false000162722300016272232024-12-132024-12-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

December 13, 2024

Date of Report (Date of Earliest Event Reported)

The Chemours Company

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

|

001-36794 |

|

46-4845564 |

(State or Other Jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

Of Incorporation) |

|

File Number) |

|

Identification No.) |

1007 Market Street

Wilmington, Delaware 19801

(Address of principal executive offices)

Registrant’s telephone number, including area code: (302) 773-1000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of Each Class |

|

Trading Symbol(s) |

|

Name of Exchange on Which Registered |

Common Stock ($0.01 par value) |

|

CC |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

Emerging growth company |

|

☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

|

☐ |

|

|

Item 1.01 |

Entry into a Material Definitive Agreement. |

On December 13, 2024, The Chemours Company (the “Company”) entered into Amendment No. 2 (the “Second Amendment”) among the Company, certain subsidiaries of the Company, the lenders from time to time party thereto and JPMorgan Chase Bank, N.A., as administrative agent (the “Administrative Agent”), which amends the Second Amended and Restated Credit Agreement, dated as of August 18, 2023, among the Company, the lenders from time to time party thereto and the Administrative Agent (as amended by Amendment No. 1, dated as of November 29, 2024 and as further amended, supplemented or otherwise modified from time to time prior to December 13, 2024, the “Existing Credit Agreement”). The Second Amendment reduces the applicable margin in respect of the Company’s €415,000,000 Euro denominated term loan facility (the “Tranche B-3 Euro Term Loan Facility”) from adjusted EURIBOR + 4.00% to adjusted EURIBOR + 3.25%. There are no changes to the maturity of the Term B-3 Euro Term Loan Facility following this repricing, and all other terms are substantially unchanged. Capitalized terms used in this Item 1.01 but not otherwise defined herein have the meanings assigned to them in the Existing Credit Agreement as amended.

The foregoing description of the Second Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Second Amendment which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

|

|

Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under Off-Balance Sheet Arrangement of a Registrant. |

The information set forth in Item 1.01 is incorporated herein by reference.

|

|

Item 7.01 |

Regulation FD Disclosure. |

On December 13, 2024, the Company issued a press release announcing entry into the Second Amendment. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

Exhibit 10.1 |

Amendment No. 2, dated as of December 13, 2024, among The Chemours Company, the other Loan Parties, and the Lenders party thereto and JPMorgan Chase Bank, N.A., as Administrative Agent, to the Second Amended and Restated Credit Agreement dated as of August 18, 2023 |

Exhibit 99.1 |

Press release dated as of December 13, 2024 issued by the Chemours Company |

Exhibit 104 |

Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

THE CHEMOURS COMPANY |

|

By: |

|

/s/ Shane Hostetter |

|

|

Shane Hostetter |

|

|

Senior Vice President, Chief Financial Officer |

Date: |

|

December 13, 2024 |

AMENDMENT NO. 2 dated as of December 13, 2024 (this “Amendment”), among THE CHEMOURS COMPANY, a Delaware corporation (the “Borrower”), the other LOAN PARTIES party hereto, the LENDERS party hereto and JPMORGAN CHASE BANK, N.A. (“JPMorgan”), as administrative agent (in such capacity, the “Administrative Agent”), to the Second Amended and Restated Credit Agreement dated as of August 18, 2023 (as amended, supplemented or otherwise modified from time to time prior to the Amendment Effective Date (as defined below), the “Existing Credit Agreement”), among the Borrower, the lenders and issuing banks party thereto and the Administrative Agent. Capitalized terms used in this Amendment but not otherwise defined shall have the meanings assigned to such terms in the Existing Credit Agreement, except as otherwise expressly set forth herein.

