FALSE000170968200017096822024-08-092024-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 9, 2024

CUSTOM TRUCK ONE SOURCE, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 001-38186 | | 84-2531628 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | |

7701 Independence Avenue Kansas City, Missouri | | 64125 |

| (Address of principal executive offices) | | (Zip Code) |

(816) 241-4888

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value | | CTOS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On August 9, 2024, NESCO Holdings II, Inc. (the “Borrower”), an indirect subsidiary of Custom Truck One Source, Inc. (the “Company”), along with certain other indirect subsidiaries of the Company entered into an amendment (the “ABL Amendment”) to its existing Revolving Credit Agreement, dated as of April 1, 2021 (as previously amended, supplemented or modified, including by the ABL Amendment, the “Credit Agreement”), among the Borrower, as borrower, Capitol Investment Merger Sub 2, LLC, as holdings, Bank of America, N.A., as administrative agent and collateral agent, and certain lenders party thereto.

Among other things, the ABL Amendment (i) increases the aggregate amount of the revolving commitments from $750,000,000 to $950,000,000, (ii) modifies certain financial thresholds and negative covenants, (iii) extends the maturity date from April 1, 2026 to August 9, 2029, or, if earlier, the date that is 91 days prior to the maturity date of the Borrower’s existing senior notes or any debt that refinances such existing notes, (iv) adds a leverage based step-down to the pricing grid otherwise based on Average Availability (as defined in the Credit Agreement) and (v) replaces the CDOR Rate provisions with Term CORRA provisions (each as defined in the Credit Agreement) as the benchmark rate for term rate loans denominated in Canadian Dollars.

The foregoing description of the ABL Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the ABL Amendment, which is filed herewith as Exhibit 10.1 and is incorporated herein by reference.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth above under Item 1.01 is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 10.1* | | Amendment No. 3 to Revolving Credit Agreement, dated as of August 9, 2024, by and among Capitol Investment Merger Sub 2, LLC, NESCO Holdings II, Inc., certain other credit parties party thereto, the lenders and other financial institutions party thereto and Bank of America, N.A., as administrative agent and collateral agent |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document and contained in Exhibit 101) |

*Certain schedules and exhibits to this Exhibit have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company agrees to provide a copy of any omitted schedule or exhibit to the SEC or its staff upon request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

|

| Date: | August 12, 2024 | Custom Truck One Source, Inc. |

| | | |

| | /s/ Christopher J. Eperjesy |

| | | Christopher J. Eperjesy

Chief Financial Officer |

AMENDMENT NO. 3 TO REVOLVING CREDIT AGREEMENT

AMENDMENT NO. 3 to the REVOLVING CREDIT AGREEMENT, dated as of August 9, 2024 (this “Amendment”), among CAPITOL INVESTMENT MERGER SUB 2, LLC, a Delaware limited liability company (“Holdings”), NESCO HOLDINGS II, INC., a Delaware corporation (the “Borrower”), each of the other Credit Parties party hereto, BANK OF AMERICA, N.A., as administrative agent (in such capacity, the “Administrative Agent”) and as collateral agent (in such capacity, the “Collateral Agent”), each Issuing Bank, the Swingline Lender and the Lenders;

WHEREAS, reference is hereby made to the Revolving Credit Agreement, dated as of April 1, 2021 (as amended by Amendment No. 1 to Revolving Credit Agreement and U.S. ABL Security Agreement, dated as of July 1, 2021, as amended by Amendment No. 2 to Revolving Credit Agreement, dated as of March 27, 2023, and as further amended, restated, amended and restated, supplemented or otherwise modified from time to time in accordance with the terms thereof prior to the date hereof, the “Credit Agreement”; the Credit Agreement as amended by this Amendment, the “Amended Credit Agreement”), among Holdings, the Borrower, the Administrative Agent, the Collateral Agent and each Lender from time to time party thereto;

WHEREAS, pursuant to Section 13.12 of the Credit Agreement, the Borrower has requested to amend the Credit Agreement with the consent of each of the Lenders, the Swingline Lender and the Issuing Banks in order to (i) extend the final scheduled maturity of the Revolving Commitments (and any Revolving Loans thereunder), (ii) increase the Revolving Commitments and (iii) make certain other changes to the Credit Agreement as set forth herein;

WHEREAS, this Amendment will become effective on the Amendment No. 3 Effective Date (as defined below) on the terms and subject to the conditions set forth herein; and

WHEREAS, the Borrower, Holdings, the Administrative Agent and each Lender and Issuing Bank party hereto agree, pursuant to and in accordance with Section 13.12 of the Credit Agreement, to the amendments to the Credit Agreement as set forth in Section 2 of this Amendment.

