Helix Energy Solutions Group, Inc. ("Helix") (NYSE: HLX)

reported a net loss of $28.3 million, or $(0.19) per diluted share,

for the fourth quarter 2023 compared to net income of $15.6

million, or $0.10 per diluted share, for the third quarter 2023 and

net income of $2.7 million, or $0.02 per diluted share, for the

fourth quarter 2022. Net loss in the fourth quarter 2023 includes a

net pre-tax loss of approximately $37.3 million, or $(0.25) per

diluted share, related to the repurchase of $159.8 million

principal amount of our Convertible Senior Notes due 2026 (“2026

Notes”). Helix reported adjusted EBITDA1 of $70.6 million for the

fourth quarter 2023 compared to $96.4 million for the third quarter

2023 and $49.2 million for the fourth quarter 2022.

For the full year 2023, Helix reported a net loss of $10.8

million, or $(0.07) per diluted share, compared to a net loss of

$87.8 million, or $(0.58) per diluted share, for the full year

2022. Net loss in 2023 includes pre-tax losses of approximately

$37.3 million, or $(0.25) per diluted share, related to the

repurchase of $159.8 million principal amount of our 2026 Notes and

$42.2 million, or $(0.28) per diluted share, related to the change

in the value of the Alliance earnout during the year. Adjusted

EBITDA for the full year 2023 was $273.4 million compared to $121.0

million for the full year 2022. The table below summarizes our

results of operations:

Summary

of Results

($ in thousands, except per

share amounts, unaudited)

Three Months Ended Year Ended

12/31/2023

12/31/2022

9/30/2023

12/31/2023

12/31/2022

Revenues

$

335,157

$

287,816

$

395,670

$

1,289,728

$

873,100

Gross Profit

$

49,278

$

31,364

$

80,545

$

200,356

$

50,616

15%

11%

20%

16%

6%

Net Income (Loss)

$

(28,333

)

$

2,709

$

15,560

$

(10,838

)

$

(87,784

)

Basic Earnings (Loss) Per Share

$

(0.19

)

$

0.02

$

0.10

$

(0.07

)

$

(0.58

)

Diluted Earnings (Loss) Per Share

$

(0.19

)

$

0.02

$

0.10

$

(0.07

)

$

(0.58

)

Adjusted EBITDA1

$

70,632

$

49,169

$

96,385

$

273,403

$

121,022

Cash and Cash Equivalents2

$

332,191

$

186,604

$

168,370

$

332,191

$

186,604

Net Debt1,3

$

29,531

$

74,964

$

58,887

$

29,531

$

74,964

Cash Flows from Operating Activities

$

94,737

$

49,712

$

31,611

$

152,457

$

51,108

Free Cash Flow1

$

91,878

$

21,198

$

23,366

$

133,798

$

17,604

1

Adjusted EBITDA, Net Debt and Free Cash

Flow are non-GAAP measures; see reconciliations below

2

Excludes restricted cash of $2.5 million

as of 12/31/22

3

Net Debt is calculated using U.S. GAAP

carrying values for long-term debt. Helix has issued a redemption

notice for the remaining 2026 Notes, and investors may elect to

convert their notes. Helix will settle all redemptions and

conversions in cash at amounts that we expect will exceed the 2026

Notes’ current carrying values.

Owen Kratz, President and Chief Executive Officer of Helix,

stated, “We finished the year strong, and our fourth quarter 2023

reflects our highest fourth quarter EBITDA since 2013 as our Well

Intervention business operated with high utilization, offsetting

much of the seasonal slowdown in our Robotics and Shallow Water

Abandonment segments. Our 2023 full-year results mark our second

consecutive year of meaningful revenue and EBITDA growth, and we

achieved our highest annual EBITDA since 2014, with significant

improvements in Well Intervention and ongoing strong contributions

from Robotics and Shallow Water Abandonment. During 2023, we

initiated important transformations to our capital structure,

issuing $300 million in senior notes and taking out most of our

2026 convertible notes with the remainder expected to be redeemed

during the first quarter 2024. This transformation, when complete,

returns us to a simpler capital structure, eliminates the potential

dilution overhang of over 28 million shares, and pushes our major

long-term debt maturities out to 2029. 2024 will not be without its

challenges, but we believe we are well-positioned to capitalize on

this strong market and to continue executing our strategy into the

future.”