WHEREAS pursuant to the Existing Credit Agreement, the Lenders and the Issuing Banks have agreed to extend credit to the Borrower on the terms and subject to the conditions set forth therein;

WHEREAS the Borrower intends to reduce the Applicable Rate applicable to the Tranche B-3 Euro Term Loans and to effect certain other modifications to the Existing Credit Agreement as set forth herein;

WHEREAS each Tranche B-3 Euro Term Lender (each, an “Existing Term Lender”) holding outstanding Tranche B-3 Euro Term Loans immediately prior to the Amendment Effective Date (“Existing Term Loans”) that executes and delivers a signature page to this Amendment (each, a “Consenting Term Lender”) will have agreed to the terms of this Amendment upon the effectiveness of this Amendment on the Amendment Effective Date. Each Existing Term Lender that is not a Consenting Term Lender (each, a “Non-Consenting Term Lender”) will be deemed not to have agreed to this Amendment as it applies to the Existing Term Loans held by such Non-Consenting Term Lender and will be subject to the mandatory assignment provisions of Section 9.02(c) of the Existing Credit Agreement upon the effectiveness of this Amendment on the Amendment Effective Date solely with respect to its Existing Term Loans (it being understood that the interests, rights and obligations of the Non-Consenting Term Lenders and of the Consenting Term Lenders that elect “Assign and Reallocation Consent Option” on their signature page hereto (collectively, the “Assigning Term Lenders”) under the Existing Credit Agreement and each other Loan Document with respect to the Existing Term Loans will be assumed by JPMorgan in accordance with Section 1 hereof and will be subsequently assigned by JPMorgan in accordance with Section 9.02(c) of the Existing Credit Agreement (JPMorgan, in its capacity as the assignee of the Existing Term Loans of the Assigning Term Lenders, the “New Term Lender”));

WHEREAS on the Amendment Effective Date, the Borrower shall have paid to the Administrative Agent, for the ratable benefit of the Existing Term Lenders, all accrued and unpaid interest to, but not including, the Amendment Effective Date, with respect to the Existing Term Loans; and

WHEREAS the undersigned Lenders are willing to amend such provisions of the Existing Credit Agreement, in each case on the terms and subject to the conditions set forth herein;

NOW, THEREFORE, in consideration of the mutual agreements herein contained and other good and valuable consideration, the sufficiency and receipt of which are hereby acknowledged, and subject to the conditions set forth herein, the parties hereto hereby agree as follows:

1.1.Tranche B-3 Euro Term Loans.

1.1.1.On the Amendment Effective Date, but immediately prior to giving effect to the amendments set forth in Section 2 hereof, (i) the New Term Lender shall become, and (subject to the assignment and reallocation of the Tranche B-3 Euro Term Loans of each Consenting Term Lender that elects the “Assign and Reallocation Consent Option” on their signature page hereto) each Consenting Term Lender shall continue to be, a “Tranche

B-3 Euro Term Lender”, a “Term Lender” and a “Lender” under the Existing Credit Agreement and (ii) the New Term Lender shall have, and (subject to the assignment and reallocation of the Tranche B-3 Euro Term Loans of each Consenting Term Lender that elects the “Assign and Reallocation Consent Option” on their signature page hereto) each Consenting Term Lender shall continue to have, all the rights and obligations of a “Tranche B-3 Euro Term Lender”, a “Term Lender” and a “Lender” holding a Tranche B-3 Euro Term Loan under the Existing Credit Agreement. The New Term Lender consents to this Amendment and appoints and authorizes the Administrative Agent to take such action as agent on its behalf and to exercise such powers under the Existing Credit Agreement and the other Loan Documents as are delegated to the Administrative Agent by the terms thereof, together with such powers as are reasonably incidental thereto.

1.1.2.Pursuant to Section 9.02(c) of the Existing Credit Agreement, on the Amendment Effective Date but immediately prior to giving effect to the amendments set forth in Section 2 hereof, (i) each Assigning Term Lender shall be deemed to have assigned all its Existing Term Loans and (ii) each other Consenting Term Lender that will be allocated an aggregate principal amount of Existing Term Loans as of the Amendment Effective Date that is less than the aggregate principal amount of the Existing Term Loans of such Consenting Term Lender immediately prior to the Amendment Effective Date (as disclosed to such Consenting Term Lender by the Administrative Agent prior to the date hereof), in each case together with all its interests, rights and obligations under the Loan Documents solely in respect of the Existing Term Loans, to the New Term Lender, as an Eligible Assignee, at a purchase price equal to the principal amount of such Existing Term Loans (the “Purchase Price”). Upon (i) payment to an Assigning Term Lender of (x) the Purchase Price with respect to its Existing Term Loans so assigned, (y) accrued and unpaid interest on such Existing Term Loans through but excluding the Amendment Effective Date and (z) any amounts that such Assigning Term Lender may be owed pursuant to Section 2.16 of the Existing Credit Agreement in respect of such Existing Term Loans, which, in the case of clause (x) shall be paid by the New Term Lender, as assignee, and in the case of clauses (y) and (z) shall be paid by the Borrower and (ii) the satisfaction or waiver of the applicable conditions set forth in Sections 9.02(c) and 9.04 of the Credit Agreement, such Assigning Term Lender shall cease to be a party to the Existing Credit Agreement solely in its capacity as a Tranche B-3 Euro Term Lender (it being understood and agreed, for the avoidance of doubt, that any Consenting Term Lender that elects “Assign and Reallocation Consent Option” on its signature page hereto that purchases from the New Term Lender via assignment of any Tranche B-3 Euro Term Loans will, upon the consummation of such purchase, be a Tranche B-3 Euro Term Lender); provided that the Administrative Agent’s delivery of a counterpart signature page shall be evidence that the Administrative Agent has deemed that the applicable conditions set forth in Sections 9.02(c) and 9.04 of the Existing Credit Agreement have been satisfied.

