As filed with the Securities and Exchange Commission on December 5, 2024

Registration No. 333-263575

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 2

to

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Lazard, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 98-0437848 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

30 Rockefeller Plaza,

New York, New York 10112

(212) 632-6000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Christian A. Weideman

Lazard, Inc.

30 Rockefeller Plaza

New York, New York 10112

(212) 632-6000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Catherine M. Clarkin

Stephen M. Salley

Sullivan & Cromwell LLP

125 Broad Street

New York, New York 10004

(212) 558-4000

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box: ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box: ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large Accelerated Filer | ☒ | Accelerated Filer | ☐ |

| Non-Accelerated Filer | ☐ | Smaller Reporting Company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

This Post-Effective Amendment No. 2 (this “Amendment”) to the Registration Statement on Form S-3 (File No. 333-263575) (the “Registration Statement”) is being filed pursuant to Rule 413(b) under the Securities Act of 1933, as amended (the “Securities Act”), by Lazard, Inc., a Delaware corporation (the “Company”), to add guarantees to the securities that may be offered by the Company under the Registration Statement.

Effective January 1, 2024, Lazard Ltd changed its jurisdiction of incorporation from Bermuda to the State of Delaware (the “Domestication”) and changed its legal name to Lazard, Inc. For the purposes of this Amendment and the Registration Statement, references to the “Company,” “Lazard,” the “Registrant,” “we,” “our,” “us” and similar terms mean, as of any time prior to the Domestication, Lazard Ltd and, as of any time after the Domestication, Lazard, Inc. The information contained in this Amendment sets forth additional information to reflect the Domestication. All documents filed by the Company under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), before the effective date of the Domestication will not reflect the change in our name, jurisdiction of incorporation or capital structure.

PROSPECTUS

Common Stock

Preferred Stock

Warrants

Stock Purchase Contracts

Stock Purchase Units

Guarantees

The securities covered by this prospectus may be sold from time to time by Lazard, Inc. In addition, selling security holders to be named in a prospectus supplement may offer and sell from time to time securities in such amounts as set forth in such prospectus supplement. We may also offer guarantees from time to time in connection with a consent solicitation or other liability management transaction. We may, and any selling security holder may, offer the securities independently or together in any combination for sale directly to purchasers or through underwriters, dealers, agents or other counterparties to be designated at a future date. Unless otherwise set forth in a prospectus supplement, we will not receive any proceeds from the sale of securities by any selling security holders.

When we offer securities, we will provide you with a prospectus supplement describing the specific terms of the specific issue of securities, including the offering price of the securities. You should carefully read this prospectus and the prospectus supplement relating to the specific issue of securities, together with the documents we incorporate by reference, before you decide to invest in any of these securities.

THIS PROSPECTUS MAY NOT BE USED TO OFFER OR SELL ANY SECURITIES UNLESS ACCOMPANIED BY A PROSPECTUS SUPPLEMENT.

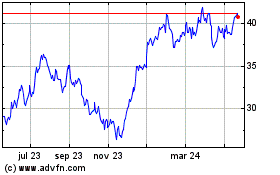

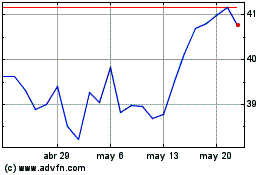

Our common stock is traded on the New York Stock Exchange under the symbol “LAZ.”

Investing in our securities involves risks. See “Risk Factors” on page 4 of this prospectus. You should carefully review the risks and uncertainties described under the heading “Risk Factors” contained in the applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other documents that we incorporate by reference. Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The securities may be offered and sold to or through underwriters, dealers or agents as designated from time to time, or directly to one or more other purchasers or through a combination of such methods. See “Plan of Distribution.” If any underwriters, dealers or agents are involved in the sale of any of the securities, their names, and any applicable purchase price, fee, commission or discount arrangements between or among them, will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement.

Prospectus dated December 5, 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed as a “well-known seasoned issuer,” or “WKSI,” as defined in Rule 405 of the Securities Act, with the United States Securities and Exchange Commission (the “Commission”) using the “automatic shelf” registration process. Under this automatic shelf registration process, we, or certain of our security holders, may sell the securities described in this prospectus in one or more offerings in amounts to be determined at the time of any such offerings.

This prospectus provides you with a general description of the securities we or a selling security holder may offer. Each time we, or, under certain circumstances, our security holders, sell securities, we will provide a prospectus supplement that will contain specific information about the terms and the means of distribution of that offering. The prospectus supplement may include other special considerations applicable to such offering of securities. The prospectus supplement may also add to, update or change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the information in the prospectus supplement. You should carefully read this prospectus and any prospectus supplement, together with additional information described under the heading “Where You Can Find More Information,” before investing in securities.

Each prospectus supplement will describe: the terms of the securities offered, any initial public offering price, the price paid to us for the securities, the net proceeds to us, the manner of distribution and any underwriting compensation and the other specific material terms related to the offering of the securities. For more detail on the terms of the securities, you should read the exhibits filed with or incorporated by reference in our registration statement of which this prospectus forms a part.

In this prospectus, unless the context otherwise requires, the terms:

•“Lazard,” “we,” “our,” “us,” the “Registrant,” the “Company” and similar terms mean, as of any time prior to the Domestication, Lazard Ltd, a Bermuda exempted company whose Class A common shares were publicly traded on the New York Stock Exchange under the symbol “LAZ” until the Domestication and, as of any time after the Domestication, Lazard, Inc., a Delaware corporation whose shares of common stock are publicly traded on the New York Stock Exchange under the symbol “LAZ,” and, in each case, its subsidiaries, including Lazard Group.

•“Lazard Group,” refers to Lazard Group LLC, a Delaware limited liability company that is the current holding company for substantially all of the subsidiaries that conduct Lazard’s business (which we refer to in this prospectus as “our business”).

References to “securities” include any security that we might sell under this prospectus or any prospectus supplement.

