0000830271false424B5Stated as percentages of average net assets attributable to Common Stock for the fiscal year ended October 31, 2023. Other Expenses is based on estimated amounts for the current fiscal year. Expenses attributable to the Fund’s investments, if any, in other investment companies are currently estimated not to exceed 0.01%. See “The Fund’s Investments—Other Investment Companies” in the SAI. Rounds to less than 0.01%. You will be charged a $2.50 service charge and pay brokerage charges if you direct ComputerShare Inc. and ComputerShare Trust Company, N.A., as agent for the Common Shareholders (the “Plan Agent”), to sell your Common Stock held in a dividend reinvestment account. Assuming a Common Stock offering price of $9.22 (the Fund’s closing price on the NYSE on May 28, 2024). The maximum sales charge for offerings made at the market is 1.00%. 0000830271 2024-06-04 2024-06-04 0000830271 cik0000830271:InterestAndOtherRelatedExpensesMember 2024-06-04 2024-06-04 0000830271 cik0000830271:CommonSharesMember 2021-11-01 2022-01-31 0000830271 cik0000830271:CommonSharesMember 2022-02-01 2022-04-30 0000830271 cik0000830271:CommonSharesMember 2022-08-01 2022-10-31 0000830271 cik0000830271:CommonSharesMember 2022-11-01 2023-01-31 0000830271 cik0000830271:CommonSharesMember 2023-02-01 2023-04-30 0000830271 cik0000830271:CommonSharesMember 2023-05-01 2023-07-31 0000830271 cik0000830271:CommonSharesMember 2023-08-01 2023-10-31 0000830271 cik0000830271:CommonSharesMember 2023-11-01 2024-01-31 0000830271 cik0000830271:CommonSharesMember 2024-02-01 2024-04-30 0000830271 cik0000830271:CommonSharesMember 2022-05-01 2022-07-31 0000830271 cik0000830271:CommonSharesMember 2024-05-28 0000830271 cik0000830271:CommonSharesMember 2024-05-28 2024-05-28 xbrli:pure iso4217:USD iso4217:USD xbrli:shares

Filed Pursuant to Rule

424(b)(5)

Registration Statement No. 333-274654

(To Prospectus dated April 29, 2024)

2 Million Shares

Common

Stock

$0.01 PAR VALUE PER SHARE

Nuveen Municipal Income Fund, Inc.

Nuveen Municipal Income Fund, Inc. (the “Fund”), a diversified,

closed-end

management investment company, is offering 2 million shares of its common stock, $0.01 par value per share (the “Common Stock”), pursuant to this prospectus supplement.

The minimum price on any day at which Common Stock may be sold will not be less than the current net asset value (“NAV”) per share plus the per share amount of the commission to be paid to the Fund’s distributor, Nuveen Securities, LLC (“Nuveen Securities”). The Fund and Nuveen Securities will suspend the sale of Common Stock if the per share price of the shares is less than such minimum price. The Fund currently intends to distribute the shares offered pursuant to this prospectus supplement primarily through transactions deemed “at the market,” as defined in Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), including sales made directly on the NYSE or sales made to or through a market maker other than on an exchange. For information on how Common Stock may be sold, see the “Plan of Distribution” section of this prospectus supplement.

The Fund will compensate Nuveen Securities with respect to sales of Common Stock at a commission rate of 1.00% of the gross proceeds of the sale of the Common Stock. Out of this commission, Nuveen Securities will compensate the applicable dealer at a rate of up to 0.80% of the gross sales proceeds of the sale of the Common Stock sold by the dealer. In connection with the sale of the Common Stock on the Fund’s behalf, Nuveen Securities may be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Nuveen Securities may be deemed to be underwriting commissions or discounts.

The shares of Common Stock are listed on the New York Stock Exchange (the “NYSE”) under the symbol “NMI.” The closing price for the Common Stock on the NYSE on May 28, 2024 was $9.22. The NAV of the Common Stock at the close of business on May 28, 2024 was $9.93 per share of Common Stock.

Common stock of

closed-end

investment companies, such as the Fund, often trade at a discount to their NAV. This creates a risk of loss for an investor purchasing shares of Common Stock in a public offering.

Investing in the Common Stock involves risks. See “

Risk Factors” beginning on page 11 of the accompanying prospectus. You should consider carefully these risks together with all of the other information in this prospectus supplement and the accompanying prospectus before making a decision to purchase Common Stock.

The date of this prospectus supplement is June 4, 2024.

(continued from previous page)

You should read this prospectus supplement, together with the accompanying prospectus, which contains important information about the Fund, before deciding whether to invest in Common Stock and retain it for future reference. A statement of additional information, dated April 29, 2024, and as it may be supplemented (the “SAI”), containing additional information about the Fund, has been filed with the SEC and is incorporated by reference in its entirety into this prospectus supplement and the accompanying prospectus. This prospectus supplement, the accompanying prospectus and the SAI are part of a “shelf” registration statement filed with the SEC. This prospectus supplement describes the specific details regarding this offering, including the method of distribution. If information in this prospectus supplement is inconsistent with the accompanying prospectus or the SAI, you should rely on this prospectus supplement. You may request a free copy of the SAI, annual and semi-annual reports to shareholders, and other information about the Fund, and make shareholder inquiries by calling (800) 257-8787 or by writing to the Fund at 333 West Wacker Drive, Chicago, Illinois 60606, or from the Fund’s website (www.nuveen.com). The information contained in, or that can be accessed through, the Fund’s website is not part of this prospectus supplement, the accompanying prospectus or the SAI, except to the extent specifically incorporated by reference herein. You also may obtain a copy of the SAI (and other information regarding the Fund) from the SEC’s website (www.sec.gov).

You should not construe the contents of this prospectus supplement and the accompanying prospectus as legal, tax or financial advice. You should consult with your own professional advisors as to the legal, tax, financial or other matters relevant to the suitability of an investment in the Common Stock.

Common Stock do not represent a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

|

|

|

|

|

| |

|

|

|

|

|

|

ii |

|

|

|

|

S-1 |

|

|

|

|

S-3 |

|

|

|

|

S-5 |

|

|

|

|

S-5 |

|

|

|

|

S-6 |

|

|

|

|

S-7 |

|

|

|

|

S-8 |

|

|

|

|

S-8 |

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

6 |

|

|

|

|

6 |

|

|

|

|

6 |

|

|

|

|

6 |

|

|

|

|

7 |

|

|

|

|

7 |

|

|

|

|

8 |

|

|

|

|

11 |

|

|

|

|

11 |

|

|

|

|

14 |

|

|

|

|

15 |

|

|

|

|

15 |

|

|

|

|

16 |

|

|

|

|

18 |

|

|

|

|

21 |

|

|

|

|

22 |

|

|

|

|

24 |

|

|

|

|

25 |

|

|

|

|

26 |

|

|

|

|

27 |

|

|

|

|

27 |

|

|

|

|

27 |

|

|

|

|

27 |

|

You should rely only on the information contained or incorporated by reference into this prospectus supplement and the accompanying prospectus. The Fund has not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The Fund is not making an offer of Common Stock in any state where the offer is not permitted. You should not assume that the information contained in this prospectus supplement and the accompanying prospectus is accurate as of any date other than the respective dates on the front covers. The Fund’s business, financial condition and prospects may have changed since that date.

