Adams Natural Resources Fund Declares Distribution and Announces First Half Performance

18 Julio 2024 - 3:53PM

The Board of Directors of Adams Natural Resources Fund, Inc. (NYSE:

PEO) today declared a distribution of $.54 per share, payable

August 30, 2024, in newly issued shares unless shareholders elect

to receive cash, to shareholders of record August 5, 2024. This

distribution represents the initial payment under the Fund’s

Managed Distribution Policy to pay at least 2% of average net asset

value each quarter. You should not draw any conclusions about the

Fund’s investment performance from the amount of the current

distribution or from the terms of the Fund’s MDP.

FIRST HALF PERFORMANCE

For the six months ended June 30th, the total

return on Adams Natural Resources’ net asset value, with dividends

and capital gains reinvested, was 10.2%. This compares to a total

return of 9.6% for the Fund’s benchmark, which is comprised of the

S&P 500 Energy Sector (80% weight) and the S&P 500

Materials Sector (20% weight), over the same period. The total

return on the market price of the Fund’s shares for the period was

15.5%.

For the twelve months ended June 30th, the total

return on Adams Natural Resources’ net asset value, with dividends

and capital gains reinvested, was 16.5%. This compares to a total

return of 14.4% for the Fund’s benchmark over the same period. The

total return on the market price of the Fund’s shares for the

period was 20.9%.

The Semi-Annual Report to Shareholders is expected

to be available on or about July 24, 2024.

|

ANNUALIZED COMPARATIVE RETURNS (6/30/2024) |

|

|

|

|

|

|

|

1 Year |

3 Year |

5 Year |

|

Adams Natural Resources Fund (NAV) |

16.5% |

21.0% |

13.5% |

|

Adams Natural Resources Fund (market price) |

20.9% |

20.8% |

14.5% |

|

S&P 500 Energy Sector |

15.9% |

24.4% |

13.0% |

|

S&P 500 Materials Sector |

8.7% |

4.5% |

10.9% |

|

|

|

|

|

NET ASSET VALUE ANNOUNCED

The Fund’s net asset value at June 30, 2024,

compared with the year earlier, was:

|

|

6/30/2024 |

6/30/2023 |

|

Net assets |

$689,986,546 |

$620,953,602 |

|

Shares outstanding |

25,453,641 |

25,033,377 |

|

Net asset value per share |

$27.11 |

$24.81 |

|

|

|

|

|

TEN LARGEST EQUITY PORTFOLIO HOLDINGS

(6/30/2024) |

|

|

|

|

|

% of Net Assets |

|

Exxon Mobil Corporation |

24.7% |

|

Chevron Corporation |

11.9% |

|

ConocoPhilips |

5.7% |

|

Linde plc |

4.4% |

|

Marathon Petroleum Corporation |

4.2% |

|

EOG Resources, Inc. |

4.0% |

|

Phillips 66 |

3.2% |

|

Hess Corporation |

3.0% |

|

Diamondback Energy, Inc. |

2.8% |

|

Williams Companies, Inc. |

2.8% |

|

Total |

66.7% |

|

|

|

|

INDUSTRY WEIGHTINGS (6/30/2024) |

|

|

|

|

|

% of Net Assets |

|

Energy |

80.5% |

|

Integrated Oil & Gas |

37.4% |

|

Exploration & Production |

20.9% |

|

Refining & Marketing |

9.3% |

|

Storage & Transportation |

7.3% |

|

Equipment & Services |

5.6% |

|

|

|

|

Materials |

18.8% |

|

Chemicals |

12.3% |

|

Metals & Mining |

3.6% |

|

Construction Materials |

1.5% |

|

Containers & Packaging |

1.4% |

|

|

|

About Adams Funds

Since 1929, Adams Funds has consistently helped generations of

investors reach their investment goals. Adams Funds is comprised of

two closed-end funds, Adams Diversified Equity Fund, Inc. (NYSE:

ADX) and Adams Natural Resources Fund, Inc. (NYSE: PEO). The Funds

are actively managed by an experienced team with a disciplined

approach and have paid dividends for more than 85 years across many

market cycles. The Funds are committed to paying a minimum annual

distribution rate of 8% of NAV or more, providing reliable income

to long-term investors. Shares can be purchased through our

transfer agent or through a broker.

For more information about Adams Funds, please visit:

adamsfunds.com. For further information please contact:

adamsfunds.com/about/contact or 800.638.2479

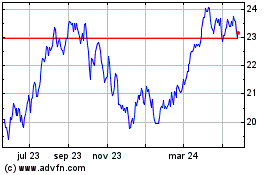

Adams Natural Resources (NYSE:PEO)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

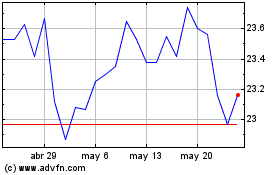

Adams Natural Resources (NYSE:PEO)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024