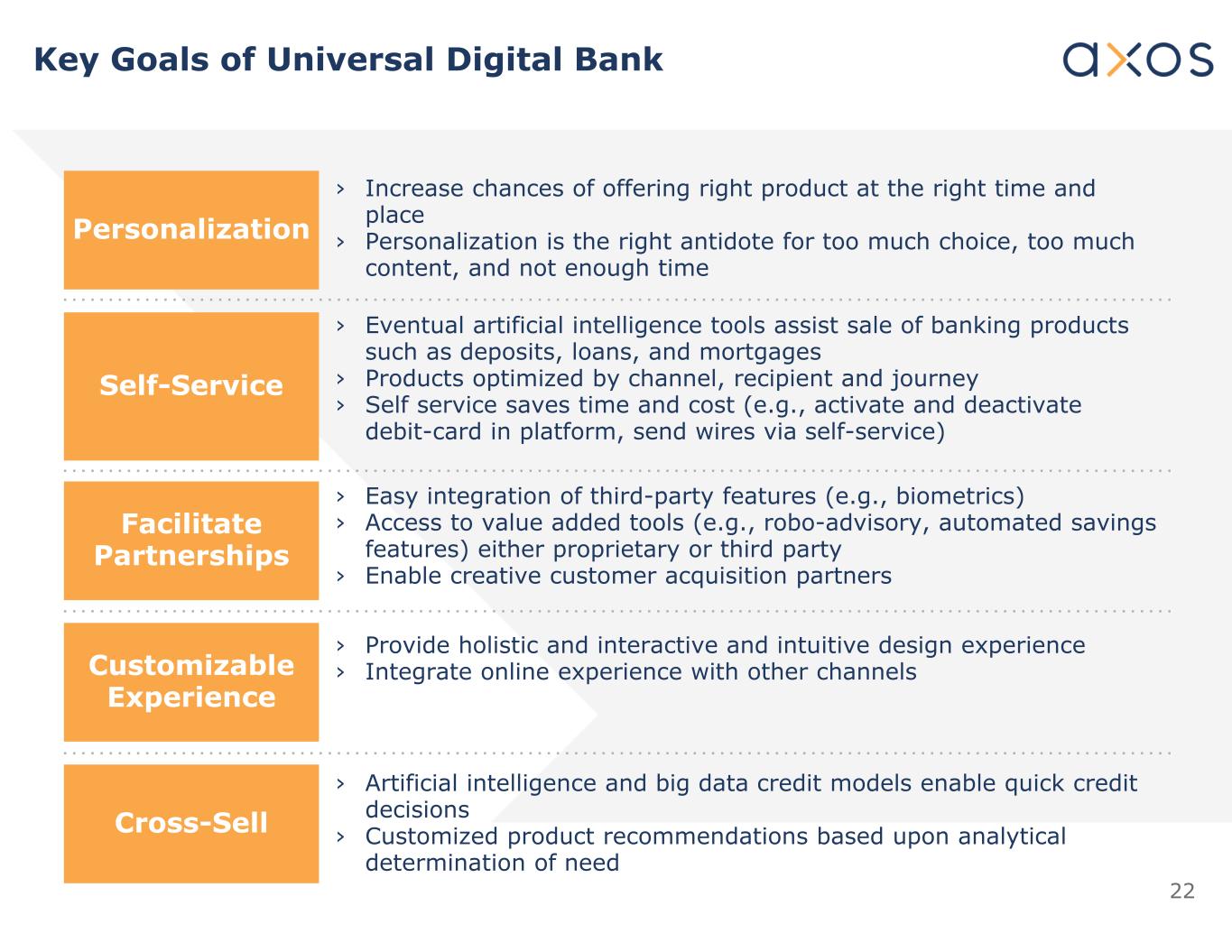

22 Key Goals of Universal Digital Bank Personalization Self-Service Facilitate Partnerships Customizable Experience Cross-Sell › Artificial intelligence and big data credit models enable quick credit decisions › Customized product recommendations based upon analytical determination of need › Provide holistic and interactive and intuitive design experience › Integrate online experience with other channels › Easy integration of third-party features (e.g., biometrics) › Access to value added tools (e.g., robo-advisory, automated savings features) either proprietary or third party › Enable creative customer acquisition partners › Eventual artificial intelligence tools assist sale of banking products such as deposits, loans, and mortgages › Products optimized by channel, recipient and journey › Self service saves time and cost (e.g., activate and deactivate debit-card in platform, send wires via self-service) › Increase chances of offering right product at the right time and place › Personalization is the right antidote for too much choice, too much content, and not enough time

