PHINIA Inc. (NYSE: PHIN), a leader in premium fuel systems,

electrical systems, and aftermarket solutions, today reported

results for the third quarter ended September 30, 2024.

Third Quarter Highlights:

- Net sales of $839 million, a decrease of 6.4% compared with Q3

2023.

- Lower Fuel Systems (FS) sales in Europe and China partially

offset by strong Aftermarket segment sales in Europe led to lower

net sales compared to Q3 2023.

- Excluding the effects of contract manufacturing that ended in

the quarter, adjusted sales were $838 million, down 3.7%

year-over-year.

- Operating income of $66 million and operating margin of 7.9%,

representing a year-over-year increase of $20 million and 280 basis

points (bps), respectively.

- Primarily driven by lower separation and transaction expenses

and lower supplier and inflationary costs partially offset by lower

revenues.

- Adjusted operating income of $87 million and adjusted operating

income margin of 10.4%, representing a year-over-year increase of

$5 million and 100 bps, respectively.

- Net earnings of $31 million and net margin of 3.7%,

representing a year-over-year increase of $32 million and 380 bps,

respectively.

- Net earnings per diluted share of $0.70.

- Adjusted net earnings per diluted share of $1.17 (excluding

$0.47 per diluted share related to non-comparable items detailed in

the non-GAAP appendix below).

- Adjusted EBITDA of $120 million with adjusted EBITDA margin of

14.3%, representing a year-over-year increase of $3 million and 90

bps, respectively.

- Increased pricing for the Aftermarket segment combined with

cost controls in both segments led to margin expansion.

- Net cash generated by operating activities of $95 million,

representing a year-over-year decrease of $60 million.

- Adjusted free cash flow was $60 million.

- Repurchased $75 million of outstanding shares with $188 million

remaining on $400 million share repurchase program.

- In the quarter, the Board increased authorization on share

repurchase program by $250 million, from $150 million to $400

million.

- Issued $450 million aggregate principal amount of 6.625% senior

unsecured notes due 2032. Net proceeds used in part to repay all of

the Company’s outstanding borrowings under its Term Loan A

Facility.

Key Wins in Strategic Growth Markets:

New business wins remained strong across all end markets. A few

examples of new business awards in Q3 are:

- Second product win in the off-highway diesel market with an

electronically-controlled, low pressure common rail injection

system for compact diesel engines for use in excavators, forklifts,

and generators and designed to reduce emissions and increase fuel

efficiency.

- Conquest win in India’s growing combustion market with a

European automaker for an LV GDi 1.0L pump.

- Conquest GDi win with a US automaker for use in a high-volume

application for light duty trucks and luxury SUVs.

- Our Aftermarket segment renewed our agreement with one of our

largest global independent aftermarket customer groups; Signed a

first-time agreement with a major customer group in Europe; and

signed a new agreement with a North American customer to expand

cooperation into their business in Mexico.

Brady Ericson, President and Chief Executive Officer of PHINIA

commented: “PHINIA achieved excellent financial performance in the

third quarter of 2024, despite revenue softness in some markets.

Our team’s ability to meet increased Aftermarket demand while

flexing overheads in appropriate parts of the business enabled

expansion of adjusted EBITDA margins by 90 basis points, and

generation of $60 million in adjusted free cash flow. We continue

to book high quality, bottom line accretive new business in both

the Fuel Systems and Aftermarket segments demonstrating the ongoing

success of our strategy.”

Balance Sheet and Cash Flow:

The Company ended the quarter with cash and cash equivalents of

$477 million and $499 million of available capacity under its

Revolving Credit Facility. Long-term debt at quarter end was $987

million.

Capital expenditures during the quarter were $25 million with

the funds primarily used for investments in new machinery and

equipment for new program launches. Dividends paid to shareholders

in the quarter were $10 million, while share repurchases totaled

$75 million. Net cash provided by operating activities was $95

million and adjusted free cash flow was $60 million.

