Provides Financial Guidance for Fiscal 2024

First Quarter and Full Year

Dollar General Corporation (NYSE: DG) today reported financial

results for its fiscal year 2023 fourth quarter (13 weeks) and

fiscal year (52 weeks) ended February 2, 2024 (“fiscal 2023”).

Note: Dollar General's results for the fiscal full year and

fourth quarter ended February 3, 2023 (“fiscal 2022”) contain an

additional, non-comparable week, or the "53rd week”, when compared

to the full year and fourth quarter results for the respective 52-

and 13-week periods ended February 2, 2024. By definition, the

Company's same-store sales growth calculations do not include the

non-comparable 53rd week in the fiscal 2022 periods. Financial

metrics discussed in this release, such as net sales, operating

income, net income and earnings per share (“EPS”), are calculated

in accordance with generally accepted accounting principles

(“GAAP”) and therefore include the 53rd week for the applicable

fiscal 2022 periods.

- Fourth Quarter Net Sales Decreased 3.4% to $9.9 Billion; Fiscal

Year Net Sales Increased 2.2% to $38.7 Billion

- Fourth Quarter Same-Store Sales Increased 0.7%; Fiscal Year

Same-Store Sales Increased 0.2%

- Fourth Quarter Operating Profit Decreased 37.9% to $579.7

Million; Fiscal Year Operating Profit Decreased 26.5% to $2.4

Billion

- Fourth Quarter Diluted EPS Decreased 38.2% to $1.83; Fiscal

Year Diluted EPS Decreased 29.3% to $7.55

- Annual Cash Flows From Operations Increased 20.5% to $2.4

Billion

- Board of Directors Declares Quarterly Cash Dividend of $0.59

per share

“We were pleased to deliver fourth quarter top and bottom-line

results at the upper end of our internal expectations,” said Todd

Vasos, Dollar General’s chief executive officer. “With customer

traffic growth and market share gains during the quarter, we

believe our actions are resonating with customers as they turn to

Dollar General for our unique combination of value and

convenience.”

“We have made solid progress executing on our Back to Basics

strategy, which we believe supported our improved operational

performance during the quarter. While we are pleased with the

operational improvement we have seen, we believe that significant

opportunity remains, as we continue to focus on enhancing the way

we support our teams and serve our customers.”

“I want to thank our associates for their resilience and

commitment to serving our customers every day. Looking ahead, we

are excited about our plans for 2024 and are confident that we are

taking the right actions to further solidify our foundation for

future growth and create sustainable long-term value for our

shareholders.”

Fourth Quarter Fiscal 2023

Highlights Net sales decreased 3.4% to $9.9 billion in

the fourth quarter of fiscal 2023 compared to $10.2 billion in the

fourth quarter of fiscal 2022, which included net sales for the

53rd week of $678.1 million. The net sales decrease was primarily

driven by the period containing one less week of sales than the

prior year period, as well as the impact of store closures;

partially offset by positive sales contributions from new stores

and growth in same-store sales. Same-store sales increased 0.7%

compared to the fourth quarter of fiscal 2022, driven by an

increase in customer traffic, partially offset by a decrease in

average transaction amount. Same-store sales in the fourth quarter

of fiscal 2023 included growth in the consumables category,

partially offset by declines in each of the home products,

seasonal, and apparel categories.

Gross profit as a percentage of net sales was 29.5% in the

fourth quarter of fiscal 2023 compared to 30.9% in the fourth

quarter of fiscal 2022, a decrease of 138 basis points. This gross

profit rate decrease was primarily attributable to increased shrink

and inventory markdowns, lower inventory markups, and a greater

proportion of sales coming from the consumables category, which

generally has a lower gross profit rate than other product

categories. These factors were partially offset by a lower LIFO

provision and decreased transportation costs.

Selling, general and administrative expenses (“SG&A”) as a

percentage of net sales were 23.6% in the fourth quarter of fiscal

2023 compared to 21.7% in the fourth quarter of fiscal 2022, an

increase of 189 basis points. The primary expenses that were a

greater percentage of net sales in the current year period were

retail labor, store occupancy costs, depreciation and amortization,

repairs and maintenance, and other services purchased, including

debit and credit card transaction fees. These factors were

partially offset by a decrease in incentive compensation.