1.1.3.This Amendment shall be deemed to be the Assignment and Assumption required to be delivered pursuant to Section 9.04(b) of the Existing Credit Agreement with respect to the assignments contemplated by this Section 1. By execution of this Amendment, the Borrower hereby consents to the assignments contemplated by this Section 1.

1.1.4.This Amendment shall be deemed to be the written consent of the Administrative Agent required pursuant to clause (i) of the proviso to Section 9.02(c) of the Existing Credit Agreement with respect to the mandatory assignments contemplated herein.

1.1.5.The Borrower hereby appoints (i) JPMorgan, BofA Securities Inc., Citigroup Global Markets Inc., UBS Securities LLC, Goldman Sachs Bank USA, RBC Capital Markets, Deutsche Bank Securities Inc. and TD Securities (USA) LLC to act as joint bookrunners and joint lead arrangers, (ii) Barclays Bank PLC, BNP Paribas Securities Corp., Mizuho Bank Ltd. and Truist Securities, Inc. to act as joint lead arrangers and (iii) Citizens Bank, National Association and M&T Bank to act as arrangers, in each case with respect to this Amendment, it being understood and agreed that JPMorgan will have “left” placement on any and all marketing materials or other documentation used in connection with this Amendment and JPMorgan will perform the roles and responsibilities conventionally understood to be associated with such left placement.

1.2.Amendments to the Existing Credit Agreement. Effective as of the Amendment Effective Date but immediately after giving effect to the transactions set forth in Section 1 hereof, the Existing Credit Agreement is hereby amended as follows (the Existing Credit Agreement as so amended, the “Amended Credit Agreement”):

1.2.1.by inserting the following definitions in the appropriate alphabetical order in Section 1.01 of the Existing Credit Agreement:

““Amendment No. 2” means Amendment No. 2 to this Agreement, dated as of December 13, 2024.

“Amendment No. 2 Effective Date” means the Amendment Effective Date as defined in Amendment No. 2, which date (for the avoidance of doubt) will be December 13, 2024.”;

1.2.2. by replacing clause (b) of the definition of “Applicable Rate” in Section 1.01 of the Existing Credit Agreement in its entirety with the following text:

“(b) with respect to any Loan that is a Tranche B-3 Euro Term Loan, (i) prior to the Amendment No. 2 Effective Date, 4.00% per annum, and (ii) on and after the Amendment No. 2 Effective Date, 3.25% per annum”; and

1.2.3.by replacing the text “(or, solely with respect to the Tranche B-3 US$ Term Borrowings, the date that is six months after the Amendment No. 1 Effective Date)” in each of clauses (i) and (ii) of Section 2.11(g) of the Existing Credit Agreement in its entirety with the following text:

“(or, solely with respect to (A) the Tranche B-3 US$ Term Borrowings, the date that is six months after the Amendment No. 1 Effective Date and (B) the Tranche B-3 Euro Term Borrowings, the date that is six months after the Amendment No. 2 Effective Date)”.

1.3.Representations and Warranties. Each Loan Party represents and warrants to the Administrative Agent and to each of the Lenders party hereto that:

1.3.1.This Amendment has been duly authorized, executed and delivered by it and constitutes a legal, valid and binding obligation of each Loan Party, enforceable against such Loan Party in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law.

