0001703644false00017036442024-02-142024-02-140001703644us-gaap:CommonStockMemberexch:XNYS2024-02-142024-02-140001703644us-gaap:SeriesAPreferredStockMemberexch:XNYS2024-02-142024-02-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 14, 2024

Granite Point Mortgage Trust Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-38124 | | 61-1843143 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

| 3 Bryant Park, Suite 2400A |

| New York, | NY | 10036 |

(Address of principal executive offices)

(Zip Code) |

Registrant’s telephone number, including area code: (212) 364-5500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class: | | Trading Symbol(s) | | Name of each exchange on which registered: |

| Common Stock, par value $0.01 per share | | GPMT | | NYSE |

7.00% Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock, par value $0.01 per share | | GPMTPrA | | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 14, 2024, Granite Point Mortgage Trust Inc. issued a press release announcing its financial results for the fiscal quarter and year ended December 31, 2023. A copy of the press release and 2023 Fourth Quarter and Full Year Earnings Call Supplemental are attached hereto as Exhibits 99.1 and 99.2, respectively, and are incorporated herein by reference.

The information in this Current Report, including Exhibits 99.1 and 99.2 attached hereto, is furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be “filed” for any other purpose, including for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in Item 2.02 of this Current Report, including Exhibits 99.1 and 99.2, shall not be deemed incorporated by reference into any filing of the registrant under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filings (unless the registrant specifically states that the information or exhibits in this Item 2.02 are incorporated by reference).

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | GRANITE POINT MORTGAGE TRUST INC. |

| | | |

| | | |

| | By: | /s/ MICHAEL J. KARBER |

| | | Michael J. Karber |

| | | General Counsel and Secretary |

| | | |

| Date: February 14, 2024 | | |

Granite Point Mortgage Trust Inc. Reports

Fourth Quarter and Full Year 2023 Financial Results

and Post Quarter-End Update

NEW YORK, February 14, 2024 – Granite Point Mortgage Trust Inc. (NYSE: GPMT) ("GPMT," "Granite Point" or the "Company") today announced its financial results for the quarter and full year ending December 31, 2023, and provided an update on its activities subsequent to quarter-end. A presentation containing fourth quarter and full year 2023 financial results can be viewed at www.gpmtreit.com.

“During 2023, in light of the challenging macro environment, we prudently managed our business by actively managing our loan portfolio and maintaining a strong liquidity position, actions which protected our investors’ capital”, said Jack Taylor, president and Chief Executive Officer of GPMT. “Over the course of the year, we realized over $725 million of loan repayments, paydowns and resolutions, repaid our maturing convertible notes with cash and maintained a level of leverage that remains meaningfully below our target range, given the ongoing market uncertainty. In addition, our proactive portfolio management has resulted in a reduction of our office exposure by over 30% over the last couple of years. While maintaining a defensive stance, we have opportunistically deployed capital into our own securities, and, given the attractive relative value, during 2023 we repurchased about 3.8% of our common shares, generating attractive returns and meaningful book value accretion for our shareholders.”

Fourth Quarter 2023 Activity

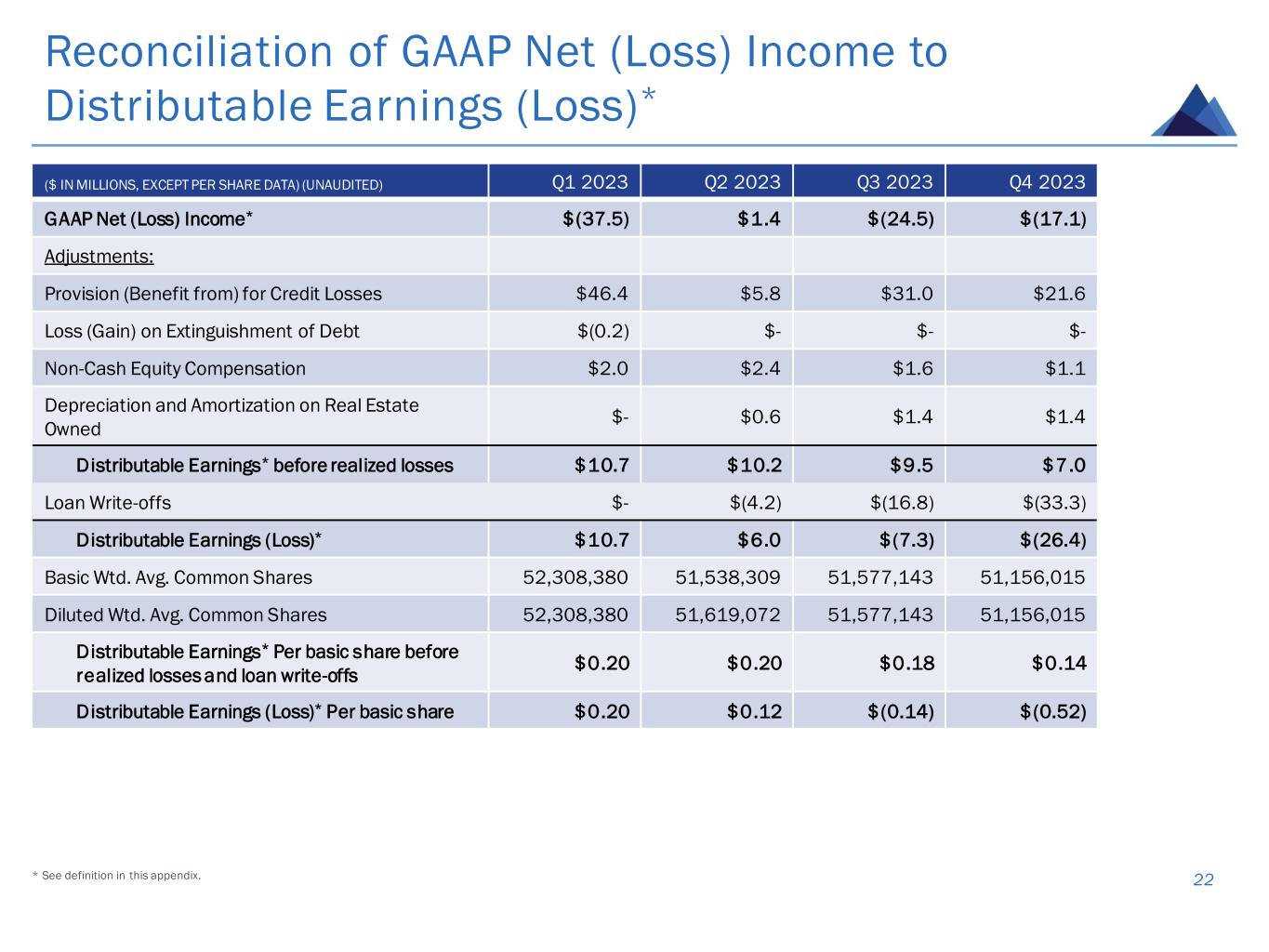

•Recognized GAAP Net (Loss)(1) of $(17.1) million, or $(0.33) per basic share, inclusive of a $(21.6) million, or $(0.42) per basic share, provision for credit losses.

•Generated Distributable (Loss)(2) of $(26.4) million, or $(0.52) per basic share, inclusive of a write-off of $(33.3) million, or $(0.65) per basic share. Distributable Earnings(2) before realized losses were $7.0 million, or $0.14 per basic share.

•Book value per common share was $12.91 as of December 31, 2023, inclusive of $(2.71) per common share of total CECL reserve.

•Declared and paid a cash dividend of $0.20 per common share and a cash dividend of $0.4375 per share of its Series A preferred stock.

•Funded $15.2 million in prior loan commitments and upsizes.

•Realized $255.2 million of total UPB in loan repayments, principal paydowns, amortization and loan resolutions.

•Opportunistically repurchased 1.0 million common shares, or approx. 2.0% of its common shares outstanding, resulting in book value accretion of approx. $0.16 per share.

•Resolved a $92.6 million senior loan that had been on nonaccrual status. The resolution involved a coordinated sale of the collateral property located in San Diego, CA, and the Company providing a new senior floating rate loan with a UPB of $48.8 million to the new ownership group, which invested meaningful fresh cash equity in the property. As a result of this transaction, the Company incurred a loss of approx. $(33.3) million.

•Opportunistically sold a $31.8 million senior loan collateralized by a property located in Dallas, TX. As a result of this transaction, the Company incurred a loss of approx. $(16.8) million.

•Carried at quarter-end a 98% floating rate loan portfolio with $2.9 billion in total commitments comprised of over 99% senior loans. As of December 31, 2023, portfolio weighted average stabilized LTV was 63.6%(3) and a realized loan portfolio yield was 8.3%(4).