NOW, THEREFORE, in consideration of the premises and agreements, provisions and covenants herein contained, the parties hereto agree as follows:

Section 1.Defined Terms; References. Unless otherwise specifically defined herein, each term used herein which is defined in the Credit Agreement has the meaning assigned to such term in the Credit Agreement. Each reference to “hereof”, “hereunder”, “herein” and “hereby” and each other similar reference and each reference to “this Agreement” and each other similar reference contained in the Credit Agreement shall, after this Amendment becomes effective, refer to the Amended Credit Agreement. This Amendment is a “Credit Document” as defined under the Amended Credit Agreement.

Section 2.Amendments to the Credit Documents.

Effective as of the Amendment No. 3 Effective Date, (I) the Credit Agreement shall be amended to delete the stricken text (indicated textually in the same manner as the following example: stricken text) and to add the double-underlined text (indicated textually in the same manner as the following example: double-underlined text) as set forth in the pages of the Amended Credit Agreement attached as Exhibit A hereto, (II) Schedule 2.01 to the Credit Agreement shall be replaced in its entirety with, and shall be superseded by, Schedule 2.01 attached as Exhibit B hereto (it being understood that any entity listed as a

“Lender” on Schedule 2.01 to the Credit Agreement as in effect immediately prior to the Amendment No. 3 Effective Date that is no longer listed as a “Lender” on Schedule 2.01 attached hereto shall no longer be considered a “Lender” under the Amended Credit Agreement), (III) the Form of Notice of Borrowing attached to the Credit Agreement as Exhibit A-1, shall be replaced with the amended Form of Notice of Borrowing attached hereto as Exhibit C, (IV) the Form of Notice of Conversion/Continuation, attached to the Credit Agreement as Exhibit A-3, shall be replaced with the amended Form of Notice of Conversion/Continuation attached hereto as Exhibit D and (V) the Form of Compliance Certificate, attached to the Credit Agreement as Exhibit J, shall be replaced with the amended Form of Compliance Certificate attached hereto as Exhibit E. On the Amendment No. 3 Effective Date, each Lender and each Issuing Bank party to the Credit Agreement immediately prior to the Amendment No. 3 Effective Date (each, an “Existing Lender”) will automatically and without further act be deemed to have assigned to each Lender and each Issuing Bank party to the Amended Credit Agreement as of the Amendment No. 3 Effective Date (each, an “Amendment No. 3 Lender”), and each such Amendment No. 3 Lender will automatically and without further act be deemed to have assumed, all or a portion of such Existing Lender’s Loans, Revolving Commitments and LC Commitments outstanding immediately prior to the Amendment No. 3 Effective Date (“Existing Loans and Commitments”) and participations under the Credit Agreement in outstanding Letters of Credit (if any are outstanding on the Amendment No. 3 Effective Date) and Swingline Loans (if any are outstanding on the Amendment No. 3 Effective Date) such that, after giving effect to each such deemed assignment and assumption of Existing Loans, Revolving Commitments and LC Commitments and participations, the percentage of the aggregate outstanding (i) Loans, (ii) participations under the Amended Credit Agreement in Letters of Credit and (iii) participations under the Amended Credit Agreement in Swingline Loans held by each Lender (including each such Amendment No. 3 Lender) will equal the percentage of the aggregate Revolving Commitments of all Lenders represented by such Lender’s Revolving Commitment as of the Amendment No. 3 Effective Date.