Segment

Information, Operational and Financial Highlights

($ in thousands,

unaudited)

Three Months Ended Year Ended

12/31/2023 12/31/2022 9/30/2023

12/31/2023 12/31/2022 Revenues: Well

Intervention

$

210,735

$

167,658

$

225,367

$

732,761

$

524,241

Robotics

62,957

48,538

75,646

257,875

191,921

Shallow Water Abandonment1

61,995

57,409

87,272

274,954

124,810

Production Facilities

19,383

27,895

24,469

87,885

82,315

Intercompany Eliminations

(19,913

)

(13,684

)

(17,084

)

(63,747

)

(50,187

)

Total

$

335,157

$

287,816

$

395,670

$

1,289,728

$

873,100

Income (Loss) from Operations: Well Intervention

$

21,041

$

2,554

$

16,120

$

32,398

$

(53,056

)

Robotics

9,224

7,127

20,665

52,450

29,981

Shallow Water Abandonment1

12,032

5,864

27,624

66,240

22,184

Production Facilities

(985

)

9,237

8,886

20,832

27,201

Change in Fair Value of Contingent Consideration

(10,927

)

(13,390

)

(16,499

)

(42,246

)

(16,054

)

Corporate / Other / Eliminations

(15,005

)

(16,520

)

(20,568

)

(66,164

)

(55,111

)

Total

$

15,380

$

(5,128

)

$

36,228

$

63,510

$

(44,855

)

1 Shallow Water Abandonment includes the results of Helix Alliance

beginning July 1, 2022, the date of acquisition.

Fourth Quarter Results

Segment Results

Well Intervention

Well Intervention revenues decreased $14.6 million, or 6%,

during the fourth quarter 2023 compared to the prior quarter

primarily due to lower revenues on the Q7000 and seasonally lower

rates on the North Sea vessels, offset in part by higher

utilization and rates in the Gulf of Mexico. Revenues decreased on

the Q7000 during the fourth quarter as the vessel had lower

operating efficiency and began transiting and mobilizing for its

Australia campaign in November following the New Zealand campaign,

which had commenced during the second quarter. Gulf of Mexico

revenues during the fourth quarter benefitted from higher rates on

the Q5000 and higher utilization on the Q4000 following an extended

docking that was completed during the prior quarter. Overall Well

Intervention vessel utilization increased to 95% during the fourth

quarter 2023 compared to 92% during the prior quarter. Well

Intervention operating income increased $4.9 million during the

fourth quarter 2023 compared to the prior quarter. The increase in

operating income during the fourth quarter, despite a reduction in

revenue, was primarily due to our mix of contracting, with higher

incremental margins in the Gulf of Mexico, offset in part by

reductions in the North Sea and higher costs on the Q7000 during

the quarter.

Well Intervention revenues increased $43.1 million, or 26%,

during the fourth quarter 2023 compared to the fourth quarter 2022.

The increase was primarily due to higher rates in the Gulf of

Mexico, Brazil and the North Sea, offset in part by lower revenues

on the Q7000. During the fourth quarter 2023, revenues in the Gulf

of Mexico benefitted from improving rates, Brazil revenues

increased as both Siem Helix vessels commenced long-term contracts

with improved day rates at the end of 2022 and North Sea revenues

improved with a stronger British pound compared to the fourth

quarter 2022. Revenues on the Q7000 decreased during the fourth

quarter 2023 compared to the fourth quarter 2022 as the vessel had

lower operating efficiency and began transiting and mobilizing for

its Australia campaign in November. Overall Well Intervention

vessel utilization decreased slightly to 95% during the fourth

quarter 2023 compared to 97% during the fourth quarter 2022. Well

Intervention operating income increased $18.5 million during the

fourth quarter 2023 compared to the fourth quarter 2022 primarily

due to higher revenues, offset in part by higher costs on the Q7000

during 2023.

