Form 8-K - Current report

24 Enero 2025 - 2:19PM

Edgar (US Regulatory)

false000088620600008862062025-01-242025-01-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

January 24, 2025

FRANKLIN COVEY CO.

(Exact name of registrant as specified in its charter)

Commission File No. 001-11107

| | |

Utah | | 87-0401551 |

(State or other jurisdiction of incorporation) | | (IRS Employer Identification Number) |

2200 West Parkway Boulevard

Salt Lake City, Utah 84119-2099

(Address of principal executive offices)(Zip Code)

Registrant’s telephone number, including area code: (801) 817-1776

Former name or former address, if changed since last report: Not Applicable

______________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ]Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ]Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ]Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ]Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $.05 Par Value | FC | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company □

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. □

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangement of Certain Officers.

As noted below, on January 24, 2025, the shareholders of Franklin Covey Co. (the Company) approved Amendment No. 1 (the Amendment) to the Franklin Covey Co. 2022 Omnibus Incentive Plan (the 2022 Plan). The 2022 Plan was adopted by the Company’s Board of Directors on November 12, 2021, and the Amendment was adopted by the Company’s Board of Directors on November 15, 2024. With shareholder approval obtained, the 2022 Plan is amended to increase the number of shares available by 575,000 shares. Subject to adjustment in certain circumstances, the 2022 Plan now authorizes up to 1,575,000 shares of common stock for issuance.

Any employees, officers, consultants, advisors, independent contractors, or non-employee directors of the Company or any of its subsidiaries or affiliates are eligible to receive an award under the 2022 Plan. Generally, grants may be made in any of the following forms:

Stock Options

Stock Appreciation Rights

Restricted Stock and Restricted Stock Units

Other Stock-Based Awards

A more complete summary of the 2022 Plan appears on pages 50 to 59 of the Company’s Proxy Statement as filed with the Securities and Exchange Commission on December 20, 2024, as revised by Amendment No. 1 and Amendment No. 2 to the Proxy Statement filed on January 13, 2025, and is incorporated by reference herein. The foregoing description and the summary contained in the Company’s Proxy Statement, as amended, do not purport to be complete and are qualified in their entirety by reference to the full text of the 2022 Plan and the Amendment, which are attached as Exhibits 10.1 and 10.2, respectively, to this current report on Form 8-K and incorporated by refence herein.

Item 5.07 Submission of Matters to a Vote of Security Holders.

The Company held its Annual Meeting of Shareholders on Friday, January 24, 2025. For more information on the following proposals, refer to the Company’s Proxy Statement filed with the Securities and Exchange Commission on December 20, 2024, the relevant portions of which are incorporated herein by reference. The matters voted on and the results of the votes are as follows:

1.The following nominees for Director were elected. Each person elected will serve until the next annual meeting of shareholders or until such person’s successor is elected and qualified.

| | | | | | |

Nominee | | Number of Votes Cast For | | Number of Votes Withheld | | Broker Non-Votes |

Anne H. Chow | | 8,470,986 | | 1,164,047 | | 1,671,059 |

Craig Cuffie | | 9,449,913 | | 185,120 | | 1,671,059 |

Donald J. McNamara | | 9,382,793 | | 252,240 | | 1,671,059 |

Joel C. Peterson | | 9,415,412 | | 219,621 | | 1,671,059 |

Nancy Phillips | | 8,949,289 | | 685,744 | | 1,671,059 |

Efrain Rivera | | 9,439,418 | | 195,615 | | 1,671,059 |

Derek C.M. van Bever | | 8,853,212 | | 781,821 | | 1,671,059 |

Paul S. Walker | | 9,444,477 | | 190,556 | | 1,671,059 |

Robert A. Whitman | | 8,977,404 | | 657,629 | | 1,671,059 |

2.The advisory vote for the approval of executive compensation as described and presented in the Compensation Discussion and Analysis of the Company’s Proxy Statement was approved with 9,093,586 votes in favor; 511,411 votes against; and 30,036 abstentions. The number of broker non-votes was 1,671,059.

3.The ratification of the appointment of Deloitte & Touche, LLP as the Company’s Independent Registered Public Accounting Firm for the fiscal year ending August 31, 2025 was approved with 11,188,529 votes cast in favor; 95,220 votes against; and 22,343 abstentions. There were no broker non-votes for this proposal.

4.Amendment No. 1 to the Franklin Covey Co. 2022 Omnibus Incentive Plan was approved with 9,255,222 votes cast in favor; 350,571 votes against; and 29,240 abstentions. The number of broker non-votes was 1,671,059.

Exhibit 10.2

AMENDMENT NO. 1 TO FRANKLIN COVEY CO. 2022 OMNIBUS INCENTIVE PLAN

WHEREAS, Franklin Covey Co. (the “Company”) sponsors and maintains the Company’s 2022 Omnibus Incentive Plan (the “2022 Plan”); and

WHEREAS, the Company proposes to amend the 2022 Plan to increase the number of the Company’s common shares reserved for issuance thereunder, subject to the approval of the Company’s stockholders at the Company’s 2025 annual meeting of shareholders (the “Annual Meeting”) and effective as of the date of such approval (the “Effective Date”).

Subject to the approval of the Company’s shareholders at the Annual Meeting (the “Shareholder Approval”), the 2022 Plan is hereby amended as of the Effective Date as follows:

Amendment to 2022 Plan.

Section 4(a)(i) of the 2022 Plan is hereby amended and restated to read in its entirety as follows:

“(i) 1,575,000 Shares, plus”

Section 6(a)(iv)(A) of the 2022 Plan is hereby amended and restated to read in its entirety as follows:

“(A) The aggregate number of Shares that may be issued under all Incentive Stock Options under the Plan shall be 1,575,000 Shares.”

Failure to Obtain Shareholder Approval. If the Shareholder Approval is not obtained, then this Amendment No. 1 to the 2022 Plan shall become null and void and shall immediately terminate.

Effect of this Amendment. Except as expressly amended hereby, the 2022 Plan shall continue in full force and effect in accordance with the provisions thereof.

IN WITNESS WHEREOF, the Company, by its duly authorized officer, has executed this Amendment No. 1 to the Franklin Covey Co. 2022 Omnibus Incentive Plan on the date indicated below.

FRANKLIN COVEY CO.

|

|

|

|

|

Date: [____], 2024

|

By:

|

|

|

|

Name

|

|

|

|

Office

|

|

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

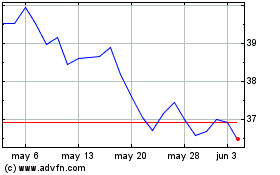

Franklin Covey (NYSE:FC)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Franklin Covey (NYSE:FC)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025