0001000753--12-3110-QJune 30, 20242024Q2FALSE2024Greater than 1 yearGreater than 1 yearP1YP1Y20242024202420242024202420242024202420242024202420242024xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:purensp:conversionRatio00010007532024-01-012024-06-300001000753us-gaap:CommonStockMember2024-01-012024-06-3000010007532024-07-3000010007532024-06-3000010007532023-12-3100010007532024-04-012024-06-3000010007532023-04-012023-06-3000010007532023-01-012023-06-3000010007532022-12-3100010007532023-06-300001000753us-gaap:CommonStockMember2023-12-310001000753us-gaap:AdditionalPaidInCapitalMember2023-12-310001000753us-gaap:TreasuryStockCommonMember2023-12-310001000753us-gaap:RetainedEarningsMember2023-12-310001000753us-gaap:CommonStockMember2024-01-012024-06-300001000753us-gaap:AdditionalPaidInCapitalMember2024-01-012024-06-300001000753us-gaap:TreasuryStockCommonMember2024-01-012024-06-300001000753us-gaap:RetainedEarningsMember2024-01-012024-06-300001000753us-gaap:CommonStockMember2024-06-300001000753us-gaap:AdditionalPaidInCapitalMember2024-06-300001000753us-gaap:TreasuryStockCommonMember2024-06-300001000753us-gaap:RetainedEarningsMember2024-06-300001000753us-gaap:CommonStockMember2022-12-310001000753us-gaap:AdditionalPaidInCapitalMember2022-12-310001000753us-gaap:TreasuryStockCommonMember2022-12-310001000753us-gaap:RetainedEarningsMember2022-12-310001000753us-gaap:CommonStockMember2023-01-012023-06-300001000753us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001000753us-gaap:TreasuryStockCommonMember2023-01-012023-06-300001000753us-gaap:RetainedEarningsMember2023-01-012023-06-300001000753us-gaap:CommonStockMember2023-06-300001000753us-gaap:AdditionalPaidInCapitalMember2023-06-300001000753us-gaap:TreasuryStockCommonMember2023-06-300001000753us-gaap:RetainedEarningsMember2023-06-3000010007532024-03-310001000753us-gaap:CommonStockMember2024-03-310001000753us-gaap:AdditionalPaidInCapitalMember2024-03-310001000753us-gaap:TreasuryStockCommonMember2024-03-310001000753us-gaap:RetainedEarningsMember2024-03-310001000753us-gaap:CommonStockMember2024-04-012024-06-300001000753us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001000753us-gaap:TreasuryStockCommonMember2024-04-012024-06-300001000753us-gaap:RetainedEarningsMember2024-04-012024-06-3000010007532023-03-310001000753us-gaap:CommonStockMember2023-03-310001000753us-gaap:AdditionalPaidInCapitalMember2023-03-310001000753us-gaap:TreasuryStockCommonMember2023-03-310001000753us-gaap:RetainedEarningsMember2023-03-310001000753us-gaap:CommonStockMember2023-04-012023-06-300001000753us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001000753us-gaap:TreasuryStockCommonMember2023-04-012023-06-300001000753us-gaap:RetainedEarningsMember2023-04-012023-06-3000010007532019-09-3000010007532019-10-010001000753nsp:NortheastMember2024-04-012024-06-300001000753nsp:NortheastMember2023-04-012023-06-300001000753nsp:NortheastMember2024-01-012024-06-300001000753nsp:NortheastMember2023-01-012023-06-300001000753nsp:SoutheastMember2024-04-012024-06-300001000753nsp:SoutheastMember2023-04-012023-06-300001000753nsp:SoutheastMember2024-01-012024-06-300001000753nsp:SoutheastMember2023-01-012023-06-300001000753nsp:CentralMember2024-04-012024-06-300001000753nsp:CentralMember2023-04-012023-06-300001000753nsp:CentralMember2024-01-012024-06-300001000753nsp:CentralMember2023-01-012023-06-300001000753nsp:SouthwestMember2024-04-012024-06-300001000753nsp:SouthwestMember2023-04-012023-06-300001000753nsp:SouthwestMember2024-01-012024-06-300001000753nsp:SouthwestMember2023-01-012023-06-300001000753nsp:WestMember2024-04-012024-06-300001000753nsp:WestMember2023-04-012023-06-300001000753nsp:WestMember2024-01-012024-06-300001000753nsp:WestMember2023-01-012023-06-300001000753nsp:OtherRevenuesMember2024-04-012024-06-300001000753nsp:OtherRevenuesMember2023-04-012023-06-300001000753nsp:OtherRevenuesMember2024-01-012024-06-300001000753nsp:OtherRevenuesMember2023-01-012023-06-300001000753us-gaap:CashAndCashEquivalentsMember2024-06-300001000753us-gaap:MoneyMarketFundsMember2024-06-300001000753us-gaap:CashAndCashEquivalentsMember2023-12-310001000753us-gaap:MoneyMarketFundsMember2023-12-310001000753us-gaap:FairValueInputsLevel12And3Member2024-06-300001000753us-gaap:FairValueInputsLevel1Member2024-06-300001000753us-gaap:FairValueInputsLevel2Member2024-06-300001000753us-gaap:FairValueInputsLevel12And3Member2023-12-310001000753us-gaap:FairValueInputsLevel1Member2023-12-310001000753us-gaap:FairValueInputsLevel2Member2023-12-310001000753us-gaap:USTreasurySecuritiesMember2024-06-300001000753us-gaap:USTreasurySecuritiesMember2023-12-310001000753srt:MinimumMember2024-06-300001000753srt:MaximumMember2024-06-300001000753us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MinimumMember2024-01-012024-06-300001000753us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MaximumMember2024-01-012024-06-300001000753srt:MinimumMemberus-gaap:BaseRateMember2024-01-012024-06-300001000753srt:MaximumMemberus-gaap:BaseRateMember2024-01-012024-06-3000010007532024-01-012024-03-3100010007532022-10-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| |

For the quarterly period ended June 30, 2024

| | | | | | | | |

| | |

| or |

| ☐ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | |

| For the transition period from _______________ to _______________ |

Commission File No. 1-13998

Insperity, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 76-0479645 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

| 19001 Crescent Springs Drive |

| Kingwood, | Texas | 77339 |

| (Address of principal executive offices) |

(Registrant’s Telephone Number, Including Area Code): (281) 358-8986

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | NSP | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Emerging growth company | ☐ |

| Smaller reporting company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

As of July 30, 2024, 37,538,464 shares of the registrant’s common stock, par value $0.01 per share, were outstanding.

| | | | | | | | |

| | Page |

| | |

| | |

| Part I, Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| Part I, Item 2. | | |

| Part I, Item 3. | | |

| Part I, Item 4. | | |

| Part II, Item 1. | | |

| Part II, Item 1A. | | |

| Part II, Item 2. | | |

| Part II, Item 5. | | |

| Part II, Item 6. | | |

| | |

| FORWARD LOOKING STATEMENTS |

The statements contained herein that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. You can identify such forward-looking statements by the words “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “likely,” “possibly,” “probably,” “could,” “goal,” “opportunity,” “objective,” “target,” “assume,” “outlook,” “guidance,” “predicts,” “appears,” “indicator” and similar expressions. Forward-looking statements involve a number of risks and uncertainties. In the normal course of business, in an effort to help keep our stockholders and the public informed about our operations, from time to time, we may issue such forward-looking statements, either orally or in writing. Generally, these statements relate to business plans or strategies; including our strategic partnership with Workday, Inc.; projected or anticipated benefits or other consequences of such plans or strategies; or projections involving anticipated revenues, earnings, average number of worksite employees (“WSEEs”), benefits and workers’ compensation costs, or other operating results. We base these forward-looking statements on our current expectations, estimates and projections. We caution you that these statements are not guarantees of future performance and involve risks, uncertainties and assumptions that we cannot predict. In addition, we have based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Therefore, the actual results of the future events described in such forward-looking statements could differ materially from those stated in such forward-looking statements. Among the factors that could cause actual results to differ materially are:

•adverse economic conditions;

•failure to comply with or meet client expectations regarding certain COVID-19 relief programs;

•bank failures or other events affecting financial institutions; labor shortages, increasing competition for highly skilled workers, and evolving employee expectations regarding the workplace;

•impact of inflation;