Robotics

Robotics revenues decreased $12.7 million, or 17%, during the

fourth quarter 2023 compared to the prior quarter. The decrease in

revenues was due to seasonally lower rates and lower vessel and

trenching days during the fourth quarter 2023 compared to the prior

quarter. Chartered vessel activity decreased to 463 days during the

fourth quarter 2023 compared to 506 days during the third quarter

2023, and vessel utilization was 97% during both the fourth and

third quarters 2023. Vessel days included 92 spot vessel days

during both the fourth and third quarters 2023 performing

renewables trenching operations offshore Taiwan. ROV and trencher

utilization increased slightly to 68% during the fourth quarter

2023 compared to 67% during the prior quarter. Integrated vessel

trenching days decreased to 271 days during the fourth quarter 2023

compared to 276 days during the prior quarter. Robotics operating

income decreased $11.4 million during the fourth quarter 2023

compared to the prior quarter due to lower revenues.

Robotics revenues increased $14.4 million, or 30%, during the

fourth quarter 2023 compared to the fourth quarter 2022 due to

higher chartered vessel, ROV and trenching activities and rates

during the current year. Chartered vessel days increased to 463

days during the fourth quarter 2023 compared to 332 days during the

fourth quarter 2022. Vessel days included 92 spot vessel days

during the fourth quarter 2023 compared to 68 spot vessel days

during the fourth quarter 2022. Chartered vessel utilization

increased slightly to 97% during the fourth quarter 2023 compared

to 96% during the fourth quarter 2022. ROV and trencher utilization

increased to 68% during the fourth quarter 2023 compared to 58%

during the fourth quarter 2022, and the fourth quarter 2023

included 271 days of integrated vessel trenching compared to 160

days during the fourth quarter 2022. Robotics operating income

increased $2.1 million during the fourth quarter 2023 compared to

the fourth quarter 2022 primarily due to higher revenues, offset in

part by weather-related losses on a fixed-price trenching contract

in the North Sea during the fourth quarter 2023.

Shallow Water Abandonment

Shallow Water Abandonment revenues decreased $25.3 million, or

29%, during the fourth quarter 2023 compared to the previous

quarter. The decrease in revenues reflected seasonally lower

utilization levels across all asset classes. Overall vessel

utilization was 72% during the fourth quarter 2023 compared to 89%

during the prior quarter. Plug and Abandonment and Coiled Tubing

systems achieved 1,386 days of utilization, or 58%, during the

fourth quarter 2023 compared to 1,531 days of utilization, or 74%,

during the prior quarter. Utilization rates in the third and fourth

quarters included five P&A systems following their acquisition

in September 2023. The Epic Hedron heavy lift barge utilization

declined to 70 days, or 76%, during the fourth quarter 2023

compared to being fully utilized during the prior quarter. Shallow

Water Abandonment operating income decreased $15.6 million during

the fourth quarter 2023 compared to the prior quarter primarily due

to lower revenue during the fourth quarter.

Shallow Water Abandonment revenues increased $4.6 million, or

8%, during the fourth quarter 2023 compared to the fourth quarter

2022. The increase in revenues reflected higher vessel and system

utilization during the fourth quarter 2023 compared to the fourth

quarter 2022. Overall vessel utilization was 72% during the fourth

quarter 2023 compared to 70% during the fourth quarter 2022. Plug

and Abandonment and Coiled Tubing systems achieved 1,386 days of

utilization, or 58% on 26 systems, during the fourth quarter 2023

compared to 1,247 days of utilization, or 65% on 21 systems, during

the fourth quarter 2022. The Epic Hedron heavy lift barge had 70

days of utilization during the fourth quarter 2023 compared to

being idle during the fourth quarter 2022. Fourth quarter 2023

performance benefitted from our full-field decommissioning contract

that commenced during the third quarter 2023. Shallow Water

Abandonment operating income increased $6.2 million during the

fourth quarter 2023 compared to the fourth quarter 2022 primarily

due to higher revenue and lower costs during the fourth quarter

2023.

Production Facilities

Production Facilities revenues decreased $5.1 million, or 21%,

during the fourth quarter 2023 compared to the prior quarter

primarily due to lower oil and gas production due to the Thunder

Hawk wells being shut-in during the entire fourth quarter.

Production Facilities incurred operating losses of $1.0 million

during the fourth quarter 2023 compared to operating income of $8.9

million during the previous quarter primarily due to lower revenues

and the incurrence of well workover costs related to the Thunder

Hawk wells during the fourth quarter 2023.

