U.S. SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES

EXCHANGE ACT OF 1934

Dated May 29, 2024

Commission File Number 1-14878

GERDAU S.A.

(Translation of Registrant’s Name into English)

Av. Dra. Ruth Cardoso, 8,501 – 8° andar

São Paulo, São Paulo - Brazil CEP

05425-070

(Address of principal executive

offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Exhibit Index

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: May 29, 2024

| |

GERDAU S.A. |

| |

|

| |

By: |

/s/ Rafael Dorneles Japur |

| |

Name: |

Rafael Dorneles Japur |

| |

Title: |

Executive Vice President Investor Relations Director |

Exhibit 99.1

ANNOUNCEMENT

OF COMMENCEMENT

OF THE PUBLIC

OFFERING OF THE 17TH (SEVENTEENTH) ISSUANCE OF SIMPLE DEBENTURES, NOT CONVERTIBLE INTO SHARES, OF THE UNSECURED TYPE, IN A SINGLE

SERIES, FOR PUBLIC DISTRIBUTION, UNDER THE AUTOMATIC REGISTRATION RIGHT OF

GERDAU S.A.

Corporate Taxpayer

ID (CNPJ/MF) No.33.611.500/0001-19

in the total amount

of

R$1,500,000,000.00

Debentures ’s

ISIN code: BRGGBRDBS060

Issuance Risk Rating

by S&P with a rating of: “brAAA”*

*This rating was

issued on May 02, 2024, and the characteristics of this security are subject to change.

THE REGISTRATION

OF THE OFFERING OF THE DEBENTURES WAS AUTOMATICALLY GRANTED BY THE CVM ON MAY 28,

2024, UNDER NO. CVM/SRE/AUT/DEB/PRI/2024/282.

Pursuant to the

provisions of section 59 of Resolution No. 160 of the Brazilian Securities and Exchange Commission (“CVM”) of July 13,

2022, as amended (“CVM Resolution 160”), GERDAU S.A. (the “Issuer”), together with certaing

placement agents (the “Placement Agents”), announce (“Announcement of Commencement”) the beginning

of the distribution period of the public offering of 1,500,000 simple debentures, not convertible into shares, of the unsecured type,

in a single series, of the 17th (seventeenth) issuance of the Issuer (the “Debentures” and “Issuance”,

respectively), with a nominal unit value of R$1,000.00, totaling, on the date of issuance of the Debentures, that is, May 29, 2024,

R$1,500,000,000.00 (the “Offering”), pursuant to the “Private Indenture of the 17th (Seventeenth) Issuance of

Simple Debentures, Non-Convertible into Shares, of the Unsecured Type, in a Single Series, for Public Distribution, Under the Automatic

Registration Right, of Gerdau S.A.” (“Issuance Deed”) executed on May 6, 2024, between the Issuer and

PENTÁGONO S.A. DISTRIBUIDORA DE TÍTULOS E VALORES MOBILIÁRIOS, registered with the CNPJ/MF under No. 17.343.682/0001-38,

as the trustee (“Trustee”), as amended by the “First Amendment to the Private Indenture of the 17th (Seventeenth)

Issuance of Simple Debentures, Non-Convertible into Shares, of the Unsecured Type, in a Single Series, for Public Distribution, Under

the Automatic Registration Right, of Gerdau S.A.” (“Amendment to the Issuance Deed”), executed on May 27,

2024, between the Issuer and the Trustee.

| 2. | AUTOMATIC

Distribution Registration RIGHT |

The Offering was

registered with the CVM under the automatic registration right, without prior analysis, pursuant to Sections 25 and 26, item V, paragraph

“a”, of CVM Resolution 160, as it is a public offering: (i) of a security representing debt; (ii) intended

exclusively for professional investors, as defined pursuant to section 11 and, as applicable, 13 of CVM Resolution No. 30, of May 11,

2021, as amended (“Professional Investors”); and (iii) the issuer is operational and is registered with

the CVM as publicly-held company (emissor de valores mobiliários (companhia aberta), categoria “A”).

