Four Corners Property Trust, Inc. (“FCPT” or the “Company”,

NYSE: FCPT) today announced financial results for the three and

nine months ended September 30, 2024.

Management Comments

“FCPT returned to accretively growing the portfolio in the third

quarter and is continuing to add to the pipeline with vigor. While

we slowed acquisitions in late 2023, we remained prepared to enter

the market when conditions improved,” said CEO Bill Lenehan. “We

anticipate 2024 will remain busy with new acquisitions through year

end. After raising $224 million of equity since July, we believe

our balance sheet is in excellent shape to support renewed AFFO

growth going forward.”

Rent Collection Update

As of September 30, 2024, the Company has received rent payments

representing 99.8% of its portfolio contractual base rent for the

quarter ending September 30, 2024.

Financial Results

Rental Revenue and Net Income Attributable to Common

Shareholders

- Rental revenue for the third quarter increased 3.7% over the

prior year to $59.3 million. Rental revenue consisted of $58.7

million in cash rents and $0.5 million of straight-line and other

non-cash rent adjustments.

- Net income attributable to common shareholders was $25.6

million for the third quarter, or $0.27 per diluted share. These

results compare to net income attributable to common shareholders

of $24.2 million for the same quarter in the prior year, or $0.27

per diluted share.

- Net income attributable to common shareholders was $74.3

million for the nine months ended September 30, 2024, or $0.80 per

diluted share. These results compare to net income attributed to

common shareholders of $70.9 million for the same nine-month period

in 2023, or $0.80 per diluted share.

Funds from Operations (FFO)

- NAREIT-defined FFO per diluted share for the third quarter was

$0.41, representing flat results compared to the same quarter in

2023.

- NAREIT-defined FFO per diluted share for the nine months ended

September 30, 2024 was $1.23, representing a $0.03 per share

increase compared to the same nine-month period in 2023.

Adjusted Funds from Operations (AFFO)

- AFFO per diluted share for the third quarter was $0.43,

representing a $0.01 per share increase compared to the same

quarter in 2023.

- AFFO per diluted share for the nine months ended September 30,

2024 was $1.29, representing a $0.05 per share increase compared to

the same nine-month period in 2023.

General and Administrative (G&A) Expense

- G&A expense for the third quarter was $5.8 million, which

included $1.8 million of stock-based compensation. These results

compare to G&A expense in the third quarter of 2023 of $5.5

million, including $1.5 million of stock-based compensation.

- Cash G&A expense (after excluding stock-based compensation)

for the third quarter was $4.0 million, representing 6.9% of cash

rental income for the quarter.

Dividends

- FCPT declared a dividend of $0.345 per common share for the

third quarter of 2024.

Real Estate Portfolio

- As of September 30, 2024, the Company’s rental portfolio

consisted of 1,153 properties located in 47 states. The properties

are 99.6% occupied (measured by square feet) under long-term, net

leases with a weighted average remaining lease term of

approximately 7.3 years.

Acquisitions

- During the third quarter, FCPT acquired 21 properties for a

combined purchase price of $70.7 million at an initial weighted

average cash yield of 7.2%, on rents in place as of September 30,

2024 and a weighted average remaining lease term of 11.5

years.

Dispositions

- During the third quarter, FCPT did not sell any

properties.

Liquidity and Capital

Markets

Capital Raising

- During the third quarter, the Company sold 7,594,019 shares of

Common Stock via the at-the-market (ATM) program at an average

gross price of $27.30 per share for anticipated gross proceeds of

$207.3 million.

- In total since July 1, 2024 through October 30, 2024, FCPT has

sold 8,186,571 shares of Common Stock via the ATM at an average

gross price of $27.38 per share for anticipated gross proceeds of

$224.1 million. As of October 30, 2024, 3,549,299 shares remain to

be settled under existing forward sale agreements for anticipated

gross proceeds of $100.2 million.

Liquidity

- On September 30, 2024, FCPT had approximately $382 million of

available liquidity including $44 million of cash and cash

equivalents, anticipated net proceeds of approximately $88 million

under existing forward sale agreements and $250 million of capacity

under the fully undrawn revolving credit facility. Including

October equity issuance, FCPT had $393 million of available

liquidity.

Credit Facility and Unsecured Notes

- On September 30, 2024, FCPT had $1,140 million of outstanding

debt, consisting of $515 million of term loans and $625 million of

unsecured fixed rate notes and no outstanding revolver balance.

