0000079879false00000798792024-07-182024-07-180000079879us-gaap:CommonStockMember2024-07-182024-07-180000079879ppg:A0.875Notesdue2025Member2024-07-182024-07-180000079879ppg:A1875NotesDue2025Member2024-07-182024-07-180000079879ppg:A1.400Notesdue2027Member2024-07-182024-07-180000079879ppg:A2750NotesDue2029Member2024-07-182024-07-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 18, 2024

| | |

|

PPG INDUSTRIES, INC. |

(Exact Name of Registrant as Specified in Charter) |

|

| | | | | | | | | | |

| Pennsylvania | | 001-1687 | | 25-0730780 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

One PPG Place, Pittsburgh, Pennsylvania, 15272

(Address of Principal Executive Offices, and Zip Code)

(412) 434-3131

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, par value $1.66 2/3 | | PPG | | New York Stock Exchange |

| 0.875% Notes due 2025 | | PPG 25 | | New York Stock Exchange |

| 1.875% Notes due 2025 | | PPG 25A | | New York Stock Exchange |

| 1.400% Notes due 2027 | | PPG 27 | | New York Stock Exchange |

| 2.750% Notes due 2029 | | PPG 29A | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | | | | |

| Item 2.02 | | Results of Operations and Financial Condition. |

On July 18, 2024, PPG Industries, Inc. ("PPG") issued the press release attached hereto as Exhibit 99, which is incorporated by reference herein. The information furnished pursuant to this Item 2.02 shall in no way be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liability of that section, except if PPG specifically incorporates it by reference into a filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act.

| | | | | | | | |

| Item 9.01 | | Financial Statements and Exhibits. |

(d) Exhibits. The following exhibits are being furnished as part of this Report.

| | | | | | | | |

Exhibit Number | | Description |

| 99 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | PPG INDUSTRIES, INC. |

| | (Registrant) |

| | |

| Date: July 18, 2024 | By: | /s/ Vincent J. Morales |

| | Vincent J. Morales |

| | Senior Vice President and Chief Financial Officer |

| | |

News

PPG Media Contact:

Mark Silvey

Corporate Communications

+1-412-434-3046

silvey@ppg.com

PPG Investor Contact:

Alex Lopez

Investor Relations

+1-412-434-3466

alejandrolopez@ppg.com

investor.ppg.com

PPG reports second quarter 2024 financial results

•Record reported earnings per diluted share (EPS) of $2.24 and adjusted EPS of $2.50

•Net sales of $4.8 billion; organic sales flat versus prior year

•Segment margins improved 110 basis points year over year, marking seven consecutive quarters of margin expansion

•Share repurchases of approximately $150 million in the quarter; $300 million year to date

PITTSBURGH, July 18, 2024 – PPG (NYSE:PPG) today reported financial results for the second quarter 2024.

Second Quarter Consolidated Results

| | | | | | | | | | | |

| $ in millions, except EPS | 2Q 2024 | 2Q 2023 | YOY change |

| Net sales | $4,794 | $4,872 | (2)% |

Net income | $528 | $490 | +8% |

Adjusted net income(a) | $590 | $534 | +10% |

EPS | $2.24 | $2.06 | +9% |

Adjusted EPS(a) | $2.50 | $2.25 | +11% |

(a) Reconciliations of reported to adjusted figures are included below

Chairman and CEO Comments

Tim Knavish, PPG chairman and chief executive officer, commented on the quarter:

PPG delivered strong financial results in an increasingly challenging macro-environment. We achieved record reported EPS and adjusted EPS and grew year-over-year adjusted EPS by 11%, marking the sixth consecutive quarter of growth.

Overall organic sales were flat, but grew in many of our businesses, including aerospace coatings, packaging coatings, architectural coatings Americas and Asia Pacific, traffic solutions and specialty coatings and materials. This growth was offset by global automotive builds that weakened as the quarter progressed and global industrial production which remained soft. Also, refinish coatings sales were down year over year reflecting a comparison to record prior year results and uneven distributor order patterns.

Overall European year-over-year sales volume comparisons improved sequentially versus the first quarter, but sales volumes remained unfavorable and were below our initial expectations. Our

financial results continued to benefit from our well-established businesses in Mexico and China, our second and third largest countries based on revenue.

We built on our segment margin growth momentum as aggregate segment margins improved 110 basis points, which marks the seventh consecutive quarter of year-over-year improvement. Also, our gross margins improved by 180 basis points year over year. Our balance sheet remains strong, including lower inventories year over year, and we remain committed to utilizing cash for shareholder value creation. For the third consecutive quarter we repurchased shares, with approximately $150 million repurchased in the quarter and about $300 million year to date.