1.3.2.The representations and warranties of each Loan Party set forth in the Loan Documents are true and correct in all material respects (or, in the case of representations and warranties qualified as to materiality, in all respects) on and as of the date hereof (other than with respect to any representation and warranty that expressly relates to a prior date, in which case such representation and warranty is true and correct in all material respects (or in all respects, as applicable) as of such earlier date).

1.3.3.At the time of and immediately after giving effect to this Amendment, no Default shall have occurred and be continuing.

1.4.Effectiveness. This Amendment shall become effective as of the date first above written (the “Amendment Effective Date”) when:

1.4.1.the Administrative Agent shall have received counterparts of this Amendment that, when taken together, bear the signatures of (i) each Loan Party, (ii) each Consenting Term Lender (if any), (iii) the New Term Lender and (iv) Tranche B-3 Euro Term Lenders under the Existing Credit Agreement that, immediately prior to the effectiveness of this Amendment, constitute the Required Lenders (but, in making this determination, only the Tranche B-3 Euro Term Lenders will be taken into account);

1.4.2.the Administrative Agent shall have received (i) with respect to each Loan Party, secretary’s certificates of the type delivered to the Administrative Agent pursuant to Section 4.01(c) of the Existing Credit Agreement (as such term is defined in the Existing Credit Agreement), dated as of the Amendment Effective Date, (ii) a certificate of a Responsible Officer confirming compliance with the condition set forth in paragraph (e) of this Section 4, and (iii) a favorable written opinion (addressed to the Administrative Agent and the Lenders party hereto), in form and substance reasonably satisfactory to the Administrative Agent, of Goodwin Procter LLP, counsel for the Loan Parties, dated as of the Amendment Effective Date and covering such matters relating to the Loan Parties and this Amendment as the Administrative Agent may reasonably request;

1.4.3.the Administrative Agent, the Consenting Term Lenders and the New Term Lender shall have received payment of all fees and expenses required to be paid or reimbursed by the Borrower or any other Loan Party under or in connection with this Amendment and any other Loan Document, including those fees and expenses set forth in Section 10 hereof;

1.4.4.the Administrative Agent shall have received payment of all accrued but unpaid interest on the Existing Term Loans through (but not including) the Amendment Effective Date;

1.4.5.the representations and warranties set forth in Section 3 hereof shall be true and correct as of the Amendment Effective Date; and

1.4.6.(i) at least five Business Days prior to the Amendment Effective Date, the Administrative Agent and the Lenders shall have received all documentation and other information required by bank regulatory authorities or reasonably requested by the Administrative Agent on behalf of itself or on behalf of any Consenting Term Lender, the New Term Lender or any other Lender under or in respect of applicable “know-your-customer” and anti-money laundering rules and regulations, including the USA PATRIOT Act, that was requested at least 10 Business Days prior to the Amendment Effective Date and (ii) to the extent the Borrower qualifies as a “legal entity customer” under the Beneficial Ownership Regulation, at least five Business Days prior to the Amendment Effective Date, any Consenting Term Lender, the New Term Lender or any other Lender that has requested, in a written notice to the Borrower at least 10 Business Days prior to the Amendment Effective Date, a Beneficial Ownership Certification in relation to the Borrower shall have received such Beneficial Ownership Certification.

1.5.Post-Closing Matters Covenant. At the time of delivery of the Supplemental Perfection Certificate due pursuant to Section 5.03(b) of the Amended Credit Agreement for the fiscal year ended December 31, 2024 (or such longer period as the Administrative Agent may agree in its reasonable discretion), each applicable Loan Party shall deliver either the items listed in paragraph (a) or the items listed in paragraph (b) as follows:

1.5.1.(i) an opinion or email confirmation from local counsel in each jurisdiction where a Mortgaged Property is located, in form and substance reasonably satisfactory to the Administrative Agent, to the effect that:

1.5.1.1.1.1.1.the recording of the existing Mortgage is the only filing or recording necessary to give constructive notice to third parties of the Lien created by such Mortgage as security for the Obligations, including the Obligations evidenced by the Amended Credit Agreement and the other documents executed in connection herewith, for the benefit of the Secured Parties; and

