Custom Truck One Source, Inc. (NYSE: CTOS), a leading provider

of specialty equipment to the electric utility, telecom, rail and

other infrastructure-related end markets, today reported financial

results for its three and nine months ended September 30, 2023.

CTOS Third-Quarter Highlights

- Total revenue of $434.4 million, an increase of $76.6 million,

or 21.4%, compared to $357.8 million for the third quarter of 2022

as a result of continued strong demand across our end markets

- Gross profit of $107.2 million, an improvement of $19.0

million, or 21.5%, compared to $88.2 million for the third quarter

of 2022

- Adjusted Gross Profit of $149.6 million, an increase of $18.8

million, or 14.4%, compared to $130.8 million for the third quarter

of 2022

- Net income of $9.2 million, an increase of $11.6 million,

compared to net loss of $2.4 million, in the third quarter of

2022

- Adjusted EBITDA of $100.2 million, an increase of $8.6 million,

or 9.3% compared to $91.6 million in the third quarter of 2022

- Maintenance of Net Leverage Ratio of 3.3 at September 30, 2023

and June 30, 2023

- Increasing full year 2023 revenue guidance and affirming

Adjusted EBITDA guidance

“As we expected, demand remained strong across our primary end

markets, which allowed us to deliver another quarter of excellent

financial results and strong year-over-year growth in all three of

our business segments. Our TES segment realized 34% revenue growth

compared to the third quarter of last year. Our ERS segment

realized 12% revenue growth, and while we experienced some

short-term slowdown in the utility end market, our team effectively

managed through it. Our rental fleet ended the quarter with

utilization of approximately 80%,” said Ryan McMonagle, Chief

Executive Officer of CTOS. “A third consecutive quarter of record

setting vehicle production by our team allowed us to both add to

our fleet and post strong year-over-year growth in new vehicle

sales. This level of production, together with the demand

environment and continued improvement in the supply chain give us

the confidence to improve our revenue outlook for 2023. In

addition, our purchase of $15.8 million of our stock in the quarter

reflects our confidence in the improved outlook, as well as the

value that we feel we will create for shareholders from continuing

to execute on our growth strategy,” McMonagle added.

Summary Actual Financial Results

Three Months Ended

September 30,

Nine Months Ended

September 30,

Three Months Ended June 30,

2023

(in $000s)

2023

2022

2023

2022

Rental revenue

$

118,209

$

115,010

$

358,666

$

336,210

$

122,169

Equipment sales

283,079

210,903

886,486

656,595

302,117

Parts sales and services

33,065

31,867

98,194

93,557

32,544

Total revenue

434,353

357,780

1,343,346

1,086,362

456,830

Gross Profit

$

107,156

$

88,172

$

327,436

$

255,423

$

110,619

Adjusted Gross Profit1

$

149,625

$

130,784

$

453,851

$

386,323

$

154,235

Net Income (Loss)

$

9,180

$

(2,382

)

$

34,590

$

7,968

$

11,610

Adjusted EBITDA1

$

100,185

$

91,634

$

308,568

$

268,494

$

103,183

1

Each of Adjusted Gross Profit and Adjusted

EBITDA is a non-GAAP financial measure. Further information and

reconciliations for our non-GAAP measures to the most directly

comparable financial measure under United States generally accepted

accounting principles in the U.S. (“GAAP”) are included at the end

of this press release.

Summary Actual Financial Results by Segment Our results

are reported for our three segments: Equipment Rental Solutions

(“ERS”), Truck and Equipment Sales (“TES”) and Aftermarket Parts

and Services (“APS”). ERS encompasses our core rental business,

inclusive of sales of used rental equipment to our customers. TES

encompasses our specialized truck and equipment production and new

equipment sales activities. APS encompasses sales and rentals of

parts, tools and other supplies to our customers, as well as our

aftermarket repair service operations. Segment performance is

presented below for the three and nine months ended September 30,

2023 and 2022 and three months ended June 30, 2023.

Equipment Rental Solutions

Three Months Ended

September 30,

Nine Months Ended

September 30,

Three Months Ended June 30,

2023

(in $000s)

2023

2022

2023

2022

Rental revenue

$

114,929

$

112,009

$

346,545

$

325,679

$

117,832

Equipment sales

52,175

37,121

195,005

133,674

50,694

Total revenue

167,104

149,130

541,550

459,353

168,526

Cost of rental revenue

29,613

27,221

90,014

79,863

31,341

Cost of equipment sales

37,828

27,015

148,711

100,663

39,802

Depreciation of rental equipment

41,652

41,776

123,969

128,126

42,805

Total cost of revenue

109,093

96,012

362,694

308,652

113,948

Gross profit

$

58,011

$

53,118

$

178,856

$

150,701

$

54,578

Truck and Equipment Sales

Three Months Ended

September 30,

Nine Months Ended

September 30,

Three Months Ended

June 30, 2023

(in $000s)

