UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13E-3

RULE 13e-3 TRANSACTION STATEMENT

UNDER SECTION 13(e) OF

THE SECURITIES EXCHANGE ACT OF 1934

ENDEAVOR

GROUP HOLDINGS, INC.

(Name of the Issuer)

Endeavor

Group Holdings, Inc.

Endeavor Operating Company, LLC

Endeavor Manager, LLC

Endeavor Executive Holdco, LLC

Endeavor Executive II Holdco, LLC

Endeavor Executive PIU Holdco, LLC

Silver Lake West Holdco, L.P.

Silver Lake West Holdco II, L.P.

Silver Lake West Voteco, L.L.C.

Wildcat EGH Holdco, L.P.

Wildcat OpCo Holdco, L.P.

Wildcat PubCo Merger Sub, Inc.

Wildcat OpCo Merger Sub, L.L.C.

Wildcat Manager Merger Sub, L.L.C.

SLP Wildcat Aggregator GP, L.L.C.

Silver Lake Partners VI, L.P.

Silver Lake Partners VII, L.P.

SL SPV-4, L.P.

Silver Lake Technology Associates VI, L.P.

Silver Lake Technology Associates VII, L.P.

SLTA SPV-4, L.P.

SLTA VI (GP), L.L.C.

SLTA VII (GP), L.L.C.

SLTA SPV-4 (GP), L.L.C.

Silver Lake Group, L.L.C.

Ariel Emanuel

Patrick

Whitesell

(Names of Persons Filing Statement)

Common Stock, par value $0.00001 per share

(Title of Class of Securities)

29260Y109

(CUSIP Number

of Class of Securities)

|

|

|

|

|

| Ariel Emanuel

Patrick Whitesell

Endeavor Executive Holdco, LLC

Endeavor Executive II Holdco, LLC

Endeavor Executive PIU Holdco, LLC

c/o Endeavor Group Holdings, Inc.

9601 Wilshire Boulevard, 3rd Floor

Beverly Hills, CA 90210

(310) 285-9000 |

|

Endeavor Group Holdings, Inc.

Endeavor Operating Company, LLC

Endeavor Manager, LLC

9601 Wilshire Boulevard, 3rd Floor

Beverly Hills, CA 90210

(310) 285-9000 |

|

Silver Lake West Holdco, L.P.

Silver Lake West Holdco II, L.P.

Silver Lake West Voteco, L.L.C.

Wildcat EGH Holdco, L.P.

Wildcat OpCo Holdco, L.P.

Wildcat PubCo Merger Sub, Inc.

Wildcat OpCo Merger Sub, L.L.C.

Wildcat Manager Merger Sub, L.L.C.

SLP Wildcat Aggregator GP, L.L.C.

Silver Lake Partners VI, L.P.

Silver Lake Partners VII, L.P.

SL SPV-4, L.P.

Silver Lake Technology Associates VI, L.P.

Silver Lake Technology Associates VII, L.P.

SLTA SPV-4, L.P.

SLTA VI (GP), L.L.C. SLTA

VII (GP), L.L.C. SLTA SPV-4 (GP), L.L.C.

Silver Lake Group, L.L.C.

2775 Sand Hill Road, Suite 100

Menlo Park, CA 94025

(650) 233-8120 |

(Name, Address and Telephone Numbers of Person Authorized to Receive Notices

and Communications on Behalf of the Persons Filing Statement)

With copies to

|

|

|

|

|

| Justin G. Hamill

Michael V. Anastasio Ian

Nussbaum Benjamin J. Cohen

Latham & Watkins LLP

1271 Avenue of the Americas

New York, NY 10020 |

|

Faiza J. Saeed

Claudia J. Ricciardi

Cravath, Swaine & Moore LLP

375 Ninth Ave New York,

NY 10001 |

|

Elizabeth Cooper

Christopher May Mark

Myott Simpson Thacher & Bartlett LLP

425 Lexington Avenue New

York, NY 10017 |

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THIS

TRANSACTION, PASSED ON THE MERITS OR THE FAIRNESS OF THE TRANSACTION OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE INFORMATION CONTAINED IN THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This statement is filed in connection with (check the appropriate box):

|

|

|

|

|

| a. |

|

☒ |

|

The filing of solicitation materials or an information statement subject to Regulation 14A (§§ 240.14a-1 through 240.14b- 2), Regulation 14C (§§ 240.14c-1 through 240.14c-101) or Rule 13e-3(c)

(§ 240.13e-3(c)) under the Securities Exchange Act of 1934 (the “Exchange Act”). |

|

|

|

| b. |

|

☐ |

|

The filing of a registration statement under the Securities Act of 1933. |

|

|

|

| c. |

|

☐ |

|

A tender offer. |

|

|

|

| d. |

|

☐ |

|

None of the above. |

Check the following box if the soliciting materials or information statement referred to in checking box (a) are

preliminary copies: ☒

Check the following box if the filing is a final amendment reporting the results of the transaction: ☐

INTRODUCTION

This Rule 13e-3 Transaction Statement on Schedule 13E-3,

together with the exhibits hereto (this “Transaction Statement”), is being filed with the Securities and Exchange Commission (the “SEC”) pursuant to Section 13(e) of the Exchange Act, by (a) Endeavor Group Holdings,

Inc., a Delaware corporation (the “Company” or “Endeavor”), (b) Endeavor Manager, LLC, a Delaware limited liability company and subsidiary of the Company (“Manager”), (c) Endeavor Operating Company, LLC, a Delaware

limited liability company and a subsidiary of Manager and indirect subsidiary of the Company (“OpCo” and, together with the Company and Manager, the “Company Entities” and each, a “Company Entity”), (d) Endeavor

Executive Holdco, LLC, a Delaware limited liability company (“Executive Holdco”), (e) Endeavor Executive II Holdco, LLC, a Delaware limited liability company (“Executive II Holdco”), (f) Endeavor Executive PIU Holdco, LLC, a

Delaware limited liability company (“Executive PIU” and, together with Executive Holdco and Executive II Holdco, the “Executive Holdcos”), (g) Silver Lake West HoldCo, L.P., a Delaware limited partnership (“West

HoldCo”), (h) Silver Lake West HoldCo II, L.P., a Delaware limited partnership (“West HoldCo II”), (i) Silver Lake West Voteco, L.L.C., a Delaware limited liability company, (j) Wildcat EGH Holdco, L.P., a Delaware limited

partnership (“Holdco Parent”), (k) Wildcat OpCo Holdco, L.P., a Delaware limited partnership (“OpCo Parent” and, together with Holdco Parent, the “Parent Entities” and each, a “Parent Entity”), (l) Wildcat

PubCo Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Holdco Parent (“Company Merger Sub”), (m) Wildcat Manager Merger Sub, L.L.C., a Delaware limited liability company and a wholly owned subsidiary of Company

Merger Sub (“Manager Merger Sub”), (n) Wildcat OpCo Merger Sub, L.L.C., a Delaware limited liability company and wholly owned subsidiary of OpCo Parent (“OpCo Merger Sub” and, together with Manager Merger Sub and Company Merger

Sub, the “Merger Subs” and each, a “Merger Sub”), (o) SLP Wildcat Aggregator GP, L.L.C., a Delaware limited liability company, (p) Silver Lake Partners VI, L.P., a Delaware limited partnership, (q) Silver Lake Partners

VII, L.P., a Delaware limited partnership, (r) SL SPV-4, L.P., a Delaware limited partnership, (s) Silver Lake Technology Associates VI, L.P., a Delaware limited partnership, (t) Silver Lake

Technology Associates VII, L.P., a Delaware limited partnership, (u) SLTA SPV-4, L.P., a Delaware limited partnership, (v) SLTA VI (GP), L.L.C., a Delaware limited liability company, (w) SLTA

VII (GP), L.L.C., a Delaware limited liability company, (x) SLTA SPV-4 (GP), L.L.C., a Delaware limited liability company, (y) Silver Lake Group, L.L.C., a Delaware limited liability company,

(z) Ariel Emanuel, a natural person and (aa) Patrick Whitesell, a natural person. Collectively, the persons filing this Transaction Statement are referred to as the “filing persons”.

This Transaction Statement relates to the Agreement and Plan of Merger, dated April 2, 2024 (the “Merger Agreement”), by and

among the Company, Manager, OpCo, Executive Holdco, Executive II Holdco, Executive PIU, Holdco Parent, OpCo Parent, Company Merger Sub, Manager Merger Sub and OpCo Merger Sub. Subject to the terms of the Merger Agreement, (a) OpCo Merger Sub

will merge with and into OpCo, with OpCo surviving the merger, collectively owned, directly or indirectly, by OpCo Parent, Manager and certain Rollover Holders (as defined below) (the “OpCo Merger”), (b) immediately following the OpCo

Merger, Manager Merger Sub will merge with and into Manager, with Manager surviving the merger, wholly owned by the Company (the “Manager Merger”) and (c) immediately following the Manager Merger, Company Merger Sub will merge with

and into the Company, with the Company surviving the merger, collectively owned, directly or indirectly, by Holdco Parent and certain Rollover Holders (the “Company Merger” and, together with the Manager Merger and the OpCo Merger, the

“Mergers” and, together with the other transactions contemplated by the Merger Agreement, collectively, the “Transactions”). In connection with the Merger Agreement, Silver Lake Partners VI, L.P. and Silver Lake Partners VII,

L.P. have entered into a limited guarantee (the “Limited Guarantee”) with OpCo with respect to the payment of a termination fee that may be payable by the Parent Entities to OpCo under the Merger Agreement, as well as certain reimbursement

obligations that may be owed by the Parent Entities pursuant to the Merger Agreement, in each case, subject to the terms of the Merger Agreement and the Limited Guarantee.