1.5.1.1.1.1.2.no other documents, instruments, filings, recordings, re-recordings, re-filings or other actions, including the payment of any mortgage recording taxes or similar taxes, are necessary or appropriate under applicable law in order to maintain the continued enforceability, validity or priority of the Lien created by such Mortgage as security for the Obligations, including the Obligations evidenced by the Amended Credit Agreement and the other documents executed in connection therewith, for the benefit of the Secured Parties; and

1.5.1.1.2.a title search to the applicable Mortgaged Property demonstrating that such Mortgaged Property is free and clear of all Liens other than Liens permitted under the Amended Credit Agreement (“Permitted Liens”); or

1.5.1.2.with respect to the existing Mortgages, the following, in each case in form and substance reasonably acceptable to the Administrative Agent:

1.5.1.2.1.with respect to each Mortgage encumbering a Mortgaged Property, an amendment or amendment and restatement thereof (each a “Mortgage Amendment”) duly executed and acknowledged by the applicable Loan Party, and in form for recording in the recording office where each Mortgage was recorded, together with such certificates, affidavits, questionnaires or returns as shall be required in connection with the recording or filing thereof under applicable law, in each case in form and substance reasonably satisfactory to the Administrative Agent;

1.5.1.2.2.with respect to each Mortgage Amendment, a date down and mortgage modification endorsement (each, a “Title Endorsement,” collectively, the “Title Endorsements”) to the existing title policy relating to the Mortgage encumbering the Mortgaged Property subject to such Mortgage assuring the Administrative Agent that such Mortgage, as amended by such Mortgage Amendment is a valid and enforceable first priority Lien on such Mortgaged Property in favor of the Administrative Agent for the benefit of the Secured Parties free and clear of all Liens other than

Permitted Liens or otherwise consented to by the Administrative Agent of such Mortgaged Property, and such Title Endorsement shall otherwise be in form and substance reasonably satisfactory to the Administrative Agent;

1.5.1.2.3.with respect to each Mortgage Amendment, opinions of local counsel to the Loan Parties, which opinions (x) shall be addressed to the Administrative Agent and the Secured Parties, (y) shall cover the enforceability, due authorization, execution and delivery of the respective Mortgage as amended by such Mortgage Amendment and such other matters customarily covered in corporate opinions as the Administrative Agent may reasonably request and (z) shall be in form and substance reasonably satisfactory to the Administrative Agent;

1.5.1.2.4.with respect to each Mortgaged Property, such affidavits, certificates, surveys (including, without limitation, no-change affidavits sufficient to remove all standard survey exceptions from the title policy relating to the applicable Mortgage), information and instruments of indemnification (including without limitation, a so-called “gap” indemnification) as shall be required by the title company to induce the title company to issue the Title Endorsements; and

1.5.1.2.5.evidence acceptable to the Administrative Agent of payment by the Borrower of all applicable title insurance premiums, search and examination charges, survey costs and related charges, mortgage recording taxes, fees, charges, costs and expenses required for the recording of the Mortgage Amendments and issuance of the Title Endorsements.

Notwithstanding the foregoing, the requirements of this Section 5 shall be deemed to be satisfied if the documentation delivered by or on behalf of the Loan Parties pursuant to Section 5 of Amendment No. 1 addresses the requirements of this Section 5 (and the Loan Parties shall not be required to deliver duplicative documentation pursuant to this Section 5).

1.6.1.Each of the Loan Parties party hereto hereby consents to this Amendment and the transactions contemplated hereby and hereby confirms its guarantees, pledges, grants of security interests and other agreements, as applicable, under each of the Security Documents to which it is party and agrees that, notwithstanding the effectiveness of this Amendment and the consummation of the transactions contemplated hereby (including the amendment of the Existing Credit Agreement), such guarantees, pledges, grants of security interests and other agreements of such Loan Parties shall continue to be in full force and effect and shall accrue to the benefit of the Secured Parties under the Amended Credit Agreement. Each of the Loan Parties party hereto further agrees to take any action that may be required under any applicable law or that is reasonably requested by the Administrative Agent, and is within the power of such Loan Party, to ensure compliance by the Borrower with the Collateral and Guarantee Requirement and Sections 5.11 and 5.12 of the Amended Credit Agreement and hereby reaffirms its obligations under each similar provision of each of the Security Documents to which it is a party.