Production Facilities revenues decreased $8.5 million, or 31%,

during the fourth quarter 2023 compared to the fourth quarter 2022

primarily due to lower oil and gas production due to the Thunder

Hawk wells being shut-in during the entire fourth quarter 2023.

Production Facilities incurred operating losses of $1.0 million

during the fourth quarter 2023 compared to operating income of $9.2

million during the fourth quarter 2022 primarily due to lower

revenues and the incurrence of well workover costs related to the

Thunder Hawk wells during the fourth quarter 2023.

Selling, General and Administrative and

Other

Selling, General and Administrative

Selling, general and administrative expenses were $23.0 million,

or 6.9% of revenue, during the fourth quarter 2023 compared to

$27.8 million, or 7.0% of revenue, during the prior quarter. The

decrease during the fourth quarter 2023 was primarily due to lower

recognized compensation costs compared to the prior quarter.

Change in Fair Value of Contingent Consideration

Change in fair value of contingent consideration related to our

acquisition of Alliance was $10.9 million during the fourth quarter

2023 and reflects an increase in the fair value of the earn-out

payable in cash in April 2024.

Debt Extinguishment Loss

The debt extinguishment loss of $37.3 million primarily relates

to the repurchase of $159.8 million principal amount of our 2026

Notes during the fourth quarter 2023 and primarily represents the

inducement cost of the repurchases above the 2026 Notes’ conversion

value.

Other Income and Expenses

Other income, net was $7.0 million during the fourth quarter

2023 compared to $8.3 million of other expense, net during the

prior quarter. Other income, net during the fourth quarter 2023

primarily includes foreign currency gains related to the

approximate 4% appreciation of the British pound on U.S. dollar

denominated intercompany debt in our U.K. entities, offset in part

by losses on conversion of our Nigerian naira into dollars during

the fourth quarter 2023.

Cash Flows

Operating cash flows were $94.7 million during the fourth

quarter 2023 compared to $31.6 million during the prior quarter and

$49.7 million during the fourth quarter 2022. Operating cash flows

during the fourth quarter 2023 benefited from strong working

capital inflows and lower capital spending, offset in part by lower

operating income compared to the prior quarter. Operating cash

flows increased during the fourth quarter 2023 compared to the

fourth quarter 2022 due to higher operating income, higher working

capital inflows and lower regulatory certification costs.

Regulatory certifications for our vessels and systems, which are

included in operating cash flows, were $3.3 million during the

fourth quarter 2023 compared to $17.9 million during the prior

quarter and $4.8 million during the fourth quarter 2022.

Capital expenditures, which are included in investing cash

flows, totaled $3.4 million during the fourth quarter 2023 compared

to $8.2 million during the prior quarter and $28.5 million during

the fourth quarter 2022. Capital expenditures during the fourth

quarter 2022 included our acquisition of three trenchers and our

interest in two subsea intervention riser systems.

Free Cash Flow was $91.9 million during the fourth quarter 2023

compared to $23.4 million during the prior quarter and $21.2

million during the fourth quarter 2022. The increase in Free Cash

Flow in the fourth quarter 2023 was due to higher operating cash

flows and lower capital expenditures compared to the prior quarter

and the fourth quarter 2022. (Free Cash Flow is a non-GAAP measure.

See reconciliation below.)

Full Year Results

Segment Results

Well Intervention

Well Intervention revenues increased $208.5 million, or 40%, in

2023 compared to 2022. The increase was primarily driven by higher

vessel utilization and rates in the North Sea and Brazil and higher

rates in the Gulf of Mexico. Revenues in Brazil benefitted from the

Siem Helix 1 and Siem Helix 2 working a full year on their

long-term contracts on improved rates compared to 2022, and the

North Sea and Gulf of Mexico have both benefitted from improved

spot rates in 2023 compared to 2022. The North Sea also benefitted

from strong winter utilization in 2023 compared to the prior year.

Revenues on the Q7000 were also higher, despite the vessel

incurring a higher number of transit and docking days in 2023

compared to 2022, as the vessel’s operations in New Zealand were on

an integrated project with higher project revenues and costs. The

improvement in rates was offset in part by lower utilization in the

Gulf of Mexico due to a higher number of regulatory docking days

during 2023 compared to 2022. Overall Well Intervention vessel

utilization increased to 88% during 2023 compared to 80% in 2022.

