Equifax Canada: Budget Planning and Fraud Prevention ‘Top the List’ this Holiday Season

14 Noviembre 2023 - 4:00AM

Facing financial pressures, Canadians are planning to be more

budget-conscious and security-minded for the 2023 holiday shopping

season, according to a new survey* from Equifax Canada.

KEY FINDINGS

- 68 per cent of respondents said they plan to budget for holiday

shopping this year, up from 57 per cent in 2022.

- Credit cards remain the preferred payment method for holiday

purchases for most people (67 per cent); the number climbs even

higher to 72 per cent for younger adults (aged 18-34).

- 44 per cent feel more vulnerable to fraudsters and identity

thieves during the holidays, with 70 per cent saying they need to

do more to protect their personal data, up from 60 per cent in

2022.

“The findings from this survey suggest people are taking steps

to be more mindful of their spending and their personal information

during the holidays,” said Julie Kuzmic, Senior Compliance Officer,

Consumer Advocacy, Equifax Canada. “It is important to remember

that you can take control of your credit and protect your identity

at any time of year. Some simple actions like budgeting and

checking your credit reports can help you avoid overspending and

find potential signs of fraud.”

HOLIDAY SPENDING AND DEBTIn a recent survey**,

37 per cent of business owners expressed having less confidence

about the 2023 holiday season than they did last year, while only

15 per cent expressed having more confidence.

Younger people (aged 18-34) are more likely to carry over

holiday debt and regret their purchases (46 per cent and 38 per

cent, respectively) versus people 55 and older (19 per cent and 13

per cent, respectively).

Shopping local is on the rise for the 2023 holiday season, with

61 per cent of shoppers planning to do so, up from 51 per cent in

2022. A 10 per cent increase in shoppers planning to shop locally

could be a boon to small business owners, who are facing a

challenging holiday season.

“It’s so important to support small businesses this holiday

season, and beyond,” said Jeff Brown, Head of Commercial Solutions

at Equifax Canada. “Small businesses create jobs, support local

communities, and offer unique products and services that consumers

value.”

PROTECTING AGAINST FRAUD AND IDENTITY THEFTOf

respondents in the survey*, 44 per cent said they feel more

vulnerable to fraudsters and identity thieves during this time of

year. Fortunately, most of the survey respondents are taking steps

to protect themselves from identity theft, with 84 per cent

checking their credit card bills for suspicious activity, 72 per

cent using up-to-date antivirus software, 27 per cent purchasing

identity theft protection products, and 87 per cent limiting the

information they share on social media. Despite these efforts, 70

per cent agree that they need to do more to protect their personal

data, up from 60 per cent in 2022.

“Fraudsters and identity thieves don’t take time off for the

holidays, so it is essential to remain vigilant and to take steps

to protect yourself,” added Kuzmic. “Be careful about where you

shop and be mindful of the information you share online.”

TOP TIPS TO HELP CONSUMERS AVOID FRAUDSTERS AND IDENTITY

THIEVES1. Only shop with trusted retailers and be careful

at the checkout2. Regularly check your credit reports and bank

statements for suspicious activity3. Be careful about what

information you share on social media and be careful about clicking

on links in emails or text messages 4. Use strong passwords that

are changed regularly and two-factor authentication for your online

accounts5. Avoid using public Wi-Fi to shop online

Visit the Equifax Canada website for additional tips to help you

budget and protect yourself and your family against fraudsters and

identity thieves.

*An online survey of 1,564 Canadians was completed between

September 15-18, 2023, using Leger’s online panel. The margin of

error for this study was +/-2.5 per cent, 19 times out of

20.

** Equifax Canada commissioned Leger to conduct an online survey

with 300 Canadian small (271) and medium-sized (29) business

owners/leaders/decision makers within the Food, Construction,

Retail, and Travel Industries. It was completed between August 28

and September 13, 2023, using Leger’s online panel.

ABOUT EQUIFAXAt Equifax (NYSE:

EFX), we believe knowledge drives progress. As a global data,

analytics, and technology company, we play an essential role in the

global economy by helping financial institutions, companies,

employers, and government agencies make critical decisions with

greater confidence. Our unique blend of differentiated data,

analytics, and cloud technology drives insights to power decisions

to move people forward. Headquartered in Atlanta and supported

by nearly 15,000 employees worldwide, Equifax operates or has

investments in 24 countries in North America, Central and South

America, Europe, and the Asia Pacific region. For more information,

visit Equifax.ca.

Media Contacts:

| Andrew FindlaterSELECT Public

Relationsafindlater@selectpr.ca (647) 444-1197 |

Heather AggarwalEquifax Canada

Media RelationsMediaRelationsCanada@equifax.com |

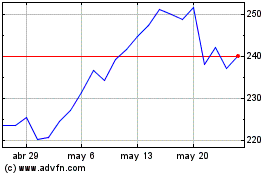

Equifax (NYSE:EFX)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Equifax (NYSE:EFX)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024