false000150707900015070792024-08-012024-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2024

Floor & Decor Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-38070 | 27-3730271 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | | | | |

| 2500 Windy Ridge Parkway SE | 30339 |

| Atlanta, | Georgia |

| (Address of principal executive offices) | (Zip Code) |

(404) 471-1634

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, $0.001 par value per share | FND | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 1, 2024, Floor & Decor Holdings, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended June 27, 2024. The text of the press release is included as Exhibit 99.1 to this Form 8-K.

The information disclosed under this Item 2.02, including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 and shall not be deemed incorporated by reference into any filing made under the Securities Act of 1933, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

| | | | | |

| Exhibit Number | Description |

| |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| FLOOR & DECOR HOLDINGS, INC. |

| | | |

| | | |

| | | |

Date: August 1, 2024 | | By: | /s/ David V. Christopherson |

| | Name: | David V. Christopherson |

| | Title: | Executive Vice President, Chief Administrative Officer and Chief Legal Officer |

Floor & Decor Holdings, Inc. Announces Second Quarter Fiscal 2024 Financial Results

Net sales of $1,133.1 million decreased 0.2% from the second quarter of fiscal 2023

Comparable store sales decreased 9.0%

Diluted earnings per share of $0.52

Opened five new warehouse stores

ATLANTA--(BUSINESS WIRE)--August 1, 2024--Floor & Decor Holdings, Inc. (NYSE: FND) (“We,” “Our,” the “Company,” or “Floor & Decor”) announces its financial results for the second quarter of fiscal 2024, which ended June 27, 2024.

Tom Taylor, Chief Executive Officer, stated, “We and our industry continue to contend with monetary policy affecting the housing market and repair and remodeling spending, including ongoing soft demand for large project discretionary hard surface flooring. Consequently, our second quarter total and comparable store sales were modestly below our expectations. However, our gross margin rate exceeded our expectations, which, coupled with prudent expense management, helped mitigate most of the impact from weak sales. This dynamic enabled us to report fiscal 2024 second quarter diluted earnings per share of $0.52, compared with $0.66 in the same period last year. We continue to implement strategies designed to grow our market share while working prudently to manage our profitability and maintain a strong balance sheet in this challenging period.”

Mr. Taylor continued, “We opened five new warehouse stores in the second quarter and plan to open 30 in 2024, in line with our prior expectation of 30 to 35 stores. Looking forward to 2025, we believe it is prudent to open approximately 25 new warehouse stores in this muted market environment. These planned openings are long-term growth investments toward our plan to operate 500 warehouse-format stores in the United States over time and should further solidify our market share and position us for strong growth when industry fundamentals improve.”

Please see “Comparable Store Sales” below for information on how the Company calculates period-over-period changes in comparable store sales.

For the Thirteen Weeks Ended June 27, 2024

•Net sales of $1,133.1 million decreased 0.2% from $1,135.9 million in the second quarter of fiscal 2023.

•Comparable store sales decreased 9.0%.

•We opened five new warehouse stores, ending the quarter with 230 warehouse stores and five design studios.

•Operating income of $71.3 million decreased 24.9% from $95.0 million in the second quarter of fiscal 2023. Operating margin of 6.3% decreased 210 basis points from the second quarter of fiscal 2023.

•Net income of $56.7 million decreased 20.7% from $71.5 million in the second quarter of fiscal 2023. Diluted earnings per share ("EPS") of $0.52 decreased 21.2% from $0.66 in the second quarter of fiscal 2023.

•Adjusted EBITDA* of $136.9 million decreased 10.4% from $152.8 million in the second quarter of fiscal 2023.

For the Twenty-six Weeks Ended June 27, 2024

•Net sales of $2,230.4 million decreased 1.2% from $2,258.0 million in the same period of fiscal 2023.

•Comparable store sales decreased 10.3%.

•We opened nine new warehouse stores.

•Operating income of $130.6 million decreased 31.4% from $190.5 million in the same period of fiscal 2023. Operating margin of 5.9% decreased 250 basis points from the same period of fiscal 2023.

