UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-22328

Columbia Seligman Premium Technology Growth Fund, Inc.

(Exact name of registrant as specified in charter)

290 Congress Street, Boston, MA 02210

(Address of principal executive offices) (Zip code)

Daniel J. Beckman

c/o Columbia Management Investment Advisers, LLC

290 Congress Street

Boston, MA 02210

Ryan C. Larrenaga, Esq.

c/o Columbia Management Investment Advisers, LLC

290 Congress Street

Boston, MA 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: (800) 345-6611

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Explanatory Note

On March 3, 2022, the undersigned registrant filed its Certified Shareholder Report on Form N-CSR for the annual period ended December 31, 2021. The registrant hereby amends the original filing Item 4.a Principal Accountant Fees and Services – Audit Fees to correct the prior year (2020) audit fee amount.

This amendment does not reflect events occurring after the filing of the original Certified Shareholder Report on Form N-CSR for the annual period ended December 31, 2021, and, other than supplementing Item 4 “Principal Accountant Fees and Services,” as stated above, does not modify or update the disclosures in the original Certified Shareholder Report on Form N-CSR in any way.

Item 1. Reports to Stockholders.

Annual Report

December 31, 2021

Columbia Seligman

Premium Technology Growth Fund, Inc.

Not Federally Insured • No

Financial Institution Guaranteed • May Lose Value

Under the managed distribution

policy of Columbia Seligman Premium Technology Growth Fund, Inc. (the Fund) and subject to the approval of the Fund’s Board of Directors (the Board), the Fund expects to make quarterly cash distributions

(in February, May, August and November) to holders of common stock (Common Stockholders). The Fund’s most recent distribution under its managed distribution policy (paid on February 22, 2022) amounted to $0.4625

per share, which is equal to a quarterly rate of 1.3960% (5.58% annualized) of the Fund’s market price of $33.13 per share as of January 31, 2022. On January 18, 2022, the Fund also paid a special fourth quarter

distribution, beyond its typical quarterly managed distribution policy, in the amount of $1.2869 per share of common stock to stockholders of record on December 13, 2021. You should not draw any conclusions about the

Fund’s investment performance from the amount of the distributions or from the terms of the Fund’s managed distribution policy. Historically, the Fund has at times distributed more than its income and net

realized capital gains, which has resulted in Fund distributions substantially consisting of return of capital or other capital source. A return of capital may occur, for example, when some or all of the money that

you invested in the Fund is paid back to you. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with ‘yield’ or

‘income’. The Fund’s Board may determine in the future that the Fund’s managed distribution policy and the amount or timing of the distributions should not be continued in light of changes in

the Fund’s portfolio holdings, market or other conditions or factors, including that the distribution rate under such policy may not be dependent upon the amount of the Fund’s earned income or realized

capital gains. The Board could also consider amending or terminating the current managed distribution policy because of potential adverse tax consequences associated with maintaining the policy. In certain situations,

returns of capital could be taxable for federal income tax purposes, and all or a portion of the Fund’s capital loss carryforwards from prior years, if any, could effectively be forfeited. The Board may amend or

terminate the Fund’s managed distribution policy at any time without prior notice to Fund stockholders; any such change or termination may have an adverse effect on the market price of the Fund’s

shares.

See Notes to Financial Statements

for additional information related to the Fund’s managed distribution policy.

Columbia Seligman Premium Technology Growth Fund,

Inc. | Annual Report 2021

Letter to the Stockholders

Dear Stockholders,

We are pleased to present the

annual stockholder report for Columbia Seligman Premium Technology Growth Fund, Inc. (the Fund). The report includes the Fund’s investment results, a discussion with the Fund’s portfolio managers, the

portfolio of investments and financial statements as of December 31, 2021.

The Fund’s common shares

(Common Stock) returned 39.38%, based on net asset value, and 48.96%, based on market price, for the 12 months ended December 31, 2021. In comparison, the Fund’s benchmark, the S&P North American Technology

Sector Index, returned 26.40% for the same time period.

During 2021, the Fund paid four

distributions in accordance with its managed distribution policy that aggregated to $1.85 per share of Common Stock of the Fund. On January 18, 2022, the Fund also paid a special fourth quarter distribution, beyond

its typical quarterly managed distribution policy, in the amount of $1.2869 per share of Common Stock to stockholders of record on December 13, 2021. The Fund has exemptive relief from the Securities and Exchange

Commission that permits the Fund to make periodic distributions of long-term capital gains more often than once in any one taxable year. Unless you elected otherwise, distributions were paid in additional shares of

the Fund.

The Board appointed Douglas A.

Hacker to the Fund’s Board. His service with the Fund began effective January 1, 2022 for a term expiring at the 2025 Annual Meeting of Stockholders. Mr. Hacker currently serves on the Board of Trustees of

the mutual funds and exchange-traded funds within the Columbia Funds Complex (the Columbia Funds Board) and, effective January 1, 2022, on the board of another Columbia closed-end fund.

Information about the Fund,

including daily pricing, current performance, Fund holdings, stockholder reports, distributions and other information can be found at columbiathreadneedleus.com/investor/ under the Closed-End Funds tab.

On behalf of the Board, I would

like to thank you for your continued support of Columbia Seligman Premium Technology Growth Fund, Inc.

Regards,

Catherine James Paglia

Chair of the BoardFor more information, go online to columbiathreadneedleus.com/investor/; or call American Stock Transfer & Trust Company, LLC, the Fund’s Stockholder Servicing Agent,

at 866.666.1532. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 8 p.m. Eastern time.

Columbia Seligman Premium Technology Growth Fund,

Inc. | Annual Report 2021

| 3

|

| 5

|

| 7

|

| 16

|

| 18

|

| 22

|

| 23

|

| 24

|

| 25

|

| 26

|

| 41

|

| 42

|

| 42

|

Columbia Seligman Premium

Technology Growth Fund, Inc. (the Fund) mails one stockholder report to each stockholder address. If you would like more than one report, please call shareholder services at 800.937.5449 and additional reports will be

sent to you.

Proxy voting policies and

procedures

The policy of the Board is to vote

the proxies of the companies in which the Fund holds investments consistent with the procedures that can be found by visiting columbiathreadneedleus.com/investor/. Information regarding how the Fund voted proxies

relating to portfolio securities is filed with the SEC by August 31 for the most recent 12-month period ending June 30 of that year, and is available without charge by visiting columbiathreadneedleus.com/investor/; or

searching the website of the SEC at sec.gov.

Quarterly schedule of

investments

The Fund files a complete schedule

of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Form N-PORT filings are available on the SEC’s website at sec.gov. The Fund’s

complete schedule of portfolio holdings, as filed on Form N-PORT, can also be obtained without charge, upon request, by calling 800.937.5449.

Additional Fund information

For more information, go online to

columbiathreadneedleus.com/investor/; or call American Stock Transfer & Trust Company, LLC, the Fund’s Stockholder Servicing Agent, at 866.666.1532. Customer Service Representatives are available to answer

your questions Monday through Friday from 8 a.m. to 8 p.m. Eastern time.

