Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

26 Noviembre 2024 - 9:21AM

Edgar (US Regulatory)

Portfolio

of

Investments

September

30,

2024

JRS

(Unaudited)

SHARES

DESCRIPTION

VALUE

LONG-TERM

INVESTMENTS

-

136.8%

(97.1%

of

Total

Investments)

X

279,537,426

REAL

ESTATE

INVESTMENT

TRUST

COMMON

STOCKS

-

98.0%

(69.6%

of

Total

Investments)

X

279,537,426

DATA

CENTER

REITS

-

11.9%

131,684

Digital

Realty

Trust

Inc

$

21,310,422

14,200

Equinix

Inc

12,604,346

TOTAL

DATA

CENTER

REITS

33,914,768

HEALTH

CARE

REITS

-

14.0%

363,968

Healthpeak

Properties

Inc

8,323,948

288,345

Ventas

Inc

18,491,565

102,946

Welltower

Inc

13,180,176

TOTAL

HEALTH

CARE

REITS

39,995,689

HOTEL

&

RESORT

REITS

-

2.8%

306,576

Host

Hotels

&

Resorts

Inc

5,395,738

95,275

Sunstone

Hotel

Investors

Inc

983,238

110,972

Xenia

Hotels

&

Resorts

Inc

1,639,056

TOTAL

HOTEL

&

RESORT

REITS

8,018,032

INDUSTRIAL

REITS

-

12.2%

145,555

First

Industrial

Realty

Trust

Inc

8,148,169

211,336

Prologis

Inc

26,687,510

TOTAL

INDUSTRIAL

REITS

34,835,679

MULTI-FAMILY

RESIDENTIAL

REITS

-

14.4%

35,632

AvalonBay

Communities

Inc

8,026,108

108,319

Camden

Property

Trust

13,380,646

93,599

Equity

Residential

6,969,382

17,895

Essex

Property

Trust

Inc

5,286,541

22,375

Mid-America

Apartment

Communities

Inc

3,555,387

85,575

UDR

Inc

3,879,970

TOTAL

MULTI-FAMILY

RESIDENTIAL

REITS

41,098,034

OFFICE

REITS

-

8.1%

50,934

Alexandria

Real

Estate

Equities

Inc

6,048,412

74,695

BXP

Inc

6,009,960

86,305

Cousins

Properties

Inc

2,544,271

42,260

JBG

SMITH

Properties

738,705

122,605

Kilroy

Realty

Corp

4,744,814

44,265

SL

Green

Realty

Corp

3,081,287

TOTAL

OFFICE

REITS

23,167,449

OTHER

SPECIALIZED

REITS

-

1.5%

129,330

VICI

Properties

Inc

4,307,982

TOTAL

OTHER

SPECIALIZED

REITS

4,307,982

RETAIL

REITS

-

16.8%

112,565

Acadia

Realty

Trust

2,643,026

70,615

Federal

Realty

Investment

Trust

8,118,607

190,865

Kimco

Realty

Corp

4,431,885

368,776

Kite

Realty

Group

Trust

9,794,691

149,159

Macerich

Co/The

2,720,660

100,309

Simon

Property

Group

Inc

16,954,227

53,818

SITE

Centers

Corp

3,255,989

TOTAL

RETAIL

REITS

47,919,085

SELF-STORAGE

REITS

-

9.5%

145,012

CubeSmart

7,805,996

46,585

Extra

Space

Storage

Inc

8,394,151

29,595

Public

Storage

10,768,733

TOTAL

SELF-STORAGE

REITS

26,968,880

SINGLE-FAMILY

RESIDENTIAL

REITS

-

5.4%

166,407

American

Homes

4

Rent,

Class

A

6,388,365

110,520

Invitation

Homes

Inc

3,896,935

36,815

Sun

Communities

Inc

4,975,547

TOTAL

SINGLE-FAMILY

RESIDENTIAL

REITS

15,260,847

Portfolio

of

Investments

September

30,

2024

(continued)

JRS

SHARES

DESCRIPTION

VALUE

TELECOM

TOWER

REITS

-

1.4%

16,830

SBA

Communications

Corp

$

4,050,981

TOTAL

TELECOM

TOWER

REITS

4,050,981

TOTAL

REAL

ESTATE

INVESTMENT

TRUST

COMMON

STOCKS

(Cost

$193,174,935)

279,537,426

SHARES

DESCRIPTION

RATE

VALUE

X

110,570,315

REAL

ESTATE

INVESTMENT

TRUST

PREFERRED

STOCKS

-

38.8%

(27.5%

of

Total

Investments)

