Third Quarter 2024

Highlights:

- Gross premiums written of $741.9 million; growth of 25.2%

from the third quarter of 2023

- Combined ratio of 87.4%

- Annualized operating return on opening common equity

(“Operating ROE”) of 16.8% and annualized operating return on

average common equity (“Operating ROAE”) of 16.4%

- Net income of $100.6 million, or $0.88 per diluted common

share and operating net income of $105.1 million, or $0.92 per

diluted common share

- Repurchased 4,279,983 common shares for $66.8 million, at a

weighted average cost per share, including commission expenses, of

$15.61

Nine Months Ended September 30, 2024

Highlights:

- Gross premiums written of $3.4 billion; growth of 23.4% from

nine months ended September 30, 2023

- Combined ratio of 88.6%

- Annualized Operating ROE of 13.9% and annualized Operating

ROAE of 13.3%

- Net income of $235.5 million, or $2.02 per diluted common

share and operating net income of $255.3 million, or $2.18 per

diluted common share

- Book value per diluted common share was $23.43 at September

30, 2024, an increase of 13.2% from December 31, 2023 of

$20.69

- Repurchased 6,570,003 common shares for $105.5 million, at a

weighted average cost per share, including commission expenses, of

$16.06

Fidelis Insurance Holdings Limited (“Fidelis” or “FIHL” or “the

Group”) (NYSE: FIHL) announced today its financial results for the

third quarter ended September 30, 2024.

Dan Burrows, Group Chief Executive Officer of Fidelis Insurance

Group, commented, “The results of the third quarter once again

demonstrate the strength of our business, the steps we have taken

to optimize our risk-adjusted returns, and our disciplined approach

to capital management. We delivered 25% growth in gross premiums

written, a combined ratio of 87.4% and annualized Operating ROAE of

16.4%. In addition, given the strength of our capital position, we

have continued to return excess capital to shareholders, including

repurchases of $66.8 million of common shares, demonstrating our

commitment to enhancing shareholder value.

"Looking ahead, we remain focused on leveraging our scale and

positioning, capitalizing on our ability to identify compelling

opportunities and produce superior underwriting results. We are

pleased with the momentum in our business and continue to pursue

attractive growth and value creation for shareholders.”

Third Quarter 2024 Consolidated

Results

- Net income for the third quarter of 2024 was $100.6 million, or

$0.88 per diluted common share. Operating net income was $105.1

million, or $0.92 per diluted common share.

- Underwriting income for the third quarter of 2024 was $80.0

million and the combined ratio was 87.4%, compared to underwriting

income of $74.8 million and a combined ratio of 85.4% for the third

quarter of 2023.

- Catastrophe and large losses for the third quarter of 2024 were

$91.6 million compared to $79.9 million in the prior year

period.

- Net favorable prior year loss reserve development for the third

quarter of 2024 was $10.1 million compared to $43.3 million in the

prior year period.

- Net investment income for the third quarter of 2024 was $52.1

million compared to $33.1 million in the prior year period.

Purchased $437.6 million of fixed income securities at an average

yield of 4.6%.

- Operating ROE of 4.2%, or 16.8% annualized, in the quarter

compared to 4.6%, or 18.4% annualized in the prior year

period.

- Operating ROAE of 4.1%, or 16.4% annualized, in the quarter

compared to 4.4%, or 17.6% annualized in the prior year

period.

Nine Months Ended September 30, 2024

Consolidated Results

- Net income for the nine months ended September 30, 2024, was

$235.5 million, or $2.02 per diluted common share. Operating net

income was $255.3 million, or $2.18 per diluted common share.

- Underwriting income for the nine months ended September 30,

2024, was $185.9 million and the combined ratio was 88.6%, compared

to underwriting income of $232.9 million and a combined ratio of

82.4% for the nine months ended September 30, 2023.

- Catastrophe and large losses for the nine months ended

September 30, 2024, were $375.8 million compared to $187.3 million

in the prior year period.

- Net favorable prior year loss reserve development of $145.7

million compared to $47.8 million in the prior year period.

- Net investment income of $139.1 million compared to $80.8

million in the prior year period. Purchased $1.5 billion of fixed

income securities at an average yield of 4.9%. At September 30,

2024 the current book yield was 4.9%.

- Operating ROE of 10.4%, or 13.9% annualized, in the nine months

ended September 30, 2024, compared to 14.7%, or 19.6% annualized in

the prior year period.

- Operating ROAE of 10.0%, or 13.3% annualized, in the nine

months ended September 30, 2024, compared to 13.3%, or 17.7%

annualized in the prior year period.

- Book value per diluted common share was $23.43 at September 30,

2024 (dilutive shares at September 30, 2024 of 636,971), compared

to $20.69 at December 31, 2023.

The following table details key financial indicators in

evaluating our performance for the three and nine months ended

September 30, 2024 and 2023:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

($ in millions, except for per

share data)

Net income

$

100.6

$

87.7

$

235.5

$

1,904.2

Operating net income(1)

105.1

90.7

255.3

263.5

Gross premiums written

741.9

592.6

3,449.4

2,795.1

Net premiums earned

634.5

509.7

1,623.6

1,324.8

Catastrophe and large losses

91.6

79.9

375.8

187.3

Net favorable prior-year reserve

development

10.1

43.3

145.7

47.8

Net investment income

$

52.1

$

33.1

$

139.1

$

80.8

Combined ratio

87.4

%

85.4

%

88.6

%

82.4

%

Operating ROE(1)

4.2

%

4.6

%

10.4

%

14.7

%

Operating ROAE(1)

4.1

%

4.4

%

10.0

%

13.3

%

Earnings per diluted common share

$

0.88

$

0.74

$

2.02

$

16.82

Operating EPS(1)

$

0.92

$

0.77

$

2.18

$

2.33

________________

(1) Operating net income, Operating ROE,

Operating ROAE and Operating EPS are non-GAAP financial measures.

See definition and reconciliation in “Non-GAAP Financial

Measures.”

