Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

18 Julio 2024 - 5:02AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

July 18, 2024

Commission File Number 001-36761

1 Temasek Avenue #37-02B

Millenia Tower

Singapore 039192

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or

Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT 99.1 TO THIS REPORT ON FORM 6-K IS INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT ON FORM

S-8 (FILE NO. 333-201716) OF KENON HOLDINGS LTD. AND IN THE PROSPECTUSES RELATING TO SUCH REGISTRATION STATEMENT.

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

KENON HOLDINGS LTD.

|

|

|

|

|

|

|

|

Date: July 18, 2024

|

By:

|

/s/ Robert L. Rosen

|

|

|

|

|

Name: Robert L. Rosen

|

|

|

|

|

Title: Chief Executive Officer

|

|

3

Exhibit 99.1

Kenon’s Subsidiary OPC Energy Ltd. Announces Results of Equity Capital Raise

Singapore, July 18,

2024. Kenon Holdings Ltd.’s (NYSE: KEN, TASE: KEN) (“Kenon”) subsidiary OPC Energy Ltd. (“OPC”) announced the results of its offering of new shares, which was announced on July 14, 2024.

OPC will issue 31,250,000 new ordinary shares in the offering at a price of NIS 25.6 per share. The total

gross consideration to be received by OPC from the offering will be NIS 800 million (approximately $220 million).

Kenon has been allocated 16,707,400 shares in the offering for an aggregate gross subscription amount of

approximately NIS 428 million (approximately $120 million). Following the completion of the offering, Kenon is expected to hold 54.5% of OPC’s shares.

The OPC securities referenced in this press release have not been registered under the Securities Act of

1933, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements under that act.

Caution Concerning Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements relating to OPC’s offering of new shares, Kenon’s allocation and post-offering holdings and other non-historical matters. These

forward-looking statements are subject to a number of risks and uncertainties, which could cause the actual results to differ materially from those indicated in Kenon’s forward-looking statements. Such risks include the risks relating to completion

of the offering, the ultimate use of the proceeds of the offering, risks relating to Kenon’s participation in the offering and ultimate holding in OPC after giving effect to the offering and other risks and uncertainties, including those set forth

under the heading “Risk Factors” in Kenon’s most recent Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission. Except as required by law, Kenon undertakes no obligation to update these forward-looking statements, whether

as a result of new information, future events, or otherwise.

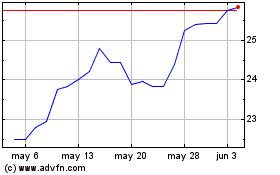

Kenon (NYSE:KEN)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Kenon (NYSE:KEN)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024