Fund investment manager

Columbia Management Investment Advisers, LLC (the

Investment Manager)

290 Congress Street

Boston, MA 02210

Fund transfer agent

American Stock Transfer & Trust Company,

LLC

6201 15th Avenue

Brooklyn, NY 11219

Columbia Seligman Premium Technology Growth Fund,

Inc. | Annual Report 2021

Investment objective

The Fund

seeks growth of capital and current income.

Portfolio management

Paul Wick

Lead Portfolio Manager

Managed Fund since 2009

Braj Agrawal

Co-Portfolio Manager

Managed Fund since 2010

Christopher Boova

Co-Portfolio Manager

Managed Fund since 2016

Jeetil Patel

Technology Team Member

Managed Fund since 2015

Vimal Patel

Technology Team Member

Managed Fund since 2018

Shekhar Pramanick

Technology Team Member

Managed Fund since 2018

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows

investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2022 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or

distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Average annual total returns (%) (for the period ended December 31, 2021)

|

|

|

| Inception

| 1 Year

| 5 Years

| 10 Years

|

| Market Price

| 11/24/09

| 48.96

| 26.97

| 21.39

|

| Net Asset Value

| 11/30/09

| 39.38

| 27.19

| 19.78

|

| S&P North American Technology Sector Index

|

| 26.40

| 29.99

| 23.54

|

The performance information shown

represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when sold, may be worth more or less than their

original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting

columbiathreadneedleus.com/investor/.

Returns reflect changes in market

price or net asset value, as applicable, and assume reinvestment of distributions. Returns do not reflect the deduction of taxes that investors may pay on distributions or the sale of shares.

The S&P North American

Technology Sector Index is an unmanaged modified capitalization-weighted index based on a universe of technology-related stocks.

Indices are not available for

investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

Fund performance may be significantly

negatively impacted by the economic impact of the COVID-19 pandemic. The COVID-19 pandemic has adversely impacted economies and capital markets around the world in ways that will likely continue and may change in

unforeseen ways for an indeterminate period. The COVID-19 pandemic may exacerbate pre-existing political, social and economic risks in certain countries and globally.

| Price Per Share

|

|

| December 31, 2021

| September 30, 2021

| June 30, 2021

| March 31, 2021

|

| Market Price ($)

| 37.01

| 32.97

| 35.51

| 31.24

|

| Net Asset Value ($)

| 35.42

| 32.43

| 33.74

| 31.12

|

| Distributions Paid Per Common Share

|

| Payable Date

| Per Share Amount ($)

|

| February 23, 2021

| 0.4625

|

| May 25, 2021

| 0.4625

|

| August 24, 2021

| 0.4625

|

| November 23, 2021

| 0.4625

|

| January 18, 2022

| 1.2869(a)

|

(a) The Fund paid this special

2021 fourth quarter distribution beyond its typical quarterly managed distribution policy to stockholders of record on December 13, 2021.

The net asset value of the

Fund’s shares may not always correspond to the market price of such shares. Common stock of many closed-end funds frequently trade at a discount from their net asset value. The Fund is subject to stock market

risk, which is the risk that stock prices overall will decline over short or long periods, adversely affecting the value of an investment in the Fund.

Columbia Seligman Premium Technology Growth Fund, Inc. | Annual Report 2021

| 3

|

Fund at a Glance (continued)

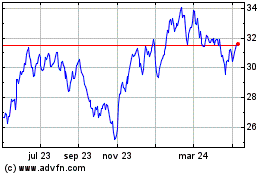

Performance of a hypothetical $10,000 investment (December 31, 2011 — December 31, 2021)

The chart above shows the change in

value of a hypothetical $10,000 investment in Columbia Seligman Premium Technology Growth Fund, Inc. during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on Fund

distributions or on the sale of Fund shares.

| Portfolio breakdown (%) (at December 31, 2021)

|

| Common Stocks

| 97.9

|

| Money Market Funds

| 2.1

|

| Total

| 100.0

|

Percentages indicated are based

upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| Equity sector breakdown (%) (at December 31, 2021)

|

| Communication Services

| 9.4

|

| Consumer Discretionary

| 2.3

|

| Health Care

| 0.1

|

| Industrials

| 2.1

|

| Information Technology

| 86.1

|

| Total

| 100.0

|

Percentages indicated are based

upon total equity investments. The Fund’s portfolio composition is subject to change.

| Equity sub-industry breakdown (%) (at December 31, 2021)

|

| Information Technology

|

|

| Application Software

| 9.0

|

| Communications Equipment

| 6.1

|

| Data Processing & Outsourced Services

| 4.0

|

| Electronic Equipment & Instruments

| 1.4

|

| Internet Services & Infrastructure

| 1.6

|

| IT Consulting & Other Services

| 0.8

|

| Semiconductor Equipment

| 15.1

|

| Semiconductors

| 23.5

|

| Systems Software

| 12.3

|

| Technology Hardware, Storage & Peripherals

| 12.3

|

| Total

| 86.1

|

Percentages indicated are based

upon total equity investments. The Fund’s portfolio composition is subject to change.

| 4

| Columbia Seligman Premium Technology Growth Fund, Inc. | Annual Report 2021

|

Manager Discussion of Fund Performance

For the 12-month period that ended

December 31, 2021, shares of the Fund returned 48.96% at market price and 39.38% at net asset value. The Fund significantly outperformed its benchmark, the S&P North American Technology Sector Index, which

returned 26.40% for the same time period.

Market overview

U.S. equities displayed

remarkable resilience during the year, finishing with a solid gain despite a number of potential headwinds. Investors had to contend with the emergence of the Omicron variant of COVID-19, which was contagious enough

to raise concerns that a new wave of lockdowns could be necessary. The markets also faced a major shift in U.S. Federal Reserve policy. Whereas the Fed had previously viewed rising inflation as a transitory

development, continued price pressures caused the central bank to announce the tapering of its stimulative quantitative easing program. In addition, it began to prepare the financial markets for the likelihood of

multiple interest rate increases in 2022. The failure of the Build Back Better bill removed a source of anticipated fiscal stimulus. Nevertheless, most major U.S. indices closed the year at or near their all-time

highs on the strength of robust investment inflows and the lack of compelling total return potential in bonds.

In a continuation of a

long-standing trend, mega-cap technology-related stocks were the key drivers of market performance. In contrast, smaller companies managed only narrow gains. While the large-cap Russell 1000 Index rose 26.45% in 2021,

the small-cap Russell 2000 Index advanced 14.82%. The ongoing dominance of technology stocks also led to outperformance for the growth style within the large-cap space. The Russell 1000 Growth Index returned 27.60%

for the year, outpacing the 25.16% gain for the Russell 1000 Value Index. However, this trend did not hold with regard to smaller cap stocks, as the value style outperformed growth by a wide margin, with the Russell

2000 Value Index returning 28.27% and the Russell 2000 Growth Index returning 2.83% for the year.

Within the benchmark,

the semiconductors & semiconductor equipment, communications equipment, communication services, interactive media & services and technology hardware storage & peripherals industries outperformed while

the IT services, internet & direct marketing retail and software industries lagged for the reporting period.