We prepare our financial statements in U.S. dollars and in conformity with U.S. generally accepted accounting principles, or “U.S. GAAP,” including all of the financial statements incorporated by reference or included in this prospectus. Our fiscal year ends on December 31. In this prospectus, except where otherwise indicated, references to “$” or “dollars” are to the lawful currency of the United States.

This prospectus contains summaries of certain provisions contained in some of the documents described herein. Please refer to the actual documents for complete information. All of the summaries are qualified in their entirety by reference to the actual documents. Copies of the documents referred to herein have been filed, or will be filed or incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

We have not authorized any other person to provide you with any information other than that contained or incorporated by reference in this prospectus. We do not take any responsibility for, or provide any assurance as to the reliability of, any other information that others may give you. The distribution of this prospectus and the sale of these securities in certain jurisdictions may be restricted by law. Persons in possession of this prospectus are

required to inform themselves about and observe any such restrictions. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

The information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus and the information we have incorporated by reference is accurate only as of the dates of the documents incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since such dates.

LAZARD, INC.

Founded in 1848, Lazard is one of the world’s preeminent financial advisory and asset management firms, with operations in North and South America, Europe, Middle East, Asia, and Australia. Lazard provides advice on mergers and acquisitions, capital markets and capital solutions, restructuring and liability management, geopolitics, and other strategic matters, as well as asset management and investment solutions to institutions, corporations, governments, partnerships, family offices, and high net worth individuals. We focus primarily on two business segments: Financial Advisory and Asset Management. We believe that the mix of our activities across business segments, geographic regions, industries and investment strategies helps to diversify and stabilize our revenue stream.

Lazard, Inc. first incorporated and commenced its existence in Bermuda on October 25, 2004 (then a Bermuda exempted company known as Lazard Ltd) and continued its existence as a Delaware corporation on January 1, 2024. Lazard Group was formed in Delaware on March 2, 2000 under the name Lazard LLC and was renamed Lazard Group LLC on May 10, 2005. Our principal executive offices are located in the United States at 30 Rockefeller Plaza, New York, New York 10112, with a general telephone number of (212) 632-6000, in France at 175 Boulevard Haussmann, 75382 Paris Cedex 08, with a general telephone number of 33-1-44-13-01-11 and in the United Kingdom at 50 Stratton Street, London W1J 8LL, with a general telephone number of 44-20-7187-2000. We also maintain a registered office in the State of Delaware at Corporation Trust Center, 1209 Orange Street, Wilmington, Delaware, 19801. We maintain a public website at http://www.lazard.com. The information contained on or connected to our website and social media sites is not a part of this prospectus, and you should not rely on any such information in making your decision whether to purchase securities.

RISK FACTORS

Investing in our securities involves risks. Potential investors are urged to read and consider the risk factors and other disclosures relating to an investment in securities issued by Lazard, Inc. described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as updated by annual, quarterly and other reports and documents we file with the Commission on or after the date of this prospectus and that are incorporated by reference herein. Before making an investment decision, you should carefully consider those risks as well as other information we include or incorporate by reference in this prospectus and any prospectus supplement relating to specific offerings of securities. See “Where You Can Find More Information” for information about how you can obtain copies of these documents. If any of the events or developments described actually occurred, our business, financial condition or results of operations would likely suffer. The risks and uncertainties we have described are not the only ones facing our Company. Additional risks and uncertainties not presently known to us or that we currently consider immaterial may also affect our business operations.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any accompanying prospectus supplement and the information incorporated herein and therein by reference include forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Such forward-looking statements can be located in this prospectus and in the information incorporated by reference in this prospectus under the captions “Business,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in other sections of this prospectus, and in other information incorporated by reference in this prospectus.

In some cases, forward-looking statements can be identified by the use of forward-looking terminology such as “may,” “might,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “target,” “goal,” or “continue,” and the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to known and unknown risks, uncertainties and assumptions about us, may include projections of our future financial performance based on our growth strategies, business plans and initiatives and anticipated trends in our business.

These forward-looking statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements.

These factors include, but are not limited to, the numerous risks and uncertainties outlined under the caption “Risk Factors” above and in the documents incorporated by reference into this prospectus, including the following:

•adverse general economic conditions or adverse conditions in global or regional financial markets;

•a decline in our revenues, for example due to a decline in overall mergers and acquisitions (“M&A”) activity, our share of the M&A market or our assets under management (“AUM”);

•losses caused by financial or other problems experienced by third parties;

•losses due to unidentified or unanticipated risks;

•a lack of liquidity, i.e., ready access to funds, for use in our businesses;

•competitive pressure on our businesses and on our ability to retain and attract employees at current compensation levels; and

•changes in relevant tax laws, regulations or treaties or an adverse interpretation of those items.

These risks and uncertainties are not exhaustive. Other sections of this prospectus or the information incorporated by reference herein may describe additional factors that could adversely affect our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for our management to predict all risks and uncertainties, nor can management assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

As a result, there can be no assurance that the forward-looking statements included in this prospectus or the information incorporated by reference herein will prove to be accurate or correct. Although we believe the statements reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance, achievements or events. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. We are under no duty to update any of these forward-looking statements after the date of this prospectus to conform our prior statements to actual results or revised expectations and we do not intend to do so.

Forward-looking statements include, but are not limited to, statements about:

•financial goals, including ratios of compensation and benefits expense to adjusted net revenue;

•ability to deploy surplus cash through dividends, share repurchases and debt repurchases;

•ability to offset stockholder dilution through share repurchases;

•possible or assumed future results of operations and operating cash flows;

•strategies and investment policies;

•financing plans and the availability of short-term borrowing;

•competitive position;

•future acquisitions or other strategic transactions, including the consideration to be paid and the timing of consummation;

•potential growth opportunities available to our businesses;

•potential impact of investments in our technology infrastructure and data science capabilities;

•recruitment and retention of our managing directors and employees;

•potential levels of compensation expense, including adjusted compensation and benefits expense, and non-compensation expense;

•potential operating performance, achievements, productivity improvements, efficiency and cost reduction efforts;

•statements regarding environmental, social and governance goals and initiatives;

•likelihood of success and impact of litigation;

•ability to realize the anticipated benefits of Lazard’s conversion to a U.S. C-Corporation and impact on the trading price of our stock;

•expected tax rates, including effective tax rates;

•changes in interest and tax rates;

•availability of certain tax benefits, including certain potential deductions;

•potential impact of certain events or circumstances on our financial statements and operations;

•changes in foreign currency exchange rates;

•expectations with respect to the economy, the securities markets, the market for mergers, acquisitions, restructuring and other financial advisory activity, the market for asset management activity and other macroeconomic, regional and industry trends;

•effects of competition on our business; and

•impact of new or future legislation and regulation, including tax laws and regulations, on our business.