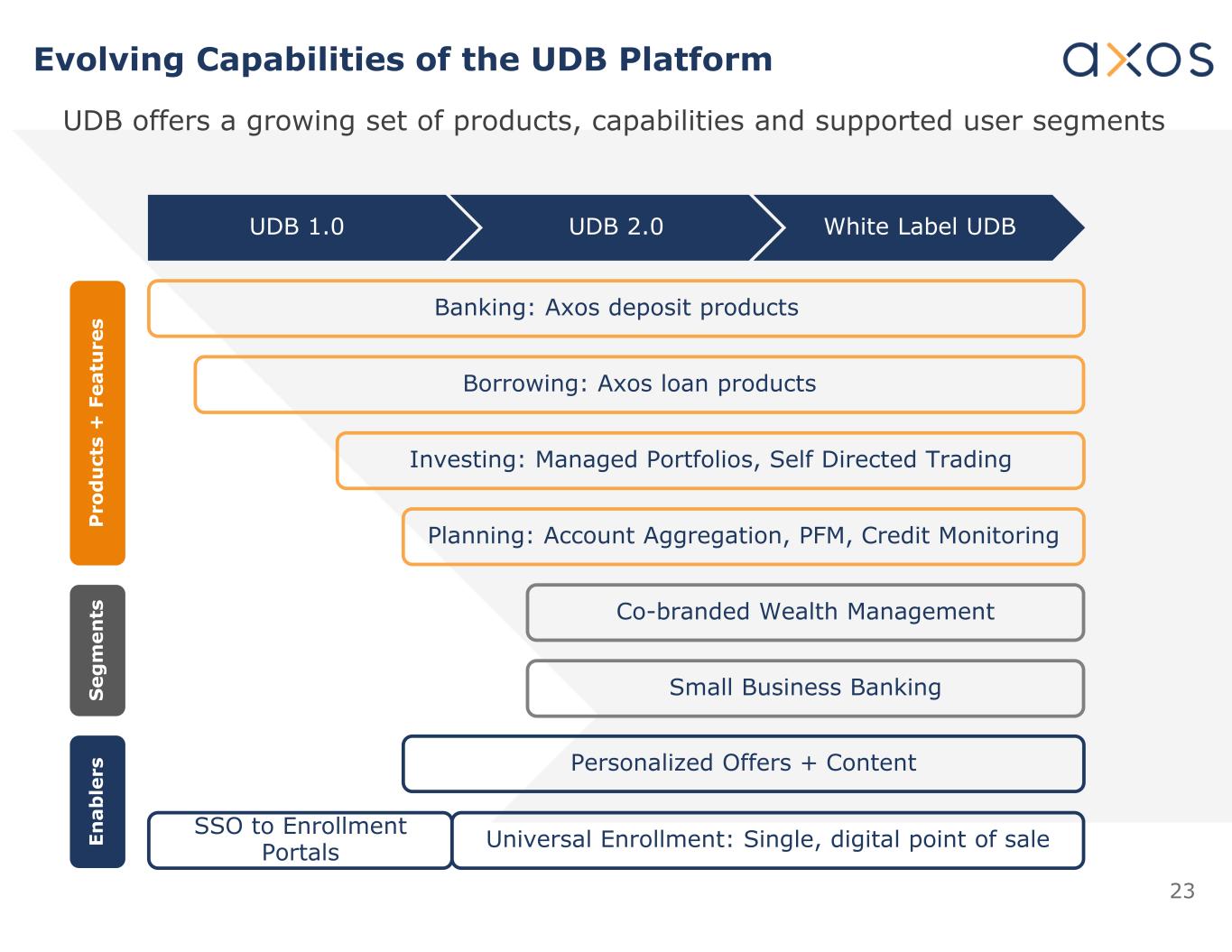

23 Evolving Capabilities of the UDB Platform UDB 1.0 UDB 2.0 White Label UDB Banking: Axos deposit products Borrowing: Axos loan products Investing: Managed Portfolios, Self Directed Trading Planning: Account Aggregation, PFM, Credit Monitoring Personalized Offers + Content Co-branded Wealth Management SSO to Enrollment Portals Universal Enrollment: Single, digital point of sale UDB offers a growing set of products, capabilities and supported user segments Small Business Banking P ro d u ct s + F ea tu re s S eg m en ts En ab le rs