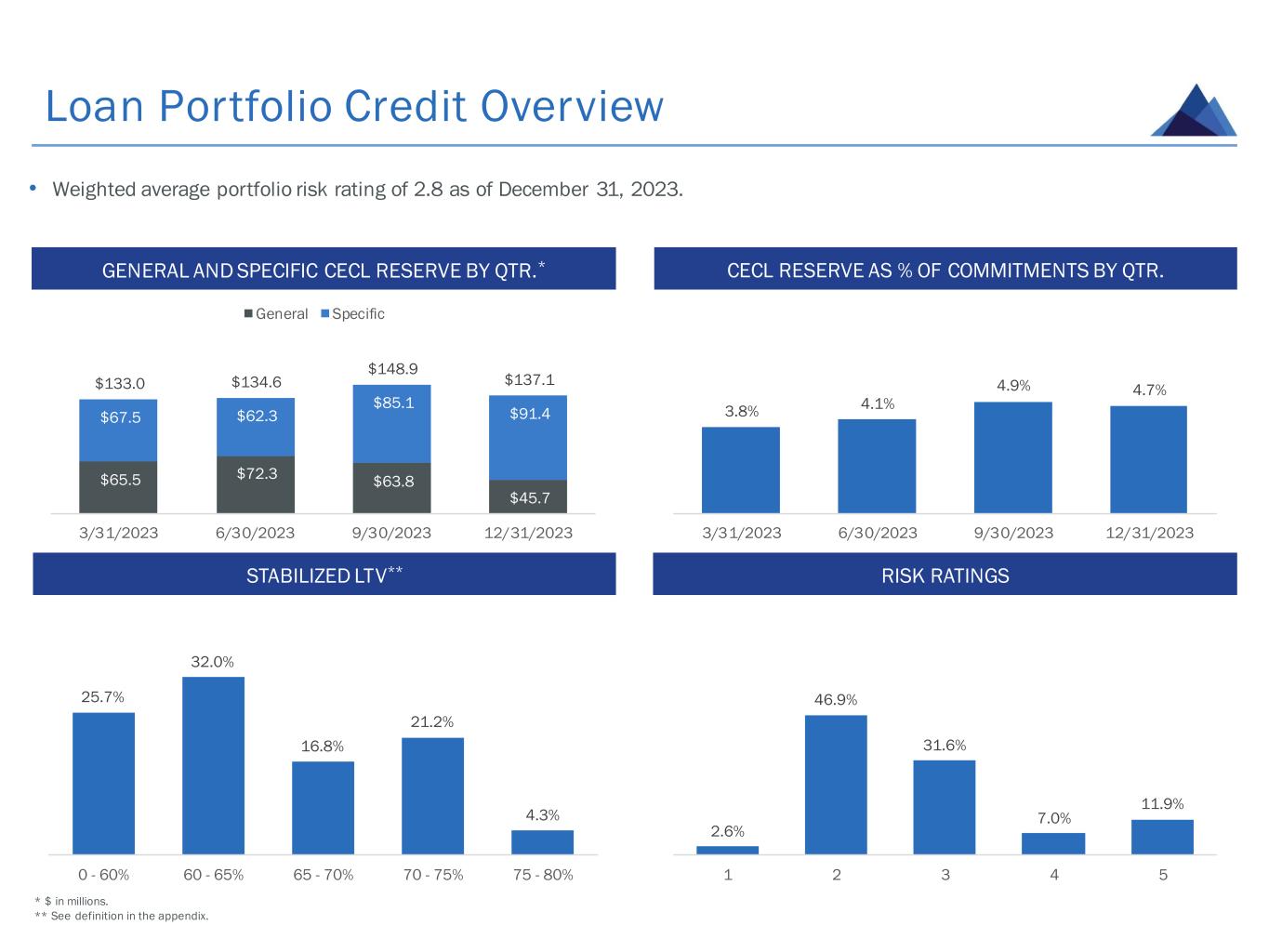

•Weighted average loan portfolio risk rating was 2.8 at December 31, 2023, with approx. 81% of loans risk ranked 3 or better.

•Total CECL reserve at quarter-end was $137.1 million, or 4.7% of total portfolio commitments.

•Increased the borrowing capacity of the JPMorgan financing facility up to $525 million and modified other terms, resulting in additional cash proceeds to the Company of $100 million.

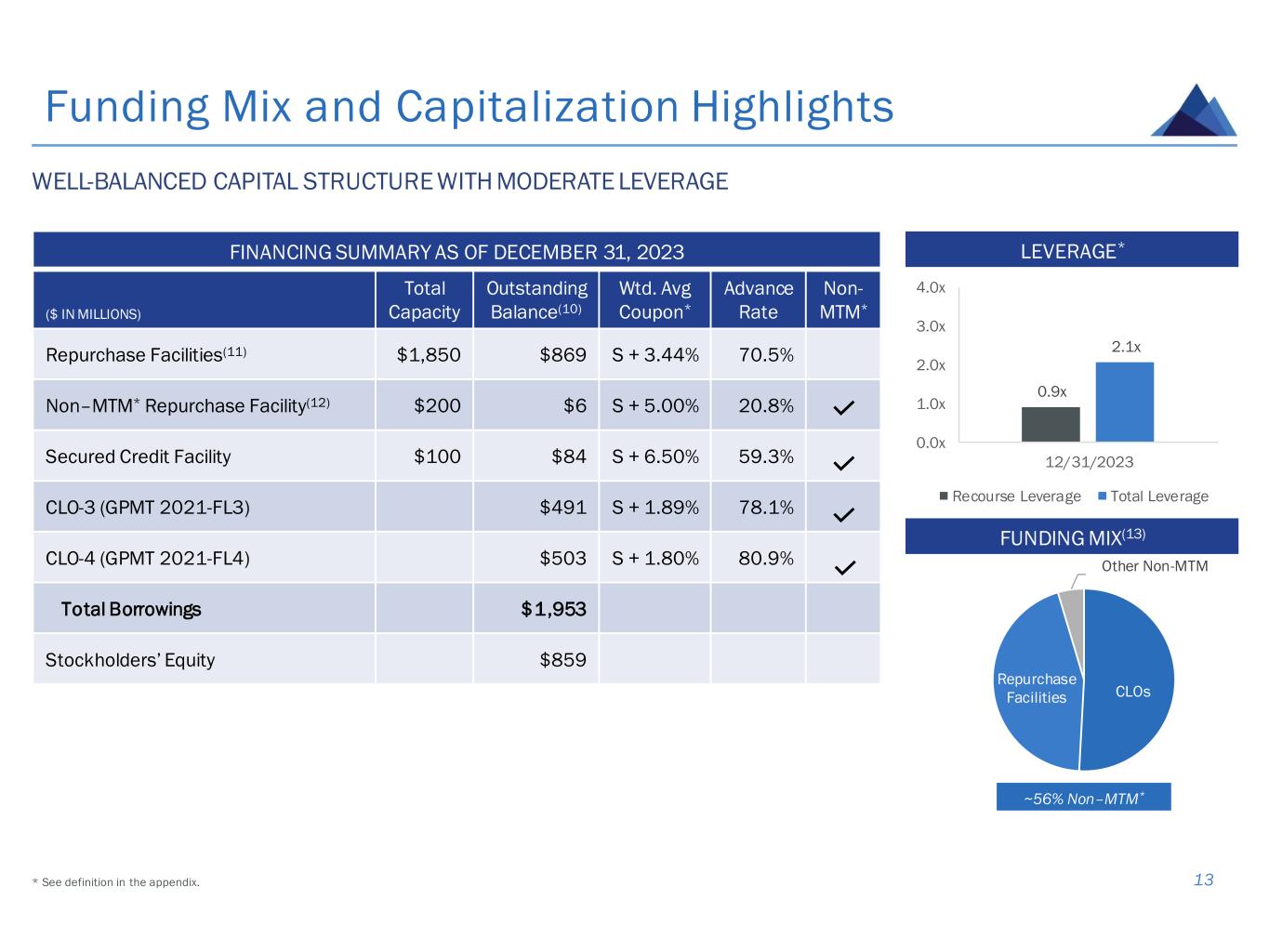

•Ended the quarter with over $188 million in cash on hand and a total leverage ratio(5) of 2.1x.

Full Year 2023 Activity

•Recognized GAAP Net (Loss)(1) of $(77.6) million, or $(1.50) per basic share, inclusive of a $(104.8) million, or $(2.03) per basic share, provision for credit losses.

•Generated Distributable (Loss)(2) of $(17.0) million, or $(0.33) per basic share, inclusive of write-offs of $(54.3) million, or $(1.05) per basic share. Distributable Earnings(2) before realized losses were $37.3 million, or $0.72 per basic share.

•Realized $730.2 million of total UPB in loan repayments, principal paydowns, amortization and loan resolutions, which consisted of approx. 35% office, 28% multifamily, 21% hotel, 10% industrial and 5% retail properties.

•During 2023, opportunistically repurchased approx. 2.0 million common shares, or approx. 3.8% of common shares outstanding, resulting in total book value accretion of approx. $0.35 per share.

•Over the course of 2023, extended the maturities of the Morgan Stanley, Goldman Sachs and JPMorgan financing facilities to June 2024, July 2024 and July 2025, respectively.

•Successfully refinanced GPMT 2019-FL2 CRE CLO, retiring inefficient liabilities and releasing approx. $85 million in cash.

Post Quarter-End Update

•So far in Q1 2024, funded $7.1 million on existing loan commitments.

•Received $5.9 million from loan payoffs and paydowns.

•As of February 9th, carried approximately $170 million in unrestricted cash.

(1)Represents Net Income Attributable to Common Stockholders.

(2)Please see page 6 for Distributable Earnings and Distributable Earnings before realized losses definition and a reconciliation of GAAP to non-GAAP financial information.

(3)Stabilized loan-to-value ratio (LTV) is calculated as the fully funded loan amount (plus any financing that is pari passu with or senior to such loan), including all contractually provided for future fundings, divided by the as stabilized value (as determined in conformance with USPAP) set forth in the original appraisal. As stabilized value may be based on certain assumptions, such as future construction completion, projected re-tenanting, payment of tenant improvement or leasing commissions allowances or free or abated rent periods, or increased tenant occupancy.

(4)Yield includes net origination fees and exit fees, but does not include future fundings, and is expressed as a monthly equivalent yield. Portfolio yield includes nonaccrual loans.