Concurrently with the execution and delivery of the Merger Agreement on April 2, 2024, and as a condition and inducement to the Parent

Entities’ willingness to enter into the Merger Agreement, the following directors

1

and/or officers of the Company (and certain of their respective affiliates) — Ariel Emanuel, Patrick Whitesell and Mark Shapiro (each, a “Rollover Holder”) — entered into a

rollover agreement (each, a “Rollover Agreement”) with the Parent Entities, in connection with the Transactions. Pursuant to the Rollover Agreements, each Rollover Holder agreed, among other things and on the terms and subject to the

conditions set forth in the Rollover Agreements, to designate as “Rollover Units” or “Rollover Shares” (as applicable) the following equity interests in OpCo and/or in the Company held by such Rollover Holder and their permitted

transferees, with such Rollover Units and Rollover Shares to be treated in accordance with the terms of the Merger Agreement:

| |

• |

|

in the case of Mr. Emanuel, a number of equity interests in OpCo and/or in the Company held by him and his

permitted transferees that are shares of Company Common Stock, OpCo Membership Interests or OpCo Profits Units (each as defined below) that collectively, using the Merger Consideration (as defined below) applicable to such interests, have a value

equal to (i) the aggregate value of all such interests (calculated using the Merger Consideration applicable to such interests) minus (ii) $200,000,000, rounded to the nearest Company Common Stock, OpCo Membership Interest or OpCo

Profits Unit, as applicable; |

| |

• |

|

in the case of Mr. Whitesell, a number of equity interests in OpCo and/or in the Company held by him and his

permitted transferees that are shares of Company Common Stock, OpCo Membership Interests or OpCo Profits Units that collectively, using the Merger Consideration applicable to such interests, have a value equal to (i) the aggregate value of all

such interests (calculated using the Merger Consideration applicable to such interests) minus (ii) $150,000,000, rounded to the nearest Company Common Stock, OpCo Membership Interest or OpCo Profits Unit, as applicable; and

|

| |

• |

|

in the case of Mr. Shapiro, a number of equity interests in OpCo and/or in the Company held by him and his

permitted transferees that are outstanding and vested shares of Company Common Stock without any restrictions on such Company Common Stock or Units of OpCo (as defined in the OpCo Operating Agreement) with a value equal to $37,187,970 (based on the

applicable Merger Consideration). |

In addition, pursuant to the Rollover Agreements, each Rollover Holder agreed, among

other things, unless consented to in writing by the Parent Entities, not to sell, dispose of, assign, pledge, collateralize, encumber or otherwise transfer any of the Rollover Shares or Rollover Units (or, prior to the final designation of equity

interests of the Company and/or OpCo held by such Rollover Holder as such, any such equity interests in the Company or OpCo, subject to certain exceptions); however, the Rollover Holders are permitted to transfer the Rollover Shares and/or Rollover

Units prior to the closing of the Transactions (the “Closing”) to certain permitted transferees subject to execution of a joinder to the applicable Rollover Agreement by such permitted transferee.

At the effective time of the OpCo Merger (the “OpCo Merger Effective Time”), as a result of the OpCo Merger, (a) each common

unit of OpCo outstanding immediately prior to the OpCo Merger Effective Time (each, an “OpCo Membership Interest” and, collectively, the “OpCo Membership Interests”) (subject to certain exceptions, including (i) each OpCo

Membership Interest owned by the Company, Manager, OpCo, or any direct or indirect wholly owned subsidiary of OpCo, the Parent Entities or any direct or indirect wholly owned subsidiary of the Parent Entities or, solely to the extent designated in

writing by the Parent Entities to the Company at least two business days prior to the Effective Time (as defined below), any affiliate of the Parent Entities so designated, immediately prior to the OpCo Merger Effective Time (collectively, the

“Excluded OpCo Membership Interests”) and (ii) the Rollover Units in OpCo held by the Rollover Holders that remain outstanding in the OpCo Merger pursuant to the respective Rollover Holders’ Rollover Agreement) will automatically

be cancelled and converted into the right to receive $27.50 in cash minus any amounts that are distributed in respect of an OpCo Membership Interest in respect of the distributions contemplated by the restructuring transactions to be

undertaken by the Company Entities prior to Closing pursuant to the Merger Agreement and in accordance with the restructuring steps plan set forth on the Company’s confidential disclosure letter delivered concurrently with the execution of the

Merger Agreement (the “Restructuring Steps”, and such amounts, the “OpCo

2

Membership Interest Distribution Amount”), without interest (the “OpCo Merger Consideration”) and subject to applicable withholding taxes, certain deferred payments under certain

terms of the existing OpCo Membership Interests and certain rights of the holders of OpCo Membership Interests to elect to cause their OpCo Membership Interests to remain outstanding through the OpCo Merger and cause the Company to acquire such OpCo

Membership Interests following the OpCo Merger for an amount in cash equal to the OpCo Merger Consideration that would have otherwise been paid in respect of such OpCo Membership Interests and (b) each profits unit of OpCo outstanding

immediately prior to the OpCo Merger Effective Time (“OpCo Profits Unit”) (other than any Rollover Units) will automatically be cancelled and converted into the right to receive the OpCo Merger Consideration less the “strike

price” of such OpCo Profits Unit in cash, without interest (the “OpCo Profits Units Merger Consideration”), and subject to applicable withholding taxes, certain deferred payments under certain terms of the existing OpCo Profits Units

and certain rights of the holders of OpCo Profits Units to elect to cause their OpCo Profits Units to remain outstanding through the OpCo Merger and cause the Company to acquire such OpCo Profits Units following the OpCo Merger for an amount in cash

equal to the OpCo Profits Units Merger Consideration that would have otherwise been paid in respect of such OpCo Profits Units.

At the

effective time of the Manager Merger (which will occur immediately after the OpCo Merger Effective Time) (the “Manager Merger Effective Time”), as a result of the Manager Merger, each common unit of Manager outstanding immediately prior to

the Manager Merger Effective Time (each, a “Manager Membership Interest”) (subject to certain exceptions, including each Manager Membership Interest owned by the Company or the Manager immediately prior to the Manager Merger Effective

Time) will automatically be cancelled and converted into the right to receive $27.50 in cash without interest (the “Manager Merger Consideration”), and subject to applicable withholding taxes and certain deferrals to take into account

certain terms of the existing Manager Membership Interests.

At the effective time of the Company Merger (which will occur immediately

after the Manager Merger Effective Time) (the “Company Merger Effective Time” or the “Effective Time”), as a result of the Company Merger, each share of Company Common Stock outstanding immediately prior to the Company Merger

Effective Time (subject to certain exceptions, including (i) (a) shares of Company Common Stock owned by the Company, Manager or OpCo or any of OpCo’s direct or indirect wholly owned subsidiaries, (b) shares of Company Common Stock

owned by the Merger Subs or the Parent Entities or any of Parent Entities’ direct or indirect wholly owned subsidiaries, or, any affiliate of the Parent Entities designated in writing by the Parent Entities to the Company at least two business

days prior to the Company Merger Effective Time and (c) shares of Class X Common Stock and Class Y Common Stock (each as defined herein) issued and outstanding immediately prior to the Company Merger Effective Time (collectively, the

“Excluded Shares”), (ii) each Rollover Share that is owned by a Rollover Holder and will remain outstanding in the Company Merger in accordance with such Rollover Holder’s Rollover Agreement and (iii) shares of Company Common

Stock owned by stockholders of the Company who have validly demanded and not withdrawn appraisal rights in accordance with Section 262 of the General Corporation Law of the State of Delaware (the “DGCL”)) will automatically be

cancelled and converted into the right to receive $27.50 in cash, without interest (the “Company Merger Consideration” and, together with the OpCo Merger Consideration, the OpCo Profits Units Merger Consideration and the Manager Merger

Consideration, with respect to such applicable equity securities, the “Merger Consideration”), and subject to applicable withholding taxes.

The Company is required to, in each calendar quarter prior to the Effective Time, declare and pay a dividend in respect of each issued and

outstanding share of Class A Common Stock at a price equal to $0.06 per share (the “Per Share Dividend Amount” and each dividend, a “Quarterly Dividend”). If, on the date that all other conditions to Closing are satisfied,

at least four Quarterly Dividends have not been paid, the Company will be required to pay, within three business days (and in any case prior to the Effective Time), a dividend in respect of each issued and outstanding share of Class A Common

Stock of the Company in an amount equal to the product of (i) the Per Share Dividend Amount and (ii) four minus the number of quarters in which a Quarterly Dividend has been declared and paid (or will be paid prior to the Effective

Time).