•vulnerability to regional economic factors because of our geographic market concentration;

•failure to comply with covenants under our credit facility;

•impact of a future outbreak of highly infectious or contagious disease;

•our liability for WSEE payroll, payroll taxes and benefits costs, or other liabilities associated with actions of our client companies or WSEEs, including if our clients fail to pay us;

•increases in health insurance costs and workers’ compensation rates and underlying claims trends, health care reform, financial solvency of workers’ compensation carriers, other insurers or financial institutions, state unemployment tax rates, liabilities for employee and client actions or payroll-related claims;

•an adverse determination regarding our status as the employer of our WSEEs for tax and benefit purposes and an inability to offer alternative benefit plans following such a determination;

•cancellation of client contracts on short notice, or the inability to renew client contracts or attract new clients;

•the ability to secure competitive replacement contracts for health insurance and workers’ compensation insurance at expiration of current contracts;

•regulatory and tax developments and possible adverse application of various federal, state and local regulations;

•failure to manage growth of our operations and the effectiveness of our sales and marketing efforts;

•the impact of the competitive environment and other developments in the human resources services industry, including the professional employer organization (or PEO) industry, on our growth and/or profitability;

•an adverse final judgment or settlement of claims against Insperity;

•disruptions of our information technology systems or failure to enhance our service and technology offerings to address new regulations or client expectations;

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 4 |

| | |

| FORWARD LOOKING STATEMENTS |

•our liability or damage to our reputation relating to disclosure of sensitive or private information as a result of data theft, cyberattacks or security vulnerabilities;

•failure of third-party providers, such as financial institutions, data centers or cloud service providers;

•our ability to fully realize the anticipated benefits of our strategic partnership and plans to develop a joint solution with Workday, Inc.; and

•our ability to integrate or realize expected returns on future product offerings, including through acquisitions, strategic partnerships, and investments.

These factors are discussed in further detail in our Annual Report on Form 10-K for the year ended December 31, 2023 under “Item 1A. Risk Factors” in Part I and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, and elsewhere in this report. Any of these factors, or a combination of such factors, could materially affect the results of our operations and whether forward-looking statements we make ultimately prove to be accurate.

Any forward-looking statements are made only as of the date hereof and, unless otherwise required by applicable securities laws, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 5 |

| | |

FINANCIAL STATEMENTS

(Unaudited) |

PART I

Item 1. Financial Statements

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | |

(in millions) | June 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Cash and cash equivalents | $ | 676 | | | $ | 693 | |

| Restricted cash | 64 | | | 57 | |

| Marketable securities | 16 | | | 16 | |

| Accounts receivable, net | 740 | | | 694 | |

| Prepaid insurance and related assets | 34 | | | 7 | |

| | | |

| | | |

Funds held for clients and other current assets | 91 | | | 128 | |

| Total current assets | 1,621 | | | 1,595 | |

| Property and equipment, net of accumulated depreciation | 186 | | | 197 | |

| Right-of-use (“ROU”) leased assets | 55 | | | 57 | |

| Prepaid health insurance | 9 | | | 9 | |

| Deposits – health insurance | 8 | | | 8 | |

| Deposits – workers’ compensation | 170 | | | 198 | |

| Goodwill and other intangible assets, net | 13 | | | 13 | |

| Deferred income taxes, net | 15 | | | 20 | |

| Other assets | 18 | | | 23 | |

| Total assets | $ | 2,095 | | | $ | 2,120 | |

| Liabilities and stockholders' equity | | | |

| Accounts payable | $ | 7 | | | $ | 11 | |

| Payroll taxes and other payroll deductions payable | 504 | | | 566 | |

| Accrued worksite employee payroll costs | 627 | | | 559 | |

| Accrued health insurance costs | 42 | | | 46 | |

| Accrued workers’ compensation costs | 67 | | | 60 | |

| Accrued corporate payroll and commissions | 59 | | | 64 | |

| Income taxes payable | 5 | | | 3 | |

Client funds liability and other accrued liabilities | 72 | | | 127 | |

| Total current liabilities | 1,383 | | | 1,436 | |

| Accrued workers’ compensation costs, net of current | 146 | | | 163 | |

| Long-term debt | 369 | | | 369 | |

| Operating lease liabilities, net of current | 55 | | | 58 | |

| | | |

| | | |

| Total noncurrent liabilities | 570 | | | 590 | |

| Commitments and contingencies | | | | | |

| Common stock | 1 | | | 1 | |

| Additional paid-in capital | 191 | | | 185 | |

| Treasury stock, at cost | (838) | | | (831) | |

| Retained earnings | 788 | | | 739 | |

| Total stockholders' equity | 142 | | | 94 | |

| Total liabilities and stockholders’ equity | $ | 2,095 | | | $ | 2,120 | |

See accompanying notes.

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 6 |

| | |

FINANCIAL STATEMENTS

(Unaudited) |

CONSOLIDATED STATEMENTS OF INCOME

| | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

(in millions, except per share amounts) | 2024 | 2023 | | 2024 | 2023 |

| | | | | |

Revenues | $ | 1,605 | | $ | 1,585 | | | $ | 3,407 | | $ | 3,355 | |

Payroll taxes, benefits and workers’ compensation costs | 1,345 | | 1,360 | | | 2,802 | | 2,798 | |

| Gross profit | 260 | | 225 | | | 605 | | 557 | |

| Salaries, wages and payroll taxes | 126 | | 110 | | | 266 | | 235 | |

| Stock-based compensation | 20 | | 15 | | | 30 | | 26 | |

| Commissions | 11 | | 12 | | | 23 | | 23 | |

| Advertising | 12 | | 17 | | | 19 | | 23 | |

| General and administrative expenses | 57 | | 44 | | | 114 | | 92 | |

| Depreciation and amortization | 11 | | 11 | | | 22 | | 21 | |

| Total operating expenses | 237 | | 209 | | | 474 | | 420 | |

| Operating income | 23 | | 16 | | | 131 | | 137 | |

| Other income (expense): | | | | | |

| Interest income | 9 | | 7 | | | 19 | | 16 | |

| Interest expense | (7) | | (7) | | | (14) | | (13) | |

| Income before income tax expense | 25 | | 16 | | | 136 | | 140 | |

| Income tax expense | 7 | | 4 | | | 39 | | 33 | |

| Net income | $ | 18 | | $ | 12 | | | $ | 97 | | $ | 107 | |

| | | | | |

| Net income per share of common stock | | | | | |

| Basic | $ | 0.48 | | $ | 0.34 | | | $ | 2.58 | | $ | 2.82 | |

| Diluted | $ | 0.48 | | $ | 0.33 | | | $ | 2.56 | | $ | 2.78 | |

See accompanying notes.

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 7 |

| | |

FINANCIAL STATEMENTS

(Unaudited) |

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | | | | | |

| Six Months Ended June 30, |

(in millions) | 2024 | 2023 |

| | |

| Cash flows from operating activities | | |

| Net income | $ | 97 | | $ | 107 | |

| Adjustments to reconcile net income to net cash provided by operating activities: |

| Depreciation and amortization | 22 | | 21 | |

| Stock-based compensation | 30 | | 26 | |

| Deferred income taxes | 5 | | 5 | |

| Changes in operating assets and liabilities: | | |

| Accounts receivable | (46) | | 18 | |

| Prepaid insurance and related assets | (27) | | (11) | |

| Other current assets | (11) | | — | |

| Other assets and ROU assets | 11 | | 1 | |

| Accounts payable | (4) | | (1) | |

| Payroll taxes and other payroll deductions payable | (62) | | (154) | |

| Accrued worksite employee payroll costs | 68 | | 11 | |

| Accrued health insurance costs | (4) | | (19) | |

| Accrued workers’ compensation costs | (10) | | (2) | |

| Accrued corporate payroll, commissions and other accrued liabilities | (20) | | (53) | |

| Income taxes payable/receivable | 2 | | (19) | |

| Total adjustments | (46) | | (177) | |

| Net cash provided by (used in) operating activities | 51 | | (70) | |

| | |

| Cash flows from investing activities | | |

| Marketable securities: | | |

| Purchases | (12) | | (32) | |

| Proceeds from maturities | 12 | | 22 | |

| Proceeds from dispositions | — | | 8 | |

| Property and equipment purchases | (11) | | (14) | |

| Net cash used in investing activities | (11) | | (16) | |

| | |

| Cash flows from financing activities | | |

| Purchase of treasury stock | (37) | | (45) | |

| Dividends paid | (44) | | (42) | |

Client funds liability and other | (46) | | 2 | |

| Net cash used in financing activities | (127) | | (85) | |

| Net decrease in cash, cash equivalents, restricted cash and funds held for clients | (87) | | (171) | |

| Cash, cash equivalents, restricted cash and funds held for clients beginning of period | 1,035 | | 1,014 | |

| Cash, cash equivalents, restricted cash and funds held for clients end of period | $ | 948 | | $ | 843 | |

| | | | | | | | |

| Supplemental cash flow information: | | |

| ROU assets obtained in exchange for lease obligations | $ | 7 | | $ | 5 | |

| | |

See accompanying notes.