(5)Borrowings outstanding on repurchase facilities, non-mtm repurchase facility, secured credit facility, CLO’s, asset-specific financing and convertible senior notes, less cash, divided by total stockholders’ equity.

Conference Call

Granite Point Mortgage Trust Inc. will host a conference call on February 15, 2024, at 11:00 a.m. ET to discuss fourth quarter and full year 2023 financial results and related information. To participate in the teleconference, please call toll-free (877) 407-8031, (or (201) 689-8031 for international callers), approximately 10 minutes prior to the above start time, and ask to be joined into the Granite Point Mortgage Trust Inc. call. You may also listen to the teleconference live via the Internet at www.gpmtreit.com, in the Investor Relations section under the News & Events link. For those unable to attend, a telephone playback will be available beginning February 15, 2024, at 12:00 p.m. ET through February 22, 2024, at 12:00 a.m. ET. The playback can be accessed by calling (877) 660-6853 (or (201) 612-7415 for international callers) and providing the Access Code 13743745. The call will also be archived on the Company’s website in the Investor Relations section under the News & Events link.

About Granite Point Mortgage Trust Inc.

Granite Point Mortgage Trust Inc. is a Maryland corporation focused on directly originating, investing in and managing senior floating rate commercial mortgage loans and other debt and debt-like commercial real estate investments. Granite Point is headquartered in New York, NY. Additional information is available at www.gpmtreit.com.

Forward-Looking Statements

This press release contains, or incorporates by reference, not only historical information, but also forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our beliefs, expectations, estimates, projections and illustrations and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “target,” “believe,” “outlook,” “potential,” “continue,” “intend,” “seek,” “plan,” “goals,” “future,” “likely,” “may” and similar expressions or their negative forms, or by references to strategy, plans or intentions. The illustrative examples herein are forward-looking statements. By their nature, forward-looking statements speak only as of the date they are made, are not statements of historical facts or guarantees of future performance and are subject to risks, uncertainties, assumptions or changes in circumstances that are difficult to predict or quantify. Our expectations, beliefs and estimates are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management's expectations, beliefs and estimates will prove to be correct or be achieved, and actual results may vary materially from what is expressed in or indicated by the forward-looking statements.

These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2022, under the caption “Risk Factors,” and any subsequent Form 10-Q or other filings made with the SEC. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or revise any such forward-looking statements, whether as a result of new information, future events or otherwise.

This press release is for informational purposes only and shall not constitute, or form a part of, an offer to sell or buy or the solicitation of an offer to sell or the solicitation of an offer to buy any securities.

Non-GAAP Financial Measures

In addition to disclosing financial results calculated in accordance with United States generally accepted accounting principles (GAAP), this press release and the accompanying earnings presentation present non-GAAP financial measures, such as Distributable Earnings and Distributable Earnings per basic common share, that exclude certain items. Granite Point management believes that these non-GAAP measures enable it to perform meaningful comparisons of past, present and future results of the Company’s core business operations, and uses these measures to gain a comparative understanding of the Company’s operating performance and business trends. The non-GAAP financial measures presented by the Company represent supplemental information to assist investors in analyzing the results of its operations. However, because these measures are not calculated in accordance with GAAP, they should not be considered a substitute for, or superior to, the

financial measures calculated in accordance with GAAP. The Company’s GAAP financial results and the reconciliations from these results should be carefully evaluated. See the GAAP to non-GAAP reconciliation table on page 6 of this release.

Additional Information

Stockholders of Granite Point and other interested persons may find additional information regarding the Company at the Securities and Exchange Commission’s Internet site at www.sec.gov or by directing requests to: Granite Point Mortgage Trust Inc., 3 Bryant Park, 24th Floor, New York, NY 10036, telephone (212) 364-5500.

Contact

Investors: Chris Petta Investor Relations, Granite Point Mortgage Trust Inc., (212) 364-5500, investors@gpmtreit.com.

GRANITE POINT MORTGAGE TRUST INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

| | | | | | | | | | | |

| December 31,

2023 | | December 31,

2022 |

| ASSETS | (unaudited) | | |

| Loans held-for-investment | $ | 2,718,486 | | | $ | 3,350,150 | |

| Allowance for credit losses | (134,661) | | | (82,335) | |

| Loans held-for-investment, net | 2,583,825 | | | 3,267,815 | |

| | | |

| | | |

| Cash and cash equivalents | 188,370 | | | 133,132 | |

| Restricted cash | 10,846 | | | 7,033 | |

| Real estate owned, net | 16,939 | | | — | |

| Accrued interest receivable | 12,380 | | | 13,413 | |

| | | |

| | | |

| | | |

| Other assets | 34,572 | | | 32,708 | |

| Total Assets | $ | 2,846,932 | | | $ | 3,454,101 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Liabilities | | | |

| Repurchase facilities | $ | 875,442 | | | $ | 1,015,566 | |

| Securitized debt obligations | 991,698 | | | 1,138,749 | |

| Asset-specific financings | — | | | 44,913 | |

| Secured credit facility | 84,000 | | | 100,000 | |

| | | |

| Convertible senior notes | — | | | 130,918 | |

| | | |

| | | |

| | | |

| Dividends payable | 14,136 | | | 14,318 | |

| Other liabilities | 22,633 | | | 24,967 | |

| Total Liabilities | 1,987,909 | | | 2,469,431 | |

| Commitments and Contingencies | | | |

10.00% cumulative redeemable preferred stock, par value $0.01 per share; 50,000,000 shares authorized | — | | | 1,000 | |

| Stockholders’ Equity | | | |

7.00% Series A cumulative redeemable preferred stock, par value $0.01 per share; 11,500,000 shares authorized, and 8,229,500 and 8,229,500 shares issued and outstanding, respectively; liquidation preference $25.00 per share | 82 | | | 82 | |

Common stock, par value $0.01 per share; 450,000,000 shares authorized, and 50,577,841 shares and 52,350,989 issued and outstanding, respectively | 506 | | | 524 | |

| Additional paid-in capital | 1,198,048 | | | 1,202,315 | |

| Cumulative earnings | 67,495 | | | 130,693 | |

| Cumulative distributions to stockholders | (407,233) | | | (350,069) | |

| Total Granite Point Mortgage Trust Inc. Stockholders’ Equity | 858,898 | | | 983,545 | |

| Non-controlling interests | 125 | | | 125 | |

| Total Equity | $ | 859,023 | | | $ | 983,670 | |

| Total Liabilities and Stockholders’ Equity | $ | 2,846,932 | | | $ | 3,454,101 | |

GRANITE POINT MORTGAGE TRUST INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Interest income: | (unaudited) | | | | (unaudited) | | |

| Loans held-for-investment | $ | 59,377 | | | $ | 60,025 | | | $ | 254,733 | | | $ | 208,500 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Cash and cash equivalents | 2,126 | | | 1,394 | | | 9,002 | | | 2,354 | |

| Total interest income | 61,503 | | | 61,419 | | | 263,735 | | | 210,854 | |

| Interest expense: | | | | | | | |

| Repurchase facilities | 21,963 | | | 18,966 | | | 86,593 | | | 49,452 | |

| Secured credit facility | 3,108 | | | 383 | | | 12,290 | | | 383 | |

| Securitized debt obligations | 18,622 | | | 16,639 | | | 72,975 | | | 51,631 | |

| Convertible senior notes | — | | | 3,824 | | | 6,975 | | | 17,527 | |

| Term financing facility | — | | | — | | | — | | | 1,713 | |

| Asset-specific financings | 478 | | | 623 | | | 2,902 | | | 1,669 | |

| | | | | | | | |

| Senior secured term loan facilities | — | | | — | | | — | | | 3,754 | |

| Total interest expense | 44,171 | | | 40,435 | | | 181,735 | | | 126,129 | |

| Net interest income | 17,332 | | | 20,984 | | | 82,000 | | | 84,725 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Other (loss) income: | | | | | | | |

| Revenue from real estate owned operations | 1,104 | | | — | | | 2,622 | | | — | |

| | | | | | | | |

| (Provision for) benefit from credit losses | (21,571) | | | (16,508) | | | (104,807) | | | (69,265) | |

| Gain (loss) on extinguishment of debt | — | | | — | | | 238 | | | (18,823) | |

| Realized losses on sales | — | | | (1,702) | | | — | | | (1,702) | |

| Fee income | 53 | | | — | | | 134 | | | 954 | |

| | | | | | | | |

| Total other (loss) income | (20,414) | | | (18,210) | | | (101,813) | | | (88,836) | |

| Expenses: | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Compensation and benefits | 4,546 | | | 3,686 | | | 21,711 | | | 20,225 | |

| Servicing expenses | 1,284 | | | 1,421 | | | 5,313 | | | 5,718 | |

| Expenses from real estate owned operations | 2,080 | | | — | | | 5,977 | | | — | |

| Other operating expenses | 2,480 | | | 3,887 | | | 10,289 | | | 10,754 | |

| | | | | | | | |

| Total expenses | 10,390 | | | 8,994 | | | 43,290 | | | 36,697 | |

| (Loss) income before income taxes | (13,472) | | | (6,220) | | | (63,103) | | | (40,808) | |

| Provision for (benefit from) income taxes | 1 | | | 6 | | | 95 | | | 17 | |

| Net (loss) income | (13,473) | | | (6,226) | | | (63,198) | | | (40,825) | |

| Dividends on preferred stock | 3,601 | | | 3,626 | | | 14,451 | | | 14,502 | |

| | | | | | | | |

| Net (loss) income attributable to common stockholders | $ | (17,074) | | | $ | (9,852) | | | $ | (77,649) | | | $ | (55,327) | |

| Basic (loss) earnings per weighted average common share | $ | (0.33) | | | $ | (0.19) | | | $ | (1.50) | | | $ | (1.04) | |

| Diluted (loss) earnings per weighted average common share | $ | (0.33) | | | $ | (0.19) | | | $ | (1.50) | | | $ | (1.04) | |

| Dividends declared per common share | $ | 0.20 | | | $ | 0.20 | | | $ | 0.80 | | | $ | 0.95 | |

| Weighted average number of shares of common stock outstanding: | | | | | | | |

| Basic | 51,156,015 | | | 52,350,989 | | | 51,641,619 | | | 53,011,806 | |

| Diluted | 51,156,015 | | | 52,350,989 | | | 51,641,619 | | | 53,011,806 | |

| | | | | | | | |

| Net (loss) income attributable to common stockholders | $ | (17,074) | | | $ | (9,852) | | | $ | (77,649) | | | $ | (55,327) | |

