Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

08 Marzo 2024 - 3:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2024

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F X Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes No X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .)

Buenos Aires, March 8, 2024

Messrs.

COMISIÓN NACIONAL DE VALORES

Argentine Securities and Exchange Commission

Issuers´ Sub-Management Office

25 de Mayo 175

City of Buenos Aires

Messrs.

BOLSAS Y MERCADOS ARGENTINOS S.A.

Sarmiento 299

City of Buenos Aires

Re:

Relevant Fact

Partial cancellation Notes Class 2

Dear Sirs:

It is my pleasure to inform you on behalf of

Empresa Distribuidora y Comercializadora Norte Sociedad Anónima (EDENOR S.A.) (or “the Company”), in compliance

with the current regulations, in order to inform you that on March 7, 2024, and in accordance with the published results notice, the Company

has issued simple Senior Notes Class 3 (not convertible into shares), denominated and payable in United States Dollars at a fixed rate

of 9.75% per annum, maturing on November 22, 2026 per a nominal value of US$ 95,762,688, of which US$ 34,157,571 correspond to the In-Kind

Integration Tranche through the delivery of Senior Notes Class 2 at the Exchange Ratio established in the Prospectus Supplement.

Consequently, the Company will proceed to request

the cancellation of Senior Notes Class 2 for a nominal value of US$32,766,541, remaining an outstanding amount of US$27,233,459.

Yours faithfully,

Solange Barthe Dennin

Market Relations Officer

Empresa Distribuidora y Comercializadora Norte Sociedad Anónima

(EDENOR S.A.)

Avda. del Libertador 6363 – Buenos Aires, C1428ARG – Argentina.

Tel.: 4346-5400 Fax: 4346-5327

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Empresa Distribuidora y Comercializadora Norte S.A. |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Germán Ranftl |

|

|

Germán Ranftl |

|

|

Chief Financial Officer |

Date:

March 8, 2024

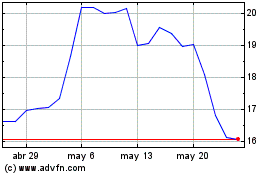

Empresa Distribuidora Y ... (NYSE:EDN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

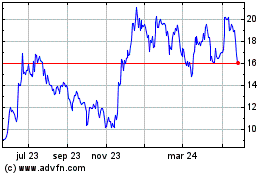

Empresa Distribuidora Y ... (NYSE:EDN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024