i

FORWARD-LOOKING STATEMENTS

Any projections, forecasts and estimates contained or incorporated by reference herein are forward looking statements and are based upon certain assumptions. Projections, forecasts and estimates are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying any projections, forecasts or estimates will not materialize or will vary significantly from actual results. Actual results may vary from any projections, forecasts and estimates and the variations may be material. Some important factors that could cause actual results to differ materially from those in any forward-looking statements include changes in interest rates, market, financial or legal uncertainties, including changes in tax law, and the timing and frequency of defaults on underlying investments. Consequently, the inclusion of any projections, forecasts and estimates herein should not be regarded as a representation by the Fund or any of its affiliates or any other person or entity of the results that will actually be achieved by the Fund. Neither the Fund nor its affiliates has any obligation to update or otherwise revise any projections, forecasts and estimates including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of unanticipated events, even if the underlying assumptions do not come to fruition. The Fund acknowledges that, notwithstanding the foregoing, the safe harbor for forward-looking statements under the Private Securities Litigation Reform Act of 1995 does not apply to investment companies such as the Fund.

ii

PROSPECTUS SUPPLEMENT SUMMARY

This is only a summary. You should review the more detailed information contained elsewhere in this prospectus supplement (“Prospectus Supplement”), in the accompanying prospectus and in the statement of additional information (“SAI”).

|

Nuveen Municipal Income Fund, Inc. (the “Fund”) is a diversified, closed-end management investment company. Shares of the Fund’s common stock, $0.01 par value (the “Common Stock”), are traded on the New York Stock Exchange (the “NYSE”) under the symbol “NMI”. See “Description of Shares—Common Stock” in the prospectus. |

|

Nuveen Fund Advisors, LLC (“Nuveen Fund Advisors”) is the Fund’s investment adviser, responsible for overseeing the Fund’s overall investment strategy and its implementation. |

| |

Nuveen Fund Advisors, a registered investment adviser, offers advisory and investment management services to a broad range of investment company clients. Nuveen Fund Advisors has overall responsibility for management of the Fund, oversees the management of the Fund’s portfolio, manages the Fund’s business affairs and provides certain clerical, bookkeeping and other administrative services. Nuveen Fund Advisors is located at 333 West Wacker Drive, Chicago, Illinois 60606. Nuveen Fund Advisors is an indirect subsidiary of Nuveen, LLC (“Nuveen”), the investment management arm of Teachers Insurance and Annuity Association of America (“TIAA”). TIAA is a life insurance company founded in 1918 by the Carnegie Foundation for the Advancement of Teaching and is the companion organization of College Retirement Equities Fund. As of March 31, 2024, Nuveen managed approximately $1.2 trillion in assets, of which approximately $143.2 billion was managed by Nuveen Fund Advisors. |

|

Nuveen Asset Management, LLC serves as the Fund’s investment sub-adviser and is an affiliate of Nuveen Fund Advisors. Nuveen Asset Management is a registered investment adviser. Nuveen Asset Management oversees the investment operations of the Fund. |

|

The Fund has entered into a distribution agreement (the “Distribution Agreement”) with Nuveen Securities, LLC (“Nuveen Securities”), a registered broker-dealer affiliate of Nuveen Fund Advisors and Nuveen Asset Management, to provide for distribution of the Common Stock. Nuveen Securities has entered into a selected dealer agreement with Stifel, Nicolaus & Company, Incorporated (“Stifel Nicolaus”) pursuant to which Stifel Nicolaus will be acting as Nuveen Securities’ sub-placement agent with respect to the Common Stock offered pursuant to this Prospectus Supplement and the accompanying prospectus. The minimum price on any day at which Common Stock |

S-1

| |

may be sold will not be less than the then current NAV per Common Stock plus the per Common Stock amount of the commission to be paid to Nuveen Securities (the “Minimum Price”). The Fund and Nuveen Securities will determine whether any sales of Common Stock will be authorized on a particular day. The Fund and Nuveen Securities, however, will not authorize sales of Common Stock if the price per Common Stock is less than the Minimum Price. The Fund and Nuveen Securities may elect not to authorize sales of Common Stock on a particular day even if the price per Common Stock is equal to or greater than the Minimum Price, or may only authorize a fixed number of Common Stock to be sold on any particular day. The Fund and Nuveen Securities will have full discretion regarding whether sales of Common Stock will be authorized on a particular day and, if so, in what amounts. |

| |

The Fund will compensate Nuveen Securities with respect to sales of the Common Stock at a commission rate of up to 1.00% of the gross proceeds of the sale of Common Stock. Nuveen Securities will compensate sub-placement agents or other broker-dealers participating in the offering at a rate of up to 0.80% of the gross sales proceeds of the sale of Common Stock sold by that sub-placement agent or other broker-dealer. Settlements of Common Stock sales will occur on the second business day following the date of sale. |

| |

In connection with the sale of the Common Stock on behalf of the Fund, Nuveen Securities may be deemed to be an underwriter within the meaning of the Securities Act of 1933, as amended (the “1933 Act”), and the compensation of Nuveen Securities may be deemed to be underwriting commissions or discounts. Unless otherwise indicated in a further prospectus supplement, Nuveen Securities will act as underwriter on a reasonable efforts basis. |

| |

The offering of Common Stock pursuant to the Distribution Agreement will terminate upon the earlier of (i) the sale of all Common Stock subject thereto or (ii) termination of the Distribution Agreement. The Fund and Nuveen Securities each have the right to terminate the Distribution Agreement in its discretion at any time. See “Plan of Distribution.” |

| |

The principal business address of Nuveen Securities is 333 West Wacker Drive, Chicago, Illinois 60606. |

|

See “Risk Factors” in the accompanying prospectus, for a discussion of the principal risks you should carefully consider before deciding to invest in Common Stock. |

S-2

The purpose of the table and the example below is to help you understand all fees and expenses that you, as a shareholder of Common Stock (“Common Shareholder”), would bear directly or indirectly. The table shows the expenses of the Fund as a percentage of the average net assets applicable to Common Stock, and not as a percentage of total assets or Managed Assets.

|

|

|

|

|

Shareholder Transaction Expenses ( as a percentage of offering price) |

|

|

|

|

Maximum Sales Charge |

|

|

1.00 |

%* |

|

|

|

0.70 |

% |

Dividend Reinvestment Plan Fees (2) |

|

$ |

2.50 |

|

| * |

The maximum sales charge for offerings made at the market is 1.00%. |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Management Fees |

|

|

0.61 |

% |

Interest and Other Related Expenses (4) |

|

|

0.00 |

% |

|

|

|

0.13 |

% |

|

|

|

|

|

Total Annual Expenses |

|

|

0.74 |

% |

|

|

|

|

|

| (1) |

Assuming a Common Stock offering price of $9.22 (the Fund’s closing price on the NYSE on May 28, 2024). |

| (2) |

You will be charged a $2.50 service charge and pay brokerage charges if you direct ComputerShare Inc. and ComputerShare Trust Company, N.A., as agent for the Common Shareholders (the “Plan Agent”), to sell your Common Stock held in a dividend reinvestment account. |

| (3) |

Stated as percentages of average net assets attributable to Common Stock for the fiscal year ended October 31, 2023. |

| (4) |

Rounds to less than 0.01%. |

| (5) |

Other Expenses is based on estimated amounts for the current fiscal year. Expenses attributable to the Fund’s investments, if any, in other investment companies are currently estimated not to exceed 0.01%. See “The Fund’s Investments—Other Investment Companies” in the SAI. |

S-3

The following example illustrates the expenses including the applicable transaction fees (referred to as the “Maximum Sales Charge” in the fee table above), if any, and estimated offering costs of $7.00, that a Common Shareholder would pay on a $1,000 investment that is held for the time periods provided in the table. The example assumes that all dividends and other distributions are reinvested in the Fund and that the Fund’s Annual Total Expenses, as provided above, remain the same. The example also assumes a transaction fee of 1.00%, as a percentage of the offering price, and a 5% annual return.

1

The example should not be considered a representation of future expenses. Actual expenses may be greater or less than those shown above.