•Net income of $106.7 million decreased 25.4% from $143.0 million in the same period of fiscal 2023. Diluted EPS of $0.99 decreased 25.6% from $1.33 in the same period of fiscal 2023.

•Adjusted EBITDA* of $259.9 million decreased 14.1% from $302.4 million in the same period of fiscal 2023.

*Non-GAAP financial measure. Please see “Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” below for more information.

Updated Outlook for the Fiscal Year Ending December 26, 2024:

•Net sales of approximately $4,400 million to $4,490 million

•Comparable store sales of approximately (8.5)% to (6.5)%

•Diluted EPS of approximately $1.55 to $1.75

•Adjusted EBITDA* of approximately $480 million to $505 million

•Depreciation and amortization expense of approximately $235 million

•Interest expense, net of approximately $6 million to $7 million

•Tax rate of approximately 18%

•Diluted weighted average shares outstanding of approximately 108 million shares

•Open 30 new warehouse stores

•Capital expenditures of approximately $360 million to $410 million

*Non-GAAP financial measure. Please see “Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” below for more information.

Conference Call Details

A conference call to discuss the second quarter fiscal 2024 financial results is scheduled for today, August 1, 2024, at 5:00 p.m. Eastern Time. A live audio webcast of the conference call, together with related materials, will be available online at ir.flooranddecor.com.

A recorded replay of the conference call is expected to be available approximately three hours after the conclusion of the call and can be accessed both online at ir.flooranddecor.com and by dialing 844-512-2921 (international callers please dial 412-317-6671). The pin number to access the telephone replay is 13747153. The replay will be available until August 8, 2024.

About Floor & Decor Holdings, Inc.

Floor & Decor is a multi-channel specialty retailer and commercial flooring distributor operating 230 warehouse-format stores and five design studios across 36 states as of June 27, 2024. The Company offers a broad assortment of in-stock hard-surface flooring, including tile, wood, laminate and vinyl, and natural stone along with decorative accessories and wall tile, installation materials, and adjacent categories at everyday low prices. The Company was founded in 2000 and is headquartered in Atlanta, Georgia.

Comparable Store Sales

Comparable store sales refer to period-over-period comparisons of our net sales among the comparable store base and are based on when the customer obtains control of the product, which is typically at the time of sale. A store is included in the comparable store sales calculation on the first day of the thirteenth full fiscal month following a store’s opening, which is when we believe comparability has been achieved. Changes in our comparable store sales between two periods are based on net sales for stores that were in operation during both of the two periods. Any change in the square footage of an existing comparable store, including for remodels and relocations within the same primary trade area of the existing store being relocated, does not eliminate that store from inclusion in the calculation of comparable store sales. Stores that are closed for a full fiscal month or longer are excluded from the comparable store sales calculation for each full fiscal month that they are closed. Since our e-commerce, regional account manager, and design studio sales are fulfilled by individual stores, they are included in comparable store sales only to the extent the fulfilling store meets the above mentioned store criteria. Sales through our Spartan Surfaces, LLC ("Spartan") subsidiary do not involve our stores and are therefore excluded from the comparable store sales calculation.

Non-GAAP Financial Measures

EBITDA and Adjusted EBITDA (which are shown in the reconciliation below) are presented as supplemental measures of financial performance that are not required by, or presented in accordance with, accounting principles generally accepted in the United States ("GAAP"). We define EBITDA as net income before interest, taxes, depreciation and amortization. We define Adjusted EBITDA as net income before interest, taxes, depreciation and amortization, adjusted to eliminate the impact of non-cash stock-based compensation expense and certain items that we do not consider indicative of our core operating performance. Reconciliations of these measures to the most directly comparable GAAP financial measure are set forth in the table below.

