Form 8-K - Current report

08 Noviembre 2024 - 3:16PM

Edgar (US Regulatory)

EQUIFAX INC false 0000033185 0000033185 2024-11-07 2024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2024

EQUIFAX INC.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Georgia |

|

001-06605 |

|

58-0401110 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 1550 Peachtree Street, N.W. Atlanta, Georgia |

|

30309 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (404) 885-8000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol |

|

Name of each exchange on which registered |

| Common stock, $1.25 par value per share |

|

EFX |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On November 7, 2024, Equifax Inc. (the “Company”) entered into a letter agreement with Mark W. Begor, the Chief Executive Officer of the Company (the “2024 Letter Agreement”), which amends certain terms of the Letter Agreement between the Company and Mr. Begor dated February 4, 2021 (the “2021 Letter Agreement”), and the Employment Agreement between the Company and Mr. Begor dated March 27, 2018 (as amended by the 2021 Letter Agreement, the “Employment Agreement”).

In anticipation of Mr. Begor serving in the role of Chief Executive Officer past December 31, 2025, the 2024 Letter Agreement amends the Employment Agreement by (i) removing the December 31, 2025 end date so Mr. Begor’s employment will continue until terminated in accordance with the Employment Agreement, (ii) amending the retirement definition for future awards and (iii) eliminating severance benefits for a termination without cause or for good reason, except in the case of a change in control.

The 2024 Letter Agreement does not otherwise affect the terms of the Employment Agreement. The foregoing summary of the terms and conditions of the 2024 Letter Agreement is qualified in its entirety by reference to the full text of the 2024 Letter Agreement, which is attached hereto as Exhibit 10.1 and incorporated by reference herein.

| Item 7.01. |

Regulation FD Disclosure. |

A copy of the Company’s press release announcing that Mr. Begor will continue to serve as Chief Executive Officer of the Company beyond December 31, 2025 is attached hereto as Exhibit 99.1.

The information contained in this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” with the Securities and Exchange Commission for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities of that section, nor incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act.

| Item 9.01. |

Financial Statements and Exhibits. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| EQUIFAX INC. |

|

|

| By: |

|

/s/ John J. Kelley III |

| Name: |

|

John J. Kelley III |

| Title: |

|

Executive Vice President, Chief Legal Officer and Corporate Secretary |

Date: November 8, 2024

Exhibit 10.1

November 7, 2024

Mark

W. Begor

c/o Equifax Inc.

1500 Peachtree Street, N.W.

Atlanta, GA 30309

Dear Mark:

The purpose of this letter (this “Letter”) is to amend, effective as of November 7, 2024, that certain Employment

Agreement between Equifax Inc. (the “Company”) and you, dated as of March 27, 2018 (the “Employment Agreement”), and that certain Letter Agreement between the Company and you, dated as of

February 4, 2021 (the “Letter Agreement”), as set forth below.

| |

1. |

Section 1 of the Letter Agreement and Section 10(c) of the Employment Agreement are hereby deleted (except

for the terms defined therein). |

| |

2. |

Section 4 of the Letter Agreement is hereby deleted and replaced with the following: |

4. For equity awards granted after November 7, 2024, for purposes of Section 10(b) of the Employment Agreement (and such

other Sections of the Employment Agreement in which Retirement is referenced) and the equity grants described in Section 3 of this Letter, the term “Retirement” means (i) your termination of employment without

Cause or resignation for Good Reason or (ii) on or after December 31, 2027, your Voluntary Resignation; provided, however, that you shall not be treated as ending your employment through Retirement if the Company has Cause to

terminate your employment at your Termination Date or pursuant to the lookback provisions in the definition of “Cause.”

Except

as modified by this Letter, the terms and conditions of the Employment Agreement and the Letter Agreement shall remain unmodified and in full force and effect. For the avoidance of doubt, nothing in this Letter is intended to affect any equity

awards that were granted to you prior to the effective date of this Letter, and the respective rights and obligations of the parties with respect thereto shall continue in effect. This Letter may be executed in one or more counterparts, each of

which shall be deemed an original and all of which taken together shall constitute one and the same instrument. Please acknowledge your understanding of and agreement to the foregoing by signing this Letter in the space provided below and returning

a signed copy to me. By signing this Letter, you agree that entry into this Letter shall not constitute “Good Reason” as defined in the Employment Agreement.