(1) |

The example assumes that all dividends and distributions are reinvested at Common Stock NAV. Actual expenses may be greater or less than those assumed. Moreover, the Fund’s actual rate of return may be greater or less than the hypothetical 5% return shown in the example. |

S-4

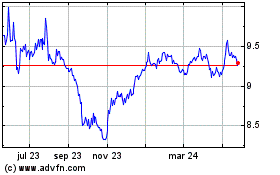

TRADING AND NET ASSET VALUE INFORMATION

The following table shows for the periods indicated: (i) the high and low sales prices for the Common Stock reported as of the end of the day on the NYSE, (ii) the high and low NAV of the Common Stock, and (iii) the high and low of the premium/(discount) to NAV (expressed as a percentage) of the Common Stock.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

April 2024 |

|

$ |

9.47 |

|

|

$ |

9.11 |

|

|

$ |

10.10 |

|

|

$ |

9.87 |

|

|

|

(5.43 |

)% |

|

|

(9.32 |

)% |

January 2024 |

|

$ |

9.42 |

|

|

$ |

8.44 |

|

|

$ |

10.04 |

|

|

$ |

9.19 |

|

|

|

(5.84 |

)% |

|

|

(10.31 |

)% |

October 2023 |

|

$ |

9.75 |

|

|

$ |

8.33 |

|

|

$ |

9.84 |

|

|

$ |

9.16 |

|

|

|

(0.91 |

)% |

|

|

(9.95 |

)% |

July 2023 |

|

$ |

9.99 |

|

|

$ |

9.13 |

|

|

$ |

9.90 |

|

|

$ |

9.67 |

|

|

|

1.94 |

% |

|

|

(7.59 |

)% |

April 2023 |

|

$ |

9.90 |

|

|

$ |

8.96 |

|

|

$ |

10.00 |

|

|

$ |

9.70 |

|

|

|

(0.30 |

)% |

|

|

(8.34 |

)% |

January 2023 |

|

$ |

10.00 |

|

|

$ |

8.57 |

|

|

$ |

9.99 |

|

|

$ |

9.27 |

|

|

|

1.23 |

% |

|

|

(8.47 |

)% |

October 2022 |

|

$ |

9.70 |

|

|

$ |

8.46 |

|

|

$ |

10.19 |

|

|

$ |

9.19 |

|

|

|

(4.72 |

)% |

|

|

(8.82 |

)% |

July 2022 |

|

$ |

9.75 |

|

|

$ |

9.03 |

|

|

$ |

10.24 |

|

|

$ |

9.72 |

|

|

|

(4.69 |

)% |

|

|

(7.80 |

)% |

April 2022 |

|

$ |

10.77 |

|

|

$ |

9.42 |

|

|

$ |

11.10 |

|

|

$ |

10.13 |

|

|

|

(2.62 |

)% |

|

|

(7.13 |

)% |

January 2022 |

|

$ |

12.24 |

|

|

$ |

10.75 |

|

|

$ |

11.37 |

|

|

$ |

11.03 |

|

|

|

7.84 |

% |

|

|

(2.63 |

)% |

The NAV per Common Stock, the market price and percentage of premium/(discount) to NAV per Common Stock on May 28, 2024, was $

9.93, $

9.22 and (

7.15)%, respectively. As of April 30, 2024, the Fund had 10,051,095 Common Stock outstanding, and net assets applicable to Common Stock of $99,372,228. See “Repurchase of Fund Shares; Conversion to

Open-End

Fund” in the accompanying prospectus.

Assuming the sale of all of the Common Stock offered under this Prospectus Supplement and the accompanying prospectus, at the last reported sale price of $9.22 per share for Common Stock on the NYSE as of May 28, 2024, the Fund estimates that the net proceeds of this offering will be approximately $18,125,600 after deducting the estimated sales load and the estimated offering expenses payable by the Fund, if any. There is no guarantee that there will be any sales of Common Stock pursuant to this Prospectus Supplement and the accompanying prospectus. Actual sales, if any, of Common Stock under this Prospectus Supplement and the accompanying prospectus may be less than as set forth above. In addition, the price per share of any such sale may be greater or less than the price set forth above, depending on the market price of Common Stock at the time of any such sale. As a result, the actual net proceeds the Fund receives may be more or less than the amount of net proceeds estimated in this Prospectus Supplement.

The net proceeds from the issuance of Common Stock hereunder will be invested in accordance with the Fund’s investment objectives and policies as set forth in the accompanying prospectus. The Fund currently anticipates that it will be able to invest substantially all of the net proceeds in investments that meet the Fund’s investment objectives and policies within approximately three months of the receipt of such proceeds. Pending investment, it is anticipated that the proceeds will be invested in short-term or long-term securities issued by the U.S. Government and its agencies or instrumentalities or in high quality, short-term money market instruments.

S-5

The Fund will bear the expenses of this offering, including but not limited to, the expenses of preparation of the prospectus, including this Prospectus Supplement, and SAI for this offering and the expense of counsel and auditors in connection with the offering.

The Fund has entered into a distribution agreement (the “Distribution Agreement”) with Nuveen Securities, LLC (“Nuveen Securities”). Subject to the terms and conditions of the Distribution Agreement, the Fund may from time to time issue and sell its Common Stock through Nuveen Securities to certain broker-dealers which have entered into selected dealer agreements with Nuveen Securities. Currently, Nuveen Securities has entered into a selected dealer agreement with Stifel, Nicolaus & Company, Incorporated (“Stifel Nicolaus”) pursuant to which Stifel Nicolaus will be acting as the exclusive

sub-placement

agent with respect to the Common Stock offered pursuant to this Prospectus Supplement and the accompanying prospectus.

The minimum price on any day at which Common Stock may be sold will not be less than the then current NAV per Common Stock plus the per Common Stock amount of the commission to be paid to Nuveen Securities (the “Minimum Price”). The Fund and Nuveen Securities will determine whether any sales of Common Stock will be authorized on a particular day. The Fund and Nuveen Securities, however, will not authorize sales of Common Stock if the price per Common Stock is less than the Minimum Price. The Fund and Nuveen Securities may elect not to authorize sales of Common Stock on a particular day even if the price per Common Stock is equal to or greater than the Minimum Price, or may only authorize a fixed number of Common Stock to be sold on any particular day. The Fund and Nuveen Securities will have full discretion regarding whether sales of Common Stock will be authorized on a particular day and, if so, in what amounts.

The Fund will compensate Nuveen Securities with respect to sales of the Common Stock at a commission rate of up to 1.00% of the gross proceeds of the sale of Common Stock. Nuveen Securities will compensate

sub-placement

agents or other broker-dealers at a rate of up to 0.80% of the gross proceeds of the sale of Common Stock sold by that

sub-placement

agent or broker-dealer. Settlements of sales of Common Stock will occur on the second business day following the date on which any such sales are made.

In connection with the sale of the Common Stock on behalf of the Fund, Nuveen Securities may be deemed to be an underwriter within the meaning of the 1933 Act, and the compensation of Nuveen Securities may be deemed to be underwriting commissions or discounts. Unless otherwise indicated in a further prospectus supplement, Nuveen Securities will act as underwriter on a reasonable efforts basis.

The offering of Common Stock pursuant to the Distribution Agreement will terminate upon the earlier of (i) the sale of all Common Stock subject thereto or (ii) termination of the Distribution Agreement. The Fund and Nuveen Securities each have the right to terminate the Distribution Agreement in its discretion at any time.

UBS, its affiliates and their respective employees hold or may hold in the future, directly or indirectly, investment interests in Nuveen, Nuveen Fund Advisors, TIAA, or any of their affiliates or funds. The interests held by employees of Stifel Nicolaus or its affiliates are not attributable to, and no investment discretion is held by, Stifel Nicolaus or its affiliates.

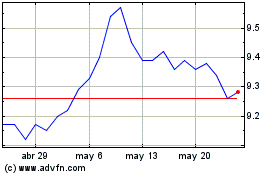

The Fund’s closing price on the NYSE on May 28, 2024 was $9.22.