Looking ahead, we expect strong momentum in Mexico. We believe that demand in China for PPG technology-advantaged products will deliver continued organic growth, albeit at lower growth rates than achieved in the first half of the year. In Europe, demand remains uneven by country and end use, but we expect to realize modest sequential year-over-year improvement. In the U.S., economic conditions have remained subdued in several end-use markets, but we expect overall improvement as the second half of the year progresses.

As we execute on various enterprise growth initiatives and capitalize on our technical and service capabilities, we expect positive momentum in driving improved sales volumes will broaden within our business portfolio. In addition to those businesses that grew in the second quarter, we expect organic growth in automotive refinish coatings and protective and marine coatings. Also, while still slightly unfavorable year over year, we are projecting modest sequential quarterly improvement in general industrial demand. As a result, in the third quarter we are projecting flat-to-low single-digit percentage aggregate organic sales growth.

The strategic reviews of the architectural coatings U.S. and Canada business and the global silicas business that were announced in the first quarter are progressing. We are diligently working toward and remain on schedule to determine paths forward as a result of each of these reviews.

Our more than 50,000 employees continue to be dedicated to delivering growth for PPG. Our record results this quarter were made possible by our PPG team around the world who make it happen and deliver on our purpose every day: We protect and beautify the world®.

Second Quarter 2024 Reportable Segment Financial Results

Performance Coatings segment

| | | | | | | | | | | |

| $ in millions | 2Q 2024 | 2Q 2023 | YOY change |

| Net sales | $3,048 | $3,041 | —% |

| Segment income | $570 | $537 | +6% |

| Segment income % | 18.7% | 17.7% | |

| Sales volumes | | | —% |

| Selling prices | | | +2% |

| Foreign currency translation | | | (1)% |

Divestitures | | | (1)% |

Performance Coatings net sales were flat, as higher selling prices were offset by the divestitures of the non-North American portion of the traffic solutions business and unfavorable foreign currency translation.

Sales of PPG’s aerospace products remained strong, as the business delivered double-digit percentage organic sales growth year over year, while the order backlog increased to approximately $290 million. Protective and marine coatings organic sales were flat as growth in Europe and the Asia

Pacific region was offset by lower sale volumes in other regions. Organic sales for architectural coatings Americas and Asia Pacific were higher by a low single-digit percentage, supported by sales volume growth in the professional contractor segment in the U.S. and Canada. In Mexico, architectural coatings delivered record sales and earnings as we continue to benefit from a strong Mexican economy and our world-class distribution network in the country. Organic sales for architectural coatings Europe, Middle East and Africa decreased by a low single-digit percentage with lower sales volumes across western Europe, which offset growth in central and eastern Europe. As expected, automotive refinish coatings organic sales were lower by a mid-single-digit percentage, as a challenging prior-year comparison and uneven distributor order patterns in the U.S. offset solid growth in Asia and Europe.

Segment operating margins of 18.7% were a second quarter record and increased by 100 basis points year over year. Segment income increased by 6% versus the prior year primarily due to improved selling prices partially offset by higher growth-related spending.

Industrial Coatings segment

| | | | | | | | | | | |

| $ in millions | 2Q 2024 | 2Q 2023 | YOY change |

| Net sales | $1,746 | $1,831 | (5)% |

| Segment income | $259 | $250 | +4% |

| Segment income % | 14.8% | 13.7% | |

| Sales volumes | | | —% |

| Selling prices | | | (3)% |

| Foreign currency translation | | | (1)% |

Other | | | (1)% |

Industrial Coatings segment net sales were lower compared to the second quarter 2023 due to lower selling prices from certain index-based customer contracts and unfavorable foreign currency translation.

Automotive original equipment manufacturer (OEM) coatings organic sales decreased by a high single-digit percentage due to lower index-based selling prices and lower U.S. and European industry volumes, partly offset by above-market PPG growth in Mexico and moderated growth in China. Industrial coatings organic sales declined by a low single-digit percentage with subdued industrial activity in the U.S. and Europe more than offsetting solid PPG growth in China and India. Packaging coatings organic sales were up a mid-single-digit percentage year over year with solidly higher sales volumes stemming from PPG share gains mitigated by lower selling prices.

Segment margins improved by 110 basis points compared to the second quarter 2023. Segment income was 4% higher than the prior year as input costs moderated. These net benefits more than offset the impact from lower selling prices based on certain index-based pricing contracts and wage cost inflation.

