Glatfelter Corporation (NYSE: GLT) (“Glatfelter”) and Berry Global

Group, Inc. (NYSE: BERY) (“Berry”) announced today that

Glatfelter’s shareholders have approved all matters relating to the

merger of Berry’s Health, Hygiene and Specialties Global Nonwovens

and Films business (“HHNF Business”) with Glatfelter required to be

approved by Glatfelter shareholders, as described in the proxy

statement/prospectus provided to its shareholders in connection

with the Special Meeting.

At the Special Meeting of Glatfelter Shareholders held earlier

today, Glatfelter shareholders voted to approve the share issuance

proposal, the charter amendment proposals, the omnibus plan

proposal and the advisory (non-binding) compensation proposal.

The transaction is expected to close on November 4, 2024,

subject to the satisfaction or waiver of the closing conditions for

the transaction. As previously announced, in connection with the

merger, Glatfelter will effect a reverse stock split and change its

name to Magnera Corporation (“Magnera”).

The Board of Directors of Glatfelter approved a final reverse

stock split ratio of 1-for-13. Accordingly, Glatfelter announced

today that it will effect a 1-for-13 reverse stock split (the

“reverse split”) of its common stock, par value $0.01 per share

(“Glatfelter common stock”), that it expects will become effective

on November 4, 2024 at 12:01 AM Eastern Time, before the opening of

trading on the New York Stock Exchange. Glatfelter’s common stock

will begin trading on the New York Stock Exchange on a

split-adjusted basis when the market opens on November 4, 2024,

under a new CUSIP number, 55939A 107.

The reverse split will affect all issued and outstanding shares

of Glatfelter common stock. All outstanding awards (including, as

applicable, stock option exercise prices), shares available for

grant or issuance under existing equity plans and the new Magnera

Corporation 2024 Omnibus Incentive Plan, and other securities

entitling their holders to purchase or otherwise receive or acquire

shares of Glatfelter common stock will be adjusted as a result of

the reverse split. Following the reverse split, the par value of

Glatfelter common stock will remain unchanged at $0.01 per

share.

Computershare Trust Company, N.A. (“Computershare”),

Glatfelter’s transfer agent, is acting as the Exchange Agent for

the reverse split.

No fractional shares of Glatfelter common stock will be issued

as a result of the reverse split. All fractional shares of

Glatfelter common stock that a holder of shares of Glatfelter

common stock would otherwise be entitled to receive as a result of

the reverse split will be aggregated by the Exchange Agent and

caused to be to be sold on their behalf in the open market at

then-prevailing market prices. The Exchange Agent will make

available the net proceeds thereof, after deducting any required

withholding taxes and brokerage charges, commissions and transfer

taxes, on a pro rata basis, without interest, as soon as

practicable to the holders of Glatfelter common stock that would

otherwise be entitled to receive such fractional shares of

Glatfelter common stock pursuant to the reverse split. The reverse

split will affect all shareholders uniformly and will not alter any

shareholder’s percentage interest in Glatfelter’s equity (other

than as a result of the treatment of fractional shares, as set

forth above).

Shareholders of record owning their shares in book-entry will be

receiving a transaction statement from Computershare regarding

their Glatfelter common stock ownership post-reverse split and are

not required to take any action to receive post-split shares.

Shareholders owning shares through a bank, broker, custodian or

other nominee will have their positions automatically adjusted to

reflect the reverse split, subject to the holding entity’s

particular processes; such shareholders will not be required to

take any action to receive post-split shares. However, these banks,

brokers, custodians or other nominees may have different procedures

than Computershare for processing the reverse split. If a

shareholder holds shares of Glatfelter common stock with a bank,

broker, custodian or other nominee and has any questions in this

regard, shareholders are encouraged to contact their bank, broker,

custodian or other nominee for more information.

About Berry

At Berry Global Group, Inc. (NYSE: BERY), we create innovative

packaging solutions that we believe make life better for people and

the planet. We do this every day by leveraging our unmatched global

capabilities, sustainability leadership, and deep innovation

expertise to serve customers of all sizes around the world.

Harnessing the strength in our diversity and industry-leading

talent of over 40,000 global employees across more than 250

locations, we partner with customers to develop, design, and

manufacture innovative products with an eye toward the circular

economy. The challenges we solve and the innovations we pioneer

benefit our customers at every stage of their journey.

About Glatfelter

Glatfelter is a leading global supplier of engineered materials

with a strong focus on innovation and sustainability. Glatfelter’s

high-quality, technology-driven, innovative, and customizable

nonwovens solutions can be found in products that are Enhancing

Everyday Life®. These include personal care and hygiene products,

food and beverage filtration, critical cleaning products, medical

and personal protection, packaging products, as well as home

improvement and industrial applications. Headquartered in

Charlotte, NC, Glatfelter’s 2023 revenue was $1.4 billion with

approximately 2,980 employees worldwide. Glatfelter’s operations

utilize a variety of manufacturing technologies including airlaid,

wetlaid and spunlace with fifteen manufacturing sites located in

the United States, Canada, Germany, France, Spain, the United

Kingdom, and the Philippines. Glatfelter has sales offices in all

major geographies serving customers under the Glatfelter and

Sontara® brands.