The principal business address of Nuveen Securities is 333 West Wacker Drive, Chicago, Illinois 60606.

S-6

The Fund may offer and sell up to 2 million of its Common Stock, $0.01 par value per share, from time to time through Stifel Nicolaus as sub-placement agent under this Prospectus Supplement and the accompanying prospectus. There is no guarantee that there will be any sales of the Common Stock pursuant to this Prospectus Supplement and the accompanying prospectus. The table below assumes that the Fund will sell 2 million of its Common Stock at a price of $9.22 per share (which represents the last reported sales price per share of the Common Stock on the NYSE on May 28, 2024). Actual sales, if any, of the Common Stock under this Prospectus Supplement and the accompanying prospectus may be greater or less than $9.22 per share, depending on the market price of the Common Stock at the time of any such sale.

The following table sets forth the Fund’s capitalization (1) on a historical basis as of April 30, 2024, (unaudited); and (2) on a pro forma basis as adjusted to reflect the assumed sale of 2 million of its Common Stock at $9.22 per share (the last reported price per share of the Common Stock on the NYSE on May 28, 2024), in an offering under this Prospectus Supplement and the accompanying prospectus, after deducting the assumed commission of $184,400 (representing an estimated commission to the Nuveen Securities of 1.00% of the gross proceeds of the sale of Common Stock, out of which the Nuveen Securities will compensate Stifel Nicolaus at a rate of up to 0.80% of the gross sales proceeds of the sale of the Common Stock sold by Stifel Nicolaus.

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

As adjusted for Offering

(unaudited) |

|

Common Stock |

|

|

10,051,095 |

|

|

|

12,051,095 |

|

Paid in Capital |

|

$ |

102,562,782 |

|

|

$ |

120,818,382 |

* |

Undistributed net investment income |

|

$ |

152,726 |

|

|

$ |

152,726 |

|

Accumulated gain/loss |

|

$ |

(3,719,061 |

) |

|

$ |

(3,719,061 |

) |

Net appreciation/depreciation |

|

$ |

375,781 |

|

|

$ |

375,781 |

|

Net assets |

|

$ |

99,372,228 |

|

|

$ |

111,627,828 |

|

Net asset value |

|

$ |

9.89 |

|

|

$ |

9.76 |

|

| * |

Assumes a total of $130,000 of the estimated offering costs will be deferred over the 3 year life of the registration. |

S-7

Certain legal matters in connection with the Common Stock will be passed upon for the Fund by Stradley Ronon Stevens & Young, LLP, located at 2005 Market Street, Suite 2600, Philadelphia, Pennsylvania. Stradley Ronon Stevens & Young, LLP may rely as to certain matters of Minnesota law on the opinion of Dorsey & Whitney LLP.

The Fund is subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the 1940 Act and is required to file reports, proxy statements and other information with the SEC. Reports, proxy statements, and other information about the Fund can be inspected at the offices of the NYSE.

This Prospectus Supplement does not contain all of the information in the Fund’s Registration Statement, including amendments, exhibits, and schedules. Additional information about the Fund and the Common Stock can be found in the Fund’s Registration Statement (including amendments, exhibits, and schedules) on Form

N-2

filed with the SEC. The SEC maintains a website (www.sec.gov) that contains the Fund’s Registration Statement, other documents incorporated by reference, and other information the Fund has filed electronically with the SEC, including proxy statements and reports filed under the Exchange Act.

S-8

BASE PROSPECTUS

2 Million Shares

Common Stock

Rights to Purchase Common Stock

Nuveen Municipal Income Fund, Inc.

The Offering. Nuveen Municipal Income Fund, Inc. (the “Fund”) is offering, on an immediate, continuous or delayed basis, in one or more offerings, 2 million shares of common stock (the “Common Stock”) and/or subscription rights to purchase Common Stock (“Rights,” and collectively with Common Stock, “Securities”), in any combination. The Fund may offer and sell such Securities directly to one or more purchasers, to or through underwriters, through dealers or agents that the Fund designates from time to time, or through a combination of these methods. The prospectus supplement relating to any offering of Securities will describe such offering, including, as applicable, the names of any underwriters, dealers or agents and information regarding any applicable purchase price, fee, commission or discount arrangements made with those underwriters, dealers or agents or the basis upon which such amount may be calculated. The prospectus supplement relating to any Rights offering will set forth the number of Common Stock issuable upon the exercise of each Right (or number of Rights) and the other terms of such Rights offering. For more information about the manners in which the Fund may offer Securities, see “Plan of Distribution.”

The Fund. The Fund is a diversified, closed-end management investment company. The Fund’s investment objective is a high level of current income exempt from federal income tax, which the Fund seeks to achieve by investing primarily in a diversified portfolio of tax-exempt municipal obligations. There can be no assurance that the Fund will achieve its investment objective or that the Fund’s investment strategies will be successful.

This Prospectus, together with any prospectus supplement, sets forth concisely information about the Fund that a prospective investor should know before investing, and should be retained for future reference. Investing in Securities involves risks. You could lose some or all of your investment. You should consider carefully these risks together with all of the other information in this Prospectus and any related prospectus supplement before making a decision to purchase any of the Securities. See “Risk Factors” beginning on page 10.

The shares of Common Stock are listed on the New York Stock Exchange (the “NYSE”). The trading or “ticker” symbol of the shares of Common Stock is “NMI.” The closing price of the shares of Common Stock, as reported by the NYSE on April 22, 2024, was $9.17 per share of Common Stock. The net asset value of the shares of Common Stock at the close of business on that same date was $9.90 per share of Common Stock. Rights issued by the Fund may also be listed on a securities exchange.

* * *

You should read this Prospectus, together with any related prospectus supplement, which contains important information about the Fund, before deciding whether to invest and retain it for future reference. A Statement of Additional Information, dated April 29, 2024 (the “SAI”), containing additional information about the Fund has been filed with the U.S. Securities and Exchange Commission (the “SEC”) and is incorporated by reference in its entirety into this Prospectus. You may request a free copy of the SAI, annual and semi-annual reports to shareholders and other information about the Fund and make shareholder inquiries by calling (800) 257-8787, by writing to the Fund at 333 West Wacker Drive, Chicago, Illinois 60606 or from the Fund’s website (http://www.nuveen.com). The information contained in, or that can be accessed through, the Fund’s website is not part of this Prospectus, except to the extent specifically incorporated by reference herein. You also may obtain a copy of the SAI (and other information regarding the Fund) from the SEC’s web site (http://www.sec.gov).

The date of this Prospectus is April 29, 2024.

The Securities do not represent a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other governmental agency.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

TABLE OF CONTENTS

You should rely only on the information contained or incorporated by reference into this Prospectus and any related prospectus supplement. The Fund has not authorized anyone to provide you with different information. The Fund is not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information contained in this Prospectus and any related prospectus supplement is accurate as of any date other than the dates on their covers. The Fund will update this Prospectus to reflect any material changes to the disclosures herein.

FORWARD-LOOKING STATEMENTS

Any projections, forecasts and estimates contained or incorporated by reference herein are forward looking statements and are based upon certain assumptions. Projections, forecasts and estimates are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying any projections, forecasts or estimates will not materialize or will vary significantly from actual results. Actual results may vary from any projections, forecasts and estimates and the variations may be material. Some important factors that could cause actual results to differ materially from those in any forward looking statements include changes in interest rates, market, financial or legal uncertainties, including changes in tax law, and the timing and frequency of defaults on underlying investments. Consequently, the inclusion of any projections, forecasts and estimates herein should not be regarded as a representation by the Fund or any of its affiliates or any other person or entity of the results that will actually be achieved by the Fund. Neither the Fund nor its affiliates has any obligation to update or otherwise revise any projections, forecasts and estimates including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of unanticipated events, even if the underlying assumptions do not come to fruition. The Fund acknowledges that, notwithstanding the foregoing, the safe harbor for forward-looking statements under the Private Securities Litigation Reform Act of 1995 does not apply to investment companies such as the Fund.