Operating profit for the fourth quarter of fiscal 2023 decreased

37.9% to $579.7 million compared to $933.2 million in the fourth

quarter of fiscal 2022.

Interest expense for the fourth quarter of fiscal 2023 increased

3.1% to $77.1 million compared to $74.8 million in the fourth

quarter of fiscal 2022.

The effective income tax rate in the fourth quarter of fiscal

2023 was 20.0% compared to 23.2% in the fourth quarter of fiscal

2022. This lower effective income tax rate was primarily due to the

effect of certain rate-impacting items (such as federal tax

credits) on lower earnings before taxes, and a lower state

effective rate resulting from increased recognition of state tax

credits.

The Company reported net income of $401.8 million for the fourth

quarter of fiscal 2023, a decrease of 39.0% compared to $659.1

million in the fourth quarter of fiscal 2022. Diluted EPS decreased

38.2% to $1.83 for the fourth quarter of fiscal 2023 compared to

diluted EPS of $2.96 in the fourth quarter of fiscal 2022.

Fiscal Year 2023 Highlights Fiscal 2023 net sales increased

2.2% to $38.7 billion compared to $37.8 billion in fiscal 2022,

which included net sales for the 53rd week of $678.1 million. The

net sales increase was primarily driven by positive sales

contributions from new stores and growth in same-store sales,

partially offset by the impact of store closures. Same-store sales

increased 0.2% compared to fiscal 2022, driven by an increase in

customer traffic, partially offset by a decline in average

transaction amount. Same-store sales increased in the consumables

category, and declined in the home products, seasonal and apparel

categories.

Gross profit as a percentage of net sales was 30.3% in fiscal

2023, compared to 31.2% in fiscal 2022, a decrease of 94 basis

points. The gross profit rate decrease in 2023 was primarily driven

by increased shrink and inventory markdowns, lower inventory

markups, a greater proportion of sales coming from the lower margin

consumables sales category, and increased damages. These factors

were partially offset by a lower LIFO provision and decreased

transportation costs.

SG&A as a percentage of net sales was 24.0% in fiscal 2023

compared to 22.4% in fiscal 2022, an increase of 153 basis points.

The primary expenses that were a higher percentage of net sales in

the current year were retail labor, store occupancy costs,

depreciation and amortization, repairs and maintenance, and other

services purchased, including debit and credit card transaction

fees. These factors were partially offset by a decrease in

incentive compensation.

Operating profit for fiscal 2023 decreased 26.5% to $2.4 billion

compared to $3.3 billion in fiscal 2022.

Interest expense for fiscal 2023 increased 54.7% to $327 million

compared to $211 million in fiscal 2022, primarily driven by higher

average borrowings and higher interest rates.

The effective income tax rate in fiscal 2023 was 21.6% compared

to 22.5% in fiscal 2022. This lower effective income tax rate was

primarily due to the effect of certain rate-impacting items (such

as federal tax credits) on lower earnings before taxes, and a lower

state effective rate resulting from increased recognition of state

tax credits compared to fiscal 2022.

The Company reported net income of $1.7 billion for fiscal 2023,

a decrease of 31.2% compared to $2.4 billion in fiscal 2022.

Diluted EPS decreased 29.3% to $7.55 for fiscal 2023 compared to

diluted EPS of $10.68 in fiscal year 2022. The decrease in diluted

EPS includes estimated negative impacts of approximately four

percentage points due to lapping the fiscal 2022 53rd week, and

approximately four percentage points due to higher interest expense

in fiscal 2023.

Merchandise Inventories As

of February 2, 2024, total merchandise inventories, at cost, were

$7.0 billion compared to $6.8 billion as of February 3, 2023, a

decrease of 1.1% on a per-store basis.

Capital Expenditures Total

additions to property and equipment in fiscal 2023 were $1.7

billion, including approximately: $683 million for improvements,

upgrades, remodels and relocations of existing stores; $542 million

for distribution and transportation-related projects; $390 million

related to store facilities, primarily for leasehold improvements,

fixtures and equipment in new stores; and $67 million for

information systems upgrades and technology-related projects.

During fiscal year 2023, the Company opened 987 new stores,

remodeled 2,007 stores, and relocated 129 stores.

Share Repurchases In fiscal

2023, as planned, the Company did not repurchase any shares under

its share repurchase program. The total remaining authorization for

future repurchases was $1.4 billion at the end of fiscal 2023.