2023

2022

2023

2022

Equipment sales

$

230,904

$

173,782

$

691,481

$

522,921

$

251,423

Cost of equipment sales

191,084

146,573

571,592

444,798

205,464

Gross profit

$

39,820

$

27,209

$

119,889

$

78,123

$

45,959

Aftermarket Parts and Services

Three Months Ended September

30,

Nine Months Ended September

30,

Three Months Ended June 30,

2023

(in $000s)

2023

2022

2023

2022

Rental revenue

$

3,280

$

3,001

$

12,121

$

10,531

$

4,337

Parts and services revenue

33,065

31,867

98,194

93,557

32,544

Total revenue

36,345

34,868

110,315

104,088

36,881

Cost of revenue

26,203

26,187

79,178

74,715

25,988

Depreciation of rental equipment

817

836

2,446

2,774

811

Total cost of revenue

27,020

27,023

81,624

77,489

26,799

Gross profit

$

9,325

$

7,845

$

28,691

$

26,599

$

10,082

Summary Combined Operating Metrics

Three Months Ended

September 30,

Nine Months Ended

September 30,

Three Months Ended June 30,

2023

(in $000s)

2023

2022

2023

2022

Ending OEC(a) (as of period end)

$

1,466,000

$

1,428,800

$

1,466,000

$

1,428,800

$

1,467,779

Average OEC on rent(b)

$

1,155,600

$

1,182,500

$

1,191,300

$

1,161,400

$

1,203,855

Fleet utilization(c)

78.9

%

83.8

%

81.3

%

83.0

%

81.7

%

OEC on rent yield(d)

40.8

%

38.5

%

39.8

%

38.9

%

40.1

%

Sales order backlog(e) (as of period

end)

$

779,295

$

709,180

$

779,295

$

709,180

$

863,757

(a)

Ending OEC — original equipment cost

(“OEC”) is the original equipment cost of units at the end of the

measurement period.

(b)

Average OEC on rent — Average OEC on rent

is calculated as the weighted-average OEC on rent during the stated

period.

(c)

Fleet utilization — total number of days

the rental equipment was rented during a specified period of time

divided by the total number of days available during the same

period and weighted based on OEC.

(d)

OEC on rent yield (“ORY”) — a measure of

return realized by our rental fleet during a 12-month period. ORY

is calculated as rental revenue (excluding freight recovery and

ancillary fees) during the stated period divided by the Average OEC

on rent for the same period. For periods of less than 12 months,

the ORY is adjusted to an annualized basis.

(e)

Sales order backlog — purchase orders

received for customized and stock equipment. Sales order backlog

should not be considered an accurate measure of future net

sales.

Management Commentary Total revenue in the third quarter

of 2023 was characterized by continued strong customer demand for

both rental and new equipment across our end markets. Third quarter

2023 rental revenue increased 2.8% to $118.2 million, compared to

$115.0 million in the third quarter of 2022, reflecting the

continued expansion of our rental fleet, stable utilization, and

pricing gains. Equipment sales increased 34.2% in the third quarter

of 2023 to $283.1 million, compared to $210.9 million in the third

quarter of 2022, reflecting record levels of production, continuing

improvements in the supply chain, and our ability to replenish

inventory. Parts sales and service revenue increased 3.8% to $33.1

million, compared to $31.9 million in the third quarter of 2022. On

a sequential quarter basis, total third quarter revenue for 2023

decreased $22.5 million, or 4.9%, primarily due to the timing of

new sales and a decline in average OEC on rent.

In our ERS segment, rental revenue in the third quarter of 2023

was $114.9 million compared to $112.0 million in the third quarter

of 2022, a 2.6% increase. Fleet utilization continued to be strong

at 78.9% compared to 83.8% in the third quarter of 2022, and we

ended the quarter at 80.5%. Average OEC on rent decreased 2.3%

year-over-year, primarily as a result of the lower utilization in

the quarter. Total segment gross profit in the third quarter of

2023 was $58.0 million, an increase of 9.2% compared to $53.1

million in the third quarter of 2022. Adjusted Gross Profit in the

segment was $99.7 million in the third quarter of 2023, compared to

$94.9 million in the third quarter of 2022, representing 5.0%

year-over-year growth. Rental Gross Profit improved to $85.3

million in the third quarter of 2023 compared to $84.8 million in

the third quarter of 2022, a 0.6% increase. On a sequential quarter

basis, total segment third quarter of 2023 revenue decreased $1.4

million, or 0.8%, driven by a 2.5% decrease in rental equipment

sales compared to the second quarter. Despite the decline, we

experienced favorable pricing, with OEC on rent yield increasing to

a record 40.8% in the third quarter of 2023, up from 40.1% in the

second quarter of 2023.