The Company is committed to providing timely and accurate information to the investing public, consistent with our legal and regulatory obligations. To that end, the Company uses its website and social media sites to convey information about its businesses, including the anticipated release of quarterly financial results, quarterly financial, statistical and business-related information, and the posting of updates of AUM in various mutual funds,

hedge funds and other investment products managed by Lazard Asset Management LLC and Lazard Frères Gestion SAS. Investors can link to Lazard Group and its operating company websites through https://www.lazard.com. The Company’s websites and social media sites and the information contained therein or connected thereto shall not be deemed to be incorporated into this prospectus.

SELLING SECURITYHOLDERS

We may register securities covered by this prospectus for re-offers and resales by any selling security holders to be named in a prospectus supplement. Because we are a WKSI, we may add secondary sales of securities by any selling security holders by filing a prospectus supplement with the Commission. We may register these securities to permit selling security holders to resell their securities when they deem appropriate. A selling security holder may resell all, a portion or none of their securities at any time and from time to time. We may register those securities for sale through an underwriter or other plan of distribution as set forth in a prospectus supplement. See “Plan of Distribution.” Selling security holders may also sell, transfer or otherwise dispose of some or all of their securities in transactions exempt from the registration requirements of the Securities Act. We may pay all expenses incurred with respect to the registration of the securities owned by the selling security holders, other than underwriting fees, discounts or commissions, which will be borne by the selling security holders. We will provide you with a prospectus supplement naming the selling security holders, the amount of securities to be registered and sold and other terms of the securities being sold by a selling security holder.

USE OF PROCEEDS

Unless otherwise indicated in a prospectus supplement, we intend to use the net proceeds from the sale of our securities for general corporate purposes, which may include additions to working capital, repayment of indebtedness, the financing of possible acquisitions and investments, stock repurchases or for such other purposes as may be specified in the applicable prospectus supplement. Unless otherwise set forth in a prospectus supplement, we will not receive any proceeds from any sales of our securities by any selling security holder to be named in a prospectus supplement and we will not receive any proceeds from the offer or issuance of guarantees.

DESCRIPTION OF COMMON STOCK WE OR SELLING SECURITYHOLDERS MAY OFFER

The following summary is a description of the material terms of our common stock. The prospectus supplement related to any offering of our common stock will contain a discussion of any material United States Federal income tax considerations applicable to such offering of common stock. This description does not purport to be complete and is subject to and qualified in its entirety by reference to applicable Delaware law, our Certificate of Incorporation and our By-laws, each of which is filed as an exhibit to this Amendment and is in incorporated by reference herein. See “Where You Can Find More Information” for information about how you can obtain copies of these documents.

General

We currently have 500,000,000 authorized shares of common stock, par value $0.01 per share.

Voting

Each share of our common stock entitles its holder to one vote per share. The members of our board of directors are periodically elected by the common stockholders. Generally, in matters other than the election of directors, all matters to be voted on by common stockholders require approval in a meeting by a majority of the shares of our common stock present in person or represented by proxy at the meeting. In general, amendments to the Certificate of Incorporation or By-laws and removal of a director for cause require approval by a majority of the votes entitled to be cast by all holders of our outstanding common stock. Furthermore, amendments by stockholders to the Certificate of Incorporation or By-laws that would alter, revoke or amend provisions of the Certificate of Incorporation or By-laws relating to the size or classified nature of the board of directors, the election of directors, the ability to remove directors only for cause, the exculpation and indemnification of directors or officers, and certain other matters require approval by at least 66 2/3% of the votes entitled to be cast by all holders of our outstanding common stock. Directors (of the applicable class then expiring) are generally elected at an annual meeting by a plurality of votes cast at the meeting of holders of our common stock. Holders of shares of common stock do not have the right to cumulate their votes in the election of directors.

Dividends and Distribution

The holders of our common stock have the right to receive dividends and distributions, whether payable in cash or otherwise, as may be declared from time to time by our board of directors, from legally available funds. Subject to compliance with applicable law, we currently intend to declare quarterly dividends on all outstanding shares of our common stock.

The declaration of any dividends and, if declared, the amount of any such dividend, will be subject to the actual future earnings, cash flow and capital requirements of our Company, to the amount of distributions to us from Lazard Group and to the discretion of our board of directors. Our board of directors will take into account:

•general economic and business conditions;

•our financial results;

•capital requirements of our subsidiaries;

•contractual, legal, tax and regulatory restrictions on and implications of the payment of dividends by us to our stockholders or by our subsidiaries (including Lazard Group) to us; and

•such other factors as our board of directors may deem relevant.

We are a holding company and have no direct operations. As a result, we depend upon distributions from Lazard Group to pay any dividends. We expect to continue to cause Lazard Group to pay distributions to us in order to fund any such dividends, subject to applicable law and the other considerations discussed above.

Liquidation, dissolution or winding up

In the event of the liquidation, dissolution or winding-up of the Company, holders of our common stock will be entitled to share equally in the assets available for distribution after payment of all creditors and the liquidation preferences of our preferred stock (if any).

Redemption, conversion, or preemptive rights

Holders of our common stock have no redemption rights, conversion rights or preemptive rights to purchase or subscribe for our securities.

Other provisions

There are no redemption provisions or sinking fund provisions applicable to our common stock.