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 8 |

| | |

FINANCIAL STATEMENTS

(Unaudited) |

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

For the Six Months Ended June 30, 2024 and 2023

| | | | | | | | | | | | | | | | | | | | |

| Common Stock Issued | Additional Paid-In Capital | Treasury Stock | Retained Earnings and AOCI | Total |

| (in millions) | Shares | Amount |

| | | | | | |

| Balance at December 31, 2023 | 55 | | $ | 1 | | $ | 185 | | $ | (831) | | $ | 739 | | $ | 94 | |

| Purchase of treasury stock, at cost | — | | — | | — | | (37) | | — | | (37) | |

| Issuance of equity-based incentive awards and dividend equivalents | — | | — | | (24) | | 28 | | (4) | | — | |

| Stock-based compensation expense | — | | — | | 29 | | 1 | | — | | 30 | |

| Other | — | | — | | 1 | | 1 | | — | | 2 | |

| Dividends paid | — | | — | | — | | — | | (44) | | (44) | |

| | | | | | |

| Net income | — | | — | | — | | — | | 97 | | 97 | |

| Balance at June 30, 2024 | 55 | | $ | 1 | | $ | 191 | | $ | (838) | | $ | 788 | | $ | 142 | |

| | | | | | |

| Balance at December 31, 2022 | 55 | | $ | 1 | | $ | 151 | | $ | (726) | | $ | 655 | | $ | 81 | |

| Purchase of treasury stock, at cost | — | | — | | — | | (45) | | — | | (45) | |

| Issuance of equity-based incentive awards and dividend equivalents | — | | — | | (21) | | 25 | | (4) | | — | |

| Stock-based compensation expense | — | | — | | 26 | | — | | — | | 26 | |

| Other | — | | — | | 2 | | 1 | | 1 | | 4 | |

| Dividends paid | — | | — | | — | | — | | (42) | | (42) | |

| | | | | | |

| Net income | — | | — | | — | | — | | 107 | | 107 | |

| Balance at June 30, 2023 | 55 | | $ | 1 | | $ | 158 | | $ | (745) | | $ | 717 | | $ | 131 | |

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 9 |

| | |

FINANCIAL STATEMENTS

(Unaudited) |

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (Continued)

For the Three Months Ended June 30, 2024 and 2023

| | | | | | | | | | | | | | | | | | | | |

| Common Stock Issued | Additional Paid-In Capital | Treasury Stock | Retained Earnings and AOCI | Total |

(in millions) | Shares | Amount |

| | | | | | |

| Balance at March 31, 2024 | 55 | | $ | 1 | | $ | 172 | | $ | (826) | | $ | 793 | | $ | 140 | |

| Purchase of treasury stock, at cost | — | | — | | — | | (14) | | — | | (14) | |

| Issuance of equity-based incentive awards and dividend equivalents | — | | — | | — | | — | | — | | — | |

| Stock-based compensation expense | — | | — | | 19 | | 1 | | — | | 20 | |

| Other | — | | — | | — | | 1 | | — | | 1 | |

| Dividends paid | — | | — | | — | | — | | (23) | | (23) | |

| | | | | | |

| Net income | — | | — | | — | | — | | 18 | | 18 | |

| Balance at June 30, 2024 | 55 | | $ | 1 | | $ | 191 | | $ | (838) | | $ | 788 | | $ | 142 | |

| | | | | | |

| Balance at March 31, 2023 | 55 | | $ | 1 | | $ | 142 | | $ | (735) | | $ | 725 | | $ | 133 | |

| Purchase of treasury stock, at cost | — | | — | | — | | (10) | | — | | (10) | |

| Issuance of equity-based incentive awards and dividend equivalents | — | | — | | — | | (1) | | 1 | | — | |

| Stock-based compensation expense | — | | — | | 15 | | — | | — | | 15 | |

| Other | — | | — | | 1 | | 1 | | 1 | | 3 | |

| Dividends paid | — | | — | | — | | — | | (22) | | (22) | |

| | | | | | |

| Net income | — | | — | | — | | — | | 12 | | 12 | |

| Balance at June 30, 2023 | 55 | | $ | 1 | | $ | 158 | | $ | (745) | | $ | 717 | | $ | 131 | |

See accompanying notes.

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 10 |

| | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

|

Insperity, Inc., a Delaware corporation (“Insperity,” “we,” “our,” and “us”), provides an array of human resources (“HR”) and business solutions designed to help improve business performance. Our most comprehensive HR services offerings are provided through our professional employer organization (“PEO”) services, known as our Workforce Optimization® and Workforce SynchronizationTM solutions (together, our “PEO HR Outsourcing Solutions”), which we provide by entering into a co-employment relationship with our clients. Our PEO HR Outsourcing Solutions encompass a broad range of HR functions, including payroll and employment administration, employee benefits, workers’ compensation, government compliance, performance management, and training and development services, along with our cloud-based human capital management solution, the Insperity PremierTM platform.

In addition to our PEO HR Outsourcing Solutions, we offer a comprehensive traditional payroll and human capital management solution, known as our Workforce AccelerationTM solution (our “Traditional Payroll Solution”). We also offer a number of other business performance solutions, including Recruiting Services, Employment Screening, Retirement Services, and Insurance Services. These other products or services are offered separately or with our other solutions.

The Consolidated Financial Statements include the accounts of Insperity, Inc. and its wholly owned subsidiaries. Intercompany accounts and transactions have been eliminated in consolidation.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States (“GAAP”) requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

The accompanying Consolidated Financial Statements should be read in conjunction with our audited Consolidated Financial Statements at and for the year ended December 31, 2023. Our Condensed Consolidated Balance Sheet at December 31, 2023 has been derived from the audited financial statements at that date, but does not include all of the information or footnotes required by GAAP for complete financial statements. Our Condensed Consolidated Balance Sheet at June 30, 2024 and our Consolidated Statements of Income for the three and six month periods ended June 30, 2024 and 2023, our Consolidated Statements of Cash Flows for the six month periods ended June 30, 2024 and 2023 and our Consolidated Statements of Stockholders' Equity for the three and six month periods ended June 30, 2024 and 2023, have been prepared by us without audit. In the opinion of management, all adjustments necessary to present fairly the consolidated financial position, results of operations and cash flows have been made, and all such adjustments are of a normal recurring nature.

The results of operations for the interim periods are not necessarily indicative of the operating results for a full year or of future operations.

Health Insurance Costs

We provide group health insurance coverage under a single-employer plan that covers both our WSEEs in our PEO HR Outsourcing Solutions and our corporate employees and utilizes a national network of carriers, including UnitedHealthcare (“United”), UnitedHealthcare of California, Kaiser Permanente, Blue Shield of California, HMSA BlueCross BlueShield of Hawaii, and Harvard Pilgrim Health Care, formerly known as Tufts, all of which provide fully insured policies or service contracts.

Approximately 87% of our costs related to health insurance coverage are provided under our policy with United. While the policy with United is a fully insured plan, as a result of certain contractual terms, we have accounted for this plan since its inception using a partially self-funded insurance accounting model. Effective January 1, 2020, under the amended agreement with United, we no longer have financial responsibilities for a participant’s annual claim costs that exceed $1 million (“Individual Claims Limit”). Accordingly, we record the cost of the United plan, including an estimate of the incurred claims, taxes and administrative fees (collectively the “Plan Costs”), as benefits expense, which is a component of direct costs, in our Consolidated Statements of Income. The estimated incurred but not reported claims are based upon: (1) the level of claims processed during each quarter; (2) estimated completion rates based upon recent claim development

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 11 |

| | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

|

patterns under the plan; and (3) the number of participants in the plan, including both active and COBRA enrollees. Each reporting period, changes in the estimated ultimate costs resulting from claim trends, plan design and migration, participant demographics, and other factors are incorporated into the benefits costs, which requires a significant level of judgment.