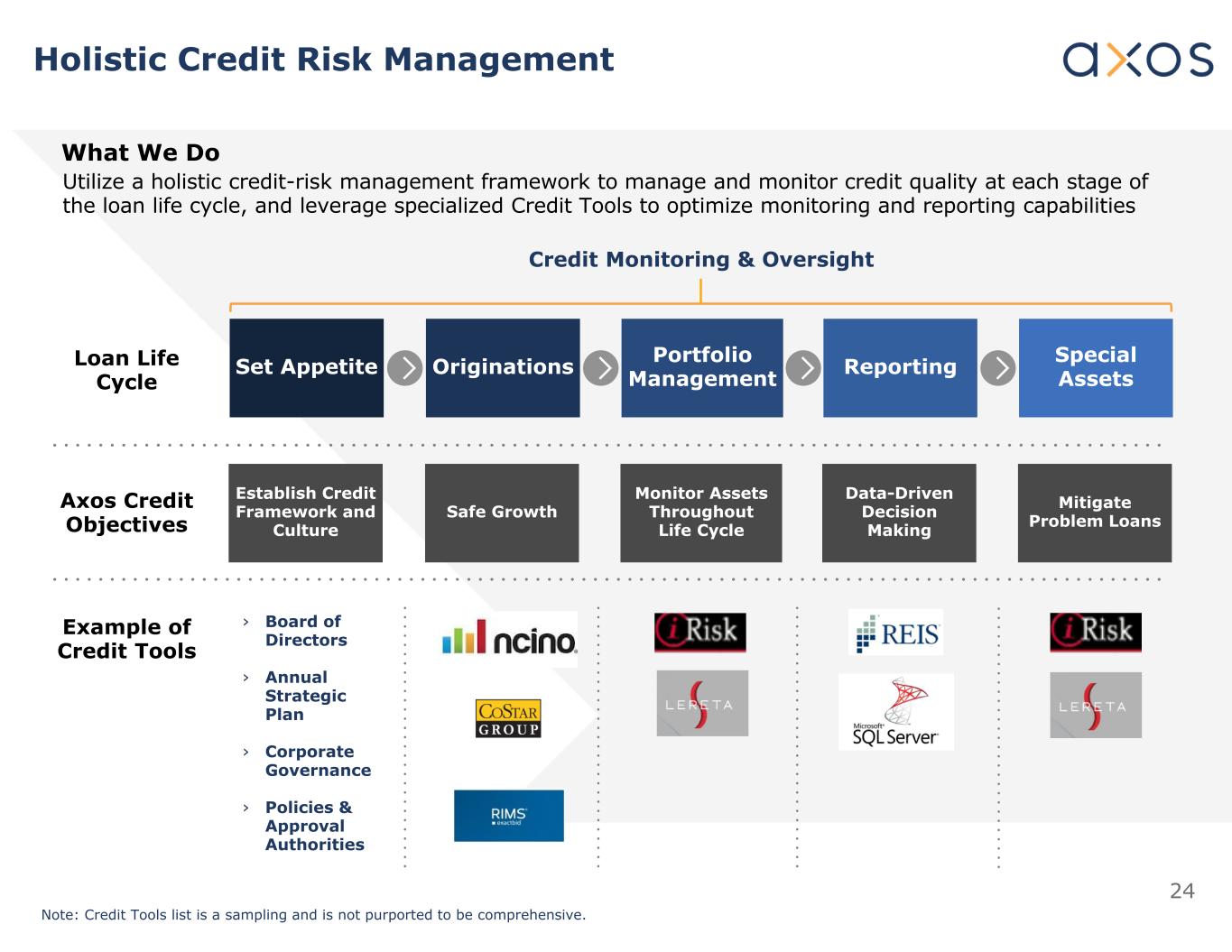

24 Holistic Credit Risk Management What We Do Loan Life Cycle Utilize a holistic credit-risk management framework to manage and monitor credit quality at each stage of the loan life cycle, and leverage specialized Credit Tools to optimize monitoring and reporting capabilities Set Appetite Originations Portfolio Management Reporting Special Assets Credit Monitoring & Oversight Axos Credit Objectives Example of Credit Tools › Board of Directors › Annual Strategic Plan › Corporate Governance › Policies & Approval Authorities Note: Credit Tools list is a sampling and is not purported to be comprehensive. Establish Credit Framework and Culture Safe Growth Monitor Assets Throughout Life Cycle Data-Driven Decision Making Mitigate Problem Loans

