NRP Enters Into an Agreement With The Cline Group to Acquire Significant Coal Reserves and Coal Transportation Assets

14 Diciembre 2006 - 3:17PM

PR Newswire (US)

* NRP will acquire 49 million tons of reserves to be mined by Cline

in West Virginia and Illinois * NRP will acquire transportation

assets associated with Cline mining operations * NRP expects

approximately $40 million in net cash flows when the initial mines

reach full production, approximately half of which will be from

transportation related assets * In 2008, NRP anticipates acquiring

a royalty stream on approximately 100 million tons of reserves and

related transportation assets to be developed by Cline in Ohio *

NRP and Cline establish a long-term relationship; Cline will

receive an equity stake in NRP and join the general partner of NRP

* Cline will provide a pipeline of future acquisition opportunities

that encompasses approximately three billion tons of recoverable

coal reserves in Illinois HOUSTON, Dec. 14 /PRNewswire-FirstCall/

-- Natural Resource Partners L.P. (NYSE:NRP) and (NYSE:NSP),

announced today that it has executed a definitive agreement to

partner with The Cline Group, a private coal company that controls

over 3 billion tons of reserves in the Illinois and Northern

Appalachian coal basins. NRP will acquire 49 million tons of

reserves that are leased to active Cline mining operations. In

addition, NRP will acquire transportation assets and related

infrastructure at those mines. Consideration for the transaction

will be 4,455,036 units representing limited partner interests in

NRP, a portion of which will be Class B units. Through its

affiliate Adena Minerals, LLC, The Cline Group will also receive a

22% interest in the general partner and in the incentive

distribution rights of NRP in return for providing NRP with the

exclusive option to acquire additional reserves, royalty interests

and certain transportation infrastructure relating to future mine

developments by The Cline Group. The transaction is expected to

close in early 2007. "This transaction gives NRP immediately

accretive growth through Cline's current developments in West

Virginia and Illinois, and a strategic opportunity to acquire

additional royalty and transportation income in Ohio and the

Illinois Basin," said Nick Carter, President and Chief Operating

Officer of NRP. "The Cline Group is well known within the coal

industry as a great developer of coal mines and a low cost

operator. Their large reserve base, active development plans and

the growing market for higher sulfur coals should provide NRP

significant opportunities for growth and diversification in the

years to come." "The general partner is using its currency in this

acquisition to give NRP an opportunity to acquire significant

additional cash flows over the next 10 to 15 years. Using the

general partner's interests as another currency adds value to NRP's

unitholders. The owners of the general partner are willing to do

this transaction because it is accretive to both NRP and our

general partner," said Corbin J. Robertson, Jr., Chairman and Chief

Executive Officer of Natural Resource Partners and the largest

owner of the general partner. "It's a good fit for us," said

Christopher Cline, owner of The Cline Group. "We struck our first

deal with NRP in 2005. As we've worked together over the last two

years, we've been continually impressed by Corby, Nick and the NRP

team. They have rapidly grown NRP's cash flow and distributions

through good deal-making over a sustained period of time. When it

came down to entering into a long term strategic partnership, the

strength of our relationship and their ability to execute on a

growth strategy gave us confidence in our combined future." West

Virginia and Illinois Properties and Projected Cash Flows Upon

closing, NRP will acquire 37 million tons at Cline's Gatling mining

operation in Mason County, West Virginia. The initial transaction

also provides an area of mutual interest, surrounding Cline's

Gatling operations, in which any additional reserves acquired by

Cline will be contributed to NRP at no cost when acquired by Cline.

NRP will receive either a royalty or an overriding royalty interest

on all properties within the area of mutual interest. NRP is also

acquiring material handling and transportation infrastructure at

Gatling that will produce significant transportation income for

NRP. The Cline Group has recently completed construction of this

mine and will begin shipping a portion of its production to AEP

under a long-term contract in the first quarter of 2007. The coal

will be transported by beltline to AEP's adjacent power plant and

to a barge facility on the Ohio River for sale to other utility

customers. NRP will also acquire 12 million tons of reserves

adjacent to reserves currently owned by NRP at Cline affiliate

Williamson Energy's Pond Creek No 1 mine in Southern Illinois. In

addition, NRP will acquire certain transportation infrastructure,

including beltlines and rail load out facilities, at that mine. The

Cline Group recently finished construction of this mine and is

currently shipping coal from the mine by rail under a long- term

contract while it develops its longwall panels. Longwall production

is expected to commence in the second half of 2007. When the mining

operations at the Gatling mine in West Virginia and the Pond Creek

No 1 mine reach full productive capacity, which is anticipated to

occur in 2008, NRP expects net cash flows of approximately $40

million, about half of which are associated with transportation and

coal handling facilities. "In addition to diversifying our

reserves, the coal handling facilities and the related

transportation assets provide us a broader platform for future

growth, which we expect will allow us to continue to increase our

distributable cash flow at a steady pace," said Corbin J.