The Fund’s notable

contributors during the period

| •

| The Fund’s significant outperformance of the benchmark during the period was driven by strong stock selection, most notably within the semiconductors & semiconductor equipment and software industries.

|

| •

| Top individual contributors included:

|

| ○

| Internet of Things (IoT) chip company Synaptics, Inc. was a top contributor after executing a turnaround over the past two years under the guidance of CEO Michael Hurlston. The company once known for touchpads and

other interface components for PCs and mobile phones jettisoned its smartphone centric fingerprint sensor and LCD touch / display drive IC (integrated circuit) businesses while making strategic acquisitions in video

and wireless connectivity and PC docking station technology which significantly boosted margins and profit growth. In 2021, the company consistently beat earnings expectations and the stock responded in

kind.

|

| ○

| Top holdings in semi-cap equipment companies Lam Research Corp. and Applied Materials, Inc. contributed meaningfully to returns during the period. The global semiconductor shortage highlights the fact that the

industry needs to add capacity to inevitably boost supply. Our investments in semiconductor capital equipment companies have benefited from this pressing need.

|

| ○

| Within software, cybersecurity holdings Fortinet, Inc. and Palo Alto Networks, Inc. benefited from strong demand for protection against hackers and ransomware.

|

| •

| Allocation decisions were also positive. The Fund’s sizable overweight to the semiconductor & semiconductor equipment industry, the strongest performing area of the benchmark, boosted relative results. An

overweight to communications equipment was also additive, as was the Fund’s underweight to the poor-performing IT services industry and the consumer discretionary sector.

|

Columbia Seligman Premium Technology Growth Fund, Inc. | Annual Report 2021

| 5

|

Manager Discussion of Fund Performance (continued)

The Fund’s notable

detractors during the period

| •

| The largest area of detraction for the Fund during the period came from the industrials sector. Overall, the sector was one of the bottom performing areas of the benchmark and the Fund’s overweight weighed on

relative performance.

|

| •

| The electronic equipment instruments and components industry was another area of underperformance for the Fund, both on an absolute and relative basis.

|

| •

| Microsoft Corp. continued to perform well due to high demand for its cloud-based offering Azure and strength in the company’s Office360 suite of products. Microsoft represents a large weighting in the

benchmark and the portfolio’s relative underweight detracted from relative returns.

|

| •

| In the industrials sector, an out-of-benchmark holding in Bloom Energy Corp. underperformed, along with other Alternative Energy stocks, despite having signed a multi-year, $4.5 billion contract to supply SK Group

of Korea with fuel cells.

|

| •

| Software holding Cerence Inc. detracted during the period. The company has seen a lull in its business due to the supply shortage induced problems in the auto industry.

|

| •

| Not owning semiconductor company NVIDIA Corp. on valuation concerns hurt relative performance as the stock rallied on strong results from the company’s gaming business as

customers upgraded to its latest graphics cards.

|

Call options contributed to

returns

| •

| Although there were strong results for technology stocks, especially in November 2021, and relatively constant volatility for both technology and technology-related stocks, the Fund’s call option writing

strategy added to returns.

|

The views expressed in this report

reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and

results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update

such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf

of any particular Columbia fund. References to specific securities should not be construed as a recommendation or investment advice.

| 6

| Columbia Seligman Premium Technology Growth Fund, Inc. | Annual Report 2021

|

Fund Investment Objective, Strategies,

Policies and Principal Risks

(Unaudited)

Fund Investment Objective

The Fund’s investment

objective is to seek growth of capital and current income. The Fund’s investment objective is non-fundamental and may be changed by the Board without approval of the Fund’s stockholders.

Fund Investment Strategies and

Policies

Under normal market conditions, the

Fund invests at least 80% of its “Managed Assets” (as defined below) in a portfolio of equity securities of technology and technology-related companies that Columbia Management Investment Advisers, LLC

(the Investment Manager) believes offer attractive opportunities for capital appreciation. Under normal market conditions, the Fund’s investment program consists primarily of (i) investing in a portfolio of

equity securities of technology and technology-related companies that seeks to exceed the total return, before fees and expenses, of the S&P North American Technology Sector Index and (ii) writing call options on

the NASDAQ 100 Index®, an unmanaged index that includes the largest and most active non-financial domestic and international companies listed on the NASDAQ Stock Market, or its exchange-traded fund equivalent

(the NASDAQ 100) on a month-to-month basis, with an aggregate notional amount typically ranging from 0%-90% of the underlying value of the Fund’s holdings of common stock (the Rules-based Option Strategy, as

further described below). The Fund expects to generate current income from premiums received from writing call options on the NASDAQ 100.

In determining the level (i.e., 0%

to 90%) of call options to be written on the NASDAQ 100, the Investment Manager’s Rules-based Option Strategy is based on the CBOE NASDAQ-100 Volatility IndexSM (the VXN Index). The VXN Index measures the market’s expectation of 30-day volatility implicit in the prices of near-term NASDAQ 100 Index

options. The VXN Index, which is quoted in percentage points (e.g., 19.36), is a leading barometer of investor sentiment and market volatility relating to the NASDAQ 100 Index. In general, the Investment Manager

intends to write more call options when market volatility, as represented by the VXN Index, is high (and premiums received for writing the option are high) and write fewer call options when market volatility, as

represented by the VXN Index, is low (and premiums for writing the option are low).

The Fund’s Rules-based Option

Strategy with respect to writing call options is as follows:

| When the VXN Index is:

| Aggregate Notional Amount of

Written Call Options as a

Percentage of the Fund’s

Holdings in Common Stocks

|

| 17 or less

| 25%

|

| Greater than 17, but less than 18

| Increase up to 50%

|

| At least 18, but less than 33

| 50%

|

| At least 33, but less than 34

| Increase up to 90%

|

| At least 34, but less than 55

| 90%

|

| At 55 or greater

| 0% to 90%

|

In addition to the Rules-based

Option Strategy, the Fund may write additional calls with aggregate notional amounts of up to 25% of the value of the Fund’s holdings in common stock (to a maximum of 90% when aggregated with the call options

written pursuant to the Rules-based Option Strategy) when the Investment Manager believes call premiums are attractive relative to the risk of the price of the NASDAQ 100. The Fund may also close (or buy back) a

written call option if the Investment Manager believes that a substantial amount of the premium (typically, 70% or more) to be received by the Fund has been captured before exercise, potentially reducing the call

position to 0% of total equity until additional calls are written. The Fund may also buy or write other call and put options on securities, indices, ETFs and market baskets of securities to generate additional income

or return or to provide the portfolio with downside protection.

The Fund’s investment policy

of investing at least 80% of its Managed Assets in equity securities of technology and technology-related companies and its policy with respect to the use of the Rules-based Option Strategy on a month-to-month basis

may be changed by the Board without stockholder approval only following the provision of 60 days’ prior written notice to stockholders.

Columbia Seligman Premium Technology Growth Fund, Inc. | Annual Report 2021

| 7

|

Fund Investment Objective, Strategies,

Policies and Principal Risks (continued)

(Unaudited)

The Fund is a non-diversified fund.

A non-diversified fund is permitted to invest a greater percentage of its total assets in fewer issuers than a diversified fund. This policy may not be changed without a stockholder vote.

The Fund has a fundamental policy

of investing at least 25% of its total assets in securities principally engaged in technology and technology-related stocks. This policy may not be changed without a stockholder vote.