GRANITE POINT MORTGAGE TRUST INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION

(dollars in thousands, except share data)

| | | | | | | | |

| Three Months Ended December 31, 2023 | Twelve Months Ended December 31, 2023 |

| (unaudited) | (unaudited) |

Reconciliation of GAAP Net (Loss) to Distributable (Loss)(1): | | |

| | |

| GAAP Net (Loss) | $ | (17,074) | | $ | (77,649) | |

| Adjustments for non-distributable earnings: | | |

| Provision for (benefit from) credit losses | 21,571 | | 104,807 | |

| Non-cash equity compensation | 1,066 | | 6,979 | |

| (Gain) loss on extinguishment of debt | — | | (238) | |

| Depreciation and Amortization on Real Estate Owned | 1,399 | | 3,375 | |

Distributable Earnings(1) before realized losses and write-offs | $ | 6,962 | | $ | 37,274 | |

| Loan write-offs | (33,324) | | (54,274) | |

Distributable (Loss)(1) | $ | (26,362) | | $ | (17,000) | |

| Basic weighted average shares outstanding | 51,156,015 | | 51,641,619 | |

Distributable Earnings(1) before realized losses and write-offs per basic common share | $ | 0.14 | | $ | 0.72 | |

Distributable (Loss)(1) per basic common share | $ | (0.52) | | $ | (0.33) | |

(1) Beginning with our Annual Report on Form 10-K for the year ended December 31, 2022, and for all subsequent reporting periods ending on or after December 31, 2022, we have elected to present Distributable Earnings, a measure that is not prepared in accordance with GAAP, as a supplemental method of evaluating our operating performance. Distributable Earnings replaces our prior presentation of Core Earnings with no changes to the definition. In order to maintain our status as a REIT, we are required to distribute at least 90% of our taxable income as dividends. Distributable Earnings is intended to overtime serve as a general, though imperfect, proxy for our taxable income. As such, Distributable Earnings is considered a key indicator of our ability to generate sufficient income to pay our common dividends, which is the primary focus of income-oriented investors who comprise a meaningful segment of our stockholder base. We believe providing Distributable Earnings on a supplemental basis to our net income and cash flow from operating activities, as determined in accordance with GAAP, is helpful to stockholders in assessing the overall run-rate operating performance of our business.

For reporting purposes, we define Distributable Earnings as net income attributable to our stockholders, computed in accordance with GAAP, excluding: (i) non-cash equity compensation expenses; (ii) depreciation and amortization; (iii) any unrealized gains (losses) or other similar non-cash items that are included in net income for the applicable reporting period (regardless of whether such items are included in other comprehensive income or in net income for such period); and (iv) certain non-cash items and one-time expenses. Distributable Earnings may also be adjusted from time to time for reporting purposes to exclude one-time events pursuant to changes in GAAP and certain other material non-cash income or expense items approved by a majority of our independent directors. The exclusion of depreciation and amortization from the calculation of Distributable Earnings only applies to debt investments related to real estate to the extent we foreclose upon the property or properties underlying such debt investments.

While Distributable Earnings excludes the impact of the unrealized non-cash current provision for credit losses, we expect to only recognize such potential credit losses in Distributable Earnings if and when such amounts are deemed non-recoverable. This is generally at the time a loan is repaid, or in the case of foreclosure, when the underlying asset is sold, but non-recoverability may also be concluded if, in our determination, it is nearly certain that all amounts due will not be collected. The realized loss amount reflected in Distributable Earnings will equal the difference between the cash received, or expected to be received, and the carrying value of the asset, and is reflective of our economic experience as it relates to the ultimate realization of the loan. During the quarter and year ended December 31, 2023, we recorded provision for credit losses of $(21.6) million $(104.8) million, respectively, which has been excluded from Distributable Earnings, consistent with other unrealized gains (losses) and other non-cash items pursuant to our existing policy for reporting Distributable Earnings referenced above. During the quarter and year ended December 31, 2023, we recorded $1.4 million and $3.4 million, respectively, in depreciation and amortization on real estate owned and related intangibles, which has been excluded from Distributable Earnings consistent with other unrealized gains (losses) and other non-cash items pursuant to our existing policy for reporting Distributable Earnings referenced above. During the year ended December 31, 2023, we recorded a $0.2 million gain on early extinguishment of debt, which has been excluded from Distributable Earnings consistent with certain one-time events pursuant to our existing policy for reporting Distributable Earnings as a helpful indicator in assessing the overall run-rate operating performance of our business.

During the year ended December 31, 2023, we recorded $(54.3) million of realized losses on loan investments consisting of (i) $(33.3) million realized loss representing a write-off of an allowance for credit losses related to the resolution of a loan secured by an office property located in San Diego, CA, (ii) $(16.8) million realized loss representing a write-off of an allowance for credit losses related to the transfer to loans held-for-sale of a loan secured by an office property located in Dallas, TX, and (iii) $(4.2) million realized loss representing a write-off of an allowance for credit losses related to the transfer to REO of a loan secured by an office property located in Phoenix, AZ. These realized losses have been included in Distributable Earnings pursuant to our existing policy for reporting Distributable Earnings referenced above.

Distributable Earnings does not represent net income or cash flow from operating activities and should not be considered as an alternative to GAAP net income, or an indication of our GAAP cash flows from operations, a measure of our liquidity, or an indication of funds available for our cash needs. In addition, our methodology for calculating Distributable Earnings may differ from the methodologies employed by other companies to calculate the same or similar supplemental performance measures, and, accordingly, our reported Distributable Earnings may not be comparable to the Distributable Earnings reported by other companies.

We believe it is useful to our stockholders to present Distributable Earnings before realized losses to reflect our run-rate operating results as (i) our operating results are mainly comprised of net interest income earned on our loan investments net of our operating expenses, which comprise our ongoing operations, (ii) it helps our stockholders in assessing the overall run-rate operating performance of our business, and (iii) it has been a useful reference related to our common dividend as it is one of the factors we and our Board of Directors consider when declaring the dividend. We believe that our stockholders use Distributable Earnings and Distributable Earnings before realized losses, or a comparable supplemental performance measure, to evaluate and compare the performance of our company and our peers.

Fourth Quarter and Full Year 2023 Earnings Supplemental February 15, 2024

Safe Harbor Statement This presentation contains, or incorporates by reference, not only historical information, but also forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our beliefs, expectations, estimates, projections and illustrations and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “target,” “believe,” “outlook,” “potential,” “continue,” “intend,” “seek,” “plan,” “goals,” “future,” “likely,” “may” and similar expressions or their negative forms, or by references to strategy, plans or intentions. The illustrative examples herein are forward-looking statements. By their nature, forward-looking statements speak only as of the date they are made, are not statements of historical facts or guarantees of future performance and are subject to risks, uncertainties, assumptions or changes in circumstances that are difficult to predict or quantify. Our expectations, beliefs and estimates are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management's expectations, beliefs and estimates will prove to be correct or be achieved, and actual results may vary materially from what is expressed in or indicated by the forward-looking statements. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2022, under the caption “Risk Factors,” and any subsequent Form 10-Q or other filings made with the SEC. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or revise any such forward-looking statements, whether as a result of new information, future events or otherwise. This presentation is for informational purposes only and shall not constitute, or form a part of, an offer to sell or buy or the solicitation of an offer to sell or the solicitation of an offer to buy any securities. 2

SU MMARY RE SU LT SI NVE ST ME NT P ORT FOLI O * All information pertaining to this slide is as of December 31, 2023, unless otherwise noted. ** Includes maximum loan commitments. Outstanding principal balance of $2.7 billion. † Represents Net Income Attributable to Common Stockholders; see definition in the appendix. †† See definition and reconciliation to GAAP net income in the appendix. 3 $2.9 billion** Total Portfolio Commitments Across 73 Loan Investments 100% Loans 99% Senior Loans 98% Floating Rate 63.6% Weighted Average LTV*** ~56% Non-Mark-to- Market Borrowings 2.1x Total Debt-to- Equity Leverage** $3.1 billion Total Financing Capacity with $2.0 billion Outstanding $188 million Unrestricted Cash Balance $37.4 million Average UPB Company Overview* CAP I TAL I ZAT I ON $(1.50) 2023 GAAP Net† (loss) per basic share $0.14 Q4’23 Distributable Earnings†† before realized losses per basic share $(0.33) Q4’23 GAAP Net† (loss) per basic share $0.72 2023 Distributable Earnings†† before realized losses per basic share $137.1 million allowance for credit losses, or 4.7% of portfolio commitments, of which 67%, or $91.4 million, is allocated to specific CECL reserves. $3.1bn financing capacity; $2.0bn outstanding including $1.0bn across six facilities and $1.0bn in non-recourse and non-mark-to-market borrowings from two CRE CLOs. No remaining corporate debt maturities. $0.20 Common Dividend per share; 13.5% Annualized Dividend Yield $12.91 Book Value per Common Share An internally-managed commercial real estate finance company operating as a REIT, focused on originating and investing in floating-rate, first mortgage loans secured by institutional-quality transitional properties. Conservatively managed balance sheet with a granular investment portfolio and a well-balanced funding profile.