Segment Results

Specialty Segment

The following table is a summary of our Specialty segment’s

underwriting results:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

Change

2024

2023

Change

($ in millions)

Gross premiums written

$

398.4

$

326.9

$

71.5

$

2,188.9

$

1,818.3

$

370.6

Reinsurance premium ceded

(113.2

)

(123.3

)

10.1

(851.4

)

(659.9

)

(191.5

)

Net premiums written

285.2

203.6

81.6

1,337.5

1,158.4

179.1

Net premiums earned

372.0

294.6

77.4

1,073.4

868.0

205.4

Losses and loss adjustment expenses

(182.3

)

(138.3

)

(44.0

)

(545.9

)

(416.4

)

(129.5

)

Policy acquisition expenses

(122.4

)

(83.4

)

(39.0

)

(313.4

)

(227.2

)

(86.2

)

Underwriting income

$

67.3

$

72.9

$

(5.6

)

$

214.1

$

224.4

$

(10.3

)

Loss ratio

49.0

%

46.9

%

2.1 pts

50.9

%

48.0

%

2.9 pts

Policy acquisition expense ratio

32.9

%

28.3

%

4.6 pts

29.2

%

26.2

%

3.0 pts

Underwriting ratio

81.9

%

75.2

%

6.7 pts

80.1

%

74.2

%

5.9 pts

For the three months ended September 30, 2024, our GPW increased

primarily driven by growth from new business and increased rates in

our Property D&F and Marine lines of business, partially offset

by decreases in our Property and Energy lines of business as a

result of timing of certain renewals.

For the nine months ended September 30, 2024, our GPW increased

primarily driven by growth from new business and improved rates in

our Property D&F, Property, and Marine lines of business,

partially offset by a decrease in our Aviation and Aerospace line

of business where certain deals did not meet our underwriting

criteria and rating hurdles.

For the three and nine months ended September 30, 2024, our NPE

increased due to earnings from higher net premiums written in the

current and prior year periods.

For the three and nine months ended September 30, 2024, our

policy acquisition expense ratio increased due to higher variable

commissions in certain lines of business and changes in the mix of

business written and ceded.

The following table is a summary of our Specialty segment’s

losses and loss adjustment expenses:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

Change

2024

2023

Change

($ in millions)

Attritional losses

$

105.3

$

103.7

$

1.6

$

300.0

$

255.9

$

44.1

Catastrophe and large losses

63.0

37.3

25.7

280.4

127.8

152.6

(Favorable)/adverse prior year

development

14.0

(2.7

)

16.7

(34.5

)

32.7

(67.2

)

Losses and loss adjustment expenses

$

182.3

$

138.3

$

44.0

$

545.9

$

416.4

$

129.5

Loss ratio - attritional losses

28.3

%

35.2

%

(6.9) pts

27.9

%

29.5

%

(1.6) pts

Loss ratio - catastrophe and large

losses

16.9

%

12.6

%

4.3 pts

26.2

%

14.7

%

11.5 pts

Loss ratio - prior accident years

3.8

%

(0.9

)%

4.7 pts

(3.2

)%

3.8

%

(7.0) pts

Loss ratio

49.0

%

46.9

%

2.1 pts

50.9

%

48.0

%

2.9 pts

For the three and nine months ended September 30, 2024, our loss

ratio in the Specialty segment increased by 2.1 points and 2.9

points, respectively, compared to the prior year periods.

The attritional loss ratio in the three months and nine months

ended September 30, 2024, improved by 6.9 points and 1.6 points,

respectively, compared to the prior year periods due to a lower

level of small losses in the current year periods.

The catastrophe and large losses in the three months ended

September 30, 2024, were primarily attributable to Hurricane Helene

and European storm Boris, impacting our Property D&F and Marine

lines of business. This compared to the prior period catastrophe

and large losses related primarily to loss events in various lines

of business including, Energy, Marine, and Aviation and Aerospace,

and losses related to the Hawaii wildfires in our Property D&F

line of business.

The catastrophe and large losses in the nine months ended

September 30, 2024 related to losses from the Baltimore Bridge

collapse in our Marine line of business, severe convective storms,

Hurricane Helene and European storm Boris in the Property D&F

and Marine lines of business, together with other smaller losses in

various lines of business. This compared to prior year period

catastrophe and large losses related to our Property D&F line

of business where we experienced losses from severe convective

storms in the U.S. and the Hawaii wildfires, our Aviation and

Aerospace line of business where we experienced losses from the

Sudan conflict, and loss events in various lines of business

including, Energy, Marine, and Aviation and Aerospace.

The adverse prior year development for the three months ended

September 30, 2024, was driven by increased estimates in our

Aviation and Aerospace line of business, partially offset by better

than expected loss emergence in our Property D&F line of

business.

The favorable prior year development for the nine months ended

September 30, 2024, was driven primarily by better than expected

loss emergence in our Property D&F and Marine lines of

business, partially offset by an increase in our Aviation and

Aerospace line of business.

Bespoke Segment

The following table is a summary of our Bespoke segment’s

underwriting results:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

Change

2024

2023

Change

($ in millions)

Gross premiums written

$

185.8

$

161.7

$

24.1

$

429.9

$

367.2

$

62.7

Reinsurance premium ceded

(76.7

)

(83.6

)

6.9

(240.1

)

(177.3

)

(62.8

)

Net premiums written

109.1

78.1

31.0

189.8

189.9

(0.1

)

Net premiums earned

105.0

98.8

6.2

287.9

280.4

7.5

Losses and loss adjustment expenses

(19.4

)

(43.2

)

23.8

(75.7

)

(72.5

)

(3.2

)

Policy acquisition expenses

(37.4

)

(34.9

)

(2.5

)

(101.1

)

(105.1

)

4.0

Underwriting income

$

48.2

$

20.7

$

27.5

$

111.1

$

102.8

$

8.3

Loss ratio

18.5

%

43.7

%

(25.2) pts

26.3

%

25.9

%

0.4 pts

Policy acquisition expense ratio

35.6

%

35.3

%

0.3 pts

35.1

%

37.5

%

(2.4) pts

Underwriting ratio

54.1

%

79.0

%

(24.9) pts

61.4

%

63.4

%

(2.0) pts

For the three and nine months ended September 30, 2024, our GPW

increased primarily driven by new business in our Bespoke Other

line of business, partially offset by timing of renewals in our

Credit & Political Risk line of business. Gross premiums

written in Bespoke can be opportunistic in nature and premiums

written may fluctuate on a quarterly basis due to the timing and

selection of the contracts we underwrite.