Revenue in our TES segment increased 32.9% to $230.9 million in

the third quarter of 2023, from $173.8 million in the third quarter

of 2022, primarily as a result of continued supply chain

improvements, which allowed us to acquire more inventory, record

production levels that led to greater order fulfillments and

sustained strong customer demand. Gross profit improved by 46.3% to

$39.8 million in the third quarter of 2023 compared to $27.2

million in the third quarter of 2022. Gross profit margin for the

quarter was 17.2%, up from 15.7% in the third quarter of 2022. On a

sequential quarter basis, total revenue in the third quarter of

2023 decreased $20.5 million, or 8.2%.

APS segment revenue increased 4.2% in the third quarter of 2023

to $36.3 million, compared to $34.9 million in the third quarter of

2022. Growth in demand for parts, tools and accessories sales was

augmented by increased tools and accessories rentals in the Parts,

Tools and Accessories (“PTA”) division. Gross profit margin

increased to 25.7% in the third quarter of 2023 from 22.5% in the

third quarter of 2022. On a sequential quarter basis, total segment

gross profit margin in the third quarter of 2023 decreased 160 bps

from 27.3%.

Net income was $9.2 million in the third quarter of 2023,

compared to net loss of $2.4 million for the third quarter of 2022.

The $11.6 million increase in net income is primarily the result of

gross profit expansion, partially offset by higher interest costs.

On a sequential quarter basis, total third quarter of 2023 net

income declined $2.4 million primarily due to lower gross profit

and higher interest expense.

Adjusted EBITDA for the third quarter of 2023 was $100.2

million, an increase of 9.3%, compared to $91.6 million for the

third quarter of 2022. The increase in Adjusted EBITDA was largely

driven by growth in rental revenue and new and used equipment

sales, all of which contributed to margin expansion. On a

sequential quarter basis, Adjusted EBITDA declined by $3.0

million.

As of September 30, 2023, cash and cash equivalents was $8.8

million, Total Debt outstanding was $1,451.2 million, Net Debt was

$1,442.4 million and Net Leverage Ratio was 3.3x. Availability

under the senior secured credit facility was $254.5 million as of

September 30, 2023, and based on our borrowing base calculation, we

have an additional $287.4 million of availability that we can

potentially utilize by upsizing our existing facility. For the

three months ended September 30, 2023, Ending OEC increased by

$37.2 million as our fleet additions were only partially offset by

our continued focus on selling older equipment from our rental

fleet at current advantageous residual values. During the three

months ended September 30, 2023, CTOS purchased $15.8 million of

its common stock.

OUTLOOK We are updating our full-year revenue guidance

for 2023 at this time, as well as affirming our full-year 2023

EBITDA guidance. We believe our ERS segment will continue to

benefit from strong demand from our rental customers, sustained

levels of average OEC on rent and for resilient demand for

purchases of rental fleet units, particularly older equipment for

the remainder of the year. While we continue to expect to make

gross investments in our rental fleet of more than $400 million

this year, higher-than-anticipated levels of rental asset sales

year-to-date likely will result in the net growth in our rental

fleet (based on Ending OEC) being more modest than expected earlier

this year. Regarding our TES segment, supply chain improvements,

improved inventory levels, record production and strong backlog

levels continue to enhance our ability to produce and deliver an

even greater number of units in 2023 than we did previously.

Commenting on the improvement outlook, McMonagle added, “Overall,

we expect a seasonally strong fourth quarter and hope that the

performance will exceed that of the fourth quarter of 2022, which

benefited from the highest level of utilization in the Company’s

history, as well as noted supply chain improvements, which allowed

for record levels of new equipment sales. Despite the confidence

implied by our improved outlook, given the level of share

repurchase activity this year, as well as the continued investment

in working capital to meet expected revenue growth, our ability to

achieve our 3.0x leverage target by year end will be delayed until

later in 2024.”

2023 Consolidated Outlook

Revenue

$1,765 million

—

$1,870 million

Adjusted EBITDA1

$425 million

—

$445 million

2023 Revenue Outlook by Segment

ERS

$710 million

—

$745 million

TES

$910 million

—

$970 million

APS

$145 million

—

$155 million

1

CTOS is not able to present a quantitative

reconciliation of its forward-looking Adjusted EBITDA for the year

ending December 31, 2023 to its most directly comparable GAAP

financial measure, net income, because management cannot reliably

present a quantitative reconciliation of its forward-looking

Adjusted EBITDA for the year ending December 31, 2023 to its most

directly comparable GAAP financial measure, net income, because

management cannot reliably forecast net income on a forward-looking

basis without unreasonable efforts due to the high variability and

difficulty in predicting certain items that affect GAAP net income

including, but not limited to, customer buyout requests on rentals

with rental purchase options, income tax expense and changes in

fair value of derivative financial instruments. Adjusted EBITDA

should not be used to predict net income as the difference between

the two measures is variable.

