Form 8-K - Current report

20 Diciembre 2024 - 2:20PM

Edgar (US Regulatory)

0000715072false00007150722024-12-172024-12-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

December 17, 2024

Date of report (Date of earliest event reported)

RENASANT CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Mississippi | 001-13253 | 64-0676974 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

209 Troy Street, Tupelo, Mississippi 38804-4827

(Address of principal executive offices)(Zip Code)

Registrant’s telephone number, including area code: (662) 680-1001

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $5.00 par value per share | RNST | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On December 17, 2024, the Board of Directors (the “Board”) of Renasant Corporation (“Renasant”) approved amendments to the employment agreements for each of Renasant’s Executive Vice Chairman and Chief Executive Officer C. Mitchell Waycaster and Renasant’s President and Chief Operating Officer Kevin D. Chapman, as described below.

C. Mitchell Waycaster. Mr. Waycaster’s employment agreement was amended in the following respects, such amendments being effective as of January 1, 2025:

•Consistent with its previously announced succession plan, the agreement was amended to provide that on May 1, 2025 (the “Transition Date”) Mr. Waycaster will step down as Chief Executive Officer of Renasant, while remaining Executive Vice Chairman. As such, Mr. Waycaster will be expected to devote such time and attention to Renasant’s and Renasant Bank’s business as required to execute the duties the Board assigns to him but in no event more than 60% of the time he previously expended as Executive Vice Chairman and Chief Executive Officer, unless Mr. Waycaster otherwise agrees.

•The term of the agreement was extended to April 30, 2027. Thereafter, the agreement automatically renews for additional one-year terms unless either Renasant or Mr. Waycaster provides the other 60 days’ prior written notice of non-renewal.

•On the Transition Date, Mr. Waycaster’s annual base salary will be reduced to an amount equal to 60% of his base salary immediately prior to the Transition Date. Beginning on January 1, 2027, Mr. Waycaster’s annual base salary will be one-third of his base salary as of December 31, 2026.

•Mr. Waycaster’s annual cash bonus under Renasant’s Performance Based Rewards Plan (the “PBRP”) for 2025 will be determined as follows: (1) for the period from January 1, 2025 through the Transition Date, Mr. Waycaster’s target bonus will be an amount equal to 105% of the base salary paid to him from January 1, 2025 through the Transition Date (with the threshold bonus percentage half the target percentage and the superior bonus percentage twice the target percentage), and (2) for the period from the Transition Date through December 31, 2025, Mr. Waycaster’s target bonus will be an amount equal to 60% of the base salary paid to him from the Transition Date through December 31, 2025 (with the threshold bonus percentage half the target percentage, and the superior bonus percentage twice the target percentage). For 2026 and thereafter, Mr. Waycaster will not participate in the PBRP.

•In connection with entering into the amendment to the agreement, Mr. Waycaster was awarded a retention bonus in the amount of $100,000, provided he remains an employee in good standing on December 31, 2026. Payment of the retention bonus is subject to acceleration in the event of Mr. Waycaster’s death, disability, involuntary termination without cause or his termination of employment on account of his constructive separation (disability, cause and constructive separation are defined in the employment agreement).

•With respect to equity awards under the Renasant Corporation 2020 Long-Term Incentive Compensation Plan, Mr. Waycaster will receive an equity award for the 2025 calendar year valued at $700,000 and he will receive an equity award for the 2026 calendar year valued at $170,000. Each award will vest on December 31, 2026 and be subject to service-based restrictions and terms consistent with the terms of prior service-based restricted stock awards made by the Company to Mr. Waycaster.

•The definition of “mandated amount” in the employment agreement was updated to more consistently align the definition with Renasant’s current practices, and the agreement’s confidentiality provision was supplemented to affirmatively state that the confidentiality provision therein does not prohibit or restrict Mr. Waycaster from reporting a possible violation of law or regulation or making other disclosures under federal and state whistleblower laws and similar statutes.

Other than the foregoing amendments, the existing terms of Mr. Waycaster’s employment agreement remain in full force and effect.

Kevin D. Chapman. Mr. Chapman’s employment agreement was amended to increase the multiple of Mr. Chapman’s base compensation and average cash bonus payable to Mr. Chapman if he is terminated within two years after a change in control of Renasant from 2.5 to 2.99. In addition, Mr. Chapman’s employment agreement was amended to include updates analogous to those described above in the last bullet of the discussion of the amendments to Mr. Waycaster’s employment agreement.

Item 9.01. Financial Statements and Exhibits.

(d) The following exhibits are furnished herewith:

Exhibit No. Description

104 The cover page of Renasant Corporation’s Form 8-K is formatted in Inline XBRL

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | RENASANT CORPORATION |

| Date: December 20, 2024 | | By: | /s/ C. Mitchell Waycaster |

| | | C. Mitchell Waycaster |

| | | Chief Executive Officer |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

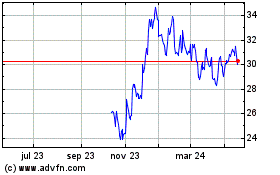

Renasant (NYSE:RNST)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

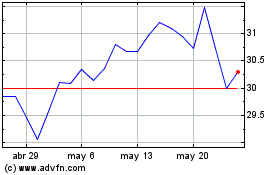

Renasant (NYSE:RNST)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025