The Fund may also invest: up to 15%

of its Managed Assets in illiquid securities (i.e., securities that at the time of purchase are not readily marketable); up to 20% of its Managed Assets in debt securities (including convertible and non-convertible

debt securities), such as debt securities issued by technology and technology-related companies and obligations of the U.S. Government, its agencies and instrumentalities, and government-sponsored enterprises, as well

as below-investment grade securities (i.e., high-yield or junk bonds); and up to 25% of its Managed Assets in equity securities of companies organized outside of the United States. The Fund may hold foreign securities

of issuers located or doing substantial business in emerging markets. Each of these policies may be changed by the Board without stockholder approval.

The Fund has other fundamental

policies that may not be changed without a stockholder vote. Under these policies, the Fund may not:

| •

|

Purchase or sell commodities or commodity contracts, except to the extent permissible under applicable law and interpretations, as they may be amended from time to time, and except this shall not prevent the Fund from

buying or selling options, futures contracts and foreign currency or from entering into forward currency contracts or from investing in securities or other instruments backed by, or whose value is derived from,

physical commodities;

|

| •

|

Issue senior securities or borrow money, except as permitted by the Investment Company Act or any rule thereunder, any SEC or SEC staff interpretations thereof or any exemptions therefrom which may be granted by the

SEC;

|

| •

|

Make loans, except as permitted by the Investment Company Act or any rule thereunder, any SEC or SEC staff interpretations thereof or any exemptions therefrom which may be granted by the SEC;

|

| •

|

Underwrite the securities of other issuers, except insofar as the Fund may be deemed an underwriter under the Securities Act of 1933 in disposing of a portfolio security or in connection with investments in other

investment companies;

|

| •

|

Buy or sell real estate, unless acquired as a result of ownership of securities or other instruments, except this shall not prevent the Fund from investing in securities or other instruments backed by real estate or

securities of companies engaged in the real estate business or real estate investment trusts; and

|

| •

|

Invest 25% or more of its Managed Assets (as defined below), at market value, in the securities of issuers in any particular industry, except that the Fund will invest at least 25% of the value of its Managed Assets

in technology and technology-related stocks (in which the Fund intends to concentrate) and may invest without limit in securities issued or guaranteed by the U.S. Government, its agencies or instrumentalities, or

government-sponsored enterprises.

|

“Managed Assets” means

the net asset value of the Fund’s outstanding common stock plus any liquidation preference of any issued and outstanding Fund preferred stock and the principal amount of any borrowings used for leverage.

The Fund’s fundamental

policies set forth above prohibit transactions “except as permitted by the Investment Company Act or any rule thereunder, any SEC or SEC staff interpretations thereof or any exemptions therefrom which may be

granted by the SEC.” The reference to the Investment Company Act, means the Investment Company Act of 1940, as amended, and the reference to the SEC means the Securities and Exchange Commission. The following

discussion explains the flexibility that the Fund gains from these exceptions.

Issuing senior securities — A

“senior security” is an obligation with respect to the earnings or assets of a company that takes precedence over the claims of that company’s common stock with respect to the same earnings or

assets. The Investment Company Act limits the ability of a closed-end fund to issue senior securities, but SEC staff interpretations allow a fund to engage in certain types of transactions that otherwise might raise

senior security concerns (such as short sales, buying and selling financial futures contracts and selling put and call options), provided that the Fund maintains segregated

| 8

| Columbia Seligman Premium Technology Growth Fund, Inc. | Annual Report 2021

|

Fund Investment Objective, Strategies,

Policies and Principal Risks (continued)

(Unaudited)

deposits or portfolio securities, or otherwise

covers the transaction with offsetting portfolio securities, in amounts sufficient to offset any liability associated with the transaction. The exception in the fundamental policy allows the Fund to operate in

reliance upon these staff interpretations.

Borrowing money — The

Investment Company Act permits the Fund to borrow up to 33 1/3% of its Managed Assets, plus an additional 5% of its Managed Assets for temporary purposes.

Making loans — The Investment

Company Act generally prohibits the Fund from making loans to affiliated persons but does not otherwise restrict the Fund’s ability to make loans.

Under the Investment Company Act,

the Fund’s fundamental policies may not be changed without the approval of the holders of a “majority of the outstanding” common stock and, if issued, preferred stock voting together as a single

class, and of the holders of a “majority of the outstanding” preferred stock voting as a separate class. When used with respect to particular shares of the Fund, a “majority of the outstanding”

shares means the lesser of: (i) 67% or more of the shares present at a stockholder meeting, if the holders of more than 50% of the outstanding shares are present at the meeting or represented by proxy, or (ii) more

than 50% of the outstanding shares of the Fund.

Principal Risks

An investment in the Fund involves

risks. In particular, investors should consider Market Risk, Information Technology Sector Risk, and Derivatives Risk. Descriptions of these and other principal risks of investing in the Fund are provided below.

There is no assurance that the Fund will achieve its investment objective and you may lose money. The value of the Fund’s holdings may decline, and the Fund’s net asset value (NAV) and share price may go

down. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. See also the Fund’s "Significant Risks" in the

Notes to Financial Statements section.

Active Management Risk. The Fund is actively managed and its performance therefore will reflect, in part, the ability of the portfolio managers to make investment decisions that seek to achieve

the Fund’s investment objective. Due to its active management, the Fund could underperform its benchmark index and/or other funds with similar investment objectives and/or strategies.

Credit Risk. Credit risk is the risk that the value of debt instruments may decline if the issuer thereof defaults or otherwise becomes unable or unwilling, or is perceived to be

unable or unwilling, to honor its financial obligations, such as making payments to the Fund when due. Various factors could affect the actual or perceived willingness or ability of the issuer to make timely interest

or principal payments, including changes in the financial condition of the issuer or in general economic conditions. Credit rating agencies, such as S&P Global Ratings, Moody’s, Fitch, DBRS and KBRA, (as

applicable), assign credit ratings to certain debt instruments to indicate their credit risk. A rating downgrade by such agencies can negatively impact the value of such instruments. Lower rated or unrated instruments

held by the Fund may present increased credit risk as compared to higher-rated instruments. Non-investment grade debt instruments may be subject to greater price fluctuations and are more likely to experience a

default than investment grade debt instruments and therefore may expose the Fund to increased credit risk. If the Fund purchases unrated instruments, or if the ratings of instruments held by the Fund are lowered after

purchase, the Fund will depend on analysis of credit risk more heavily than usual.

Derivatives Risk. Derivatives may involve significant risks. Derivatives are financial instruments, traded on an exchange or in the over-the-counter (OTC) markets, with a value in relation

to, or derived from, the value of an underlying asset(s) (such as a security, commodity or currency) or other reference, such as an index, rate or other economic indicator (each an underlying reference). Derivatives

may include those that are privately placed or otherwise exempt from SEC registration, including certain Rule 144A eligible securities. Derivatives could result in Fund losses if the underlying reference does not

perform as anticipated. Use of derivatives is a highly specialized activity that can involve investment techniques, risks, and tax planning different from those associated with more traditional investment instruments.