For the three and nine months ended September 30, 2024, our NPE

remained consistent compared to the prior year periods.

Our policy acquisition expense ratio for the three and nine

months ended September 30, 2024 changed due to changes in the mix

of business written and ceded, and commissions earned from

reinsurance partners.

The following table is a summary of our Bespoke segment’s losses

and loss adjustment expenses:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

Change

2024

2023

Change

($ in millions)

Attritional losses

$

17.1

$

28.3

$

(11.2

)

$

60.7

$

67.1

$

(6.4

)

Large losses

13.4

27.2

(13.8

)

77.2

34.0

43.2

Favorable prior year development

(11.1

)

(12.3

)

1.2

(62.2

)

(28.6

)

(33.6

)

Losses and loss adjustment expenses

$

19.4

$

43.2

$

(23.8

)

$

75.7

$

72.5

$

3.2

Loss ratio - attritional losses

16.3

%

28.6

%

(12.3) pts

21.1

%

23.9

%

(2.8) pts

Loss ratio - large losses

12.8

%

27.5

%

(14.7) pts

26.8

%

12.2

%

14.6 pts

Loss ratio - prior accident years

(10.6

)%

(12.4

)%

1.8 pts

(21.6

)%

(10.2

)%

(11.4) pts

Loss ratio

18.5

%

43.7

%

(25.2) pts

26.3

%

25.9

%

0.4 pts

For the three months ended September 30, 2024, our loss ratio in

the Bespoke segment improved by 25.2 points compared to the prior

year period, driven by a decrease in our large loss ratio and lower

attritional losses in the period.

For the nine months ended September 30, 2024, our loss ratio in

the Bespoke segment increased by 0.4 points compared to the prior

year period, driven by an increase in our large loss ratio,

partially offset by higher prior year favorable development in the

period.

The attritional loss ratio for the three and nine months ended

September 30, 2024, improved by 12.3 points and 2.8 points compared

to the prior year periods due to a lower level of small losses in

the current year periods.

The large losses in the three months ended September 30, 2024

related to our Bespoke Other line of business. The large losses in

the nine months ended September 30, 2024 related to intellectual

property losses in our Credit & Political Risk line of

business. The large losses in the three and nine months ended

September 30, 2023 related to intellectual property losses in our

Credit & Political Risk line of business.

The favorable prior year development for the three and nine

months ended September 30, 2024 was driven by benign attritional

experience and favorable claims settlements.

Reinsurance Segment

The following table is a summary of our Reinsurance segment’s

underwriting results:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

Change

2024

2023

Change

($ in millions)

Gross premiums written

$

157.7

$

104.0

$

53.7

$

830.6

$

609.6

$

221.0

Reinsurance premium ceded

(84.1

)

(73.1

)

(11.0

)

(442.0

)

(370.5

)

(71.5

)

Net premiums written

73.6

30.9

42.7

388.6

239.1

149.5

Net premiums earned

157.5

116.3

41.2

262.3

176.4

85.9

Losses and loss adjustment expenses

(36.1

)

(10.2

)

(25.9

)

(21.2

)

(20.7

)

(0.5

)

Policy acquisition expenses

(36.9

)

(32.5

)

(4.4

)

(60.7

)

(45.6

)

(15.1

)

Underwriting income

$

84.5

$

73.6

$

10.9

$

180.4

$

110.1

$

70.3

Loss ratio

22.9

%

8.8

%

14.1 pts

8.1

%

11.7

%

(3.6) pts

Policy acquisition expense ratio

23.4

%

27.9

%

(4.5) pts

23.1

%

25.9

%

(2.8) pts

Underwriting ratio

46.3

%

36.7

%

9.6 pts

31.2

%

37.6

%

(6.4) pts

For the three and nine months ended September 30, 2024, GPW

increased driven by new business as well as rate increases, while

NPE increased driven by earnings from higher net premiums written

in the current year periods.

For the three and nine months ended September 30, 2024, our

policy acquisition expense ratio decreased, primarily due to change

in business mix and the impact of commissions on outwards

reinsurance.

The following table is a summary of our Reinsurance segment’s

losses and loss adjustment expenses:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

Change

2024

2023

Change

($ in millions)

Attritional losses

$

33.9

$

23.1

$

10.8

$

52.0

$

47.1

$

4.9

Catastrophe and large losses

15.2

15.4

(0.2

)

18.2

25.5

(7.3

)

Favorable prior year development

(13.0

)

(28.3

)

15.3

(49.0

)

(51.9

)

2.9

Losses and loss adjustment expenses

$

36.1

$

10.2

$

25.9

$

21.2

$

20.7

$

0.5

Loss ratio - attritional losses

21.5

%

19.9

%

1.6 pts

19.9

%

26.6

%

(6.7) pts

Loss ratio - catastrophe and large

losses

9.7

%

13.2

%

(3.5) pts

6.9

%

14.5

%

(7.6) pts

Loss ratio - prior accident years

(8.3

)%

(24.3

)%

16.0 pts

(18.7

)%

(29.4

)%

10.7 pts

Loss ratio

22.9

%

8.8

%

14.1 pts

8.1

%

11.7

%

(3.6) pts

For the three months ended September 30, 2024, our loss ratio in

the Reinsurance segment increased by 14.1 points compared to the

prior year period, as a result of lower favorable prior year

development.

The loss ratio improved by 3.6 points for the nine months ended

September 30, 2024, compared to the prior year period, due to

improvements in our attritional and catastrophe and large loss

ratios, partially offset by lower favorable prior year

development.

The attritional loss ratio in the three months ended September

30, 2024 increased by 1.6 points compared to the prior year period,

both of which were benign in terms of attritional losses.

The attritional loss ratio in the nine months ended September

30, 2024, improved by 6.7 points due to favorable experience

compared to the prior year period.

The catastrophe and large losses in the three and nine months

ended September 30, 2024 were primarily from Hurricane Helene.

For the three and nine months ended September 30, 2024,

favorable prior year development was driven by positive development

on catastrophe losses and benign prior year attritional

experience.

Other Underwriting Expenses

We do not allocate The Fidelis Partnership commissions or

general and administrative expenses by segment.