EBITDA and Adjusted EBITDA are key metrics used by management and our board of directors to assess our financial performance and enterprise value. We believe that EBITDA and Adjusted EBITDA are useful measures, as they eliminate certain items that are not indicative of our core operating performance and facilitate a comparison of our core operating performance on a consistent basis from period to period. We also use Adjusted EBITDA as a basis to determine covenant compliance with respect to our credit facilities, to supplement GAAP measures of performance to evaluate the effectiveness of our business strategies, to make budgeting decisions, and to compare our performance against that of other peer companies using similar measures. EBITDA and Adjusted EBITDA are also frequently used by analysts, investors and other interested parties to evaluate companies in our industry.

EBITDA and Adjusted EBITDA are non-GAAP measures of our financial performance and should not be considered as alternatives to net income as a measure of financial performance, or any other performance measure derived in accordance with GAAP and they should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Additionally, EBITDA and Adjusted EBITDA are not intended to be measures of liquidity or free cash flow for management's discretionary use. In addition, these non-GAAP measures exclude certain non-recurring and other charges. Each of these non-GAAP measures has its limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of our results as reported under GAAP. In evaluating EBITDA and Adjusted EBITDA, you should be aware that in the future we may incur expenses that are the same as or similar to some of the items eliminated in the adjustments made to determine EBITDA and Adjusted EBITDA, such as stock-based compensation expense, fair value adjustments related to contingent earn-out liabilities, and other adjustments. Our presentation of EBITDA and Adjusted EBITDA should not be construed to imply that our future results will be unaffected by any such adjustments. Definitions and calculations of EBITDA and Adjusted EBITDA differ among companies in the retail industry, and therefore EBITDA and Adjusted EBITDA disclosed by us may not be comparable to the metrics disclosed by other companies.

Please see “Reconciliation of GAAP to Non-GAAP Financial Measures” below for reconciliations of non-GAAP financial measures used in this release to their most directly comparable GAAP financial measures.

Floor & Decor Holdings, Inc.

Condensed Consolidated Statements of Income

(In thousands, except for per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Thirteen Weeks Ended | | |

| June 27, 2024 | | June 29, 2023 | | % Increase

(Decrease) |

| Amount | | % of Net Sales | | Amount | | % of Net Sales | |

| Net sales | $ | 1,133,139 | | | 100.0 | % | | $ | 1,135,899 | | | 100.0 | % | | (0.2) | % |

| Cost of sales | 642,105 | | | 56.7 | | | 656,266 | | | 57.8 | | | (2.2) | % |

| Gross profit | 491,034 | | | 43.3 | | | 479,633 | | | 42.2 | | | 2.4 | % |

| Operating expenses: | | | | | | | | | |

| Selling and store operating | 341,408 | | | 30.1 | | | 311,406 | | | 27.4 | | | 9.6 | % |

| General and administrative | 67,671 | | | 6.0 | | | 63,279 | | | 5.5 | | | 6.9 | % |

| Pre-opening | 10,627 | | | 0.9 | | | 9,974 | | | 0.9 | | | 6.5 | % |

| Total operating expenses | 419,706 | | | 37.0 | | | 384,659 | | | 33.8 | | | 9.1 | % |

| Operating income | 71,328 | | | 6.3 | | | 94,974 | | | 8.4 | | | (24.9) | % |

| Interest expense, net | 663 | | | 0.1 | | | 2,898 | | | 0.3 | | | (77.1) | % |

| Income before income taxes | 70,665 | | | 6.2 | | | 92,076 | | | 8.1 | | | (23.3) | % |

| Income tax expense | 13,999 | | | 1.2 | | | 20,624 | | | 1.8 | | | (32.1) | % |

| Net income | $ | 56,666 | | | 5.0 | % | | $ | 71,452 | | | 6.3 | % | | (20.7) | % |

| Basic weighted average shares outstanding | 107,046 | | | | | 106,206 | | | | | |

| Diluted weighted average shares outstanding | 108,274 | | | | | 107,805 | | | | | |

| Basic earnings per share | $ | 0.53 | | | | | $ | 0.67 | | | | | (20.9) | % |

| Diluted earnings per share | $ | 0.52 | | | | | $ | 0.66 | | | | | (21.2) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Twenty-six Weeks Ended | | |