Additionally, since the plan’s inception, under the terms of the contract, United establishes cash funding rates 90 days in advance of the beginning of a reporting quarter. If the Plan Costs for a reporting quarter are greater than the premiums paid and owed to United, a deficit in the plan would be incurred and a liability for the excess costs would be accrued in our Condensed Consolidated Balance Sheets. On the other hand, if the Plan Costs for the reporting quarter are less than the premiums paid and owed to United, a surplus in the plan would be incurred and we would record an asset for the excess premiums in our Condensed Consolidated Balance Sheets. The terms of the arrangement require us to maintain an accumulated cash surplus in the plan of $9 million, which is reported as long-term prepaid health insurance. In addition, United requires a deposit equal to approximately one day of claims funding activity, which was $7 million at June 30, 2024, and is included in deposits - health insurance as a long-term asset on our Condensed Consolidated Balance Sheets. As of June 30, 2024, Plan Costs were less than the net premiums paid and owed to United by $27 million. As this amount is in excess of the agreed-upon $9 million surplus maintenance level, the $18 million difference is included in prepaid insurance, a current asset, in our Condensed Consolidated Balance Sheets. The premiums, including the additional quarterly premiums, owed to United at June 30, 2024 were $35 million, which is included in accrued health insurance costs, a current liability in our Condensed Consolidated Balance Sheets. Our benefits costs incurred in the first six months of 2024 included a decrease of $26 million for changes in estimated run-off related to prior periods, net of Individual Claims Limit. Our benefits costs incurred in the first six months of 2023 included a decrease of $10 million for changes in estimated run-off related to prior periods, net of Individual Claims Limit.

Workers’ Compensation Costs

Our workers’ compensation coverage for our WSEEs in our PEO HR Outsourcing Solutions has been provided through an arrangement with the Chubb Group of Insurance Companies or its predecessors (the “Chubb Program”) since 2007. The Chubb Program is fully insured in that Chubb has the responsibility to pay all claims incurred under the policy regardless of whether we satisfy our responsibilities. Under the Chubb Program, for claims incurred on or before September 30, 2019, we have financial responsibility to Chubb for the first $1 million layer of claims per occurrence and, for claims over $1 million, up to a maximum aggregate amount of $6 million per policy year for claims that exceed $1 million. Chubb bears the financial responsibility for all claims in excess of these levels. Effective for claims incurred on or after October 1, 2019, we have financial responsibility to Chubb for the first $1.5 million layer of claims per occurrence and, for claims over $1.5 million, up to a maximum aggregate amount of $6 million per policy year for claims that exceed $1.5 million.

Because we bear the financial responsibility for claims up to the levels noted above, such claims, which are the primary component of our workers’ compensation costs, are recorded in the period incurred. Workers’ compensation insurance includes ongoing health care and indemnity coverage whereby claims are paid over numerous years following the date of injury. Accordingly, the accrual of related incurred costs in each reporting period includes estimates, which take into account the ongoing development of claims and therefore requires a significant level of judgment.

We utilize a third-party actuary to estimate our loss development rate, which is primarily based upon the nature of WSEEs’ job responsibilities, the location of WSEEs, the historical frequency and severity of workers’ compensation claims, and an estimate of future cost trends. Each reporting period, changes in the actuarial assumptions resulting from changes in actual claims experience and other trends are incorporated into our workers’ compensation claims cost estimates. During the six months ended June 30, 2024 and 2023, we reduced accrued workers’ compensation costs by $17 million and $15 million, respectively, for changes in estimated losses related to prior periods. Workers’ compensation cost estimates are discounted to present value at a rate based upon the U.S. Treasury rates that correspond with the weighted average estimated claim payout period (the average discount rate utilized in the 2024 period was 4.5% and in the 2023 period was 4.0%) and are accreted over the estimated claim payment period and included as a component of direct costs in our Consolidated Statements of Income.

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 12 |

| | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

|

The following table provides the activity and balances related to incurred but not paid workers’ compensation claims:

| | | | | | | | | | | |

| Six Months Ended June 30, |

(in millions) | 2024 | | 2023 |

| | | |

| Beginning balance, January 1, | $ | 220 | | | $ | 229 | |

| Accrued claims | 31 | | | 31 | |

| Present value discount, net of accretion | (7) | | | (6) | |

| Paid claims | (33) | | | (26) | |

| Ending balance | $ | 211 | | | $ | 228 | |

| | | |

| Current portion of accrued claims | $ | 65 | | | $ | 48 | |

| Long-term portion of accrued claims | 146 | | | 180 | |

| Total accrued claims | $ | 211 | | | $ | 228 | |

The current portion of accrued workers’ compensation costs on our Condensed Consolidated Balance Sheets at June 30, 2024 and 2023 includes $2 million and $3 million, respectively, of workers’ compensation administrative fees.

The undiscounted accrued workers’ compensation costs were $244 million as of June 30, 2024 and $253 million as of June 30, 2023.

At the beginning of each policy period, the workers’ compensation insurance carrier establishes monthly funding requirements comprised of premium costs and funds to be set aside for payment of future claims (“claim funds”). The level of claim funds is primarily based upon anticipated WSEE payroll levels and expected workers’ compensation loss rates, as determined by the insurance carrier. Monies funded into the program for incurred claims expected to be paid within one year are recorded as restricted cash, a short-term asset, while the remainder of claim funds are included in deposits – workers’ compensation, a long-term asset in our Condensed Consolidated Balance Sheets. At June 30, 2024, we had restricted cash of $64 million and deposits – workers’ compensation of $170 million.

Our estimate of incurred claim costs expected to be paid within one year is included in short-term liabilities, while our estimate of incurred claim costs expected to be paid beyond one year is included in long-term liabilities on our Condensed Consolidated Balance Sheets.

Revenues

We enter into contracts with our customers for human resources services based on a stated rate and price in the contract. Our contracts generally establish pricing for a period of 12 months and are generally cancellable at any time by either party with 30-days’ notice. Our performance obligations are satisfied as services are rendered each month. The term between invoicing and when our performance obligations are satisfied is not significant. Our payment terms typically require payment concurrently with the invoicing of our PEO services. We do not have significant financing components or significant payment terms.

Our revenue is generally recognized ratably over the payroll period as WSEEs perform their service at the client worksite in accordance with Accounting Standards Codification (“ASC”) 606, Revenue from Contracts with Customers. Customers are invoiced concurrently with each periodic payroll of its WSEEs. Revenues that have been recognized but not invoiced represent unbilled accounts receivable of $727 million and $669 million at June 30, 2024 and December 31, 2023, respectively, and are included in accounts receivable, net on our Condensed Consolidated Balance Sheets.

Pursuant to the “practical expedients” provided under ASC 340-40, Other Assets and Deferred Costs - Contracts with Customers, we expense sales commissions when incurred because the terms of our contracts are cancellable by either party with a 30-day notice. These costs are recorded in commissions in our Consolidated Statements of Income.

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 13 |

| | |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

Our revenue for our PEO HR Outsourcing Solutions by geographic region and for our other products and services offerings are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| (in millions) | 2024 | 2023 | % Change | | 2024 | 2023 | % Change |

| | | | | | | |

| Northeast | $ | 437 | | $ | 426 | | 3 | % | | $ | 946 | | $ | 918 | | 3 | % |

| Southeast | 225 | | 221 | | 2 | % | | 471 | | 460 | | 2 | % |

| Central | 292 | | 285 | | 2 | % | | 616 | | 604 | | 2 | % |

| Southwest | 304 | | 308 | | (1) | % | | 644 | | 648 | | (1) | % |

| West | 329 | | 330 | | — | % | | 695 | | 693 | | — | % |

| 1,587 | | 1,570 | | 1 | % | | 3,372 | | 3,323 | | 1 | % |

| Other revenue | 18 | | 15 | | 20 | % | | 35 | | 32 | | 9 | % |

| Total revenue | $ | 1,605 | | $ | 1,585 | | 1 | % | | $ | 3,407 | | $ | 3,355 | | 2 | % |

Our PEO HR Outsourcing Solutions revenues are primarily derived from our gross billings, which are based on (1) the payroll cost of our WSEEs; and (2) a markup computed as a percentage of the payroll cost. The gross billings are invoiced concurrently with each periodic payroll of our WSEEs. Revenues, which exclude the payroll cost component of gross billings and therefore consist solely of the markup, are recognized ratably over the payroll period as WSEEs perform their service at the client worksite.