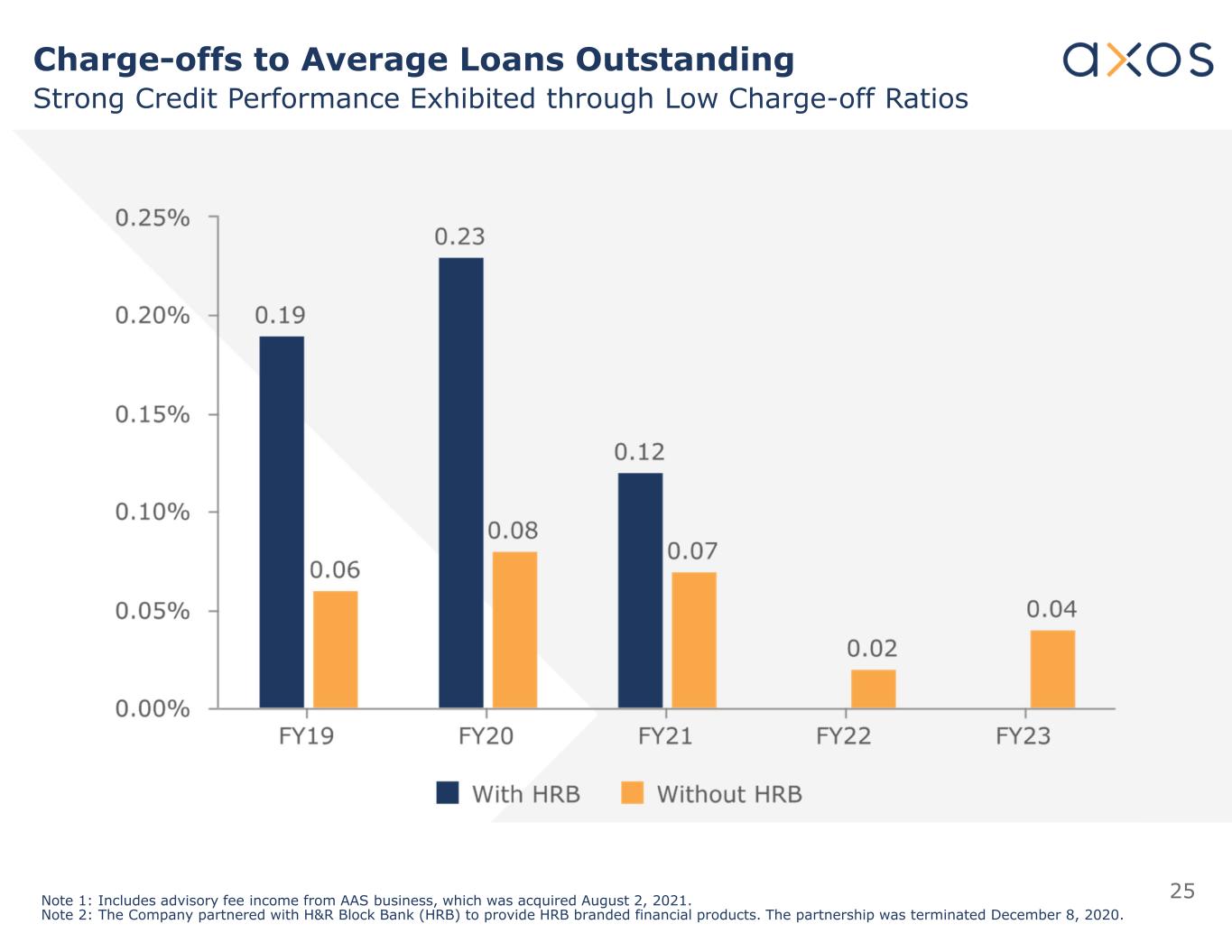

25 Charge-offs to Average Loans Outstanding Strong Credit Performance Exhibited through Low Charge-off Ratios Note 1: Includes advisory fee income from AAS business, which was acquired August 2, 2021. Note 2: The Company partnered with H&R Block Bank (HRB) to provide HRB branded financial products. The partnership was terminated December 8, 2020.