3

Following completion of the Mergers, the shares of Company Common Stock will cease to be

listed on the New York Stock Exchange and registration of the Company Common Stock under the Exchange Act will be terminated.

The Merger

Agreement and the Transactions were unanimously approved by the Executive Committee of the Company (the “Executive Committee”) upon the unanimous recommendation of a special committee of the board of directors of the Company (the

“Special Committee” and, such recommendation, the “Special Committee Recommendation”)—a committee comprised solely of independent and disinterested directors that was established by the Executive Committee to review,

evaluate and negotiate the Merger Agreement, make a determination as to whether the Transactions are fair to, and in the best interests of, the Company, its stockholders, and the equityholders of Manager and OpCo and make a recommendation to the

Executive Committee with respect to the Transactions.

Concurrently with the filing of this Transaction Statement, the Company is filing a

notice of written consent and appraisal rights and information statement (the “Information Statement”) under Section 14(c) of the Exchange Act. A copy of the Information Statement is attached hereto as Exhibit (a)(1) and a copy of the

Merger Agreement is attached as Annex A to the Information Statement. The adoption of the Merger Agreement and the approval of the Mergers and the other Transactions required the affirmative vote or written consent of the holders of Company Common

Stock representing a majority of the aggregate voting power of the outstanding shares of Company Common Stock entitled to vote thereon pursuant to Section 228 and Section 251 of the DGCL. Following execution of the Merger Agreement,

(a) Silver Lake West HoldCo, L.P. and Silver Lake West HoldCo II, L.P. (together, the “SLP Holders”) and (b) Ariel Emanuel and Patrick Whitesell and each of their respective personal revocable trusts that holds shares of Company

Common Stock and/or OpCo Membership Interests, and the Executive Holdcos (together, the “Management Holders” and, together with the SLP Holders, the “Specified Stockholders”), who collectively held more than a majority of the

combined voting power of the outstanding shares of Class A Common Stock, par value $0.00001 per share (the “Class A Common Stock”), Class X common stock of the Company, par value $0.00001 per share (the “Class X

Common Stock”) and Class Y common stock of the Company, par value $0.00001 per share (the “Class Y Common Stock” and together with Class A Common Stock and the Class X Common Stock, the “Company Common

Stock”), executed and delivered to the Company a written consent (the “Written Consent”) approving and adopting the Merger Agreement and the Transactions, including the Mergers.

Pursuant to General Instruction F to Schedule 13E-3, the information contained in the Information

Statement, including all annexes thereto, is expressly incorporated herein by reference in its entirety, and responses to each item herein are qualified in their entirety by the information contained in the Information Statement and the annexes

thereto. The cross-references below are being supplied pursuant to General Instruction G to Schedule 13E-3 and show the location in the Information Statement of the information required to be included in

response to the items of Schedule 13E-3. As of the date hereof, the Information Statement is in preliminary form and is subject to completion.

All information contained in this Transaction Statement concerning any of the filing persons has been provided by such filing person and no

filing person has produced any disclosure with respect to any other filing persons.

ITEM 1. SUMMARY TERM SHEET

The information set forth in the Information Statement under the following captions is incorporated herein by reference:

“Summary”

“Questions and Answers about the

Mergers”

4

ITEM 2. SUBJECT COMPANY INFORMATION

(a) Name and Address. The information set forth in the Information Statement under the following caption is incorporated herein

by reference:

“The Parties to the Merger Agreement”

(b) Securities. The information set forth in the Information Statement under the following captions is incorporated herein by

reference:

“Summary”

“Market Information,

Dividends and Certain Transactions in the Shares of Company Common Stock”

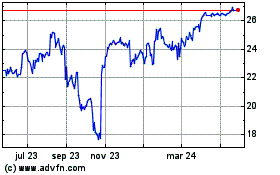

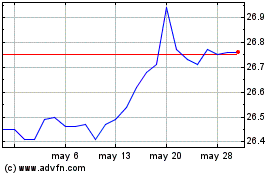

(c) Trading Market and Price. The

information set forth in the Information Statement under the following caption is incorporated herein by reference:

“Market Information, Dividends

and Certain Transactions in the Shares of Company Common Stock”

(d) Dividends. The information set forth in the

Information Statement under the following caption is incorporated herein by reference:

“The Merger Agreement — Conduct of Business by the

Company Entities Prior to Consummation of the Mergers”

“Market Information, Dividends and Certain Transactions in the Shares of Company Common

Stock”

(e) Prior Public Offerings. The information set forth in the Information Statement under the following captions

is incorporated herein by reference:

“Summary”

“Market Information, Dividends and Certain Transactions in the Shares of Company Common Stock”

(f) Prior Stock Purchases. The information set forth in the Information Statement under the following caption is incorporated

herein by reference:

“Market Information, Dividends and Certain Transactions in the Shares of Company Common Stock”

ITEM 3. IDENTITY AND BACKGROUND OF FILING PERSONS

(a)–(c) Name and Address; Business and Background of Entities; Business and Background of Natural Persons. The information

set forth in the Information Statement under the following captions is incorporated herein by reference:

“Summary”

“The Parties to the Merger Agreement”

“Directors,

Executive Officers and Controlling Persons of the Company”

“Where You Can Find More Information”

ITEM 4. TERMS OF THE TRANSACTION

(a)(1) Material Terms – Tender Offers. Not applicable.

(a)(2) Material Terms – Merger or Similar Transactions. The information set forth in the Information Statement under the

following captions is incorporated herein by reference:

“Summary”

5

“Questions and Answers about the Mergers”

“The Special Factors — Background of the Mergers”

“The Special Factors — Recommendation of the Executive Committee; Reasons for the Mergers”

“The Special Factors — Recommendation of the Special Committee; Reasons for the Recommendation”

“The Special Factors — Required Stockholder Approval for the Mergers”

“The Special Factors — Opinion of Centerview”

“The Special Factors — Opinion of Kroll”

“The Special Factors — Opinion of Houlihan Lokey”

“The Special Factors — Position of the Company, Manager and OpCo on the Fairness of the Mergers”

“The Special Factors — Position of the SLP Entities and the Director Rollover Holders in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the Company, Manager and OpCo in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the Director Rollover Holders in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the SLP Entities in Connection with the Mergers”

“The Special Factors — Interests of Our Directors and Executive Officers in the Mergers”

“The Special Factors — Delisting and Deregistration of Company Common Stock”

“The Special Factors — Certain Material United States Federal Income Tax Consequences of the Company Merger”

“The Special Factors — Regulatory Approvals”

“The Merger Agreement”

“Annex A: Agreement and

Plan of Merger”

“Annex C: Opinion of Centerview Partners LLC”

“Annex D: Opinion of Kroll, LLC”

“Annex E:

Opinion of Houlihan Lokey Capital, Inc.”

“Annex F: Voting and Support Agreement”

“Annex G: Emanuel Rollover Agreement”

“Annex H:

Whitesell Rollover Agreement”

“Annex I: Shapiro Rollover Agreement”

“Annex J: Emanuel Letter Agreement”

“Annex K:

Whitesell Letter Agreement”

“Annex L: Shapiro Employment Agreement Amendment”

“Annex M: Shapiro A&R Employment Agreement”

(c) Different Terms. The information set forth in the Information Statement under the following captions is incorporated herein

by reference:

“Summary”

“Questions and

Answers about the Merger”

“The Special Factors — Interests of Our Directors and Executive Officers in the Mergers”

“The Merger Agreement — Consideration to be Received in the Mergers”

“The Merger Agreement — Treatment of Company Equity Awards and Phantom Units”

“Other Agreements”

“Annex F: Voting and Support

Agreement”

“Annex G: Emanuel Rollover Agreement”

“Annex H: Whitesell Rollover Agreement”

“Annex I:

Shapiro Rollover Agreement”

“Annex J: Emanuel Letter Agreement”

“Annex K: Whitesell Letter Agreement”

“Annex L:

Shapiro Employment Agreement Amendment”

“Annex M: Shapiro A&R Employment Agreement”

6

(d) Appraisal Rights. The information set forth in the Information Statement

under the following captions is incorporated herein by reference:

“Summary”

“Questions and Answers about the Mergers”

“The

Merger Agreement — Dissenting Shares”

“Appraisal Rights”

“Annex C: Section 262 of the Delaware General Corporation Law”

(e) Provisions for Unaffiliated Security Holders. The information set forth in the Information Statement under the following

captions is incorporated herein by reference:

“The Special Factors — Recommendation of the Special Committee; Reasons for the

Recommendation”

“The Special Factors — Position of the Company, Manager and OpCo on the Fairness of the Mergers”

“The Special Factors — Position of the SLP Entities and the Director Rollover Holders in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the Company, Manager and OpCo in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the Director Rollover Holders in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the SLP Entities in Connection with the Mergers”

“Provisions for Unaffiliated Stockholders”

“Appraisal Rights”

(f)

Eligibility for Listing or Trading. Not applicable.