In determining the pricing of the markup component of our gross billings, we take into consideration our estimates of the costs directly associated with our WSEEs, including payroll taxes, benefits and workers’ compensation costs, plus an acceptable gross profit margin. As a result, our operating results are significantly impacted by our ability to accurately estimate our direct costs relative to the revenues derived from the markup component of our gross billings.

Revenues are comprised of gross billings less WSEE payroll costs as follows:

| | | | | | | | | | | | | | |

| Three Months Ended June 30, | Six Months Ended June 30, |

| (in millions) | 2024 | 2023 | 2024 | 2023 |

| | | | |

| Gross billings | $ | 10,361 | | $ | 10,245 | | $ | 21,844 | | $ | 21,696 | |

| Less: WSEE payroll cost | 8,756 | | 8,660 | | 18,437 | | 18,341 | |

| Revenues | $ | 1,605 | | $ | 1,585 | | $ | 3,407 | | $ | 3,355 | |

| | | | | |

| 3. | Other Balance Sheet Information |

Cash, Cash Equivalents and Marketable Securities

The following table summarizes our cash and investments in cash equivalents and marketable securities held by investment managers and overnight investments:

| | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

(in millions) | Cash & Cash Equivalents | Marketable Securities | Total | | Cash & Cash Equivalents | Marketable Securities | Total |

| | | | | | | |

| Overnight holdings | $ | 520 | | $ | — | | $ | 520 | | | $ | 611 | | $ | — | | $ | 611 | |

| Investment holdings | 158 | | 16 | | 174 | | | 119 | | 16 | | 135 | |

| 678 | | 16 | | 694 | | | 730 | | 16 | | 746 | |

| Cash in demand accounts | 14 | | — | | 14 | | | 27 | | — | | 27 | |

| Outstanding checks | (16) | | — | | (16) | | | (64) | | — | | (64) | |

| Total | $ | 676 | | $ | 16 | | $ | 692 | | | $ | 693 | | $ | 16 | | $ | 709 | |

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 14 |

| | |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

Our cash and overnight holdings fluctuate based on the timing of clients’ payroll processing cycles. Our cash, cash equivalents and marketable securities at June 30, 2024 and December 31, 2023 included $459 million and $510 million, respectively, of funds associated with federal and state income tax withholdings, employment taxes, and other payroll deductions, as well as $22 million and $28 million, respectively, in client prepayments. At June 30, 2024, our cash, cash equivalents and marketable securities included $97 million of funds we received in late June 2024 from the Internal Revenue Service related to employee retention tax credits claimed by our PEO clients under the COVID relief programs, that were distributed to clients in early July 2024.

Cash, Cash Equivalents, Restricted Cash and Funds Held for Clients

The following table summarizes our cash, cash equivalents, restricted cash, funds held for clients, and deposits - workers’ compensation as reported in our Consolidated Statements of Cash Flows:

| | | | | | | | | | | |

| Six Months Ended June 30, |

(in millions) | 2024 | | 2023 |

| | | |

| Supplemental schedule of cash and cash equivalents, restricted cash and funds held for clients | | | |

| Cash and cash equivalents | $ | 693 | | | $ | 733 | |

| Restricted cash | 57 | | | 50 | |

Other current assets – funds held for clients(1) | 87 | | | 35 | |

| Deposits – workers’ compensation | 198 | | | 196 | |

| Cash, cash equivalents, restricted cash and funds held for clients beginning of period | $ | 1,035 | | | $ | 1,014 | |

| | | |

| Cash and cash equivalents | $ | 676 | | | $ | 580 | |

| Restricted cash | 64 | | | 48 | |

Other current assets – funds held for clients(1) | 38 | | | 34 | |

| Deposits – workers’ compensation | 170 | | | 181 | |

| Cash, cash equivalents, restricted cash and funds held for clients end of period | $ | 948 | | | $ | 843 | |

____________________________________(1)Funds held for clients represent amounts held on behalf of our Traditional Payroll Solution customers that are restricted for the purpose of satisfying obligations to remit funds to clients’ employees and various tax authorities.

Please read Note 2. “Accounting Policies,” for a discussion of our accounting policies for deposits – workers’ compensation and restricted cash. Payroll Taxes and Other Payroll Deductions Payable

As a co-employer, we generally assume responsibility for the withholding and remittance of federal and state payroll taxes and other payroll deductions with respect to wages and salaries paid to our WSEEs. As of June 30, 2024 and December 31, 2023, payroll taxes and other payroll deductions payable were $504 million and $566 million, respectively. The balance at June 30, 2024 includes $97 million of funds we received in late June 2024 from the Internal Revenue Service related to employee retention tax credits claimed by our PEO clients under the COVID relief programs, that were distributed to clients in early July 2024.

| | | | | |

| 4. | Fair Value Measurements |

We account for our financial assets in accordance with ASC 820, Fair Value Measurement. This standard defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. The fair value measurement disclosures are grouped into three levels based on valuation factors:

•Level 1 - quoted prices in active markets using identical assets

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 15 |

| | |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

•Level 2 - significant other observable inputs, such as quoted prices for similar assets or liabilities, quoted prices in markets that are not active, or other observable inputs

•Level 3 - significant unobservable inputs

Fair Value of Instruments Measured and Recognized at Fair Value

The following table summarizes the levels of fair value measurements of our financial assets:

| | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

(in millions) | Total | Level 1 | Level 2 | | Total | Level 1 | Level 2 |

| | | | | | | |

| Money market funds | $ | 678 | | $ | 678 | | $ | — | | | $ | 730 | | $ | 730 | | $ | — | |

| U.S. Treasury bills | 16 | | 16 | | — | | | 16 | | 16 | | — | |

| | | | | | | |

| 694 | | 694 | | — | | | 746 | | 746 | | — | |

Deposits - money market funds | 59 | | 59 | | — | | | 22 | | 22 | | — | |

Total | $ | 753 | | $ | 753 | | $ | — | | | $ | 768 | | $ | 768 | | $ | — | |

Our valuation techniques used to measure fair value for these securities during the period consisted primarily of third-party pricing services that utilized actual market data such as trades of comparable bond issues, broker/dealer quotations for the same or similar investments in active markets and other observable inputs.

The following is a summary of our available-for-sale marketable securities:

| | | | | | | | | | | | | | |

(in millions) | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Estimated Fair Value |

| | | | |

| June 30, 2024 | | | | |

| U.S. Treasury bills | $ | 16 | | $ | — | | $ | — | | $ | 16 | |

| | | | |

| | | | |

| December 31, 2023 | | | | |

| U.S. Treasury bills | $ | 16 | | $ | — | | $ | — | | $ | 16 | |

| | | | |

As of June 30, 2024, the contractual maturities of all marketable securities in our portfolio were less than one year.

Fair Value of Other Financial Instruments

The carrying amounts of cash, cash equivalents, restricted cash, accounts receivable, deposits and accounts payable approximate their fair values due to the short-term maturities of these instruments.

As of June 30, 2024, the carrying value of borrowings under our revolving credit facility approximates fair value and was classified as Level 2 in the fair value hierarchy. Please read Note 5, “Long-Term Debt,” for additional information. We have a revolving credit facility (the “Facility”) with a borrowing capacity of up to $650 million. The Facility may be further increased to $700 million based on the terms and subject to the conditions set forth in the agreement relating to the Facility (as amended, the “Credit Agreement”). The Facility is available for working capital and general corporate purposes, including acquisitions, stock repurchases and issuances of letters of credit. Our obligations under the Facility are secured by 100% of the stock of our captive insurance subsidiary and are guaranteed by all of our subsidiaries other than our captive insurance subsidiary and certain other excluded subsidiaries. At June 30, 2024, our outstanding balance on the Facility was $369 million, and we had an outstanding $1 million letter of credit issued under the Facility, resulting in an available borrowing capacity of $280 million.