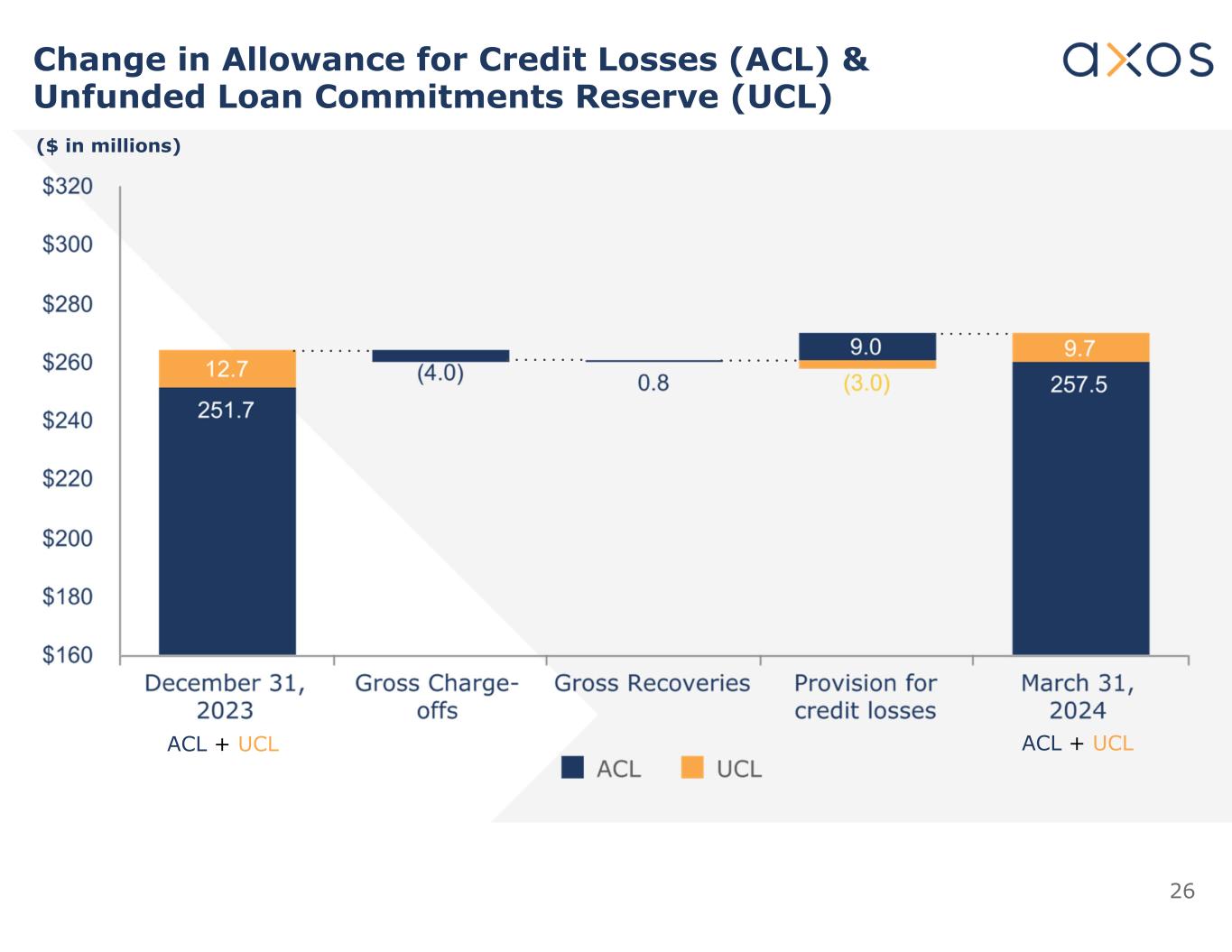

26 Change in Allowance for Credit Losses (ACL) & Unfunded Loan Commitments Reserve (UCL) ($ in millions) ACL + UCL ACL + UCL