CONFERENCE CALL INFORMATION The Company has scheduled a

conference call at 5:00 P.M. Eastern Time on November 7, 2023, to

discuss its third quarter 2023 financial results. A webcast and a

presentation of financial information will be publicly available

at: investors.customtruck.com. To listen by phone, please dial

1-855-327-6837 or 1-631-891-4304. A replay of the call will be

available until midnight ET, Tuesday, November 14, 2023, by dialing

1-844-512-2921 or 1-412-317-6671 and entering passcode

10022473.

ABOUT CTOS CTOS is one of the largest providers of

specialty equipment, parts, tools, accessories and services to the

electric utility transmission and distribution, telecommunications

and rail markets in North America, with a differentiated

“one-stop-shop” business model. CTOS offers its specialized

equipment to a diverse customer base for the maintenance, repair,

upgrade and installation of critical infrastructure assets,

including electric lines, telecommunications networks and rail

systems. The Company's coast-to-coast rental fleet of more than

10,200 units includes aerial devices, boom trucks, cranes, digger

derricks, pressure drills, stringing gear, Hi-rail equipment,

repair parts, tools and accessories. For more information, please

visit customtruck.com.

FORWARD-LOOKING STATEMENTS This press release includes

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995, as amended, and within the meaning

of Section 21E of the Securities Exchange Act of 1934, as amended,

and Section 27A of the Securities Act of 1933, as amended. When

used in this press release, the words “estimates,” “projected,”

“expects,” “anticipates,” “forecasts,” “plans,” “intends,”

“believes,” “seeks,” “may,” “will,” “should,” “future,” “propose”

and variations of these words or similar expressions (or the

negative versions of such words or expressions) are intended to

identify forward-looking statements. These forward-looking

statements are not guarantees of future performance, conditions or

results, and involve a number of known and unknown risks,

uncertainties, assumptions and other important factors, many of

which are outside the Company's management’s control, that could

cause actual results or outcomes to differ materially from those

discussed in this press release. This press release is based on

certain assumptions that the Company's management has made in light

of its experience in the industry, as well as the Company’s

perceptions of historical trends, current conditions, expected

future developments and other factors the Company believes are

appropriate in these circumstances. As you read and consider this

press release, you should understand that these statements are not

guarantees of performance or results. Many factors could affect the

Company’s actual performance and results and could cause actual

results to differ materially from those expressed in this press

release. Important factors, among others, that may affect actual

results or outcomes include: increases in labor costs, our

inability to obtain raw materials, component parts and/or finished

goods in a timely and cost-effective manner, and our inability to

manage our rental equipment in an effective manner; our sales order

backlog may not be indicative of the level of our future revenues;

increases in unionization rate in our workforce; our inability to

recruit and retain the experienced personnel, including skilled

technicians, we need to compete in our industries; our inability to

attract and retain highly skilled personnel and our inability to

retain our senior management; material disruptions to our operation

and manufacturing locations as a result of public health concerns,

equipment failures, natural disasters, work stoppages, power

outages or other reasons; potential impairment charges; any further

increase in the cost of new equipment that we purchase for use in

our rental fleet or for sale as inventory; aging or obsolescence of

our existing equipment, and the fluctuations of market value

thereof; disruptions in our supply chain; our business may be

impacted by government spending; we may experience losses in excess

of our recorded reserves for receivables; unfavorable conditions in

the capital and credit markets and our inability to obtain

additional capital as required; increases in price of fuel or

freight; regulatory technological advancement, or other changes in

our core end-markets may affect our customers’ spending; difficulty

in integrating acquired businesses and fully realizing the

anticipated benefits and cost savings of the acquired businesses,

as well as additional transaction and transition costs that we will

continue to incur following acquisitions; material weakness in our

internal control over financial reporting which, if not remediated,

could result in material misstatements in our financial statements;

the interest of our majority stockholder, which may not be

consistent with the other stockholders; our significant

indebtedness, which may adversely affect our financial position,

limit our available cash and our access to additional capital,

prevent us from growing our business and increase our risk of

default; our inability to generate cash, which could lead to a

default; significant operating and financial restrictions imposed

by our debt agreements; changes in interest rates, which could

increase our debt service obligations on the variable rate

indebtedness and decrease our net income and cash flows;

disruptions in our information technology systems or a compromise

of our system security, limiting our ability to effectively monitor

and control our operations, adjust to changing market conditions,

and implement strategic initiatives; we are subject to complex laws

and regulations, including environmental and safety regulations

that can adversely affect cost, manner or feasibility of doing

business; we are subject to a series of risks related to climate

change; and increased attention to, and evolving expectations for,

sustainability and environmental, social and governance

initiatives. For a more complete description of these and other

possible risks and uncertainties, please refer to the Company's

Annual Report on Form 10-K for the year ended December 31, 2022,

and its subsequent reports filed with the Securities and Exchange

Commission. All forward-looking statements attributable to the

Company or persons acting on its behalf are expressly qualified in

their entirety by the foregoing cautionary statements.