The Fund’s derivatives strategy may not be successful and use of certain derivatives could result in substantial, potentially unlimited, losses to the Fund regardless of the Fund’s actual investment. A

relatively small movement in the price, rate or other economic indicator associated with the underlying reference may result in substantial losses for the Fund. Derivatives may be more volatile than other types

of

Columbia Seligman Premium Technology Growth Fund, Inc. | Annual Report 2021

| 9

|

Fund Investment Objective, Strategies,

Policies and Principal Risks (continued)

(Unaudited)

investments. Derivatives can increase the

Fund’s risk exposure to underlying references and their attendant risks, including the risk of an adverse credit event associated with the underlying reference (credit risk), the risk of an adverse movement in

the value, price or rate of the underlying reference (market risk), the risk of an adverse movement in the value of underlying currencies (foreign currency risk) and the risk of an adverse movement in underlying

interest rates (interest rate risk). Derivatives may expose the Fund to additional risks, including the risk of loss due to a derivative position that is imperfectly correlated with the underlying reference it is

intended to hedge or replicate (correlation risk), the risk that a counterparty will fail to perform as agreed (counterparty risk), the risk that a hedging strategy may fail to mitigate losses, and may offset gains

(hedging risk), the risk that the return on an investment may not keep pace with inflation (inflation risk), the risk that losses may be greater than the amount invested (leverage risk), the risk that the Fund may be

unable to sell an investment at an advantageous time or price (liquidity risk), the risk that the investment may be difficult to value (pricing risk), and the risk that the price or value of the investment fluctuates

significantly over short periods of time (volatility risk). The value of derivatives may be influenced by a variety of factors, including national and international political and economic developments. Potential

changes to the regulation of the derivatives markets may make derivatives more costly, may limit the market for derivatives, or may otherwise adversely affect the value or performance of derivatives.

Derivatives Risk – Options

Risk. Options are derivatives that give the purchaser the option to buy (call) or sell (put) an underlying reference from or to a counterparty at a specified price (the strike

price) on or before an expiration date. The Fund may purchase or write (i.e., sell) put and call options on an underlying reference it is otherwise permitted to invest in. When writing options, the Fund is exposed to

the risk that it may be required to buy or sell the underlying reference at a disadvantageous price on or before the expiration date. If the Fund sells a put option, the Fund may be required to buy the underlying

reference at a strike price that is above market price, resulting in a loss. If the Fund sells a call option, the Fund may be required to sell the underlying reference at a strike price that is below market price,

resulting in a loss. If the Fund sells a call option that is not covered (it does not own the underlying reference), the Fund’s losses are potentially unlimited. Options may involve economic leverage, which

could result in greater volatility in price movement. Options may be traded on a securities exchange or in the over-the-counter market. At or prior to maturity of an options contract, the Fund may enter into an

offsetting contract and may incur a loss to the extent there has been adverse movement in options prices. Options can increase the Fund’s risk exposure to underlying references and their attendant risks such as

credit risk, market risk, foreign currency risk and interest rate risk, while also exposing the Fund to correlation risk, counterparty risk, hedging risk, inflation risk, leverage risk, liquidity risk, pricing risk

and volatility risk.

Emerging Market Securities

Risk. Securities issued by foreign governments or companies in emerging market countries, such as China, Russia and certain countries in Eastern Europe, the Middle East, Asia,

Latin America or Africa, are more likely to have greater exposure to the risks of investing in foreign securities that are described in Foreign Securities Risk. In addition, emerging market countries are more likely

to experience instability resulting, for example, from rapid changes or developments in social, political, economic or other conditions. Their economies are usually less mature and their securities markets are

typically less developed with more limited trading activity (i.e., lower trading volumes and less liquidity) than more developed countries. Emerging market securities tend to be more volatile, and may be more

susceptible to market manipulation, than securities in more developed markets. Many emerging market countries are heavily dependent on international trade and have fewer trading partners, which makes them more

sensitive to world commodity prices and economic downturns in other countries. Some emerging market countries have a higher risk of currency devaluations, and some of these countries may experience periods of high

inflation or rapid changes in inflation rates and may have hostile relations with other countries. Due to the differences in the nature and quality of financial information of issuers of emerging market securities,

including auditing and financial reporting standards, financial information and disclosures about such issuers may be unavailable or, if made available, may be considerably less reliable than publicly available

information about other foreign securities.

Foreign Securities Risk. Investments in or exposure to foreign companies involve certain risks not associated with investments in or exposure to securities of U.S. companies. For example, foreign

markets can be extremely volatile. Foreign securities may also be less liquid, making them more difficult to trade, than securities of U.S. companies so that the Fund may, at times, be unable to sell foreign

securities at desirable times or prices. Brokerage commissions, custodial costs and other fees are also generally higher for foreign securities. The Fund may have limited or no legal recourse in the event of default

with respect to certain foreign securities, including those issued by foreign governments. In addition, foreign

| 10

| Columbia Seligman Premium Technology Growth Fund, Inc. | Annual Report 2021

|

Fund Investment Objective, Strategies,

Policies and Principal Risks (continued)

(Unaudited)

governments may impose withholding or other taxes

on the Fund’s income, capital gains or proceeds from the disposition of foreign securities, which could reduce the Fund’s return on such securities. In some cases, such withholding or other taxes could

potentially be confiscatory. Other risks include: possible delays in the settlement of transactions or in the payment of income; generally less publicly available information about foreign companies; the impact of

economic, political, social, diplomatic or other conditions or events (including, for example, military confrontations, war, terrorism and disease/virus outbreaks and epidemics), possible seizure, expropriation or

nationalization of a company or its assets or the assets of a particular investor or category of investors; accounting, auditing and financial reporting standards that may be less comprehensive and stringent than

those applicable to domestic companies; the imposition of economic and other sanctions against a particular foreign country, its nationals or industries or businesses within the country; and the generally less

stringent standard of care to which local agents may be held in the local markets. In addition, it may be difficult to obtain reliable information about the securities and business operations of certain foreign

issuers. Governments or trade groups may compel local agents to hold securities in designated depositories that are not subject to independent evaluation. The less developed a country’s securities market is, the

greater the level of risks. Economic sanctions may be, and have been, imposed against certain countries, organizations, companies, entities and/or individuals. Economic sanctions and other similar governmental actions

could, among other things, effectively restrict or eliminate the Fund’s ability to purchase or sell securities, and thus may make the Fund’s investments in such securities less liquid or more difficult to

value. In addition, as a result of economic sanctions, the Fund may be forced to sell or otherwise dispose of investments at inopportune times or prices, which could result in losses to the Fund and increased

transaction costs. These conditions may be in place for a substantial period of time and enacted with limited advance notice to the Fund. The risks posed by sanctions against a particular foreign country, its

nationals or industries or businesses within the country may be heightened to the extent the Fund invests significantly in the affected country or region or in issuers from the affected country that depend on global

markets. Additionally, investments in certain countries may subject the Fund to a number of tax rules, the application of which may be uncertain. Countries may amend or revise their existing tax laws, regulations

and/or procedures in the future, possibly with retroactive effect. Changes in or uncertainties regarding the laws, regulations or procedures of a country could reduce the after-tax profits of the Fund, directly or

indirectly, including by reducing the after-tax profits of companies located in such countries in which the Fund invests, or result in unexpected tax liabilities for the Fund. The performance of the Fund may also be

negatively affected by fluctuations in a foreign currency’s strength or weakness relative to the U.S. dollar, particularly to the extent the Fund invests a significant percentage of its assets in foreign

securities or other assets denominated in currencies other than the U.S. dollar. Currency rates in foreign countries may fluctuate significantly over short or long periods of time for a number of reasons, including

changes in interest rates, imposition of currency exchange controls and economic or political developments in the U.S. or abroad. The Fund may also incur currency conversion costs when converting foreign currencies

into U.S. dollars and vice versa.

