Kimberly-Clark to Boost Prices as Commodity Costs Rise -- Update

31 Marzo 2021 - 9:59AM

Noticias Dow Jones

By Dave Sebastian and Colin Kellaher

Kimberly-Clark Corp. on Wednesday said it would raise selling

prices across the bulk of its North America consumer-products

business to help counter rising costs of raw materials.

The maker of Huggies diapers and Scott paper products said it

would raise prices by a percentage in the mid- to high-single

digits, and the increases will go into effect in late June.

The moves will affect its baby- and child-care, adult-care and

Scott bathroom-tissue businesses, Kimberly-Clark said.

The Irving, Texas, company said the increases, which it will

implement almost entirely through changes in list prices, are

needed to help offset significant commodity cost inflation.

The company in January guided for a commodity inflation of $450

million to $600 million in 2021, expecting costs to rise for

materials like pulp, recycled fiber and resin. At that time, Chief

Executive Michael Hsu said the company wasn't planning for

broad-based increases to list prices.

"The pricing plans we outlined in January were based on the

commodity inflation outlook we provided at that time, so it's fair

to say that we wouldn't be announcing these price increases if the

commodity environment hadn't worsened," a company spokesman said

Wednesday.

Since then, global supply chains, which were already

experiencing a crunch due to the Covid-19 pandemic, have seen

additional disruptions. The February freeze that triggered mass

blackouts in Texas led to chemical plant shutdowns and caused a

shortage of the raw materials needed for everything from medical

face shields to smartphones. As a result, prices for polyethylene,

polypropylene and other chemical compounds reached their highest

levels in years in the U.S. as supplies tighten.

Inflation is poised to leap higher in the next few months due to

a sharp dip in prices a year ago, Federal Reserve Chairman Jerome

Powell said in March.

"We could also see upward pressure on prices if spending

rebounds quickly as the economy continues to reopen, particularly

if supply bottlenecks limit how quickly production can respond in

the near term," Mr. Powell said. "However, these one-time increases

in prices are likely to have only transient effects on

inflation."

Meanwhile, shipowners, exporters and importers are now racing to

secure berths and containers at ports while warning of delays and

higher costs for cargoes after engineers freed the Ever Given, a

1,300-foot container ship that had been stuck in the Suez Canal. In

the U.S., container ships anchored off the Southern California

coast are waiting for space at the ports of Los Angeles and Long

Beach. The ships are carrying tens of thousands of boxes holding

millions of dollars' worth of washing machines, medical equipment,

consumer electronics and other goods that make up global ocean

trade.

A raft of consumer-facing companies, including Cheerios maker

General Mills Inc. and Olive Garden parent Darden Restaurants Inc.,

have also recently signaled concerns about rising commodity

prices.

Write to Dave Sebastian at dave.sebastian@wsj.com and Colin

Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

March 31, 2021 11:44 ET (15:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

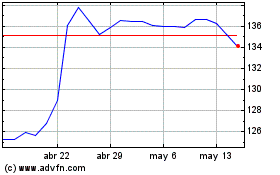

Kimberly Clark (NYSE:KMB)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Kimberly Clark (NYSE:KMB)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024