Six Flags Announces Closing of Offering of $850 Million of 6.625% Senior Secured Notes due 2032

02 Mayo 2024 - 8:20AM

Business Wire

Six Flags Entertainment Corporation (NYSE: SIX) (the “Company,”

“Six Flags,” “we,” “us” or “our”), the world’s largest regional

theme park company and the largest operator of water parks in North

America, today announced that the Company and its wholly-owned

subsidiary, Six Flags Theme Parks Inc. (“SFTP”), as co-issuers,

have closed their private offering of $850 million aggregate

principal amount of 6.625% Senior Secured Notes due 2032 (the

“Notes”).

As previously announced, on November 2, 2023, the Company

entered into that certain Agreement and Plan of Merger (the “Merger

Agreement” and the merger transactions contemplated thereby, the

“Mergers”), by and among the Company, Cedar Fair, L.P. (“Cedar

Fair”), CopperSteel HoldCo, Inc. (“HoldCo”) and CopperSteel Merger

Sub, LLC. Pursuant to the Merger Agreement, Cedar Fair and Six

Flags will each merge with and into HoldCo, with HoldCo continuing

as the surviving entity.

The Company intends to apply the net proceeds from the Notes

towards (i) the principal amounts outstanding under its existing

term loan facility and revolving credit facility and (ii) a portion

of the outstanding 7.000% Senior Secured Notes due July 1, 2025

issued by SFTP. The remainder of the net proceeds from the Notes

offering are expected to be used (together with other sources of

cash) for general corporate purposes, including but not limited to

working capital, operating expenses, capital expenditures, debt

service requirements, the payment of the special dividend in

connection with the Mergers, and the payment of fees and expenses

related to the Mergers.

The Notes have been offered and sold only to persons reasonably

believed to be qualified institutional buyers pursuant to Rule 144A

under the Securities Act of 1933, as amended (the “Securities

Act”), and to certain persons outside of the United States pursuant

to Regulation S under the Securities Act. The Notes and the related

guarantees have not been registered under the Securities Act or the

securities laws of any state or other jurisdiction and may not be

offered or sold in the United States without registration or an

applicable exemption from the Securities Act and applicable state

securities or blue sky laws and foreign securities laws.

This press release is for informational purposes only and does

not constitute an offer to sell, or a solicitation of an offer to

buy, any security. No offer, solicitation, or sale will be made in

any jurisdiction in which such an offer, solicitation, or sale

would be unlawful. Any offers of the Notes will be made only by

means of a private offering memorandum.

About Six Flags Entertainment Corporation

Six Flags Entertainment Corporation is the world’s largest

regional theme park company with 27 parks across the United States,

Mexico and Canada. For 63 years, Six Flags has entertained hundreds

of millions of guests with world-class coasters, themed rides,

thrilling water parks and unique attractions. Six Flags is

committed to creating an inclusive environment that fully embraces

the diversity of our team members and guests.

Cautionary Information Regarding

Forward-Looking Statements

This Press Release contains forward-looking statements within

the meaning of Section 27A of the Securities Act, and Section 21E

of the Exchange Act. Forward-looking statements include all

statements that are not historical facts and can be identified by

words such as “anticipates,” “intends,” “plans,” “seeks,”

“believes,” “estimates,” “expects,” “may,” “should,” “could” and

variations of such words or similar expressions. These

forward-looking statements are not guarantees of future performance

and are subject to risks, uncertainties, assumptions and other

factors, some of which are beyond our control, which could cause

actual results to differ materially from those expressed or implied

by such forward-looking statements. These factors include (i) the

adequacy of our cash flows from operations, available cash and

available amounts under our credit facilities to meet our liquidity

needs, (ii) the risk that the proposed Mergers disrupt current

plans and operations of the Company and the effect of the

announcement or pendency of the Mergers on the business

relationships, operating results and business generally of the

Company, (iii) our expectations regarding the timing, costs,

benefits and results of our strategic plan, (iv) the impact of

macro-economic conditions, including inflation on consumer

spending, (v) our ability to implement our capital plans in a

timely and cost effective manner, and our expectations regarding

the anticipated costs, benefits and results of such capital plans,

(vi) the extent to which having parks in diverse geographical

locations protects our consolidated results against the effects of

adverse weather and other events, (vii) our ongoing compliance with

laws and regulations, and the effect of, and cost and timing of

compliance with, newly enacted laws and regulations, (viii) our

ability to obtain additional financing and the increased cost of

capital due to rising interest rates, (ix) our expectations

regarding the effect of certain accounting pronouncements, (x) our

expectations regarding the cost or outcome of any litigation or

other disputes, (xi) our annual income tax liability and the

availability and effect of net operating loss carryforwards and

other tax benefits, and (xii) our expectations regarding uncertain

tax positions.

Forward-looking statements are based on our current expectations

and assumptions regarding our business, the economy and other

future conditions. Because forward-looking statements relate to the

future, they are, by their nature, subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict. A more complete discussion of these factors

and other risks applicable to our business is contained in the

Company’s Annual Report on Form 10-K, filed with the Securities and

Exchange Commission on February 29, 2024, as amended by the

Company’s Annual Report on Form 10-K/A filed with the Securities

and Exchange Commission on April 29, 2024. While we believe that

the expectations reflected in such forward-looking statements are

reasonable, we make no assurance that such expectations will be

realized and actual results could vary materially. Factors or

events that could cause our actual results to differ may emerge

from time to time, and it is not possible for us to predict all of

them. We undertake no obligation, except as required by applicable

law, to publicly update any forward-looking statement, whether as a

result of new information, future developments or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240501112126/en/

Evan Bertrand Investor Relations +1-972-595-5180

investorrelations@sftp.com

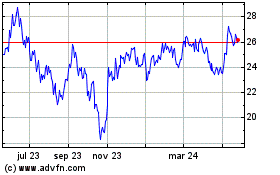

Six Flags Entertainment (NYSE:SIX)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

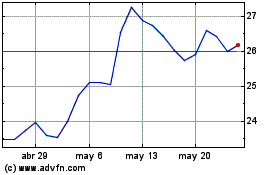

Six Flags Entertainment (NYSE:SIX)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025