High-Yield Investments Risk. Securities and other debt instruments held by the Fund that are rated below investment grade (commonly called “high-yield” or “junk” bonds) and

unrated debt instruments of comparable quality tend to be more sensitive to credit risk than higher-rated debt instruments and may experience greater price fluctuations in response to perceived changes in the ability

of the issuing entity or obligor to pay interest and principal when due than to changes in interest rates. These investments are generally more likely to experience a default than higher-rated debt instruments.

High-yield debt instruments are considered to be predominantly speculative with respect to the issuer’s capacity to pay interest and repay principal. These debt instruments typically pay a premium – a

higher interest rate or yield – because of the increased risk of loss, including default. High-yield debt instruments may require a greater degree of judgment to establish a price, may be difficult to sell at

the time and price the Fund desires, may carry high transaction costs, and also are generally less liquid than higher-rated debt instruments. The ratings provided by third party rating agencies are based on analyses

by these ratings agencies of the credit quality of the debt instruments and may not take into account every risk related to whether interest or principal will be timely repaid. In adverse economic and other

circumstances, issuers of lower-rated debt instruments are more likely to have difficulty making principal and interest payments than issuers of higher-rated debt instruments.

Interest Rate Risk. Interest rate risk is the risk of losses attributable to changes in interest rates. In general, if prevailing interest rates rise, the values of debt instruments tend to

fall, and if interest rates fall, the values of debt instruments tend to rise. Changes in the value of a debt instrument usually will not affect the amount of income the Fund receives from it but will

Columbia Seligman Premium Technology Growth Fund, Inc. | Annual Report 2021

| 11

|

Fund Investment Objective, Strategies,

Policies and Principal Risks (continued)

(Unaudited)

generally affect the value of your investment in

the Fund. Changes in interest rates may also affect the liquidity of the Fund’s investments in debt instruments. In general, the longer the maturity or duration of a debt instrument, the greater its sensitivity

to changes in interest rates. Interest rate declines also may increase prepayments of debt obligations, which, in turn, would increase prepayment risk (the risk that the Fund will have to reinvest the money received

in securities that have lower yields). Very low or negative interest rates may impact the Fund’s yield and may increase the risk that, if followed by rising interest rates, the Fund’s performance will be

negatively impacted. The Fund is subject to the risk that the income generated by its investments may not keep pace with inflation. Actions by governments and central banking authorities can result in increases or

decreases in interest rates. Higher periods of inflation could lead such authorities to raise interest rates. Such actions may negatively affect the value of debt instruments held by the Fund, resulting in a negative

impact on the Fund’s performance and NAV. Any interest rate increases could cause the value of the Fund’s investments in debt instruments to decrease. Rising interest rates may prompt redemptions from the

Fund, which may force the Fund to sell investments at a time when it is not advantageous to do so, which could result in losses.

Issuer Risk. An issuer in which the Fund invests or to which it has exposure may perform poorly or below expectations, and the value of its securities may therefore decline, which may

negatively affect the Fund’s performance. Underperformance of an issuer may be caused by poor management decisions, competitive pressures, breakthroughs in technology, reliance on suppliers, labor problems or

shortages, corporate restructurings, fraudulent disclosures, natural disasters, military confrontations, war, terrorism, disease/virus outbreaks, epidemics or other events, conditions and factors which may impair the

value of an investment in the Fund.

Small- and Mid-Cap Stock Risk. Securities of small- and mid-cap companies can, in certain circumstances, have a higher potential for gains than securities of larger companies but are more likely to

have more risk than larger companies. For example, small- and mid-cap companies may be more vulnerable to market downturns and adverse business or economic events than larger companies because they may have more

limited financial resources and business operations. Small- and mid-cap companies are also more likely than larger companies to have more limited product lines and operating histories and to depend on smaller and

generally less experienced management teams. Securities of small- and mid-cap companies may trade less frequently and in smaller volumes and may be less liquid and fluctuate more sharply in value than securities of

larger companies. When the Fund takes significant positions in small- and mid-cap companies with limited trading volumes, the liquidation of those positions, particularly in a distressed market, could be prolonged and

result in Fund investment losses that would affect the value of your investment in the Fund. In addition, some small- and mid-cap companies may not be widely followed by the investment community, which can lower the

demand for their stocks.

Large-Cap Stock Risk. Investments in larger, more established companies (larger companies) may involve certain risks associated with their larger size. For instance, larger companies may be

less able to respond quickly to new competitive challenges, such as changes in consumer tastes or innovation from smaller competitors. Also, larger companies are sometimes less able to achieve as high growth rates as

successful smaller companies, especially during extended periods of economic expansion.

Leverage Risk. Leverage occurs when the Fund increases its assets available for investment using borrowing, derivatives, or similar instruments or techniques. Use of leverage can

produce volatility and may exaggerate changes in the NAV of Fund shares and in the return on the Fund’s portfolio, which may increase the risk that the Fund will lose more than it has invested. The use of

leverage may cause the Fund to liquidate portfolio positions when it may not be advantageous to do so to satisfy its obligations or to meet any required asset segregation or position coverage requirements. Futures

contracts, options, forward contracts and other derivatives can allow the Fund to obtain large investment exposures in return for meeting relatively small margin requirements. As a result, investments in those

transactions may be highly leveraged. If the Fund uses leverage, through the purchase of particular instruments such as derivatives, the Fund may experience capital losses that exceed the net assets of the Fund.

Leverage can create an interest expense that may lower the Fund’s overall returns. Leverage presents the opportunity for increased net income and capital gains, but may also exaggerate the Fund’s

volatility and risk of loss. There can be no guarantee that a leveraging strategy will be successful.

| 12

| Columbia Seligman Premium Technology Growth Fund, Inc. | Annual Report 2021

|

Fund Investment Objective, Strategies,

Policies and Principal Risks (continued)

(Unaudited)

Market Risk. The Fund may incur losses due to declines in the value of one or more securities in which it invests. These declines may be due to factors affecting a particular issuer,

or the result of, among other things, political, regulatory, market, economic or social developments affecting the relevant market(s) more generally. In addition, turbulence in financial markets and reduced liquidity

in equity, credit and/or fixed income markets may negatively affect many issuers, which could adversely affect the Fund, including causing difficulty in assigning prices to hard-to-value assets in thinly traded and

closed markets, significant redemptions and operational challenges. Global economies and financial markets are increasingly interconnected, and conditions and events in one country, region or financial market may

adversely impact issuers in a different country, region or financial market. These risks may be magnified if certain events or developments adversely interrupt the global supply chain; in these and other

circumstances, such risks might affect companies worldwide. As a result, local, regional or global events such as terrorism, war, natural disasters, disease/virus outbreaks and epidemics or other public health issues,

recessions, depressions or other events – or the potential for such events – could have a significant negative impact on global economic and market conditions.

