Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

25 Noviembre 2024 - 1:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of

Foreign Private Issuer

Pursuant to Rule 13a-16 or

15d-16

of the Securities Exchange Act of 1934

For the month of November, 2024

Commission File Number 1-06262

BP p.l.c.

(Translation

of registrant’s name into English)

1 ST

JAMES’S SQUARE, LONDON, SW1Y 4PD, ENGLAND

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE IN THE

REGISTRATION STATEMENT ON FORM F-3 (FILE NOS. 333-277842, 333-277842-01 AND 333-277842-02) OF BP CAPITAL MARKETS AMERICA INC., BP CAPITAL MARKETS p.l.c AND BP p.l.c., AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS FURNISHED, TO THE

EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

BP p.l.c. AND SUBSIDIARIES

FORM 6-K DATED 25 November 2024

Table of Contents

EX-5.1

EX-5.2

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

BP p.l.c.

(Registrant) |

|

|

|

|

| Dated: 25 November 2024 |

|

|

|

|

|

/s/ Ben J.S. Mathews |

|

|

|

|

|

|

Ben J.S. Mathews |

|

|

|

|

|

|

Company Secretary |

[Form 6-K – Signature Page]

INDEX TO EXHIBITS

[Form 6-K – Signature Page]

Exhibit 5.1

Jo Norman

|

|

|

| Managing Counsel |

|

BP p.l.c. 25 North Colonnade

Canary Wharf London E14 5HS

United Kingdom |

| BP Legal |

| 25 November 2024 |

| Direct 020 3683 5338 |

| Main 020 7496 4000 |

| Fax 020 7948 7982 |

|

|

| Jo.Norman@uk.bp.com |

|

|

November 25, 2024

BP

p.l.c.,

1 St. James’s Square,

London SW1Y 4PD,

England.

BP Capital America Markets America Inc.,

501

Westlake Boulevard,

Houston, Texas 77079.

Ladies and

Gentlemen:

In connection with the registration under the Securities Act of 1933, as amended (the “Act”), of U.S.$400,000,000 in aggregate

principal amount of 5.017% Guaranteed Notes due 2027 (the “2027 Notes”), U.S.$950,000,000 in aggregate principal amount of 5.227% Guaranteed Notes due 2034 (the “2034 Notes”) and U.S.$650,000,000 in aggregate principal

amount of 4.868% Guaranteed Notes due 2029 (the “2029 Notes” and together with the 2027 Notes and the 2034 Notes, the “Securities”), of BP Capital Markets America Inc., a Delaware corporation (“BP Capital

America”), and the related guarantees (the “Guarantees”) of the Securities by BP p.l.c., an English company (“BP”), pursuant to a Registration Statement on Form F-3

(the “Registration Statement”), as Managing Counsel – Treasury of BP, I have examined such corporate records, certificates and other documents and such questions of law as I have considered necessary or appropriate for the

purposes of this opinion.

Upon the basis of such examination, I advise you that, in my opinion:

1. BP is a public limited company duly incorporated and is a validly existing company under the laws of England and Wales;

2. the Indenture, dated as of June 4, 2003, among BP Capital America, BP and The Bank

of New York Mellon Trust Company, N.A. (as successor to JPMorgan Chase Bank), as Trustee (the “Trustee”) (the “Base Indenture”), as supplemented by an Eighteenth Supplemental Indenture, dated as of May 17, 2024 (the

“Eighteenth Supplemental Indenture”) and a Nineteenth Supplemental Indenture, dated as of November 25, 2024 (the “Nineteenth Supplemental Indenture” and, together with the Base Indenture and the Eighteenth Supplemental

Indenture, the “Indenture”), relating to the Securities has been duly authorised, executed and delivered by BP; and

3. when

(a) the Securities and the Guarantees have been duly executed and, in the case of the Securities, authenticated in accordance with the Indenture relating thereto, and (b) the Securities and the Guarantees have been issued and sold as

contemplated in the Registration Statement, the Guarantees will constitute valid and legally binding obligations of BP, subject to bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and similar laws of general applicability

relating to or affecting creditors’ rights and to general equity principles.

The foregoing opinion is limited to the laws of England

in force on this date and I am expressing no opinion as to the effect of the laws of any other jurisdiction. I understand you are relying as to all matters governed by the laws of the state of New York and the state of Delaware upon the opinion

dated the date hereof of Sullivan & Cromwell LLP, United States counsel to BP, which opinion is being delivered to you by such counsel.

I consent to the filing of this opinion as an exhibit to a Form 6-K to be incorporated by reference

into the Registration Statement relating to the Securities and the Guarantees and to the references to me under the caption “Validity of Securities” in the Prospectus included therein, as supplemented by the Prospectus Supplement dated as

of November 20, 2024. In giving such consent I do not thereby admit that I am within the category of persons whose consent is required under Section 7 of the Act.

|

|

|

|

|

|

|

Yours faithfully, |

|

|

|

|

/s/ Jo Norman |

|

|

|

|

Jo Norman |

[Signature Page to the AGC Exhibit 5 Opinion]

Exhibit 5.2

|

|

|

|

A LIMITED LIABILITY

PARTNERSHIP TELEPHONE: +44 (0)20-7959-8900 FACSIMILE: +44 (0)20-7959-8950

WWW.SULLCROM.COM |

|

One New Fetter Lane

London EC4A 1AN, England

________

BRUSSELS • FRANKFURT • PARIS

LOS ANGELES • NEW YORK • PALO ALTO • WASHINGTON, D.C.