Well Intervention generated operating income of $32.4 million

during 2023 compared to operating losses of $53.1 million during

2022. The increase in operating results was due primarily to higher

revenues in 2023.

Robotics

Robotics revenues increased $66.0 million, or 34%, in 2023

compared to 2022. The increase was due to higher vessel, trenching

and ROV utilization and rates in 2023. Chartered vessel days

increased to 1,699 days, which included 310 spot vessel days, in

2023 compared to 1,401 days, which included 420 spot vessel days,

in 2022. Vessel trenching days increased to 807 days in 2023

compared to 483 days in 2022. Overall ROV and trencher utilization

increased to 62% in 2023 compared to 53% in 2022. Robotics

operating income increased $22.5 million in 2023 compared to 2022.

The increase in operating income was primarily due to higher

revenues during 2023.

Shallow Water Abandonment

Shallow Water Abandonment generated revenues of $275.0 million

during 2023 compared to $124.8 million during 2022 following the

Alliance acquisition on July 1, 2022. Revenues increased year over

year on an annualized basis with higher utilization and rates on

our systems and vessels in 2023. Plug and Abandonment and Coiled

Tubing systems achieved 5,748 days of utilization, or 70%, during

2023 compared to 2,324 days, or 62%, during 2022. Overall vessel

utilization in 2023 was relatively flat at 74%, compared to 73%

during 2022; however, vessel utilization in 2023 included 247 days

on the Epic Hedron compared to only 38 days during 2022. Shallow

Water Abandonment generated operating income of $66.2 million

during 2023 compared to $22.2 million during 2022 following the

Alliance acquisition on July 1, 2022, primarily due to higher

revenue in 2023.

Production Facilities

Production Facilities revenues increased $5.6 million, or 7%,

during 2023 compared to 2022. The increase was due to higher oil

and gas production volumes, offset in part by lower oil and gas

prices during 2023. Production Facilities operating income

decreased $6.4 million during 2023 primarily due to higher well

maintenance costs related to the Thunder Hawk wells, offset in part

by increases in revenues compared to 2022.

Selling, General and Administrative and

Other

Selling, General and Administrative

Selling, general and administrative expenses were $94.4 million,

or 7.3% of revenue, in 2023 compared to $76.8 million, or 8.8% of

revenue, in 2022. The increase in expense was primarily due to a

full year of general and administrative expenses related to Helix

Alliance as well as an increase in employee incentive and

share-based compensation costs in 2023.

Net Interest Expense

Net interest expense decreased to $17.3 million in 2022 compared

to $19.0 million in 2022. The decrease was due to higher interest

income on our invested cash reserves and the maturity of the

remaining $30 million of our Convertible Senior Notes due 2023

during the third quarter, offset in part by interest expense on our

$300 million Senior Notes due 2029 (the “2029 Notes”) issued during

the fourth quarter 2023.

Change in Fair Value of Contingent Consideration

Change in fair value of contingent consideration related to our

acquisition of Alliance was $42.2 million during 2023 and reflects

an increase in the fair value of the earn-out payable in cash in

April 2024.

Debt Extinguishment Loss

The debt extinguishment loss of $37.3 million primarily relates

to the repurchase of $159.8 million principal amount of the 2026

Notes during the fourth quarter 2023 and primarily represents the

inducement cost of the repurchases above the 2026 Notes’ conversion

value.

Other Income and Expenses

Other expense, net was $3.6 million in 2023 compared to $23.3

million in 2022. The change was primarily due to lower foreign

currency losses due to a strengthening of the British pound in 2023

compared to 2022, offset in part by losses associated with the

devaluation of our Nigerian naira holdings during 2023.

Cash Flows

Helix generated operating cash flows of $152.5 million in 2023

compared to $51.1 million in 2022. The increase in operating cash

flows in 2023 was due primarily to higher operating income in 2023,

offset in part by higher regulatory certification costs and working

capital outflows in 2023 compared to 2022. Regulatory certification

costs, which are considered part of Helix’s capital spending

program but are classified in operating cash flows, were $62.5

million in 2023 compared to $35.1 million in 2022.

Capital expenditures decreased to $19.6 million in 2023 compared

to $33.5 million in 2022. Capital expenditures during 2022 included

the acquisition of three subsea trenchers and our interest in two

subsea intervention systems.