1.6.2.Each of the Loan Parties party hereto hereby confirms and agrees that the Tranche B-3 Euro Term Loans, the Tranche B-3 US$ Term Loans, the Revolving Loans and the Letters of Credit (in each case, if any) have constituted and continue to constitute Obligations (or any word of like import) under each of the Security Documents.

1.7.Credit Agreement. Except as expressly set forth herein, this Amendment (a) shall not by implication or otherwise limit, impair, constitute a waiver of or otherwise affect the rights and remedies of the Lenders (including, without limitation, the Tranche B-3 Euro Term Lenders), the Administrative Agent, the Borrower or any other Loan Party under the Existing Credit Agreement, the Amended Credit Agreement or any other Loan Document and (b) shall not alter, modify, amend or in any way affect any of the terms, conditions, obligations, covenants or agreements contained in the Existing Credit Agreement, the Amended Credit Agreement or any other Loan Document, all of which are ratified and affirmed in all respects and shall continue in full force and effect. Nothing herein shall be deemed to entitle the Borrower or any other Loan Party to any future consent to, or waiver, amendment, modification or other change of, any of the terms, conditions, obligations, covenants or agreements contained in the Amended Credit Agreement or any other Loan Document in similar or different circumstances. After the date hereof, any reference in the Loan Documents to the “Credit Agreement” shall mean the Amended Credit Agreement. This Amendment shall constitute a “Loan Document” for all purposes of the Existing Credit Agreement, the Amended Credit Agreement and the other Loan Documents.

1.8.Tax Treatment. The Borrower intends to treat this Amendment as resulting in a “significant modification” of the Existing Term Loan within the meaning of Section 1.100-3 of the U.S. Treasury Regulations.

1.9.Applicable Law; Waiver of Jury Trial. (a) THIS AMENDMENT SHALL BE CONSTRUED IN ACCORDANCE WITH AND GOVERNED BY THE LAWS OF THE STATE OF NEW YORK.

1.9.1.EACH PARTY HERETO HEREBY AGREES AS SET FORTH IN SECTION 9.10 OF THE EXISTING CREDIT AGREEMENT AS IF SUCH SECTION WERE SET FORTH IN FULL HEREIN.

1.10.Counterparts; Amendment. This Amendment may be executed in two or more counterparts, each of which shall constitute an original but all of which when taken together shall constitute a single contract. Delivery of an executed counterpart of a signature page of this Amendment by telecopy or electronic transmission shall be effective as delivery of a manually executed counterpart of this Amendment. This Amendment may not be amended nor may any provision hereof be waived except pursuant to a writing signed by each Loan Party, each Consenting Term Lender, the New Term Lender, the Administrative Agent and the Required Lenders (but, in making this determination, only the Tranche B-3 Euro Term Lenders will be taken into account). The words “execution”, “signed”, “signature”, “delivery” and words of like import in or relating to this Amendment and/or any document to be signed in connection with this Amendment and the transactions contemplated hereby shall be deemed to include Electronic Signatures (as defined below), deliveries or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature, physical delivery thereof or the use of a paper-based recordkeeping system, as the case may be. For purposes hereof, “Electronic Signature” shall mean an electronic sound, symbol or process attached to, or associated with, a contract or other record and adopted by a person with the intent to sign, authenticate or accept such contract or record.

1.11.1.The Borrower agrees to pay to the Administrative Agent, for the account of each Arranger, the fees previously agreed by the Borrower to be paid to such Arranger on the Amendment Effective Date. The fees payable pursuant to this Section 10(a) will be paid in dollars in immediately available funds on the Amendment Effective Date.

1.11.3.The Borrower agrees to reimburse the Administrative Agent for its reasonable out-of-pocket expenses in connection with this Amendment to the extent required under Section 9.03 of the Existing Credit Agreement.