FCPT’s leverage, as measured by the ratio of net debt to adjusted

EBITDAre, is 5.3x at quarter-end, or 4.9x inclusive of outstanding

equity under forward sales agreements as of September 30,

2024.

Conference Call

Information

Company management will host a conference call and audio webcast

on Thursday, October 31 at 11:00 a.m. Eastern Time to discuss the

results.

Interested parties can listen to the call via the following:

Phone: 1 833 470 1428 (domestic) or 1 404 975

4839 (international), Call Access Code: 363244

Live webcast:

https://events.q4inc.com/attendee/716655745

In order to pre-register for the call,

investors can visit

https://www.netroadshow.com/events/login?show=bdd4c743&confId=72137

Replay: Available through January 29, 2025 by

dialing 1 866 813 9403 (domestic) or 1 929 458 6194

(international), Replay Access Code 205606

About FCPT

FCPT, headquartered in Mill Valley, CA, is a real estate

investment trust primarily engaged in the ownership, acquisition

and leasing of restaurant and retail properties. The Company seeks

to grow its portfolio by acquiring additional real estate to lease,

on a net basis, for use in the restaurant and retail industries.

Additional information about FCPT can be found on the website at

fcpt.com.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements include all statements that are not historical

statements of fact and those regarding the Company’s intent, belief

or expectations, including, but not limited to, statements

regarding: operating and financial performance, announced

transactions, expectations regarding the making of distributions

and the payment of dividends, and the effect of pandemics on the

business operations of the Company and the Company’s tenants and

their continued ability to pay rent in a timely manner or at all.

Words such as “anticipate(s),” “expect(s),” “intend(s),” “plan(s),”

“believe(s),” “may,” “will,” “would,” “could,” “should,” “seek(s)”

and similar expressions, or the negative of these terms, are

intended to identify such forward-looking statements.

Forward-looking statements speak only as of the date on which such

statements are made and, except in the normal course of the

Company’s public disclosure obligations, the Company expressly

disclaims any obligation to publicly release any updates or

revisions to any forward-looking statements to reflect any change

in the Company’s expectations or any change in events, conditions

or circumstances on which any statement is based. Forward-looking

statements are based on management’s current expectations and

beliefs and the Company can give no assurance that its expectations

or the events described will occur as described. Forward-looking

statements are subject to a number of risks and uncertainties that

could cause actual results to differ materially from those set

forth in or implied by such forward-looking statements. For a

further discussion of these and other factors that could cause the

company’s future results to differ materially from any

forward-looking statements, see the section entitled “Risk Factors”

in the company’s most recent annual report on Form 10-K, and other

risks described in documents subsequently filed by the company from

time to time with the Securities and Exchange Commission.

Notice Regarding Non-GAAP Financial

Measures:

In addition to U.S. GAAP financial measures, this press release

and the referenced supplemental financial and operating report

contain and may refer to certain non-GAAP financial measures. These

non-GAAP financial measures are in addition to, not a substitute

for or superior to, measures of financial performance prepared in

accordance with GAAP. These non-GAAP financial measures should not

be considered replacements for, and should be read together with,

the most comparable GAAP financial measures. Reconciliations to the

most directly comparable GAAP financial measures and statements of

why management believes these measures are useful to investors are

included in the supplemental financial and operating report, which

can be found in the investor relations section of our website.

Supplemental Materials and

Website:

Supplemental materials on the Third Quarter 2024 operating

results and other information on the Company are available on the

investors relations section of FCPT’s website at

investors.fcpt.com.

Four Corners Property

Trust

Consolidated Statements of

Income

(Unaudited)

(In thousands, except share

and per share data)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenues:

Rental revenue

$59,288

$57,243

$176,400

$162,267

Restaurant revenue

7,503

7,596

23,337

23,196

Total revenues

66,791

64,839

199,737

185,463

Operating expenses:

General and administrative

5,847

5,498

18,064

17,153

Depreciation and amortization

13,606

13,418

40,418

37,411

Property expenses

2,614

2,916

8,531

8,742

Restaurant expenses

7,029

7,229

21,925

21,721

Total operating expenses

29,096

29,061

88,938

85,027

Interest expense

(12,324)

(12,276)

(36,929)

(32,245)

Other income, net

331

283

721

809

Realized gain on sale, net

-

318

-

2,053

Income tax expense

(90)

89

(203)

(50)

Net income

25,612

24,192

74,388

71,003

Net income attributable to noncontrolling

interest

(31)