The coronavirus disease 2019 and

its variants (COVID-19) pandemic has resulted in, and may continue to result in, significant global economic and societal disruption and market volatility due to disruptions in market access, resource availability,

facilities operations, imposition of tariffs, export controls and supply chain disruption, among others. Such disruptions may be caused, or exacerbated by, quarantines and travel restrictions, workforce displacement

and loss in human and other resources. The uncertainty surrounding the magnitude, duration, reach, costs and effects of the global pandemic, as well as actions that have been or could be taken by governmental

authorities or other third parties, present unknowns that are yet to unfold. The impacts, as well as the uncertainty over impacts to come, of COVID-19 – and any other infectious illness outbreaks, epidemics and

pandemics that may arise in the future – could negatively affect global economies and markets in ways that cannot necessarily be foreseen. In addition, the impact of infectious illness outbreaks and epidemics in

emerging market countries may be greater due to generally less established healthcare systems, governments and financial markets. Public health crises caused by the COVID-19 outbreak may exacerbate other pre-existing

political, social and economic risks in certain countries or globally. The disruptions caused by COVID-19 could prevent the Fund from executing advantageous investment decisions in a timely manner and negatively

impact the Fund’s ability to achieve its investment objective. Any such events could have a significant adverse impact on the value and risk profile of the Fund.

Non-Diversified Fund Risk. The Fund is non-diversified, which generally means that it will invest a greater percentage of its total assets in the securities of fewer issuers than a

“diversified” fund. This increases the risk that a change in the value of any one investment held by the Fund could affect the overall value of the Fund more than it would affect that of a diversified fund

holding a greater number of investments. Accordingly, the Fund’s value will likely be more volatile than the value of a more diversified fund.

Rule 144A and Other Exempted

Securities Risk. The Fund may invest in privately placed and other securities or instruments exempt from SEC registration (collectively “private placements”). In the U.S.

market, private placements are typically sold only to qualified institutional buyers, or qualified purchasers, as applicable. An insufficient number of buyers interested in purchasing private placements at a

particular time could adversely affect the marketability of such investments and the Fund might be unable to dispose of them promptly or at reasonable prices, subjecting the Fund to liquidity risk (the risk that it

may not be possible for the Fund to liquidate the instrument at an advantageous time or price). The Fund may invest in private placements determined to be liquid as well as those determined to be illiquid. Even if

determined to be liquid, the Fund’s holdings of private placements may increase the level of Fund illiquidity if eligible buyers are unable or unwilling to purchase them at a particular time. The Fund may also

have to bear the expense of registering the securities for resale and the risk of substantial delays in effecting the registration. Additionally, the purchase price and subsequent valuation of private placements

typically reflect a discount, which may be significant, from the market price of comparable securities for which a more liquid market exists. Issuers of Rule 144A eligible securities are required to furnish

information to potential investors upon request. However, the required disclosure is much less extensive than that required of public companies and is not publicly available since the offering information is not filed

with the SEC. Further, issuers of Rule 144A eligible securities can require recipients of the offering information (such as the Fund) to agree contractually to keep the information confidential, which could also

adversely affect the Fund’s ability to dispose of the security.

Columbia Seligman Premium Technology Growth Fund, Inc. | Annual Report 2021

| 13

|

Fund Investment Objective, Strategies,

Policies and Principal Risks (continued)

(Unaudited)

Sector Risk. At times, the Fund may have a significant portion of its assets invested in securities of companies conducting business within one or more economic sectors, including the

information technology sector. Companies in the same sector may be similarly affected by economic, regulatory, political or market events or conditions, which may make the Fund more vulnerable to unfavorable

developments in that sector than funds that invest more broadly. Generally, the more broadly the Fund invests, the more it spreads risk and potentially reduces the risks of loss and volatility.

Information Technology Sector. The Fund is more susceptible to the particular risks that may affect companies in the information technology sector than if it were invested in a wider variety of

companies in unrelated sectors. Companies in the information technology sector are subject to certain risks, including the risk that new services, equipment or technologies will not be accepted by consumers and

businesses or will become rapidly obsolete. Performance of such companies may be affected by factors including obtaining and protecting patents (or the failure to do so) and significant competitive pressures,

including aggressive pricing of their products or services, new market entrants, competition for market share and short product cycles due to an accelerated rate of technological developments. Such competitive

pressures may lead to limited earnings and/or falling profit margins. As a result, the value of their securities may fall or fail to rise. In addition, many information technology sector companies have limited

operating histories and prices of these companies’ securities historically have been more volatile than other securities, especially over the short term. Some companies in the information technology sector are

facing increased government and regulatory scrutiny and may be subject to adverse government or regulatory action, which could negatively impact the value of their securities.

Semiconductors and Semiconductor

Equipment Industry Risk. The Fund has a significant portion of its assets invested in securities of companies conducting business within the semiconductors and semiconductor equipment industry,

which is included within the Information Technology sector. Companies in the same or related industries may be similarly affected by economic, regulatory, political or market events or conditions, which may make the

Fund more vulnerable to unfavorable developments than funds that invest more broadly. Generally, the more broadly a fund invests, the more it spreads risk and potentially reduces the risks of loss and

volatility.

The Fund is sensitive to, and its

performance may depend to a greater extent on, the overall condition of the semiconductor and semiconductor equipment industry. The risks of investments in this industry include: intense competition, both domestically

and internationally, including competition from subsidized foreign competitors with lower production costs; wide fluctuations in securities prices due to risks of rapid obsolescence of products and related technology;

economic performance of the customers of semiconductor and related companies; their research costs and the risks that their products may not prove commercially successful; and thin capitalization and limited product

lines, markets, financial resources or quality management and personnel. Semiconductor design and process methodologies are subject to rapid technological change requiring large expenditures, potentially requiring

financing that may be difficult or impossible to obtain, for research and development in order to improve product performance and increase manufacturing yields. These companies rely on a combination of patents, trade

secret laws and contractual provisions to protect their technologies. The process of seeking patent protection can be long and expensive. The industry is characterized by frequent litigation regarding patent and other

intellectual property rights, which may require such companies to defend against competitors’ assertions of intellectual property infringement or misappropriation. Some companies are also engaged in other lines

of business unrelated to the semiconductor business, and these companies may experience problems with these lines of business that could adversely affect their operating results. The international operations of many

companies expose them to the risks associated with instability and changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, tariffs, and trade disputes. Business

conditions in this industry can change rapidly from periods of strong demand to periods of weak demand. Any future downturn in the industry could harm the business and operating results of these companies. The stock

prices of companies in the industry have been and will likely continue to be volatile relative to the overall market.