1.12.Headings. The Section headings used herein are for convenience of reference only, are not part of this Amendment and are not to affect the construction of, or to be taken into consideration in interpreting, this Amendment.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed by their respective authorized officers as of the day and year first written above.

|

|

THE CHEMOURS COMPANY |

By /s/ Shane Hostetter |

|

|

|

Name: Shane Hostetter |

|

Title: Chief Financial Officer |

|

|

THE CHEMOURS COMPANY FC, LLC |

By /s/ Shane Hostetter |

|

|

|

Name: Shane Hostetter |

|

Title: Chief Financial Officer |

|

|

ft chemical, inc. |

By /s/ Shane Hostetter |

|

|

|

Name: Shane Hostetter |

|

Title: Chief Financial Officer |

|

|

first chemical holdings, llc |

By /s/ Shane Hostetter |

|

|

|

Name: Shane Hostetter |

|

Title: Chief Financial Officer |

|

|

first chemical texas, l.p., By FT Chemical, Inc., its general partner |

By /s/ Shane Hostetter |

|

|

|

Name: Shane Hostetter |

|

Title: Chief Financial Officer |

|

|

jpmoRGAN CHASE BANK, N.A., individually as a Lender, as the New Term Lender and as the Administrative Agent, |

By /s/ James Shender |

|

|

|

Name: James Shender |

|

Title: Executive Director |

|

|

|

|

|

EXHIBIT 99.1

The Chemours Company Announces Completion of Euro denominated Term Loan Repricing

Wilmington, Del., December 13, 2024 -- The Chemours Company (Chemours) (NYSE: CC) today announced the successful repricing of its Tranche B-3 Euro denominated Term Loan under its senior secured term loan facility due in August 2028.

The Second Amendment reduces the applicable margin in respect of the Company’s €415,000,000 Euro denominated term loan facility, the “Tranche B-3 Euro Term Loan Facility,” from adjusted EURIBOR + 4.00% to adjusted EURIBOR + 3.25%. There are no changes to the maturity of the Term B-3 Euro Term Loan Facility following this repricing, and all other terms are substantially unchanged.

About The Chemours Company

The Chemours Company (NYSE: CC) is a global leader in providing industrial and specialty chemicals products for markets, including coatings, plastics, refrigeration and air conditioning, transportation, semiconductor and advanced electronics, general industrial, and oil and gas. Through our three businesses – Thermal & Specialized Solutions, Titanium Technologies, and Advanced Performance Materials – we deliver application expertise and chemistry-based innovations that solve customers’ biggest challenges. Our flagship products are sold under prominent brands such as Opteon™, Freon™, Ti-Pure™, Nafion™, Teflon™, Viton™, and Krytox™. Headquartered in Wilmington, Delaware and listed on the NYSE under the symbol CC, Chemours has approximately 6,100 employees and 28 manufacturing sites and serves approximately 2,700 customers in approximately 110 countries.

For more information, we invite you to visit chemours.com or follow us on X (formerly Twitter) @Chemours or LinkedIn.

EXHIBIT 99.1

Forward-Looking Statements

This press release contains forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which involve risks and uncertainties. Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to a historical or current fact. The words “believe,” “expect,” “will,” “anticipate,” “plan,” “estimate,” “target,” “project” and similar expressions, among others, generally identify “forward-looking statements,” which speak only as of the date such statements were made. Forward-looking statements are based on certain assumptions and expectations of future events that may not be accurate or realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond Chemours’ control. Additionally, there may be other risks and uncertainties that Chemours is unable to identify at this time or that Chemours does not currently expect to have a material impact on its business. Factors that could cause or contribute to these differences include the risks, uncertainties and other factors discussed in Chemours’ filings with the U.S. Securities and Exchange Commission, including in Chemours’ Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, and in Chemours’ Annual Report on Form 10-K for the year ended December 31, 2023. Chemours assumes no obligation to revise or update any forward-looking statement for any reason, except as required by law.

CONTACTS:

INVESTORS

Brandon Ontjes

VP, Head of Strategy & Investor Relations

+1.302.773.3300

investor@chemours.com

NEWS MEDIA

Cassie Olszewski

Media Relations & Reputation Leader

+1.302.219.7140

media@chemours.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

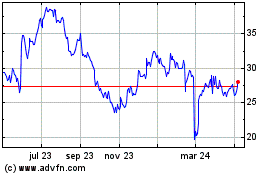

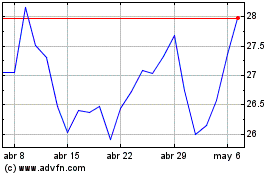

Chemours (NYSE:CC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Chemours (NYSE:CC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024