Additional Financial Information

•At quarter end, the company had cash and short-term investments totaling $1.2 billion. Net debt was $5.2 billion, down $0.4 billion from the second quarter 2023.

•Corporate expenses were $69 million in the second quarter, which was $16 million lower than the prior year, as lower incentive-based compensation and cost savings initiatives were partially offset by general inflation.

•Net interest expense was $17 million in the second quarter.

•The effective tax rate was approximately 23% in the second quarter.

Outlook

The company today reported the following projections for the third quarter and full-year 2024 based on current global economic activity, continued uneven global industrial production, lower global automotive production, uneven but stabilizing demand in Europe, continued growth in Mexico and India, and low single-digit growth in China.

| | | | | | | | |

| Outlook | 3Q 2024 | FY 2024 |

| Organic sales growth | Flat to up low single digits | Flat to up low single digits |

| Adjusted EPS | $2.10 - $2.20 per share | $8.15 - $8.30 per share |

The effective tax rate for the third quarter 2024 is expected to be between 23.5% to 24.5%, higher than the prior year adjusted rate of 19.5%, including the impact of several regional tax rate increases, the expected mix of country-specific earnings and the absence of certain prior year favorable discrete tax items.

Additional information related to 2024 financial projections are available in the detailed commentary and associated presentation slides related to the second quarter financial information, which are posted within the Investors section of PPG.com.

The term organic sales as used in this press release is defined as net sales excluding the impact of currency, acquisitions and divestitures.

PPG: WE PROTECT AND BEAUTIFY THE WORLD®

At PPG (NYSE:PPG), we work every day to develop and deliver the paints, coatings and specialty materials that our customers have trusted for more than 140 years. Through dedication and creativity, we solve our customers’ biggest challenges, collaborating closely to find the right path forward. With headquarters in Pittsburgh, we operate and innovate in more than 70 countries and reported net sales of $18.2 billion in 2023. We serve customers in construction, consumer products, industrial and transportation markets and aftermarkets. To learn more, visit www.ppg.com.

The PPG Logo and We protect and beautify the world are registered trademarks of PPG Industries Ohio, Inc.

Additional Information

PPG will provide detailed commentary regarding its financial performance, including presentation-slide content, on the PPG Investor Center at www.ppg.com at about 4:30 p.m. ET today, July 18. The company will hold a conference call to review its second quarter 2024 financial performance on July 19, at 8:00 a.m. ET. Participants can pre-register for the conference by navigating to https://www.netroadshow.com/events/login?show=b15d2051&confId=67003. The conference call also will be available in listen-only mode via Internet broadcast from the PPG Investor Center at www.ppg.com. A telephone replay will be available July 19, beginning at approximately 11:00 a.m. ET, through August 2, at 11:59 p.m. ET. The dial-in numbers for the replay are: in the United States, 1-866-813-9403; Canada, 1-226-828-7578; UK (Local), 0204-525-0658; international, +44-204-525-0658; passcode 281083. A web replay also will be available shortly after the call on the PPG Investor Center at www.ppg.com, and will remain through Thursday, July 17, 2025.

Forward-Looking Statements

Statements contained herein relating to matters that are not historical facts are forward-looking statements reflecting PPG’s current view with respect to future events and financial performance. These matters within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, involve risks and uncertainties that may affect PPG’s operations, as discussed in the company’s filings with the Securities and Exchange Commission pursuant to Sections 13(a), 13(c) or 15(d) of the Exchange Act, and the rules and regulations promulgated thereunder. Accordingly, many factors could cause actual results to differ materially from the forward-looking statements contained herein. Such factors include statements related to the effects on our business of COVID-19, global economic conditions, geopolitical issues, the amount of future share repurchases, increasing price and product competition by our competitors, fluctuations in cost and availability of raw materials, energy, labor and logistics, the ability to achieve selling

price increases, the ability to recover margins, customer inventory levels, PPG inventory levels, the ability to maintain favorable supplier relationships and arrangements, the timing of realization of anticipated cost savings from restructuring and other initiatives, the ability to identify additional cost savings opportunities, the timing and expected benefits of potential future and completed acquisitions, difficulties in integrating acquired businesses and achieving expected synergies therefrom, economic and political conditions in international markets, the ability to penetrate existing, developing and emerging foreign and domestic markets, foreign exchange rates and fluctuations in such rates, fluctuations in tax rates, the impact of future legislation, the impact of environmental regulations, unexpected business disruptions, the unpredictability of existing and possible future litigation, including asbestos litigation, and governmental investigations. However, it is not possible to predict or identify all such factors. Consequently, while the list of factors presented here and in our 2023 Annual Report on Form 10-K considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results compared with those anticipated in the forward-looking statements could include, among other things, lower sales or earnings, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on PPG’s consolidated financial condition, results of operations or liquidity.