PORTFOLIO CREDIT QUALITY ▪ Defensively-positioned and broadly-diversified portfolio of 100% CRE loans (over 99% senior first mortgages) with a weighted average stabilized LTV of 63.6%*. ▪ Weighted average portfolio risk rating of 2.8 as of December 31, 2023. ▪ Well-positioned portfolio with approx. 81% risk ranked 3 and lower. ▪ Actively pursuing asset resolution options including with respect to the five risk-rated “5” loans with a carrying value of $234 million. PORTFOLIO ACTIVITY ▪ In Q4’23, the Company resolved a $92.6 million senior loan that had been on nonaccrual status. The resolution involved a coordinated sale of the collateral property located in San Diego, CA, and the Company providing a new senior floating rate loan with a UPB of $48.8 million to the new ownership group, which invested meaningful fresh cash equity in the property. As a result of this transaction, the Company incurred a loss of approx. $(33.3) million. ▪ In Q4’23, the Company opportunistically sold a $31.8 million senior loan collateralized by a property located in Dallas, TX. As a result of this transaction, the Company incurred a loss of approx. $(16.8) million. CAPITALIZATION & LIQUIDITY ▪ On October 1, 2023, the Company redeemed for cash the $132 million of Convertible Senior Notes. Following the redemption, the Company has no corporate debt outstanding. ▪ In Q4’23, the Company increased the borrowing capacity of the JPMorgan financing facility up to $525 million and modified other terms, resulting in additional cash proceeds to the Company of $100 million. ▪ Over the course of 2023, extended the maturities of the Morgan Stanley, Goldman Sachs and JPMorgan financing facilities to June 2024, July 2024 and July 2025, respectively. ▪ During 2023, the Company successfully refinanced GPMT 2019-FL2 CRE CLO, retiring inefficient liabilities and releasing approx. $85 million in cash. SUBSEQUENT EVENTS ▪ So far in Q1’24, the Company funded $7.1 million on existing loan commitments and realized $5.9 million in loan repayments and paydowns. ▪ As of February 9th, carried approx. $170 million in unrestricted cash. Company Business Update 4 * See definition in the appendix.

FINANCIAL SUMMARY ▪ Q4 GAAP Net (Loss)* of $(17.1) million, or $(0.33) per basic share, inclusive of a $(21.6) million, or $(0.42) per basic share, provision for credit losses. ▪ Q4 Distributable (Loss)** of $(26.4) million, or $(0.52) per basic share, inclusive of a write-off of $(33.3) million, or $(0.65) per basic share. Distributable Earnings** before realized losses were $7.0 million, or $0.14 per basic share. ▪ FY 2023 GAAP Net (Loss)* of $(77.6) million, or $(1.50) per basic share, inclusive of a $(104.8) million, or $(2.03) per basic share, provision for credit losses. ▪ FY 2023 Distributable (Loss)** of $(17.0) million, or $(0.33) per basic share, inclusive of write-offs of $(54.3) million, or $(1.05) per basic share. Distributable Earnings** before realized losses were $37.3 million, or $0.72 per basic share. ▪ Q4 Common stock quarterly dividend per share of $0.20; Series A preferred dividend per share of $0.4375. ▪ Q4 Book value per common share of $12.91, inclusive of $(2.71) per common share of total CECL reserve; $0.80 of common dividends per share in 2023. PORTFOLIO ACTIVITY ▪ In Q4, funded $15.2 million on existing loan commitments and upsizes. During 2023 funded $69.3 million on existing loan commitments. ▪ In Q4, realized $255.2 million of total UPB in loan repayments, principal paydowns, amortization and loan resolutions. In 2023 realized $730.2 million of loan repayments, principal paydowns, amortization, and loan resolutions, which consisted of approx. 35% office, 28% multifamily, 21% hotel, 10% industrial and 5% retail properties. PORTFOLIO OVERVIEW ▪ Portfolio with $2.9 billion in total commitments across 73 loan investments comprised of over 99% senior loans with a weighted average stabilized LTV of 63.6%† and a realized loan portfolio yield of 8.3%†; over 98% floating rate. ▪ Total CECL reserve of $137.1 million, or 4.7% of total portfolio commitments as of December 31, 2023. CAPITALIZATION & LIQUIDITY ▪ During 2023, opportunistically repurchased approx. 2.0 million common shares, or approx. 3.8% of common shares outstanding, resulting in book value accretion of approx. $0.35 per share. ▪ Ended Q4 with over $188 million in unrestricted cash and total leverage ratio†† of 2.1x with no corporate debt maturities remaining. Q4 and Full Year 2023 Summary Results 5 * Represents Net Income Attributable to Common Stockholders; see definition in the appendix. ** See definition and reconciliation to GAAP net income in the appendix. † See definition in the appendix. Includes nonaccrual loans. †† See definition in the appendix.

SUMMARY INCOME STATEMENT ($ IN MILLIONS, EXCEPT PER SHARE DATA) (UNAUDITED) Net Interest Income $17.3 Fee Income $0.1 (Provision) for Credit Losses $(21.6) Revenue / (Expenses) from REO Operations, net $(1.0) Operating Expenses $(8.3) Dividends on Preferred Stock $(3.6) GAAP Net (Loss)* $(17.1) Basic Wtd. Avg. Common Shares 51,156,015 Diluted Wtd. Avg. Common Shares 51,156,015 Net (Loss) Per Basic Share $(0.33) Net (Loss) Per Diluted Share $(0.33) Common Dividend Per Share $0.20 Series A Preferred Dividend Per Share $0.4375 Q4 2023 Financial Summary 6* See definition in the appendix. Due to rounding figures may not result in the totals presented. SUMMARY BALANCE SHEET ($ IN MILLIONS, EXCEPT PER SHARE DATA, REFLECTS CARRYING VALUES) (UNAUDITED) Cash $188.4 Restricted Cash $10.8 Loans Held-for-Investment, net $2,583.8 Real Estate Owned, net(1) $20.5 Repurchase Facilities $875.4 Securitized (CLO) Debt $991.7 Secured Credit Facility $84.0 Preferred Equity $205.7 Common Equity $653.2 Total Stockholders’ Equity $858.9 Common Shares Outstanding 50,577,841 Book Value Per Common Share $12.91

$13.28 $12.91 $0.18 $(0.42) $(0.07) $(0.20) $0.16 $(0.02) $9.00 $10.00 $11.00 $12.00 $13.00 $14.00 $15.00 9/30/2023 Pre-Provision Earnings (Provision for) Credit Losses Series A Preferred Dividend Declaration Common Stock Dividend Declaration Share Repurchase Equity Compensation 12/31/2023 Key Drivers of Q4 2023 Earnings and Book Value Per Share • GAAP Net (Loss)* of $(17.1) million, or $(0.33) per basic share, inclusive of a $(21.6) million, or $(0.42) per basic share, of provision for credit losses. • Distributable (Loss)** of $(26.4) million, or $(0.52) per basic share, inclusive of a write-off of $(33.3) million, or $(0.65) per basic share. Distributable Earnings** before realized losses were $7.0 million, or $0.14 per basic share. • Q4 2023 book value per common share of $12.91, inclusive of $(2.71) per common share total CECL reserve. 7 B OOK VA L U E WA L K P E R SHA R E * Represents Net Income Attributable to Common Stockholders; see definition in the appendix. ** See definition and reconciliation to GAAP net income in the appendix.

25.7% 32.0% 16.8% 21.2% 4.3% 0 - 60% 60 - 65% 65 - 70% 70 - 75% 75 - 80% Loan Portfolio Credit Overview 8 GENERAL AND SPECIFIC CECL RESERVE BY QTR.* CECL RESERVE AS % OF COMMITMENTS BY QTR. STABILIZED LTV** RISK RATINGS * $ in millions. ** See definition in the appendix. • Weighted average portfolio risk rating of 2.8 as of December 31, 2023. $65.5 $72.3 $63.8 $45.7 $67.5 $62.3 $85.1 $91.4 $133.0 $134.6 $148.9 $137.1 3/31/2023 6/30/2023 9/30/2023 12/31/2023 General Specific 3.8% 4.1% 4.9% 4.7% 3/31/2023 6/30/2023 9/30/2023 12/31/2023 2.6% 46.9% 31.6% 7.0% 11.9% 1 2 3 4 5

Office, 43.2% Multifamily, 32.0% Retail, 10.0% Hotel, 7.0% Industrial, 4.4% Other, 3.4% Loan Portfolio Overview as of December 31, 2023 9 PROPERTY TYPE(2) REGION(2) * See definition in the appendix. ** See definition in the appendix. Includes nonaccrual loans. KEY PORTFOLIO STATISTICS Outstanding Principal Balance $2.7 billion Total Loan Commitments $2.9 billion Number of Investments 73 Average UPB ~$37.4 mil Realized Loan Portfolio Yield** 8.3% Weighted Average Stabilized LTV* 63.6% Weighted Average Fully- Extended Remaining Term(3) 1.6 years Well-diversified and granular portfolio comprised of over 99% senior loans with a weighted average stabilized LTV at origination of 63.6%*. Northeast, 27.5% Southeast, 24.3% Southwest, 19.2% Midwest, 16.3% West, 12.7%