Under the authorization, repurchases may be made from time to

time in open market transactions, including pursuant to trading

plans adopted in accordance with Rule 10b5-1 of the Securities

Exchange Act of 1934, as amended, or in privately negotiated

transactions. The timing, manner and number of shares repurchased

will depend on a variety of factors, including price, market

conditions, compliance with the covenants and restrictions under

the Company’s debt agreements, cash requirements, excess debt

capacity, results of operations, financial condition and other

factors. The authorization has no expiration date. See also “Fiscal

Year 2024 Financial Guidance and Store Growth Outlook.”

Dividend On March 13, 2024,

the Company’s Board of Directors declared a quarterly cash dividend

of $0.59 per share on the Company’s common stock, payable on or

before April 23, 2024 to shareholders of record on April 9, 2024.

While the Board of Directors currently intends to continue regular

cash dividends, the declaration and amount of future dividends are

subject to the sole discretion of the Board and will depend upon,

among other things, the Company’s results of operations, cash

requirements, financial condition, contractual restrictions, excess

debt capacity, and other factors the Board may deem relevant in its

sole discretion.

Fiscal Year 2024 Financial Guidance and

Store Growth Outlook For the 52-week fiscal year ending

January 31, 2025 (“fiscal year 2024”), the Company expects the

following:

- Net sales growth in the range of approximately 6.0% to

6.7%

- Same-store sales growth in the range of 2.0% to 2.7%

- Diluted EPS in the range of approximately $6.80 to $7.55

- The Company currently anticipates an estimated negative impact

to EPS of approximately $0.50 due to higher incentive compensation

expense

- Diluted EPS guidance assumes an effective tax rate in the range

of approximately 22.5% to 23.5%

- Capital expenditures, including those related to investments in

the Company’s strategic initiatives, in the range of $1.3 billion

to $1.4 billion

The Company is also reiterating its plans to execute

approximately 2,385 real estate projects in fiscal year 2024,

including approximately 800 new store openings, 1,500 remodels, and

85 store relocations.

The Company’s guidance assumes no share repurchases in fiscal

year 2024.

Fiscal Year 2024 First Quarter

Financial Guidance For the 13-week quarter ending May 3,

2024, the Company currently expects a same-store sales increase of

1.5% to 2.0%, and Diluted EPS in the range of $1.50 to $1.60.

“We are encouraged by the progress we are making with our

efforts in getting Back to the Basics, and we anticipate the

benefit of these actions will continue to grow as we move

throughout fiscal year 2024,” said Kelly Dilts, Dollar General’s

chief financial officer. “While we anticipate the first quarter

will be pressured by our lowest expected same-store-sales increase

of any quarter in fiscal 2024, as well as the annualization of

prior year headwinds such as retail labor and shrink, we are

focused on delivering our full year plans, including anticipated

strong EPS growth in the back half of the year.”

Conference Call Information

The Company will hold a conference call on March 14, 2024 at 9:00

a.m. CT/10:00 a.m. ET, hosted by Todd Vasos, chief executive

officer, and Kelly Dilts, chief financial officer. To participate

via telephone, please call (877) 407-0890 at least 10 minutes

before the conference call is scheduled to begin. The conference ID

is 13743905. There will also be a live webcast of the call

available at https://investor.dollargeneral.com under “News &

Events, Events & Presentations.” A replay of the conference

call will be available through April 11, 2024, and will be

accessible via webcast replay or by calling (877) 660-6853. The

conference ID for the telephonic replay is 13743905.

Forward-Looking Statements

This press release contains forward-looking information within the

meaning of the federal securities laws, including the Private

Securities Litigation Reform Act. Forward-looking statements

include those regarding the Company’s outlook, strategy,

initiatives, plans, intentions or beliefs, including, but not

limited to, statements made within the quotations of Mr. Vasos and

Ms. Dilts, and in the sections entitled “Share Repurchases,”

“Dividend,” “Fiscal Year 2024 Financial Guidance and Store Growth

Outlook,” and “Fiscal Year 2024 First Quarter Financial Guidance.”