X

110,570,315

DATA

CENTER

REITS

-

3.4%

194,920

Digital

Realty

Trust

Inc

5.200

%

$

4,631,299

105,960

Digital

Realty

Trust

Inc

5.250

2,570,590

96,245

Digital

Realty

Trust

Inc

5.850

2,398,425

TOTAL

DATA

CENTER

REITS

9,600,314

DIVERSIFIED

REITS

-

0.4%

34,560

Armada

Hoffler

Properties

Inc

6.750

882,662

10,000

CTO

Realty

Growth

Inc

6.375

235,300

TOTAL

DIVERSIFIED

REITS

1,117,962

HOTEL

&

RESORT

REITS

-

4.5%

90,130

Chatham

Lodging

Trust

6.625

2,086,509

134,915

DiamondRock

Hospitality

Co

8.250

3,440,333

151,610

Pebblebrook

Hotel

Trust

6.375

3,347,549

56,950

Pebblebrook

Hotel

Trust

5.700

1,127,610

21,740

Pebblebrook

Hotel

Trust

6.300

483,063

64,310

Sunstone

Hotel

Investors

Inc

5.700

1,407,746

41,335

Sunstone

Hotel

Investors

Inc

6.125

926,317

TOTAL

HOTEL

&

RESORT

REITS

12,819,127

INDUSTRIAL

REITS

-

2.7%

59,877

Prologis

Inc

8.540

3,405,887

158,030

Rexford

Industrial

Realty

Inc

5.625

3,797,461

23,316

Rexford

Industrial

Realty

Inc

5.875

563,081

TOTAL

INDUSTRIAL

REITS

7,766,429

MULTI-FAMILY

RESIDENTIAL

REITS

-

0.7%

35,658

Mid-America

Apartment

Communities

Inc

8.500

2,119,508

TOTAL

MULTI-FAMILY

RESIDENTIAL

REITS

2,119,508

OFFICE

REITS

-

10.7%

12,713

Highwoods

Properties

Inc

8.625

13,540,362

144,320

SL

Green

Realty

Corp

6.500

3,538,726

226,090

Vornado

Realty

Trust

5.250

4,053,794

222,827

Vornado

Realty

Trust

5.250

3,995,288

176,330

Vornado

Realty

Trust

4.450

2,881,232

126,524

Vornado

Realty

Trust

5.400

2,381,182

TOTAL

OFFICE

REITS

30,390,584

OTHER

SPECIALIZED

REITS

-

0.1%

12,465

EPR

Properties

5.750

286,570

TOTAL

OTHER

SPECIALIZED

REITS

286,570

REAL

ESTATE

OPERATING

COMPANIES

-

0.9%

52,815

DigitalBridge

Group

Inc

7.150

1,355,761

44,840

DigitalBridge

Group

Inc

7.125

1,150,595

TOTAL

REAL

ESTATE

OPERATING

COMPANIES

2,506,356

RETAIL

REITS

-

8.4%

123,025

Agree

Realty

Corp

4.250

2,597,058

144,110

Federal

Realty

Investment

Trust

5.000

3,337,588

156,704

Kimco

Realty

Corp

5.250

3,890,960

126,039

Kimco

Realty

Corp

5.125

3,027,457

30,155

Kimco

Realty

Corp

7.250

1,851,517

60,045

Regency

Centers

Corp

6.250

1,538,953

51,590

Regency

Centers

Corp

5.875

1,256,216

130,415

Saul

Centers

Inc

6.000

3,076,490

19,725

Saul

Centers

Inc

6.125

457,945

5,494

Simon

Property

Group

Inc

8.375

351,616

Investments

in

Derivatives

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

SHARES

DESCRIPTION

RATE

VALUE

RETAIL

REITS

(continued)

107,345

SITE

Centers

Corp

6.375

%

$

2,602,043

TOTAL

RETAIL

REITS

23,987,843

SELF-STORAGE

REITS

-

5.4%

74,661

National

Storage

Affiliates

Trust

6.000

1,865,779

227,370

Public

Storage

5.600

5,661,513

112,599

Public

Storage

5.050

2,792,455

88,555

Public

Storage

4.625

1,941,126

79,910

Public

Storage

4.875

1,858,707

72,365

Public

Storage

4.000

1,388,684

TOTAL

SELF-STORAGE

REITS

15,508,264

SINGLE-FAMILY

RESIDENTIAL

REITS

-

1.6%

102,970

American

Homes

4

Rent

6.250

2,579,399

63,105

American

Homes

4

Rent

5.875

1,594,663

12,175

UMH

Properties

Inc

6.375

293,296

TOTAL

SINGLE-FAMILY

RESIDENTIAL

REITS

4,467,358

TOTAL

REAL

ESTATE

INVESTMENT

TRUST

PREFERRED

STOCKS

(Cost

$117,343,208)