Section 3.Representations Correct. By its execution of this Amendment, each Credit Party party hereto hereby represents and warrants, as of the date hereof, that:

(a)Each such Credit Party has the corporate, partnership, limited liability company, unlimited liability company or other applicable business entity power and authority, as the case may be, to execute, deliver and perform the terms and provisions of this Amendment (and by extension the Amended Credit Agreement) and has taken all necessary corporate, partnership, limited liability company, unlimited liability company or other applicable business entity action, as the case may be, to authorize the execution, delivery and performance by it of this Amendment. Each such Credit Party has duly executed and delivered this Amendment, and this Amendment (and by extension the Amended Credit Agreement) constitutes its legal, valid and binding obligation enforceable in accordance with its terms, except to the extent that the enforceability thereof may be limited by applicable Debtor Relief Law and by equitable principles (regardless of whether enforcement is sought in equity or at law);

(b)Each of the representations and warranties made by any Credit Party set forth in Article 8 of the Credit Agreement or in any other Credit Document are true and correct in all material respects (without duplication of any materiality standard set forth in any such representation or warranty) on and as of the Amendment No. 3 Effective Date with the same effect as though made on and as of such date, except to the extent such representations and warranties expressly relate to an earlier date, in which case such representations and warranties were true and correct in all material respects as of such date (without duplication of any materiality standard set in any such representation or warranty); and

(c)No Default or Event of Default has occurred and is continuing or will exist immediately after giving effect to this Amendment.

Section 4.Effectiveness. This Amendment shall become effective as of the date hereof (the “Amendment No. 3 Effective Date”), upon satisfaction or waiver of the following conditions:

(a)Counterparts of this Amendment shall have been executed and delivered by Holdings, the Borrower, the other Credit Parties, the Administrative Agent, the Collateral Agent, each Lender party hereto, each Issuing Bank and the Swingline Lender;

(b)The Administrative Agent shall have received customary secretary’s or assistant secretary’s certificates for each Credit Party (together with (i) applicable attachments or (ii) certifications that there have been no changes to the applicable attachments to the certificates delivered on the Closing Date), in each case, substantially similar to the secretary’s or assistant secretary’s certificates (amended as necessary to reflect the transactions contemplated hereby) for such Credit Party that was delivered on the Closing Date or otherwise in form and substance reasonably satisfactory to the Administrative Agent;

(c)The Administrative Agent shall have received good standing certificates (or equivalent evidence) and bring-down letters or facsimiles, if any, for the U.S. Credit Parties, and in the case of a Canadian Credit Party, only to the extent such concept is applicable in such Canadian Credit Party’s jurisdiction of incorporation, formation or organization;

(d) The Administrative Agent shall have received from (i) Latham & Watkins LLP, special New York, Delaware, Texas and California counsel to the Credit Parties, (ii) Stikeman Elliott LLP, Canadian counsel to the Canadian Credit Parties, (iii) Taft Stettinius & Hollister LLP, Indiana counsel to the Credit Parties and (iv) Polsinelli PC, Missouri counsel to the Credit Parties, in each case, opinions addressed to the Administrative Agent, each Lender and each Issuing Bank and dated the Amendment No. 3 Effective Date, substantially similar to the opinions (amended as necessary to reflect changes in law and the transactions contemplated hereby) that were delivered on the Closing Date or otherwise in form and substance reasonably satisfactory to the Administrative Agent;

(e)Each of the representations and warranties made by any Credit Party set forth in Article 8 of the Credit Agreement or in any other Credit Document are true and correct in all material respects (without duplication of any materiality standard set forth in any such representation or warranty) on and as of the Amendment No. 3 Effective Date with the same effect as though made on and as of such date, except to the extent such representations and warranties expressly relate to an earlier date, in which case such representations and warranties were true and correct in all material respects as of such date (without duplication of any materiality standard set in any such representation or warranty);

(f)No Default or Event of Default has occurred and is continuing or will exist immediately after giving effect to this Amendment;

(g)All fees and expenses required to be paid by the Credit Parties on or prior to the Amendment No. 3 Effective Date shall have been paid or substantially simultaneously with the Amendment No. 3 Effective Date shall be paid;