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 16 |

| | |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

The Facility matures on June 30, 2027. Borrowings under the Facility bear interest at an annual rate equal to an alternate base rate or Adjusted Term SOFR for term SOFR loans, in either case plus an applicable margin. Adjusted Term SOFR is a forward-looking term rate based on the secured overnight financing rate plus a spread adjustment, which ranges from 0.10% to 0.25% depending on the interest period and type of loan. Depending on our leverage ratio, the applicable margin varies (1) in the case of SOFR loans, from 1.50% to 2.25% and (2) in the case of alternate base rate loans, from 0.00% to 0.50%. The alternate base rate is the highest of (1) the prime rate most recently published in The Wall Street Journal, (2) the federal funds rate plus 0.50%; and (3) the Adjusted Term SOFR rate plus 2.00%. We also pay an unused commitment fee on the average daily unused portion of the Facility at a rate of 0.25% per year. The average interest rate for the six month period ended June 30, 2024 was 7.2%. Interest expense and unused commitment fees are recorded in other income (expense).

The Facility contains both affirmative and negative covenants that we believe are customary for arrangements of this nature. Covenants include, but are not limited to, limitations on our ability to incur additional indebtedness, sell material assets, retire, redeem or otherwise reacquire our capital stock, acquire the capital stock or assets of another business, make investments and pay dividends. In addition, the Credit Agreement requires us to comply with financial covenants limiting our total funded debt, minimum interest coverage ratio, and maximum leverage ratio. We were in compliance with all financial covenants under the Credit Agreement at June 30, 2024.

During the six months ended June 30, 2024, we repurchased or withheld an aggregate of 383,790 shares of our common stock, as described below.

Repurchase Program

Our Board of Directors (the “Board”) has authorized a program to repurchase shares of our outstanding common stock (“Repurchase Program”). The purchases may be made from time to time in the open market or directly from stockholders at prevailing market prices based on market conditions and other factors. During the six months ended June 30, 2024, 203,744 shares were repurchased under the Repurchase Program. As of June 30, 2024, we were authorized to repurchase an additional 1,765,818 shares under the Repurchase Program.

Withheld Shares

During the six months ended June 30, 2024, we withheld 180,046 shares to satisfy tax withholding obligations for the vesting of long-term incentive and restricted stock unit awards.

Dividends

The Board declared and paid quarterly dividends as follows:

| | | | | | | | | | | |

| (amounts per share) | 2024 | | 2023 |

| | | |

| First quarter | $ | 0.57 | | | $ | 0.52 | |

| Second quarter | 0.60 | | | 0.57 | |

| | | |

| | | |

During the six months ended June 30, 2024 and 2023, we declared and paid dividends totaling $44 million and $42 million, respectively.

Basic EPS is computed by dividing net income by the weighted average number of common shares outstanding during the period. Diluted EPS is computed by dividing net income by the weighted average number of common shares outstanding during the period, plus the dilutive effect of time-vested and performance-based restricted stock units (“RSUs”).

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 17 |

| | |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

The following table summarizes the net income and the basic and diluted shares used in the earnings per share computations:

| | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (in millions) | 2024 | 2023 | | 2024 | 2023 |

| | | | | |

| Net income | $ | 18 | | $ | 12 | | | $ | 97 | | $ | 107 | |

| | | | | |

| Weighted average common shares outstanding | 38 | | 38 | | | 38 | | 38 | |

| Incremental shares from assumed time-vested and performance-based RSU awards | — | | 1 | | | — | | 1 | |

| Adjusted weighted average common shares outstanding | 38 | | 39 | | | 38 | | 39 | |

| | | | | |

| | | | | |

An insignificant number of shares of time-vested and performance-based RSU awards were excluded from the calculation of diluted earnings per share due to anti-dilution during each of the three and six month periods ended June 30, 2024 and 2023, respectively.

| | | | | |

| 8. | Commitments and Contingencies |

Litigation

We are a defendant in various lawsuits and claims arising in the normal course of business. Management believes it has valid defenses in these cases and is defending them vigorously. While the results of litigation cannot be predicted with certainty, management believes the final outcome of such litigation will not have a material adverse effect on our financial position or results of operations.

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 18 |

| | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2023, as well as our Consolidated Financial Statements and notes thereto included in this Quarterly Report on Form 10-Q.

Executive Summary

Overview

Insperity, Inc. (“Insperity,” “we,” “our,” and “us”) provides an array of human resources (“HR”) and business solutions designed to help improve business performance. Our most comprehensive HR services offerings are provided through our professional employer organization (“PEO”) services, known as our Workforce Optimization® and Workforce SynchronizationTM solutions (together, our “PEO HR Outsourcing Solutions”), which we provide by entering into a co-employment relationship with our clients. Our PEO HR Outsourcing Solutions encompass a broad range of HR functions, including payroll and employment administration, employee benefits, workers’ compensation, government compliance, performance management, and training and development services, along with our cloud-based human capital management solution, the Insperity PremierTM platform.

2024 Highlights

Second Quarter 2024 Compared to Second Quarter 2023

•Average number of WSEEs paid per month decreased 1%

•Net income and diluted earnings per share (“diluted EPS”) increased 50% and 45% to $18 million and $0.48, respectively

•Adjusted EPS increased 34% to $0.86

•Adjusted EBITDA increased 29% to $66 million

First Six Months 2024 Compared to First Six Months 2023

•Average number of WSEEs paid per month decreased 1%

•Net income and diluted EPS decreased 9% and 8% to $97 million and $2.56, respectively

•Adjusted EPS decreased 5% to $3.13

•Adjusted EBITDA increased 2% to $208 million

Please read “Non-GAAP Financial Measures” for a reconciliation of adjusted EBITDA and adjusted EPS to their most directly comparable financial measures calculated and presented in accordance with accounting principles generally accepted in the United States (“GAAP”). | | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 19 |

| | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Results of Operations

Key Financial and Statistical Data

| | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share, WSEE and statistical data) | Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | 2023 | % Change | | 2024 | 2023 | % Change |

| | | | | | | |

| Financial data: | | | | | | | |

Revenues | $ | 1,605 | | $ | 1,585 | | 1 | % | | $ | 3,407 | | $ | 3,355 | | 2 | % |

| Gross profit | 260 | | 225 | | 16 | % | | 605 | | 557 | | 9 | % |

| Operating expenses | 237 | | 209 | | 13 | % | | 474 | | 420 | | 13 | % |

| Operating income | 23 | | 16 | | 44 | % | | 131 | | 137 | | (4) | % |

| Other income (expense), net | 2 | | — | | — | % | | 5 | | 3 | | 67 | % |

| Net income | 18 | | 12 | | 50 | % | | 97 | | 107 | | (9) | % |

Diluted EPS | 0.48 | | 0.33 | | 45 | % | | 2.56 | | 2.78 | | (8) | % |

| | | | | | | |

Non-GAAP financial measures(1): | | | | | | |

| Adjusted net income | $ | 33 | | $ | 25 | | 32 | % | | $ | 119 | | $ | 128 | | (7) | % |

| Adjusted EBITDA | 66 | | 51 | | 29 | % | | 208 | | 203 | | 2 | % |

Adjusted EPS | 0.86 | | 0.64 | | 34 | % | | 3.13 | | 3.30 | | (5) | % |

| | | | | | | |

| Average WSEEs paid | 306,958 | | 311,304 | | (1) | % | | 305,431 | | 308,998 | | (1) | % |

| | | | | | | |

Statistical data (per WSEE per month): | | | | | | |

Revenues(2) | $ | 1,743 | | $ | 1,697 | | 3 | % | | $ | 1,859 | | $ | 1,809 | | 3 | % |

| Gross profit | 282 | | 241 | | 17 | % | | 330 | | 300 | | 10 | % |

Operating expenses | 257 | | 224 | | 15 | % | | 259 | | 226 | | 15 | % |

Operating income | 25 | | 17 | | 47 | % | | 71 | | 74 | | (4) | % |

| Net income | 20 | | 14 | | 43 | % | | 53 | | 58 | | (9) | % |

____________________________________

(1)Please read “Non-GAAP Financial Measures” for a reconciliation of the non-GAAP financial measures to their most directly comparable financial measures calculated and presented in accordance with GAAP. (2)Revenues per WSEE per month are comprised of gross billings per WSEE per month less WSEE payroll costs per WSEE per month as follows:

| | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| (per WSEE per month) | 2024 | 2023 | | 2024 | 2023 |

| Gross billings | $ | 11,251 | | $ | 10,969 | | | $ | 11,920 | | $ | 11,702 | |

| Less: WSEE payroll cost | 9,508 | | 9,272 | | | 10,061 | | 9,893 | |

| Revenues | $ | 1,743 | | $ | 1,697 | | | $ | 1,859 | | $ | 1,809 | |

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 20 |

| | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Key Operating Metrics

We monitor certain key metrics to measure our performance, including:

•WSEEs

•Adjusted EBITDA

•Adjusted EPS

Our growth in the number of WSEEs paid is affected by three primary sources: new client sales, client retention and the net change in WSEEs paid at existing clients through new hires and employee terminations.