| June 27, 2024 | | June 29, 2023 | | % Increase

(Decrease) |

| Amount | | % of Net Sales | | Amount | | % of Net Sales | |

| Net sales | $ | 2,230,428 | | | 100.0 | % | | $ | 2,257,951 | | | 100.0 | % | | (1.2) | % |

| Cost of sales | 1,269,368 | | | 56.9 | | | 1,309,200 | | | 58.0 | | | (3.0) | % |

| Gross profit | 961,060 | | | 43.1 | | | 948,751 | | | 42.0 | | | 1.3 | % |

| Operating expenses: | | | | | | | | | |

| Selling and store operating | 675,753 | | | 30.3 | | | 615,077 | | | 27.3 | | | 9.9 | % |

| General and administrative | 134,448 | | | 6.0 | | | 125,190 | | | 5.5 | | | 7.4 | % |

| Pre-opening | 20,220 | | | 0.9 | | | 17,994 | | | 0.8 | | | 12.4 | % |

| Total operating expenses | 830,421 | | | 37.2 | | | 758,261 | | | 33.6 | | | 9.5 | % |

| Operating income | 130,639 | | | 5.9 | | | 190,490 | | | 8.4 | | | (31.4) | % |

| Interest expense, net | 2,618 | | | 0.2 | | | 7,760 | | | 0.3 | | | (66.3) | % |

| Income before income taxes | 128,021 | | | 5.7 | | | 182,730 | | | 8.1 | | | (29.9) | % |

| Income tax expense | 21,323 | | | 0.9 | | | 39,754 | | | 1.8 | | | (46.4) | % |

| Net income | $ | 106,698 | | | 4.8 | % | | $ | 142,976 | | | 6.3 | % | | (25.4) | % |

| Basic weighted average shares outstanding | 106,908 | | | | | 106,084 | | | | | |

| Diluted weighted average shares outstanding | 108,266 | | | | | 107,764 | | | | | |

| Basic earnings per share | $ | 1.00 | | | | | $ | 1.35 | | | | | (25.9) | % |

| Diluted earnings per share | $ | 0.99 | | | | | $ | 1.33 | | | | | (25.6) | % |

Condensed Consolidated Balance Sheets

(In thousands, except for share and per share data)

(Unaudited)

| | | | | | | | | | | |

| As of June 27, 2024 | | As of December 28, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 138,063 | | | $ | 34,382 | |

| Income taxes receivable | 4,109 | | | 27,870 | |

| Receivables, net | 109,334 | | | 99,513 | |

| Inventories, net | 1,037,284 | | | 1,106,150 | |

| Prepaid expenses and other current assets | 53,415 | | | 48,725 | |

| Total current assets | 1,342,205 | | | 1,316,640 | |

| Fixed assets, net | 1,700,787 | | | 1,629,917 | |

| Right-of-use assets | 1,342,345 | | | 1,282,625 | |

| Intangible assets, net | 152,036 | | | 153,869 | |

| Goodwill | 257,940 | | | 257,940 | |

| Deferred income tax assets, net | 15,239 | | | 14,227 | |

| Other assets | 7,510 | | | 7,332 | |

| Total long-term assets | 3,475,857 | | | 3,345,910 | |

| Total assets | $ | 4,818,062 | | | $ | 4,662,550 | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

| Current portion of term loan | $ | 2,103 | | | $ | 2,103 | |

| Current portion of lease liabilities | 132,770 | | | 126,428 | |

| Trade accounts payable | 698,716 | | | 679,265 | |

| Accrued expenses and other current liabilities | 302,275 | | | 332,940 | |

| | | |

| Deferred revenue | 13,322 | | | 11,277 | |

| Total current liabilities | 1,149,186 | | | 1,152,013 | |

| Term loan | 194,733 | | | 194,939 | |

| | | |

| Lease liabilities | 1,362,140 | | | 1,301,754 | |

| Deferred income tax liabilities, net | 53,974 | | | 67,188 | |

| Other liabilities | 11,435 | | | 15,666 | |

| Total long-term liabilities | 1,622,282 | | | 1,579,547 | |

| Total liabilities | 2,771,468 | | | 2,731,560 | |

| Stockholders’ equity | | | |

| Capital stock: | | | |

Preferred stock, $0.001 par value; 10,000,000 shares authorized; 0 shares issued and outstanding at June 27, 2024 and December 28, 2023 | — | | | — | |