2024 Full Year Guidance:

Given the softening of the end vehicle markets, the Company is

revising its full-year 2024 guidance and now expects net sales of

$3.36 billion to $3.41 billion and adjusted sales of $3.34 billion

to $3.39 billion. The refined net earnings and adjusted EBITDA are

projected at $105 million to $125 million and $470 million to $490

million, respectively, resulting in earnings margin of 3.1% and

3.7% and adjusted EBITDA margin of 14.1% to 14.5%. PHINIA continues

to expect to generate $160 million to $200 million in adjusted free

cash flow. Adjusted tax rate is expected to be in the range of 33%

to 37%.

The Company will host a conference call to review third quarter

2024 results and take questions from the investment community at

8:30 a.m. ET today. This call will be webcast at PHINIA Q3 2024 Earnings Call. Additional

presentation materials will be available at Investors.phinia.com.

About PHINIA

PHINIA is an independent, market-leading, premium solutions and

components provider with over 100 years of manufacturing expertise

and industry relationships, with a strong brand portfolio that

includes DELPHI®, DELCO REMY® and HARTRIDGETM. With over 13,000

employees across 44 locations in 20 countries, PHINIA is

headquartered in Auburn Hills, Michigan, USA.

Across commercial vehicles and industrial applications

(heavy-duty and medium-duty trucks, off-highway construction,

marine, aviation, and agricultural), and light vehicles (passenger

cars, trucks, vans and sport-utility), we develop fuel systems,

electrical systems and aftermarket solutions designed to keep

combustion engines operating at peak performance, while at the same

time investing in advanced technologies to unlock the potential of

alternative fuels.

By providing what the market needs today to become more

efficient and sustainable, while also developing innovative

products and solutions to contribute to lower carbon mobility, we

are the partner of choice for a diverse array of customers –

powering our shared journey toward a cleaner tomorrow.

(DELCO REMY is a registered trademark of General Motors LLC,

licensed to PHINIA Technologies Inc.)

Forward-Looking Statements: This press release contains

forward-looking statements within the meaning of the U.S. federal

securities laws. Forward-looking statements are statements other

than historical fact that provide current expectations or forecasts

of future events based on certain assumptions and are not

guarantees of future performance. Forward-looking statements use

words such as “anticipate,” “believe,” “continue,” “could,”

“designed,” “effect,” “estimate,” “evaluate,” “expect,” “forecast,”

“goal,” “initiative,” “intend,” “likely,” “may,” “outlook,” “plan,”

“potential,” “predict,” “project,” “pursue,” “seek,” “should,”

“target,” “when,” “will,” “would,” or other words of similar

meaning.

Forward-looking statements are subject to risks, uncertainties,

and factors relating to our business and operations, all of which

are difficult to predict and which could cause our actual results

to differ materially from the expectations expressed in or implied

by such forward-looking statements. Risks, uncertainties, and

factors that could cause actual results to differ materially from

those implied by these forward-looking statements include, but are

not limited to: adverse changes in general business and economic

conditions, including recessions, adverse market conditions or

downturns impacting the vehicle and industrial equipment

industries; our ability to deliver new products, services and

technologies in response to changing consumer preferences,

increased regulation of greenhouse gas emissions, and acceleration

of the market for electric vehicles; competitive industry

conditions; failure to identify, consummate, effectively integrate

or realize the expected benefits from acquisitions or partnerships;

pricing pressures from original equipment manufacturers (OEMs);

inflation rates and volatility in the costs of commodities used in

the production of our products; changes in U.S. and foreign

administrative policy, including changes to existing trade

agreements and any resulting changes in international trade

relations; our ability to protect our intellectual property;

failure of or disruption in our information technology

infrastructure, including a disruption related to cybersecurity;

our ability to identify, attract, retain and develop a qualified

global workforce; difficulties launching new vehicle programs;

failure to achieve the anticipated savings and benefits from

restructuring and product portfolio optimization actions;

extraordinary events (including natural disasters or extreme

weather events), political disruptions, terrorist attacks,

pandemics or other public health crises, and acts of war; risks

related to our international operations; the impact of economic,

political, and market conditions on our business in China; our

reliance on a limited number of OEM customers; supply chain

disruptions; work stoppages, production shutdowns and similar

events or conditions; governmental investigations and related

proceedings regarding vehicle emissions standards, including the

ongoing investigation into diesel defeat devices; current and

future environmental and health and safety laws and regulations;

