Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

30 Mayo 2024 - 7:46AM

Edgar (US Regulatory)

March 31, 2024

(unaudited)

| |

|

|

Shares

|

|

|

Value (a)

|

|

| Common Stocks — 99.5% |

|

|

Energy — 80.3%

|

|

|

Equipment & Services — 5.9%

|

|

|

Baker Hughes Company

|

|

|

|

|

296,400 |

|

|

|

|

$ |

9,929,400 |

|

|

|

Halliburton Company

|

|

|

|

|

177,353 |

|

|

|

|

|

6,991,255 |

|

|

|

Schlumberger N.V.

|

|

|

|

|

377,933 |

|

|

|

|

|

20,714,508 |

|

|

|

TechnipFMC plc

|

|

|

|

|

173,800 |

|

|

|

|

|

4,364,118 |

|

|

| |

|

|

|

|

41,999,281 |

|

|

|

Exploration & Production — 24.9%

|

|

|

APA Corporation

|

|

|

|

|

56,000 |

|

|

|

|

|

1,925,280 |

|

|

|

Chesapeake Energy Corporation

|

|

|

|

|

40,200 |

|

|

|

|

|

3,570,966 |

|

|

|

Chord Energy Corporation

|

|

|

|

|

225 |

|

|

|

|

|

40,104 |

|

|

|

Chord Energy Corporation warrants, strike price $166.37, 1 warrant for .5774 share, expires 9/1/24 (b)

|

|

|

|

|

2,654 |

|

|

|

|

|

94,323 |

|

|

|

Chord Energy Corporation warrants, strike price $133.70, 1 warrant for .5774 share, expires 9/1/25 (b)

|

|

|

|

|

1,327 |

|

|

|

|

|

34,130 |

|

|

|

ConocoPhillips

|

|

|

|

|

341,876 |

|

|

|

|

|

43,513,977 |

|

|

|

Coterra Energy Inc.

|

|

|

|

|

125,900 |

|

|

|

|

|

3,510,092 |

|

|

|

Devon Energy Corporation

|

|

|

|

|

284,700 |

|

|

|

|

|

14,286,246 |

|

|

|

Diamondback Energy, Inc.

|

|

|

|

|

97,900 |

|

|

|

|

|

19,400,843 |

|

|

|

EOG Resources, Inc.

|

|

|

|

|

220,467 |

|

|

|

|

|

28,184,501 |

|

|

|

EQT Corporation

|

|

|

|

|

61,400 |

|

|

|

|

|

2,276,098 |

|

|

|

Hess Corporation

|

|

|

|

|

141,989 |

|

|

|

|

|

21,673,201 |

|

|

|

Marathon Oil Corporation

|

|

|

|

|

95,400 |

|

|

|

|

|

2,703,636 |

|

|

|

Occidental Petroleum Corporation

|

|

|

|

|

151,951 |

|

|

|

|

|

9,875,296 |

|

|

|

Pioneer Natural Resources Company

|

|

|

|

|

101,500 |

|

|

|

|

|

26,643,750 |

|

|

|

|

|

|

|

177,732,443 |

|

|

|

Integrated Oil & Gas — 32.0%

|

|

|

Cenovus Energy Inc.

|

|

|

|

|

293,300 |

|

|

|

|

|

5,863,067 |

|

|

|

Chevron Corporation

|

|

|

|

|

541,671 |

|

|

|

|

|

85,443,184 |

|

|

|

Exxon Mobil Corporation

|

|

|

|

|

1,173,430 |

|

|

|

|

|

136,399,503 |

|

|

| |

|

|

|

|

227,705,754 |

|

|

|

Refining & Marketing — 10.3%

|

|

|

Marathon Petroleum Corporation

|

|

|

|

|

167,812 |

|

|

|

|

|

33,814,118 |

|

|

|

Phillips 66

|

|

|

|

|

154,475 |

|

|

|

|

|

25,231,947 |

|

|

|

Valero Energy Corporation

|

|

|

|

|

86,000 |

|

|

|

|

|

14,679,340 |

|

|

|

|

|

|

|

73,725,405 |

|

|

Schedule of Investments (continued)

March 31, 2024

(unaudited)

| |

|

|

Shares

|

|

|

Value (a)

|

|

|

Storage & Transportation — 7.2%

|

|

|

Kinder Morgan, Inc.

|

|

|

|

|

694,492 |

|

|

|

|

$ |

12,736,983 |

|

|

|

ONEOK, Inc.