The Fidelis Partnership Commissions

For the three and nine months ended September 30, 2024, The

Fidelis Partnership commissions were $97.3 million and $249.0

million, respectively, or 15.3% and 15.3% of the combined ratio,

respectively, (2023: $70.6 million and $147.4 million or 13.9% and

11.1% of the combined ratio) and comprise ceding and profit

commissions as part of the Framework Agreement effective from

January 1, 2023. The increase was due to the full impact of earning

such commissions since January 1, 2023 together with the increase

in net premiums earned. The Fidelis Partnership manages

origination, underwriting, underwriting administration, outwards

reinsurance and claims handling under delegated authority

agreements with the Group.

The following table summarizes The Fidelis Partnership

commissions earned:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

($ in millions)

Ceding commission expense

$

84.2

$

56.3

$

225.3

$

107.4

Profit commission expense

13.1

14.3

23.7

40.0

Total commissions

$

97.3

$

70.6

$

249.0

$

147.4

Ceding commission expense ratio

13.2

%

11.1

%

13.8

%

8.1

%

Profit commission expense ratio

2.1

%

2.8

%

1.5

%

3.0

%

Total Fidelis Partnership commissions

ratio

15.3

%

13.9

%

15.3

%

11.1

%

General and Administrative Expenses

For the three and nine months ended September 30, 2024, general

and administrative expenses were $22.7 million and $70.7 million,

respectively, or 3.6% and 4.4% of the combined ratio, respectively

(2023: $21.8 million and $57.0 million or 4.3% and 4.3% of the

combined ratio). For the three months ended, the general and

administrative expense remained consistent compared to the prior

year period. For the nine months ended, the increase was driven

primarily by employment costs relating to increased head count to

support the growth of the business.

Investments

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

($ in millions)

Net investment income

$

52.1

$

33.1

$

139.1

$

80.8

Net realized and unrealized investment

losses

(0.5

)

(5.3

)

(16.5

)

(2.4

)

Net investment return

$

51.6

$

27.8

$

122.6

$

78.4

Net Investment Income

The increase in our net investment income in the three and nine

months ended September 30, 2024, was due to the increase in

investible assets and a higher yield achieved on the fixed income

portfolio and cash balances. During the three and nine months ended

September 30, 2024, we purchased $437.6 million and $1.5 billion,

respectively, of fixed maturity securities at an average yield of

4.6% and 4.9%, respectively.

Net Realized and Unrealized Investment Gains/(Losses)

The net realized and unrealized investment losses in the three

and nine months ended September 30, 2024 resulted primarily from

realized losses on the sale of $203.0 million and $632.0 million,

respectively, of fixed maturity securities with an average yield of

1.0% and 1.1%, respectively, the proceeds of which were reinvested

at higher yields.

Conference Call

Fidelis will host a teleconference to discuss its financial

results on Wednesday, November 13, 2024, at 9:00 a.m. Eastern time.

The call can be accessed by dialing 1-800-549-8228 (U.S. callers),

or 1-289-819-1520 (international callers), and entering the

passcode 83511 approximately 10 minutes in advance of the call. A

live, listen-only webcast of the call will also be available via

the Investors section of the Company’s website at

https://investors.fidelisinsurance.com. A recording of the webcast

will be available in the Investor Relations section of the

Company’s website approximately two hours after the event concludes

and will be archived on the site for one year.

About Fidelis Insurance Group

Fidelis Insurance Group is a global specialty insurer,

leveraging strategic partnerships to offer innovative and tailored

insurance solutions.

We have a highly diversified portfolio focused on three

segments: Specialty, Bespoke, and Reinsurance, which we believe

allows us to take advantage of the opportunities presented by

evolving (re)insurance markets, proactively shift our business mix

across market cycles, and produce superior underwriting

returns.

Headquartered in Bermuda, with worldwide offices including

Ireland and the UK, Fidelis Insurance Group operating companies

have a financial strength rating of A from AM Best, A- from S&P

and A3 from Moody’s. For additional information about Fidelis

Insurance, our people, and our products please visit our website at

www.FidelisInsurance.com.

Non-GAAP Financial Measures

This Press Release includes, and the related conference call

will include, certain financial measures that are not calculated in

accordance with generally accepted accounting principles in the

U.S. (“U.S. GAAP”) including Operating net income, Operating EPS,

Operating ROE and Operating ROAE, attritional loss ratio and

catastrophe and large loss ratio, and therefore are non-U.S. GAAP

financial measures. Reconciliations of such measures to the most

comparable U.S. GAAP figures are included in the attached financial

information in accordance with Regulation G.

RPI Measure

Renewal price index (“RPI”) is a measure that Fidelis has used

to assess an approximate index of rate increases on a particular

set of contracts, using the base of 100% for the rates for the

relevant prior year. Although management considers RPI to be an

appropriate statistical measure, it is not a financial measure that

directly relates to the Fidelis consolidated financial results.

Management’s calculation of RPI involves a degree of judgment in

relation to comparability of contracts and the relative impacts of

changes in price, exposure, retention levels, as well as any other

changing terms and conditions on the RPI calculation. Consideration

is given to potential renewals of a comparable nature so it does

not reflect every contract in Fidelis’ portfolio. The future

profitability and performance of a portfolio of contracts expressed

within the RPI is dependent upon many factors besides the trends in

premium rates, including policy terms, conditions and wording.

Safe Harbor Regarding Forward-Looking Statements

This press release, related posts on our website and LinkedIn

and the related discussion and analysis relating to our financial

results for the third quarter ended September 30, 2024, contain,

and our officers and representatives may from time to time make

(including on our related earnings conference call),

“forward-looking statements" which include all statements that do

not relate solely to historical or current facts and which may

concern our strategy, plans, targets, projections or intentions and

are made pursuant to the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements can be identified by words such as: “continue,” “grow,”

“opportunity,” “create,” “anticipate,” “intend,” “plan,” “goal,”

“seek,” “believe,” “project,” “estimate,” “target,” “expect,”

“evolve,” “achieve,” “remain,” “proactive,” “pursue,” “optimize,”

“emerge,” “seek,” “build,” “looking ahead,” “commit,” “strategy,”

“predict,” “potential,” “assumption,” “future,” “likely,” “may,”

“should,” “could,” “will” and the negative of these and also

similar terms and phrases. Forward-looking statements are neither

historical facts nor assurances of future performance. Instead,

they are qualified by these cautionary statements, because they are

based only on our current beliefs, expectations and assumptions

regarding the future of our business, future plans and strategies,

targets, projections, anticipated events and trends, the economy

and other future conditions, but are subject to significant

business, economic and competitive uncertainties, many of which are

beyond our control or are subject to change. Our actual results and

financial condition may differ materially from those indicated in

the forward-looking statements. Therefore, you should not rely on

any of these forward-looking statements.