the impact of climate change and regulations related to climate

change; liabilities related to product warranties, litigation and

other claims; compliance with legislation, regulations, and

policies, investigations and legal proceedings, and changes in and

new interpretations of existing rules and regulations; tax audits

and changes in tax laws or tax rates taken by taxing authorities;

volatility in the credit market environment; impairment charges on

goodwill and indefinite-lived intangible assets; the impact of

changes in interest rates and asset returns on our pension funding

obligations; the impact of restrictive covenants and requirements

in the agreements governing our indebtedness on our financial and

operating flexibility; our ability to achieve some or all of the

benefits that we expect to achieve from the spin-off; other risks

relating to the spin-off, including a determination that the

spin-off does not qualify as tax-free for U.S. federal income tax

purposes, restrictions and obligations under the Tax Matters

Agreement, and our or BorgWarner Inc.’s failure to perform under,

and any dispute relating to, the various transaction agreements;

and other risks and uncertainties described in our reports filed

from time to time with the Securities and Exchange Commission.

We caution readers not to place undue reliance upon any such

forward-looking statements, which speak only as of the date they

are made. We undertake no obligation to publicly update

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

PHINIA Inc.

Condensed Consolidated Statements of

Operations (Unaudited)

(in millions, except earnings per

share)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Fuel Systems

$

484

$

561

$

1,529

$

1,621

Aftermarket

355

335

1,041

997

Net sales

839

896

2,570

2,618

Cost of sales

652

719

2,003

2,080

Gross profit

187

177

567

538

Gross margin

22.3

%

19.8

%

22.1

%

20.6

%

Selling, general and administrative

expenses

108

104

324

306

Other operating expense, net

13

27

35

72

Operating income

66

46

208

160

Equity in affiliates’ earnings, net of

tax

(3

)

(2

)

(8

)

(8

)

Interest expense

20

22

81

34

Interest income

(4

)

(4

)

(12

)

(9

)

Other postretirement income, net

—

—

1

(1

)

Earnings before income taxes

53

30

146

144

Provision for income taxes

22

31

72

75

Net earnings (loss)

$

31

$

(1

)

$

74

$

69

Earnings (loss) per share— diluted

$

0.70

$

(0.02

)

$

1.63

$

1.46

Weighted average shares outstanding —

diluted

44.1

47.0

45.4

47.0

PHINIA Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

(in millions)

September 30, 2024

December 31, 2023

ASSETS

Cash and cash equivalents

$

477

$

365

Receivables, net

920

1,017

Inventories

486

487

Prepayments and other current assets

93

58

Total current assets

1,976

1,927

Property, plant and equipment, net

882

921

Other non-current assets

1,166

1,193

Total assets

$

4,024

$

4,041

LIABILITIES AND EQUITY

Short-term borrowings and current portion

of long-term debt

$

—

$

89

Accounts payable

588

639

Other current liabilities

434

420

Total current liabilities

1,022

1,148

Long-term debt

987

709

Other non-current liabilities

311

297

Total liabilities

2,320

2,154

Total equity

1,704

1,887

Total liabilities and equity

$

4,024

$

4,041

PHINIA Inc.

Condensed Consolidated Statements of

Cash Flows (Unaudited)

(in millions)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

OPERATING

Net cash provided by operating

activities

$

95

$

155

$

235

$

188

INVESTING

Capital expenditures, including tooling

outlays

(25

)

(37

)

(85

)

(117

)

Payments for investment in equity

securities

(1

)

—

(1

)

(2

)

Proceeds from asset disposals and other,

net

1

—

2

2

Net cash used in investing activities

(25

)

(37

)

(84

)

(117

)

FINANCING

Proceeds from issuance of long-term debt,

net of discount

450

708

975

708

Payments for debt issuance costs

(6

)

(14

)

(15

)

(14

)

Borrowings (repayments) under Revolving

Facility

—

75

(75

)

75

Repayments of debt, including current

portion

(294

)

(1

)

(722

)

(1

)

Dividends paid to PHINIA stockholders

(10

)

(12

)

(33

)

(12

)