|

|

|

|

|

137,900 |

|

|

|

|

|

11,055,443 |

|

|

|

Targa Resources Corp.

|

|

|

|

|

73,300 |

|

|

|

|

|

8,208,867 |

|

|

|

Williams Companies, Inc.

|

|

|

|

|

491,750 |

|

|

|

|

|

19,163,498 |

|

|

| |

|

|

|

|

51,164,791 |

|

|

|

Materials — 19.2%

|

|

|

Chemicals — 13.5%

|

|

|

Air Products and Chemicals, Inc.

|

|

|

|

|

21,700 |

|

|

|

|

|

5,257,259 |

|

|

|

Albemarle Corporation

|

|

|

|

|

7,200 |

|

|

|

|

|

948,528 |

|

|

|

Celanese Corporation

|

|

|

|

|

35,777 |

|

|

|

|

|

6,148,635 |

|

|

|

CF Industries Holdings, Inc.

|

|

|

|

|

13,369 |

|

|

|

|

|

1,112,435 |

|

|

|

Corteva Inc.

|

|

|

|

|

93,145 |

|

|

|

|

|

5,371,672 |

|

|

|

Dow, Inc.

|

|

|

|

|

63,945 |

|

|

|

|

|

3,704,334 |

|

|

|

DuPont de Nemours, Inc.

|

|

|

|

|

33,526 |

|

|

|

|

|

2,570,438 |

|

|

|

Eastman Chemical Company

|

|

|

|

|

7,700 |

|

|

|

|

|

771,694 |

|

|

|

Ecolab Inc.

|

|

|

|

|

50,000 |

|

|

|

|

|

11,545,000 |

|

|

|

FMC Corporation

|

|

|

|

|

7,255 |

|

|

|

|

|

462,144 |

|

|

|

International Flavors & Fragrances Inc.

|

|

|

|

|

21,006 |

|

|

|

|

|

1,806,306 |

|

|

|

Linde plc

|

|

|

|

|

71,000 |

|

|

|

|

|

32,966,720 |

|

|

|

LyondellBasell Industries N.V.

|

|

|

|

|

68,700 |

|

|

|

|

|

7,026,636 |

|

|

|

Mosaic Company

|

|

|

|

|

21,201 |

|

|

|

|

|

688,184 |

|

|

|

PPG Industries, Inc.

|

|

|

|

|

55,000 |

|

|

|

|

|

7,969,500 |

|

|

|

Sherwin-Williams Company

|

|

|

|

|

23,100 |

|

|

|

|

|

8,023,323 |

|

|

| |

|

|

|

|

96,372,808 |

|

|

|

Construction Materials — 1.7%

|

|

|

Martin Marietta Materials, Inc.

|

|

|

|

|

5,000 |

|

|

|

|

|

3,069,700 |

|

|

|

Vulcan Materials Company

|

|

|

|

|

32,100 |

|

|

|

|

|

8,760,732 |

|

|

| |

|

|

|

|

11,830,432 |

|

|

|

Containers & Packaging — 0.9%

|

|

|

Amcor plc

|

|

|

|

|

92,400 |

|

|

|

|

|

878,724 |

|

|

|

Avery Dennison Corporation

|

|

|

|

|

5,500 |

|

|

|

|

|

1,227,875 |

|

|

|

Ball Corporation

|

|

|

|

|

23,300 |

|

|

|

|

|

1,569,488 |

|

|

|

International Paper Company

|

|

|

|

|

21,500 |

|

|

|

|

|

838,930 |

|

|

|

Packaging Corporation of America

|

|

|

|

|

5,900 |

|

|

|

|

|

1,119,702 |

|

|

|

WestRock Company

|

|

|

|

|

15,400 |

|

|

|

|

|

761,530 |

|

|

| |

|

|

|

|

6,396,249 |

|

|

|

Metals & Mining — 3.1%

|

|

|

Freeport-McMoRan, Inc.

|

|

|

|

|

256,300 |

|

|

|

|

|

12,051,226 |

|

|

|

Newmont Corporation

|

|

|

|

|

107,100 |

|

|

|

|

|

3,838,464 |

|

|

|

Nucor Corporation

|

|

|

|

|

22,600 |

|

|

|

|

|

4,472,540 |

|

|

|

Steel Dynamics, Inc.

|

|

|

|

|

12,526 |

|

|

|

|

|

1,856,729 |

|

|

| |

|

|

|

|

22,218,959 |

|

|

| Total Common Stocks |

|

|

(Cost $476,056,749)

|

|

|

|

|

|

|

|

|

|

|

709,146,122 |

|

|

Schedule of Investments (continued)