110,570,315

TOTAL

LONG-TERM

INVESTMENTS

(Cost

$310,518,143)

390,107,741

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

SHORT-TERM

INVESTMENTS

-

4.1% (2.9%

of

Total

Investments)

X

11,600,489

REPURCHASE

AGREEMENTS

-

4.1%

(2.9%

of

Total

Investments)

X

11,600,489

$

11,600,489

(a)

Fixed

Income

Clearing

Corporation

1.520

10/01/24

$

11,600,489

TOTAL

REPURCHASE

AGREEMENTS

(Cost

$11,600,489)

11,600,489

TOTAL

SHORT-TERM

INVESTMENTS

(Cost

$11,600,489)

11,600,489

TOTAL

INVESTMENTS

-

140.9%

(Cost

$322,118,632

)

401,708,230

BORROWINGS

-

(39.4)%

(b),(c)

(112,400,000)

OTHER

ASSETS

&

LIABILITIES,

NET

- (1.5)%

(4,243,061)

NET

ASSETS

APPLICABLE

TO

COMMON

SHARES

-

100%

$

285,065,169

Interest

Rate

Swaps

-

OTC

Uncleared

Counterparty

Notional

Amount

Fund

Pay/Receive

Floating

Rate

Floating

Rate

Index

Fixed

Rate

(Annualized)

Fixed

Rate

Payment

Frequency

Effective

Date

(d)

Optional

Termination

Date

Maturity

Date

Value

Unrealized

Appreciation

(Depreciation)

Morgan

Stanley

$

72,400,000

Receive

SOFR

1.994%

Monthly

6/01/18

7/01/25

7/01/27

$

1,280,877

$

1,280,877

Portfolio

of

Investments

September

30,

2024

(continued)

JRS

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Real

Estate

Investment

Trust

Common

Stocks

$

279,537,426

$

–

$

–

$

279,537,426

Real

Estate

Investment

Trust

Preferred

Stocks

110,570,315

–

–

110,570,315

Short-Term

Investments:

Repurchase

Agreements

–

11,600,489

–

11,600,489

Investments

in

Derivatives:

Interest

Rate

Swaps*

–

1,280,877

–

1,280,877

Total

$

390,107,741

$

12,881,366

$

–

$

402,989,107

*

Represents

net

unrealized

appreciation

(depreciation).

For

Fund

portfolio

compliance

purposes,

the

Fund’s

industry

classifications

refer

to

any

one

or

more

of

the

industry

sub-classifications

used

by

one

or

more

widely

recognized

market

indexes

or

ratings

group

indexes,

and/or

as

defined

by

Fund

management.

This

definition

may

not

apply

for

purposes

of

this

report,

which

may

combine

industry

sub-classifications

into

sectors

for

reporting

ease.

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(a)

Agreement

with

Fixed

Income

Clearing

Corporation,

1.520%

dated

9/30/24

to

be

repurchased

at

$11,600,979

on

10/1/24,

collateralized

by

Government

Agency

Securities,

with

coupon

rate

3.500%

and

maturity

date

9/30/26,

valued

at

$11,832,663.

(b)

Borrowings

as

a

percentage

of

Total

Investments

is

28.0%.

(c)

The

Fund

may

pledge

up

to

100%

of

its

eligible

investments

(excluding

any

investments

separately

pledged

as

collateral

for

specific

investments

in

derivatives,

when

applicable)

in

the

Portfolio

of

Investments

as

collateral

for

borrowings.

As

of

the

end

of

the

reporting

period,

investments

with

a

value

of

$209,857,407

have

been

pledged

as

collateral

for

borrowings.

(d)

Effective

date

represents

the

date

on

which

both

the

Fund

and

counterparty

commence

interest

payment

accruals

on

each

contract.

SOFR

Secured

Overnight

Financing

Rate

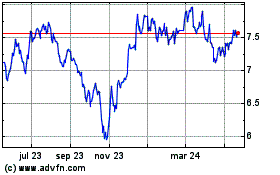

Nuveen Real Estate Income (NYSE:JRS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

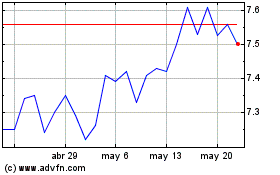

Nuveen Real Estate Income (NYSE:JRS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024