(h)The Administrative Agent shall have received a certificate from an appropriate officer of the Borrower certifying that the conditions set forth in clauses (e) and (f) of this Section 4 have been satisfied;

(i)The Administrative shall have received a solvency certificate from the chief financial officer or treasurer (or officer with equivalent duties) of Holdings substantially in the form of Exhibit I to the Credit Agreement;

(j)The Administrative Agent shall have received, in form and substance reasonably satisfactory to it, the results of customary bring-down UCC, PPSA, tax (with respect to the U.S. Credit Parties only) and judgment lien searches;

(k)(i) At least three Business Days prior to the Amendment No. 3 Effective Date, each Lender shall have received all documentation and other information required by bank regulatory authorities under applicable “know your customer” and anti-money laundering rules and regulations, including the Patriot Act, in each case, to the extent reasonably requested by such Person in writing at least ten Business Days prior to the Amendment No. 3 Effective Date, and (ii) to the extent the Borrower qualifies as a “legal entity customer” under 31 C.F.R. § 1010.230 (the “Beneficial Ownership Regulation”), any Lender that has requested, in writing at least ten Business Days prior to the Amendment No. 3 Effective Date, a certification regarding beneficial ownership as required by the Beneficial Ownership Regulation (a “Beneficial Ownership Certification”) shall have received, at least three Business Days prior to the Amendment No. 3 Effective Date, such Beneficial Ownership Certification (provided that, upon the execution and delivery by such Lender of its signature page to this Amendment, the condition set forth in this clause (ii) shall be deemed to be satisfied); and

(l)The Borrower shall have paid to the Administrative Agent, for the account of each Existing Lender, all accrued and unpaid interest and fees, if any, that are outstanding under the Credit Agreement immediately prior to the Amendment No. 3 Effective Date.

(m)Acknowledgments and Confirmations.

(n)Each Credit Party hereby expressly acknowledges the terms of this Amendment and reaffirms, as of the date hereof, (i) the covenants and agreements contained in each Credit Document (and each joinder to such Credit Documents) to which it is a party, including, in each case, such covenants and agreements as in effect immediately after giving effect to this Amendment and the transactions contemplated hereby, (ii) its guarantee of the Obligations (including, without limitation, the Obligations that may arise pursuant to the increased Revolving Commitments), and (iii) its prior grant of Liens on the Collateral to secure the Obligations (including, without limitations, the Obligations that may arise pursuant to the increased Revolving Commitments) owed or otherwise guaranteed by it pursuant to the Security Documents with all such Liens continuing in full force and effect after giving effect to this Amendment.

(o)Notwithstanding the above, each of the Credit Parties consents to the amendments of and increases to the Credit Agreement effected by this Amendment and confirms that (i) its obligations as a Guarantor under the Guaranty Agreement are not discharged or otherwise affected by those amendments and/or increases or the other provisions of this Amendment and shall accordingly continue in full force and effect, (ii) its obligations under, and the Liens granted by it in and pursuant to, the Security Documents to which it is a party are not discharged or otherwise affected by those amendments and/or increases or the other provisions of this Amendment and shall accordingly remain in full force and effect and (iii) the Obligations so guaranteed and secured shall, after the Amendment No. 3 Effective Date, extend to the Obligations under the Credit Documents (including under the Credit Agreement as amended pursuant to this Amendment).

Section 5.Miscellaneous Provisions. The provisions of Sections 13.01, 13.09, 13.11, 13.13, 13.21 and 13.22 of the Amended Credit Agreement shall apply with like effect as to this Amendment.

Section 6.Amendment, Modification and Waiver. After the effectiveness hereof, this Amendment may not be amended, modified or waived except in accordance with Section 13.12 of the Amended Credit Agreement.

Section 7.Liens Unimpaired. After giving effect to this Amendment, neither the modification of the Credit Agreement effected pursuant to this Amendment nor the execution, delivery, performance or effectiveness of this Amendment:

(a)impairs the validity, effectiveness or priority of the Liens granted pursuant to any Credit Document, and such Liens continue unimpaired with the same priority applicable to such Liens immediately prior to giving effect to this Amendment to secure repayment of all Obligations, whether heretofore or hereafter incurred; or

(b)requires that any new filings be made under any Credit Document or that any other action be taken under any Credit Document to perfect or to maintain the perfection of such Liens.