March 31, 2024

(unaudited)

| |

|

|

Shares

|

|

|

Value (a)

|

|

| Short-Term Investments — 0.5% |

|

|

Money Market Funds — 0.5%

|

|

|

Morgan Stanley Institutional Liquidity Funds

Prime Portfolio, 5.38% (c)

|

|

|

|

|

2,900,659 |

|

|

|

|

$ |

2,900,949 |

|

|

|

Northern Institutional Treasury Premier

Portfolio, 5.15% (c)

|

|

|

|

|

517,842 |

|

|

|

|

|

517,842 |

|

|

| Total Short-Term Investments |

|

|

(Cost $3,419,371)

|

|

|

|

|

|

|

|

|

|

|

3,418,791 |

|

|

| Total — 100.0% of Net Assets |

|

|

(Cost $479,476,120)

|

|

|

|

|

|

|

|

|

|

|

712,564,913 |

|

|

| Other Assets Less Liabilities — 0.0% |

|

|

|

|

|

|

|

|

|

|

143,896 |

|

|

|

Net Assets — 100.0%

|

|

|

|

|

|

|

|

|

|

$ |

712,708,809 |

|

|

| |

Total Return Swap Agreements — 0.0%

|

Description

|

|

|

|

|

|

|

|

|

|

|

Value and

Unrealized

Appreciation

(Assets)

|

|

|

Value and

Unrealized

Depreciation

(Liabilities)

|

|

|

Terms

|

|

|

Contract

Type

|

|

|

Underlying

Security

|

|

|

Termination

Date

|

|

|

Notional

Amount

|

|

|

Receive total return on underlying

security and pay financing

amount based on notional

amount and daily U.S. Federal

Funds rate plus 0.55%.

|

|

|

Long

|

|

|

Avery Dennison Corporation (15,500 shares) |

|

|

4/16/2025

|

|

|

|

$ |

3,356,530 |

|

|

|

|

$ |

93,428 |

|

|

|

|

$ |

— |

|

|

|

Pay total return on underlying security and receive financing amount based on notional amount and daily U.S. Federal Funds rate less 0.45%.

|

|

|

Short

|

|

|

Materials Select

Sector SPDR Fund

(37,100 shares)

|

|

|

4/16/2025

|

|

|

|

|

(3,349,926) |

|

|

|

|

|

— |

|

|

|

|

|

(99,718) |

|

|

|

Receive total return on underlying

security and pay financing

amount based on notional

amount and daily U.S. Federal

Funds rate plus 0.55%.

|

|

|

Long

|

|

|

HF Sinclair Corporation

(59,100 shares) |

|

|

4/30/2025

|

|

|

|

|

3,515,002 |

|

|

|

|

|

50,566 |

|

|

|

|

|

— |

|

|

|

Pay total return on underlying security and receive financing amount based on notional amount and daily U.S. Federal Funds rate less 0.45%.

|

|

|

Short

|

|

|

Energy Select

Sector SPDR Fund

(37,800 shares)

|

|

|

4/30/2025

|

|

|

|

|

(3,514,614) |

|

|

|

|

|

— |

|

|

|

|

|

(52,175) |

|

|

| Gross unrealized gain (loss) on open total return swap agreements |

|

|

|

$ |

143,994 |

|

|

|

|

$ |

(151,893) |

|

|

| Net unrealized loss on open total return swap agreements (d) |

|

|

|

|

|

|

|

|

|

$ |

(7,899) |

|

|

(a)

Common stocks and warrants are listed on the New York Stock Exchange or NASDAQ and are valued at the last reported sale price on the day of valuation.

(b)

Presently non-dividend paying.

(c)

Rate presented is as of period-end and represents the annualized yield earned over the previous seven days.

(d)

Counterparty for all open total return swap agreements is Morgan Stanley.

Information regarding transactions in equity securities during the quarter can be found on our website at: www.adamsfunds.com.

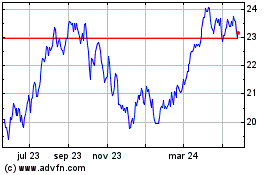

Adams Natural Resources (NYSE:PEO)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

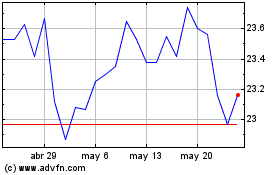

Adams Natural Resources (NYSE:PEO)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025