CUSTOM TRUCK ONE SOURCE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

Three Months Ended June 30,

2023

(in $000s except per share data)

2023

2022

2023

2022

Revenue

Rental revenue

$

118,209

$

115,010

$

358,666

$

336,210

$

122,169

Equipment sales

283,079

210,903

886,486

656,595

302,117

Parts sales and services

33,065

31,867

98,194

93,557

32,544

Total revenue

434,353

357,780

1,343,346

1,086,362

456,830

Cost of Revenue

Cost of rental revenue

29,874

28,207

91,754

82,791

31,981

Depreciation of rental equipment

42,469

42,612

126,415

130,900

43,616

Cost of equipment sales

228,912

173,588

720,303

545,461

245,266

Cost of parts sales and services

25,942

25,201

77,438

71,787

25,348

Total cost of revenue

327,197

269,608

1,015,910

830,939

346,211

Gross Profit

107,156

88,172

327,436

255,423

110,619

Operating Expenses

Selling, general and administrative

expenses

56,955

49,835

171,974

152,269

58,028

Amortization

6,698

6,794

19,976

27,000

6,606

Non-rental depreciation

2,602

1,938

7,973

7,302

2,721

Transaction expenses and other

2,890

6,498

10,039

17,192

3,689

Total operating expenses

69,145

65,065

209,962

203,763

71,044

Operating Income

38,011

23,107

117,474

51,660

39,575

Other Expense

Interest expense, net

34,144

22,887

94,945

62,324

31,625

Financing and other income

(5,745

)

(1,747

)

(14,744

)

(25,905

)

(5,048

)

Total other expense

28,399

21,140

80,201

36,419

26,577

Income Before Income Taxes

9,612

1,967

37,273

15,241

12,998

Income Tax Expense

432

4,349

2,683

7,273

1,388

Net Income (Loss)

$

9,180

$

(2,382

)

$

34,590

$

7,968

$

11,610

Net Income Per Share

Basic

$

0.04

$

(0.01

)

$

0.14

$

0.03

$

0.05

Diluted

$

0.04

$

(0.01

)

$

0.14

$

0.03

$

0.05

CUSTOM TRUCK ONE SOURCE, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(unaudited)

(in $000s)

September 30, 2023

December 31, 2022

Assets

Current Assets

Cash and cash equivalents

$

8,793

$

14,360

Accounts receivable, net

156,305

193,106

Financing receivables, net

41,914

38,271

Inventory

888,755

596,724

Prepaid expenses and other

21,036

25,784

Total current assets

1,116,803

868,245

Property and equipment, net

136,567

121,956

Rental equipment, net

924,315

883,674

Goodwill

703,812

703,827

Intangible assets, net

284,146

304,132

Operating lease assets

36,920

29,434

Other assets

25,107

26,944

Total Assets

$

3,227,670

$

2,938,212

Liabilities and Stockholders'

Equity

Current Liabilities

Accounts payable

$

130,466

$

87,255

Accrued expenses

72,550

68,784

Deferred revenue and customer deposits

22,641

34,671

Floor plan payables - trade

194,929

136,634

Floor plan payables - non-trade

396,891

293,536

Operating lease liabilities - current

6,198

5,262

Current maturities of long-term debt

1,286

6,940

Current portion of finance lease

obligations

—

1,796

Total current liabilities

824,961

634,878

Long-term debt, net

1,426,062

1,354,766

Finance leases

—

3,206

Operating lease liabilities -

noncurrent

31,559

24,818

Deferred income taxes

31,091

29,086

Derivative, warrants and other

liabilities

606

3,015

Total long-term liabilities

1,489,318

1,414,891

Stockholders' Equity

Common stock

25

25

Treasury stock, at cost

(37,256

)

(15,537

)

Additional paid-in capital

1,533,823

1,521,487

Accumulated other comprehensive loss

(9,206

)

(8,947

)

Accumulated deficit

(573,995

)

(608,585

)

Total stockholders' equity

913,391

888,443

Total Liabilities and Stockholders'

Equity

$

3,227,670

$

2,938,212

CUSTOM TRUCK ONE SOURCE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(unaudited)

Nine Months Ended September

30,

(in $000s)

2023

2022

Operating Activities

Net income

$

34,590

$

7,968

Adjustments to reconcile net income to net

cash flow from operating activities:

Depreciation and amortization

162,084

171,121

Amortization of debt issuance costs

4,221

3,485

Provision for losses on accounts

receivable

4,522

5,905

Share-based compensation

10,312

9,526

Gain on sales and disposals of rental

equipment

(48,392

)

(35,064

)

Change in fair value of derivative and

warrants

(2,409

)

(18,013

)

Deferred tax expense

1,959

6,792

Changes in assets and liabilities:

Accounts and financing receivables

21,978

(17,637

)

Inventories

(290,302

)

(155,111

)