ITEM 5. PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS

(a) Transactions. The information set forth in the Information Statement under the following caption is incorporated herein by

reference:

“The Special Factors — Interests of Our Directors and Executive Officers in the Mergers”

“Market Information, Dividends and Certain Transactions in the Shares of Company Common Stock”

“Where You Can Find More Information”

(b)–(c) Significant Corporate Events; Negotiations or Contacts. The information set forth in the Information Statement

under the following captions is incorporated herein by reference:

“Summary”

“Questions and Answers about the Mergers”

“The

Special Factors — Background of the Merger”

“The Special Factors — Recommendation of the Executive Committee; Reasons for the

Mergers”

“The Special Factors — Recommendation of the Special Committee; Reasons for the Recommendation”

“The Special Factors — Required Stockholder Approval for the Mergers”

“The Special Factors — Financing”

“The

Special Factors — Limited Guarantee”

“The Special Factors — Position of the Company, Manager and OpCo on the Fairness of the

Mergers”

“The Special Factors — Position of the SLP Entities and the Director Rollover Holders in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the Company, Manager and OpCo in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the Director Rollover Holders in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the SLP Entities in Connection with the Mergers”

“The Special Factors — Delisting and Deregistration of Company Common Stock”

“The Special Factors — Fees and Expenses”

7

“The Merger Agreement — Form of Mergers”

“The Merger Agreement — Consummation and Effectiveness of the Mergers”

“The Merger Agreement — Consideration to be Received in the Mergers”

“The Merger Agreement — Treatment of Company Equity Awards and Phantom Units”

“The Merger Agreement — Dividends”

“The

Merger Agreement — Company Sales”

“The Merger Agreement — Written Consent”

“The Merger Agreement — Pre-Closing Restructuring”

“Other Agreements”

“Market Information, Dividends

and Certain Transactions in the Shares of Company Common Stock”

“Where You Can Find More Information”

“Annex A: Agreement and Plan of Merger”

“Annex F:

Voting and Support Agreement”

“Annex G: Emanuel Rollover Agreement”

“Annex H: Whitesell Rollover Agreement”

“Annex I:

Shapiro Rollover Agreement”

“Annex J: Emanuel Letter Agreement”

“Annex K: Whitesell Letter Agreement”

“Annex L:

Shapiro Employment Agreement Amendment”

“Annex M: Shapiro A&R Employment Agreement”

Equity Commitment Letter, dated April 2, 2024, by and among Wildcat EGH Holdco, L.P., Wildcat OpCo Holdco, L.P., Silver Lake Partners VI,

L.P., Silver Lake Partners VII, L.P. and SL SPV-4, L.P., attached hereto as Exhibit (b)(1).

Preferred Equity Commitment Letter, dated April 2, 2024, by and among Wildcat EGH Holdco, L.P., DFO Private Investments, L.P. and Thirty

Fifth Investment Company L.L.C., attached hereto as Exhibit (b)(2).

Preferred Equity Commitment Letter, dated June 6, 2024, by and

among Wildcat EGH Holdco, L.P. and Coatue Tactical Solutions PS Holdings AIV 9 LP, attached hereto as Exhibit (b)(4).

Preferred Equity

Commitment Letter, dated July 29, 2024, by and among Wildcat EGH Holdco, L.P., and Meritage Fund Select I LLC, attached hereto as Exhibit (b)(5).

Debt Commitment Letter, dated April 2, 2024, by and among Wildcat EGH Holdco, L.P., JPMorgan Chase Bank, N.A., Morgan Stanley Senior

Funding, Inc., Bank of America, N.A., Goldman Sachs Bank USA, Barclays Bank PLC, Deutsche Bank Securities Inc., Deutsche Bank AG New York Branch and Royal Bank of Canada, attached hereto as Exhibit (b)(3).

Limited Guarantee, dated April 2, 2024, by and among Silver Lake Partners VI, L.P., Silver Lake Partners VII, L.P. and Endeavor Operating

Company, LLC, attached hereto as Exhibit (b)(6).

(e) Agreements Involving the Subject Company’s Securities. The

information set forth in the Information Statement under the following captions is incorporated herein by reference:

“Summary”

“Questions and Answers about the Mergers”

“The

Special Factors — Background of the Mergers”

“The Special Factors — Recommendation of the Executive Committee; Reasons for the

Mergers”

“The Special Factors — Recommendation of the Special Committee; Reasons for the Recommendation”

“The Special Factors — Required Stockholder Approval for the Mergers”

“The Special Factors — Financing”

“The

Special Factors — Limited Guarantee”

8

“The Special Factors — Position of the Company, Manager and OpCo on the Fairness of the

Mergers”

“The Special Factors — Position of the SLP Entities and the Director Rollover Holders in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the Company, Manager and OpCo in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the Director Rollover Holders in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the SLP Entities in Connection with the Mergers”

“The Special Factors — Interests of Our Directors and Executive Officers in the Mergers”

“The Special Factors — Delisting and Deregistration of Company Common Stock”

“The Special Factors — Fees and Expenses”

“The Merger Agreement — Form of Merger”

“The

Merger Agreement — Consummation and Effectiveness of the Mergers”

“The Merger Agreement — Consideration to be Received in the

Mergers”

“The Merger Agreement — Treatment of Company Equity Awards and Phantom Units”

“The Merger Agreement — Dividends”

“The

Merger Agreement — Company Sales”

“The Merger Agreement — Written Consent”

“The Merger Agreement — Financing Covenant; Company Cooperation”

“The Merger Agreement — Pre-Closing Restructuring”

“Other Agreements”

“Market Information, Dividends

and Certain Transactions in the Shares of Company Common Stock”

“Annex A: Agreement and Plan of Merger”

“Annex F: Voting and Support Agreement”

“Annex G:

Emanuel Rollover Agreement”

“Annex H: Whitesell Rollover Agreement”

“Annex I: Shapiro Rollover Agreement”

ITEM 6. PURPOSES OF THE TRANSACTION AND PLANS OR PROPOSALS

(b) Use of Securities Acquired. The information set forth in the Information Statement under the following captions is

incorporated herein by reference:

“Summary”

“Questions and Answers about the Mergers”

“The

Special Factors — Delisting and Deregistration of Company Common Stock”

“The Merger Agreement — Form of Mergers”

“The Merger Agreement — Consideration to be Received in the Mergers”

“The Merger Agreement — Treatment of Company Equity Awards and Phantom Units”

(c)(1)–(8) Plans. The information set forth in the Information Statement under the following captions is incorporated herein by

reference:

“Summary”

“Questions and Answers

about the Mergers”

“The Special Factors — Background of the Mergers”

“The Special Factors — Recommendation of the Executive Committee; Reasons for the Mergers”

“The Special Factors — Recommendation of the Special Committee; Reasons for the Recommendation”

“The Special Factors — Position of the Company, Manager and OpCo on the Fairness of the Mergers”

“The Special Factors — Position of the SLP Entities and the Director Rollover Holders in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the Company, Manager and OpCo in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the Director Rollover Holders in Connection with the Mergers”

9

“The Special Factors — Purposes and Reasons of the SLP Entities in Connection with the

Mergers”

“The Special Factors — Interests of Our Directors and Executive Officers in the Merger”

“The Special Factors — Delisting and Deregistration of Company Common Stock”

“The Special Factors — Fees and Expenses”

“The Merger Agreement”

“Other Agreements”

“Market Information, Dividends and Certain Transactions in the Shares of Company Common Stock”

“Annex A: Agreement and Plan of Merger”

“Annex J:

Emanuel Letter Agreement”

“Annex K: Whitesell Letter Agreement”

“Annex L: Shapiro Employment Agreement Amendment”

“Annex M: Shapiro A&R Employment Agreement”

ITEM 7. PURPOSES, ALTERNATIVES, REASONS AND EFFECTS

(a) Purposes. The information set forth in the Information Statement under the following captions is incorporated herein by

reference:

“Summary”

“The Special Factors

— Background of the Mergers”

“The Special Factors — Recommendation of the Executive Committee; Reasons for the Mergers”

“The Special Factors — Recommendation of the Special Committee; Reasons for the Recommendation”

“The Special Factors — Position of the Company, Manager and OpCo on the Fairness of the Mergers”

“The Special Factors — Position of the SLP Entities and the Director Rollover Holders in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the Company, Manager and OpCo in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the Director Rollover Holders in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the SLP Entities in Connection with the Mergers”

(b) Alternatives. The information set forth in the Information Statement under the following captions is incorporated herein by

reference:

“The Special Factors — Background of the Mergers”

“The Special Factors — Recommendation of the Executive Committee; Reasons for the Mergers”

“The Special Factors — Recommendation of the Special Committee; Reasons for the Recommendation”

“The Special Factors — Position of the Company, Manager and OpCo on the Fairness of the Mergers”

“The Special Factors — Position of the SLP Entities and the Director Rollover Holders in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the Company, Manager and OpCo in Connection with the Mergers”

(c) Reasons. The information set forth in the Information Statement under the following captions is incorporated herein by

reference:

“Summary”

“The Special Factors

— Background of the Mergers”

“The Special Factors — Recommendation of the Executive Committee; Reasons for the Mergers”

“The Special Factors — Recommendation of the Special Committee; Reasons for the Recommendation”

“The Special Factors — Position of the Company, Manager and OpCo on the Fairness of the Mergers”

“The Special Factors — Position of the SLP Entities and the Director Rollover Holders in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the Company, Manager and OpCo in Connection with the Mergers”

10

“The Special Factors — Purposes and Reasons of the Director Rollover Holders in Connection with

the Mergers”

“The Special Factors — Purposes and Reasons of the SLP Entities in Connection with the Mergers”

(d) Effects. The information set forth in the Information Statement under the following captions is incorporated herein by

reference:

“Summary”

“Questions and Answers

about the Mergers”

“The Special Factors — Background of the Merger”

“The Special Factors — Recommendation of the Executive Committee; Reasons for the Mergers”

“The Special Factors — Recommendation of the Special Committee; Reasons for the Recommendation”

“The Special Factors — Financing”

“The

Special Factors — Limited Guarantee”

“The Special Factors — Position of the Company, Manager and OpCo on the Fairness of the

Mergers”

“The Special Factors — Position of the SLP Entities and the Director Rollover Holders in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the Company, Manager and OpCo in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the Director Rollover Holders in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the SLP Entities in Connection with the Mergers”

“The Special Factors — Interests of Our Directors and Executive Officers in the Mergers”

“The Special Factors — Delisting and Deregistration of Company Common Stock”

“The Special Factors — Fees and Expenses”

“The Special Factors — Certain Material United States Federal Income Tax Consequences of the Mergers”

“The Merger Agreement — Form of Mergers”

“The Merger Agreement — Consummation and Effectiveness of the Mergers”

“The Merger Agreement — Consideration to be Received in the Mergers”

“The Merger Agreement — Dissenting Shares”

“The Merger Agreement — Treatment of Company Equity Awards and Phantom Units”

“The Merger Agreement — Certificate of Incorporation; Bylaws”

“The Merger Agreement — Continuing Employee Matters”

“The Merger Agreement — Company Sales”

“The

Merger Agreement — Indemnification and Insurance”

“Other Agreements”

“Appraisal Rights”

“Annex A: Agreement and Plan

of Merger”

“Annex C: Section 262 of the Delaware General Corporation Law”

“Annex F: Voting and Support Agreement”

“Annex G:

Emanuel Rollover Agreement”

“Annex H: Whitesell Rollover Agreement”

“Annex I: Shapiro Rollover Agreement”

“Annex J:

Emanuel Letter Agreement”

“Annex K: Whitesell Letter Agreement”

“Annex L: Shapiro Employment Agreement Amendment”

“Annex M: Shapiro A&R Employment Agreement”

Equity Commitment Letter, dated April 2, 2024, by and among Wildcat EGH Holdco, L.P., Wildcat OpCo Holdco, L.P., Silver Lake Partners VI,

L.P., Silver Lake Partners VII, L.P. and SL SPV-4, L.P., attached hereto as Exhibit (b)(1).

Preferred Equity Commitment Letter, dated April 2, 2024, by and among Wildcat EGH Holdco, L.P., DFO Private Investments, L.P. and Thirty

Fifth Investment Company L.L.C., attached hereto as Exhibit (b)(2).

11

Preferred Equity Commitment Letter, dated June 6, 2024, by and among Wildcat EGH

Holdco, L.P. and Coatue Tactical Solutions PS Holdings AIV 9 LP, attached hereto as Exhibit (b)(4).

Preferred Equity Commitment Letter,

dated July 29, 2024, by and among Wildcat EGH Holdco, L.P., and Meritage Fund Select I LLC, attached hereto as Exhibit (b)(5).

Debt

Commitment Letter, dated April 2, 2024, by and among Wildcat EGH Holdco, L.P., JPMorgan Chase Bank, N.A., Morgan Stanley Senior Funding, Inc., Bank of America, N.A., Goldman Sachs Bank USA, Barclays Bank PLC, Deutsche Bank Securities Inc.,

Deutsche Bank AG New York Branch and Royal Bank of Canada, attached hereto as Exhibit (b)(3).

Limited Guarantee, dated April 2,

2024, by and among Silver Lake Partners VI, L.P., Silver Lake Partners VII, L.P. and Endeavor Operating Company, LLC, attached hereto as Exhibit (b)(6).

ITEM 8. FAIRNESS OF THE TRANSACTION

(a)–(b) Fairness; Factors Considered in Determining Fairness. The information set forth in the Information Statement under

the following captions is incorporated herein by reference:

“Summary”

“Questions and Answers about the Mergers”

“The

Special Factors — Background of the Mergers”

“The Special Factors — Recommendation of the Executive Committee; Reasons for the

Mergers”

“The Special Factors — Recommendation of the Special Committee; Reasons for the Recommendation”

“The Special Factors — Opinion of Centerview”

“The Special Factors — Certain Company Financial Forecasts”

“The Special Factors — Position of the Company, Manager and OpCo on the Fairness of the Mergers”

“The Special Factors — Position of the SLP Entities and the Director Rollover Holders in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the Company, Manager and OpCo in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the Director Rollover Holders in Connection with the Mergers”

“The Special Factors — Purposes and Reasons of the SLP Entities in Connection with the Mergers”

“The Special Factors – Interests of Our Directors and Executive Officers in the Mergers”

“Annex C: Opinion of Centerview Partners LLC”

The confidential discussion materials prepared by Centerview Partners LLC and provided to the Special Committee, dated March 8, 2024,

March 21, 2024, March 29, 2024, March 30, 2024, March 30, 2024, March 31, 2024 and April 2, 2024, are attached hereto as Exhibits (c)(2) through and including (c)(8), and are incorporated by reference herein.

(c) Approval of Security Holders. The information set forth in the Information Statement under the following captions is

incorporated herein by reference:

“Summary”

“Questions and Answers about the Mergers”

“The

Special Factors — Background of the Merger”

“The Special Factors — Recommendation of the Executive Committee; Reasons for the

Mergers”

“The Special Factors — Recommendation of the Special Committee; Reasons for the Recommendation”

“The Special Factors — Required Stockholder Approval for the Mergers”

“The Merger Agreement — Written Consent”

(d) Unaffiliated Representative. Not applicable.

12

(e) Approval of Directors. The information set forth in the Information

Statement under the following captions is incorporated herein by reference:

“Summary”

“Questions and Answers about the Mergers”

“The

Special Factors — Background of the Mergers”

“The Special Factors — Recommendation of the Executive Committee; Reasons for the

Mergers”

“The Special Factors — Recommendation of the Special Committee; Reasons for the Recommendation”

“The Special Factors — Position of the Company, Manager and OpCo on the Fairness of the Mergers”

“The Special Factors — Position of the SLP Entities and the Director Rollover Holders in Connection with the Mergers”

(f) Other Offers. The information set forth in the Information Statement under the following captions is incorporated by

reference:

“The Special Factors — Background of the Mergers”

“The Special Factors — Recommendation of the Executive Committee; Reasons for the Mergers”

“The Special Factors — Recommendation of the Special Committee; Reasons for the Recommendation”

“The Special Factors — Position of the Company, Manager and OpCo on the Fairness of the Mergers”

“The Special Factors — Position of the SLP Entities and the Director Rollover Holders in Connection with the Mergers”

“The Merger Agreement — No Solicitation”

ITEM 9. REPORTS, OPINIONS, APPRAISALS AND NEGOTIATIONS

(a)–(c) Report, Opinion or Appraisal; Preparer and Summary of the Report, Opinion or Appraisal; Availability of Documents.

The information set forth in the Information Statement under the following captions is incorporated herein by reference:

“Summary”

“The Special Factors — Background

of the Mergers”

“The Special Factors — Recommendation of the Executive Committee; Reasons for the Mergers”

“The Special Factors — Recommendation of the Special Committee; Reasons for the Recommendation”

“The Special Factors — Opinion of Centerview”

“The Special Factors — Opinion of Kroll”

“The Special Factors — Opinion of Houlihan Lokey”

“The Special Factors — Certain Company Financial Forecasts”

“The Special Factors — Position of the Company, Manager and OpCo on the Fairness of the Mergers”

“The Special Factors — Position of the SLP Entities and the Director Rollover Holders in Connection with the Mergers”

“Annex C: Opinion of Centerview Partners LLC”

“Annex D: Opinion of Kroll, LLC”

“Annex E:

Opinion of Houlihan Lokey Capital, Inc.”

The confidential discussion materials prepared by Centerview Partners LLC and provided to

the Special Committee, dated March 8, 2024, March 21, 2024, March 29, 2024, March 30, 2024, March 30, 2024, March 31, 2024 and April 2, 2024, are attached hereto as Exhibits (c)(2) through and including (c)(8), and

are incorporated by reference herein.