Section 8.Entire Agreement. This Amendment, the Credit Agreement and the other Credit Documents constitute the entire agreement among the parties hereto with respect to the subject matter hereof and thereof and supersede all other prior agreements and understandings, both written and verbal, among the parties hereto with respect to the subject matter hereof. Except as expressly set forth herein, this Amendment shall not by implication or otherwise limit, impair, constitute a waiver of, or otherwise affect the rights and remedies of any party under, the Credit Agreement, nor alter, modify, amend or in any way affect any of the terms, conditions, obligations, covenants or agreements contained in the Credit Agreement, all of which are ratified and affirmed in all respects and shall continue in full force and effect. It is understood and agreed that each reference in each Credit Document to the Credit Agreement, whether direct or indirect, shall hereafter be deemed to be a reference to the Credit Agreement as amended hereby and that this Amendment is a Credit Document. This Amendment shall not constitute a novation of the Credit Agreement or any other Credit Document.

Section 9.GOVERNING LAW. THIS AMENDMENT AND THE RIGHTS AND OBLIGATIONS OF THE PARTIES HEREUNDER AND ANY CLAIM, CONTROVERSY, DISPUTE, PROCEEDING OR CAUSE OF ACTION (WHETHER IN CONTRACT, TORT OR OTHERWISE AND WHETHER AT LAW OR IN EQUITY) BASED UPON, ARISING OUT OF OR RELATING TO THIS AMENDMENT AND THE TRANSACTIONS CONTEMPLATED HEREBY SHALL BE GOVERNED BY, CONSTRUED AND INTERPRETED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK. SECTION 13.08 OF THE AMENDED CREDIT AGREEMENT IS HEREBY INCORPORATED MUTATIS MUTANDIS AND SHALL APPLY HERETO.

Section 10.Severability. If any provision of this Amendment is held to be illegal, invalid or unenforceable, the legality, validity and enforceability of the remaining provisions of this Amendment shall not be affected or impaired thereby. The invalidity of a provision in a particular jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction.

Section 11.Counterparts. This Amendment may, if agreed by the Administrative Agent, be in the form of an Electronic Record and may be executed using Electronic Signatures (including, without

limitation, facsimile and .pdf) and shall be considered an original, and shall have the same legal effect, validity and enforceability as a paper record. This Amendment may be executed in as many counterparts as necessary or convenient, including both paper and electronic counterparts, but all such counterparts are one and the same Amendment. For the avoidance of doubt, the authorization under this paragraph may include, without limitation, use or acceptance by the Administrative Agent of a manually signed paper communication which has been converted into electronic form (such as scanned into PDF format), or an electronically signed communication converted into another format, for transmission, delivery and/or retention. Notwithstanding anything contained herein to the contrary, the Administrative Agent is under no obligation to accept an Electronic Signature in any form or in any format unless expressly agreed to by it pursuant to procedures approved by it; provided, further, without limiting the foregoing, (a) to the extent the Administrative Agent has agreed to accept such Electronic Signature, it shall be entitled to rely on any such Electronic Signature without further verification and (b) upon the request of the Administrative Agent any Electronic Signature shall be promptly followed by a manually executed, original counterpart. For purposes hereof, “Electronic Record” and “Electronic Signature” shall have the meanings assigned to them, respectively, by 15 U.S.C. § 7006, as it may be amended from time to time.

Section 12.Headings. The headings of this Amendment are for purposes of reference only and shall not limit or otherwise affect the meaning hereof.

[Remainder of Page Intentionally Left Blank]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed by their respective authorized officers as of the day and year first above written.