Examples of forward-looking statements include, among others,

statements we make in relation to: targeted operating results such

as return on equity, net earnings and net earnings per share,

underwriting profitability and target combined, loss and expense

ratios, growth in gross written premiums and book value; our

expectations regarding our business and capital management strategy

and the performance of our business; information regarding our

estimates for catastrophes and other loss events; our liquidity and

capital resources; and expectations of the effect on our financial

condition of claims, litigation, environmental costs, contingent

liabilities and governmental and regulatory investigations and

proceedings.

Our actual results in the future could differ materially from

those anticipated in any forward-looking statements as a result of

changes in assumptions, risks, uncertainties and other factors

impacting us, many of which are outside our control, including:

- the recent trend of premium rate hardening and factors likely

to drive continued rate hardening or a softening leading to a

cyclical downturn of pricing in the (re)insurance industry;

- the development and pattern of earned and written premiums

impacting embedded premium value;

- our ability to manage risks associated with macroeconomic

conditions resulting from any public health crisis, rising energy

prices, inflation and interest rates, current or anticipated

military conflict or terrorism, including the ongoing Ukraine

Conflict and the escalation of conflict in the Middle East,

sanctions and other geopolitical events globally;

- changes to our strategic relationship with The Fidelis

Partnership and our dependence on the Delegated Underwriting

Authority Agreements for our underwriting and claims-handling

operations;

- our ability to successfully implement our long-term strategy

and compete successfully with more established competitors and

increased competition relating to consolidation in the reinsurance

and insurance industries;

- the possibility of greater frequency or severity of claims and

loss activity than our underwriting, reserving or investment

practices have anticipated;

- the reliability of pricing, accumulation and estimated loss

models;

- the impact of complex causation and coverage issues associated

with attribution of losses;

- the actual development of losses and expenses impacting

estimates for claims which arose as a result of loss activity,

particularly for events where estimates are preliminary until the

development of such reserves based on emerging information over

time;

- any downgrades, potential downgrades or other negative actions

by rating agencies relating to us or our industry;

- our dependence on key executives and ability to attract

qualified personnel;

- our dependence on letter of credit facilities that may not be

available on commercially acceptable terms;

- our potential inability to pay dividends or distributions in

accordance with our current dividend policy, due to changing

conditions;

- availability of outwards reinsurance on commercially acceptable

terms;

- the recovery of losses and reinstatement premiums from our

reinsurance providers;

- our potential need for additional capital in the future and the

potential unavailability of such capital to us on favorable terms

or at all;

- our dependence on clients’ evaluation of risks associated with

such clients’ insurance underwriting;

- the suspension or revocation of our subsidiaries’ insurance

licenses;

- our potentially being subject to certain adverse tax or

regulatory consequences in the U.S., U.K. or Bermuda;

- risks associated with our investment strategy such as market

risk, interest rate risk, currency risk and credit default

risk;

- the impact of tax reform and changes in the regulatory

environment and the potential for greater regulatory scrutiny of

the Group as a result of the outsourcing arrangements;

- heightened risk of cybersecurity incidents and their potential

impact on our business;

- the impact of inflation or deflation in relevant economies in

which we operate;

- our ability to evaluate and measure our business, prospects and

performance metrics and respond accordingly;

- the failure of our risk management policies and procedures to

be adequate to identify, monitor and manage risks, which may leave

us exposed to unidentified or unanticipated risks;

- operational failures, including the operational risk associated

with outsourcing to The Fidelis Partnership, failure of information

systems or failure to protect the confidentiality of customer

information, including by service providers, or losses due to

defaults, errors or omissions by third parties and affiliates;

- risks relating to our ability to identify and execute

opportunities for growth or our ability to complete transactions as

planned or realize the anticipated benefits of our acquisitions or

other investments; and

- and those risks, uncertainties and other factors disclosed

under the section titled ‘Risk Factors’ in Fidelis Insurance

Holdings Limited’s Form 20-F filed with the SEC on March 15, 2024

(which such section is incorporated herein by reference), as well

as subsequent filings with the SEC available electronically at

www.sec.gov.

Any forward-looking statements, expectations, beliefs and

projections made by us in this release and on our related

conference call speak only as of the date referenced on such date

on which they are made and are expressed in good faith and our

management believes that there is reasonable basis for them, based

only on information currently available to us. However, there can

be no assurance that management’s expectations, beliefs, and

projections will be achieved and actual results may vary materially

from what is expressed or indicated by the forward-looking

statements. Furthermore, our past performance, and that of our

management team and of The Fidelis Partnership, should not be

construed as a guarantee of future performance. We undertake no

obligation to publicly update any forward-looking statement,

whether written or oral, that may be made from time to time,

whether as a result of new information, future developments or

otherwise.

FIDELIS INSURANCE HOLDINGS

LIMITED

Consolidated Balance

Sheets

At September 30, 2024

(Unaudited) and December 31, 2023

(Expressed in millions of U.S.

dollars, except share and per share amounts)

September 30,

2024

December 31, 2023

Assets

Fixed maturity securities,

available-for-sale, at fair value

(amortized cost: $3,471.8, 2023: $3,271.4

(net of allowances for credit losses of $0.3, 2023: $1.3))

$

3,535.3

$

3,244.9

Short-term investments,

available-for-sale, at fair value

(amortized cost: $133.1, 2023: $49.0 (net

of allowances for credit losses of $nil, 2023: $nil))

133.3

49.0

Other investments, at fair value

(amortized cost: $50.1, 2023: $50.8)

48.7

47.5

Total investments

3,717.3

3,341.4

Cash and cash equivalents

806.8

712.4

Restricted cash and cash equivalents

212.3

251.7

Accrued investment income

27.4

27.2

Premiums and other receivables (net of

allowances for credit losses of $13.4, 2023: $17.3)