All information in this release speaks only as of July 18, 2024, and any distribution of this release after that date is not intended and will not be construed as updating or confirming such information. PPG undertakes no obligation to update any forward-looking statement, except as otherwise required by applicable law.

Regulation G Reconciliation

PPG believes investors’ understanding of the company’s performance is enhanced by the disclosure of net income, earnings per diluted share from continuing operations and PPG’s effective tax rate adjusted for certain items. PPG’s management considers this information useful in providing insight into the company’s ongoing performance because it excludes the impact of items that cannot reasonably be expected to recur on a quarterly basis or that are not attributable to our primary operations. Net income, earnings per diluted share from continuing operations and the effective tax rate adjusted for these items are not recognized financial measures determined in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) and should not be considered a substitute for net income, earnings per diluted share, the effective tax rate or other financial measures as computed in accordance with U.S. GAAP. In addition, adjusted net income, adjusted earnings per diluted share and the adjusted effective tax rate may not be comparable to similarly titled measures as reported by other companies. PPG is not able to provide a reconciliation of third quarter and full-year 2024 expected adjusted earnings per diluted share to the most directly comparable GAAP financial measure without unreasonable effort because certain items that impact such measure are uncertain or cannot be reasonably predicted at this time.

Regulation G Reconciliation - Net Income and Earnings per Diluted Share

($ in millions, except per-share amounts) | | | | | | | | | | | | | | | | | | | | | | | |

| Second Quarter

2024 | | Second Quarter

2023 |

| $ | | EPS(a) | | $ | | EPS(a) |

| Reported net income from continuing operations | $528 | | | $2.24 | | | $490 | | | $2.06 | |

| Acquisition-related amortization expense | 27 | | | 0.11 | | | 30 | | | 0.13 | |

Business restructuring-related costs, net(b) | 2 | | | 0.01 | | | 11 | | | 0.05 | |

Portfolio optimization(c) | 18 | | | 0.08 | | | 3 | | | 0.01 | |

Legacy environmental remediation charges(d) | 15 | | | 0.06 | | | — | | | — | |

| Adjusted net income from continuing operations, excluding certain items | $590 | | | $2.50 | | | $534 | | | $2.25 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Second Quarter

2024 | | Second Quarter

2023 |

| Income Before Income Taxes | | Tax Expense | | Effective Tax Rate | | Income Before Income Taxes | | Tax Expense | | Effective Tax Rate |

| Effective tax rate, continuing operations | $693 | | | $156 | | | 22.5 | % | | $646 | | | $149 | | | 23.1 | % |

| Acquisition-related amortization expense | 36 | | | 9 | | | 24.6 | % | | 40 | | | 10 | | | 24.6 | % |

Business restructuring-related costs, net(b) | 4 | | | 2 | | | 46.0 | % | | 14 | | | 3 | | | 24.0 | % |

Portfolio optimization(c) | 26 | | | 8 | | | 31.3 | % | | 7 | | | 2 | | | 24.3 | % |

Legacy environmental remediation charges(d) | 20 | | | 5 | | | 24.3 | % | | — | | | — | | | — | % |

| Adjusted effective tax rate, continuing operations, excluding certain items | $779 | | | $180 | | | 23.1 | % | | $707 | | | $164 | | | 23.2 | % |

(a)Earnings per diluted share is calculated based on unrounded numbers. Figures in the table may not recalculate due to rounding.

(b)Business restructuring-related costs, net include business restructuring charges, offset by releases related to previously approved programs, which are included in Other charges/(income), net on the condensed consolidated statement of income, accelerated depreciation of certain assets, which is included in Depreciation on the condensed consolidated statement of income, and other restructuring-related costs, which are included in Cost of sales, exclusive of depreciation and amortization and Selling, general and administrative on the condensed consolidated statement of income.

(c)Portfolio optimization includes losses on the sale of non-core assets, including the loss recognized on the sale of the Company's traffic solutions business in Argentina during the second quarter 2024, which is included in Other charges/(income), net in the condensed consolidated statement of income. Portfolio optimization also includes advisory, legal, accounting, valuation, other professional or consulting fees and certain internal costs directly incurred to effect acquisitions, as well as similar fees and other costs to effect divestitures and other portfolio optimization exit actions. These costs are included in Selling, general and administrative expense on the condensed consolidated statement of income. In 2023, net loss of $2 million was attributable to noncontrolling interests.