Limitations on Rights of Holders of Common Stock

Pursuant to Delaware law, a company may vary the rights of a class of stock with the approval of a majority of the outstanding shares of such class, unless the certificate of incorporation provides otherwise. Our Certificate of Incorporation provides that, subject to the rights of the holders of any series of preferred stock, the number of authorized shares of any class or series of preferred stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority of the outstanding shares of such class or series, voting together as a single class. As such, the holders of common stock shall not be entitled to vote on any amendment of the Certificate of Incorporation that alters or changes the powers, preferences, rights or other terms of one or more outstanding series of preferred stock if the holders of such affected series are entitled, either separately or together with the holders of one or more other series of preferred stock, to vote thereon pursuant to the Certificate of Incorporation or pursuant to Delaware law as then in effect.

We may issue preferred stock. Preferred stock may be issued independently or together with any other securities and may be attached to or separate from the securities. Pursuant to Delaware law, our Certificate of Incorporation, and our By-laws, our board of directors by resolution may establish one or more series of preferred stock having such number of shares, designations, dividend rates, relative voting rights, conversion or exchange rights, redemption rights, liquidation rights and other relative participation, optional or other special rights, qualifications, limitations or restrictions as may be fixed by the board of directors without any stockholder approval. The rights, preferences, and privileges of the holders of our common stock will be subject to, and may be adversely affected by, the rights of the holders of any series of our preferred stock that may be issued from time to time. Such rights, preferences, powers and limitations as may be established could also have the effect of discouraging an attempt to obtain control of the Company.

Board of Directors

Under Delaware law, directors of a Delaware corporation may, by the certificate of incorporation or by an initial by-law, or by a by-law adopted by a vote of the stockholders, be divided into one, two or three classes (the term of office of those of the first class to expire at the first annual meeting held after such classification becomes effective, the second class one year thereafter, and the third class two years thereafter). At each annual election held after such classification becomes effective, directors shall be chosen for a full term, as the case may be, to succeed those whose terms expire. Our board of directors is divided into three classes of directors serving staggered three-year terms. As a result, approximately one-third of the board of directors will be elected each year. The existence of a classified board of directors may deter a stockholder from removing incumbent directors and simultaneously gaining control of the board of directors by filling vacancies with its own nominees. Furthermore, our By-laws provide that vacancies may only be filled by a majority of the directors then in office, although less than a quorum, or by the sole remaining director.

Additionally, our By-laws provide that any stockholder entitled to vote thereat generally may nominate one or more persons for election as directors at an annual meeting (but not a special meeting) only if written notice of such stockholder’s intent to make such nomination(s) has been received by the Secretary of the Company, generally, not

less than 90 nor more than 120 days prior to the first anniversary of the preceding year’s annual meeting. Under our By-laws, directors (of the applicable class then expiring) are elected at an annual meeting of stockholders by a plurality of votes cast at the meeting.

Delaware Anti-Takeover Laws

We are subject to Section 203 of the General Corporation Law of the State of Delaware (the “DGCL”). Section 203 prohibits us from engaging in any business combination (as defined in Section 203) with an “interested stockholder” for a period of three years subsequent to the date on which the stockholder became an interested stockholder unless:

•prior to such date, our board of directors approved either the business combination or the transaction in which the stockholder became an interested stockholder;

•upon completion of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owns at least 85% of our outstanding voting stock (with certain exclusions); or

•the business combination is approved by our board of directors and authorized by a vote (and not by written consent) of at least 66 2/3% of our outstanding voting stock not owned by the interested stockholder.

For purposes of Section 203, an “interested stockholder” is defined as an entity or person beneficially owning 15% or more of the outstanding voting stock of the corporation, based on voting power, and any entity or person affiliated with or controlling or controlled by such an entity or person.

A “business combination” includes mergers, asset sales and other transactions resulting in financial benefit to a stockholder. Section 203 could prohibit or delay mergers or other takeover or change of control attempts with respect to us and, accordingly, may discourage attempts that might result in a premium over the market price for the shares held by stockholders.

Such provisions may have the effect of deterring hostile takeovers or delaying changes in control of management or us.

Listing and Transfer Agent

Our common stock is listed on the New York Stock Exchange and trades under the symbol “LAZ.” The Transfer Agent for our common stock is Computershare Inc.

DESCRIPTION OF PREFERRED STOCK WE MAY OFFER

The following description of the terms of the preferred stock we may issue sets forth certain general terms and provisions of any series of preferred stock to which any prospectus supplement may relate. The particular terms of the preferred stock offered by any prospectus supplement and the extent, if any, to which these general terms and provisions may apply to those series of preferred stock will be described in the prospectus supplement relating to the applicable preferred stock. The applicable prospectus supplement may also state that any of the terms set forth in this description are inapplicable to such series of preferred stock. This description does not purport to be complete and is subject to and qualified in its entirety by reference to applicable Delaware law, our Certificate of Incorporation and our By-laws, each of which is filed as an exhibit to this Amendment and is in incorporated by reference herein.

We may issue shares of preferred stock. Shares of preferred stock may be issued independently or together with any other securities and may be attached to or separate from the securities.

Under the Company’s Certificate of Incorporation and By-laws, our board of directors by resolution may establish one or more series of preferred stock having such number of shares, designations, dividend rates, relative voting rights, conversion or exchange rights, redemption rights, liquidation rights and other relative participation, optional or other special rights, qualifications, limitations or restrictions as may be fixed by the board of directors without any stockholder approval. Any issuance of shares of preferred stock could adversely affect the voting power of holders of common stock and the likelihood that such holders would receive dividend payments and payments on liquidation. In addition, the issuance of shares of preferred stock could have the effect of delaying, deterring or preventing a change of control or other corporate action.