•During Q2 2024, average WSEEs paid decreased 1% compared to Q2 2023. The number of WSEEs paid from new client sales remained consistent with Q2 2023, while the net gain in our client base and client retention declined compared to Q2 2023.

•During the first six months of 2024 (“YTD 2024”), average WSEEs paid decreased 1% compared to the first six months of 2023 (“YTD 2023”). The number of WSEEs paid from new client sales remained consistent with YTD 2023, while the net gain in our client base and client retention declined when compared to YTD 2023.

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 21 |

| | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

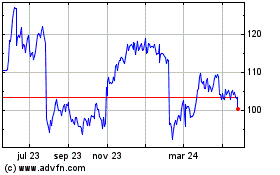

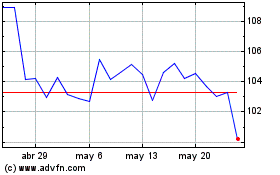

Average WSEEs Paid and

Year-over-Year Growth Percentage

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 22 |

| | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

| | | | | |

Adjusted EBITDA and Year-over-Year Growth Percentage (in millions) |

| | | | | |

Adjusted EPS and Year-over-Year Growth Percentage (amounts per share) |

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 23 |

| | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Revenues

Our PEO HR Outsourcing Solutions revenues are primarily derived from our gross billings, which are based on (1) the payroll cost of our WSEEs and (2) a monthly markup component.

Our revenues are primarily dependent on the number of clients enrolled, the resulting number of WSEEs paid each period and the number of WSEEs enrolled in our benefit plans. Because our monthly markup is computed in part as a percentage of payroll cost, certain revenues are also affected by the payroll cost of WSEEs, which may fluctuate based on the composition of the WSEE base, inflationary effects on wage levels and differences in the local economies of our markets.

Revenue and

Year-over-Year Growth Percentage

(in millions)

Second Quarter 2024 Compared to Second Quarter 2023

Our revenues for Q2 2024 were $1.6 billion, an increase of 1%, primarily due to the following:

•Revenues per WSEE per month increased 3%, or $46, partially offset by a 1% decrease in average WSEEs paid.

First Six Months 2024 Compared to First Six Months 2023

Our revenues for YTD 2024 were $3.4 billion, an increase of 2%, primarily due to the following:

•Revenues per WSEE per month increased 3%, or $50, partially offset by a 1% decrease in average WSEEs paid.

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 24 |

| | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

We provide our PEO HR Outsourcing Solutions to small and medium-sized businesses throughout the United States. Our PEO HR Outsourcing Solutions revenue distribution by region follows:

PEO HR Outsourcing Solutions Revenue by Region

(in millions)

________________________________________________________

(1)The Southwest region includes Texas.

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 25 |

| | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The percentage of total PEO HR Outsourcing Solutions revenue in our significant markets includes the following:

Significant Markets

The middle market sector, which we generally define as those companies with approximately 150 to 5,000 WSEEs, includes smaller clients whose number of WSEEs has grown to approximately 150 or more WSEEs. Currently, we have a dedicated sales management, service personnel, and consulting staff who concentrate solely on the middle market sector. Our average number of WSEEs per month in our middle market sector decreased 4% during YTD 2024 compared to YTD 2023, representing approximately 25% and 26% of our total average paid WSEEs during YTD 2024 and YTD 2023, respectively.

Gross Profit

In determining the pricing of the markup component of our gross billings, we take into consideration our estimates of the costs directly associated with our WSEEs, including payroll taxes, benefits and workers’ compensation costs, plus an acceptable gross profit margin. As a result, our operating results are significantly impacted by our ability to accurately estimate our direct costs relative to the revenues derived from the markup component of our gross billings.

Our gross profit per WSEE is primarily determined by our ability to accurately estimate direct costs and our ability to incorporate changes in these costs into the gross billings charged to PEO HR Outsourcing Solutions clients, which are subject to pricing arrangements that are typically renewed annually. We use gross profit per WSEE per month as our principal measurement of relative performance at the gross profit level.

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 26 |

| | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

| | | | | |

Gross Profit and

Year-over-Year Growth Percentage

(in millions) |

| | | | | |

Gross Profit per WSEE per Month and

Year-over-Year Growth Percentage |

Second Quarter 2024 Compared to Second Quarter 2023

Gross profit for Q2 2024 increased 16% to $260 million compared to $225 million in Q2 2023. Gross profit per WSEE per month for Q2 2024 increased $41 to $282 compared to $241 in Q2 2023 due primarily to higher average pricing and lower direct costs, as discussed below.

Our pricing objectives attempt to achieve a level of revenue per WSEE that matches or exceeds changes in primary direct costs and operating expenses. Our revenues per WSEE per month increased $46 due to higher average pricing of 3%.

The net decrease in direct costs between Q2 2024 and Q2 2023 attributable to the changes in cost estimates for benefits and workers’ compensation totaled $25 million as discussed below. The $5 per WSEE per month increase in direct costs

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 27 |

| | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

is due primarily to the direct cost component changes as follows:

Benefits costs

•The cost of group health insurance and related employee benefits decreased $18 per WSEE per month and decreased 0.4% on a cost per covered employee basis in Q2 2024 as compared to Q2 2023. We did not experience the number and severity of large claims in Q2 2024 as compared to Q2 2023.

•The percentage of WSEEs covered under our health insurance plans was 64% in Q2 2024 compared to 65% in Q2 2023.

•Reported results include changes in estimated claims run-off related to prior periods, which was a reduction in costs of $25 million, or $27 per WSEE per month, in Q2 2024 compared to an increase in costs of $1 million, or $1 per WSEE per month, in Q2 2023.

Workers’ compensation costs

Our continued discipline around our client selection, workplace safety and claims management contributed to the small increase in our cost per WSEE and, as a result, has allowed for claims within our policy periods to be closed out at amounts below our original cost estimates.

•Workers’ compensation costs increased $1 per WSEE per month in Q2 2024 compared to Q2 2023 while non-bonus payroll costs increased 1%.

•As a percentage of non-bonus payroll cost, workers’ compensation costs were 0.23% in both Q2 2024 and Q2 2023.

•We recorded a reduction in workers’ compensation costs of $7 million, or 0.09% of non-bonus payroll costs in Q2 2024, as a result of closing out claims at lower than expected costs. In Q2 2023, we recorded a reduction of $8 million, or 0.10% of non-bonus payroll costs.

Payroll tax costs

•Payroll taxes increased 2%, or $20 per WSEE per month, while payroll costs remained flat.

•Payroll taxes as a percentage of payroll costs were 7% in both Q2 2024 and Q2 2023.

First Six Months 2024 Compared to First Six Months 2023

Gross profit for YTD 2024 increased 9% to $605 million compared to $557 million in YTD 2023. Gross profit per WSEE per month for YTD 2024 increased $30 to $330 compared to $300 in YTD 2023 due primarily to higher average pricing, offset in part by higher direct costs, as discussed below.

Our pricing objectives attempt to achieve a level of revenue per WSEE that matches or exceeds changes in primary direct costs and operating expenses. Our revenues per WSEE per month increased $50 due to higher average pricing of 3%.

The net decrease in direct costs between YTD 2024 and YTD 2023 attributable to the changes in cost estimates for benefits and workers’ compensation totaled $18 million as discussed below. The $20 per WSEE per month increase in direct costs is due primarily to the direct cost component changes as follows:

Benefits costs

•The cost of group health insurance and related employee benefits increased $1 per WSEE per month, or 1.9% on a cost per covered employee basis. We did not experience the number and severity of large claims in YTD 2024 as compared to YTD 2023.