Free Cash Flow was $133.8 million in 2023 compared to $17.6

million in 2022. The increase was due to higher operating cash

flows and lower capital expenditures in 2023 compared to 2022.

(Free Cash Flow is a non-GAAP measure. See reconciliation

below.)

Share Repurchases

2023 share repurchases totaled approximately 1.6 million shares

for approximately $12.0 million, an average purchase price of $7.57

per share.

Financial Condition and Liquidity

During the fourth quarter 2023, Helix issued the 2029 Notes

receiving proceeds, net of discounts and issuance costs, of $291.1

million and used a portion of the proceeds to purchase

approximately $159.8 million principal amount of the 2026 Notes for

approximately $229.7 million in cash and 1.5 million shares of

Helix common stock. Helix also settled a proportionate amount of

the capped calls that were hedging the 2026 Notes and received

approximately $15.6 million.

Cash and cash equivalents were $332.2 million on December 31,

2023. Available capacity under our ABL facility on December 31,

2023, was $99.3 million, resulting in total liquidity of $431.5

million. Consolidated long-term debt increased to $361.7 million on

December 31, 2023, from $227.3 million on September 30, 2023.

Consolidated Net Debt on December 31, 2023, was $29.5 million. (Net

Debt is a non-GAAP measure. See reconciliation below.)

Conference Call Information

Further details are provided in the presentation for Helix’s

quarterly teleconference to review its fourth quarter and full year

2023 results (see the "For the Investor" page of Helix's website,

www.helixesg.com). The teleconference, scheduled for Tuesday,

February 27, 2024, at 9:00 a.m. Central Time, will be audio webcast

live from the "For the Investor" page of Helix’s website. Investors

and other interested parties wishing to participate in the

teleconference may join by dialing 1-800-952-1718 for participants

in the United States and 1-212-231-2900 for international

participants. The passcode is "Staffeldt." A replay of the webcast

will be available on the "For the Investor" page of Helix's website

by selecting the "Audio Archives" link beginning approximately two

hours after the completion of the event.

About Helix

Helix Energy Solutions Group, Inc., headquartered in Houston,

Texas, is an international offshore energy services company that

provides specialty services to the offshore energy industry, with a

focus on well intervention, robotics and full field decommissioning

operations. Our services are key in supporting a global energy

transition by maximizing production of existing oil and gas

reserves, decommissioning end-of-life oil and gas fields and

supporting renewable energy developments. For more information

about Helix, please visit our website at www.helixesg.com.

Non-GAAP Financial Measures

Management evaluates operating performance and financial

condition using certain non-GAAP measures, primarily EBITDA,

Adjusted EBITDA, Free Cash Flow and Net Debt. We define EBITDA as

earnings before income taxes, net interest expense, gains and

losses on equity investments, net other income or expense, and

depreciation and amortization expense. Non-cash impairment losses

on goodwill and other long-lived assets are also added back if

applicable. To arrive at our measure of Adjusted EBITDA, we exclude

gains or losses on disposition of assets, acquisition and

integration costs, gains or losses on extinguishment of long-term

debt, the change in fair value of contingent consideration, and the

general provision (release) for current expected credit losses, if

any. We define Free Cash Flow as cash flows from operating

activities less capital expenditures, net of proceeds from asset

sales and insurance recoveries (related to property and equipment),

if any. Net Debt is calculated as long-term debt including current

maturities of long-term debt less cash and cash equivalents and

restricted cash.