Payments for purchase of treasury

stock

(75

)

(9

)

(188

)

(9

)

Payments for stock-based compensation

items

—

—

(3

)

—

Cash outflows related to debt due to

Former Parent

—

(634

)

—

(728

)

Cash inflows related to debt due from

Former Parent

—

—

—

36

Net transfers to Former Parent

—

(63

)

—

(5

)

Net cash provided by (used in) financing

activities

65

50

(61

)

50

Effect of exchange rate changes on

cash

3

(14

)

22

(5

)

Net increase in cash and cash

equivalents

138

154

112

116

Cash and cash equivalents at beginning of

period

339

213

365

251

Cash and cash equivalents at end of

period

$

477

$

367

$

477

$

367

PHINIA Inc.

Net Debt (Unaudited)

(in millions)

September 30, 2024

December 31, 2023

Total debt

$

987

$

798

Cash and cash equivalents

477

365

Net debt

$

510

$

433

Non-GAAP Financial Measures

This press release contains information about PHINIA’s financial

results that is not presented in accordance with accounting

principles generally accepted in the United States (GAAP). Such

non-GAAP financial measures are reconciled to their most directly

comparable GAAP financial measures below. The reconciliations

include all information reasonably available to the Company at the

date of this press release and the adjustments that management can

reasonably predict.

Management believes that these non-GAAP financial measures are

useful to management, investors, and banking institutions in their

analysis of the Company's business and operating performance.

Management also uses this information for operational planning and

decision-making purposes.

Non-GAAP financial measures are not and should not be considered

a substitute for any GAAP measure. Additionally, because not all

companies use identical calculations, the non-GAAP financial

measures as presented by PHINIA may not be comparable to similarly

titled measures reported by other companies.

A reconciliation of each of projected Adjusted EBITDA, Adjusted

EBITDA Margin and Adjusted Free Cash Flow, which are

forward-looking non-GAAP financial measures, to the most directly

comparable GAAP financial measure, is not provided because the

Company is unable to provide such reconciliation without

unreasonable effort. The inability to provide each reconciliation

is due to the unpredictability of the amounts and timing of events

affecting the items we exclude from the non-GAAP measure.

Adjusted EBITDA and Adjusted EBITDA Margin

The Company defines adjusted earnings before interest, taxes,

depreciation and amortization (EBITDA) as net earnings less

interest, taxes, depreciation and amortization, adjusted to exclude

the impact of restructuring expense, separation and transaction

costs, other postretirement income and expense, equity in

affiliates' earnings, net of tax, impairment charges, other net

expenses, and other gains and losses not reflective of our ongoing

operations. Adjusted EBITDA margin is defined as adjusted EBITDA

divided by adjusted sales.

Adjusted Operating Income and Adjusted Operating

Margin

The Company defines adjusted operating income as operating

income adjusted to exclude the impact of restructuring expense,

separation and transaction costs, intangible asset amortization

expense, impairment charges, other net expenses, and other gains

and losses not reflective of the Company’s ongoing operations.

Adjusted operating margin is defined as adjusted operating income

divided by adjusted sales.

Adjusted Sales

The Company defines adjusted sales as net sales adjusted to

exclude certain agreements with BorgWarner that were entered into

in connection with the spin-off.

Adjusted Net Earnings Per Diluted Share

The Company defines adjusted net earnings per diluted share as

net earnings per share adjusted to exclude the tax-effected impact

of restructuring expense, separation and transaction costs,

impairment charges, other net expenses, and other gains, losses and

tax amounts not reflective of the Company’s ongoing operations.

Adjusted Free Cash Flow

The Company defines adjusted free cash flow as net cash provided

by operating activities after adding back adjustments related to

the ongoing effects of separation-related transactions, less

capital expenditures, including tooling outlays.