The board of directors, in approving the issuance of a class or series of preferred stock, will set forth with respect to such class or series, the following:

•the distinctive serial designation of such series which shall distinguish it from other series;

•the number of shares constituting such series;

•the dividend rate (or method of determining such rate) on the shares of such series, any conditions upon which such dividends shall be paid (such as the relative rights of priority, if any, of the payment of dividends on shares of such series) and the date or dates upon which such dividends shall be payable;

•whether dividends on the shares of such series shall be cumulative and, in the case of shares of any series having cumulative dividend rights, the date or dates or method of determining the date or dates from which dividends on the shares of such series shall be cumulative;

•the amount or amounts which shall be payable out of the assets of the Company to the holders of the shares of such series upon voluntary or involuntary liquidation, dissolution or winding up the Company, and the relative rights of priority, if any, of payment of the shares of such series;

•the price or prices at which, the period or periods within which and the terms and conditions upon which the shares of such series may be redeemed, in whole or in part, at the option of the Company or at the option of the holder or holders thereof or upon the happening of a specified event or events;

•the obligation, if any, of the Company to purchase or redeem shares of such series pursuant to a sinking fund or otherwise and the price or prices at which, the period or periods within which and the terms and conditions upon which the shares of such series shall be redeemed or purchased, in whole or in part, pursuant to such obligation;

•whether or not the shares of such series shall be convertible or exchangeable, at any time or times at the option of the holder or holders thereof or at the option of the Company or upon the happening of a specified event or events, into shares of any other class or classes or any other series of the same or any other class or classes of stock of the Company, and the price or prices or rate or rates of exchange or conversion and any adjustments applicable thereto;

•the right of the shares of that series to the benefit of conditions and restrictions upon the creation of indebtedness of the Company or any subsidiary, upon the issue of any additional shares (including additional shares of such series or any other series) and upon the payment of dividends or the making of other distributions on, and the purchase, redemption or other acquisition by the Company or any subsidiary of any issued shares of the Company;

•whether or not the holders of the shares of such series shall have voting rights, in addition to the voting rights provided by law, and if so the terms of such voting rights; and

•any other powers, preferences and rights and qualifications, limitations and restrictions not inconsistent with the DGCL.

The terms of each class or series of preferred stock will be described in any prospectus supplement related to such class or series of preferred stock and will contain a discussion of any material United States Federal income tax considerations applicable to such class or series of preferred stock. We currently have 15,000,000 authorized shares of preferred stock. We have no present plans to issue any shares of preferred stock.

DESCRIPTION OF WARRANTS WE MAY OFFER

The following description of the terms of warrants we may issue sets forth certain general terms and provisions of any warrants to which any prospectus supplement may relate. The particular terms of warrants offered by any prospectus supplement and the extent, if any, to which these general terms and provisions may apply to those warrants will be described in the prospectus supplement relating to the applicable warrants. The applicable prospectus supplement may also state that any of the terms set forth in this description are inapplicable to such warrants. This description does not purport to be complete and is subject to and qualified in its entirety by reference to applicable Delaware law, our Certificate of Incorporation and our By-laws, each of which is filed as an exhibit to this Amendment and is in incorporated by reference herein.

General

We may issue warrants, including warrants to purchase shares of our common stock and preferred stock. Warrants may be issued independently or together with any securities and may be attached to or separate from the securities. Each series of warrants will be issued under a separate warrant agreement to be entered into between us and a bank or trust company, as warrant agent.

Other Warrants

The applicable prospectus supplement will describe the following terms of any other warrants that we may issue:

•the title of the warrants;

•the securities (which may include common stock or preferred stock) for which the warrants are exercisable;

•the price or prices at which the warrants will be issued;

•the currency or currencies, including composite currencies or currency units, in which the price of the warrants may be payable;

•if applicable, the designation and terms of the common stock or preferred stock with which the warrants are issued, and the number of the warrants issued with each share of common stock or preferred stock;

•if applicable, the date on and after which the warrants and the related common stock or preferred stock will be separately transferable;

•if applicable, a discussion of any material United States Federal income tax considerations; and

•any other terms of the warrants, including terms, procedures and limitations relating to the exchange and exercise of the warrants.

Exercise of Warrants

Each warrant will entitle the holder to purchase for cash or other consideration the number of shares of our preferred stock or shares of our common stock at the exercise price as will in each case be described in, or can be determined from, the applicable prospectus supplement relating to the offered warrants. Warrants may be exercised at any time up to the close of business on the expiration date described in the applicable prospectus supplement. After the close of business on the expiration date, unexercised warrants will become void.

Warrants may be exercised as described in the applicable prospectus supplement. Upon receipt of payment and the certificate representing the warrant properly completed and duly executed at the corporate trust office of the warrant agent or any other offices indicated in the applicable prospectus supplement, we will, as soon as practicable, forward the securities issuable upon exercise. If less than all of the warrants represented by the certificate are exercised, a new certificate will be issued for the remaining warrants.

DESCRIPTION OF STOCK PURCHASE CONTRACTS AND STOCK PURCHASE UNITS WE MAY OFFER

The following description of the terms of stock purchase contracts and stock purchase units we may issue sets forth certain general terms and provisions of any stock purchase contracts or stock purchase units to which any prospectus supplement may relate. The particular terms of stock purchase contracts or stock purchase units offered by any prospectus supplement and the extent, if any, to which these general terms and provisions may apply to those stock purchase contracts or stock purchase units will be described in the prospectus supplement relating to the applicable stock purchase contracts or stock purchase units. The applicable prospectus supplement may also state that any of the terms set forth in this description are inapplicable to such stock purchase contracts or stock purchase units. This description does not purport to be complete and is subject to and qualified in its entirety by reference to applicable Delaware law, our Certificate of Incorporation and our By-laws, each of which is filed as an exhibit to this Amendment and is in incorporated by reference herein.

We may issue stock purchase contracts, including contracts obligating holders to purchase from or sell to us, and obligating us to sell to or purchase from the holders, a specified number of shares of our common stock or preferred stock at a future date or dates, which we refer to in this prospectus as “stock purchase contracts.” The price per share of the securities and the number of shares of the securities may be fixed at the time the stock purchase contracts are issued or may be determined by reference to a specific formula set forth in the stock purchase contracts, and may be subject to adjustment under anti-dilution formulas. The stock purchase contracts may be issued separately or as part of units consisting of a stock purchase contract and debt securities or debt obligations of third parties, including U.S. treasury securities, any other securities described in the applicable prospectus supplement or any combination of the foregoing, securing the holders’ obligations to purchase the securities under the stock purchase contracts, which we refer to herein as “stock purchase units.” The stock purchase contracts may require holders to secure their obligations under the stock purchase contracts in a specified manner. The stock purchase contracts also may require us to make periodic payments to the holders of the stock purchase contracts or the stock purchase units, as the case may be, or vice versa, and those payments may be unsecured or pre-funded on some basis.