CAPITOL INVESTMENT MERGER SUB 2, LLC,

as Holdings

By: /s/ Paul Jolas

Name: Paul Jolas

Title: Executive Vice President, General Counsel, Secretary

NESCO HOLDINGS II, INC.,

as Borrower

By: /s/ Paul Jolas

Name: Paul Jolas

Title: Executive Vice President, General Counsel, Secretary

CTOS BLOCKER I, L.P., by its general partner,

CTOS BLOCKER GP I L.L.C.,

as Subsidiary Guarantor

By: /s/ Paul Jolas

Name: Paul Jolas

Title: Executive Vice President, General Counsel, Secretary

CTOS BLOCKER II, L.P., by its general partner,

CTOS BLOCKER GP II L.L.C.,

as Subsidiary Guarantor

By: /s/ Paul Jolas

Name: Paul Jolas

Title: Executive Vice President, General Counsel, Secretary

[Signature Page to Amendment No. 3 to the Revolving Credit Agreement]

CUSTOM TRUCK ONE SOURCE, L.P.,

by its general partner, UTILITY ONE SOURCE GP, L.L.C.,

as Subsidiary Guarantor

By: /s/ Paul Jolas

Name: Paul Jolas

Title: Executive Vice President, General Counsel, Secretary

UTILITY FLEET SALES, LTD., by its general partner, UTILITY ONE SOURCE GP, L.L.C.,

as Subsidiary Guarantor

By: /s/ Paul Jolas

Name: Paul Jolas

Title: Executive Vice President, General Counsel, Secretary

[Signature Page to Amendment No. 3 to the Revolving Credit Agreement]

CTE PROPERTIES, LLC

CTE, LLC

CTEC HOLDING CO., LLC

CTEC, LLC

CTOS RENTALS, LLC

CTOS, LLC

CTOS BLOCKER GP I L.L.C.

CTOS BLOCKER GP II L.L.C.

CTOS CALIFORNIA, LLC

CTOS CANADA, LTD.

CUSTOM CRANE RENTAL, LLC

CUSTOM EQUIPMENT RENTAL, LLC

CUSTOM FABRICATION & EQUIPMENT, LLC

CUSTOM TRUCK & EQUIPMENT, LLC

CUSTOM TRUCK ONE SOURCE FORESTRY EQUIPMENT, LLC

EQUIPMENT REPAIR SOLUTIONS, LLC

LOAD KING, LLC

LOAD KING PARTS, LLC

NESCO FINANCE CORPORATION

NESCO, LLC

NORTH AMERICAN EQUIPMENT ROAD SERVICE, LLC

NORTH AMERICAN EQUIPMENT UPFITTERS, LLC

TNT EQUIPMENT SALES & RENTALS, LLC

UCO EQUIPMENT, LLC

UTILITY FLEET RENTAL, LLC

UTILITY FLEET TRANSPORT, LLC

UTILITY ONE SOURCE GP, L.L.C.,

each as a Subsidiary Guarantor

By: /s/ Paul Jolas

Name: Paul Jolas

Title: Executive Vice President, General Counsel, Secretary

[Signature Page to Amendment No. 3 to the Revolving Credit Agreement]

BANK OF AMERICA, N.A.,

as Administrative Agent, Collateral Agent, Swingline Lender, Lender and Issuing Bank

By: /s/ Zach Nobis-Olson

Name: Zach Nobis-Olson

Title: Senior Vice President

[Signature Page to Amendment No. 3 to the Revolving Credit Agreement]

PNC BANK, NATIONAL ASSOCIATION,

as a Lender and an Issuing Bank

By: /s/ Kevin Curtis

Name: Kevin Curtis

Title: Vice President

[Signature Page to Amendment No. 3 to the Revolving Credit Agreement]

WELLS FARGO BANK, NATIONAL ASSOCIATION,

as a Lender and an Issuing Bank

By: /s/ Carolyn Weinschenk

Name: Carolyn Weinschenk

Title: Vice President

[Signature Page to Amendment No. 3 to the Revolving Credit Agreement]

Citibank, N.A.,

as a Lender and an Issuing Bank

By: /s/ Christopher Marino

Name: Christopher Marino

Title: Vice President & Director

[Signature Page to Amendment No. 3 to the Revolving Credit Agreement]