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 28 |

| | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

•The percentage of WSEEs covered under our health insurance plans was 64% in YTD 2024 compared to 65% in YTD 2023.

•Reported results include changes in estimated claims run-off related to prior periods, which was a decrease in costs of $26 million, or $14 per WSEE per month, in YTD 2024 compared to a decrease in costs of $10 million, or $5 per WSEE per month, in YTD 2023.

Workers’ compensation costs

Our continued discipline around our client selection, workplace safety and claims management has allowed for claims within our policy periods to be closed out at amounts below our original cost estimates.

•Workers’ compensation costs decreased 5%, or $1 per WSEE per month, in YTD 2024 compared to YTD 2023.

•As a percentage of non-bonus payroll cost, workers’ compensation costs were 0.23% in YTD 2024 and 0.24% in YTD 2023.

•We recorded a reduction in workers’ compensation costs of $17 million, or 0.11% of non-bonus payroll costs, in YTD 2024 compared to a reduction of $15 million, or 0.10% of non-bonus payroll costs, in YTD 2023, primarily as a result of closing out claims at lower than expected costs.

Payroll tax costs

•Payroll taxes increased 2% on a 1% increase in payroll costs, or $19 per WSEE per month.

•Payroll taxes as a percentage of payroll costs was 7% in both YTD 2024 and YTD 2023.

Operating Expenses

•Salaries, wages and payroll taxes — Salaries, wages and payroll taxes (“Salaries”) are primarily a function of the number of corporate employees, their associated average pay and any additional cash incentive compensation.

•Stock-based compensation — Our stock-based compensation relates to the recognition of non-cash compensation expense over the requisite service period of time-vested and performance-based awards.

•Commissions — Commissions expense consists primarily of amounts paid to sales managers and other sales personnel, including business performance advisors (“BPAs”), as well as channel referral fees. Commissions are based on new accounts sold and a percentage of revenue generated by such personnel.

•Advertising — Advertising expense primarily consists of media advertising and other business promotions in our current and anticipated sales markets.

•General and administrative expenses — Our general and administrative expenses primarily include:

◦rent expenses related to our service centers and sales offices

◦outside professional service fees related to legal, consulting and accounting services

◦administrative costs, such as postage, printing and supplies

◦employee travel and training expenses

◦facility costs, including repairs and maintenance

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 29 |

| | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

◦technology costs, including software-as-a-service (“SaaS”) subscription costs, amortization of SaaS implementation costs and costs related to our strategic partnership with Workday, Inc.

•Depreciation and amortization — Depreciation and amortization expense is primarily a function of our capital investments in corporate facilities, service centers, sales offices, software development, and technology infrastructure.

Second Quarter 2024 Compared to Second Quarter 2023

The following table presents certain information related to our operating expenses:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, |

| | | per WSEE |

(in millions, except per WSEE) | 2024 | 2023 | % Change | | 2024 | 2023 | % Change |

| | | | | | | |

| Salaries | $ | 126 | | $ | 110 | | 15 | % | | $ | 137 | | $ | 119 | | 15 | % |

| Stock-based compensation | 20 | | 15 | | 33 | % | | 22 | | 16 | | 38 | % |

| Commissions | 11 | | 12 | | (8) | % | | 12 | | 13 | | (8) | % |

| Advertising | 12 | | 17 | | (29) | % | | 13 | | 18 | | (28) | % |

| | | | | | | |

General and administrative: | | | | | | | |

Amortization of SaaS implementation costs | 3 | | 2 | | 50 | % | | 3 | | 1 | | 200 | % |

Workday SaaS licensing and implementation expense | 8 | | — | | — | | | 9 | | — | | — | |

All other general and administrative | 46 | | 42 | | 10 | % | | 49 | | 45 | | 9 | % |

Total general and administrative | 57 | | 44 | | 30 | % | | 61 | | 46 | | 33 | % |

| | | | | | | |

| Depreciation and amortization | 11 | | 11 | | — | % | | 12 | | 12 | | — | |

| Total operating expenses | $ | 237 | | $ | 209 | | 13 | % | | $ | 257 | | $ | 224 | | 15 | % |

Operating expenses for Q2 2024 increased 13% to $237 million compared to $209 million in Q2 2023. Operating expenses per WSEE per month for Q2 2024 increased 15% to $257 compared to $224 in Q2 2023.

•Salaries of corporate and sales staff for Q2 2024 increased 15% to $126 million, or $18 per WSEE per month, compared to Q2 2023. The increase was primarily due to a 6% increase in BPA, service and support headcount in Q2 2024 compared to Q2 2023 and higher incentive compensation accruals in Q2 2024.

•Stock-based compensation expense for Q2 2024 increased 33% to $20 million, or $6 per WSEE per month, compared to Q2 2023. The increase was primarily due to an increase in the number of stock awards anticipated to be earned related to performance-based awards granted under our long-term incentive plans based on our higher than expected operating results in Q2 2024 and time-vested restricted stock unit awards issued under our incentive plan.

•Advertising expense for Q2 2024 decreased 29% to $12 million, or $5 per WSEE per month, compared to Q2 2023 due to a change in timing of advertising spend.

•General and administrative expenses for Q2 2024 increased 30% to $57 million, or $15 per WSEE per month, compared to Q2 2023. The increase was primarily due to increased software licensing, maintenance costs, SaaS implementation expense, and professional services fees.

| | | | | |

Insperity | 2024 Second Quarter Form 10-Q | 30 |

| | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

First Six Months 2024 Compared to First Six Months 2023

The following table presents certain information related to our operating expenses:

| | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, |

| | | per WSEE |

| (in millions, except per WSEE) | 2024 | 2023 | % Change | | 2024 | 2023 | % Change |

| | | | | | | |

| Salaries | $ | 266 | | $ | 235 | | 13 | % | | $ | 145 | | $ | 127 | | 14 | % |

| Stock-based compensation | 30 | | 26 | | 15 | % | | 16 | | 14 | | 14 | % |

| Commissions | 23 | | 23 | | — | | | 13 | | 12 | | 8 | % |

| Advertising | 19 | | 23 | | (17) | % | | 10 | | 12 | | (17) | % |

| General and administrative: | | | | | | | |

| Amortization of SaaS implementation costs | 6 | | 3 | | 100 | % | | 3 | | 1 | | 200 | % |

| Workday SaaS licensing and implementation expense | 12 | | — | | — | | | 7 | | — | | — | |

| All other general and administrative | 96 | | 89 | | 8 | % | | 53 | | 49 | | 8 | % |

| Total general and administrative | 114 | | 92 | | 24 | % | | 63 | | 50 | | 26 | % |

| Depreciation and amortization | 22 | | 21 | | 5 | % | | 12 | | 11 | | 9 | % |

| Total operating expenses | 474 | | 420 | | 13 | % | | $ | 259 | | $ | 226 | | 15 | % |

Operating expenses for YTD 2024 increased 13% to $474 million compared to $420 million in YTD 2023. Operating expenses per WSEE per month for YTD 2024 increased 15% to $259 compared to $226 in YTD 2023.

•Salaries of corporate and sales staff for YTD 2024 increased 13% to $266 million, or $18 per WSEE per month, compared to YTD 2023. The increase was primarily due to a 6% increase in BPA, service and support headcount and staff compensation levels, and higher incentive compensation expense in YTD 2024 compared to YTD 2023.

•Stock-based compensation expense for YTD 2024 increased 15% to $30 million, or $2 per WSEE per month, compared to YTD 2023. The increase was primarily due to time-vested restricted stock unit awards issued under our incentive plan.

•Advertising expense for YTD 2024 decreased 17% to $19 million, or $2 per WSEE per month, compared to YTD 2023 due to a change in timing of advertising spend.

•General and administrative expenses for YTD 2024 increased 24% to $114 million, or $13 per WSEE per month, compared to YTD 2023. The increase was primarily due to increased professional services fees, software licensing and maintenance costs and amortization of SaaS implementation costs.

•Depreciation and amortization expense for YTD 2024 increased 5% to $22 million, or $1 per WSEE per month, compared to YTD 2023. The increase was primarily due to increased capital expenditures related to computer hardware and software and software development costs.

Income Tax Expense

| | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| | | | | |

| Effective income tax rate | 28% | 25% | | 29% | 24% |