BEIJING • HONG KONG • TOKYO

MELBOURNE • SYDNEY |

November 25, 2024

BP p.l.c.,

1 St. James’s Square,

London SW1Y 4PD, England.

BP Capital Markets

America Inc.,

501 Westlake Park Boulevard,

Houston, Texas 77079.

Ladies and Gentlemen:

In connection with the registration under the Securities Act of 1933 (the “Act”), of U.S.$400,000,000 in aggregate principal

amount of 5.017% Guaranteed Notes due 2027 (the “2027 Notes”), U.S.$950,000,000 in aggregate principal amount of 5.227% Guaranteed Notes due 2034 (the “2034 Notes”) and U.S.$650,000,000 in aggregate principal amount of 4.868%

Guaranteed Notes due 2029 (the “2029 Notes” and together with the 2027 Notes and the 2034 Notes, the “Securities”) of BP Capital Markets America Inc., a Delaware corporation (“BP Capital”), and the related guarantees

(the “Guarantees”) of the Securities by BP p.l.c., an English company (“BP”), we, as your United States counsel, have examined such corporate records, certificates and other documents and such questions of law as we have

considered necessary or appropriate for the purposes of this opinion.

Sullivan & Cromwell LLP carries on business in England and

Wales through Sullivan & Cromwell MNP LLP, a registered limited liability partnership established under the laws of the State of New York.

The personal liability of our partners is limited to the extent provided in such laws. Additional information is available upon request or at

www.sullcrom.com.

Sullivan & Cromwell MNP LLP is authorized and regulated by the Solicitors Regulation Authority (Number

00308712).

A list of the partners’ names and professional qualifications is available for inspection at 1 New Fetter Lane, London EC4A

1AN. All partners are either registered foreign lawyers or solicitors.

|

|

|

| BP p.l.c BP Capital Markets America

Inc. |

|

-2- |

Upon the basis of such examination, we advise you that, in our opinion, (1) the

Securities constitute valid and legally binding obligations of BP Capital and (2) assuming the Guarantees have been duly authorized, executed and delivered by BP insofar as the laws of England and Wales are concerned, the Guarantees constitute

valid and legally binding obligations of BP, subject, in each case, to bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and similar laws of general applicability relating to or affecting creditors’ rights and to general

equity principles.

In rendering the foregoing opinion, we are not passing upon, and assume no responsibility for, any disclosure in any

registration statement or any related prospectus or other offering material relating to the offer and sale of the Securities.

The

foregoing opinion is limited to the Federal laws of the United States, the laws of the State of New York and the General Corporation Law of the State of Delaware, and we are expressing no opinion as to the effect of the laws of any other

jurisdiction. For purposes of our opinion, we have assumed that (1) BP has been duly incorporated and is an existing public limited company under laws of England and Wales and (2) the Indenture relating to the Securities has been duly

authorized, executed and delivered by BP insofar as the laws of England and Wales are concerned. With respect to all matters of English law, we note that you have received an opinion, dated as of the date hereof, of Jo Norman, Managing Counsel

– Treasury of BP.

|

|

|

| BP p.l.c BP Capital Markets America

Inc. |

|

-3- |

We have relied as to certain factual matters on information obtained from public officials,

officers of BP and BP Capital and other sources believed by us to be responsible, and we have assumed that the Indenture has been duly authorized, executed and delivered by The Bank of New York Mellon Trust Company, N.A. (the “Trustee”)

thereunder, that the Securities conform to the specimens thereof examined by us, that the Trustee’s certificate of authentication of the Securities has been signed by one of the Trustee’s authorized officers and that the signatures on all

documents examined by us are genuine, assumptions which we have not independently verified.

We hereby consent to the filing of this

opinion as an exhibit to a Form 6-K to be incorporated by reference into the Registration Statement on Form F-3 relating to the Securities (File Nos. 333-277842 and 333-277842-02) and to the references to us under the heading “Validity of Securities” in the Prospectus

included therein, as supplemented by the Prospectus Supplement dated November 20, 2024. In giving such consent we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Act.

Very truly yours,

/s/ Sullivan & Cromwell LLP

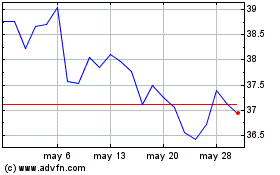

BP (NYSE:BP)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

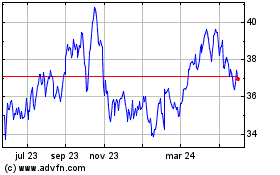

BP (NYSE:BP)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024