A reader can identify forward-looking statements because they are

not limited to historical fact or they use words such as “outlook,”

“may,” “will,” “should,” “could,” “would,” “can,” “believe,”

“anticipate,” “plan,” “project,” “expect,” “estimate,” “target,”

“forecast,” “accelerate,” “predict,” “position,” “assume,”

“opportunities,” “prospects,” “investments,” “intend,” “continue,”

“future,” “beyond,” “ongoing,” “potential,” “long-term,” “longer

term,” “near-term,” “guidance,” “goal,” “outcome,” “uncertainty,”

“look to,” “move into,” “moving forward,” “looking ahead,” “years

ahead,” “subject to,” “committed,” “confident,” “focus on,” or

“likely to,” and similar expressions that concern the Company’s

outlook, strategies, plans, initiatives, intentions or beliefs

about future occurrences or results. These matters involve risks,

uncertainties and other factors that may change at any time and may

cause actual results to differ materially from those which the

Company expected. Many of these statements are derived from the

Company’s operating budgets and forecasts as of the date of this

release, which are based on many detailed assumptions and estimates

that the Company believes are reasonable. However, it is very

difficult to predict the effect of known factors on future results,

and the Company cannot anticipate all factors that could affect

future results that may be important to an investor. All

forward-looking information should be evaluated in the context of

these risks, uncertainties and other factors. Important factors

that could cause actual results to differ materially from the

expectations expressed in or implied by such forward-looking

statements include, but are not limited to:

- economic factors, including but not limited to employment

levels; inflation (and the Company’s ability to adjust prices

sufficiently to offset the effect of inflation); pandemics (such as

the COVID-19 pandemic); higher fuel, energy, healthcare, housing

and product costs; higher interest rates, consumer debt levels, and

tax rates; lack of available credit; tax law changes that

negatively affect credits and refunds; decreases in, or elimination

of, government assistance programs or subsidies such as

unemployment and food/nutrition assistance programs, student loan

repayment forgiveness and economic stimulus payments; commodity

rates; transportation, lease and insurance costs; wage rates

(including the heightened possibility of increased federal, and

further increased state and/or local minimum wage rates); foreign

exchange rate fluctuations; measures that create barriers to or

increase the costs of international trade (including increased

import duties or tariffs); and changes in laws and regulations and

their effect on, as applicable, customer spending and disposable

income, the Company’s ability to execute its strategies and

initiatives, the Company’s cost of goods sold, the Company’s

SG&A expenses (including real estate costs), and the Company’s

sales and profitability;

- failure to achieve or sustain the Company’s strategies,

initiatives and investments, including those relating to

merchandising (including those related to non-consumable products),

real estate and new store development, international expansion,

store formats and concepts, digital, marketing, shrink, damages,

sourcing, private brand, inventory management, supply chain,

private fleet, store operations, expense reduction, technology,

pOpshelf, self-checkout, and DG Media Network;

- competitive pressures and changes in the competitive

environment and the geographic and product markets where the

Company operates, including, but not limited to, pricing,

promotional activity, expanded availability of mobile, web-based

and other digital technologies, and alliances or other business

combinations;

- failure to timely and cost-effectively execute the Company’s

real estate projects or to anticipate or successfully address the

challenges imposed by the Company’s expansion, including into new

countries or domestic markets, states, or urban or suburban

areas;

- levels of inventory shrinkage and damages;

- failure to successfully manage inventory balances and in-stock

levels, as well as to predict customer trends;

- failure to maintain the security of the Company’s business,

customer, employee or vendor information or to comply with privacy

laws, or the Company or one of its vendors falling victim to a

cyberattack (which risk is heightened as a result of political

uncertainty involving China, the conflict between Russia and

Ukraine and the conflict in the Middle East) that prevents the

Company from operating all or a portion of its business;

- damage or interruption to the Company’s information systems as

a result of external factors, staffing shortages or challenges in

maintaining or updating the Company’s existing technology or

developing, implementing or integrating new technology;

- a significant disruption to the Company’s distribution network,

the capacity of the Company’s distribution centers or the timely

receipt of inventory; increased fuel or transportation costs;

issues related to supply chain disruptions or seasonal buying

pattern disruptions; or delays in constructing, opening or staffing

new distribution centers (including temperature-controlled

distribution centers);

- risks and challenges associated with sourcing merchandise from

suppliers, including, but not limited to, those related to

international trade (for example, political uncertainty involving

China and disruptive political events such as the conflict between

Russia and Ukraine and the conflict in the Middle East);