Robertson. Ohio Properties At the closing of the initial

transaction, NRP will also enter into an agreement to purchase the

reserves and transportation infrastructure at Cline's Gatling Ohio

complex. This complex, with recoverable reserves of over 100

millions tons, is located in Meigs County, Ohio directly across the

river from Cline's Gatling mining operation in West Virginia. The

parties have agreed to a similar area of mutual interest for Ohio

with respect to reserves not controlled by Cline. The closing of

the second transaction is subject to customary closing conditions

and will occur upon commencement of coal production, which is

currently expected to be in 2008. As consideration for the

transaction, NRP will issue Adena 2,280,000 additional Class B

units, and the general partner of NRP will issue Adena an

additional 9% interest in the general partner and the incentive

distribution rights. Based on current projections and existing

market conditions, once the Gatling mine in Ohio has reached full

productive capacity, NRP anticipates receiving net cash flows in

excess of $70 million annually from the combined transactions in

Ohio, West Virginia and Illinois. Class B Units As discussed above,

a portion of the total units issued will be in the form of Class B

units. The Class B units to be issued to Adena are a new class of

limited partnership interests in NRP that will be converted to

regular common units upon the approval of NRP's unitholders (other

than Cline). The Class B units will be subordinate to the regular

common units, but senior to the subordinated units, with respect to

cash distributions (and in liquidation) and will be entitled to

110% of the cash distributions per common unit if they have not

been converted to common units six months following the closing of

the Ohio acquisition or September 30, 2008, whichever occurs first.

The Class B units are not listed for trading on the New York Stock

Exchange. All of the NRP units to be issued to Adena will be issued

in a transaction exempt from registration under the Securities Act.

"By issuing units in connection with these transactions, NRP

continues to maintain its strong balance sheet," said Dwight

Dunlap, Chief Financial Officer of Natural Resource Partners.

Future Acquisition Opportunities In consideration for the general

partner interest, The Cline Group will also enter into an agreement

under which NRP will receive the right to acquire any producing

coal reserves and royalty interests owned by Cline, as well as coal

transportation infrastructure associated with several identified

future development projects. "With over three billion tons of

reserves that The Cline Group currently controls, principally in

the Illinois Basin NRP's unitholders will substantially benefit

from the issuance of the interest in the general partner as The

Cline Group will have significant economic incentives to develop

and contribute additional properties to NRP," said Corbin J.

Robertson. "This pipeline of future development projects in the

Illinois Basin will also significantly diversify our coal holdings

into a growing market." New Directors The Cline Group will name two

directors to the board of directors of the general partner of NRP,

one of whom will be independent. Cline will nominate J. Matthew

Fifield, Managing Director of Adena Minerals LLC, as one of the two

directors and anticipates nominating an independent director in the

near term. With the addition of these two directors, NRP will have

nine directors, five of whom will be independent. Natural Resource

Partners L.P. is headquartered in Houston, TX, with its operation's

headquarters in Huntington, WV. NRP is a master limited partnership

that is principally engaged in the business of owning and managing

coal properties in the three major coal producing regions of the

United States: Appalachia, the Illinois Basin and the Powder River

Basin. The common units are traded on the New York Stock Exchange

(NYSE) under the symbol NRP and the subordinated units are traded

on the NYSE under the symbol NSP. For additional information,

please contact Kathy Hager at 713-751-7555 or . Further information

about NRP is available on the partnership's website at

http://www.nrplp.com/ . This press release includes

"forward-looking statements" as defined by the Securities and

Exchange Commission. Such statements include the estimated

reserves, revenues, cash flow, the date of anticipated production,

as well as the accretive nature of the transaction. All statements,

other than statements of historical facts, included in this press

release that address activities, events or developments that the

partnership expects, believes or anticipates will or may occur in

the future are forward-looking statements. These statements are

based on certain assumptions made by the partnership based on its

experience and perception of historical trends, current conditions,

expected future developments and other factors it believes are

appropriate in the circumstances. Such statements are subject to a

number of assumptions, risks and uncertainties, many of which are

beyond the control of the partnership. These risks include, but are

not limited to, decreases in demand for coal; changes in operating

conditions and costs; production cuts by our lessees; commodity

prices; unanticipated geologic problems; changes in the legislative

or regulatory environment and other factors detailed in Natural

Resource Partners' Securities and Exchange Commission filings.

Natural Resource Partners L.P. has no obligation to publicly update

or revise any forward-looking statement, whether as a result of new

information, future events or otherwise.

http://www.newscom.com/cgi-bin/prnh/20060109/NRPLOGO

http://photoarchive.ap.org/ DATASOURCE: Natural Resource Partners

L.P. CONTACT: Kathy Hager of Natural Resource Partners L.P.,

+1-713-751-7555, or Web site: http://www.nrplp.com/

Copyright

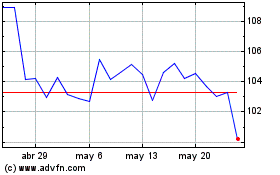

Insperity (NYSE:NSP)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

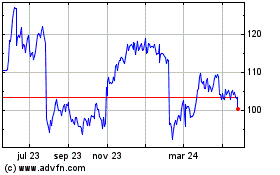

Insperity (NYSE:NSP)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024