PROSPECTUS SUMMARY

This is only a summary. You should review the more detailed information contained elsewhere in this Prospectus and any related prospectus supplement and in the Statement of Additional Information (the “SAI”).

| The Fund |

Nuveen Municipal Income Fund, Inc. (the “Fund”) is a diversified, closed-end management investment company. See “The Fund.” Shares of the Fund’s common stock, $0.01 par value (“Common Stock”), are traded on the New York Stock Exchange (the “NYSE”) under the symbol “NMI.” Rights issued by the Fund may also be listed on a securities exchange. |

| |

The closing price of shares of the Common Stock, as reported by the NYSE on April 22, 2024, was $9.17 per share of Common Stock. The net asset value (“NAV”) of the shares of Common Stock at the close of business on that same date was $9.90 per share of Common Stock. As of February 29, 2024, the Fund had 10,051,095 shares of Common Stock outstanding and net assets of $100,922,780. See “Description of Shares.” |

| The Offering |

The Fund may offer, from time to time, in one or more offerings, 2 million shares of Common Stock and/or subscription rights to purchase Common Stock (“Rights,” and collectively with Common Stock, “Securities”), in any combination, on terms to be determined at the time of the offering. The Fund may offer and sell such Securities directly to one or more purchasers, to or through underwriters, through dealers or agents that the Fund designates from time to time, or through a combination of these methods. The prospectus supplement relating to any offering of Securities will describe such offering, including, as applicable, the names of any underwriters, dealers or agents and information regarding any applicable purchase price, fee, commission or discount arrangements made with those underwriters, dealers or agents or the basis upon which such amount may be calculated. For more information about the manners in which the Fund may offer Securities, see “Plan of Distribution.” The prospectus supplement relating to any Rights offering will set forth the number of shares of Common Stock issuable upon the exercise of each Right (or number of Rights) and the other terms of such Rights offering. The minimum price on any day at which the Common Stock may be sold will not be less than the NAV per share of Common Stock at the time of the offering plus the per share amount of any underwriting commission or discount; provided that Rights offerings that meet certain conditions may be offered at a price below the then current NAV. See “Rights Offerings.” |

| |

The Fund may not sell any Securities through agents, underwriters or dealers without delivery, or deemed delivery, of a prospectus, including the appropriate prospectus supplement, describing the method and terms of the particular offering of such Securities. You should read this Prospectus and the applicable prospectus supplement carefully before you invest in our Securities. |

1

| Investment Objective and Policies |

Please refer to the section of the Fund’s most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies and Principal Risks of the Funds—Investment Objective” and “Investment Policies,” as such investment objective and investment policies may be supplemented from time to time, which are incorporated by reference herein, for a discussion of the Fund’s investment objectives and policies. |

| |

There can be no assurance that such strategies will be successful. For a more complete discussion of the Fund’s portfolio composition and its corresponding risks, see “The Fund’s Investments” and “Risk Factors.” |

| Investment Adviser |

Nuveen Fund Advisors, LLC (“Nuveen Fund Advisors”), the Fund’s investment adviser, is responsible for overseeing the Fund’s overall investment strategy and its implementation. Nuveen Fund Advisors offers advisory and investment management services to a broad range of investment company clients. Nuveen Fund Advisors has overall responsibility for management of the Fund, oversees the management of the Fund’s portfolio, manages the Fund’s business affairs and provides certain clerical, bookkeeping and other administrative services. Nuveen Fund Advisors is located at 333 West Wacker Drive, Chicago, Illinois 60606. Nuveen Fund Advisors is an indirect subsidiary of Nuveen, LLC (“Nuveen”), the investment management arm of Teachers Insurance and Annuity Association of America (“TIAA”). TIAA is a life insurance company founded in 1918 by the Carnegie Foundation for the Advancement of Teaching and is the companion organization of College Retirement Equities Fund. As of December 31, 2023, Nuveen managed approximately $1.2 trillion in assets, of which approximately $140.2 billion was managed by Nuveen Fund Advisors. |

| Sub-Adviser |

Nuveen Asset Management, LLC serves as the Fund’s sub-adviser. Nuveen Asset Management, a registered investment adviser, is a wholly-owned subsidiary of Nuveen Fund Advisors. Nuveen Asset Management oversees the day-to-day investment operations of the Fund. |

| Use of Leverage |

As a fundamental policy, the Fund will not leverage its capital structure by issuing senior securities such as preferred shares or debt instruments. However, the Fund may (i) borrow for temporary, emergency or other purposes and (ii) invest in certain instruments, including inverse floating rate securities, that have the economic effect of financial leverage. As of February 29, 2024, the Fund’s total effective leverage was approximately 0.00% of its Managed Assets. |

| |

As of February 29, 2024, the Fund was not invested in inverse floating rate securities. An investment in inverse floating rate securities involves special risks. See “Inverse Floating Rate Securities Risk,” as contained in the section of the Fund’s most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies and Principal Risks of the Funds—Principal Risks of the Funds—Portfolio Level Risks.” |

2

| |

The Fund, along with certain other funds managed by Nuveen Fund Advisors (the “Participating Funds”), also established a 364-day, approximately $2.7 billion standby credit facility with a group of lenders, under which the Participating Funds may borrow for various purposes other than leveraging for investment purposes. A large portion of this facility’s capacity is currently dedicated for use by a small number of Participating Funds, which does not include the Fund. The remaining capacity under the facility (and the corresponding portion of the facility’s annual costs) is separately dedicated to most of the other open-end funds in the Nuveen fund family, along with a number of Nuveen closed-end funds, including the Fund. The credit facility expires in June 2024 unless extended or renewed. |

| Distributions |

The Fund pays regular monthly cash distributions to shareholders of Common Stock (stated in terms of a fixed cents per share of Common Stock dividend distribution rate which may be set from time to time). The Fund intends to distribute all or substantially all of its net investment income each year through its regular monthly distributions and to distribute realized capital gains at least annually. In addition, in any monthly period, to maintain its declared per common stock distribution amount, the Fund may distribute more or less than its net investment income during the period. In the event the Fund distributes more than its net investment income, such distributions may also include realized gains and/or a return of capital. To the extent that a distribution includes a return of capital the NAV per share may erode. If a distribution includes anything other than net investment income, the Fund provides a notice of the best estimate of its distribution sources at the time. See “Distributions.” |

The Fund reserves the right to change its distribution policy and the basis for establishing the rate of its monthly distributions at any time and may do so without prior notice to shareholders of Common Stock.

| Custodian and Transfer Agent |

State Street Bank and Trust Company serves as the Fund’s custodian, and Computershare Inc. and Computershare Trust Company, N.A. serves as the Fund’s transfer agent. See “Custodian and Transfer Agent.” |

| Risk Factors |

Investment in the Fund involves risk. The Fund is designed as a long-term investment and not as a trading vehicle. The Fund is not intended to be a complete investment program. Please refer to the section of the Fund’s most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies and Principal Risks of the Funds—Principal Risks of the Funds,” as such principal risks may be supplemented from time to time, which is incorporated by reference herein, for a discussion of the principal risks you should consider before making an investment in the Fund. The specific risks applicable to a particular offering of Securities will be set forth in the related prospectus supplement. |