Prepaids, operating leases and other

6,143

2,475

Accounts payable

42,707

9,900

Accrued expenses and other liabilities

3,620

9,397

Floor plan payables - trade, net

58,295

8,726

Customer deposits and deferred revenue

(12,034

)

(5,126

)

Net cash flow from operating

activities

(2,706

)

4,344

Investing Activities

Acquisition of business, net of cash

acquired

—

(49,832

)

Purchases of rental equipment

(289,984

)

(224,002

)

Proceeds from sales and disposals of

rental equipment

177,623

135,436

Purchase of non-rental property and cloud

computing arrangements

(33,251

)

(15,529

)

Net cash flow from investing

activities

(145,612

)

(153,927

)

Financing Activities

Proceeds from debt

13,537

—

Share-based payments

387

(1,250

)

Borrowings under revolving credit

facilities

111,057

87,000

Repayments under revolving credit

facilities

(56,377

)

(34,945

)

Repayments of notes payable

(6,674

)

(6,126

)

Finance lease payments

(2,682

)

(3,308

)

Repurchase of common stock

(19,936

)

(1,752

)

Acquisition of inventory through floor

plan payables - non-trade

571,062

451,202

Repayment of floor plan payables -

non-trade

(467,707

)

(348,961

)

Payment of debt issuance costs

(110

)

—

Net cash flow from financing

activities

142,557

141,860

Effect of exchange rate changes on cash

and cash equivalents

194

(2,005

)

Net Change in Cash and Cash

Equivalents

(5,567

)

(9,728

)

Cash and Cash Equivalents at Beginning

of Period

14,360

35,902

Cash and Cash Equivalents at End of

Period

$

8,793

$

26,174

Nine Months Ended September

30,

(in $000s)

2023

2022

Supplemental Cash Flow

Information

Interest paid

$

51,142

$

44,414

Income taxes paid

1,897

—

Non-Cash Investing and Financing

Activities

Rental equipment and property and

equipment purchases in accounts payable

596

—

Rental equipment sales in accounts

receivable

1,573

747

CUSTOM TRUCK ONE SOURCE, INC.

NON-GAAP FINANCIAL AND PERFORMANCE MEASURES In our

press release and schedules, and on the related conference call, we

report certain financial measures that are not required by, or

presented in accordance with, United States generally accepted

accounting principles (“GAAP”). We utilize these financial measures

to manage our business on a day-to-day basis and some of these

measures are commonly used in our industry to evaluate performance.

We believe these non-GAAP measures provide investors expanded

insight to assess performance, in addition to the standard

GAAP-based financial measures. The press release schedules

reconcile the most directly comparable GAAP measure to each

non-GAAP measure that we refer to. Although management evaluates

and presents these non-GAAP measures for the reasons described

herein, please be aware that these non-GAAP measures have

limitations and should not be considered in isolation or as a

substitute for revenue, operating income/loss, net income/loss,

earnings/loss per share or any other comparable operating measure

prescribed by GAAP. In addition, we may calculate and/or present

these non-GAAP financial measures differently than measures with

the same or similar names that other companies report, and as a

result, the non-GAAP measures we report may not be comparable to

those reported by others.

Adjusted EBITDA. Adjusted EBITDA is a non-GAAP financial

performance measure that we use to monitor our results of

operations, to measure performance against debt covenants and

performance relative to competitors. We believe Adjusted EBITDA is

a useful performance measure because it allows for an effective

evaluation of operating performance, without regard to financing

methods or capital structures. We exclude the items identified in

the reconciliations of net income (loss) to Adjusted EBITDA because

these amounts are either non-recurring or can vary substantially

within the industry depending upon accounting methods and book

values of assets, including the method by which the assets were

acquired, and capital structures. Adjusted EBITDA should not be

considered as an alternative to, or more meaningful than, net

income (loss) determined in accordance with GAAP. Certain items

excluded from Adjusted EBITDA are significant components in

understanding and assessing a company’s financial performance, such

as a company’s cost of capital and tax structure, as well as the

historical costs of depreciable assets, none of which are reflected

in Adjusted EBITDA. Our presentation of Adjusted EBITDA should not

be construed as an indication that results will be unaffected by

the items excluded from Adjusted EBITDA. Our computation of

Adjusted EBITDA may not be identical to other similarly titled

measures of other companies.

We define Adjusted EBITDA as net income or loss before interest

expense, income taxes, depreciation and amortization, share-based

compensation, and other items that we do not view as indicative of

ongoing performance. Our Adjusted EBITDA includes an adjustment to

exclude the effects of purchase accounting adjustments when

calculating the cost of inventory and used rental equipment sold.