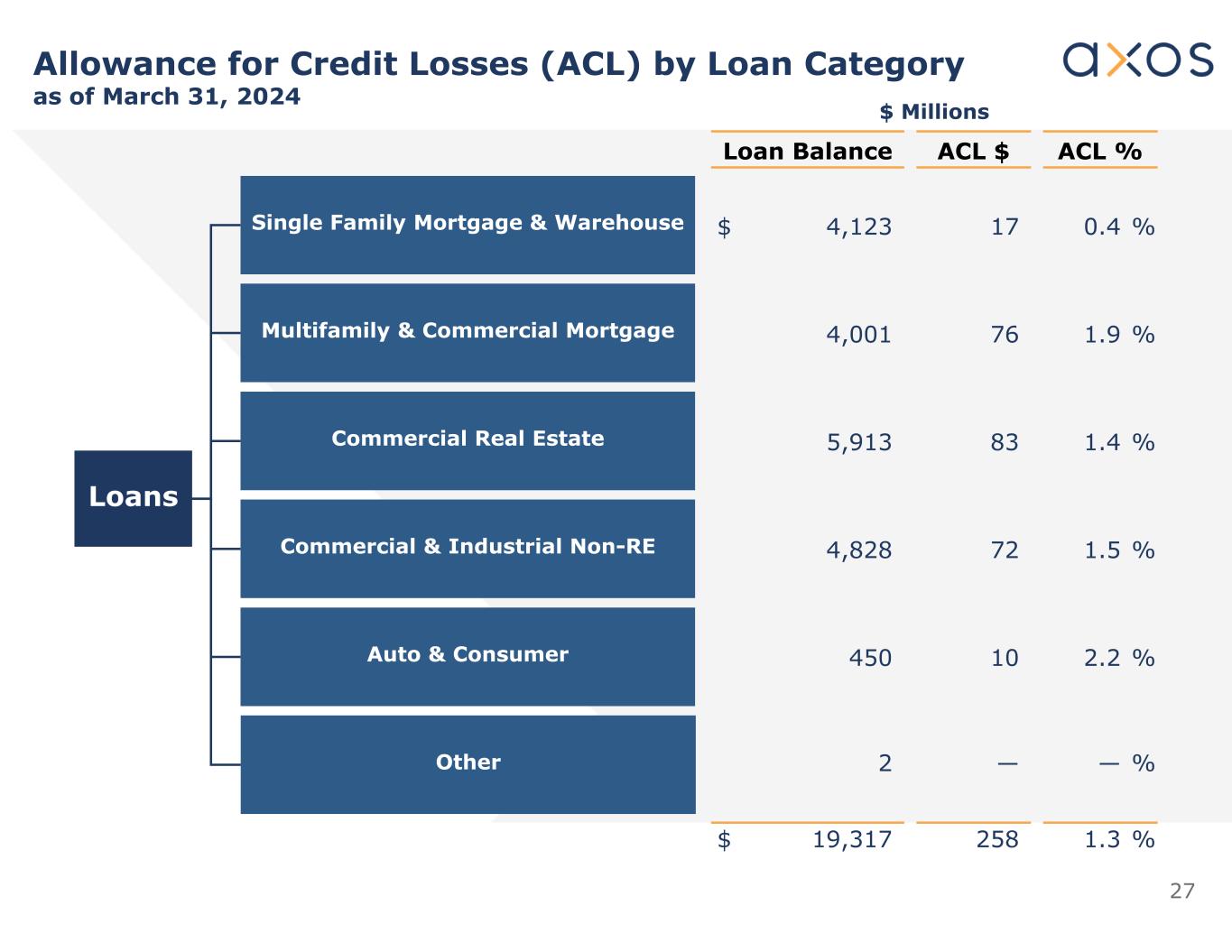

27 Allowance for Credit Losses (ACL) by Loan Category as of March 31, 2024 $ Millions ACL %ACL $Loan Balance 0.4 %17$ 4,123 1.9 %764,001 1.4 %835,913 1.5 %724,828 2.2 %10450 — %—2 1.3 %258$ 19,317 Single Family Mortgage & Warehouse Multifamily & Commercial Mortgage Commercial Real Estate Commercial & Industrial Non-RE Auto & Consumer Other Loans

28 Greg Garrabrants, President and CEO Derrick Walsh, EVP and CFO investors@axosfinancial.com www.axosfinancial.com Johnny Lai, SVP Corporate Development and Investor Relations Phone: 858.649.2218 Mobile: 858.245.1442 jlai@axosfinancial.com Contact Information