2,808.1

2,209.3

Amounts due from The Fidelis Partnership

(net of allowances for credit losses of $nil, 2023: $nil)

248.5

173.3

Deferred reinsurance premiums

1,405.5

1,061.4

Reinsurance balances recoverable on paid

losses (net of allowances for credit losses of $nil, 2023:

$nil)

194.1

182.7

Reinsurance balances recoverable on

reserves for losses and loss adjustment expenses (net of allowances

for credit losses of $1.3, 2023: $1.3)

1,164.9

1,108.6

Deferred policy acquisition costs

(includes The Fidelis Partnership deferred

commissions of $220.8, 2023: $164.1)

926.3

786.6

Other assets

173.9

173.5

Total assets

$

11,685.1

$

10,028.1

Liabilities and shareholders'

equity

Liabilities

Reserves for losses and loss adjustment

expenses

$

2,800.8

$

2,448.9

Unearned premiums

3,789.3

3,149.5

Reinsurance balances payable

1,402.9

1,071.5

Amounts due to The Fidelis Partnership

410.7

334.5

Long term debt

448.8

448.2

Preference securities ($0.01 par,

redemption price and liquidation preference $10,000)

58.4

58.4

Other liabilities

141.9

67.3

Total liabilities

9,052.8

7,578.3

Commitments and contingencies

Shareholders' equity

Common shares ($0.01 par, issued and

outstanding: 111,726,363, 2023: 117,914,754)

1.2

1.2

Additional paid-in capital

2,043.6

2,039.0

Accumulated other comprehensive

income/(loss)

56.1

(27.0

)

Retained earnings

636.9

436.6

Common shares held in treasury, at cost

(shares held: 6,570,003, 2023: nil)

(105.5

)

—

Total shareholders' equity

2,632.3

2,449.8

Total liabilities and shareholders'

equity

$

11,685.1

$

10,028.1

FIDELIS INSURANCE HOLDINGS

LIMITED

Consolidated Statements of

Income and Comprehensive Income (Unaudited)

For the three and nine months

ended September 30, 2024 and September 30, 2023

(Expressed in millions of U.S.

dollars, except for share and per share amounts)

Three Months Ended

Nine Months Ended

September 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

Revenues

Gross premiums written

$

741.9

$

592.6

$

3,449.4

$

2,795.1

Reinsurance premiums ceded

(274.0

)

(280.0

)

(1,533.5

)

(1,207.7

)

Net premiums written

467.9

312.6

1,915.9

1,587.4

Change in net unearned premiums

166.6

197.1

(292.3

)

(262.6

)

Net premiums earned

634.5

509.7

1,623.6

1,324.8

Net investment income

52.1

33.1

139.1

80.8

Net realized and unrealized investment

losses

(0.5

)

(5.3

)

(16.5

)

(2.4

)

Other income

—

—

—

0.2

Total revenues before net gain on

distribution of The Fidelis Partnership

686.1

537.5

1,746.2

1,403.4

Net gain on distribution of The Fidelis

Partnership

—

—

—

1,639.1

Total revenues

686.1

537.5

1,746.2

3,042.5

Expenses

Losses and loss adjustment expenses

237.8

191.7

642.8

509.6

Policy acquisition expenses (includes The

Fidelis Partnership commissions of $97.3 and $249.0 (2023: $70.6

and $147.4))

294.0

221.4

724.2

525.3

General and administrative expenses

22.7

21.8

70.7

57.0

Corporate and other expenses

—

0.4

1.6

3.4

Net foreign exchange (gains)/losses

4.8

(2.4

)

4.9

(0.8

)

Financing costs

8.9

9.0

26.1

26.6

Total expenses

568.2

441.9

1,470.3

1,121.1

Income before income taxes

117.9

95.6

275.9

1,921.4

Income tax expense

(17.3

)

(7.9

)

(40.4

)

(17.2

)

Net income

$

100.6

$

87.7

$

235.5

$

1,904.2

Other comprehensive income

Unrealized gains/(losses) on

available-for-sale investments

$

79.0

$

(0.1

)

$

70.4

$

14.9

Reclassification of net realized losses

recognized in net income

6.0

0.2

19.5

0.6

Income tax (expense)/benefit, all of which

relates to unrealized gains/(losses) on available-for-sale

investments

(6.6

)

0.2

(6.8

)

(1.4

)

Total other comprehensive

income

78.4

0.3

83.1

14.1

Comprehensive income

$

179.0

$

88.0

$

318.6

$

1,918.3

Per share data

Earnings per common share

Earnings per common share

$

0.88

$

0.75

$

2.02

$

16.84

Earnings per diluted common share

$

0.88

$

0.74

$

2.02

$

16.82

Weighted average common shares

outstanding

114,445,447

117,681,835

116,390,461

113,100,521

Weighted average diluted common shares

outstanding

114,734,526

117,975,099

116,845,991

113,232,930

FIDELIS INSURANCE HOLDINGS

LIMITED

Consolidated Segment Data

(Unaudited)

For the three and nine months

ended September 30, 2024 and September 30, 2023

(Expressed in millions of U.S.

dollars)

Three Months Ended September

30, 2024

Specialty

Bespoke

Reinsurance

Other

Total

Gross premiums written

$

398.4

$

185.8

$

157.7

$

—

$

741.9

Net premiums written

285.2

109.1

73.6

—

467.9

Net premiums earned

372.0

105.0

157.5

—

634.5

Losses and loss adjustment expenses

(182.3

)

(19.4

)

(36.1

)

—

(237.8

)

Policy acquisition expenses

(122.4

)

(37.4

)

(36.9

)

(97.3

)

(294.0

)

General and administrative expenses

—

—

—

(22.7

)

(22.7

)

Underwriting income

67.3

48.2

84.5

(120.0

)

80.0

Net investment income

52.1

Net realized and unrealized investment

losses

(0.5

)

Corporate and other expenses

—

Net foreign exchange losses

(4.8

)

Financing costs

(8.9

)

Income before income taxes

117.9

Income tax expense

(17.3

)

Net income

$

100.6

Losses and loss adjustment expenses

incurred - current year

(168.3

)

(30.5

)

(49.1

)

$

(247.9

)

Losses and loss adjustment expenses

incurred - prior accident years

(14.0

)

11.1

13.0

10.1

Losses and loss adjustment expenses

incurred - total

$

(182.3

)

$

(19.4

)

$

(36.1

)

$

(237.8

)

Underwriting Ratios(1)

Loss ratio - current year

45.2

%

29.1

%

31.2

%

39.1

%

Loss ratio - prior accident years

3.8

%

(10.6

%)

(8.3

%)

(1.6

%)

Loss ratio - total

49.0

%

18.5

%

22.9

%

37.5

%

Policy acquisition expense ratio

32.9

%

35.6

%

23.4

%

31.0

%

Underwriting ratio

81.9

%

54.1

%

46.3

%

68.5

%

The Fidelis Partnership commissions

ratio

15.3

%

General and administrative expense

ratio

3.6

%

Combined ratio

87.4

%

________________

(1) Underwriting ratios are calculated by

dividing the related expense by net premiums earned.