When inventory or rental equipment is purchased in connection with

a business combination, the assets are revalued to their current

fair values for accounting purposes. The consideration transferred

(i.e., the purchase price) in a business combination is allocated

to the fair values of the assets as of the acquisition date, with

amortization or depreciation recorded thereafter following

applicable accounting policies; however, this may not be indicative

of the actual cost to acquire inventory or new equipment that is

added to product inventory or the rental fleets apart from a

business acquisition. We also includes an adjustment to remove the

impact of accounting for certain of our rental contracts that are

accounted for under GAAP as a sales-type lease, however, in

actuality, the rental contract remains in place and we continue to

invoice the rentals to the customers. Sales-type lease accounting

results in an accelerated revenue recognition profile compared to

the period of service (that is, time of use by the rental customer)

that is provided evenly over the duration of our time-based rental

contracts, and compared to the cash payment profile, which is

typically received evenly over the duration of our rental

contracts. We include this adjustment because we believe continuing

to reflect the transactions as an operating lease more closely

measures the period of service provided and rental payments

received better reflects the economics of the transactions given

our large portfolio of rental contracts. These, and other,

adjustments to GAAP net income or loss that are applied to derive

Adjusted EBITDA conform to the definitions in our senior secured

credit agreements.

Adjusted Gross Profit. We present total gross profit

excluding rental equipment depreciation (“Adjusted Gross Profit”)

as a non-GAAP financial performance measure. This measure differs

from the GAAP definition of gross profit, as we do not include the

impact of depreciation expense, which represents non-cash expense.

We use these measures to evaluate operating margins and the

effectiveness of the cost of our rental fleet.

Net Debt. We present the non-GAAP financial measure “Net

Debt,” which is total debt (the most comparable GAAP measure,

calculated as current and long-term debt, excluding deferred

financing fees, plus current and long-term finance lease

obligations) minus cash and cash equivalents. We believe this

non-GAAP measure is useful to investors to evaluate our financial

position.

Net Leverage Ratio. Net Leverage Ratio is a non-GAAP

financial performance measure used by management and we believe it

provides useful information to investors because it is an important

measure that reflects our ability to service debt. We define net

leverage ratio as net debt divided by Adjusted EBITDA.

CUSTOM TRUCK ONE SOURCE, INC.

ADJUSTED EBITDA RECONCILIATION

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

Three Months Ended June 30,

2023

(in $000s)

2023

2022

2023

2022

Net income (loss)

$

9,180

$

(2,382

)

$

34,590

$

7,968

$

11,610

Interest expense

24,044

19,338

69,982

54,833

23,575

Income tax expense

432

4,349

2,683

7,273

1,388

Depreciation and amortization

54,552

54,001

162,083

171,121

55,441

EBITDA

88,208

75,306

269,338

241,195

92,014

Adjustments:

Non-cash purchase accounting impact

(1)

5,884

3,408

13,552

14,801

469

Transaction and integration costs (2)

2,890

6,501

10,039

17,192

3,689

Sales-type lease adjustment (3)

1,640

1,232

7,736

3,793

3,293

Share-based payments (4)

2,843

4,378

10,312

9,526

4,322

Change in fair value of derivative and

warrants (5)

(1,280

)

809

(2,409

)

(18,013

)

(604

)

Adjusted EBITDA

$

100,185

$

91,634

$

308,568

$

268,494

$

103,183

Adjusted EBITDA is defined as net income plus interest

expense, provision for income taxes, depreciation and amortization,

and further adjusted for non-cash purchase accounting impact,

transaction and process improvement costs, including business

integration expenses, share-based payments, the change in fair

value of derivative instruments, sales-type lease adjustment, and

other special charges that are not expected to recur. This non-GAAP

measure is subject to certain limitations.

(1)

Represents the non-cash impact of purchase

accounting, net of accumulated depreciation, on the cost of

equipment and inventory sold. The equipment and inventory acquired

received a purchase accounting step-up in basis, which is a

non-cash adjustment to the equipment cost pursuant to our credit

agreement.

(2)

Represents transaction and process

improvement costs related to acquisitions of businesses, including

post-acquisition integration costs, which are recognized within

operating expenses in our Condensed Consolidated Statements of

Income and Comprehensive Income. These expenses are comprised of

professional consultancy, legal, tax and accounting fees. Also

included are expenses associated with the integration of acquired

businesses. These expenses are presented as adjustments to net

income pursuant to our ABL Credit Agreement.

(3)

Represents the adjustment for the impact

of sales-type lease accounting for certain leases containing rental

purchase options (or “RPOs”), as the application of sales-type

lease accounting is not deemed to be representative of the ongoing

cash flows of the underlying rental contracts. This adjustment is

made pursuant to our credit agreement.