We use EBITDA, Adjusted EBITDA, Free Cash Flow and Net Debt to

monitor and facilitate internal evaluation of the performance of

our business operations, to facilitate external comparison of our

business results to those of others in our industry, to analyze and

evaluate financial and strategic planning decisions regarding

future investments and acquisitions, to plan and evaluate operating

budgets, and in certain cases, to report our results to the holders

of our debt as required by our debt covenants. We believe that our

measures of EBITDA, Adjusted EBITDA, Free Cash Flow and Net Debt

provide useful information to the public regarding our operating

performance and ability to service debt and fund capital

expenditures and may help our investors understand and compare our

results to other companies that have different financing, capital

and tax structures. Other companies may calculate their measures of

EBITDA, Adjusted EBITDA, Free Cash Flow and Net Debt differently

from the way we do, which may limit their usefulness as comparative

measures. EBITDA, Adjusted EBITDA, Free Cash Flow and Net Debt

should not be considered in isolation or as a substitute for, but

instead are supplemental to, income from operations, net income,

cash flows from operating activities, or other income or cash flow

data prepared in accordance with GAAP. Users of this financial

information should consider the types of events and transactions

that are excluded from these measures. See reconciliation of the

non-GAAP financial information presented in this press release to

the most directly comparable financial information presented in

accordance with GAAP. We have not provided reconciliations of

forward-looking non-GAAP financial measures to comparable GAAP

measures due to the challenges and impracticability with estimating

some of the items without unreasonable effort, which amounts could

be significant.

Forward-Looking Statements

This press release contains forward-looking statements that

involve risks, uncertainties and assumptions that could cause our

results to differ materially from those expressed or implied by

such forward-looking statements. All statements, other than

statements of historical fact, are "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995, including, without limitation, any statements regarding:

our plans, strategies and objectives for future operations; any

projections of financial items including projections as to guidance

and other outlook information; future operations expenditures; our

ability to enter into, renew and/or perform commercial contracts;

the spot market; our current work continuing; visibility and future

utilization; our protocols and plans; energy transition or energy

security; our spending and cost management efforts and our ability

to manage changes; oil price volatility and its effects and

results; our ability to identify, effect and integrate

acquisitions, joint ventures or other transactions, including the

integration of the Alliance acquisition and the earn-out payable in

connection therewith and any subsequently identified legacy issues

with respect thereto; developments; any financing transactions or

arrangements or our ability to enter into such transactions or

arrangements; our sustainability initiatives; future economic

conditions or performance; our share repurchase program or

execution; any statements of expectation or belief; and any

statements of assumptions underlying any of the foregoing.

Forward-looking statements are subject to a number of known and

unknown risks, uncertainties and other factors that could cause

results to differ materially from those in the forward-looking

statements, including but not limited to market conditions and the

demand for our services; volatility of oil and natural gas prices;

results from acquired properties; our ability to secure and realize

backlog; the performance of contracts by customers, suppliers and

other counterparties; actions by governmental and regulatory

authorities; operating hazards and delays, which include delays in

delivery, chartering or customer acceptance of assets or terms of

their acceptance; the effectiveness of our sustainability

initiatives and disclosures; human capital management issues;

complexities of global political and economic developments;

geologic risks; and other risks described from time to time in our

filings with the Securities and Exchange Commission ("SEC"),

including our most recently filed Annual Report on Form 10-K, which

are available free of charge on the SEC's website at www.sec.gov.

We assume no obligation and do not intend to update these

forward-looking statements, which speak only as of their respective

dates, except as required by law.

HELIX ENERGY SOLUTIONS GROUP, INC. Comparative Condensed

Consolidated Statements of Operations

Three Months Ended Dec.

31,

Year Ended Dec. 31,

(in thousands, except per share data)

2023

2022

2023

2022

(unaudited) (unaudited) Net revenues

$

335,157

$

287,816

$

1,289,728

$

873,100

Cost of sales

285,879

256,452

1,089,372

822,484

Gross profit

49,278

31,364

200,356

50,616

Gain on disposition of assets, net

-

-

367

-

Acquisition and integration costs

-

(315

)

(540

)

(2,664

)

Change in fair value of contingent consideration

(10,927

)

(13,390

)

(42,246

)

(16,054

)

Selling, general and administrative expenses

(22,971

)

(22,787

)

(94,427

)

(76,753

)

Income (loss) from operations

15,380

(5,128

)

63,510

(44,855

)

Equity in earnings of investment

-

-

-

8,262

Net interest expense

(4,771

)

(4,333

)

(17,338

)

(18,950

)

Loss on extinguishment of long-term debt

(37,277

)

-

(37,277

)

-

Other income (expense), net

6,963

14,293

(3,590

)

(23,330

)

Royalty income and other

93

406

2,209

3,692

Income (loss) before income taxes

(19,612

)

5,238

7,514

(75,181

)

Income tax provision

8,721

2,529

18,352

12,603

Net income (loss)

$

(28,333

)

$

2,709

$

(10,838

)

$

(87,784

)

Earnings (loss) per share of common stock: Basic

$

(0.19

)