- natural disasters, unusual weather conditions (whether or not

caused by climate change), pandemic outbreaks or other health

crises (for example, the COVID-19 pandemic), political or civil

unrest, acts of war, violence or terrorism, and disruptive global

political events (for example, political uncertainty involving

China, the conflict between Russia and Ukraine and the conflict in

the Middle East);

- product liability, product recall or other product safety or

labeling claims;

- incurrence of material uninsured losses, excessive insurance

costs or accident costs;

- failure to attract, develop and retain qualified employees

while controlling labor costs (including the heightened possibility

of increased federal, and further increased state and/or local

minimum wage rates/salary levels, including the effects of

potential regulatory changes related to the overtime exemption

under the Fair Labor Standards Act if implemented) and other labor

issues, including employee safety issues and employee expectations

and productivity;

- loss of key personnel or inability to hire additional qualified

personnel, ability to successfully execute management transitions

within the Company’s senior leadership; or inability to enforce

non-compete agreements that we have in place with management

personnel;

- risks associated with the Company’s private brands, including,

but not limited to, the Company’s level of success in improving

their gross profit rate at expected levels;

- failure to protect the Company’s reputation;

- seasonality of the Company’s business;

- the impact of changes in or noncompliance with governmental

regulations and requirements, including, but not limited to, those

dealing with the sale of products, including without limitation,

product and food safety, marketing, labeling or pricing;

information security and privacy; labor and employment; employee

wages, salary levels and benefits (including the heightened

possibility of increased federal, and further increased state

and/or local minimum wage rates and the effects of potential

regulatory changes related to the overtime exemption under the Fair

Labor Standards Act if implemented); health and safety; real

property; public accommodations; imports and customs;

transportation; intellectual property; bribery; climate change; and

environmental compliance (including required public disclosures

related thereto), as well as tax laws (including those related to

the federal, state or foreign corporate tax rate), the

interpretation of existing tax laws, or the Company’s failure to

sustain its reporting positions negatively affecting the Company’s

tax rate, and developments in or outcomes of private actions, class

actions, multi-district litigation, arbitrations, derivative

actions, administrative proceedings, regulatory actions or other

litigation or of inquiries from federal, state and local agencies,

regulatory authorities, attorneys general, committees,

subcommittees and members of the U.S. Congress, and other local,

state, federal and international governmental authorities;

- new accounting guidance or changes in the interpretation or

application of existing guidance;

- deterioration in market conditions, including market

disruptions, adverse conditions in the financial markets including

financial institution failures, limited liquidity and interest rate

increases, changes in the Company’s credit profile, compliance with

covenants and restrictions under the Company’s debt agreements, and

the amount of the Company’s available excess capital;

- the factors disclosed under “Risk Factors” in the Company’s

most recent Annual Report on Form 10-K and any subsequently filed

Quarterly Reports on Form 10-Q; and

- such other factors as may be discussed or identified in this

press release.

All forward-looking statements are qualified in their entirety

by these and other cautionary statements that the Company makes

from time to time in its SEC filings and public communications. The

Company cannot assure the reader that it will realize the results

or developments the Company anticipates or, even if substantially

realized, that they will result in the consequences or affect the

Company or its operations in the way the Company expects.

Forward-looking statements speak only as of the date made. The

Company undertakes no obligation, and specifically disclaims any

duty, to update or revise any forward-looking statements as a

result of new information, future events or circumstances, or

otherwise, except as otherwise required by law. As a result of

these risks and uncertainties, readers are cautioned not to place

undue reliance on any forward-looking statements included herein or

that may be made elsewhere from time to time by, or on behalf of,

the Company.

Investors should also be aware that while the Company does, from

time to time, communicate with securities analysts and others, it

is against the Company’s policy to disclose to them any material,

nonpublic information or other confidential commercial information.

Accordingly, shareholders should not assume that the Company agrees

with any statement or report issued by any securities analyst

regardless of the content of the statement or report. Furthermore,

the Company has a policy against confirming projections, forecasts

or opinions issued by others. Thus, to the extent that reports

issued by securities analysts contain any projections, forecasts or

opinions, such reports are not the Company’s responsibility.