(31)

(91)

(92)

Net Income Attributable to Common

Shareholders

$25,581

$24,161

$74,297

$70,911

Basic net income per share

$0.27

$0.27

$0.80

$0.81

Diluted net income per share

$0.27

$0.27

$0.80

$0.80

Regular dividends declared per share

$0.3450

$0.3400

$1.0350

$1.0200

Weighted-average shares outstanding:

Basic

94,390,037

90,366,861

92,645,482

87,872,205

Diluted

94,877,995

90,595,872

93,061,647

88,105,134

Four Corners Property

Trust

Consolidated Balance

Sheets

(In thousands, except share

data)

September 30, 2024

December 31, 2023

ASSETS

(Unaudited)

Real estate investments:

Land

$1,289,751

$1,240,865

Buildings, equipment and improvements

1,783,185

1,708,556

Total real estate investments

3,072,936

2,949,421

Less: Accumulated depreciation

(766,401)

(738,946)

Total real estate investments, net

2,306,535

2,210,475

Intangible lease assets, net

118,473

118,027

Total real estate investments and

intangible lease assets, net

2,425,008

2,328,502

Real estate held for sale

-

-

Cash and cash equivalents

44,495

16,322

Straight-line rent adjustment

68,095

64,752

Derivative assets

14,495

20,952

Deferred tax assets

1,401

1,248

Other assets

10,850

19,858

Total Assets

$2,564,344

$2,451,634

LIABILITIES AND EQUITY

Liabilities:

Term loan and revolving credit facility

($515,000 and $446,000 of principal, respectively)

$510,760

$441,745

Senior unsecured notes

621,476

670,944

Dividends payable

33,218

31,539

Rent received in advance

13,187

14,309

Derivative liabilities

7,373

2,968

Other liabilities

23,589

30,266

Total liabilities

1,209,603

1,191,771

Equity:

Preferred stock, $0.0001 par value per

share, 25,000,000 shares authorized, zero shares issued and

outstanding

-

-

Common stock, $0.0001 par value per share,

500,000,000 shares authorized, 96,510,405 and 91,617,477 shares

issued and outstanding, respectively

10

9

Additional paid-in capital

1,390,314

1,261,940

Accumulated other comprehensive income

10,792

21,977

Noncontrolling interest

2,172

2,213

Accumulated deficit

(48,547)

(26,276)

Total equity

1,354,741

1,259,863

Total Liabilities and Equity

$2,564,344

$2,451,634

Four Corners Property

Trust

FFO and AFFO

(Unaudited)

(In thousands, except share

and per share data)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Funds from operations (FFO):

Net income

$25,612

$24,192

$74,388

$71,003

Depreciation and amortization

13,572

13,382

40,312

37,308

Realized gain on sales of real estate

-

(318)

-

(2,053)

FFO (as defined by NAREIT)

$39,184

$37,256

$114,700

$106,258

Straight-line rental revenue

(1,056)

(1,719)

(3,343)

(4,358)

Deferred income tax benefit (1)

(61)

(184)

(153)

(232)

Stock-based compensation

1,815

1,472

5,186

4,798

Non-cash amortization of deferred

financing costs

653

592

1,944

1,720

Non-real estate investment

depreciation

34

36

106

103

Other non-cash revenue adjustments

511

526

1,563

1,510

Adjusted Funds from Operations

(AFFO)

$41,080

$37,979

$120,003

$109,799

Fully diluted shares outstanding (2)

94,992,554

90,710,431

93,176,206

88,219,693

FFO per diluted share

$0.41

$0.41

$1.23

$1.20

AFFO per diluted share

$0.43

$0.42

$1.29

$1.24

(1) Amount represents non-cash deferred

income tax benefit recognized at the Kerrow Restaurant Business

(2) Assumes the issuance of common shares

for OP units held by non-controlling interest

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030585942/en/

FCPT Bill Lenehan, 415-965-8031 CEO

Patrick Wernig, 415-965-8038 CFO

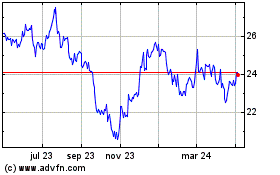

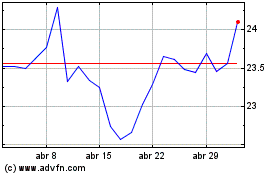

Four Corners Property (NYSE:FCPT)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Four Corners Property (NYSE:FCPT)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024