The applicable prospectus supplement will describe the terms of any stock purchase contracts or stock purchase units offered thereby and will contain a discussion of any material United States Federal income tax considerations applicable to such stock purchase contracts or stock purchase units.

DESCRIPTION OF GUARANTEES WE MAY OFFER

We may offer to sell or otherwise issue guarantees of the indebtedness of our subsidiaries, including debt securities previously issued by Lazard Group pursuant to the indenture dated as of May 10, 2005, between Lazard Group and The Bank of New York Mellon, as trustee, as it may be amended or supplemented from time to time. Except as otherwise described in any prospectus supplement, each guarantee will be a full and unconditional guarantee of the prompt payment, when due, of any amount owed to the holders of the indebtedness of our subsidiaries, and any other amounts due pursuant to any indenture, fiscal agency agreement or other contract governing such indebtedness. Each guarantee will be an unsecured unsubordinated obligation of Lazard.

The applicable prospectus supplement will describe the terms of any guarantees that may be offered pursuant to this prospectus.

PLAN OF DISTRIBUTION

We may sell our securities, and any selling security holder may offer and sell securities covered by this prospectus, in any one or more of the following ways from time to time:

•through agents;

•to or through underwriters;

•through brokers or dealers;

•through a block trade in which the broker or dealer engaged to handle the block trade will attempt to sell the securities as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

•directly by us or any selling security holders to purchasers, including through a specific bidding, auction or other process; or

•through a combination of any of these methods of sale.

In addition, we may sell or otherwise issue the guarantees being offered under this prospectus directly to holders of the indebtedness of our subsidiaries.

We will describe in a prospectus supplement the particular terms of the offering of the securities, which may include the following:

•the names of any underwriters, dealers, agents or other counterparties;

•the purchase price of the securities and the net proceeds, if any, we will receive from the sale;

•any underwriting discounts and other items constituting underwriters’ compensation;

•any initial public offering price and any discounts or concessions allowed or reallowed or paid to dealers;

•details regarding any over-allotment options under which underwriters may purchase additional securities from us or any selling securityholders;

•any securities exchanges on which the securities of the series may be listed; and

•any other information we think is material.

In addition, we and any selling security holder may sell any securities covered by this prospectus in private transactions or under Rule 144 of the Securities Act rather than pursuant to this prospectus.

We may sell offered securities directly or through agents designated by us from time to time. Any agent in the offer or sale of the securities for which this prospectus is delivered will be named, and any commissions payable by us to that agent will be set forth, in the prospectus supplement. Unless indicated in the prospectus supplement, the agents will have agreed to use their reasonable best efforts to solicit purchases for the period of their appointment.

In connection with the sale of securities covered by this prospectus, broker-dealers may receive commissions or other compensation from us in the form of commissions, discounts or concessions. Broker-dealers may also receive compensation from purchasers of the securities for whom they act as agents or to whom they sell as principals or both. Compensation as to a particular broker-dealer may be in excess of customary commissions or in amounts to be negotiated. In connection with any underwritten offering, underwriters may receive compensation in the form of discounts, concessions or commissions from us or from purchasers of the securities for whom they act as agents. Underwriters may sell the securities to or through dealers, and such dealers may receive compensation in the form of discounts, concessions or commissions from the underwriters and/or commissions from the purchasers for whom they may act as agents. Any underwriters, broker-dealers, agents or other persons acting on our behalf that

participate in the distribution of the securities may be deemed to be “underwriters” within the meaning of the Securities Act, and any profit on the sale of the securities by them and any discounts, commissions or concessions received by any of those underwriters, broker-dealers, agents or other persons may be deemed to be underwriting discounts and commissions under the Securities Act.

In connection with the distribution of the securities covered by this prospectus or otherwise, we or any selling security holder may enter into hedging transactions with broker-dealers or other financial institutions. In connection with such transactions, broker-dealers or other financial institutions may engage in short sales of our securities in the course of hedging the positions they assume with us or any selling security holder. We or any selling security holder may also sell securities short and deliver the securities offered by this prospectus to close out our short positions. We or any selling security holder may also enter into options or other transactions with broker-dealers or other financial institutions that require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus, as supplemented or amended to reflect such transaction. We or any selling security holder may also from time to time pledge our securities pursuant to the margin provisions of our customer agreements with our brokers. Upon our default, the broker may offer and sell such pledged securities from time to time pursuant to this prospectus, as supplemented or amended to reflect such transaction.

At any time a particular offer of the securities covered by this prospectus is made, a revised prospectus or prospectus supplement, if required, will be distributed which will set forth the aggregate amount of securities covered by this prospectus being offered and the terms of the offering, including the name or names of any underwriters, dealers, brokers or agents, any discounts, commissions, concessions and other items constituting compensation from us and any discounts, commissions or concessions allowed or reallowed or paid to dealers. Such prospectus supplement, and, if necessary, a post-effective amendment to the registration statement of which this prospectus is a part, will be filed with the Commission to reflect the disclosure of additional information with respect to the distribution of the securities covered by this prospectus. In order to comply with the securities laws of certain states, if applicable, the securities sold under this prospectus may only be sold through registered or licensed broker-dealers. In addition, in some states the securities may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from registration or qualification requirements is available and is complied with.

