Form 424B3 - Prospectus [Rule 424(b)(3)]

20 Septiembre 2024 - 12:33PM

Edgar (US Regulatory)

Nuveen

Municipal Income Fund, Inc. (NYSE: NMI)

(the

“Fund”)

Supplement

Dated September 20, 2024

to

the Fund’s Prospectus Supplement Dated June 4, 2024

(the

“Prospectus Supplement”)

Effective

September 20, 2024, the compensation to be paid to Nuveen Securities, LLC (“Nuveen”), pursuant to the distribution agreement

between the Fund and Nuveen, and the compensation to be paid to Stifel, Nicolaus & Company, Incorporated (“Stifel Nicolaus”),

pursuant to the selected dealer agreement between Nuveen and Stifel with respect to the Fund, has changed. Accordingly, effective September

20, 2024, the Prospectus Supplement is amended as follows:

| 1. | The

third paragraph on the cover of the Prospectus Supplement is hereby deleted and replaced

with the following: |

The

Fund will compensate Nuveen Securities with respect to sales of Common Stock at a variable commission rate. The variable commission rate

shall be equal to the sum of (i) seventy-five percent (75%) of the premium to net asset value with respect to the sale of any Common

Stock sold until such compensation is equal to 0.80% of the aggregate gross sales proceeds and (ii) twenty-five percent (25%) of the

premium to net asset value with respect to the sale of any Common Stock sold until such compensation is equal to 0.20% of the aggregate

gross sales proceeds. Out of this commission, Nuveen Securities will compensate the applicable dealer at a variable commission rate equal

to seventy-five percent (75%) of the premium to net asset value with respect to the sale of any Common Stock sold until such compensation

is equal to 0.80% of the aggregate gross sales proceeds. In connection with the sale of the Common Stock on the Fund’s behalf,

Nuveen Securities may be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Nuveen

Securities may be deemed to be underwriting commissions or discounts.

| 2. | The

second paragraph in the section of the Prospectus Supplement titled “Prospectus Supplement

Summary – The Offering” is hereby deleted and replaced with the following: |

The

Fund will compensate Nuveen Securities with respect to sales of Common Stock at a variable commission rate. The variable commission rate

shall be equal to the sum of (i) seventy-five percent (75%) of the premium to net asset value with respect to the sale of any Common

Stock sold until such compensation is equal to 0.80% of the aggregate gross sales proceeds and (ii) twenty-five percent (25%) of the

premium to net asset value with respect to the sale of any Common Stock sold until such compensation is equal to 0.20% of the aggregate

gross sales proceeds. “Gross sales proceeds” with respect to each sale of Common Stock shall be the gross sales price per

Common Stock multiplied by the number of Common Stock sold. The gross sales price with respect to each sale of Common Stock sold pursuant

to the Distribution Agreement shall be the gross sales price per Common Stock of such Common Stock. Nuveen Securities will compensate

Stifel Nicolaus as sub-placement agent at a variable commission rate equal to seventy-five percent (75%) of the premium to net asset

value with respect to the sale of any Common Stock sold until such compensation is equal to 0.80% of the aggregate gross sales proceeds.

Settlements of sales of Common Stock will occur on the first business day following the date on which any such sales are made.

| 3. | The

fourth paragraph in the section of the Prospectus Supplement titled “Plan of Distribution”

is hereby deleted and replaced with the following: |

The

Fund will compensate Nuveen Securities with respect to sales of Common Stock at a variable commission rate. The variable commission rate

shall be equal to the sum of (i) seventy-five percent (75%) of the premium to net asset value with respect to the sale of any Common

Stock sold until such compensation is equal to 0.80% of the aggregate gross sales proceeds and (ii) twenty-five percent (25%) of the

premium to net asset value with respect to the sale of any Common Stock sold until such compensation is equal to 0.20% of the aggregate

gross sales proceeds. “Gross sales proceeds” with respect to each sale of Common Stock shall be the gross sales price per

Common Stock multiplied by the number of Common Stock sold. The gross sales price with respect to each sale of Common Stock sold pursuant

to the Distribution Agreement shall be the gross sales price per Common Stock of such Common Stock. Nuveen Securities will compensate

Stifel Nicolaus as sub-placement agent at a variable commission rate equal to seventy-five percent (75%) of the premium to net asset

value with respect to the sale of any Common Stock sold until such compensation is equal to 0.80% of the aggregate gross sales proceeds.

Settlements of sales of Common Stock will occur on the first business day following the date on which any such sales are made.

PLEASE

KEEP THIS WITH YOUR

FUND’S

PROSPECTUS SUPPLEMENT FOR FUTURE REFERENCE

EGN-NMIP-0924P

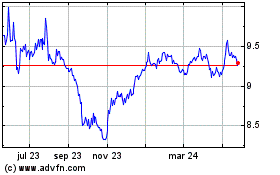

Nuveen Muni Income (NYSE:NMI)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

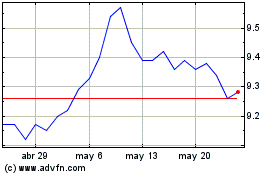

Nuveen Muni Income (NYSE:NMI)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025