The Offering will not be submitted to prior analysis by the Brazilian Association of Financial and Capital Markets Entities – ANBIMA,

the CVM or any regulatory or self-regulatory entity.

| 3. | Registration

of the Offering with CVM |

The registration

of the Offering was automatically granted by the CVM on May 28, 2024, under No. CVM/SRE/AUT/DEB/PRI/2024/282.

| 4. | Estimated

Timeline of Offering Stages |

| No. |

EVENT

(1) |

DATE

(2) |

| 1 |

Submission

of an electronic application form for the Offering to CVM |

05/07/2024 |

| 2 |

Release

of the Notice to the Market to inform the launch of the Offering |

05/07/2024 |

| 3 |

Conclusion

of the Bookbuilding Procedure |

05/27/2024 |

| 4 |

Release

of the Notice to the Market to inform the results of the Bookbuilding Procedure |

05/27/2024 |

| 5 |

Submission

of a supplement application to CVM for registration of the Offering with CVM |

05/28/2024 |

| 6 |

Release

of this Announcement of Commencement |

05/28/2024 |

| 7 |

Estimated

date for the financial settlement of the Debentures |

05/29/2024 |

| 8 |

Release

of Notice to the Market to inform the closing of the Offering |

11/24/2024 |

(1) The

dates that describe future events are merely indicative and are subject to changes, delays and anticipations without prior notice,

at the discretion of the Issuer and the Placement Agents. Any change to the distribution schedule must be notified to CVM and may

be analyzed as a change to the Offer, in accordance with the provisions of sections 67 and 69 of CVM Resolution 160.

(2) Any

communications or announcements relating to the Offering will be made available on CVM’s world wide web, B3 S.A. - Brasil, Bolsa,

Balcão - Balcão B3 (“B3”), the Issuer and the Coordinators, under the terms of section 13 of CVM

Resolution 160. |

| 5. | WAIVER

OF DISCLOSURE OF PROSPECTUS AND BLADE |

The Offering does

not have a prospectus or a sheet, as provided for in the terms of section 9, item I and section 23, paragraph 1, both of CVM Resolution

160, since the Offer is directed exclusively to Professional Investors.

CONSIDERING

THAT THE OFFERING IS INTENDED EXCLUSIVELY FOR PROFESSIONAL INVESTORS, PURSUANT TO SECTION 26, ITEM V, PARAGRAPH “A”,

OF CVM RESOLUTION 160 AND IS SUBJECT TO THE AUTOMATIC DISTRIBUTION REGISTRATION RIGHT PROVIDED FOR IN CVM RESOLUTION 160, THE DEBENTURES

WILL BE SUBJECT TO RESTRICTIONS ON RESALE, AS INDICATED IN SECTION 86, ITEM II, OF CVM RESOLUTION 160.

THE REGISTRATION

OF THE OFFERING DOES NOT IMPLY, ON THE PART OF THE CVM, A GUARANTEE OF THE VERACITY OF THE INFORMATION PROVIDED OR IN JUDGMENT ON

THE QUALITY OF THE DEBENTURES TO BE DISTRIBUTED.

Capitalized terms

used in this Announcement of Commencement, which are not defined herein, shall have the meaning ascribed to them in the Indenture.

The date of this

Announcement of Commencement is May 28, 2024.

Placement Agents

Exhibit 99.2

NOTICE TO THE

MARKET

IN CONNECTION

WITH THE RESULT OF THE BOOKBUILDING PROCEDURE OF THE PUBLIC OFFERING OF THE 17TH (SEVENTEENTH) ISSUANCE OF SIMPLE DEBENTURES,

NOT CONVERTIBLE INTO SHARES, OF THE UNSECURED TYPE, IN A SINGLE SERIES, FOR PUBLIC DISTRIBUTION, UNDER THE AUTOMATIC REGISTRATION

RIGHT OF

GERDAU S.A.

