Brandywine Realty Trust Generates $137 Million of Asset Sales as Part of Strategic Disposition Program

24 Diciembre 2024 - 8:06AM

Brandywine Realty Trust (NYSE: BDN) today announced the completion

of two significant sales within our joint venture portfolio: 4040

Wilson, a mixed-use development in Arlington, VA, and the Dabney

and Brittons Hill portfolio in Richmond, VA. These transactions

yielded combined gross sale proceeds of $265.8 million, advancing

Brandywine’s strategic objectives to improve its competitive

position, reduce forward capital commitments, and generate

incremental liquidity for future investments.

4040 Wilson, located in Arlington’s Ballston

submarket, was sold for $190.5 million ($95.25 million for

Brandywine’s 50% share). The property has 405,000 square feet of

office, retail, and residential space, as well as 494 parking

spaces. 4040 Wilson was 96% leased (residential) and 94% leased

(commercial) at the time of sale.

The Dabney and Brittons Hill portfolio,

representing 14 industrial/flex buildings totaling 643,000 square

feet, was sold for $66.8 million, generating approximately $15.5

million of net proceeds to Brandywine for its 50% ownership

interest. In connection with the sale, Brandywine sold an 11-acre

land parcel operating under a long-term parking lease valued at

$8.5 million. The assets were fully leased at closing.

“We are delighted to have significantly

outperformed our original 2024 sales target totaling $90.0 million

and our revised sales target totaling $150.0 million. These

transactions highlight Brandywine’s commitment to redeploying

capital in high-quality core markets where we see significant

growth potential while enhancing our financial flexibility,” said

Jerry Sweeney, President and CEO of Brandywine Realty Trust. “This

disciplined approach aligns with our strategic focus to maximize

portfolio value and our commitment to delivering results.”

Together with previously disclosed asset sales,

the Company has generated gross sales proceeds of approximately

$310 million and $191 million of net cash proceeds. The proceeds

from these transactions will further strengthen Brandywine’s

balance sheet and support reinvestment in strategic initiatives

that align with the company’s vision and market strategy.

For more information on Brandywine Realty Trust,

visit www.brandywinerealty.com.

About Brandywine Realty

Trust

Brandywine Realty Trust (NYSE: BDN) is one of

the largest, publicly traded, full-service, integrated real estate

companies in the United States with a core focus in the

Philadelphia and Austin markets. Organized as a real estate

investment trust (REIT), we own, develop, lease and manage an

urban, town center and transit-oriented portfolio comprising 147

properties and 21.1 million square feet as of September 30, 2024.

Our purpose is to shape, connect and inspire the world around us

through our expertise, the relationships we foster, the communities

in which we live and work, and the history we build together. For

more information, please visit www.brandywinerealty.com.

Company / Investor Contact:Tom WirthEVP &

CFO610-832-7434 tom.wirth@bdnreit.com

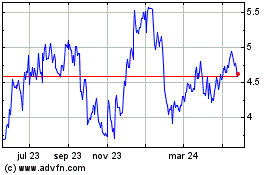

Brandywine Realty (NYSE:BDN)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

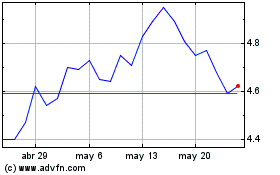

Brandywine Realty (NYSE:BDN)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025