In connection with an underwritten offering, we and any selling security holder would execute an underwriting agreement with an underwriter or underwriters. Unless otherwise indicated in the revised prospectus or applicable prospectus supplement, such underwriting agreement would provide that the obligations of the underwriter or underwriters are subject to certain conditions precedent, and that the underwriter or underwriters with respect to a sale of the covered securities will be obligated to purchase all of the covered securities, if any such securities are purchased. We or any selling security holder may grant to the underwriter or underwriters an option to purchase additional securities at the public offering price, less any underwriting discount, as may be set forth in the revised prospectus or applicable prospectus supplement. If we or any selling security holder grants any such option, the terms of that option will be set forth in the revised prospectus or applicable prospectus supplement.

Underwriters, agents, brokers or dealers may be entitled, pursuant to relevant agreements entered into with us, to indemnification by us or any selling security holder against certain civil liabilities, including liabilities under the Securities Act that may arise from any untrue statement or alleged untrue statement of a material fact, or any omission or alleged omission to state a material fact in this prospectus, any supplement or amendment hereto, or in the registration statement of which this prospectus forms a part, or to contribution with respect to payments which the underwriters, agents, brokers or dealers may be required to make.

VALIDITY OF THE SECURITIES

The validity of the securities will be passed upon for us by Sullivan & Cromwell LLP, New York, NY. If the securities are being distributed in an underwritten offering, certain legal matters will be passed upon for the underwriters by counsel identified in the related prospectus supplement.

EXPERTS

The financial statements of Lazard, Inc. as of December 31, 2023 and 2022, and for each of the three years in the period ended December 31, 2023, incorporated by reference in this Registration Statement, and the effectiveness of Lazard, Inc.’s internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their reports. Such financial statements are incorporated by reference in reliance upon the reports of such firm given their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file current, annual and quarterly reports, proxy statements and other information required by the Exchange Act with the Commission. Our filings are available to the public from the Commission’s internet site at https://www.sec.gov.

We maintain a public website at https://www.lazard.com. The information contained on or connected to our website and social media sites is not a part of this prospectus, and you should not rely on any such information.

We are “incorporating by reference” into this prospectus specific documents that we file with the Commission, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered part of this prospectus, and information that we file subsequently with the Commission and incorporate herein as set forth in the next sentence will automatically update and supersede this information. We incorporate by reference the documents listed below, and, any future documents that we file with the Commission (in each case, excluding any portions of such documents that are “furnished” but not “filed” for purposes of the Exchange Act) under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act. This prospectus is part of a registration statement filed with the Commission.

We are “incorporating by reference” into this prospectus the following documents filed with the Commission (excluding any portions of such documents that have been “furnished” but not “filed” for purposes of the Exchange Act):

1.the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as filed with the Commission on February 23, 2024; 2.the Company’s Quarterly Report on Form 10-Q for the quarterly periods ended March 31, 2024, June 30, 2024, and September 30, 2024, as filed with the Commission on April 26, 2024, July 26, 2024, and November 1, 2024, respectively; 3.the Company’s Current Reports on Form 8-K, as filed with the Commission on January 2, 2024, February 1, 2024 (Items 5.02 and 8.01 only), March 6, 2024, March 12, 2024, March 13, 2024, May 13, 2024, November 25, 2024 and December 4, 2024; 4.the Company’s Definitive Proxy Statement on Schedule 14A for the Annual General Meeting of Shareholders on May 9, 2024, as filed with the Commission on March 21, 2024; and 5.the description of the Company’s common stock, contained in Exhibit 4.8 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as filed with the Commission on February 23, 2024, and all amendments or reports filed for the purpose of updating such description. We will provide to each person, including any beneficial owner, to whom a prospectus is delivered, upon written or oral request and without charge, a copy of the documents referred to above that we have incorporated in this prospectus by reference. You can request copies of such documents if you write to us at the following address: Investor Relations, Lazard, Inc., 30 Rockefeller Plaza, New York, New York 10112, or call us at (212) 632-6000. You may also obtain copies of any such documents by visiting our website at https://www.lazard.com. The information contained on or connected to our website is not a part of this prospectus, and you should not rely on any such information.

This prospectus, any accompanying prospectus supplement and information incorporated by reference herein and therein, contain summaries of certain agreements that we have filed as exhibits to various filings, as well as certain agreements that we will enter into in connection with the offering of securities covered by any particular accompanying prospectus supplement. The descriptions of these agreements contained in this prospectus, any accompanying prospectus supplement or information incorporated by reference herein or therein do not purport to be complete and are subject to, and qualified in their entirety by reference to, the definitive agreements. Copies of

the definitive agreements will be made available without charge to you by making a written or oral request to us at the address or telephone number listed above.

We have not authorized any other person to provide you with any information other than that contained or incorporated by reference in this prospectus. We do not take any responsibility for, or provide any assurance as to the reliability of, any other information that others may give you. The information contained in this prospectus is current only as of the date on the front of this prospectus and the information we have incorporated by reference is accurate only as of the dates of the documents incorporated by reference.

Any statement contained herein or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein, in any other subsequently filed document which also is or is deemed to be incorporated by reference herein or in any accompanying prospectus supplement modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified and superseded, to constitute a part of this prospectus.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth the estimated costs and expenses, other than underwriting discounts and commissions, payable by Lazard, Inc. in connection with the sale or distribution of the securities registered under this registration statement.

| | | | | |

| Amount |

Securities and Exchange Commission filing fee | $ * |

Legal fees and expenses | $ ** |

Accounting fees and expenses | $ ** |

Miscellaneous (including any applicable listing fees, printing and engraving expenses and Transfer Agent’s fees and expenses) | $ ** |

Total | $ ** |

__________________

*Under Rules 456(b) and 457(r) of the Securities Act of 1933, as amended (the “Securities Act”), applicable United States Securities and Exchange Commission (the “Commission”) registration fees have been deferred and will be paid at the time of any particular offering of securities under this registration statement, and are therefore not estimable at this time.

** These fees and expenses are incurred in connection with the issuance of securities and will vary based on the securities offered and the number of issuances and, accordingly, are not estimable at this time. An estimate of the aggregate expenses in connection with the issuance and distribution of the securities being offered will be included in the applicable prospectus supplement.

Item 15. Indemnification of Directors and Officers.