3

| Use of Proceeds |

Unless otherwise specified in a prospectus supplement, the Fund will use the net proceeds from any sales of Securities, pursuant to this Prospectus, to make investments in accordance with the Fund’s investment objective. See “Use of Proceeds.” |

| Federal Income Tax |

The Fund has elected to be treated, and intends to qualify each year, as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). To qualify for the favorable U.S. federal income tax treatment generally accorded to a RIC under Subchapter M of the Code the Fund must, among other requirements, derive in each taxable year at least 90% of its gross income from certain prescribed sources and satisfy a diversification test on a quarterly basis. If the Fund fails to satisfy the qualifying income or diversification requirements in any taxable year, the Fund may be eligible for relief provisions if the failures are due to reasonable cause and not willful neglect and if a penalty tax is paid with respect to each failure to satisfy the applicable requirements. Additionally, relief is provided for certain de minimis failures of the diversification requirements where the Fund corrects the failure within a specified period. In order to be eligible for the relief provisions with respect to a failure to meet the diversification requirements, the Fund may be required to dispose of certain assets. If these relief provisions were not available to the Fund and it were to fail to qualify for treatment as a RIC for a taxable year, all of its taxable income (including its net capital gain) would be subject to tax at the 21% regular corporate rate without any deduction for distributions to shareholders, and such distributions would be taxable as ordinary dividends to the extent of the Fund’s current and accumulated earnings and profits. To qualify to pay exempt-interest dividends, which are treated as items of interest excludable from gross income for federal income tax purposes, at least 50% of the value of the total assets of the Fund must consist of obligations exempt from regular income tax as of the close of each quarter of the Fund’s taxable year. If the proportion of taxable investments held by the Fund exceeds 50% of the Fund’s total assets as of the close of any quarter of any Fund taxable year, the Fund will not for that taxable year satisfy the general eligibility test that otherwise permits it to pay exempt-interest dividends. |

| |

The value of the Fund’s investments and its NAV may be adversely affected by changes in tax rates and policies. Because interest income from municipal securities is normally not subject to regular federal income taxation, the attractiveness of municipal securities in relation to other investment alternatives is affected by changes in federal income tax rates or changes in the tax-exempt status of interest income from municipal securities. Any proposed or actual changes in such rates or exempt status, therefore, can significantly affect the demand for and supply, liquidity and marketability of municipal securities. This could in turn affect the Fund’s NAV and ability to acquire and dispose of municipal securities at desirable yield and price levels. Additionally, the Fund may not be a suitable investment |

4

| |

for individual retirement accounts, for other tax-exempt or tax-deferred accounts or for investors who are not sensitive to the federal income tax consequences of their investments. |

| |

See “Fund Level and Other Risks—Fund Tax Risk” and “Portfolio Level Risks—Tax Risk” and “—Taxability Risk,” each as contained in the section of the Fund’s most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies and Principal Risks of the Funds—Principal Risks of the Funds,” and see “Tax Matters” below. |

| Special Tax Considerations |

If you are, or as a result of investment in the Fund would become, subject to the federal alternative minimum tax, the Fund may not be a suitable investment for you. In addition, distributions of ordinary taxable income (including any net short-term capital gain) will be taxable to shareholders as ordinary income (and not eligible for favorable taxation as “qualified dividend income”), and capital gain dividends will be taxable as long-term capital gains. See “Tax Matters.” |

| Governing Law |

The Fund’s Articles of Incorporation (the “Articles”) are governed by the laws of the State of Minnesota. |

5

SUMMARY OF FUND EXPENSES

Please refer to the section of the Fund’s most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies and Principal Risks of the Funds—Updated Disclosures for the Fund’s Effective Shelf Offering Registration Statement—Summary of Fund Expenses,” which is incorporated by reference herein, for a discussion of fees and expenses of the Fund.

FINANCIAL HIGHLIGHTS

The Fund’s financial highlights for the fiscal years ended October 31, 2023, October 31, 2022, October 31, 2021, October 31, 2020, and October 31, 2019, are incorporated by reference from the Fund’s Annual Report for the fiscal year ended October 31, 2023 (File No. 811-05488), as filed with the SEC on Form N-CSR on January 5, 2024. The financial highlights for each of these fiscal years have been derived from financial statements audited by KPMG LLP, the Fund’s independent registered public accounting firm, for the last five fiscal years. The Fund’s financial highlights for the fiscal years ended October 31, 2018, October 31, 2017, October 31, 2016, October 31, 2015, and October 31, 2014, are incorporated by reference from the Fund’s Annual Report for the fiscal year ended October 31, 2018 (File No. 811-05488), as filed with the SEC on Form N-CSR on January 7, 2019.

TRADING AND NET ASSET VALUE INFORMATION

Please refer to the section of the Fund’s most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies and Principal Risks of the Funds—Updated Disclosures for the Fund’s Effective Shelf Offering Registration Statement—Trading and Net Asset Value Information,” which is incorporated by reference herein, for a discussion of the following information for the periods indicated: (i) the high and low sales prices for Common Stock reported as of the end of the day on the NYSE, (ii) the high and low net asset values of Common Stock, and (iii) the high and low of the premium/(discount) to net asset value (expressed as a percentage) of Common Stock.

The net asset value per share of Common Stock, the market price, and percentage of premium/(discount) to net asset value per share of Common Stock on April 22, 2024 was $9.90, $9.17 and (7.37)%, respectively. As of February 29, 2024, the Fund had 10,051,095 shares of Common Stock outstanding and net assets of $100,922,780.

THE FUND

The Fund is a diversified, closed-end management investment company registered under the 1940 Act. The Fund was incorporated on February 26, 1988, pursuant to the Articles, and is governed by the laws of the State of Minnesota. The Fund’s Common Stock is listed on the NYSE under the symbol “NMI.”

The following provides information about the Fund’s outstanding shares of Common Stock as of February 29, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of Class

|

|

Amount

Authorized

|

|

|

Amount Held

by the Fund or

for its Account

|

|

|

Amount

Outstanding

|

|

| Common Stock |

|

|

200,000,000 |

|

|

|

0 |

|

|

|

10,051,095 |

|

6

USE OF PROCEEDS

Unless otherwise specified in a prospectus supplement, the net proceeds from the issuance of shares of Common Stock will be invested in accordance with the Fund’s investment objective and policies as stated below. Pending investment, the timing of which may vary depending on the size of the investment but in no case is expected to exceed 30 days, it is anticipated that the proceeds will be invested in short-term or long-term securities issued by the U.S. Government or its agencies or instrumentalities or in high-quality, short-term money market instruments. See “Use of Leverage.”

THE FUND’S INVESTMENTS

Investment Objective and Policies

Please refer to the section of the Fund’s most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies and Principal Risks of the Funds—Investment Objective” and “—Investment Policies,” as such investment objective and investment policies may be supplemented from time to time, which is incorporated by reference herein, for a discussion of the Fund’s investment objective and policies.

Portfolio Composition and Other Information

Please refer to the section of the Fund’s most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies and Principal Risks of the Funds—Investment Policies—Portfolio Contents,” as such portfolio contents may be supplemented from time to time, which is incorporated by reference herein, for a discussion of the investments principally included in the Fund’s portfolio. More detailed information about the Fund’s portfolio investments are contained in the SAI under “The Fund’s Investments.”

Portfolio Turnover

The Fund may engage in portfolio trading when considered appropriate, but short-term trading will not be used as the primary means of achieving the Fund’s investment objective. Although the Fund cannot accurately predict its annual portfolio turnover rate, it is generally not expected to exceed 25% under normal circumstances. For the fiscal year ended October 31, 2023, the Fund’s portfolio turnover rate was 33%. However, there are no limits on the Fund’s rate of portfolio turnover, and investments may be sold without regard to length of time held when, in Nuveen Asset Management’s opinion, investment considerations warrant such action. A higher portfolio turnover rate would result in correspondingly greater brokerage commissions and other transactional expenses that are borne by the Fund. Although these commissions and expenses are not reflected in the Fund’s “Total Annual Expenses” disclosed in this Prospectus, they will be reflected in the Fund’s total return. In addition, high portfolio turnover may result in the realization of net short-term capital gains by the Fund which, when distributed to shareholders, will be taxable as ordinary income. See “Tax Matters.”