The reports, opinions or appraisals referenced in this Item 9 are filed herewith and will be made

available for inspection and copying at the principal executive offices of Endeavor during its regular business hours by any interested holder of Company Common Stock or representative who has been designated in writing, and copies

13

may be obtained by requesting them in writing from Endeavor at the email address provided under the caption “Where You Can Find More Information” in the Information Statement, which is

incorporated herein by reference.

ITEM 10. SOURCE AND AMOUNTS OF FUNDS OR OTHER CONSIDERATION

(a)—(b) Source of Funds; Conditions. The information set forth in the Information Statement under the following captions is

incorporated herein by reference:

“Summary”

“Questions and Answers about the Mergers”

“The

Special Factors — Financing”

“The Special Factors — Limited Guarantee”

“The Special Factors — Position of the SLP Entities and the Director Rollover Holders in Connection with the Mergers”

“The Merger Agreement — Consummation and Effectiveness of the Mergers”

“The Merger Agreement — Financing Covenant; Company Cooperation”

(c) Expenses. The information set forth in the Information Statement under the following caption is incorporated herein by

reference:

“The Special Factors — Fees and Expenses”

(d) Borrowed Funds. The information set forth in the Information Statement under the following captions is incorporated herein by

reference:

“Summary”

“Questions and Answers

about the Merger”

“The Special Factors — Financing”

“The Special Factors — Limited Guarantee”

“The Special Factors — Position of the SLP Entities and the Director Rollover Holders in Connection with the Mergers”

“The Merger Agreement — Financing Covenant; Company Cooperation”

ITEM 11. INTEREST IN SECURITIES OF THE SUBJECT COMPANY

(a) Securities Ownership. The information set forth in the Information Statement under the following caption is incorporated

herein by reference:

“Security Ownership of Certain Beneficial Owners and Management”

(b) Securities Transactions. The information set forth in the Information Statement under the following captions is incorporated

herein by reference:

“The Special Factors — Background of the Mergers”

“The Special Factors — Interests of Our Directors and Executive Officers in the Mergers”

“The Merger Agreement”

“Other Agreements”

“Market Information, Dividends and Certain Transactions in the Shares of Company Common Stock”

“Annex A: Agreement and Plan of Merger”

“Annex G:

Emanuel Rollover Agreement”

“Annex H: Whitesell Rollover Agreement”

“Annex I: Shapiro Rollover Agreement”

“Annex J:

Emanuel Letter Agreement”

“Annex K: Whitesell Letter Agreement”

“Annex L: Shapiro Employment Agreement Amendment”

“Annex M: Shapiro A&R Employment Agreement”

14

ITEM 12. THE SOLICITATION OR RECOMMENDATION

(d) Intent to Tender or Vote in a Going-Private Transaction. Not applicable.

(e) Recommendations of Others. Not applicable.

ITEM 13. FINANCIAL STATEMENTS

(a) Financial Statements. The audited financial statements set forth in Endeavor’s Annual Report on Form 10-K for the year ended December 31, 2023 and the unaudited balance sheets, comparative year-to-date statements of comprehensive

income and related earnings per share data and statements of cash flows set forth in Endeavor’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 are incorporated by reference

herein. The information is set forth in the Information Statement under the following caption is incorporated herein by reference:

“Where You Can

Find More Information”

(b) Pro Forma Information. Not applicable.

ITEM 14. PERSONS/ASSETS, RETAINED, EMPLOYED, COMPENSATED OR USED

(a) Solicitations or Recommendations. Not applicable.

(b) Employees and Corporate Assets. The information set forth in the Information Statement under the following captions is

incorporated herein by reference:

“Summary”

“The Special Factors — Background of the Mergers”

“The Special Factors — Recommendation of the Executive Committee; Reasons for the Mergers”

“The Special Factors — Recommendation of the Special Committee; Reasons for the Recommendation”

“The Special Factors — Opinion of Centerview”

“The Special Factors — Opinion of Kroll”

“The Special Factors — Opinion of Houlihan Lokey”

“The Special Factors — Interests of Our Directors and Executive Officers in the Merger”

“The Special Factors — Fees and Expenses”

“Other Agreements”

“Annex C: Opinion of

Centerview Partners LLC”

“Annex D: Opinion of Kroll, LLC”

“Annex E: Opinion of Houlihan Lokey Capital, Inc.”

“Annex G: Emanuel Rollover Agreement”

“Annex H:

Whitesell Rollover Agreement”

“Annex I: Shapiro Rollover Agreement”

“Annex J: Emanuel Letter Agreement”

“Annex K:

Whitesell Letter Agreement”

“Annex L: Shapiro Employment Agreement Amendment”

“Annex M: Shapiro A&R Employment Agreement”

15

ITEM 15. ADDITIONAL INFORMATION

(b) Golden Parachute Compensation. The information set forth in the Information Statement under the following captions is incorporated

herein by reference:

“The Special Factors — Interests of Our Directors and Executive Officers in the Mergers”

(c) Other Material Information. The information set forth in the Information Statement, including all annexes thereto, is

incorporated herein by reference.

Equity Commitment Letter, dated April 2, 2024, by and among Wildcat EGH Holdco, L.P., Wildcat OpCo

Holdco, L.P., Silver Lake Partners VI, L.P., Silver Lake Partners VII, L.P. and SL SPV-4, L.P., attached hereto as Exhibit (b)(1).

Preferred Equity Commitment Letter, dated April 2, 2024, by and among Wildcat EGH Holdco, L.P., DFO Private Investments, L.P. and Thirty

Fifth Investment Company L.L.C., attached hereto as Exhibit (b)(2).

Preferred Equity Commitment Letter, dated June 6, 2024, by and

among Wildcat EGH Holdco, L.P. and Coatue Tactical Solutions PS Holdings AIV 9 LP, attached hereto as Exhibit (b)(4).

Preferred Equity

Commitment Letter, dated July 29, 2024, by and among Wildcat EGH Holdco, L.P. and Meritage Fund Select I LLC, attached hereto as Exhibit (b)(5).

Debt Commitment Letter, dated April 2, 2024, by and among Wildcat EGH Holdco, L.P., JPMorgan Chase Bank, N.A., Morgan Stanley Senior

Funding, Inc., Bank of America, N.A., Goldman Sachs Bank USA, Barclays Bank PLC, Deutsche Bank Securities Inc., Deutsche Bank AG New York Branch and Royal Bank of Canada, attached hereto as Exhibit (b)(3).

Limited Guarantee, dated April 2, 2024, by and among Silver Lake Partners VI, L.P., Silver Lake Partners VII, L.P. and Endeavor Operating

Company, LLC, attached hereto as Exhibit (b)(6).

ITEM 16. EXHIBITS

|

|

|

| Exhibit No. |

|

Description |

|

|

| (a)(1) |

|

Preliminary Information Statement of Endeavor Group Holdings, Inc. (included in the Schedule 14C filed on August 5, 2024, and incorporated herein by reference) (the “Preliminary Information Statement”). |

|

|

| (b)(1)* |

|

Equity Commitment Letter, dated April 2, 2024, by and among Wildcat EGH Holdco, L.P., Wildcat OpCo Holdco, L.P., Silver Lake Partners VI, L.P., Silver Lake Partners VII, L.P. and SL SPV-4, L.P. |

|

|

| (b)(2)* |

|

Preferred Equity Commitment Letter, dated April 2, 2024, by and among Wildcat EGH Holdco, L.P., DFO Private Investments, L.P. and Thirty Fifth Investment Company L.L.C. |

|

|

(b)(3)*

|

|

Amended and Restated Commitment Letter, dated April 19, 2024, by and among Wildcat EGH Holdco, L.P., JPMorgan Chase Bank, N.A., BofA Securities, Inc., Morgan Stanley Senior Funding, Inc., Bank of America, N.A., Goldman Sachs Bank USA, Barclays Bank PLC, Deutsche Bank Securities Inc., Deutsche Bank AG New York Branch, Royal Bank of Canada, Wells Fargo Bank, National Association, Wells Fargo Securities, Inc., Citigroup Global Markets Inc., HSBC Bank USA, National Association and HSBC Securities (USA) Inc. |

|

|

| (b)(4)* |

|

Preferred Equity Commitment Letter, dated June 6, 2024, by and among Wildcat EGH Holdco, L.P. and Coatue Tactical Solutions PS Holdings AIV 9 LP. |

|

|

| (b)(5)* |

|

Preferred Equity Commitment Letter, dated July 29, 2024, by and among Wildcat EGH Holdco, L.P., and Meritage Fund Select I LLC. |