About Dollar General

Corporation Dollar General Corporation (NYSE: DG) is

proud to serve as America’s neighborhood general store. Founded in

1939, Dollar General lives its mission of Serving Others every day

by providing access to affordable products and services for its

customers, career opportunities for its employees, and literacy and

education support for its hometown communities. As of February 2,

2024, the Company’s 19,986 Dollar General, DG Market, DGX and

pOpshelf stores across the United States and Mi Súper Dollar

General stores in Mexico provide everyday essentials including

food, health and wellness products, cleaning and laundry supplies,

self-care and beauty items, and seasonal décor from our

high-quality private brands alongside many of the world’s most

trusted brands such as Coca Cola, PepsiCo/Frito-Lay, General Mills,

Hershey, J.M. Smucker, Kraft, Mars, Nestlé, Procter & Gamble

and Unilever.

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES Consolidated

Balance Sheets (In thousands) (Unaudited)

February 2 February 3,

2024

2023

ASSETS Current assets: Cash and cash equivalents

$

537,283

$

381,576

Merchandise inventories

6,994,266

6,760,733

Income taxes receivable

112,262

135,775

Prepaid expenses and other current assets

366,913

302,925

Total current assets

8,010,724

7,581,009

Net property and equipment

6,087,722

5,236,309

Operating lease assets

11,098,228

10,670,014

Goodwill

4,338,589

4,338,589

Other intangible assets, net

1,199,700

1,199,700

Other assets, net

60,628

57,746

Total assets

$

30,795,591

$

29,083,367

LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities:

Current portion of long-term obligations

$

768,645

$

-

Current portion of operating lease liabilities

1,387,083

1,288,939

Accounts payable

3,587,374

3,552,991

Accrued expenses and other

971,890

1,036,919

Income taxes payable

10,709

8,919

Total current liabilities

6,725,701

5,887,768

Long-term obligations

6,231,539

7,009,399

Long-term operating lease liabilities

9,703,499

9,362,761

Deferred income taxes

1,133,784

1,060,906

Other liabilities

251,949

220,761

Total liabilities

24,046,472

23,541,595

Commitments and contingencies Shareholders' equity:

Preferred stock

-

-

Common stock

192,206

191,718

Additional paid-in capital

3,757,005

3,693,871

Retained earnings

2,799,415

1,656,140

Accumulated other comprehensive income (loss)

493

43

Total shareholders' equity

6,749,119

5,541,772

Total liabilities and shareholders' equity

$

30,795,591

$

29,083,367

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

Consolidated Statements of Income (In thousands, except

per share amounts) (Unaudited) For the Quarter

Ended (13 Weeks) (14 Weeks)

February 2 % of Net February 3, % of

Net

2024

Sales

2023

Sales Net sales

$

9,858,514

100.00

%

$

10,202,907

100.00

%

Cost of goods sold

6,952,178

70.52

7,054,590

69.14

Gross profit

2,906,336

29.48

3,148,317

30.86

Selling, general and administrative expenses

2,326,682

23.60

2,215,143

21.71

Operating profit

579,654

5.88

933,174

9.15

Interest expense

77,117

0.78

74,818

0.73

Income before income taxes

502,537

5.10

858,356

8.41

Income tax expense

100,724

1.02

199,221

1.95

Net income

$

401,813

4.08

%

$

659,135

6.46

%

Earnings per share:

Basic

$

1.83

$

2.97

Diluted

$

1.83

$

2.96

Weighted average shares outstanding: Basic

219,585

221,564

Diluted

219,893

222,702

For the Year Ended (52

Weeks) (53 Weeks) February 2 %

of Net February 3, % of Net

2024

Sales

2023

Sales Net sales

$

38,691,609

100.00

%

$

37,844,863

100.00

%

Cost of goods sold

26,972,585

69.71

26,024,765

68.77

Gross profit

11,719,024

30.29

11,820,098

31.23

Selling, general and administrative expenses

9,272,724

23.97

8,491,796

22.44

Operating profit

2,446,300

6.32

3,328,302

8.79

Interest expense

326,781

0.84

211,273

0.56

Other (income) expense

-

0.00

415

0.00

Income before income taxes

2,119,519

5.48

3,116,614

8.24

Income tax expense

458,245

1.18

700,625

1.85

Net income

$

1,661,274

4.29

%

$

2,415,989

6.38

%

Earnings per share:

Basic

$

7.57

$

10.73

Diluted

$

7.55

$

10.68

Weighted average shares outstanding: Basic

219,415

225,148

Diluted

219,938

226,297

DOLLAR GENERAL CORPORATION AND

SUBSIDIARIES Consolidated Statements of Cash Flows

(In thousands) (Unaudited) For the Year

Ended (52 Weeks) (53 Weeks)