Other Policies

Certain investment policies specifically identified in the SAI as such are considered fundamental and may not be changed without shareholder approval. See “Investment Restrictions” in the SAI.

USE OF LEVERAGE

As a fundamental policy, the Fund will not leverage its capital structure by issuing senior securities such as preferred shares or debt instruments. However, the Fund may borrow for temporary, emergency or certain other

7

purposes as permitted by the Investment Company Act of 1940, as amended, and invest in certain instruments, including inverse floating rate securities that have the economic effect of financial leverage. Inverse floating rate securities have the economic effect of financial leverage because the Fund’s investment exposure to the underlying bonds held by the trust have been effectively financed by the trust’s issuance of floating rate certificates. As of February 29, 2024, the Fund did not invest in inverse floating rate securities.

The Fund, along with certain other funds managed by Nuveen Fund Advisors (the “Participating Funds”), also established a 364-day, approximately $2.7 billion standby credit facility with a group of lenders, under which the Participating Funds may borrow for various purposes other than leveraging for investment purposes. A large portion of this facility’s capacity is currently dedicated for use by a small number of Participating Funds, which does not include the Fund. The remaining capacity under the facility (and the corresponding portion of the facility’s annual costs) is separately dedicated to most of the other open-end funds in the Nuveen fund family, along with a number of Nuveen closed-end funds, including the Fund. The credit facility expires in June 2024 unless extended or renewed.

8

RISK FACTORS

Risk is inherent in all investing. Investing in any investment company security involves risk, including the risk that you may receive little or no return on your investment or even that you may lose part or all of your investment. Please refer to the section of the Fund’s most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies and Principal Risks of the Funds—Principal Risks of the Funds,” as such principal risks may be supplemented from time to time, which is incorporated by reference herein, for a discussion of the principal risks you should consider before making an investment in the Fund. The specific risks applicable to a particular offering of Securities will be set forth in the related prospectus supplement.

MANAGEMENT OF THE FUND

Directors and Officers

The Board is responsible for the management of the Fund, including supervision of the duties performed by Nuveen Fund Advisors and Nuveen Asset Management. The names and business addresses of the directors and officers of the Fund and their principal occupations and other affiliations during the past five years are set forth under “Management of the Fund” in the SAI.

Investment Adviser, Sub-Adviser and Portfolio Managers

Investment Adviser. Nuveen Fund Advisors, LLC, the Fund’s investment adviser, is responsible for overseeing the Fund’s overall investment strategy and implementation. Nuveen Fund Advisors offers advisory and investment management services to a broad range of investment company clients. Nuveen Fund Advisors has overall responsibility for management of the Fund, oversees the management of the Fund’s portfolio, manages the Fund’s business affairs and provides certain clerical, bookkeeping and other administrative services. Nuveen Fund Advisors is located at 333 West Wacker Drive, Chicago, Illinois 60606. Nuveen Fund Advisors is an indirect subsidiary of Nuveen, the investment management arm of TIAA. TIAA is a life insurance company founded in 1918 by the Carnegie Foundation for the Advancement of Teaching and is the companion organization of College Retirement Equities Fund. As of December 31, 2023, Nuveen managed approximately $1.2 trillion in assets, of which approximately $140.2 billion was managed by Nuveen Fund Advisors.

Sub-Adviser. Nuveen Asset Management, LLC, 333 West Wacker Drive, Chicago, Illinois 60606, serves as the Fund’s sub-adviser pursuant to a sub-advisory agreement between Nuveen Fund Advisors and Nuveen Asset Management (the “Sub-Advisory Agreement”). Nuveen Asset Management, a registered investment adviser, is a wholly owned subsidiary of Nuveen Fund Advisors. Nuveen Asset Management oversees day-to-day investment operations of the Fund. Pursuant to the Sub-Advisory Agreement, Nuveen Asset Management is compensated for the services it provides to the Fund with a portion of the management fee Nuveen Fund Advisors receives from the Fund. Nuveen Fund Advisors and Nuveen Asset Management retain the right to reallocate investment advisory responsibilities and fees between themselves in the future.

Portfolio Managers. Nuveen Asset Management is responsible for the execution of specific investment strategies and day-to-day investment operations of the Fund. Nuveen Asset Management manages the Nuveen funds using a team of analysts and portfolio managers that focuses on a specific group of funds. The day-to-day operation of the Fund and the execution of its specific investment strategies is the primary responsibility of Kristen M. DeJong and Scott R. Romans, the designated portfolio managers of the Fund.

Kristen M. DeJong, CFA, is Managing Director and Portfolio Manager at Nuveen Asset Management, LLC (“NAM”). She began her career in the financial services industry in 2005 and joined NAM in 2008. She served as a research associate in the wealth management services area and then as a senior research analyst for NAM’s municipal fixed income team before assuming portfolio management responsibilities in 2021.

9

Scott R. Romans, PhD, is Managing Director and Portfolio Manager at NAM. He began his career in the financial services industry when he joined NAM in 2000. He assumed portfolio management responsibilities in 2003.

Additional information about the Portfolio Manager’s compensation, other accounts managed by the Portfolio Manager and the Portfolio Manager’s ownership of securities in the Fund is provided in the SAI. The SAI is available free of charge by calling (800) 257-8787 or by visiting the Fund’s website at www.nuveen.com. The information contained in, or that can be accessed through, the Fund’s website is not part of this Prospectus or the SAI, except to the extent specifically incorporated by reference herein or in the SAI.

Investment Management and Sub-Advisory Agreements

Investment Management Agreement. Pursuant to an investment management agreement between Nuveen Fund Advisors and the Fund (the “Investment Management Agreement”), the Fund has agreed to pay an annual management fee for the services and facilities provided by Nuveen Fund Advisors, payable on a monthly basis, based on the sum of a fund-level fee and a complex-level fee, as described below.

Fund-Level Fee. The annual fund-level fee for the Fund, payable monthly, is calculated according to the following schedule:

|

|

|

|

|

| Average Daily Net Assets

|

|

Fund-Level

Fee Rate

|

|

| For the first $125 million |

|

|

0.4500 |

% |

| For the next $125 million |

|

|

0.4375 |

% |

| For the next $250 million |

|

|

0.4250 |

% |

| For the next $500 million |

|

|

0.4125 |

% |

| For the next $1 billion |

|

|

0.4000 |

% |

| For the next $3 billion |

|

|

0.3750 |

% |

| For net assets over $5 billion |

|

|

0.3625 |

% |

Complex-Level Fee. The overall complex-level fee, payable monthly, begins at a maximum rate of 0.1600% of the Fund’s average daily managed assets, with breakpoints for eligible complex-level assets above $124.3 billion. Therefore, the maximum management fee rate for the Fund is the Fund-level fee plus 0.1600%. The current overall complex-level fee schedule is as follows:

|

|

|

|

|

| Complex-Level Eligible Asset Breakpoint Level*

|

|

Effective

Complex-Level

Fee Rate at

Breakpoint

Level

|

|

| For the first $124.3 billion |

|

|

0.1600 |

% |

| For the next $75.7 billion |

|

|

0.1350 |

% |

| For the next $200 billion |

|

|

0.1325 |

% |

| For eligible assets over $400 billion |

|

|

0.1300 |

% |

| * |

See “Investment Adviser, Sub-Adviser and Portfolio Managers” in the SAI for more detailed information about the complex-level fee and eligible complex-level assets. |

10

In addition to the fee of Nuveen Fund Advisors, the Fund pays all other costs and expenses of its operations, including compensation of its directors (other than those affiliated with Nuveen Fund Advisors and Nuveen Asset Management), custodian, transfer agency and dividend disbursing expenses, legal fees, expenses of independent auditors, expenses of repurchasing shares, expenses associated with any borrowings, expenses of preparing, printing and distributing shareholder reports, notices, proxy statements and reports to governmental agencies, and taxes, if any. All fees and expenses are accrued daily and deducted before payment of dividends to investors.