16

|

|

|

| Exhibit No. |

|

Description |

|

|

| (b)(6)* |

|

Limited Guarantee, dated April 2, 2024, by and among Silver Lake Partners VI, L.P., Silver Lake Partners VII, L.P. and Endeavor Operating Company, LLC. |

|

|

| (c)(1) |

|

Opinion of Centerview Partners LLC to the Special Committee of the Board of Directors of Endeavor Group Holdings, Inc., dated April 2, 2024 (included as Annex C to the Preliminary Information Statement and incorporated herein

by reference). |

|

|

| (c)(2)†* |

|

Confidential discussion materials prepared by Centerview Partners LLC, dated March 8, 2024, for the Special Committee of the Board of Directors of Endeavor Group Holdings, Inc. |

|

|

| (c)(3)†* |

|

Confidential discussion materials prepared by Centerview Partners LLC, dated March 21, 2024, for the Special Committee of the Board of Directors of Endeavor Group Holdings, Inc. |

|

|

| (c)(4)* |

|

Confidential discussion materials prepared by Centerview Partners LLC, dated March 29, 2024, for the Special Committee of the Board of Directors of Endeavor Group Holdings, Inc. |

|

|

| (c)(5)* |

|

Confidential discussion materials prepared by Centerview Partners LLC, dated March 30, 2024, for the Special Committee of the Board of Directors of Endeavor Group Holdings, Inc. |

|

|

| (c)(6)* |

|

Confidential discussion materials prepared by Centerview Partners LLC, dated March 30, 2024, for the Special Committee of the Board of Directors of Endeavor Group Holdings, Inc. |

|

|

| (c)(7)* |

|

Confidential discussion materials prepared by Centerview Partners LLC, dated March 31, 2024, for the Special Committee of the Board of Directors of Endeavor Group Holdings, Inc. |

|

|

| (c)(8)* |

|

Confidential discussion materials prepared by Centerview Partners LLC, dated April 2, 2024, for the Special Committee of the Board of Directors of Endeavor Group Holdings, Inc. |

|

|

| (c)(9) |

|

Opinion of Kroll, LLC to the to the General Partners (as defined therein) and the LPAC (as defined therein) of the Selling Funds (as defined therein), dated April 1, 2024 (included as Annex D to the Preliminary Information

Statement and incorporated herein by reference) |

|

|

| (c)(10) |

|

Opinion of Houlihan Lokey Capital, Inc. to the to the GPs (as defined therein) and the Buying Funds (as defined therein), dated April 1, 2024 (included as Annex E to the Preliminary Information Statement and incorporated herein

by reference). |

|

|

| (d)(1) |

|

Agreement and Plan of Merger, dated as of April 2, 2024, by and among Endeavor Group Holdings, Inc., Endeavor Executive Holdco, LLC, Endeavor Executive II Holdco, LLC, Endeavor Executive PIU Holdco, LLC, Endeavor Manager, LLC,

Endeavor Operating Company, LLC, Wildcat EGH Holdco, L.P., Wildcat OpCo Holdco, L.P., Wildcat PubCo Merger Sub, Inc., Wildcat OpCo Merger Sub, L.L.C. and Wildcat Manager Merger Sub, L.L.C. (included as Annex A to the Preliminary Information

Statement and incorporated herein by reference). |

|

|

| (d)(2) |

|

Voting and Support Agreement, dated as of April 2, 2024, by and among Endeavor Group Holdings, Inc., Endeavor Manager, LLC, Endeavor Operating Company, LLC, Silver Lake West HoldCo, L.P. and Silver Lake West HoldCo II, L.P.

(included as Annex F to the Preliminary Information Statement and incorporated herein by reference). |

|

|

| (d)(3) |

|

Letter Agreement, dated as of April 2, 2024, by and among Ariel Emanuel, Endeavor Group Holdings, Inc., Endeavor Operating Company, LLC, Wildcat EGH Holdco, L.P., Wildcat Opco Holdco, L.P. and, for purposes of certain specified

sections therein, William Morris Endeavor Entertainment, LLC (included as Annex J to the Preliminary Information Statement and incorporated herein by reference). |

|

|

| (d)(4) |

|

Letter Agreement, dated as of April 2, 2024, by and among Patrick Whitesell, Endeavor Group Holdings, Inc., Endeavor Operating Company, LLC, Wildcat EGH Holdco, L.P., Wildcat Opco Holdco, L.P. and, for purposes of certain

specified sections therein, William Morris Endeavor Entertainment, LLC (included as Annex K to the Preliminary Information Statement and incorporated herein by reference). |

17

|

|

|

| Exhibit No. |

|

Description |

|

|

| (d)(5) |

|

Amendment No. 2 to Term Employment Agreement, dated as of April 2, 2024, by and among Mark Shapiro, Endeavor Group Holdings, Inc. and Endeavor Operating Company, LLC (included as Annex L to the Preliminary Information

Statement and incorporated herein by reference). |

|

|

| (d)(6) |

|

Amended and Restated Term Employment Agreement, dated as of April 2, 2024, by and among Mark Shapiro, Endeavor Group Holdings, Inc., Wildcat EGH Holdco, L.P., Wildcat Opco Holdco, L.P., Endeavor Operating Company, LLC and, for

purposes of certain specified sections therein, William Morris Endeavor Entertainment, LLC (included as Annex M to the Preliminary Information Statement and incorporated herein by reference). |

|

|

| (d)(7) |

|

Rollover Agreement, dated April 2, 2024, by and among Wildcat EGH Holdco, L.P., Wildcat OpCo Holdco, L.P., Ariel Emanuel, The Ariel Z. Emanuel Living Trust, dated November 13, 2017, Endeavor Executive Holdco, LLC, Endeavor

Executive Holdco II, LLC and Endeavor Executive PIU Holdco, LLC (included as Annex G to the Preliminary Information Statement and incorporated herein by reference). |

|

|

| (d)(8) |

|

Rollover Agreement, dated April 2, 2024, by and among Wildcat EGH Holdco, L.P., Wildcat OpCo Holdco, L.P., Patrick Whitesell, The Patrick Whitesell Revocable Trust, dated May 31, 2019, Endeavor Executive Holdco, LLC,

Endeavor Executive Holdco II, LLC and Endeavor Executive PIU Holdco, LLC (included as Annex H to the Preliminary Information Statement and incorporated herein by reference). |

|

|

| (d)(9) |

|

Rollover Agreement, dated April 2, 2024, by and among Wildcat EGH Holdco, L.P., Wildcat OpCo Holdco, L.P. and Mark Shapiro (included as Annex I to the Preliminary Information Statement and incorporated herein by

reference). |

|

|

| (f)(1) |

|

Section 262 of the Delaware General Corporation Law (included as Annex B to the Preliminary Information Statement and incorporated herein by reference). |

|

|

| 107* |

|

Filing Fee Table. |

| † |

Certain portions of this exhibit have been redacted and separately filed with the SEC pursuant to a request for

confidential treatment. |

18

SIGNATURES

After due inquiry and to the best of each of the undersigned’s knowledge and belief, each of the undersigned certifies that the

information set forth in this statement is true, complete and correct.