Corporate Taxpayer

ID (CNPJ/MF) No. 33.611.500/0001-19

in the total amount

of

R$1,500,000,000.00

Debentures ’s

ISIN code: BRGGBRDBS060

Issuance Risk Rating

by S&P with a rating of: “brAAA”*

*This rating was

issued on May 02, 2024, and the characteristics of this security are subject to change.

| 1. | RESULT

BOOKBUILDING PROCEDURE |

GERDAU S.A.

(“Issuer”), together with certain placement agents of the Offering, announce, pursuant to CVM Resolution No. 160,

of July 13, 2022, as amended (“CVM Resolution 160”), that on May 27, 2024 was concluded the Bookbuilding

Procedure (as defined in the Indenture referred to below) carried out by the Coordinators through the collection of investment intentions

in relation to the public offering of 1,500,000 simple debentures, not convertible into shares, of the unsecured type, in a single series,

of the 17th issue of the Issuer (“Debentures” and “Issuance”, respectively”), with a nominal

unit value of R$1,000.00, totaling, on the date of issuance of the Debentures, that is, May 29, 2024, the total amount of R$1,500,000,000.00

(“Offering”), pursuant to the “Private Indenture of the 17th (Seventeenth) Issuance of Simple Debentures,

Non-Convertible into Shares, of the Unsecured Type, in a Single Series, for Public Distribution, Under the Automatic Registration Right,

of Gerdau S.A.” (“Issuance Deed ”) executed on May 6, 2024, between the Issuer and PENTÁGONO

S.A. DISTRIBUIDORA DE TÍTULOS E VALORES MOBILIÁRIOS, as fiduciary agent (“Fiduciary Agent”), as

amended by “First Amendment to the Private Indenture of the 17th (Seventeenth) Issuance of Simple Debentures, Non-Convertible

into Shares, of the Unsecured Type, in a Single Series, for Public Distribution, Under the Automatic Registration Right, of Gerdau S.A.”

(“Amendment to the Issuance Deed”), entered into on date hereof, between the Issuer and the Trustee, as defined as

follows:

| ⮚ | Interest.

Interest on the Unit Face Value or the balance of the Unit Face Value of the Debentures,

as the case may be, will be charged corresponding to the accumulated variation of 100% of

the average daily rates of the DI – One-day Interbank Deposits, “over extra-group”,

expressed as a percentage per year, based on 252 business days, calculated and disclosed

daily by B3, in the daily newsletter available on its website (http://www.b3.com.br), plus

a spread (surcharge) of 0.60% per year, based on 252 business days (“Interest”).

The Interest will be calculated exponentially and cumulatively pro rata temporis for

business days elapsed, from the first payment date (inclusive) or from the immediately preceding

interest payment date (inclusive), as the case may be, until the date of its effective payment

(exclusive). |

CONSIDERING

THAT THE OFFERING IS INTENDED EXCLUSIVELY FOR PROFESSIONAL INVESTORS, PURSUANT TO SECTION 26, ITEM V, PARAGRAPH “A”,

OF CVM RESOLUTION 160 AND IS SUBJECT TO THE AUTOMATIC DISTRIBUTION REGISTRATION PROCEDURE PROVIDED FOR IN CVM RESOLUTION 160, THE DEBENTURES

WILL BE SUBJECT TO RESTRICTIONS ON RESALE, AS INDICATED IN SECTION 86, ITEM II, OF CVM RESOLUTION 160.

Capitalized terms

used in this Notice to the Market, which are not defined herein, shall have the meaning ascribed to them in the Indenture.

The date of this

Notice to the Market is May 27, 2024.

Coordinators

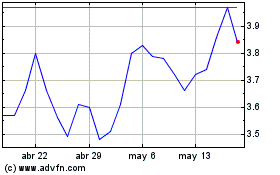

Gerdau (NYSE:GGB)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

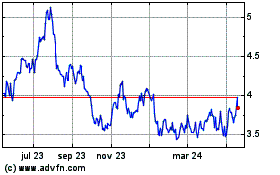

Gerdau (NYSE:GGB)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024