February 2 February 3,

2024

2023

Cash flows from operating activities: Net income

$

1,661,274

$

2,415,989

Adjustments to reconcile net income to net cash from

operating activities: Depreciation and amortization

848,793

724,877

Deferred income taxes

72,847

235,299

Noncash share-based compensation

51,891

72,712

Other noncash (gains) and losses

88,982

530,530

Change in operating assets and liabilities: Merchandise inventories

(299,066

)

(1,665,352

)

Prepaid expenses and other current assets

(63,576

)

(65,102

)

Accounts payable

36,940

(194,722

)

Accrued expenses and other liabilities

(39,189

)

(25,409

)

Income taxes

25,303

(37,517

)

Other

7,599

(6,750

)

Net cash provided by (used in) operating activities

2,391,798

1,984,555

Cash flows from investing

activities: Purchases of property and equipment

(1,700,222

)

(1,560,582

)

Proceeds from sales of property and equipment

6,199

5,236

Net cash provided by (used in) investing activities

(1,694,023

)

(1,555,346

)

Cash flows from financing activities: Issuance of

long-term obligations

1,498,260

2,296,053

Repayments of long-term obligations

(19,723

)

(911,330

)

Net increase (decrease) in commercial paper outstanding

(1,501,900

)

1,447,600

Borrowings under revolving credit facilities

500,000

-

Repayments of borrowings under revolving credit facilities

(500,000

)

-

Costs associated with issuance of debt

(12,438

)

(16,925

)

Repurchases of common stock

-

(2,748,014

)

Payments of cash dividends

(517,979

)

(493,726

)

Other equity and related transactions

11,712

33,880

Net cash provided by (used in) financing activities

(542,068

)

(392,462

)

Net increase (decrease) in cash and cash equivalents

155,707

36,747

Cash and cash equivalents, beginning of period

381,576

344,829

Cash and cash equivalents, end of period

$

537,283

$

381,576

Supplemental cash flow information: Cash paid

for: Interest

$

352,473

$

195,312

Income taxes

$

359,578

$

500,814

Supplemental schedule of non-cash investing and financing

activities: Right of use assets obtained in exchange for new

operating lease liabilities

$

1,804,934

$

1,836,718

Purchases of property and equipment awaiting processing for

payment, included in Accounts payable

$

148,137

$

150,694

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

Selected Additional Information (Unaudited)

Sales by Category (in thousands) For the

Quarter Ended (13 Weeks) (14 Weeks)

February 2 February 3,

2024

2023

% Change Consumables

$

7,897,564

$

8,054,072

-1.9

%

Seasonal

1,104,316

1,191,702

-7.3

%

Home products

581,501

658,398

-11.7

%

Apparel

275,133

298,735

-7.9

%

Net sales

$

9,858,514

$

10,202,907

-3.4

%

For the Year Ended (52 Weeks)

(53 Weeks) February 2 February

3,

2024

2023

% Change Consumables

$

31,342,595

$

30,155,218

3.9

%

Seasonal

4,083,790

4,182,815

-2.4

%

Home products

2,163,806

2,332,411

-7.2

%

Apparel

1,101,418

1,174,419

-6.2

%

Net sales

$

38,691,609

$

37,844,863

2.2

%

Store Activity

For the 52 Weeks Ended (52 Weeks)

(53 Weeks) February 2 February

3,

2024

2023

Beginning store count

19,104

18,130

New store openings

987

1,039

Store closings

(105

)

(65

)

Net new stores

882

974

Ending store count

19,986

19,104

Total selling square footage (000's)

151,095

142,987

Growth rate (square footage)

5.7

%

6.3

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240312291397/en/

Investor Contact: investorrelations@dollargeneral.com

Media Contact: dgpr@dollargeneral.com

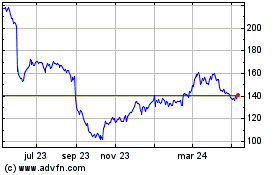

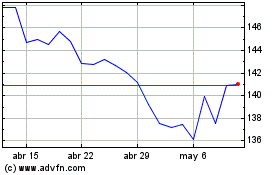

Dollar General (NYSE:DG)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Dollar General (NYSE:DG)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024