The industry may also be affected

by risks that affect the broader technology sector, including: government regulation, dramatic and often unpredictable changes in growth rates and competition for qualified personnel, a small number of companies

representing a large portion of the technology semiconductor industry as a whole, cyclical market patterns, significant product price erosion hampering company profits, periods of over-capacity and production

shortages, changing demand, variations in manufacturing costs and yields and significant expenditures for capital equipment and product development.

| 14

| Columbia Seligman Premium Technology Growth Fund, Inc. | Annual Report 2021

|

Fund Investment Objective, Strategies,

Policies and Principal Risks (continued)

(Unaudited)

Transactions in Derivatives. The Fund may enter into derivative transactions or otherwise have exposure to derivative transactions through underlying investments. Derivatives are financial contracts

whose values are, for example, based on (or “derived” from) traditional securities (such as a stock or bond), assets (such as a commodity like gold or a foreign currency), reference rates (such as the

Secured Overnight Financing Rate (commonly known as SOFR) or the London Interbank Offered Rate (commonly known as LIBOR)) or market indices (such as the Standard & Poor’s 500® Index). The use of

derivatives is a highly specialized activity which involves investment techniques and risks different from those associated with ordinary portfolio securities transactions. Derivatives involve special risks and may

result in losses or may limit the Fund’s potential gain from favorable market movements. Derivative strategies often involve leverage, which may exaggerate a loss, potentially causing the Fund to lose more money

than it would have lost had it invested in the underlying security or other asset directly. The values of derivatives may move in unexpected ways, especially in unusual market conditions, and may result in increased

volatility in the value of the derivative and/or the Fund’s shares, among other consequences. The use of derivatives may also increase the amount of taxes payable by shareholders holding shares in a taxable

account. Other risks arise from the Fund’s potential inability to terminate or to sell derivative positions. A liquid secondary market may not always exist for the Fund’s derivative positions at times when

the Fund might wish to terminate or to sell such positions. Over-the-counter instruments (investments not traded on an exchange) may be illiquid, and transactions in derivatives traded in the over-the-counter

market are subject to the risk that the other party will not meet its obligations. The use of derivatives also involves the risks of mispricing or improper valuation and that changes in the value of the

derivative may not correlate perfectly with the underlying security, asset, reference rate or index. The Fund also may not be able to find a suitable derivative transaction counterparty, and thus may be unable to

engage in derivative transactions when it is deemed favorable to do so, or at all. U.S. federal legislation has been enacted that provides for new clearing, margin, reporting and registration requirements for

participants in the derivatives market. These changes could restrict and/or impose significant costs or other burdens upon the Fund’s participation in derivatives transactions. The U.S. government and the

European Union (and some other jurisdictions) have enacted regulations and similar requirements that prescribe clearing, margin, reporting and registration requirements for participants in the derivatives market.

These requirements are evolving and their ultimate impact on the Fund remains unclear, but such impact could include restricting and/or imposing significant costs or other burdens upon the Fund’s participation

in derivatives transactions. Additionally, in October 2020, the SEC adopted new regulations governing the use of derivatives by registered investment companies. Once effective, Rule 18f-4 will, among other things,

require funds that invest in derivative instruments beyond a specified limited amount to apply a value-at-risk-based limit to their use of certain derivative instruments and establish a comprehensive derivatives risk

management program. A fund that uses derivative instruments in a limited amount will not be subject to the full requirements of Rule 18f-4. Compliance with Rule 18f-4 will not be required until August 2022. Rule 18f-4

could have an adverse impact on the Fund’s performance and ability to implement its investment strategies as it has historically.

Columbia Seligman Premium Technology Growth Fund, Inc. | Annual Report 2021

| 15

|

Fees and Expenses and Share Price Data

Fees and Expenses of the Fund

This table describes the fees and

expenses that you may pay if you buy, hold and sell shares of the Fund’s Common Stock. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

| Stockholder Transaction Expenses

|

| Dividend investment plan

| None(a)

|

| Annual Expenses (as a percentage of net asset attributable to common shares)

|

| Management fees(b)

| 1.06%

|

| Other expenses

| 0.07%

|

| Acquired fund fees and expenses

| 0.00%

|

| Total Annual Expenses(c)

| 1.13%

|

| (a)

| There are no service or brokerage charges to participants in the dividend investment plan; however, the Fund reserves the right to amend the plan to include a service charge payable to the Fund by the participants.

The Fund reserves the right to amend the plan to provide for payment of brokerage fees by the plan participants in the event the plan is changed to provide for open market purchases of Fund Common Stock on behalf of

plan participants.

|

| (b)

| The Fund’s management fee is 1.06% of the Fund’s average daily Managed Assets (which means the net asset value of Fund’s outstanding common stock plus the liquidation preference of any issued and

outstanding preferred stock of the Fund and the principal amount of any borrowing used for leverage). The management fee rate noted in the table reflects the rate paid by Common Stockholders as a percentage of the

Fund’s net assets attributable to Common Stock.

|

| (c)

| “Total Annual Expenses" include acquired fund fees and expenses (expenses the Fund incurs indirectly through its investments in other investment companies) and may be higher than “Total

gross expenses” shown in the Financial Highlights section of this report because “Total gross expenses” does not include acquired fund fees and expenses.

|

Example

The following example is intended

to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example illustrates the hypothetical expenses that you would incur over the time periods indicated, and assumes

that:

| •

|

you invest $1,000 in the Fund for the periods indicated,

|

| •

|

your investment has a 5% return each year, and

|

| •

| the Fund’s total annual operating expenses remain the same as shown in the Annual Fund Operating Expenses table above.

|

Although your actual costs may be

higher or lower, based on the assumptions listed above, your costs would be:

|

| 1 year

| 3 years

| 5 years

| 10 years

|

| Columbia Seligman Premium Technology Growth Fund, Inc. Common Stock

| $115

| $359

| $622

| $1,375

|

The purpose of the tables above is

to assist you in understanding the various costs and expenses you will bear directly or indirectly.

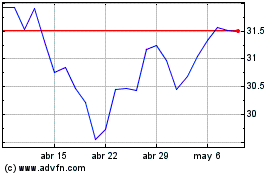

Share Price Data

The Fund’s Common Stock is

traded primarily on the New York Stock Exchange (the Exchange). The following table shows the high and low closing prices of the Fund’s Common Stock on the Exchange for each calendar quarter since the beginning

of 2020, as well as the net asset values and the range of the percentage (discounts)/premiums to net asset value per share that correspond to such prices.

| 16

| Columbia Seligman Premium Technology Growth Fund, Inc. | Annual Report 2021

|

Fees and Expenses and Share Price Data (continued)

|

| Market Price ($)

| Corresponding NAV ($)

| Corresponding (Discount)/Premium to NAV (%)

|

|

| High

| Low

| High

| Low

| High

| Low

|

| 2020

|

|

|

|

|

|

|

| 1st Quarter

| 25.25

| 14.44

| 24.69

| 15.42

| 2.27

| (6.36)

|

| 2nd Quarter

| 23.37

| 16.18

| 21.01

| 17.28

| 11.23

| (6.37)

|

| 3rd Quarter

| 23.33

| 21.09

| 22.31

| 21.35

| 4.57

| (1.22)

|

| 4th Quarter

| 27.63

| 21.33

| 27.41

| 21.91

| 0.80

| (2.65)

|

| 2021

|

|

|

|

|

|

|

| 1st Quarter

| 31.45

| 26.67

| 31.75

| 28.10

| (0.94)

| (5.09)

|

| 2nd Quarter

| 35.94

| 31.05

| 33.83

| 29.82

| 6.24

| 4.12

|

| 3rd Quarter

| 35.33

| 32.60

| 33.69

| 32.17

| 4.87

| 1.34

|

| 4th Quarter

| 39.07

| 32.10

| 35.81

| 31.86

| 9.10

| 0.75

|

The Fund’s Common Stock has