Common stock Class A, $0.001 par value; 450,000,000 shares authorized; 107,132,849 shares issued and outstanding at June 27, 2024 and 106,737,532 issued and outstanding at December 28, 2023 | 107 | | | 107 | |

Common stock Class B, $0.001 par value; 10,000,000 shares authorized; 0 shares issued and outstanding at June 27, 2024 and December 28, 2023 | — | | | — | |

Common stock Class C, $0.001 par value; 30,000,000 shares authorized; 0 shares issued and outstanding at June 27, 2024 and December 28, 2023 | — | | | — | |

| Additional paid-in capital | 523,282 | | | 513,060 | |

| Accumulated other comprehensive income, net | 106 | | | 1,422 | |

| Retained earnings | 1,523,099 | | | 1,416,401 | |

| Total stockholders’ equity | 2,046,594 | | | 1,930,990 | |

| Total liabilities and stockholders’ equity | $ | 4,818,062 | | | $ | 4,662,550 | |

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| Twenty-six Weeks Ended |

| June 27, 2024 | | June 29, 2023 |

Operating activities | | | |

| Net income | $ | 106,698 | | | $ | 142,976 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 114,807 | | | 96,028 | |

| Stock-based compensation expense | 15,587 | | | 15,047 | |

| Deferred income taxes | (13,770) | | | (13,480) | |

| Loss on asset impairments and disposals, net | 1,511 | | | 765 | |

| Change in fair value of contingent earn-out liabilities | (87) | | | 1,787 | |

| Interest cap derivative contracts | 85 | | | 57 | |

| Changes in operating assets and liabilities, net of effects of acquisition: | | | |

| Receivables, net | (9,821) | | | 12,595 | |

| Inventories, net | 68,866 | | | 128,554 | |

| Trade accounts payable | 19,136 | | | 84,885 | |

| Accrued expenses and other current liabilities | 18,969 | | | 6,579 | |

| Income taxes | 24,390 | | | (6,755) | |

| Deferred revenue | 2,045 | | | 4,324 | |

| Other, net | (6,936) | | | 3,283 | |

| Net cash provided by operating activities | 341,480 | | | 476,645 | |

| Investing activities | | | |

| Purchases of fixed assets | (225,614) | | | (279,175) | |

| Acquisition, net of cash acquired | — | | | (17,156) | |

| | | |

| Net cash used in investing activities | (225,614) | | | (296,331) | |

| Financing activities | | | |

| Payments on term loan | (1,051) | | | (1,051) | |

| Borrowings on revolving line of credit | 258,600 | | | 384,200 | |

| Payments on revolving line of credit | (258,600) | | | (559,400) | |

| Payments of contingent earn-out liabilities | (5,769) | | | (5,241) | |

| Proceeds from exercise of stock options | 5,442 | | | 4,858 | |

| Proceeds from employee stock purchase plan | 2,720 | | | 2,558 | |

| | | |

| Tax payments for stock-based compensation awards | (13,527) | | | (11,861) | |

| Net cash used in financing activities | (12,185) | | | (185,937) | |

| Net increase (decrease) in cash and cash equivalents | 103,681 | | | (5,623) | |

| Cash and cash equivalents, beginning of the period | 34,382 | | | 9,794 | |

| Cash and cash equivalents, end of the period | $ | 138,063 | | | $ | 4,171 | |

| Supplemental disclosures of cash flow information | | | |

| Buildings and equipment acquired under operating leases | $ | 128,008 | | | $ | 112,554 | |

| Cash paid for interest, net of capitalized interest | $ | 2,121 | | | $ | 7,455 | |

| Cash paid for income taxes, net of refunds | $ | 10,699 | | | $ | 60,792 | |

| Fixed assets accrued at the end of the period | $ | 93,506 | | | $ | 116,555 | |