Cautionary Statement Concerning Forward-Looking

Statements

Statements in this release that are not historical, including

statements relating to the expected timing, completion and effects

of the proposed transaction between Berry and Glatfelter are

considered “forward-looking” within the meaning of the federal

securities laws and are presented pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

You can identify forward-looking statements because they contain

words such as “believes,” “expects,” “may,” “will,” “should,”

“would,” “could,” “seeks,” “approximately,” “intends,” “plans,”

“estimates,” “projects,” “outlook,” “anticipates” or “looking

forward,” or similar expressions that relate to strategy, plans,

intentions, or expectations. All statements relating to estimates

and statements about the expected timing and structure of the

proposed transaction, the ability of the parties to complete the

proposed transaction, benefits of the transaction, including future

financial and operating results, executive and Board transition

considerations, the combined company’s plans, objectives,

expectations and intentions, and other statements that are not

historical facts are forward-looking statements. In addition,

senior management of Berry and Glatfelter, from time to time may

make forward-looking public statements concerning expected future

operations and performance and other developments.

Actual results may differ materially from those that are

expected due to a variety of factors, including without limitation:

the occurrence of any event, change or other circumstances that

could give rise to the termination of the proposed transaction; the

risk that the Glatfelter shareholders may not approve the

transaction proposals; the risk that the necessary regulatory

approvals may not be obtained or may be obtained subject to

conditions that are not anticipated or may be delayed; risks that

any of the other closing conditions to the proposed transaction may

not be satisfied in a timely manner; risks that the anticipated tax

treatment of the proposed transaction is not obtained; risks

related to potential litigation brought in connection with the

proposed transaction; uncertainties as to the timing of the

consummation of the proposed transactions; unexpected costs,

charges or expenses resulting from the proposed transactions; risks

and costs related to the implementation of the separation of HHNF

Business into Spinco, including timing anticipated to complete the

separation; any changes to the configuration of the businesses

included in the separation if implemented; the risk that the

integration of the combined company is more difficult, time

consuming or costly than expected; risks related to financial

community and rating agency perceptions of each of Berry and

Glatfelter and its business, operations, financial condition and

the industry in which they operate; risks related to disruption of

management time from ongoing business operations due to the

proposed transaction; failure to realize the benefits expected from

the proposed transaction; effects of the announcement, pendency or

completion of the proposed transaction on the ability of the

parties to retain customers and retain and hire key personnel and

maintain relationships with their counterparties, and on their

operating results and businesses generally; and other risk factors

detailed from time to time in Glatfelter’s and Berry’s reports

filed with the Securities and Exchange Commission (the “SEC”),

including annual reports on Form 10-K, quarterly reports on Form

10-Q, current reports on Form 8-K and other documents filed with

the SEC. These risks, as well as other risks associated with the

proposed transaction, are more fully discussed in the proxy

statement/prospectus, registration statement on Form S-4 and the

registration statement on Form 10 filed with the SEC in connection

with the proposed transaction. The foregoing list of important

factors may not contain all of the material factors that are

important to you. New factors may emerge from time to time, and it

is not possible to either predict new factors or assess the

potential effect of any such new factors. Accordingly, readers

should not place undue reliance on those statements. All

forward-looking statements are based upon information available as

of the date hereof. All forward-looking statements are made only as

of the date hereof and neither Berry, Glatfelter, the Issuer,

Spinco nor Magnera undertake any obligation to update or revise any

forward-looking statement as a result of new information, future

events or otherwise, except as otherwise required by law.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in

respect of the proposed transaction between Berry and Glatfelter.

In connection with the proposed transaction, Glatfelter filed a

registration statement on Form S-4 containing a proxy

statement/prospectus with the SEC which was declared effective on

September 17, 2024. Glatfelter has also filed a proxy

statement/prospectus which was sent to Glatfelter’s shareholders on

or about September 20, 2024. In addition, Spinco filed a

registration statement on Form 10 in connection with its separation

from Berry. This communication is not a substitute for the

registration statements, proxy statement/prospectus or any other

document which Berry and/or Glatfelter may file with the SEC.

STOCKHOLDERS OF BERRY AND GLATFELTER ARE URGED TO READ ALL RELEVANT

DOCUMENTS FILED WITH THE SEC, INCLUDING THE REGISTRATION

STATEMENTS, ANY AMENDMENTS OR SUPPLEMENTS THERETO, AND PROXY

STATEMENT/PROSPECTUS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION

ABOUT THE PROPOSED TRANSACTION. Investors and security holders will

be able to obtain copies of the registration statements and proxy

statement/prospectus as well as other filings containing

information about Berry and Glatfelter, as well as Spinco, without

charge, at the SEC’s website, www.sec.gov. Copies of documents

filed with the SEC by Berry or Spinco are available free of charge

on Berry’s investor relations website at ir.berryglobal.com. Copies

of documents filed with the SEC by Glatfelter are available free of

charge on Glatfelter’s investor relations website at

www.glatfelter.com/investors.

No Offer or Solicitation

This communication is for informational purposes only and is not

intended to and does not constitute an offer to sell, or the

solicitation of an offer to sell, subscribe for or buy, or a

solicitation of any vote or approval in any jurisdiction, nor shall

there be any sale, issuance or transfer of securities in any

jurisdiction in which such offer, sale or solicitation would be

unlawful, prior to registration or qualification under the

securities laws of any such jurisdiction. No offer or sale of

securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act, as amended,

and otherwise in accordance with applicable law.

Investor ContactRamesh

Shettigar+1 717.225.2746Ramesh.Shettigar@glatfelter.com

Berry Global, Inc.

Investor ContactDustin Stilwell

VP, Investor Relations+1 812.306.2964ir@berryglobal.com

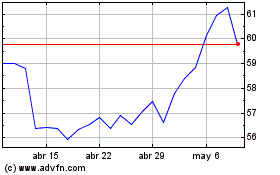

Berry Global (NYSE:BERY)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

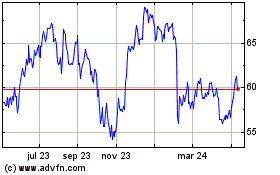

Berry Global (NYSE:BERY)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024