11.7% 14.3% 34.5% 2.5% 18.8% 16.4% 1.8% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% Pre-2018 2018 2019 2020 2021 2022 2023 % o f P o rt fo li o 1 -M o n th U .S . S O F R % of Floating Rate Loan Portfolio Wtd. Avg. SOFR Floor by Loan Vintage Wtd. Avg. Portfolio SOFR Floor 10 Sensitivity to Short-term Interest Rates QTR. NET INTEREST INCOME PER SHARE SENSITIVITY TO CHANGES IN 1-MO. U.S. SOFR AS OF DECEMBER 31, 2023(5) • Over 98% floating-rate senior loan portfolio indexed to Term SOFR. WEIGHTED AVERAGE SOFR BY LOAN VINTAGE (4) $(0.02) $(0.02) $(0.01) $(0.01) $(0.01) $- $- $0.01 (1.50%) (1.25%) (1.00%) (0.75%) (0.50%) (0.25%) 0.25% 0.50% Change in 1-Month U.S. SOFR (%) Term SOFR 5.35%

Overview of Risk-Rated “5” Loans 11 Minneapolis, MN Office(6) Chicago, IL Office(7) Baton Rouge, LA Mixed-use(7) Los Angeles, CA Mixed-use(8) Minneapolis, MN Hotel(9) Loan Structure Senior floating-rate Senior floating-rate Senior floating-rate Senior floating-rate Senior floating-rate Origination Date August 2019 July 2019 December 2015 November 2018 December 2018 Collateral Property 409,000 sq. ft. office building 346,545 sq. ft. office building 504,482 sq. ft. office/retail building 83,100 sq. ft. office/retail building 154 key full-service hotel Total Commitment $93 million $90 million $86 million $37 million $28 million Current UPB $93 million $80 million $86 million $37 million $28 million Cash Coupon* S + 2.8% S + 3.7% S + 4.2% S + 3.6% S + 3.9% * See definition in the appendix. • In Q4’23, the Company resolved a $92.6 million senior loan that had been on nonaccrual status resulting in a realized loss of approx. $(33.3) million. The resolution involved a coordinated sale of the collateral property located in San Diego, CA, and the Company providing a new senior floating rate loan with a UPB of $48.8 million to the new ownership group, which invested meaningful cash equity in the property. • In Q4’23, the Company opportunistically sold a $31.8 million senior loan collateralized by a property located in Dallas, TX. As a result of this transaction, the Company incurred a loss of approx. $(16.8) million. • During Q4’23, the Company downgraded to a risk rating of “5” an $85.6 million senior loan collateralized by a mixed-use office and retail property located in Baton Rouge, LA as the collateral property’s operating performance has been adversely affected by the ongoing real estate and capital markets challenges. The loan was placed on nonaccrual status as of December 31, 2023. • During Q4’23, the Company downgraded to a risk rating of “5” an $80.0 million senior loan collateralized by an office property located in Chicago, IL as the collateral property’s operating performance has been adversely affected by the ongoing real estate and capital markets challenges. The loan was placed on nonaccrual status as of December 31, 2023. • As of December 31, 2023, the Company held five loans that were risk-rated “5” with an aggregate principal balance of $323.9 million. The Company is actively pursuing resolution options with respect to these loans, which may include a foreclosure, a deed-in-lieu, a loan restructuring, a sale of the loan, or a sale of the collateral property.

Office Loan Portfolio Overview 12 • Since 2021, reduced the office exposure by over $525 million, or over 30%, primarily through repayments and paydowns, and also through other proactive loan resolutions. • Granular office portfolio across 20 MSAs and 17 States. • 55% CBD locations, 45% suburban locations. • 35% Top 5 markets, 65% secondary markets. • Average principal balance $34.2 million. • Weighted average stabilized LTV of 63.8%. • 5-rated office exposure in Minneapolis, Chicago and Downtown LA. • No office exposure in Washington DC, San Francisco Bay Area, Portland or Seattle. * Includes mixed-use properties. REDUCTION IN OFFICE EXPOSURE* ($ IN MILLIONS) OFFICE PORTFOLIO BY REGION(2) Northeast, 39.1% Southeast, 23.6% West, 18.3% Midwest, 12.2% Southwest, 6.8% $1,723 $1,404 $1,195 $1,000 $1,250 $1,500 $1,750 $2,000 2021 2022 2023

FINANCING SUMMARY AS OF DECEMBER 31, 2023 ($ IN MILLIONS) Total Capacity Outstanding Balance(10) Wtd. Avg Coupon* Advance Rate Non- MTM* Repurchase Facilities(11) $1,850 $869 S + 3.44% 70.5% Non–MTM* Repurchase Facility(12) $200 $6 S + 5.00% 20.8% Secured Credit Facility $100 $84 S + 6.50% 59.3% CLO-3 (GPMT 2021-FL3) $491 S + 1.89% 78.1% CLO-4 (GPMT 2021-FL4) $503 S + 1.80% 80.9% Total Borrowings $1,953 Stockholders’ Equity $859 CLOs Repurchase Facilities Other Non-MTM Funding Mix and Capitalization Highlights 13* See definition in the appendix. FUNDING MIX(13) WELL-BALANCED CAPITAL STRUCTURE WITH MODERATE LEVERAGE LEVERAGE* 0.9x 2.1x 0.0x 1.0x 2.0x 3.0x 4.0x 12/31/2023 Recourse Leverage Total Leverage ~56% Non–MTM*

Endnotes

Endnotes 15 1) As of December 31, 2023, real estate owned, net included $3.6 million in other assets and liabilities related to acquired leases. 2) Mixed-use properties represented based on allocated loan amounts. Percentages are based off of carrying value. 3) Max remaining term assumes all extension options are exercised and excludes four loans that have passed its maturity date and are not eligible for extension, if applicable. 4) Reflects changes to SOFR floors arising from loan modifications in prior period. 5) Represents estimated change in net interest income for theoretical (+)(-) 25 basis points parallel shifts in 1 -month U.S. SOFR, as of 12/31/2023, spot SOFR was 5.35%. All projected changes in quarterly net interest income are measured as the change from our projected quarterly net interest income based off of current performance returns on portfolio as it existed on December 31, 2023. Actual results of changes in annualized net interest income may differ from the information presented in the sensitivity graph due to differences between the dates of actual interest rate resets in our loan investments and our floating rate interest-bearing liabilities, and the dates as of which the analysis was performed. 6) Loan was placed on nonaccrual status as of June 2022. 7) Loan was placed on nonaccrual status as of December 2023. 8) Loan was placed on nonaccrual status as of September 2023. 9) Loan was placed on nonaccrual status as of March 2023. 10) Outstanding principal balance, excludes deferred debt issuance costs. 11) Includes option to be exercised at the Company’s discretion, subject to customary terms and conditions, to increase the maximum facility amount of the Goldman Sachs facility from $250 million to $350 million. 12) Includes option to be exercised at the Company’s discretion, subject to customary terms and conditions, to increase the maximum facility amount of the Centennial facility from $150 million to $200 million. 13) Other non-MTM includes non-mark-to-market repurchase facility and secured credit facility.

Appendix

Summary of Investment Portfolio 17 ($ IN MILLIONS) Maximum Loan Commitment Principal Balance Carrying Value Cash Coupon* All-in Yield at Origination* Original Term (Years)* Initial LTV* Stabilized LTV* Senior Loans* $2,874.4 $2,713.7 $2,570.7 S + 3.75% S + 4.03% 3.1 66.8% 63.7% Subordinated Loans $13.5 $13.5 $13.1 8.00% 8.11% 10.0 41.4% 36.2% Total Weighted/Average** $2,887.9 $2,727.2 $2,583.8 S + 3.75% S + 4.03% 3.2 66.7% 63.6% * See definition in this appendix. ** Due to rounding figures may not result in the totals presented.