[Signature Page Follows]

|

|

|

| Sincerely, |

|

| EQUIFAX INC. |

|

|

| By: |

|

/s/ Mark L. Feidler |

|

| Mark L. Feidler |

| Chairman of the Board of Directors |

|

| Date: November 7, 2024 |

ACKNOWLEDGED AND AGREED as of the 7th day of November 2024:

|

|

| /s/ Mark W. Begor |

|

| Mark W. Begor |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Equifax CEO Mark W. Begor to Continue

Company Leadership Beyond 2025

ATLANTA, NOVEMBER 7, 2024 – Equifax® (NYSE: EFX) today

announced that Mark W. Begor will continue to serve as Chief Executive Officer (CEO) beyond the current expiration of his employment agreement in 2025.

“Over the last 6 years, Mark has provided a clear vision and strong, decisive leadership for Equifax. He has delivered strong financial results in the

face of challenging economic conditions, growing revenue by 50% since 2018 despite a decline in the mortgage market of 34% in 2022 and 2023 and driving the Equifax market capitalization from $14 billion in 2018 to $33 billion, a CAGR

of 14%,” said Mark Feidler, Equifax Chairman of the Board. “Mark and his team have successfully completed an enterprise-wide, more than $1.5 billion Cloud-based technology transformation that they are now leveraging to drive global

innovation and growth. The Board of Directors remains confident that he is uniquely positioned to continue to lead the business and drive value for our shareholders.”

Begor joined Equifax in April 2018, and has successfully driven a complete technology transformation that has changed nearly every facet of the company’s

infrastructure. This transformation to the Cloud is the largest investment in Equifax history, and is a critical enabler to accelerating innovation, new products and growth for the benefit of customers, consumers and investors. Begor has also

expanded Equifax differentiated data assets by investing over $4.5 billion in 25 strategic bolt-on acquisitions since 2018, and under his leadership the company has delivered more than 100 new products

each year for four consecutive years with a Vitality Index above 10% since 2022.

“I am energized now more than ever about the future of the New

Equifax and am excited to lead the company as it realizes the benefits of its industry leading Cloud technology investment. Leveraging the power of the Equifax Cloud alongside its differentiated data assets and patented EFX.AI techniques will enable

Equifax to help our customers grow from higher performing scores, models, and products,” said Begor. “I am excited to be leading the next chapter of the new Equifax that we expect will deliver higher growth, margin expansion, and expanding

free cash flow generation positioning Equifax to accelerate returning cash to investors and driving shareholder returns.”

FORWARD-LOOKING STATEMENTS

This release contains forward-looking statements and forward-looking information. All statements that address events or developments that we expect

or anticipate will occur in the future, including statements about future operating results, and similar statements about our financial outlook and business plans, are forward-looking statements. We believe these forward-looking statements are

reasonable as and when made. However, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from our historical experience and our present expectations or projections. These risks and

uncertainties include, but are not limited to, those described in our Form 10-K for the year ended December 31, 2023 and subsequent filings with the U.S. Securities and Exchange Commission. As a result of

such risks and uncertainties, we urge you not to place undue reliance on any forward-looking statements. Forward-looking statements speak only as of the date when made. We undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

ABOUT EQUIFAX INC.

At Equifax (NYSE: EFX), we believe knowledge drives progress. As a global data, analytics, and technology company, we play an essential role in the

global economy by helping financial institutions, companies, employers, and government agencies make critical decisions with greater confidence. Our unique blend of differentiated data, analytics, and cloud technology drives insights to power

decisions to move people forward. Headquartered in Atlanta and supported by nearly 15,000 employees worldwide, Equifax operates or has investments in 24 countries in North America, Central and South America, Europe, and the Asia Pacific region. For

more information, visit Equifax.com.

FOR MORE INFORMATION:

Trevor Burns

Investor Relations

Trevor.Burns@equifax.com

Kate Walker

Media Relations

mediainquiries@equifax.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

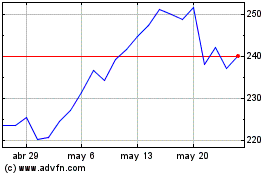

Equifax (NYSE:EFX)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

Equifax (NYSE:EFX)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025