Three Months Ended September

30,

Nine Months Ended September

30,

Three Months Ended June 30,

2023

(in $000s)

2023

2022

2023

2022

Equipment sales

(12,760

)

$

(7,099

)

$

(56,535

)

$

(27,007

)

$

(19,603

)

Cost of equipment sales

11,714

5,938

54,354

23,073

19,415

Gross profit

(1,046

)

(1,161

)

(2,181

)

(3,934

)

(188

)

Interest income

(4,461

)

(2,719

)

(12,295

)

(7,827

)

(4,406

)

Rentals invoiced

7,147

5,112

22,212

15,554

7,887

Sales-type lease adjustment

1,640

$

1,232

$

7,736

$

3,793

$

3,293

(4)

Represents non-cash share-based

compensation expense associated with the issuance of stock options

and restricted stock units.

(5)

Represents the credit to earnings for the

change in fair value of the liability for private warrants.

Reconciliation of Adjusted Gross

Profit

(unaudited)

The following table presents the

reconciliation of Adjusted Gross Profit:

Three Months Ended September

30,

Nine Months Ended September

30,

Three Months Ended June 30,

2023

(in $000s)

2023

2022

2023

2022

Revenue

Rental revenue

$

118,209

$

115,010

$

358,666

$

336,210

$

122,169

Equipment sales

283,079

210,903

886,486

656,595

302,117

Parts sales and services

33,065

31,867

98,194

93,557

32,544

Total revenue

434,353

357,780

1,343,346

1,086,362

456,830

Cost of Revenue

Cost of rental revenue

29,874

28,207

91,754

82,791

31,981

Depreciation of rental equipment

42,469

42,612

126,415

130,900

43,616

Cost of equipment sales

228,912

173,588

720,303

545,461

245,266

Cost of parts sales and services

25,942

25,201

77,438

71,787

25,348

Total cost of revenue

327,197

269,608

1,015,910

830,939

346,211

Gross Profit

107,156

88,172

327,436

255,423

110,619

Add: depreciation of rental equipment

42,469

42,612

126,415

130,900

43,616

Adjusted Gross Profit

$

149,625

$

130,784

$

453,851

$

386,323

$

154,235

Reconciliation of ERS Segment Adjusted

Gross Profit and Rental Gross Profit

(unaudited)

The following table presents the

reconciliation of ERS segment Adjusted Gross Profit:

Three Months Ended September

30,

Nine Months Ended September

30,

Three Months Ended June 30,

2023

(in $000s)

2023

2022

2023

2022

Revenue

Rental revenue

$

114,929

$

112,009

$

346,545

$

325,679

$

117,832

Equipment sales

52,175

37,121

195,005

133,674

50,694

Total revenue

167,104

149,130

541,550

459,353

168,526

Cost of Revenue

Cost of rental revenue

29,613

27,221

90,014

79,863

31,341

Cost of equipment sales

37,828

27,015

148,711

100,663

39,802

Depreciation of rental equipment

41,652

41,776

123,969

128,126

42,805

Total cost of revenue

109,093

96,012

362,694

308,652

113,948

Gross profit

58,011

53,118

178,856

150,701

54,578

Add: depreciation of rental equipment

41,652

41,776

123,969

128,126

42,805

Adjusted Gross Profit

$

99,663

$

94,894

$

302,825

$

278,827

$

97,383

The following table presents the

reconciliation of ERS Rental Gross Profit:

Three Months Ended September

30,

Nine Months Ended September

30,

Three Months Ended June 30,

2023

(in $000s)

2023

2022

2023

2022

Rental revenue

$

114,929

$

112,009

$

346,545

$

325,679

$

117,832

Cost of rental revenue

29,613

27,221

90,014

79,863

31,341

Rental Gross Profit

$

85,316

$

84,788

$

256,531

$

245,816

$

86,491

Reconciliation of Net Debt

(unaudited)

The following table presents the

reconciliation of Net Debt:

(in $000s)

September 30, 2023

Current maturities of long-term debt

$

1,286

Long-term debt, net

1,426,062

Deferred financing fees

23,838

Less: cash and cash equivalents

(8,793

)

Net Debt

$

1,442,393

Reconciliation of Net Leverage

Ratio

(unaudited)

The following table presents the

reconciliation of the Net Leverage Ratio:

Twelve Months Ended

(in $000s)

September 30, 2023

June 30, 2023

Net Debt (as of period end)

$

1,442,393

$

1,414,906

Divided by: Adjusted EBITDA

$

433,052

$

424,501

Net Leverage Ratio

3.33

3.33

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231107531834/en/

INVESTOR CONTACT Brian Perman, Vice President, Investor

Relations (844) 403-6138 investors@customtruck.com

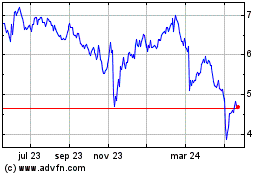

Custom Truck One Source (NYSE:CTOS)

Gráfica de Acción Histórica

De Oct 2024 a Oct 2024

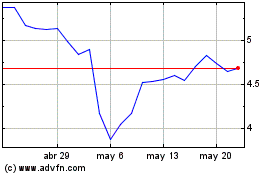

Custom Truck One Source (NYSE:CTOS)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024