A discussion regarding the basis for the Board’s most recent approval of the Investment Management Agreement for the Fund may be found in the Fund’s annual report to shareholders dated October 31 of each year.

Sub-Advisory Agreement. Pursuant to the Sub-Advisory Agreement, Nuveen Asset Management receives from Nuveen Fund Advisors a management fee equal to 71.4286% of Nuveen Fund Advisors’ net management fee from the Fund. Nuveen Fund Advisors and Nuveen Asset Management retain the right to reallocate investment advisory responsibilities and fees between themselves in the future.

A discussion regarding the basis for the Board’s most recent approval of the Sub-Advisory Agreement may be found in the Fund’s annual report to shareholders dated October 31 of each year.

NET ASSET VALUE

The Fund’s NAV per share is determined as of the close of trading (normally 4:00 p.m. Eastern time) on each day the New York Stock Exchange is open for business. NAV is calculated by taking the market value of the Fund’s total assets, less all liabilities, and dividing by the total number of shares outstanding. The result, rounded to the nearest cent, is the NAV per share.

11

The Fund utilizes independent pricing services approved by the Board to value portfolio instruments at their market value. Independent pricing services typically value non-equity portfolio instruments utilizing a range of market-based inputs and assumptions, including readily available market quotations obtained from broker-dealers making markets in such instruments, cash flows and transactions for comparable instruments. In valuing municipal securities, the pricing services may also consider, among other factors, the yields or prices of municipal securities of comparable quality, type of issue, coupon, maturity and rating and the obligor’s credit characteristics considered relevant by the pricing service or Nuveen Fund Advisors. In pricing certain securities, particularly less liquid and lower quality securities, the pricing services may consider information about a security, its issuer or market activity provided by Nuveen Fund Advisors or Nuveen Asset Management.

If a price cannot be obtained from a pricing service or other pre-approved source, or if the Fund’s valuation designee deems such price to be unreliable, or if a significant event occurs after the close of the local market but prior to the time at which the Fund’s NAV is calculated, a portfolio instrument will be valued at its fair value as determined in good faith by the Fund’s valuation designee. The Fund’s valuation designee may determine that a price is unreliable in various circumstances. For example, a price may be deemed unreliable if it has not changed for an identified period of time, or has changed from the previous day’s price by more than a threshold amount, and recent transactions and/or broker dealer price quotations differ materially from the price in question.

The Board has designated Nuveen Fund Advisors as the Fund’s valuation designee pursuant to Rule 2a-5 under the 1940 Act and delegated to Nuveen Fund Advisors the day-to-day responsibility of making fair value determinations. All fair value determinations made by Nuveen Fund Advisors are subject to review by the Board. As a general principle, the fair value of a portfolio instrument is the amount that an owner might reasonably expect to receive upon the instrument’s current sale. A range of factors and analysis may be considered when determining fair value, including relevant market data, interest rates, credit considerations and/or issuer specific news. However, fair valuation involves subjective judgments, and it is possible that the fair value determined for a portfolio instrument may be materially different from the value that could be realized upon the sale of that instrument.

DISTRIBUTIONS

The Fund pays regular monthly cash distributions to Common Stockholders (stated in terms of a fixed cents per share of Common Stock dividend distribution rate which may be set from time to time). The Fund intends to distribute all or substantially all of its net investment income each year through its regular monthly distributions and to distribute realized capital gains at least annually. In addition, in any monthly period, to maintain its declared per common stock distribution amount, the Fund may distribute more or less than its net investment income during the period. In the event the Fund distributes more than its net investment income, such distributions may also include realized gains and/or a return of capital.

To the extent that a distribution includes a return of capital the NAV per share may erode. A return of capital may occur, for example, when some or all of the money that you invested in the Fund is paid back to you. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.”

If the Fund’s distribution includes anything other than net investment income, the Fund will provide a notice to Common Stockholders of its best estimate of the distribution sources at the time of the distribution. These estimates may not match the final tax characterization (for the full year’s distributions) contained in the Common Stockholders’ 1099-DIV forms after the end of the year.

While the Fund intends to distribute all realized capital gains at least annually, the Fund may elect to retain all or a portion of any net capital gain (which is the excess of net long-term capital gain over net short-term capital loss) otherwise allocable to Common Stockholders and pay U.S. federal income tax on the retained gain.

12

As provided under U.S. federal income tax law, Common Stockholders of record as of the end of the Fund’s taxable year will include their share of the retained net capital gain in their income for the year as a long-term capital gain (regardless of their holding period in the common stocks), and will be entitled to an income tax credit or refund for the federal income tax deemed paid on their behalf by the Fund. If the Fund’s total distributions during a given year is an amount that exceeds the Fund’s current and accumulated earnings and profits, the excess would be treated by Common Stockholders as return of capital for federal income tax purposes to the extent of the Common Stockholder’s basis in their shares and thereafter as capital gain.

Distributions will be reinvested in additional shares of Common Stock under the Fund’s Dividend Reinvestment Plan unless a shareholder elects to receive cash. The Fund reserves the right to change its distribution policy and the basis for establishing the rate of its monthly distributions at any time and may do so without prior notice to Common Stockholders.

DIVIDEND REINVESTMENT PLAN

Please refer to the section of the Fund’s most recent annual report on Form N-CSR entitled “Shareholder Update—Dividend Reinvestment Plan,” which is incorporated by reference herein, for a discussion of the Fund’s dividend reinvestment plan.

PLAN OF DISTRIBUTION

The Fund may offer and sell Securities from time to time on an immediate, continuous or delayed basis, in one or more offerings under this Prospectus and a related prospectus supplement, on terms to be determined at the time of the offering. The Fund may offer and sell such Securities directly to one or more purchasers, to or through underwriters, through dealers or agents that the Fund designates from time to time, or through a combination of these methods. Sales of Securities may be made in transactions that are deemed to be “at the market” as defined in Rule 415 under the Securities Act of 1933, as amended (the “1933 Act”), including sales made directly on the NYSE or sales made to or through a market maker other than on an exchange.

The prospectus supplement relating to any offering of Securities will describe the terms of such offering, including, as applicable:

| |

• |

|

The names of any agents, underwriters or dealers; |

| |

• |

|

any sales loads, underwriting discounts and commissions or agency fees and other items constituting underwriters’ or agents’ compensation; |

| |

• |

|

any discounts, commissions, fees or concessions allowed or reallowed or paid to dealers or agents; |

| |

• |

|

the public offering or purchase price of the offered Securities, the estimated net proceeds the Fund will receive from the sale and the use of proceeds; and |

| |

• |

|

any securities exchange on which the offered Securities may be listed. |

The prospectus supplement relating to any Rights offering will set forth the number of Common Stock issuable upon the exercise of each Right (or number of Rights) and the other terms of such Rights offering.

Direct Sales

The Fund may offer and sell Securities directly to, and solicit offers from, institutional investors or others who may be deemed to be underwriters as defined in the 1933 Act for any resales of Securities. In this case, no underwriters or agents would be involved. The Fund may use electronic media, including the Internet, to sell offered Securities directly. The Fund will describe the terms of any of those sales in a prospectus supplement.

13

By Agents

The Fund may offer and sell Securities through an agent or agents designated by the Fund from time to time. An agent may sell Securities it has purchased from the Fund as principal to other dealers for resale to investors and other purchasers, and may reallow all or any portion of the discount received in connection with the purchase from the Fund to the dealers. After the initial offering of Securities, the offering price (in the case of Securities to be resold at a fixed offering price), the concession and the discount may be changed.

By Underwriters