$

0.02

$

(0.07

)

$

(0.58

)

Diluted

$

(0.19

)

$

0.02

$

(0.07

)

$

(0.58

)

Weighted average common shares outstanding: Basic

150,580

151,425

150,917

151,276

Diluted

150,580

151,425

150,917

151,276

Comparative Condensed Consolidated Balance Sheets

Dec. 31, 2023 Dec. 31, 2022 (in thousands)

(unaudited)

ASSETS Current Assets: Cash and

cash equivalents

$

332,191

$

186,604

Restricted cash

-

2,507

Accounts receivable, net

280,427

212,779

Other current assets

85,223

58,699

Total Current Assets

697,841

460,589

Property and equipment, net

1,572,849

1,641,615

Operating lease right-of-use assets

169,233

197,849

Deferred recertification and dry dock costs, net

71,290

38,778

Other assets, net

44,823

50,507

Total Assets

$

2,556,036

$

2,389,338

LIABILITIES AND SHAREHOLDERS' EQUITY Current

Liabilities: Accounts payable

$

134,552

$

135,267

Accrued liabilities

203,112

73,574

Current maturities of long-term debt

48,292

38,200

Current operating lease liabilities

62,662

50,914

Total Current Liabilities

448,618

297,955

Long-term debt

313,430

225,875

Operating lease liabilities

116,185

154,686

Deferred tax liabilities

110,555

98,883

Other non-current liabilities

66,248

95,230

Shareholders' equity

1,501,000

1,516,709

Total Liabilities and Equity

$

2,556,036

$

2,389,338

Helix Energy Solutions Group, Inc. Reconciliation of

Non-GAAP Measures Three Months Ended

Year Ended (in thousands, unaudited)

12/31/2023

12/31/2022 9/30/2023 12/31/2023

12/31/2022 Reconciliation

from Net Income (Loss) to Adjusted EBITDA: Net income

(loss)

$

(28,333

)

$

2,709

$

15,560

$

(10,838

)

$

(87,784

)

Adjustments: Income tax provision

8,721

2,529

8,337

18,352

12,603

Net interest expense

4,771

4,333

4,152

17,338

18,950

Other (income) expense, net

(6,963

)

(14,293

)

8,257

3,590

23,330

Depreciation and amortization

44,103

40,096

43,249

164,116

142,686

Gain on equity investment

-

-

-

-

(8,262

)

EBITDA

22,299

35,374

79,555

192,558

101,523

Adjustments: Gain on disposition of assets, net

-

-

-

(367

)

-

Acquisition and integration costs

-

315

-

540

2,664

Change in fair value of contingent consideration

10,927

13,390

16,499

42,246

16,054

General provision for current expected credit losses

129

90

331

1,149

781

Loss on extinguishment of long-term debt

37,277

-

-

37,277

-

Adjusted EBITDA

$

70,632

$

49,169

$

96,385

$

273,403

$

121,022

Free Cash Flow:

Cash flows from operating activities

$

94,737

$

49,712

$

31,611

$

152,457

$

51,108

Less: Capital expenditures, net of proceeds from asset sales and

insurance recoveries

(2,859

)

(28,514

)

(8,245

)

(18,659

)

(33,504

)

Free Cash Flow

$

91,878

$

21,198

$

23,366

$

133,798

$

17,604

Net Debt:

Long-term debt including current maturities

$

361,722

$

264,075

$

227,257

$

361,722

$

264,075

Less: Cash and cash equivalents and restricted cash

(332,191

)

(189,111

)

(168,370

)

(332,191

)

(189,111

)

Net Debt

$

29,531

$

74,964

$

58,887

$

29,531

$

74,964

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240226148615/en/

Erik Staffeldt, Executive Vice President and CFO email:

estaffeldt@helixesg.com Ph: 281-618-0465

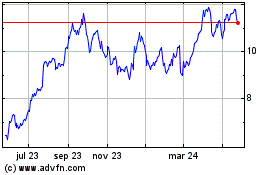

Helix Energy Solutions (NYSE:HLX)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

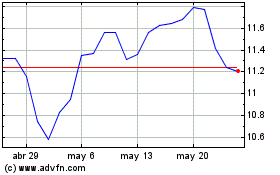

Helix Energy Solutions (NYSE:HLX)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025