New York Public Service Commission Approves New Rates for New York Utility Business

19 Diciembre 2024 - 3:15PM

National Fuel Gas Distribution Corporation (Distribution), the

Utility segment of National Fuel Gas Company (NYSE: NFG) (National

Fuel or the Company), today received approval from the New York

Public Service Commission (PSC) on the terms of a Joint Proposal

filed in Distribution’s rate proceeding resulting in a three-year

settlement with new rates commencing January 1, 2025.

The incremental revenues will support necessary investments in

Distribution’s pipeline infrastructure and workforce, address the

rising cost of operating its gas delivery system, and advance more

affordable decarbonization initiatives to comply with state climate

goals.

This is the first increase to Distribution’s base delivery rates

in New York since 2017 and only the second increase in 16 years.

The terms of the Joint Proposal, as approved and modified by the

PSC, also include several provisions relating to gas safety and

customer service that will provide benefits and protections to

customers.

Key Financial Outcomes

The rate case settlement reflects a rate base of $1.04 billion

(in year one), a return on equity of 9.7%, and an equity ratio of

48% (consistent with the terms outlined in the Joint Proposal filed

in September). The settlement also results in an increase in the

revenue requirement of $57 million in fiscal 2025, $73 million (or

increase of $16 million) in fiscal 2026, and $86 million (or

increase of $13 million) in fiscal 2027, with a portion

(approximately $13 million per year) relating to the recovery of

regulatory assets that were previously recorded to accrue revenues

under Distribution’s system modernization trackers. See table below

for additional information.

Key Ratemaking Items

The settlement continues previously existing rate mechanisms

such as weather normalization and revenue decoupling, which seek to

mitigate the impact of weather and align returns with energy

conservation goals and adds a new uncollectible expense tracker for

the first two rate years, which will allow Distribution to timely

collect customer arrearages that have remained elevated due to

policies in place during the pandemic.

The rate increase also allows Distribution to recover costs

associated with investments needed to support critical resiliency

through our long-standing modernization program, such as a pipeline

replacement target of a minimum of 105 miles per year.

Timing

The settlement includes a make-whole provision which allows

Distribution to recover the impact of higher rates from October 1,

2024, when new rates were requested to take effect, through January

1, 2025, when new rates will commence. The recovery of earnings

from the make-whole provision will be recognized in fiscal

2025.

Summary of Key Financial Items

|

($ millions, except as noted) |

Current Rates |

|

|

Approved (New) Rates |

|

|

Fiscal 2024 |

|

|

Fiscal 2025 |

Fiscal 2026 |

Fiscal 2027 |

|

|

Revenue Requirement Increase (relative to

fiscal 2024) |

n/a |

|

|

$57.3 |

|

$73.1 |

|

$85.8 |

|

|

Rate Base |

$858 |

|

|

$1,044 |

|

$1,104 |

|

$1,163 |

|

|

Overall Rate of Return |

n/a |

|

|

7.3% |

|

7.4% |

|

7.5% |

|

|

Authorized Return on Equity |

8.7% |

|

|

9.7% |

|

9.7% |

|

9.7% |

|

|

Authorized Equity Ratio |

43% |

|

|

48% |

|

48% |

|

48% |

|

The terms and key financial items from the New York rate case,

as outlined above, were incorporated into the Company’s previously

issued guidance for fiscal 2025.

About National Fuel Gas Company:National Fuel

is a diversified energy company headquartered in Western New York

that operates an integrated collection of natural gas assets across

four business segments: Exploration and Production, Pipeline and

Storage, Gathering and Utility.

Additional information about National Fuel is available

at www.nationalfuel.com.

Cautionary StatementsCertain statements

contained herein, including statements identified by the use of the

words “anticipates,” “expects,” “intends,” “plans,” “predicts,”

“projects,” “believes,” “will,” “may,” and similar expressions, and

statements other than statements of historical facts, are

“forward-looking statements” as defined by the Private Securities

Litigation Reform Act of 1995. Forward-looking statements involve

risks and uncertainties, which could cause actual results or

outcomes to differ materially from those expressed in the

forward-looking statements. While National Fuel’s expectations,

beliefs, and projections are expressed in good faith and are

believed to have a reasonable basis, actual results may differ

materially from those projected in forward-looking statements. In

addition to other factors, the following are important factors that

could cause actual results to differ materially from those

discussed in the forward-looking statements: (1) National Fuel’s

ability to estimate accurately the time and resources necessary to

implement new practices; (2) governmental/regulatory actions and/or

market pressures to reduce or eliminate reliance on natural gas;

and (3) the other risks and uncertainties described in (i) National

Fuel’s most recent Annual Report on Form 10-K at Item 7, MD&A,

and (ii) the “Risk Factors” included in National Fuel’s most recent

Annual Report on Form 10-K at Item 1A. National Fuel disclaims any

obligation to update any forward-looking statements to reflect

events or circumstances after the date hereof. Because of these

risks and uncertainties, readers should not place undue reliance on

these forward-looking statements or use them for anything other

than their intended purpose.

NFG Contacts:

Natalie Fischer

Investor Contact

716-857-7315

Karen Merkel

Media Contact

716-857-7654

National Fuel Gas (NYSE:NFG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

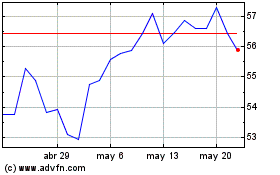

National Fuel Gas (NYSE:NFG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025