Reconciliation of GAAP to Non-GAAP Financial Measures

(In thousands)

(Unaudited)

EBITDA and Adjusted EBITDA

| | | | | | | | | | | |

| Thirteen Weeks Ended |

| June 27, 2024 | | June 29, 2023 |

| Net income (GAAP): | $ | 56,666 | | | $ | 71,452 | |

| Depreciation and amortization (a) | 57,837 | | | 49,177 | |

| Interest expense, net | 663 | | | 2,898 | |

| Income tax expense | 13,999 | | | 20,624 | |

| EBITDA | 129,165 | | | 144,151 | |

| Stock-based compensation expense (b) | 8,355 | | | 8,306 | |

| Other (c) | (663) | | | 353 | |

| Adjusted EBITDA | $ | 136,857 | | | $ | 152,810 | |

| | | | | | | | | | | |

| Twenty-six Weeks Ended |

| June 27, 2024 | | June 29, 2023 |

| Net income (GAAP): | $ | 106,698 | | | $ | 142,976 | |

| Depreciation and amortization (a) | 113,716 | | | 95,103 | |

| Interest expense, net | 2,618 | | | 7,760 | |

| Income tax expense | 21,323 | | | 39,754 | |

| EBITDA | 244,355 | | | 285,593 | |

| Stock-based compensation expense (b) | 15,587 | | | 15,047 | |

| Other (c) | (87) | | | 1,787 | |

| Adjusted EBITDA | $ | 259,855 | | | $ | 302,427 | |

(a)Excludes amortization of deferred financing costs, which is included as part of interest expense, net in the table above.

(b)Non-cash charges related to stock-based compensation programs, which vary from period to period depending on the timing of awards and forfeitures.

(c)Other adjustments include amounts management does not consider indicative of our core operating performance. Amounts for both the thirteen and twenty-six weeks ended June 27, 2024 and June 29, 2023 relate to changes in the fair value of contingent earn-out liabilities.