Dated as of August 5, 2024

|

|

|

| ENDEAVOR GROUP HOLDINGS, INC. |

|

|

| By: |

|

/s/ Jason Lublin |

| Name: Jason Lublin |

| Title: Chief Financial Officer |

|

| ENDEAVOR OPERATING COMPANY, LLC |

|

|

| By: |

|

/s/ Jason Lublin |

| Name: Jason Lublin |

| Title: Chief Financial Officer |

|

| ENDEAVOR MANAGER, LLC |

|

|

| By: |

|

/s/ Jason Lublin |

| Name: Jason Lublin |

| Title: Chief Financial Officer |

|

| ENDEAVOR EXECUTIVE HOLDCO, LLC |

|

|

| By: |

|

/s/ Patrick Whitesell |

| Name: Patrick Whitesell |

| Title: Director |

|

| ENDEAVOR EXECUTIVE II HOLDCO, LLC |

|

|

| By: |

|

/s/ Patrick Whitesell |

| Name: Patrick Whitesell |

| Title: Director |

|

| ENDEAVOR EXECUTIVE PIU HOLDCO, LLC |

|

|

| By: |

|

/s/ Patrick Whitesell |

| Name: Patrick Whitesell |

| Title: Director |

|

| SILVER LAKE WEST HOLDCO, L.P. |

|

| By: SILVER LAKE WEST VOTECO, L.L.C., its general partner |

|

|

| By: |

|

/s/ Egon Durban |

| Name: Egon Durban |

| Title: Managing Member |

19

|

|

|

| SILVER LAKE WEST HOLDCO II, L.P. |

|

| By: SILVER LAKE WEST VOTECO, L.L.C., its general partner |

|

|

| By: |

|

/s/ Egon Durban |

| Name: Egon Durban |

| Title: Managing Member |

|

| SILVER LAKE WEST VOTECO, L.L.C. |

|

|

| By: |

|

/s/ Egon Durban |

| Name: Egon Durban |

| Title: Managing Member |

|

| WILDCAT EGH HOLDCO, L.P. |

|

| By: SLP WILDCAT AGGREGATOR GP, L.L.C., its general partner |

|

| By: SILVER LAKE TECHNOLOGY ASSOCIATES VII, L.P., its managing member |

|

| By: SLTA VII (GP), L.L.C., its general partner |

|

| By: SILVER LAKE GROUP, L.L.C., its managing member |

|

|

| By: |

|

/s/ Egon Durban |

| Name: Egon Durban |

| Title: Co-CEO |

|

| WILDCAT OPCO HOLDCO, L.P. |

|

| By: SLP WILDCAT AGGREGATOR GP, L.L.C., its general partner |

|

| By: SILVER LAKE TECHNOLOGY ASSOCIATES VII, L.P., its managing member |

|

| By: SLTA VII (GP), L.L.C., its general partner |

|

| By: SILVER LAKE GROUP, L.L.C., its managing member |

|

|

| By: |

|

/s/ Egon Durban |

| Name: Egon Durban |

| Title: Co-CEO |

20

|

|

|

|

| WILDCAT PUBCO MERGER SUB, INC. |

|

|

| By: |

|

/s/ Egon Durban |

| Name: Egon Durban |

| Title: President |

|

| WILDCAT OPCO MERGER SUB, L.L.C. |

|

| By: WILDCAT OPCO HOLDCO, L.P., its managing member |

|

| By: SLP WILDCAT AGGREGATOR GP, L.L.C., its general partner |

|

| By: SILVER LAKE TECHNOLOGY ASSOCIATES VII, L.P., its managing member |

|

| By: SLTA VII (GP), L.L.C., its general partner |

|

| By: SILVER LAKE GROUP, L.L.C., its managing member |

|

|

| By: |

|

/s/ Egon Durban |

| Name: Egon Durban |

| Title: Co-CEO |

|

| WILDCAT MANAGER MERGER SUB, L.L.C. |

|

| By: WILDCAT PUBCO MERGER SUB, INC., its managing member |

|

|

| By: |

|

/s/ Egon Durban |

| Name: Egon Durban |

| Title: President |

|

| SLP WILDCAT AGGREGATOR GP, L.L.C. |

|

| By: SILVER LAKE TECHNOLOGY ASSOCIATES VII, L.P., its managing member |

|

| By: SLTA VII (GP), L.L.C., its general partner |

|

| By: SILVER LAKE GROUP, L.L.C., its managing member |

|

|

| By: |

|

/s/ Egon Durban |

| Name: Egon Durban |

| Title: Co-CEO |

21

|

|

|

| SILVER LAKE PARTNERS VI, L.P. |

|

| By: SILVER LAKE TECHNOLOGY ASSOCIATES VI, L.P., its general partner |

|

| By: SLTA VI (GP), L.L.C., its general partner |

|

| By: SILVER LAKE GROUP, L.L.C., its managing member |

|

|

| By: |

|

/s/ Egon Durban |

| Name: Egon Durban |

| Title: Co-CEO |

|

| SILVER LAKE PARTNERS VII, L.P. |

|

| By: SILVER LAKE TECHNOLOGY ASSOCIATES VII, L.P., its general partner |

|

| By: SLTA VII (GP), L.L.C., its general partner |

|

| By: SILVER LAKE GROUP, L.L.C., its managing member |

|

|

| By: |

|

/s/ Egon Durban |

| Name: Egon Durban |

| Title: Co-CEO |

|

| SL SPV-4, L.P. |

|

| By: SLTA SPV-4, L.P., its general partner |

|

| By: SLTA SPV-4 (GP), L.L.C., its general partner |

|

| By: SILVER LAKE GROUP, L.L.C., its managing member |

|

|

| By: |

|

/s/ Egon Durban |

| Name: Egon Durban |

| Title: Co-CEO |

|

| SILVER LAKE TECHNOLOGY ASSOCIATES VI, L.P. |

|

| By: SLTA VI (GP), L.L.C., its general partner |

|

| By: SILVER LAKE GROUP, L.L.C., its managing member |

|

|

| By: |

|

/s/ Egon Durban |

| Name: Egon Durban |

| Title: Co-CEO |

22

|

|

|

|

| SILVER LAKE TECHNOLOGY ASSOCIATES VII, L.P. |

|

| By: SLTA VII (GP), L.L.C., its general partner |

|

| By: SILVER LAKE GROUP, L.L.C., its managing member |

|

|

| By: |

|

/s/ Egon Durban |

| Name: Egon Durban |

| Title: Co-CEO |

|

|

|

| SLTA SPV-4, L.P. |

|

| By: SLTA SPV-4 (GP), L.L.C., its general partner |

|

| By: SILVER LAKE GROUP, L.L.C., its managing member |

|

|

| By: |

|

/s/ Egon Durban |

| Name: Egon Durban |

| Title: Co-CEO |

|

| SLTA VI (GP), L.L.C. |

|

| By: SILVER LAKE GROUP, L.L.C., its managing member |

|

|

| By: |

|

/s/ Egon Durban |

| Name: Egon Durban |

| Title: Co-CEO |

|

| SLTA VII (GP), L.L.C. |

|

| By: SILVER LAKE GROUP, L.L.C., its managing member |

|

|

| By: |

|

/s/ Egon Durban |

| Name: Egon Durban |

| Title: Co-CEO |

|

| SLTA SPV-4 (GP), L.L.C. |

|

| By: SILVER LAKE GROUP, L.L.C., its managing member |

|

|

| By: |

|

/s/ Egon Durban |

| Name: Egon Durban |

| Title: Co-CEO |

23

|

|

|

| SILVER LAKE GROUP, L.L.C. |

|

|

| By: |

|

/s/ Egon Durban |

| Name: Egon Durban |

| Title: Co-CEO |

|

| ARIEL EMANUEL |

|

| /s/ Ariel Emanuel |

|

| PATRICK WHITESELL |

|

| /s/ Patrick Whitesell |

24

Exhibit (B)(1)

April 2, 2024

Wildcat EGH Holdco, L.P.

c/o Silver Lake Partners

2775 Sand Hill Road, Suite 100

Menlo Park, CA 94025

c/o Wildcat OpCo Holdco, L.P.

c/o Silver Lake Partners

2775 Sand Hill Road, Suite 100

Menlo Park, CA 94025

| Re: |

Equity Financing Commitment |

Ladies and Gentlemen:

Reference is made to the

Agreement and Plan of Merger, dated as of the date hereof (as amended, supplemented or otherwise modified from time to time in accordance with its terms, the “Merger Agreement”), by and among Wildcat EGH Holdco, L.P., a Delaware

limited partnership (“Holdco Parent”), Wildcat OpCo Holdco, L.P., a Delaware limited partnership (“OpCo Parent” and, together with Holdco Parent, the “Parent Entities” and each, a “Parent

Entity”), Wildcat PubCo Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of Holdco Parent (“Company Merger Sub”), Wildcat Manager Merger Sub, L.L.C., a Delaware limited liability company and wholly-owned

subsidiary of Company Merger Sub (“Manager Merger Sub”), Wildcat OpCo Merger Sub, L.L.C., a Delaware limited liability company and wholly-owned subsidiary of OpCo Parent (“OpCo Merger Sub” and, together with Company

Merger Sub and Manager Merger Sub, the “Merger Subs” and each, a “Merger Sub”), Endeavor Group Holdings, Inc., a Delaware corporation (the “Company”), Endeavor Manager, LLC, a Delaware limited

liability company and subsidiary of the Company (the “Manager”), and Endeavor Operating Company, LLC, a Delaware limited liability company and subsidiary of the Manager (“OpCo” and, together with the Company and the

Manager, the “Company Entities” and each, a “Company Entity”), pursuant to which, upon the terms and subject to the conditions set forth therein, among other things, the Parent Entities will acquire the Company

Entities by (i) causing Company Merger Sub to merge with and into the Company, with the Company surviving as a wholly-owned subsidiary of Holdco Parent, (ii) causing Manager Merger Sub to merge with and into the Manager, with the Manager

surviving as an indirect subsidiary of Holdco Parent and (iii) causing OpCo Merger Sub to merge with and into OpCo, with the OpCo surviving as the surviving company owned by the OpCo Parent, the Manager and the Rollover Holders (as defined

therein). Each capitalized term or other term used and not defined herein but defined in the Merger Agreement shall have the meaning ascribed to it in the Merger Agreement, except as otherwise provided. Each of Silver Lake Partners VI, L.P.

(“SLP Fund VI”), Silver Lake Partners VII, L.P. (“SLP Fund VII”) and SL SPV-4, L.P. (“SLP SPV”) is referred to herein as an “Equity Investor” and

collectively, the “Equity Investors”. This letter agreement is being delivered by the Equity Investors to the Parent Entities in connection with the execution of the Merger Agreement.

1. Commitment. Subject to the conditions set forth herein, each Equity Investor

hereby agrees to purchase immediately prior to the Closing, equity interests of Holdco Parent (or, to the extent designated by Holdco Parent prior to Closing, OpCo Parent) (collectively, the “Subject Equity Securities”) for an

aggregate purchase price equal to, or otherwise make contributions to or invest funds as equity in Holdco Parent (or, to the extent designated by Holdco Parent prior to Closing, OpCo Parent) in an aggregate amount equal to, the respective proportion

set forth opposite such Equity Investor’s name on Schedule A hereto (such proportion for such Equity Investor, as may be adjusted pursuant to the terms hereof, being its “Respective Proportion”) such that the aggregate

purchase price for all such equity interests purchased by all such Equity Investors shall equal an aggregate purchase price of $6,376,940,000 (the “Equity Financing Commitment”) (the allocation of the Equity Financing Commitment