Investment Portfolio 18 ($ IN MILLIONS) Type * Origination Date Maximum Loan Commitment Principal Balance Carrying Value Cash Coupon * All-in Yield at Origination * Original Term (Years) * State Property Type Initial LTV * Stabilized LTV * Asset 1 Senior 12/19 $111.1 $109.2 $108.9 S + 2.80% S + 3.23% 3.0 IL Multifamily 76.5% 73.0% Asset 2 Senior 12/18 96.5 92.2 92.0 S + 3.75% S + 5.21% 3.0 NY Mixed-Use 26.2% 47.6% Asset 3 Senior 08/19 93.1 93.1 93.2 S + 2.85% S + 3.26% 3.0 MN Office 73.1% 71.2% Asset 4 Senior 07/19 89.8 80.0 79.9 S + 3.74% S + 4.32% 3.0 IL Office 70.0% 64.4% Asset 5 Senior 10/19 87.4 87.2 86.8 S + 2.60% S + 3.05% 3.0 TN Office 70.2% 74.2% Asset 6 Senior 12/15 86.0 85.6 85.4 S + 4.15% S + 4.43% 4.0 LA Mixed-Use 65.5% 60.0% Asset 7 Senior 06/19 81.2 81.0 80.5 S + 3.29% S + 3.05% 3.0 TX Mixed-Use 71.7% 72.2% Asset 8 Senior 12/18 78.1 60.1 60.0 S + 3.40% S + 3.44% 3.0 TX Office 68.5% 66.7% Asset 9 Senior 10/19 77.3 77.3 77.0 S + 3.41% S + 3.73% 3.0 FL Mixed-Use 67.7% 62.9% Asset 10 Senior 10/22 77.3 77.3 77.3 S + 4.50% S + 4.61% 2.0 CA Retail 47.7% 36.6% Asset 11 Senior 12/19 69.2 62.9 62.8 S + 3.50% S + 3.28% 3.0 NY Office 68.8% 59.3% Asset 12 Senior 12/16 66.0 66.0 66.0 S + 5.15% S + 4.87% 4.0 FL Office 73.3% 63.2% Asset 13 Senior 12/23 61.8 48.8 48.8 S + 5.50% S + 5.65% 2.0 CA Office 80.0% 79.2% Asset 14 Senior 05/22 55.5 46.7 46.5 S + 3.29% S + 3.70% 3.0 TX Multifamily 59.3% 62.9% Asset 15 Senior 06/19 54.1 54.1 53.9 S + 3.35% S + 3.70% 3.0 VA Office 49.3% 49.9% Assets 16-77 Various Various $1,703.5 $1,605.7 $1,599.5 S + 3.86% S + 4.11% 3.3 Various Various 68.2% 64.0% Allowance for Credit Losses $(134.7) Total/Weighted Average ** $2,887.9 $2,727.2 $2,583.8 S + 3.75% S + 4.03% 3.2 66.7% 63.6% * See definition in this appendix. ** Due to rounding figures may not result in the totals presented.

Average Balances and Yields/Cost of Funds 19 Quarter Ended December 31, 2023 ($ IN THOUSANDS) Average Balance** Interest Income/Expense† Net Yield/Cost of Funds Interest-earning assets Loans held-for-investment Senior loans* $2,840,239 $59,101 8.3% Subordinated loans 13,529 276 8.2% Total loan interest income/net asset yield $2,855,925 $59,377 8.3% Other - Interest on cash and cash equivalents $2,126 Total interest income $61,503 Interest-bearing liabilities Borrowings collateralized by: Loans held-for-investment Senior loans* $2,049,046 $43,994 8.6% Subordinated loans 8,123 177 8.7% Total interest expense/cost of funds $2,057,169 $44,171 8.6% Net interest income/spread $17,332 (0.3)% * See definition in this appendix. Included in collateralized borrowings is the Centennial repurchase facility with an outsta nding balance $6.2 million, which became collateralized by REO on May 16, 2023. ** Average balance represents average amortized cost on loans held-for-investment. † Includes amortization of deferred debt issuance costs.

Consolidated Balance Sheets 20 GRANITE POINT MORTGAGE TRUST INC. CONSOLIDATED BALANCE SHEETS (IN THOUSANDS, EXCEPT SHARE DATA) December 31, 2023 December 31, 2022 ASSETS (unaudited) Loans held-for-investment $ 2,718,486 $ 3,350,150 Allowance for credit losses (134,661) (82,335) Loans held-for-investment, net 2,583,825 3,267,815 Cash and cash equivalents 188,370 133,132 Restricted cash 10,846 7,033 Real estate owned, net 16,939 — Accrued interest receivable 12,380 13,413 Other assets 34,572 32,708 Total Assets $ 2,846,932 $ 3,454,101 LIABILITIES AND STOCKHOLDERS’ EQUITY Li abilities Repurchase facilities $ 875,442 $ 1,015,566 Securitized debt obligations 991,698 1,138,749 Asset-specific financings — 44,913 Secured credit facility 84,000 100,000 Convertible senior notes — 130,918 Dividends payable 14,136 14,318 Other liabilities 22,633 24,967 Total Liabilities 1,987,909 2,469,431 Commitments and Contingencies 10% cumulative redeemable preferred stock, par value $0.01 per share; 50,000,000 shares authorized and 1,000 issued and outstanding ($1,000,000 liquidation preference) — 1,000 Stockholders’ Equity 7.00% Series A cumulative redeemable preferred stock, par value $0.01 per share; 11,500,000 shares authorized and 8,229,500 a nd 8,229,500 shares issued and outstanding, respectively; liquidation preference $25.00 per share 82 82 Common stock, par value $0.01 per share; 450,000,000 shares authorized and 50,577,841 and 52,350,989 shares issued and outstanding, respectively 506 524 Additional paid-in capital 1,198,048 1,202,315 Cumulative earnings 67,495 130,693 Cumulative distributions to stockholders (407,233) (350,069) Total Granite Point Mortgage Trust Inc. Stockholders’ Equity 858,898 983,545 Non-controlling interests 125 125 Total Equity $ 859,023 $ 983,670 Total Liabilities and Stockholders’ Equity $ 2,846,932 $ 3,454,101

Consolidated Statements of Comprehensive Income (Loss) 21 GRANITE POINT MORTGAGE TRUST INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (in thousands, except share data) Three Months Ended December 31, Twelve Months Ended December 31, 2023 2022 2023 2022 In t erest income: (unaudited) (unaudited) Loans held-for-investment $ 59,377 $ 60,025 $ 254,733 $ 208,500 Cash and cash equivalents 2,126 1,394 9,002 2,354 To t al interest income 61,503 61,419 263,735 210,854 In t erest expense: Repurchase facilities 21,963 18,966 86,593 49,452 Secured credit facility 3,108 383 12,290 383 Securitized debt obligations 18,622 16,639 72,975 51,631 Convertible senior notes — 3,824 6,975 17,527 Term financing facility — — — 1,713 Asset-specific financings 478 623 2,902 1,669 Senior secured term loan facilities — — — 3,754 To t al Interest Expense 44,171 40,435 181,735 126,129 Ne t interest income 17,332 20,984 82,000 84,725 O t her (loss) income: Revenue from real estate owned operations 1,104 — 2,622 — (Provision for) Benefit from credit losses (21,571) (16,508) (104,807) (69,265) Gain (loss) on extinguishment of debt — — 238 (18,823) Realized losses on sales — (1,702) — (1,702) Fee income 53 — 134 954 To t al other (loss) income (20,414) (18,210) (101,813) (88,836) Ex p enses: Compensation and benefits 4,546 3,686 21,711 20,225 Servicing expenses 1,284 1,421 5,313 5,718 Expenses from real estate owned operations 2,080 — 5,977 — Other operating expenses 2,480 3,887 10,289 10,754 To t al expenses 10,390 8,994 43,290 36,697 ( Lo ss) income b efore income taxes (13,472) (6,220) (63,103) (40,808) Provision for (benefit from) income taxes 1 6 95 17 Ne t (loss) income (13,473) (6,226) (63,198) (40,825) Dividends on preferred stock 3,601 3,626 14,451 14,502 Ne t (loss) income attributable to common stockholders $ (17,074) $ (9,852) $ (77,649) $ (55,327) Basic earnings (loss) per weighted average common share $ (0.33) $ (0.19) $ (1.50) $ (1.04) Diluted earnings (loss) per weighted average common share $ (0.33) $ (0.19) $ (1.50) $ (1.04) D iv idends declared per common share $ 0.20 $ 0.20 $ 0.80 $ 0.95 We ighted a verage number of shares of common stock outstanding: Basic 51,156,015 52,350,989 51,641,619 53,011,806 Diluted 51,156,015 52,350,989 51,641,619 53,011,806 Ne t (loss) income attributable to common stockholders $ (17,074) $ (9,852) $ (77,649) $ (55,327)

Reconciliation of GAAP Net (Loss) Income to Distributable Earnings (Loss)* 22 ($ IN MILLIONS, EXCEPT PER SHARE DATA) (UNAUDITED) Q1 2023 Q2 2023 Q3 2023 Q4 2023 GAAP Net (Loss) Income* $(37.5) $1.4 $(24.5) $(17.1) Adjustments: Provision (Benefit from) for Credit Losses $46.4 $5.8 $31.0 $21.6 Loss (Gain) on Extinguishment of Debt $(0.2) $- $- $- Non-Cash Equity Compensation $2.0 $2.4 $1.6 $1.1 Depreciation and Amortization on Real Estate Owned $- $0.6 $1.4 $1.4 Distributable Earnings* before realized losses $10.7 $10.2 $9.5 $7.0 Loan Write-offs $- $(4.2) $(16.8) $(33.3) Distributable Earnings (Loss)* $10.7 $6.0 $(7.3) $(26.4) Basic Wtd. Avg. Common Shares 52,308,380 51,538,309 51,577,143 51,156,015 Diluted Wtd. Avg. Common Shares 52,308,380 51,619,072 51,577,143 51,156,015 Distributable Earnings* Per basic share before realized losses and loan write-offs $0.20 $0.20 $0.18 $0.14 Distributable Earnings (Loss)* Per basic share $0.20 $0.12 $(0.14) $(0.52) * See definition in this appendix.

($ in thousands) At 3/31/23 At 6/30/23 At 9/30/23 At 12/31/23 ASSETS Loans Held-for-Investment $3,310,830 $3,096,500 $2,908,855 $2,718,486 Allowance for credit losses $(128,451) $(130,412) $(145,297) $(134,661) Carrying Value $3,182,379 $2,966,088 $2,763,558 $2,583,825 LIABILITIES Other liabilities impact* $4,543 $4,200 $3,572 $2,455 STOCKHOLDERS’ EQUITY Cumulative earnings impact $(132,994) $(134,611) $(148,869) $(137,116) Financial Statements Impact of CECL Reserves 23 • Total allowance for credit losses of $137.1 million, of which $2.5 million is related to future funding obligations and recorded in other liabilities. • Loans reported on the balance sheet are net of the allowance for credit losses. ($ in thousands) Q4 2023 Change in allowance for credit losses: (Provision for) credit losses $(21,571) Write-off $33,324 Total change in allowance for credit losses $11,753 * Represents estimated allowance for credit losses on unfunded loan commitments.