Forward-Looking Statements

This release and the associated webcast/conference call contain forward-looking statements within the meaning of the federal securities laws. All statements other than statements of historical fact contained in this release and the associated webcast/conference call, including statements regarding the Company’s future operating results and financial position, business strategy and plans, and objectives of management for future operations, are forward-looking statements. These statements are based on our current expectations, assumptions, estimates, and projections. These statements involve known and unknown risks, uncertainties, and other important factors that may cause the Company’s actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Forward-looking statements are based on management’s current expectations and assumptions regarding the Company’s business, the economy, and other future conditions, including the impact of natural disasters on sales.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “seeks,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “budget,” “potential,” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements contained in this release are only predictions. Although the Company believes that the expectations reflected in the forward-looking statements in this release and the associated webcast/conference call are reasonable, the Company cannot guarantee future events, results, performance or achievements. A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements in this release or the associated webcast/conference call, including, without limitation, (1) an overall decline in the health of the economy, the hard surface flooring industry, consumer confidence and discretionary spending, and the housing market, including as a result of persistently high or rising inflation or interest rates, (2) our failure to successfully manage the challenges that our planned new store growth poses or the impact of unexpected difficulties or higher costs during our expansion, (3) our inability to enter into leases for additional stores on acceptable terms or renew or replace our current store leases, (4) our failure to successfully anticipate and manage trends, consumer preferences, and demand, (5) our inability to successfully manage increased competition, (6) our inability to manage our inventory, including the impact of inventory obsolescence, shrinkage, and damage, (7) political and regulatory conditions that contribute to uncertainty and market volatility, including the upcoming U.S. presidential election and legislative, regulatory, trade and policies associated with a new administration, (8) any disruption in our distribution capabilities, supply chain, and our related planning and control processes, including carrier capacity constraints, port congestion or shut down, transportation costs, and other supply chain costs or product shortages, (9) any increases in wholesale prices of products, materials, and transportation costs beyond our control, including increases in costs due to inflation, (10) the resignation, incapacitation, or death of any key personnel, including our executive officers, (11) our inability to attract, hire, train, and retain highly qualified managers and staff, (12) the impact of any labor activities, (13) our dependence on foreign imports for the products we sell, including risks associated with obtaining products from abroad, (14) geopolitical risks, such as the conflict in the Middle East, the ongoing war in Ukraine, and U.S. policies related to global trade and tariffs, such as import restrictions under the Uyghur Forced Labor Prevention Act, or any antidumping and countervailing duties, any of which could impact our ability to import from foreign suppliers or raise our costs, (15) our ability to manage our comparable store sales, (16) any failure by any of our suppliers to supply us with quality products on attractive terms and prices, (17) any failure by our suppliers to adhere to the quality standards that we set for our products, (18) our inability to locate sufficient suitable natural products, particularly products made of more exotic species or unique stone, (19) the effects of weather conditions, natural disasters, or other unexpected events, including public health crises that may disrupt our operations, (20) our inability to maintain sufficient levels of cash flow or liquidity to fund our expanding business and service our existing indebtedness, (21) restrictions imposed by our indebtedness on our current and future operations, including risks related to our variable rate debt, (22) any allegations, investigations, lawsuits, or violations of laws and regulations applicable to us, our products, or our suppliers, (23) our inability to adequately protect the privacy and security of information related to our customers, us, our associates, our suppliers, and other third parties, (24) any material disruption in our information systems, including our website, (25) new or changing laws or regulations, including tax laws and trade policies and regulations, (26) any failure to protect our intellectual property rights or disputes regarding our intellectual property or the intellectual property of third parties, (27) the impact of any future strategic transactions, and (28) our ability to manage risks related to corporate social responsibility. Additional information concerning these and other factors are described in “Forward-Looking Statements,” Item 1, “Business,” Item 1A, “Risk Factors,” and Item 1C "Cybersecurity" of Part I and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 9A, “Controls and Procedures” of Part II of the Company’s Annual Report for fiscal 2023 filed with the Securities and Exchange Commission (the “SEC”) on February 22, 2024 (the “Annual Report”) and elsewhere in the Annual Report, and those described in Item 2, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of the Company’s Quarterly Report on Form 10-Q for the quarterly period ended June 27, 2024 (the “10-Q”) and elsewhere in the 10-Q, and those described in the Company’s other filings with the SEC.

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The forward-looking statements contained in this release or the associated webcast/conference call speak only as of the date hereof. New risks and uncertainties arise over time, and it is not possible for the Company to predict those events or how they may affect the Company. If a change to the events and circumstances reflected in the Company’s forward-looking statements occurs, the Company’s business, financial condition, and operating results may vary materially from those expressed in the Company’s forward-looking statements. Except as required by applicable law, the Company does not plan to publicly update or revise any forward-looking statements contained herein or in the associated webcast/conference call, whether as a result of any new information, future events, or otherwise.

Contacts

Investor Contacts:

Wayne Hood

Senior Vice President of Investor Relations

678-505-4415

wayne.hood@flooranddecor.com

or

Matt McConnell

Senior Manager of Investor Relations

770-257-1374

matthew.mcconnell@flooranddecor.com

v3.24.2.u1

Cover Page

|

Aug. 01, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 01, 2024

|

| Entity Registrant Name |

Floor & Decor Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38070

|

| Entity Tax Identification Number |

27-3730271

|

| Entity Address, Address Line One |

2500 Windy Ridge Parkway SE

|

| Entity Address, City or Town |

Atlanta,

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30339

|

| City Area Code |

404

|

| Local Phone Number |

471-1634

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, $0.001 par value per share

|

| Trading Symbol |

FND

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001507079

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

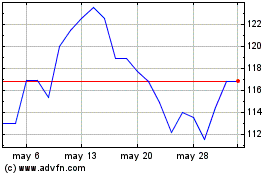

Floor and Decor (NYSE:FND)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

Floor and Decor (NYSE:FND)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024