(d)Legacy environmental remediation charges represent environmental remediation costs at certain non-operating PPG manufacturing sites. These charges are included in Other charges/(income), net in the condensed consolidated statement of income.

| | | | | | | | | | | | | | | | | | | | | | | |

| PPG INDUSTRIES, INC. AND SUBSIDIARIES | | | | | | | |

| CONDENSED CONSOLIDATED STATEMENT OF INCOME (unaudited) |

| (All amounts in millions except per-share data) | | | | | | | |

| Three Months Ended June 30 | | Six Months Ended June 30 |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | $4,794 | | $4,872 | | $9,105 | | $9,252 |

| Cost of sales, exclusive of depreciation and amortization | 2,734 | | 2,866 | | 5,179 | | 5,462 |

| Selling, general and administrative | 1,077 | | 1,069 | | 2,141 | | 2,061 |

| Depreciation | 98 | | 93 | | 201 | | 185 |

| Amortization | 36 | | 40 | | 74 | | 81 |

| Research and development, net | 111 | | 110 | | 220 | | 214 |

| Interest expense | 62 | | 67 | | 117 | | 126 |

| Interest income | (45) | | (32) | | (87) | | (57) |

| | | | | | | |

| Pension settlement charge | — | | — | | — | | 190 |

| Other charges/(income), net | 28 | | 13 | | 29 | | (9) |

| Income before income taxes | $693 | | $646 | | $1,231 | | $999 |

| Income tax expense | 156 | | 149 | | 285 | | 229 |

| | | | | | | |

| | | | | | | |

| Net income attributable to controlling and noncontrolling interests | $537 | | $497 | | $946 | | $770 |

| Net income attributable to noncontrolling interests | (9) | | (7) | | (18) | | (16) |

| Net income (attributable to PPG) | $528 | | $490 | | $928 | | $754 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Earnings per common share (attributable to PPG) | $2.25 | | $2.08 | | $3.95 | | $3.20 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Earnings per common share (attributable to PPG) - assuming dilution | $2.24 | | $2.06 | | $3.93 | | $3.18 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Average shares outstanding | 234.5 | | 236.0 | | 235.1 | | 235.9 |

| | | | | | | |

| Average shares outstanding - assuming dilution | 235.7 | | 237.3 | | 236.3 | | 237.1 |

| | | | | | | | | | | | | | |

| PPG INDUSTRIES, INC. AND SUBSIDIARIES | | | |

| CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS HIGHLIGHTS (unaudited) | | |

| ($ in millions) | | | |

| | Six Months Ended June 30 |

| | 2024 | | 2023 |

Cash from operating activities | $305 | | $621 |

| Cash used for investing activities: | | | |

| Capital expenditures | $374 | | $242 |

| Business acquisitions, net of cash balances acquired | $27 | | $106 |

| Cash used for financing activities: | | | |

| Dividends paid on PPG common stock | $305 | | $292 |

| | | | | | | | | | | | | | | | | |

| PPG INDUSTRIES, INC. AND SUBSIDIARIES | | |

| CONDENSED CONSOLIDATED BALANCE SHEET HIGHLIGHTS (unaudited) | | |

| ($ in millions) | | | | | |

| June 30 | | December 31 | | June 30 |

| 2024 | | 2023 | | 2023 |

| Current assets: | | | | | |

| Cash and cash equivalents | $1,131 | | $1,514 | | $1,228 |

| Short-term investments | 61 | | 75 | | 68 |

| Receivables, net | 3,845 | | 3,279 | | 3,821 |

| Inventories | 2,299 | | 2,127 | | 2,506 |

| Other current assets | 448 | | 436 | | 445 |

| Total current assets | $7,784 | | $7,431 | | $8,068 |

| | | | | |

| Current liabilities: | | | | | |

| Short-term debt and current portion of long-term debt | $639 | | $306 | | $809 |