Section 102(b)(7) of the General Corporation Law of the State of Delaware (the “DGCL”) allows a corporation to provide in its certificate of incorporation that a director or officer of the corporation will not be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director or officer, except (1) for any breach of the director’s or officer’s duty of loyalty to the corporation or its stockholders, (2) for acts or omissions by a director or officer not in good faith or which involve intentional misconduct or a knowing violation of law, (3) for payments of unlawful dividends or unlawful stock repurchases or redemptions made to a director, (4) for any transaction from which the director or officer derived an improper personal benefit or (5) an officer in any action by or in the right of the corporation.

Section 145(a) of the DGCL provides, in general, that a corporation may indemnify any person who was or is a party to or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation), because he or she is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding, if he or she acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful.

Section 145(b) of the DGCL provides, in general, that a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor because the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees) actually and reasonably incurred by the person in connection with the defense or settlement of such action or suit if he or she acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation, except that no indemnification will be made with respect to any claim, issue or matter as to which he or she will have been adjudged to be liable to the corporation unless and only to the extent that the Court

of Chancery or other adjudicating court determines that, despite the adjudication of liability but in view of all of the circumstances of the case, he or she is fairly and reasonably entitled to indemnity for such expenses that the Court of Chancery or other adjudicating court will deem proper.

Section 145(g) of the DGCL provides, in general, that a corporation may purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against such person and incurred by such person in any such capacity, or arising out of his or her status as such, whether or not the corporation would have the power to indemnify the person against such liability under Section 145 of the DGCL.

Our certificate of incorporation provides that no director or officer of Lazard, Inc. shall be liable to the Company or its stockholders for monetary damages for breach of fiduciary duty as a director or officer (including with regard to any actions taken or omitted as a director or officer of Lazard Ltd, whether taken or omitted prior to the effective time of the Domestication, in connection with the discontinuance of Lazard Ltd in Bermuda or the continuance of Lazard Ltd in the State of Delaware or otherwise) except to the extent that such exemption from liability or limitation thereof is not permitted under the DGCL as currently in effect or as the same may be amended. This provision in the certificate of incorporation does not eliminate the directors’ or officers’ fiduciary duty, and in appropriate circumstances, equitable remedies such as injunctive or other forms of non-monetary relief will remain available under Delaware law. In addition, each director or officer will be subject to liability for breach of the director’s or officer’s duty of loyalty to the Company, for acts or omissions not in good faith or involving intentional misconduct, for knowing violations of law, for actions leading to improper personal benefit to the director or officer, and for payment of dividends or approval of stock repurchases or redemptions that are unlawful under Delaware law. The provision also does not affect a director’s or officer’s responsibilities under any other law, such as the federal securities laws or state or federal environmental laws.

The Company’s by-laws also provide that Lazard, Inc. shall indemnify and hold harmless to the fullest extent permitted by law any and all of its directors and officers, or former directors and officers, or any person who serves or served at the Company’s request as a director, officer, employee or agent of corporation, limited liability company, public limited company, partnership, joint venture, trust, employee benefit plan, fund or other enterprise. For purposes of the indemnification described in this paragraph, references to Lazard, Inc. include Lazard Ltd as incorporated under Bermuda law prior to the continuance of its existence under Delaware law as Lazard, Inc. Lazard, Inc. will remain obligated on any indemnification obligations of Lazard Ltd arising prior to the Domestication.

We maintain directors’ and officers’ insurance policies that cover our directors and officers.

Subject to limitations imposed by Delaware law, the Company may enter into agreements that provide indemnification to the directors, officers and other persons serving at our request as a director, officer, employee or agent of another enterprise for all actions, liabilities, losses, damages or expenses incurred or suffered by the indemnified person arising out of such person’s service in such capacity.

Item 16. Exhibits.

(a)The following exhibits are filed herewith or incorporated herein by reference unless otherwise indicated:

| | | | | | | | |

| Exhibit No. | | Description |

| 1.1 | | Form of Equity Securities Underwriting Agreement.** |

| | |

| 1.2 | | Form of Common Stock Underwriting Agreement.** |

| | |

| 3.1 | | |

| | |

| 3.2 | | |

| | |

| | | | | | | | |

| Exhibit No. | | Description |

| 4.1 | | |

| | |

| 4.2 | | |

| | |

| 4.3 | | |

| | |

| 4.4 | | |

| | |

| 4.5 | | |

| | |

| 4.6 | | |

| | |

| 4.7 | | |

| | |

| 4.8 | | |

| | |

| 4.9 | | |

| | |

| 4.10 | | Form of Warrant Agreement.** |

| | |

| 4.11 | | Form of Warrant Certificate.** |

| | |

| 4.12 | | Form of Stock Purchase Unit Agreement.** |

| | |

| 4.13 | | Form of Stock Purchase Unit Certificate.** |

| | |

| 4.14 | | Form of Stock Purchase Contract Agreement.** |

| | |

| 4.15 | | Form of Stock Purchase Contract Certificate.** |

| | |

| 4.16 | | Form of Guarantee.** |

| | |

| 5.1 | | |

| | |

| 23.1 | | |

| | |

| 23.2 | | |

| | |

| 24.1 | | |

| | |

| 24.2 | | |

| | |

| 24.3 | | |

| | |

| 25.1 | | |

| | |

| 107 | | |

__________________

*Filed herewith.

** To be filed, if necessary, as an exhibit to a post-effective amendment to this registration statement or as an exhibit to a Current Report on Form 8-K to be filed by Lazard, Inc. in connection with a specific offering, and incorporated herein by reference.

Item 17. Undertakings.

(a)The undersigned registrant hereby undertakes:

(1)To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii)To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table, as applicable, in the effective registration statement; and

(iii)To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that (a)(1)(i), (ii) and (iii) of Item 512 of Regulation S-K do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement;

(2)That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof;

(3)To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering;

(4)That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i)If the registrant is relying on Rule 430B:

(A)Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B)Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the

initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date;

(5)That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities:

The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii)Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii)The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv)Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b)The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.