Three Months Ended September

30, 2023

Specialty

Bespoke

Reinsurance

Other

Total

Gross premiums written

$

326.9

$

161.7

$

104.0

$

—

$

592.6

Net premiums written

203.6

78.1

30.9

—

312.6

Net premiums earned

294.6

98.8

116.3

—

509.7

Losses and loss adjustment expenses

(138.3

)

(43.2

)

(10.2

)

—

(191.7

)

Policy acquisition expenses

(83.4

)

(34.9

)

(32.5

)

(70.6

)

(221.4

)

General and administrative expenses

—

—

—

(21.8

)

(21.8

)

Underwriting income

72.9

20.7

73.6

(92.4

)

74.8

Net investment income

33.1

Net realized and unrealized investment

losses

(5.3

)

Corporate and other expenses

(0.4

)

Net foreign exchange gains

2.4

Financing costs

(9.0

)

Income before income taxes

95.6

Income tax expense

(7.9

)

Net income

$

87.7

Losses and loss adjustment expenses

incurred - current year

(141.0

)

(55.5

)

(38.5

)

$

(235.0

)

Losses and loss adjustment expenses

incurred - prior accident years

2.7

12.3

28.3

43.3

Losses and loss adjustment expenses

incurred - total

$

(138.3

)

$

(43.2

)

$

(10.2

)

$

(191.7

)

Underwriting Ratios(1)

Loss ratio - current year

47.8

%

56.1

%

33.1

%

46.1

%

Loss ratio - prior accident years

(0.9

%)

(12.4

%)

(24.3

%)

(8.5

%)

Loss ratio - total

46.9

%

43.7

%

8.8

%

37.6

%

Policy acquisition expense ratio

28.3

%

35.3

%

27.9

%

29.6

%

Underwriting ratio

75.2

%

79.0

%

36.7

%

67.2

%

The Fidelis Partnership commissions

ratio

13.9

%

General and administrative expense

ratio

4.3

%

Combined ratio

85.4

%

________________

(1) Underwriting ratios are calculated by

dividing the related expense by net premiums earned.

Nine months ended September

30, 2024

Specialty

Bespoke

Reinsurance

Other

Total

Gross premiums written

$

2,188.9

$

429.9

$

830.6

$

—

$

3,449.4

Net premiums written

1,337.5

189.8

388.6

—

1,915.9

Net premiums earned

1,073.4

287.9

262.3

—

1,623.6

Losses and loss adjustment expenses

(545.9

)

(75.7

)

(21.2

)

—

(642.8

)

Policy acquisition expenses

(313.4

)

(101.1

)

(60.7

)

(249.0

)

(724.2

)

General and administrative expenses

—

—

—

(70.7

)

(70.7

)

Underwriting income

214.1

111.1

180.4

(319.7

)

185.9

Net investment income

139.1

Net realized and unrealized investment

losses

(16.5

)

Corporate and other expenses

(1.6

)

Net foreign exchange losses

(4.9

)

Financing costs

(26.1

)

Income before income taxes

275.9

Income tax expense

(40.4

)

Net income

$

235.5

Losses and loss adjustment expenses

incurred - current year

(580.4

)

(137.9

)

(70.2

)

$

(788.5

)

Losses and loss adjustment expenses

incurred - prior accident years

34.5

62.2

49.0

145.7

Losses and loss adjustment expenses

incurred - total

$

(545.9

)

$

(75.7

)

$

(21.2

)

$

(642.8

)

Underwriting Ratios(1)

Loss ratio - current year

54.1

%

47.9

%

26.8

%

48.6

%

Loss ratio - prior accident years

(3.2

%)

(21.6

%)

(18.7

%)

(9.0

%)

Loss ratio - total

50.9

%

26.3

%

8.1

%

39.6

%

Policy acquisition expenses ratio

29.2

%

35.1

%

23.1

%

29.3

%

Underwriting ratio

80.1

%

61.4

%

31.2

%

68.9

%

The Fidelis Partnership commissions

ratio

15.3

%

General and administrative expenses

ratio

4.4

%

Combined ratio

88.6

%

________________

(1) Underwriting ratios are calculated by

dividing the related expense by net premiums earned.

Nine months ended September

30, 2023

Specialty

Bespoke

Reinsurance

Other

Total

Gross premiums written

$

1,818.3

$

367.2

$

609.6

$

—

$

2,795.1

Net premiums written

1,158.4

189.9

239.1

—

1,587.4

Net premiums earned

868.0

280.4

176.4

—

1,324.8

Losses and loss adjustment expenses

(416.4

)

(72.5

)

(20.7

)

—

(509.6

)

Policy acquisition expenses

(227.2

)

(105.1

)

(45.6

)

(147.4

)

(525.3

)

General and administrative expenses

—

—

—

(57.0

)

(57.0

)

Underwriting income

224.4

102.8

110.1

(204.4

)

232.9

Net investment income

80.8

Net realized and unrealized investment

gains

(2.4

)

Other income

0.2

Net gain on distribution of The Fidelis

Partnership

1,639.1

Corporate and other expenses

(3.4

)

Net foreign exchange losses

0.8

Financing costs

(26.6

)

Income before income taxes

1,921.4

Income tax expense

(17.2

)

Net income

$

1,904.2

Losses and loss adjustment expenses

incurred - current year

(383.7

)

(101.1

)