| Accounts payable and accrued liabilities | 4,332 | | 4,467 | | 4,306 |

| Current portion of operating lease liabilities | 194 | | 194 | | 188 |

| Restructuring reserves | 60 | | 87 | | 113 |

| Total current liabilities | $5,225 | | $5,054 | | $5,416 |

| | | | | |

| Long-term debt | $5,765 | | $5,748 | | $6,099 |

| | | | | |

| | | | | |

| PPG OPERATING METRICS (unaudited) | | | | | |

| ($ in millions) | | | | | |

| June 30 | | December 31 | | June 30 |

| 2024 | | 2023 | | 2023 |

| Operating Working Capital (a) | $3,264 | | $2,645 | | $3,485 |

| As a percent of quarter sales, annualized | 17.0 | % | | 15.2 | % | | 17.9 | % |

| | | | | |

(a) Operating working capital includes: (1) receivables from customers, net of allowance for doubtful accounts, (2) FIFO inventories and (3) trade liabilities. |

| | | | | | | | | | | | | | | | | | | | | | | |

| PPG INDUSTRIES, INC. AND SUBSIDIARIES | | | | | | | |

| CONSOLIDATED BUSINESS SEGMENT INFORMATION (unaudited) | | | | |

| ($ in millions) | | | | | | | |

| Three Months Ended June 30 | | Six Months Ended June 30 |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | | | | | | | |

| Performance Coatings | $3,048 | | $3,041 | | $5,662 | | $5,669 |

| Industrial Coatings | 1,746 | | 1,831 | | 3,443 | | 3,583 |

| Total | $4,794 | | $4,872 | | $9,105 | | $9,252 |

| | | | | | | |

| Segment income | | | | | | | |

| Performance Coatings | $570 | | $537 | | $972 | | $932 |

| Industrial Coatings | 259 | | 250 | | 508 | | 490 |

| Total | $829 | | $787 | | $1,480 | | $1,422 |

| | | | | | | |

| Items not allocated to segments | | | | | | | |

| Corporate | (69) | | (85) | | (152) | | (152) |

| Interest expense, net of interest income | (17) | | (35) | | (30) | | (69) |

| Business restructuring-related costs, net (Note A) | (4) | | (14) | | (15) | | (14) |

| Portfolio optimization (Note B) | (26) | | (7) | | (32) | | (7) |

| Legacy environmental remediation charges (Note C) | (20) | | — | | (20) | | — |

| Pension settlement charge (Note D) | — | | — | | — | | (190) |

| Insurance recovery (Note E) | — | | — | | — | | 9 |

| Income before income taxes | $693 | | $646 | | $1,231 | | $999 |

| | | | | | | |

| Note A: | | | | | | | |

Business restructuring-related costs, net include business restructuring charges, offset by releases related to previously approved programs, which are included in Other charges/(income), net on the condensed consolidated statement of income, accelerated depreciation of certain assets, which is included in Depreciation on the condensed consolidated statement of income and other restructuring-related costs, which are included in Cost of sales, exclusive of depreciation and amortization and Selling, general and administrative on the condensed consolidated statement of income. |

| Note B: | | | | | | | |

Portfolio optimization includes losses on the sale of non-core assets, including the loss recognized on the sale of the Company's traffic solutions business in Argentina during the second quarter 2024, which is included in Other charges/(income), net in the condensed consolidated statement of income. Portfolio optimization also includes advisory, legal, accounting, valuation, other professional or consulting fees, and certain internal costs directly incurred to effect acquisitions, as well as similar fees and other costs to effect divestitures and other portfolio optimization exit actions. These costs are included in Selling, general and administrative expense on the condensed consolidated statement of income. |

| Note C: | | | | | | | |

Legacy environmental remediation charges represent environmental remediation costs at certain non-operating PPG manufacturing sites. These charges are included in Other charges/(income), net in the condensed consolidated statement of income. |

| Note D: | | | | | | | |

| In the first quarter 2023, PPG purchased group annuity contracts that transferred pension benefit obligations for certain of the company’s retirees in the U.S. to third-party insurance companies, resulting in a non-cash pension settlement charge. |

| Note E: | | | | | | | |

| In the first quarter 2023, the company received reimbursement under its insurance policies for damages incurred at a southern U.S. factory from a winter storm in 2020. |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ppg_A0.875Notesdue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ppg_A1875NotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ppg_A1.400Notesdue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ppg_A2750NotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

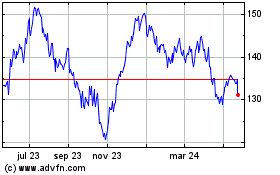

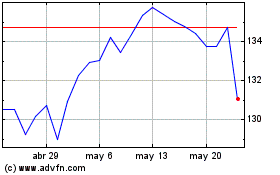

PPG Industries (NYSE:PPG)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

PPG Industries (NYSE:PPG)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024