MISTRAS Group, Inc. (MG: NYSE), a leading "one source"

multinational provider of integrated technology-enabled asset

protection solutions, today provided an update on the status of

Project Phoenix, the Company’s strategic program to increase Income

from Operations through reductions in corporate administrative

overhead and enhancements to pricing.

In February 2023, the Board of Directors announced that the

Company engaged with Alix Partners to undertake an operational

review designed to accelerate profitable growth by identifying

meaningful margin improvement opportunities and steps to achieve

sustained cost savings, referred to as Project Phoenix. In

addition, as part of this initiative a new commercial function was

established, to drive top-line profitable revenue growth via

strategic pricing and sales enablement.

Project Phoenix identified various opportunities, which the

Company subsequently vetted through a comprehensive diligence

process and has completed the validation of a majority of the

initial Project Phoenix opportunities. The first completed

initiative was the transformation of the Company’s Products and

Systems’ segment announced on October 2, 2023. The Company also

implemented additional initiatives in the month of October 2023

related to streamlining our North American operations and

improvements related to pricing actions.

The following is a brief overview of the additional actions

being implemented as a result of Project Phoenix:

- Strategic Pricing: The Company has developed and will be

further enhancing a proactive structural pricing strategy intended

to address inflationary costs experienced in our business.

- Reductions to Overhead: The Company’s goal is to reduce

selling, general, and administrative expenses (“SG&A”) to

approximately 21% of total revenues by the end of 2024, primarily

through a rationalization of the overhead workforce, including a

targeted 15% reduction in administrative headcount, without

adversely impacting the Company’s technician base or ability to

support operations and service its customers.

- New Leadership: As part of the Company’s transformation plan to

improve shareholder value by lowering SG&A, improving free cash

flow, and accelerating growth, the Board made recent changes to

senior leadership within the Company to further strengthen the

organization and enhance the execution of the various initiatives

comprising Project Phoenix.

As summarized in the first row of the table below, the actions

completed by the Company during the nine months ended September 30,

2023, are expected to yield annualized projected 2024 cost savings

of approximately $12 million, of which approximately $7 million is

expected to be realized in 2023, due to actions completed as of

September 30, 2023 including the transformation of the Company’s

Products and Systems segment announced on October 2, 2023, in

addition to other ancillary initiatives.

Subsequent to September 30, 2023, and prior to the release of

the Company’s third quarter 2023 financial results, the Company

completed further actions that are expected to yield incremental

annualized projected 2024 cost reductions of approximately $12

million including the optimization of North America administrative

support functions, of which approximately $2 million is expected to

be realized in the fourth quarter of 2023, as summarized in the

second row of the table below.

|

Benefit* (amounts in millions) |

Actual In-year Benefit 2023 Savings |

|

Annualized Projected 2024 Run Rate Savings |

|

Nine months ended September 30, 2023 |

$ |

7 |

|

$ |

12 |

| Fourth

Quarter 2023 |

|

2 |

|

|

12 |

|

Anticipated 2023 Totals |

$ |

9 |

|

$ |

24 |

* Benefit is comprised of a reduction in Cost of Revenue or

SG&A, as detailed in the table below.

These initiatives, including those previously disclosed, combine

to yield a projected annualized cost savings of approximately $24

million, of which approximately $9 million is expected to be

realized in fiscal 2023, with the full $24 million benefit expected

to be realized in fiscal 2024. This would result in an approximate

$15 million incremental benefit from Project Phoenix in 2024 as

compared to 2023. The Company will be working to finalize

additional opportunities in the fourth quarter of 2023, which are

anticipated to provide further benefit to the figures presented

above.

In addition to the aforementioned projected cost savings, the

Company is focused on the implementation of strategic price

increases which will improve revenue in 2023 by approximately $1

million and are expected to provide an additional $6 million

revenue benefit in 2024. Refer to the chart below for a summary of

the estimated revenue increase and cost saving by year in

connection with Project Phoenix.

|

Anticipated Benefit (amounts in millions) |

Fiscal 2023 |

|

Fiscal 2024 |

|

Revenue |

$ |

1 |

|

$ |

6 |

| Gross

Profit |

|

- |

|

|

3 |

|

SG&A |

|

9 |

|

|

21 |

|

Total in Year Benefit |

$ |

10 |

|

$ |

30 |

Manny N. Stamatakis, Chairman of the Board and Interim President

& CEO, stated, “In addition to identifying material cost saving

opportunities, Project Phoenix has provided a roadmap to long term

profitable growth, and I am very optimistic for the future of

MISTRAS. In addition, we intend to invest in initiatives that can

expand MISTRAS into existing and emerging industries that represent

growing markets for our software and analytical services.

We will continue to run our legacy businesses with a new focus

on optimizing returns through strategic pricing actions to help

offset the inflationary cost increases to our business, and produce

efficiency and productivity improvements, which will benefit our

bottom line. Our goal is for these collective actions to improve

our Income from Operations in 2024 by approximately $30 million,

before any restructuring or other charges related to implementing

Project Phoenix Initiatives in 2024. This would result in an

all-time high in Adjusted EBITDA achieved in the history of the

Company.”