Adjusted Sales (Unaudited)

(in millions)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Fuel Systems net sales

$

484

$

561

$

1,529

$

1,621

Spin-Off agreement adjustment

(1

)

(26

)

(23

)

(26

)

Fuel Systems adjusted sales

483

535

1,506

1,595

Aftermarket net sales

355

335

1,041

997

Adjusted sales

$

838

$

870

$

2,547

$

2,592

Adjusted Operating Income and Operating

Margin (Unaudited)

(in millions)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Operating income

$

66

$

46

$

208

$

160

Separation and transaction costs

4

25

24

84

Intangible asset amortization expense

7

7

21

21

Restructuring expense

6

4

11

10

Losses for other one-time events

4

—

4

—

Royalty income from Former Parent

—

—

—

(17

)

Adjusted operating income

$

87

$

82

$

268

$

258

Net sales

$

839

$

896

$

2,570

$

2,618

Operating margin %

7.9

%

5.1

%

8.1

%

6.1

%

Adjusted sales

$

838

$

870

$

2,547

$

2,592

Adjusted operating margin %

10.4

%

9.4

%

10.5

%

10.0

%

Adjusted EBITDA and EBITDA Margin

(Unaudited)

(in millions)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net earnings (loss)

$

31

$

(1

)

$

74

$

69

Depreciation and tooling amortization

33

35

100

105

Interest expense

20

22

81

34

Provision for income taxes

22

31

72

75

Intangible asset amortization expense

7

7

21

21

Interest income

(4

)

(4

)

(12

)

(9

)

EBITDA

109

90

336

295

Separation and transaction costs

4

25

24

84

Restructuring expense

6

4

11

10

Losses for other one-time events

4

—

4

—

Other postretirement expense (income),

net

—

—

1

(1

)

Royalty income from Former Parent

—

—

—

(17

)

Equity in affiliates' earnings, net of

tax

(3

)

(2

)

(8

)

(8

)

Adjusted EBITDA

$

120

$

117

$

368

$

363

Adjusted sales

$

838

$

870

$

2,547

$

2,592

Adjusted EBITDA margin %

14.3

%

13.4

%

14.4

%

14.0

%

Net Earnings (Loss) to Adjusted Net

Earnings (Unaudited)

(in millions)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net earnings (loss)

$

31

$

(1)

$

74

$

69

Separation and transaction costs

3

22

22

81

Intangible asset amortization

6

6

18

19

Loss on extinguishment of debt

2

—

17

—

Restructuring expense

5

4

9

8

Losses for other one-time events

3

—

3

—

Royalty income from Former Parent

—

—

—

(17)

Tax adjustments

2

1

—

1

Adjusted net earnings

$

52

$

32

$

143

$

161

Adjusted Net Earnings Per Diluted Share

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net earnings per diluted share

$

0.70

$

(0.02)

$

1.63

$

1.46

Separation and transaction costs

0.08

0.48

0.48

1.72

Loss on extinguishment of debt

0.03

—

0.37

—

Intangible asset amortization expense

0.13

0.13

0.40

0.40

Restructuring expense

0.11

0.08

0.19

0.17

Losses for other one-time events

0.08

—

0.08

—

Royalty income from Former Parent

—

—

—

(0.36)

Tax adjustments

0.04

0.02

—

0.03

Adjusted net earnings per diluted

share

$

1.17

$

0.69

$

3.15

$

3.42

Adjusted Free Cash Flow

(Unaudited)

(in millions)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net cash provided by operating

activities

$

95

$

155

$

235

$

188

Capital expenditures, including tooling

outlays

(25

)

(37

)

(85

)

(117

)

Effects of separation-related

transactions

(10

)

(25

)

31

35

Adjusted free cash flow

$

60

$

93

$

181

$

106

Adjusted Sales Guidance

(Unaudited)

(in millions)

Full Year 2024 Guidance

Low

High

Net sales

$

3,363

$

3,413

Spin-Off agreement adjustment

(23

)

(23

)

Adjusted sales

$

3,340

$

3,390

Category: IR

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031557830/en/

IR contact: Kellen Ferris Vice President of Investor Relations

investors@phinia.com +1 574-210-5713

Media contact: Kevin Price Global Brand & Communications

Director media@phinia.com +44 (0) 7795 463871

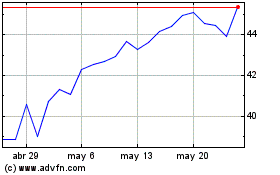

PHINIA (NYSE:PHIN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

PHINIA (NYSE:PHIN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024