Deutsche Bank AG New York Branch,

as a Lender and an Issuing Bank

By: /s/ Philip Tancorra

Name: Philip Tancorra

Title: Director

By: /s/ Lauren Danbury

Name: Lauren Danbury

Title: Vice President

[Signature Page to Amendment No. 3 to the Revolving Credit Agreement]

Fifth Third Bank, National Association

as a Lender and an Issuing Bank

By: /s/ Susan Rich

Name: Susan Rich

Title: Director

[Signature Page to Amendment No. 3 to the Revolving Credit Agreement]

BANK OF MONTREAL,

as a Lender and an Issuing Bank

By: /s/ James Meyer

Name: James Meyer

Title: Vice President

[Signature Page to Amendment No. 3 to the Revolving Credit Agreement]

CIBC Bank USA,

as a Lender and an Issuing Bank

By: /s/ Zach Strube

Name: Zach Strube

Title: Managing Director

[Signature Page to Amendment No. 3 to the Revolving Credit Agreement]

Stifel Bank & Trust,

as a Lender and an Issuing Bank

By: /s/ Jordan Morrison

Name: Jordan Morrison

Title: Loan Officer

[Signature Page to Amendment No. 3 to the Revolving Credit Agreement]

MORGAN STANLEY SENIOR FUNDING, INC.,

as a Lender and an Issuing Bank

By: / Fred Gonfiantini/

Name: Fred Gonfiantini

Title: Vice President

[Signature Page to Amendment No. 3 to the Revolving Credit Agreement]

Exhibit A

Omitted pursuant to Item 601(a)(5) of Regulation S-K

Exhibit B

SCHEDULE 2.01

Commitments

Revolving Commitments

| | | | | | | | |

| Lender | Revolving Commitment | Pro Rata Share |

Bank of America, N.A. | $291,333,333.33 | 30.666666667% |

PNC Bank, National Association | $152,000,000.00 | 16.000000000% |

Wells Fargo Bank, N.A. | $114,000,000.00 | 12.000000000% |

Citibank, N.A. | $85,500,000.00 | 9.000000000% |

Deutsche Bank AG New York Branch | $85,500,000.00 | 9.000000000% |

Fifth Third Bank, National Association | $80,750,000.00 | 8.500000000% |

Bank of Montreal | $57,000,000.00 | 6.000000000% |

CIBC Bank USA | $31,666,666.67 | 3.333333333% |

Stifel Bank & Trust | $28,500,000.00 | 3.000000000% |

Morgan Stanley Senior Funding, Inc. | $23,750,000.00 | 2.500000000% |

| Total | $950,000,000.00 | 100.000000000% |

LC Commitments

| | | | | |

| Issuing Bank | LC Commitment |

Bank of America, N.A. | $15,333,333.33 |

PNC Bank, National Association | $8,000,000.00 |

Wells Fargo Bank, N.A. | $6,000,000.00 |

Citibank, N.A. | $4,500,000.00 |

Deutsche Bank AG New York Branch | $4,500,000.00 |

Fifth Third Bank, National Association | $4,250,000.00 |

Bank of Montreal | $3,000,000.00 |

CIBC Bank USA | $1,666,666.67 |

Stifel Bank & Trust | $1,500,000.00 |

Morgan Stanley Senior Funding, Inc. | $1,250,000.00 |

| Total | $50,000,000.00 |

Exhibit C

Amended Form of Notice of Borrowing

Omitted pursuant to Item 601(a)(5) of Regulation S-K

Exhibit D

Amended Form of Notice of Conversion/Continuation

Omitted pursuant to Item 601(a)(5) of Regulation S-K

Exhibit E

Amended Form of Compliance Certificate

Omitted pursuant to Item 601(a)(5) of Regulation S-K

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

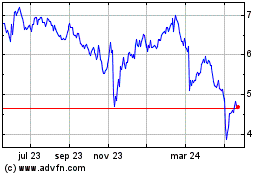

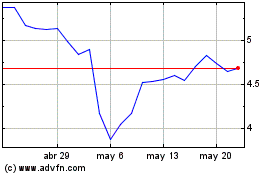

Custom Truck One Source (NYSE:CTOS)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

Custom Truck One Source (NYSE:CTOS)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024