(72.6

)

$

(557.4

)

Losses and loss adjustment expenses

incurred - prior accident years

(32.7

)

28.6

51.9

47.8

Losses and loss adjustment expenses

incurred - total

$

(416.4

)

$

(72.5

)

$

(20.7

)

$

(509.6

)

Underwriting Ratios(1)

Loss ratio - current year

44.2

%

36.1

%

41.1

%

42.1

%

Loss ratio - prior accident years

3.8

%

(10.2

%)

(29.4

%)

(3.6

%)

Loss ratio - total

48.0

%

25.9

%

11.7

%

38.5

%

Policy acquisition expenses ratio

26.2

%

37.5

%

25.9

%

28.5

%

Underwriting ratio

74.2

%

63.4

%

37.6

%

67.0

%

The Fidelis Partnership commissions

ratio

11.1

%

General and administrative expenses

ratio

4.3

%

Combined ratio

82.4

%

________________

(1) Underwriting ratios are calculated by

dividing the related expense by net premiums earned.

FIDELIS INSURANCE HOLDINGS LIMITED

NON-GAAP FINANCIAL MEASURES RECONCILIATION

(UNAUDITED)

Attritional loss ratio and catastrophe and large loss

ratio: The attritional loss ratio is a non-GAAP measure of the

loss ratio excluding the impact of catastrophe and large losses.

Management believes that the attritional loss ratio is a

performance measure that is useful to investors as it excludes

losses that are not as predictable as to timing and amount. The

attritional loss ratio is calculated by dividing the current year

losses and loss adjustment expenses, excluding catastrophe and

large losses, by NPE. The catastrophe and large loss ratio is a

non-GAAP measure that is calculated by dividing the current year

catastrophe and large loss expense by NPE. The reconciliation of

these non-GAAP measures is included in each segment’s summary of

losses and loss adjustment expenses table.

Operating net income: is a non-GAAP financial measure of

our performance which does not consider the impact of certain

non-recurring and other items that may not properly reflect the

ordinary activities of our business, its performance or its future

outlook. This measure is calculated as net income excluding net

gain on distribution of The Fidelis Partnership, net realized and

unrealized investment gains/(losses), net foreign exchange

gains/(losses), and corporate and other expenses which include

warrant costs, reorganization expenses, any non-recurring income

and expenses, and the income tax effect on these items.

Return on average common equity (“ROAE”): represents net

income divided by average common shareholders’ equity.

Operating return on opening common equity (“Operating

ROE”): is a non-U.S. GAAP measure that represents a meaningful

comparison between periods of our financial performance expressed

as a percentage and is calculated as operating net income divided

by adjusted opening common shareholders’ equity.

Operating return on average common equity (“Operating

ROAE”): is a non-GAAP financial measure that represents a

meaningful comparison between periods of our financial performance

expressed as a percentage and is calculated as operating net income

divided by adjusted average common shareholders’ equity.

Operating net income per diluted share (“Operating EPS”):

is a non-GAAP financial measure that represents a valuable measure

of profitability and enables investors, analysts, rating agencies

and other users of Fidelis Insurance Group’s financial information

to more easily analyze Fidelis Insurance Group’s results in a

manner similar to how management analyzes Fidelis Insurance Group’s

underlying business performance. It is calculated by dividing

operating net income by the weighted average diluted Common Shares

outstanding.

The table below sets out the calculation of the adjusted common

shareholders’ equity, operating net income, ROAE, Operating ROE,

Operating ROAE and Operating EPS, for the three and nine months

ended September 30, 2024 and 2023.

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

($ in millions)

Net income

$

100.6

$

87.7

$

235.5

$

1,904.2

Adjustment for net gain on distribution of

The Fidelis Partnership

—

—

—

(1,639.1

)

Adjustment for net realized and unrealized

investment losses

0.5

5.3

16.5

2.4

Adjustment for net foreign exchange

(gains)/losses

4.8

(2.4

)

4.9

(0.8

)

Adjustment for corporate and other

expenses

—

0.4

1.6

3.4

Income tax effect of the above items

(0.8

)

(0.3

)

(3.2

)

(6.6

)

Operating net income

$

105.1

$

90.7

$

255.3

$

263.5

Average common shareholders'

equity

$

2,581.1

$

2,070.4

$

2,541.1

$

2,068.5

Opening common shareholders' equity

2,529.9

1,980.6

2,449.8

1,976.8

Adjustments related to the Separation

Transactions

—

—

—

(178.4

)

Adjusted opening common shareholders’

equity

2,529.9

1,980.6

2,449.8

1,798.4

Closing common shareholders' equity

2,632.3

2,160.1

2,632.3

2,160.1

Adjusted average common shareholders'

equity

$

2,581.1

$

2,070.4

$

2,541.1

$

1,979.3

Weighted average Common Shares

outstanding

114,445,447

117,681,835

116,390,461

113,100,521

Share-based compensation plans

289,079

293,264

455,530

132,409

Weighted average diluted Common Shares

outstanding

114,734,526

117,975,099

116,845,991

113,232,930

ROAE

3.9

%

4.2

%

9.3

%

92.1

%

Operating ROE

4.2

%

4.6

%

10.4

%

14.7

%

Operating ROAE

4.1

%

4.4

%

10.0

%

13.3

%

Earnings per diluted Common

Share

$

0.88

$

0.74

$

2.02

$

16.82

Operating EPS

$

0.92

$

0.77

$

2.18

$

2.33

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112254817/en/

Fidelis Insurance Group Investor Contact: Fidelis

Insurance Group Miranda Hunter +1 (441) 279 2561

miranda.hunter@fidelisinsurance.com Fidelis Insurance Group

Media Contacts: Rein4ce Sarah Hills +44 (0)7718 882011

sarah.hills@rein4ce.co.uk

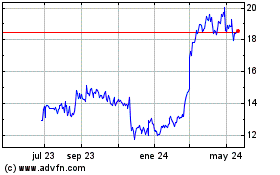

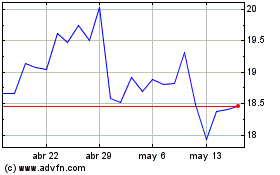

Fidelis Insurance (NYSE:FIHL)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Fidelis Insurance (NYSE:FIHL)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024