Edward Prajzner, Senior Executive Vice President and Chief

Financial Officer, commented, “I also share Manny’s optimism for

the future of MISTRAS. We will continue to make strategic

investments related to efficiency and productivity, which we

believe will help us further benefit from our existing customer

base as well as expand into adjacent markets.”

Mr. Stamatakis continued, “MISTRAS has persevered and overcame

unprecedented headwinds and challenges over the past several years,

including the significant shock of the COVID 19 Pandemic, global

supply chain disruptions, and persistent inflation. Nevertheless,

MISTRAS has generated strong cash flow and reduced debt by nearly

$100 million since the beginning of 2019.Given the need to

accelerate progress, and knowing we could become more efficient and

improve our commercial efforts, Project Phoenix was conceived and

launched, and is well on the way towards successful implementation.

With the progress made thus far in 2023, I believe that we have a

good plan to improve shareholder value in 2024.”

About MISTRAS Group, Inc. - One Source for Asset

Protection Solutions®

MISTRAS Group, Inc. (NYSE: MG) is a leading "one source"

multinational provider of integrated technology-enabled asset

protection solutions, helping to maximize the safety and

operational uptime for civilization’s most critical industrial and

civil assets.

Backed by an innovative, data-driven asset protection portfolio,

proprietary technologies, strong commitment to Environmental,

Social, and Governance (ESG) initiatives, and a decades-long legacy

of industry leadership, MISTRAS leads clients in the oil and gas,

aerospace and defense, renewable and nonrenewable power, civil

infrastructure, and manufacturing industries towards achieving

operational and environmental excellence. By supporting these

organizations that help fuel our vehicles and power our society,

inspecting components that are trusted for commercial, defense, and

space craft; building real-time monitoring equipment to enable safe

travel across bridges; and helping to propel sustainability,

MISTRAS helps the world at large.

MISTRAS enhances value for its clients by integrating asset

protection throughout supply chains and centralizing integrity data

through a suite of Industrial IoT-connected digital software and

data analytical and monitoring solutions. The company’s core

capabilities also include non-destructive testing (“NDT”) field

inspections enhanced by advanced robotics, laboratory quality

control and assurance testing, sensing technologies and NDT

equipment, asset and mechanical integrity engineering services, and

light mechanical maintenance and access services.

For more information about how MISTRAS helps protect

civilization’s critical infrastructure, visit www.mistrasgroup.com

or contact Nestor S. Makarigakis, Group Vice President of Marketing

& Communications at marcom@mistrasgroup.com.

Forward-Looking and Cautionary Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Such forward-looking statements include, but are not

limited to, cost savings and other benefits we expect to realize

from Project Phoenix and actions that we expect or seek to take in

furtherance of our strategies and activities to enhance our

financial results and future growth. These forward-looking

statements generally use words such as "future," "possible,"

"potential," "targeted," "anticipate," "believe," "estimate,"

"expect," "intend," "plan," "predict," "project," "will," "may,"

"should," "could," "would" and other similar words and phrases.

Such statements are not guarantees of future performance or

results, and will not necessarily be accurate indications of the

times at, or by which, such performance or results will be

achieved, if at all. These statements are subject to risks and

uncertainties that could cause actual performance or results to

differ materially from those expressed in these statements,

including risks and uncertainties related to the timing of and the

realization of anticipated cost savings from restructuring

initiatives and the ability to identify additional cost savings

opportunities including with respect to Project Phoenix. A list,

description and discussion of these and other risks and

uncertainties can be found in the "Risk Factors" section of the

Company's 2022 Annual Report on Form 10-K dated March 15, 2023, as

updated by our reports on Form 10-Q and Form 8-K. The

forward-looking statements are made as of the date hereof, and

MISTRAS undertakes no obligation to update such statements as a

result of new information, future events or otherwise.

Use of Non-GAAP Financial Measures

In addition to financial information prepared in accordance with

generally accepted accounting principles in the U.S. (GAAP), this

press release also contains adjusted financial measures that are

not prepared in accordance with GAAP and that we believe provide

investors and management with supplemental information relating to

operating performance and trends that facilitate comparisons

between periods and with respect to trends and forward-looking

information. The term "Adjusted EBITDA" used in this release is a

financial measure not calculated in accordance with GAAP and is

defined by the Company as net income attributable to MISTRAS Group,

Inc. plus: interest expense, provision for income taxes,

depreciation and amortization, share-based compensation expense,

certain acquisition related costs (including transaction due

diligence costs and adjustments to the fair value of contingent

consideration), foreign exchange (gain) loss, non-cash impairment

charges, reorganization and related charges and, if applicable,

certain additional special items which are noted. This non-GAAP

financial measure has material limitations as a performance or

liquidity measure and should not be considered an alternative to

net income (loss) or any other measures derived in accordance with

GAAP. As the non-GAAP financial measure used in this press release

may not be calculated in the same manner by all companies, this

measure may not be comparable to other similarly titled measures

used by other companies.

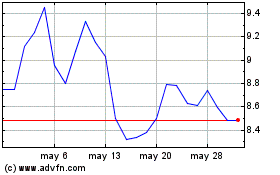

Mistras (NYSE:MG)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Mistras (NYSE:MG)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024