▪ Beginning with our Annual Report on Form 10-K for the year ended December 31, 2022, and for all subsequent reporting periods ending on or after December 31, 2022, we have elected to present Distributable Earnings, a measure that is not prepared in accordance with GAAP, as a supplemental method of evaluating our operating performance. Distributable Earnings replaces our prior presentation of Core Earnings with no changes to the definition. In order to maintain our status as a REIT, we are required to distribute at least 90% of our taxable income as dividends. Distributable Earnings is intended to overtime serve as a general, though imperfect, proxy for our taxable income. As such, Distributable Earnings is considered a key indicator of our ability to generate sufficient income to pay our common dividends, which is the primary focus of income-oriented investors who comprise a meaningful segment of our stockholder base. We believe providing Distributable Earnings on a supplemental basis to our net income and cash flow from operating activities, as determined in accordance with GAAP, is helpful to stockholders in assessing the overall run-rate operating performance of our business. ▪ For reporting purposes, we define Distributable Earnings as net income attributable to our stockholders, computed in accordance with GAAP, excluding: (i) non-cash equity compensation expenses; (ii) depreciation and amortization; (iii) any unrealized gains (losses) or other similar non-cash items that are included in net income for the applicable reporting period (regardless of whether such items are included in other comprehensive income or in net income for such period); and (iv) certain non-cash items and one- time expenses. Distributable Earnings may also be adjusted from time to time for reporting purposes to exclude one-time events pursuant to changes in GAAP and certain other material non-cash income or expense items approved by a majority of our independent directors. The exclusion of depreciation and amortization from the calculation of Distributable Earnings only applies to debt investments related to real estate to the extent we foreclose upon the property or properties underlying such debt investments. Distributable Earnings 24

▪ While Distributable Earnings excludes the impact of the unrealized non-cash current provision for credit losses, we expect to only recognize such potential credit losses in Distributable Earnings if and when such amounts are deemed non-recoverable. This is generally at the time a loan is repaid, or in the case of foreclosure, when the underlying asset is sold, but non-recoverability may also be concluded if, in our determination, it is nearly certain that all amounts due will not be collected. The realized loss amount reflected in Distributable Earnings will equal the difference between the cash received, or expected to be received, and the carrying value of the asset, and is reflective of our economic experience as it relates to the ultimate realization of the loan. During the quarter and year ended December 31, 2023, we recorded provision for credit losses of $(21.6) million $(104.8) million, respectively, which has been excluded from Distributable Earnings, consistent with other unrealized gains (losses) and other non- cash items pursuant to our existing policy for reporting Distributable Earnings referenced above. During the quarter and year ended December 31, 2023, we recorded $1.4 million and $3.4 million, respectively, in depreciation and amortization on real estate owned and related intangibles, which has been excluded from Distributable Earnings consistent with other unrealized gains (losses) and other non-cash items pursuant to our existing policy for reporting Distributable Earnings referenced above. During the year ended December 31, 2023, we recorded a $0.2 million gain on early extinguishment of debt, which has been excluded from Distributable Earnings consistent with certain one-time events pursuant to our existing policy for reporting Distributable Earnings as a helpful indicator in assessing the overall run-rate operating performance of our business. ▪ During the year ended December 31, 2023, we recorded $(54.3) million of realized losses on loan investments consisting of (i) $(33.3) million realized loss representing a write-off of an allowance for credit losses related to the resolution of a loan secured by an office property located in San Diego, CA, (ii) $(16.8) million realized loss representing a write-off of an allowance for credit losses related to the transfer to loans held-for-sale of a loan secured by an office property located in Dallas, TX, and (iii) $(4.2) million realized loss representing a write-off of an allowance for credit losses related to the transfer to REO of a loan secured by an office property located in Phoenix, AZ. These realized losses have been included in Distributable Earnings pursuant to our existing policy for reporting Distributable Earnings referenced above. Distributable Earnings (cont’d) 25

▪ Distributable Earnings does not represent net income or cash flow from operating activities and should not be considered as an alternative to GAAP net income, or an indication of our GAAP cash flows from operations, a measure of our liquidity, or an indication of funds available for our cash needs. In addition, our methodology for calculating Distributable Earnings may differ from the methodologies employed by other companies to calculate the same or similar supplemental performance measures, and, accordingly, our reported Distributable Earnings may not be comparable to the Distributable Earnings reported by other companies. ▪ We believe it is useful to our stockholders to present Distributable Earnings before realized losses to reflect our run-rate operating results as (i) our operating results are mainly comprised of net interest income earned on our loan investments net of our operating expenses, which comprise our ongoing operations, (ii) it helps our stockholders in assessing the overall run-rate operating performance of our business, and (iii) it has been a useful reference related to our common dividend as it is one of the factors we and our Board of Directors consider when declaring the dividend. We believe that our stockholders use Distributable Earnings and Distributable Earnings before realized losses, or a comparable supplemental performance measure, to evaluate and compare the performance of our company and our peers. Distributable Earnings (cont’d) 26

Other Definitions 27 Realized Loan Portfolio Yield ▪ Provided for illustrative purposes only. Calculations of realized loan portfolio yield are based on a number of assumptions (some or all of which may not occur) and are expressed as monthly equivalent yields that include net origination fees and exit fees and exclude future fundings and any potential or completed loan amendments or modifications. Cash Coupon ▪ Cash coupon does not include origination or exit fees. Future Fundings ▪ Fundings to borrowers of loan principal balances under existing commitments on our loan portfolio. Net (Loss) Income Attributable to Common Stockholders ▪ GAAP Net (Loss) Income attributable to our common stockholders after deducting dividends attributable to our cumulative redeemable preferred stock. Initial LTV ▪ The initial loan amount (plus any financing that is pari passu with or senior to such loan) divided by the as is appraised value (as determined in conformance with USPAP) as of the date the loan was originated set forth in the original appraisal. Stabilized LTV ▪ The fully funded loan amount (plus any financing that is pari passu with or senior to such loan), including all contractually provided for future fundings, divided by the as stabilized value (as determined in conformance with USPAP) set forth in the original appraisal. As stabilized value may be based on certain assumptions, such as future construction completion, projected re-tenanting, payment of tenant improvement or leasing commissions allowances or free or abated rent periods, or increased tenant occupancies. Non—MTM ▪ Non-Mark-to-Market. Original Term (Years) ▪ The initial maturity date at origination and does not include any extension options and has not been updated to reflect any subsequent extensions or modifications, if applicable. Pre-Provision Earnings ▪ Net interest income, less operating expenses and provision for income taxes. Recourse Leverage ▪ Borrowings outstanding on repurchase facilities, non-mtm repurchase facility, secured credit facility, asset-specific financing and convertible senior notes, less cash, divided by total stockholders’ equity.

Other Definitions (cont’d) 28 REO ▪ Real estate owned. Senior Loans ▪ “Senior” means a loan primarily secured by a first priority lien on commercial real property and related personal property and also includes, when applicable, any companion subordinate loans. Total Leverage ▪ Borrowings outstanding on repurchase facilities, non-mtm repurchase facility, secured credit facility, CLO’s, asset-specific financing and convertible senior notes, less cash, divided by total stockholders’ equity. Wtd. Avg Coupon ▪ Does not include fees and other transaction related expenses.

Company Information 29 Granite Point Mortgage Trust Inc. is an internally-managed real estate finance company that focuses primarily on directly originating, investing in and managing senior floating rate commercial mortgage loans and other debt and debt-like commercial real estate investments. Granite Point was incorporated in Maryland on April 7, 2017, and has elected to be treated as a real estate investment trust for U.S. federal income tax purposes. For more information regarding Granite Point, visit www.gpmtreit.com. Contact Information: Corporate Headquarters: 3 Bryant Park, 24th Floor New York, NY 10036 212-364-5500 New York Stock Exchange: Symbol: GPMT Investor Relations: Chris Petta Investor Relations 212-364-5500 Investors@gpmtreit.com Transfer Agent: Equiniti Trust Company P.0. Box 64856 St. Paul, MN 55164-0856 800-468-9716 www.shareowneronline.com JMP Securities Steven DeLaney (212) 906-3517 Keefe, Bruyette & Woods Jade Rahmani (212) 887-3882 Raymond James Stephen Laws (901) 579-4868 UBS Doug Harter (212) 882-0080 Analyst Coverage:* *No report of any analyst is incorporated by reference herein and any such report represents the sole views of such analyst.

v3.24.0.1

Document and Entity Information Document

|

Feb. 14, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 14, 2024

|

| Entity Registrant Name |

Granite Point Mortgage Trust Inc.

|

| Entity Central Index Key |

0001703644

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-38124

|

| Entity Tax Identification Number |

61-1843143

|

| Entity Address, Address Line One |

3 Bryant Park, Suite 2400A

|

| Entity Address, City or Town |

New York,

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10036

|

| City Area Code |

212

|

| Local Phone Number |

364-5500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| NEW YORK STOCK EXCHANGE, INC. [Member] | Series A Preferred Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

7.00% Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock, par value $0.01 per share

|

| Trading Symbol |

GPMTPrA

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. [Member] | Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

GPMT

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |