UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

| | |

For the Month of: May, 2024 |

Commission File Number: 001-32562 |

STANTEC INC.

(Translation of registrant’s name into English)

300 – 10220 103 Avenue NW

Edmonton, Alberta

Canada T5J 0K4

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| | | | | | | | |

| Form 20-F ___ | | Form 40-F X ___ |

EXHIBIT INDEX

| | | | | |

| Exhibit Number | Description |

| |

| Stantec Inc. First Quarter 2024 Management’s Discussion and Analysis |

| Stantec Inc. First Quarter 2024 Unaudited Interim Condensed Consolidated Financial Statements |

| Certification of Interim Filings – President and Chief Executive Officer |

| Certification of Interim Filings – Executive Vice President and Chief Financial Officer |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| STANTEC INC.

(Registrant) |

| | |

Date: May 8, 2024 | By: | /s/ Theresa B. Y. Jang |

| Name: | Theresa B. Y. Jang |

| Title: | Executive Vice President and CFO |

Exhibit 99.1 - Stantec Inc.’s Management's Discussion and Analysis

Management’s Discussion and Analysis

May 8, 2024

This discussion and analysis of Stantec Inc.’s (Stantec or the Company) operations, financial position, and cash flows for the quarter ended March 31, 2024, dated May 8, 2024, should be read in conjunction with the Company’s unaudited interim condensed consolidated financial statements and related notes for the quarter ended March 31, 2024, and the Management’s Discussion and Analysis (MD&A) and audited consolidated financial statements and related notes included in our 2023 Annual Report filed on February 28, 2024.

Our unaudited interim consolidated financial statements and related notes for the quarter ended March 31, 2024, are prepared in accordance with International Accounting Standard 34 "Interim Financial Reporting" as issued by the International Accounting Standards Board. We continue to apply the same accounting policies as those used in 2023. Amendments to accounting standards adopted in the quarter and disclosed in note 3 of our unaudited interim consolidated financial statements for the quarter ended March 31, 2024 (incorporated here by reference), did not have a material impact on the Company's consolidated financial statements or accounting policies. All amounts shown in this report are in Canadian dollars unless otherwise indicated.

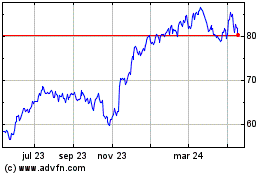

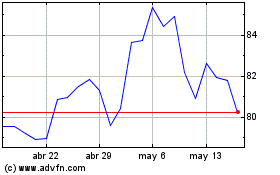

Additional information regarding our Company, including our Annual Information Form, is available on SEDAR+ at sedarplus.ca and on EDGAR at sec.gov. Such additional information is not incorporated here by reference, unless otherwise specified, and should not be deemed to be part of this MD&A. Stantec trades on the TSX and the NYSE under the symbol STN. Visit us at stantec.com or find us on social media.

Non-IFRS Accounting Standards (non-IFRS) and Other Financial Measures

The Company reports its financial results in accordance with IFRS Accounting Standards. However, certain indicators used by the Company to analyze and evaluate its results are non-IFRS or other financial measures and ratios, including: adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA), adjusted net income, adjusted earnings per share (EPS), adjusted return on invested capital (ROIC), net debt to adjusted EBITDA, days sales outstanding (DSO), free cash flow, margin (percentage of net revenue), organic growth (retraction), acquisition growth, measures described as on a constant currency basis and the impact of foreign exchange or currency fluctuations, compound annual growth rate (CAGR), net debt, total capital managed, working capital, and current ratio, as well as measures and ratios calculated using these non-IFRS or other financial measures. These measures are categorized as non-IFRS financial measures and ratios, supplementary financial measures, or capital management measures and described in the Definitions of Non-IFRS and Other Financial Measures (Definitions) and Liquidity and Capital Resources sections of this MD&A and, where applicable, reconciliations from the non-IFRS measure to the most directly comparable measure calculated in accordance with IFRS Accounting Standards are provided (see the Q1 2024 Financial Highlights, Financial Performance, Liquidity and Capital Resources, and Definitions sections).

These non-IFRS and other financial measures do not have a standardized meaning under IFRS Accounting Standards and, therefore, may not be comparable to similar measures presented by other issuers. Management believes that, in addition to conventional measures prepared in accordance with IFRS Accounting Standards, these non-IFRS and other financial measures and ratios provide useful information to investors to assist them in understanding components of and trends in our financial results. These measures should not be considered in isolation or viewed as a substitute for the related financial information prepared in accordance with IFRS Accounting Standards.

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-1 | Stantec Inc. | |

Business Model

Stantec is a global design and delivery leader in sustainable engineering, architectural planning, and environmental services. As a trusted advisor for our clients and communities, Stantec’s multidisciplinary teams address climate change, urbanization, and infrastructure resiliency. Our strategy is guided by our purpose, which is to empower people to rise to the world’s greatest challenges. The success of our clients, communities, and people worldwide is our greatest ambition.

The Stantec community unites more than 30,000 employees working in over 450 locations across six continents. We cultivate close client relationships through our geographic and service offering diversification. Please see pages M-1 to M-2 of Stantec’s 2023 Annual Report for further details on our business model.

Strategic Acquisitions Completed in 2024 and 2023

Following is a list of acquisitions that contributed to revenue growth in our reportable segments and business operating units:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | BUSINESS OPERATING UNITS |

| REPORTABLE SEGMENTS | Date

Acquired | Primary Location | # of Employees | Infrastructure | Water | Buildings | Environmental Services | | Energy & Resources |

| Canada | | | | | | | | | |

Morrison Hershfield Group Inc. (Morrison Hershfield) | February 2024 | Markham, Ontario | 950 | ● | | ● | ● | | |

| United States | | | | | | | | | |

Environmental Systems Design, Inc. (ESD) | June 2023 | Chicago, Illinois | 300 | | | ● | | | |

| Morrison Hershfield | February 2024 | Atlanta, Georgia | 200 | ● | | ● | ● | | |

| Global | | | | | | | | | |

ZETCON Ingenieure GmbH (ZETCON) | January 2024 | Bochum, Germany | 645 | ● | | | | | |

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-2 | Stantec Inc. | |

Q1 2024 Financial Highlights

| | | | | | | | | | | | | | | | | | |

| For the quarter ended

March 31, | |

| 2024 | 2023 | | |

(In millions of Canadian dollars, except per share

amounts and percentages) | $ | % of Net

Revenue | $ | % of Net

Revenue | | | | |

| Gross revenue | 1,721.4 | | 125.6 | % | 1,539.2 | | 125.3 | % | | | | |

| Net revenue | 1,370.1 | | 100.0 | % | 1,228.5 | | 100.0 | % | | | | |

| Direct payroll costs | 627.6 | | 45.8 | % | 568.5 | | 46.3 | % | | | | |

| Project margin | 742.5 | | 54.2 | % | 660.0 | | 53.7 | % | | | | |

| Administrative and marketing expenses | 542.9 | | 39.6 | % | 488.3 | | 39.7 | % | | | | |

| Depreciation of property and equipment | 15.8 | | 1.2 | % | 15.5 | | 1.3 | % | | | | |

| Depreciation of lease assets | 31.5 | | 2.3 | % | 30.9 | | 2.5 | % | | | | |

| | | | | | | | |

| Amortization of intangible assets | 31.0 | | 2.3 | % | 26.3 | | 2.1 | % | | | | |

| Net interest expense and other net finance expense | 24.2 | | 1.8 | % | 21.6 | | 1.8 | % | | | | |

| Other | (5.3) | | (0.5 | %) | (6.4) | | (0.5 | %) | | | | |

| Income taxes | 23.0 | | 1.7 | % | 18.9 | | 1.5 | % | | | | |

| Net income | 79.4 | | 5.8 | % | 64.9 | | 5.3 | % | | | | |

| Basic and diluted earnings per share (EPS) | 0.70 | | n/m | 0.59 | | n/m | | | | |

| | | | | | | | |

| | | | | | | | |

Adjusted EBITDA (note) | 211.9 | | 15.5 | % | 179.1 | | 14.6 | % | | | | |

Adjusted net income (note) | 103.0 | | 7.5 | % | 80.9 | | 6.6 | % | | | | |

Adjusted diluted EPS (note) | 0.90 | | n/m | 0.73 | | n/m | | | | |

| Dividends declared per common share | 0.210 | | n/m | 0.195 | | n/m | | | | |

note: Adjusted EBITDA, adjusted net income, and adjusted diluted EPS are non-IFRS measures (discussed in the Definitions section of this MD&A).

n/m = not meaningful

Q1 2024 compared to Q1 2023

In the first quarter of 2024, we delivered solid results driven by record net revenue, strong organic and acquisition growth, and operational efficiency gains.

•Net revenue increased 11.5% or $141.6 million to $1.4 billion, primarily driven by 6.6% organic and 5.5% acquisition net revenue growth. We achieved organic growth in all of our regional and business operating units with the exception of Energy & Resources. Double-digit organic growth was achieved in the United States and in our Water business.

•Project margin increased 12.5% or $82.5 million to $742.5 million. As a percentage of net revenue, project margin increased by 50 basis points to 54.2% due to strong project execution.

•Adjusted EBITDA increased 18.3% or $32.8 million, to $211.9 million. Adjusted EBITDA margin increased by 90 basis points over Q1 2023 to 15.5%, driven by strong net revenue growth, enhanced project margins, and disciplined cost management. The strengthening of our share price in Q1 2024 resulted in a 40 basis point headwind to our Adjusted EBITDA margin due to the revaluation of our long-term incentive program (LTIP) compared to the 60 basis point headwind for Q1 2023.

•Net income increased 22.3%, or $14.5 million, to $79.4 million, and diluted EPS increased 18.6%, or $0.11, to $0.70, mainly due to strong net revenue growth, solid project margins, and consistent administrative and marketing expenses as a percentage of net revenue.

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-3 | Stantec Inc. | |

•Adjusted net income grew 27.3%, or $22.1 million, to $103.0 million, achieving 7.5% of net revenue—an increase of 90 basis points, and adjusted diluted EPS increased 23.3% to $0.90. Q1 2024 LTIP revaluation reduced adjusted EPS by $0.04, $0.01 less than the impact in Q1 2023.

•Contract backlog increased to $7.0 billion at March 31, 2024, a record high reflecting 7.1% acquisition growth and 3.1% organic growth from December 31, 2023. Organic backlog growth was achieved in Canada and US, while Global retracted by less than 1%. We achieved double-digit organic backlog growth in our Environmental Services business. Contract backlog represents 13 months of work.

•Operating cash flows increased $20.2 million, with cash inflows of $56.9 million, reflecting revenue growth and solid operational performance.

•DSO was 79 days, remaining below our target of 80 days.

•Net debt to adjusted EBITDA (on a trailing twelve-month basis) at March 31, 2024 was 1.5x, reflecting the funding of recent acquisitions, and remaining within our internal target range of 1.0x to 2.0x.

•Consistent with our growth strategy, we completed the following acquisitions:

◦On January 8, 2024, we acquired ZETCON Engineering, a 645-person engineering firm headquartered in Bochum, Germany. ZETCON provides a strong platform in infrastructure planning, inspection, project management, and construction management.

◦On February 9, 2024, we acquired Morrison Hershfield, a 1,150-person engineering and management firm headquartered in Markham, Canada. The firm has a highly respected industry reputation in transportation, buildings, and environmental services.

◦On April 30, 2024, we completed the acquisition of Hydrock Holdings Limited (Hydrock), a 950-person integrated engineering design firm headquartered in Bristol, England. Hydrock holds a nationwide presence with 22 locations in the UK and industry-renowned experience, bolstering our offering to the energy, buildings, and infrastructure markets.

•On May 8, 2024, our Board of Directors declared a dividend of $0.21 per share, payable on July 15, 2024, to shareholders of record on June 28, 2024.

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-4 | Stantec Inc. | |

Reconciliation of Non-IFRS Financial Measures

| | | | | | | | | | |

| For the quarter ended

March 31, | |

| (In millions of Canadian dollars, except per share amounts) | 2024 | 2023 | | |

| Net income | 79.4 | | 64.9 | | | |

| Add back (deduct): | | | | |

| Income taxes | 23.0 | | 18.9 | | | |

| Net interest expense | 24.0 | | 20.7 | | | |

Net impairment (reversal) of lease assets and property and equipment (note 1) | 0.5 | | (2.9) | | | |

| Depreciation and amortization | 78.3 | | 72.7 | | | |

| | | | |

| | | | |

| | | | |

Unrealized gain on equity securities | (1.9) | | (3.9) | | | |

| | | | |

| Acquisition, integration, and restructuring costs (note 4) | 8.6 | | 8.7 | | | |

| | | | |

| Adjusted EBITDA | 211.9 | | 179.1 | | | |

| | | | | | | | | | |

| For the quarter ended

March 31, | |

| (In millions of Canadian dollars, except per share amounts) | 2024 | 2023 | | |

| Net income | 79.4 | | 64.9 | | | |

| Add back (deduct) after tax: | | | | |

Net impairment (reversal) of lease assets and property and equipment (note 1) | 0.3 | | (2.2) | | | |

| Amortization of intangible assets related to acquisitions (note 2) | 18.1 | | 14.5 | | | |

Unrealized gain on equity securities (note 3) | (1.5) | | (3.0) | | | |

| | | | |

| Acquisition, integration, and restructuring costs (note 4) | 6.7 | | 6.7 | | | |

| | | | |

| Adjusted net income | 103.0 | | 80.9 | | | |

| | | | |

| Weighted average number of shares outstanding - diluted | 114,066,995 | | 110,927,669 | | | |

| | | | |

| | | | |

| | | | |

| Adjusted earnings per share - diluted | 0.90 | | 0.73 | | | |

See the Definitions section of this MD&A for our discussion of non-IFRS and other financial measures used and additional reconciliations of non-IFRS financial measures.

note 1: The net impairment (reversal) of lease assets and property and equipment includes onerous contracts associated with the impairment for the quarter ended March 31, 2024 of $0.1 (2023 - $(0.4)). For the quarter ended March 31, 2024, this amount is net of tax of $0.2 (2023 - $(0.7)).

note 2: The add back of intangible amortization relates only to the amortization from intangible assets acquired through acquisitions and excludes the amortization of software purchased by Stantec. For the quarter ended March 31, 2024, this amount is net of tax of $5.3 (2023 - $4.2).

note 3: For the quarter ended March 31, 2024, this amount is net of tax of $(0.4) (2023 - $(0.9)).

note 4: The add back of certain administrative and marketing costs and depreciation primarily related to acquisition and integration expenses associated with our acquisitions and restructuring costs. For the quarter ended March 31, 2024, this amount is net of tax of $1.9 (2023 - $2.0).

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-5 | Stantec Inc. | |

Financial Targets

We provided our annual targets for 2024 on page M-11 in our 2023 Annual Report (incorporated here by reference).

| | | | | | | | |

| | | 2024 Annual Range | |

| Targets | | | | |

Net revenue growth | | | 11% to 15% | |

Adjusted EBITDA as % of net revenue (note) | | | 16.2% to 17.2% | |

Adjusted net income as % of net revenue (note) | | | above 8% | |

Adjusted diluted EPS growth (note) | | | 12% to 16% | |

Adjusted ROIC (note) | | | above 11% | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | |

| | | | |

Our targets and guidance assumed the average value for the US dollar to be $1.35, GBP to be $1.70, and AU dollar $0.90. For all other underlying assumptions, see page M-22. These targets do not include the impact of revaluing our share-based compensation, which fluctuates primarily due to share price movements subsequent to December 31, 2023, as further described below.

note: Adjusted EBITDA, adjusted net income, adjusted diluted EPS, and adjusted ROIC are non-IFRS measures discussed in the Definitions section of this MD&A.

Outlook

We reaffirm our guidance provided in the Outlook section of our 2023 Annual Report (incorporated here by reference).

We expect that net revenue will increase between 11% and 15% in 2024. Stantec continues to see high levels of activity in all regions. We reaffirm our expectations for organic net revenue growth in the mid to high single digits, with the US and Global regions in the mid to high single digits, and Canada in the mid-single digits. We expect acquisition net revenue growth, including a partial year contribution from Hydrock, to be in the mid-single digits.

We anticipate adjusted EBITDA margin will be in the range of 16.2% - 17.2%, reflecting continued discipline in the management of administrative and marketing costs to drive operational efficiency. Adjusted EBITDA margin in Q1 and Q4 2024 is expected to be near or below the low end of this range because of the additional effects of regular seasonal factors in the northern hemisphere. We expect to move to the higher end of the range in Q2 and Q3 of 2024, when we typically achieve stronger organic net revenue growth and increased utilization in our operations.

We expect adjusted net income to achieve a margin above 8.0%, adjusted diluted EPS growth to be in the range of 12% - 16%, and adjusted ROIC to be above 11%.

Effect of Long-term Incentive Plan

Consistent with guidance previously provided, our targets do not include the impact of revaluing our share-based compensation, which fluctuates primarily due to share price movements subsequent to December 31, 2023. For Q1 2024, the revaluation resulted in a $5.8 million expense (pre-tax), the equivalent of 40 basis points as a percentage of net revenue and $0.04 EPS. If the LTIP metrics existing at Q1 remain constant to the end of the year, the impact of higher share-based compensation expense to the remaining three quarters would be approximately $2.1 million (pre-tax) or $0.01 EPS, and the full year impact would be approximately $7.9 million (pre-tax) or $0.05 EPS.

The above targets do not include any assumptions for additional acquisitions given the unpredictable nature of the size and timing of such acquisitions, or the impact from share price movements subsequent to December 31, 2023 and the relative total shareholder return components on our share-based compensation programs.

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-6 | Stantec Inc. | |

Financial Performance

The following sections outline specific factors that affected the results of our operations in Q1 2024.

Gross and Net Revenue

While providing professional services, we incur certain direct costs for subconsultants, equipment, and other expenditures that are recoverable directly from our clients. Revenue associated with these direct costs is included in gross revenue. Because these direct costs and associated revenue can vary significantly from contract to contract, changes in gross revenue may not be indicative of our revenue trends. Accordingly, we also report net revenue (which is gross revenue less subconsultant and other direct expenses) and analyze results in relation to net revenue rather than gross revenue.

We generate over 75% of our gross revenue in foreign currencies, primarily in US dollars, British pounds (GBP), and Australian (AU) dollars. Fluctuations in these and other currencies had a net $6.7 million negative impact on our net revenue results in Q1 2024 compared to Q1 2023:

•The US dollar averaged $1.35 in Q1 2023 and Q1 2024—remaining consistent with limited impact on gross and net revenue.

•The GBP averaged $1.64 in Q1 2023 and $1.71 in Q1 2024—a 4.3% increase. The strengthening GBP compared to the Canadian dollar had a positive effect on gross and net revenues.

•The AU dollar averaged $0.92 in Q1 2023 and $0.89 in Q1 2024—a 3.3% decrease. The weakening AU dollar compared to the Canadian dollar had a negative effect on gross and net revenues.

Fluctuations in other foreign currencies did not have a material impact on our gross and net revenue.

Revenue earned by acquired companies in the first 12 months following an acquisition is reported as revenue from acquisitions and thereafter as organic revenue.

| | | | | | | | | | | | | | | | | | | | | | | |

Gross Revenue by Reportable Segment - Q1 2024 |

| (In millions of Canadian dollars, except percentages) | Q1 2024 | Q1 2023 | Total Change | Change Due to Acquisitions | Change Due to Foreign Exchange | Change Due to Organic Growth (Retraction) | % of Organic Growth (Retraction) |

| Canada | 355.7 | 344.1 | 11.6 | 22.5 | n/a | (10.9) | (3.1 | %) |

| United States | 985.4 | 844.5 | 140.9 | 46.9 | (3.1) | 97.1 | 11.5 | % |

| Global | 380.3 | 350.6 | 29.7 | 24.3 | (5.6) | 11.0 | 3.1 | % |

| Total | 1,721.4 | 1,539.2 | 182.2 | 93.7 | (8.7) | 97.2 | |

Percentage Growth (Retraction) | | | 11.8 | % | 6.1 | % | (0.6 | %) | 6.3 | % | |

| | | | | | | | | | | | | | | | | | | | | | | |

Net Revenue by Reportable Segment - Q1 2024 |

| (In millions of Canadian dollars, except percentages) | Q1 2024 | Q1 2023 | Total Change | Change Due to Acquisitions | Change Due to Foreign Exchange | Change Due to Organic Growth | % of Organic Growth |

| Canada | 323.7 | 303.0 | 20.7 | 17.8 | n/a | 2.9 | 1.0 | % |

| United States | 733.9 | 643.2 | 90.7 | 28.2 | (2.4) | 64.9 | 10.1 | % |

| Global | 312.5 | 282.3 | 30.2 | 21.5 | (4.3) | 13.0 | 4.6 | % |

| Total | 1,370.1 | 1,228.5 | 141.6 | 67.5 | (6.7) | 80.8 | |

Percentage Growth (Retraction) | | | 11.5 | % | 5.5 | % | (0.6 | %) | 6.6 | % | |

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-7 | Stantec Inc. | |

| | | | | | | | | | | | | | | | | | | | | | | |

Gross Revenue by Business Operating Unit - Q1 2024 |

| (In millions of Canadian dollars, except percentages) | Q1 2024 | Q1 2023 | Total Change | Change Due to Acquisitions | Change Due to Foreign Exchange | Change Due to Organic Growth (Retraction) | % of Organic Growth (Retraction) |

| Infrastructure | 463.2 | 412.5 | 50.7 | 35.7 | (1.4) | 16.4 | 4.0 | % |

| Water | 380.0 | 327.7 | 52.3 | — | (0.7) | 53.0 | 16.2 | % |

| Buildings | 383.9 | 291.1 | 92.8 | 55.9 | (1.3) | 38.2 | 13.1 | % |

| Environmental Services | 322.0 | 321.6 | 0.4 | 2.1 | (1.2) | (0.5) | (0.2 | %) |

| Energy & Resources | 172.3 | 186.3 | (14.0) | — | (4.1) | (9.9) | (5.3 | %) |

| Total | 1,721.4 | 1,539.2 | 182.2 | 93.7 | (8.7) | 97.2 | |

Percentage Growth (Retraction) | | | 11.8 | % | 6.1 | % | (0.6 | %) | 6.3 | % | |

| | | | | | | | | | | | | | | | | | | | | | | |

Net Revenue by Business Operating Unit - Q1 2024 |

| (In millions of Canadian dollars, except percentages) | Q1 2024 | Q1 2023 | Total Change | Change Due to Acquisitions | Change Due to Foreign Exchange | Change Due to Organic Growth (Retraction) | % of Organic Growth (Retraction) |

| Infrastructure | 377.2 | 332.6 | 44.6 | 29.3 | (1.1) | 16.4 | 4.9 | % |

| Water | 301.3 | 259.8 | 41.5 | — | (0.6) | 42.1 | 16.2 | % |

| Buildings | 290.7 | 232.4 | 58.3 | 36.6 | (1.2) | 22.9 | 9.9 | % |

| Environmental Services | 248.4 | 239.3 | 9.1 | 1.6 | (0.8) | 8.3 | 3.5 | % |

| Energy & Resources | 152.5 | 164.4 | (11.9) | — | (3.0) | (8.9) | (5.4 | %) |

| Total | 1,370.1 | 1,228.5 | 141.6 | 67.5 | (6.7) | 80.8 | |

Percentage Growth (Retraction) | | | 11.5 | % | 5.5 | % | (0.6 | %) | 6.6 | % | |

We continued to achieve growth from solid performance in our geographies, particularly in our Water and Buildings businesses, and through our acquisitions of ZETCON and Morrison Hershfield, which contributed to an 11.5% net revenue increase in Q1 2024 compared to Q1 2023. Public infrastructure spending and private investment continue to be key growth drivers in 2024, with increased project work in water security, and transportation. Another key driver is the urgent challenge to tackle climate change and resource security. The focus on Smart(ER) cities and buildings, including hospitals, data centers, and other mission-critical facilities to meet the needs in the civic, healthcare, residential, and industrial markets, also continues to drive growth.

Canada

We achieved 6.8% net revenue growth in our Canadian operations, reflecting acquisition growth of 5.8% and organic growth of 1.0%. Continued public infrastructure spending drove double-digit organic net revenue growth in Infrastructure and Water, which was partly offset with a retraction in Energy & Resources. The ramp up of major roadway projects and continued momentum on wastewater solution projects contributed to organic growth in Infrastructure and Water, respectively. Public sector investment in western Canada drove growth in Buildings, primarily in our education and civic sectors. Energy & Resources retracted in the quarter as we experienced delays in the ramp up of new projects while several significant projects wound down in late 2023.

United States

Net revenue increased 14.1%, reflecting strong organic growth of 10.1% and acquisition growth of 4.4%. Our US operations achieved double-digit organic growth as public and private sector demand continued to fuel solid organic growth across all of our business operating units, particularly in Water and Buildings, both achieving double-digit

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-8 | Stantec Inc. | |

growth. Leading with organic growth of over 20%, our Water team capitalized on robust public sector and industrial project demands across the US, and continued work on large-scale water security projects in the western US. Organic growth in Buildings was spurred by continued solid investment across most of our sectors, particularly in healthcare, industrial, and science and technology. Momentum on major Infrastructure projects continued to drive solid organic growth, particularly on transit and rail projects in the western US and roadway work in the eastern US. Our Environmental Services team capitalized on an earlier field work season due to favorable weather conditions.

Global

In our Global operations, we achieved net revenue growth of 10.7%, reflecting acquisition growth of 7.6% and organic net revenue growth of 4.6%, with double-digit organic growth in Buildings, Water, and Environmental Services. The ramp up of projects spurred over 20% organic growth in Buildings, achieving growth in every region, most notably in the Middle East where we are the lead designer of the Hamdan Bin Rashid Cancer Center in Dubai. Our industry-leading Water business delivered strong organic growth across the UK, New Zealand, and Australia through long-term framework agreements and public sector investment in water infrastructure. Environmental Services also drove growth with momentum from energy transition projects, particularly in Europe. Partly offsetting the increases was a retraction in Infrastructure primarily due to the Australia government’s decision to cancel or delay certain transportation projects

Backlog

We define “backlog” as the total value of all contracts that have been awarded less the total value of work completed on these contracts as of the reporting date. Our backlog equates to our remaining performance obligations that are unsatisfied (or partially satisfied) at the end of the reporting period, as reported under IFRS Accounting Standards.

| | | | | | | | | | | | | | | | | | | | | | | |

| (In millions of Canadian dollars, except percentages) | Mar 31, 2024 | Dec 31, 2023 | Total Change | Change Due to Acquisitions | Change Due to Foreign Exchange | Change Due to Organic Growth (Retraction) | % of Organic Growth (Retraction) |

| Canada | 1,568.1 | 1,342.6 | | 225.5 | 206.1 | n/a | 19.4 | 1.4 | % |

| United States | 4,265.1 | 3,950.8 | | 314.3 | 45.4 | 87.1 | 181.8 | 4.6 | % |

| Global | 1,197.0 | 1,012.5 | | 184.5 | 194.8 | (3.7) | (6.6) | (0.7) | % |

| Total | 7,030.2 | 6,305.9 | | 724.3 | 446.3 | 83.4 | 194.6 | |

Percentage Growth | | | 11.5 | % | 7.1 | % | 1.3 | % | 3.1 | % | |

Our contract backlog at March 31, 2024 stands at $7.0 billion, a new record representing approximately 13 months of work, an increase of 1 month from December 31, 2023. Acquisitions completed in 2024, contributed to 7.1% growth or $446.3 million, primarily within Infrastructure and Buildings. Backlog also grew 3.1% organically, or $194.6 million, primarily in our Canada and US operations and particularly in Environmental Services and Infrastructure business units. The slight retraction in Global backlog reflects the Australia government’s recent cancellation of certain transportation projects due to the rising cost environment, and the draw down of our UK backlog associated with the AMP7 cycle during the transition to AMP8 where certain awarded contracts are not yet in backlog.

Major Project Awards

Through our innovative and collaborative approach to engineering and design, we are well-positioned to provide solutions to positively impact our clients, communities, and climate action. Through our business relations, we continue to capture traditional and emerging opportunities in backlog and also in our master services agreement wins.

Canada

The pursuit of clean, reliable energy has spurred additional projects across Canada that support hydro power generation. Our Energy & Resources team was selected by BC Hydro & Power Authority to provide project management as well as transmission and distribution engineering through a seven-year $186 million master services agreement. And in eastern Canada, we were selected by Hydro-Quebec to provide professional environmental

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-9 | Stantec Inc. | |

services, including environmental assessments and geomorphology studies, under a seven-year master services agreement with the potential to renew for up to three years. Our Water group was selected for a number of water resource management projects, including the preliminary design of a potable water conveyance infrastructure project for a long-standing client in Alberta. Our Buildings team has been selected to design Canada’s first cancer care facility offering proton therapy, the Ben Stelter Proton Facility and Neuroscience Centre of Excellence, in Edmonton.

United States

The priority for the treatment and recycling of wastewater to potable and non-potable water continues to expand in the US. In northern Virginia, our Water team was selected for the $175 million design-build biosolids project for the Arlington County Water Pollution Control Plant to upgrade the solids handling facilities. The project will also incorporate cutting-edge technology to transform wastewater to a renewable energy source, reduce greenhouse gas emissions, and convert wastewater biosolids to a nutrient rich soil amendment. The intersection of Communities and Infrastructure continues to stimulate projects in the US, such as our planning for the Bi-State Sustainable Reinvestment Corridor in Missouri. This corridor will connect four cities in two states and two counties by implementing a 24-mile, zero-emission regional transit route. Project wins in healthcare and workplaces & offices continue to bolster our Buildings group.

Global

Our Water, Environmental Services, and Infrastructure teams will be assisting with the $595 million North West Treatment Hub Growth Program in Sydney, Australia. This latest award from Sydney Water will span four years and include support for construction, operational readiness, and commissioning. In the UK, our industry leading Water team has been successful in securing design and construction services for several AMP 8 frameworks. Through our expertise in mission critical facilities and data centers, our Buildings team in Australia was selected for the full design services of a new 87 MW IT data center.

Project Margin

In general, project margin fluctuations depend on the particular mix of projects in progress during any quarter and on project execution. The fluctuations reflect our business model, which is based on providing services across diverse geographic locations, business operating units, and all phases of the infrastructure and facilities project life cycle. For a definition of project margin, refer to the Financial Performance section of our 2023 Annual Report (incorporated here by reference).

| | | | | | | | | | | | | | | | | | |

| Project Margin by Reportable Segment | | | | |

| | | Quarter Ended Mar 31, |

| | | | 2024 | 2023 |

| (In millions of Canadian dollars, except percentages) | | | | | $ | % of Net

Revenue | $ | % of Net

Revenue |

| Canada | | | | | 172.3 | | 53.2 | % | 162.1 | | 53.5% |

| United States | | | | | 402.5 | | 54.8 | % | 351.2 | | 54.6% |

| Global | | | | | 167.7 | | 53.7 | % | 146.7 | | 52.0% |

| Total | | | | | 742.5 | | 54.2 | % | 660.0 | | 53.7% |

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-10 | Stantec Inc. | |

| | | | | | | | | | | | | | | | | | |

| Project Margin by Business Operating Unit | | | | |

| | | Quarter Ended Mar 31, |

| | | | 2024 | 2023 |

| (In millions of Canadian dollars, except percentages) | | | | | $ | % of Net

Revenue | $ | % of Net

Revenue |

| Infrastructure | | | | | 200.3 | | 53.1 | % | 176.3 | | 53.0% |

| Water | | | | | 167.2 | | 55.5 | % | 138.5 | | 53.3% |

| Buildings | | | | | 160.1 | | 55.1 | % | 126.3 | | 54.3% |

| Environmental Services | | | | | 137.1 | | 55.2 | % | 133.2 | | 55.7% |

| Energy & Resources | | | | | 77.8 | | 51.0 | % | 85.7 | | 52.1% |

| Total | | | | | 742.5 | | 54.2 | % | 660.0 | | 53.7% |

Project margin increased $82.5 million, or 12.5%, and as a percentage of net revenue, project margin increased to 54.2% from 53.7%. Net revenue growth driven by robust public and private investment contributed to the project margin increases. As a percentage of net revenue, project margin remained in line with our expectations as a result of our continued discipline in project execution, our ability to increase rates on certain projects to mitigate the impacts of wage inflation, and increased selectivity in project pursuits.

In Canada, project margin increased $10.2 million to $172.3 million. As a percentage of net revenue, project margin was 53.2%, a 30 basis point decrease compare to Q1 2023. Project margin as a percentage of net revenue remained consistent with expectations, decreasing slightly due to the wind down of several higher margin projects in Environmental Services and a shift in project mix.

In our US operations, project margin increased $51.3 million to $402.5 million. As a percentage of net revenue, project margin increased 20 basis points in the quarter to 54.8% primarily due to favorable project mix and solid project performance, most notably in Water.

In our Global operations, project margin increased $21.0 million to $167.7 million. As a percentage of net revenue, project margin increased 170 basis points to 53.7%. Strong project performance in UK Water and Buildings contributed to project margin increases, as well as the resolution of a number of contributing factors that affected the comparative period, as described in our Q1 2023 report.

Administrative and Marketing Expenses

Administrative and marketing expenses were $542.9 million in Q1 2024 compared to $488.3 million in Q1 2023, and decreased as a percentage of net revenue by 10 basis points to 39.6%. The impact of revaluating our LTIP due to the strengthening of our share price was 20 basis points lower as a percentage of net revenue than in Q1 2023.

Amortization of Intangible Assets

The timing of completed acquisitions, size of acquisitions, and type of intangible assets acquired impact the amount of amortization of intangible assets in a period. Client relationships are amortized over estimated useful lives ranging from 10 to 15 years and contract backlog is amortized over an estimated useful life of 1 to 3 years. Consequently, the impact of amortization can be significant in the reporting periods following an acquisition.

Amortization of intangible assets increased $4.7 million in the quarter as a result of recent acquisitions completed, including acquisitions in 2024 which added $99.6 million to client relationships and $38.0 million to backlog.

Net Interest Expense and Other Net Finance Expense

Net interest expense and other net finance expense increased $2.6 million in the quarter, primarily due to overall higher net debt to fund our acquisitions of ZETCON and Morrison Hershfield.

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-11 | Stantec Inc. | |

Other Income

Other income was $5.3 million in Q1 2024 compared to $6.4 million Q1 2023. Other income from our investments held for self-insured liabilities included a net gain of $5.9 million in Q1 2024 compared to $4.0 million in Q1 2023. The comparative period also included a non-cash net impairment reversal of leased assets and property and equipment of $2.5 million.

Income Taxes

Our effective income tax rate remained consistent with the prior quarter at 22.5% in Q1 2024, which was in line with our guidance and consistent with the annual effective tax rate of 22.5% in 2023.

Summary of Quarterly Results

The following table presents selected data derived from our consolidated financial statements for each of the eight most recently completed quarters. This information should be read in conjunction with the applicable interim unaudited and annual audited consolidated financial statements and related notes.

Quarterly Unaudited Financial Information

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2024 | 2023 | 2022 |

| (In millions of Canadian dollars, except per share amounts) | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 |

| Gross revenue | 1,721.4 | | 1,609.0 | | 1,693.2 | | 1,638.2 | | 1,539.2 | | 1,513.5 | | 1,473.2 | | 1,376.6 | |

| Net revenue | 1,370.1 | | 1,242.2 | | 1,316.8 | | 1,278.7 | | 1,228.5 | | 1,130.4 | | 1,160.0 | | 1,116.7 | |

| | | | | | | | |

| | | | | | | | |

| Net income | 79.4 | | 74.4 | | 103.9 | | 88.0 | | 64.9 | | 73.5 | | 68.0 | | 60.7 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Diluted earnings per share | 0.70 | | 0.66 | | 0.94 | | 0.79 | | 0.59 | | 0.66 | | 0.61 | | 0.55 | |

| | | | | | | | |

Adjusted net income (note) | 103.0 | | 91.4 | | 126.7 | | 109.4 | | 80.9 | | 91.1 | | 95.0 | | 92.6 | |

Adjusted diluted EPS (note) | 0.90 | | 0.82 | | 1.14 | | 0.99 | | 0.73 | | 0.82 | | 0.86 | | 0.83 | |

| | | | | | | | |

note: Adjusted net income and adjusted diluted EPS are non-IFRS measures further discussed in the Definitions section of this MD&A.

Quarterly EPS and adjusted diluted EPS are not additive and may not equal the annual EPS reported. This is a result of the effect of shares issued on the weighted average number of shares. Quarterly and annual diluted EPS and adjusted diluted EPS are also affected by the change in the market price of our shares since we do not include dilutive options when the exercise price of the option is not in the money.

The table below compares quarters, summarizing the impact of acquisitions, organic growth, and foreign exchange on net revenue:

| | | | | | | | | | | | | | |

| Q1 2024 | Q4 2023 | Q3 2023 | Q2 2023 |

| vs. | vs. | vs. | vs. |

| (In millions of Canadian dollars) | Q1 2023 | Q4 2022 | Q3 2022 | Q2 2022 |

Increase in net revenue due to | | | | |

| Organic growth | 80.8 | | 85.3 | | 104.3 | | 125.2 | |

| Acquisition growth | 67.5 | 21.3 | | 26.9 | | 3.1 | |

| Impact of foreign exchange rates on revenue earned by foreign subsidiaries | (6.7) | | 5.2 | | 25.6 | | 33.7 | |

| Total increase in net revenue | 141.6 | | 111.8 | | 156.8 | | 162.0 | |

We experience variability in our results of operations from quarter to quarter due to the nature of the sectors and geographic locations we operate in. In the first and fourth quarters, we see slowdowns related to winter weather conditions in the northern hemisphere and holiday schedules. The increase in net revenue from Q1 2024 compared to Q1 2023 primarily reflects organic growth due to a strong macro environment and acquisition growth from revenues

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-12 | Stantec Inc. | |

contributed from acquisitions completed in the last twelve months, partly offset by net negative foreign exchange impacts. (See additional information on the operating results in our MD&A for each respective quarter.)

Statements of Financial Position

The following table highlights the major changes to assets, liabilities, and equity since December 31, 2023:

| | | | | | | | |

| (In millions of Canadian dollars) | Mar 31, 2024 | Dec 31, 2023 |

| | |

| Total current assets | 2,276.6 | | 2,272.5 | |

| Property and equipment | 288.4 | | 267.5 | |

| Lease assets | 486.5 | | 442.9 | |

| Goodwill | 2,796.2 | | 2,384.0 | |

| Intangible assets | 429.9 | | 265.7 | |

| Net employee defined benefit asset | 73.9 | | 72.3 | |

| | |

| Deferred tax assets | 96.3 | | 92.6 | |

| Other assets | 248.0 | | 279.2 | |

| Total assets | 6,695.8 | | 6,076.7 | |

| | |

| Current portion of long-term debt | 181.1 | | 146.7 | |

| Current portion of provisions | 57.6 | | 51.7 | |

| Current portion of lease liabilities | 113.3 | | 101.3 | |

| All other current liabilities | 1,344.4 | | 1,316.0 | |

| | |

| Total current liabilities | 1,696.4 | | 1,615.7 | |

| Lease liabilities | 519.4 | | 477.8 | |

| | |

| Long-term debt | 1,315.8 | | 982.3 | |

| Provisions | 146.1 | | 134.8 | |

| Net employee defined benefit liability | 28.5 | | 29.5 | |

| Deferred tax liabilities | 65.2 | | 24.4 | |

| Other liabilities | 67.0 | | 55.6 | |

| Equity | 2,857.4 | | 2,756.6 | |

| | |

| Total liabilities and equity | 6,695.8 | | 6,076.7 | |

Refer to the Liquidity and Capital Resources section of this MD&A for an explanation of the changes in current assets, current liabilities, and shareholders’ equity.

The carrying amounts of assets and liabilities for our US operations and other global subsidiaries on our consolidated statements of financial position increased marginally primarily due to the strengthening of the US dollar and British pound, relative to the Canadian dollar, partially offset by the weakening of the Australian dollar, relative to the Canadian dollar. Other factors that impacted our long-term assets and liabilities are indicated below.

The impact of the ZETCON and Morrison Hershfield acquisitions and measurement period adjustments for prior acquisitions increased goodwill by $384.7 million, intangible assets by $140.6 million, and lease assets by $43.9 million. These values are based on a preliminary purchase price allocation and are pending a final determination of the fair value of the assets and liabilities acquired. The final allocation may differ from the preliminary allocation.

Other increases to long-term assets include additions to lease assets and intangible assets. Partly offsetting the increases were depreciation and amortization expense and a decrease in other assets, primarily as a result of the sale of investments held for self-insured liabilities.

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-13 | Stantec Inc. | |

Long-term debt increased $367.9 million, due to higher draws on the revolving credit facility and increases to notes payable, primarily to finance our 2024 acquisitions, as well as higher other financing obligations. Acquisition additions increased lease liabilities by $42.4 million and deferred tax liabilities by $39.6 million. Other increases include additions and modifications to lease liabilities and higher accrued obligations for cash-settled share-based compensation included in other liabilities.

Liquidity and Capital Resources

We are able to meet our liquidity needs through various sources, including cash generated from operations; long- and short-term borrowings (further described in the Capital Management section of this MD&A); and the issuance of common shares. We use funds primarily to pay operational expenses; complete acquisitions; sustain capital spending on property, equipment, and software; repay long-term debt; repurchase shares; and pay dividend distributions to shareholders.

We believe that internally generated cash flows, supplemented by borrowings, if necessary, will be sufficient to cover our normal operating and capital expenditures. However, under certain favorable market conditions, we do consider issuing common shares to facilitate acquisition growth or to reduce borrowings under our credit facilities.

Working Capital

The following table summarizes working capital information at March 31, 2024, compared to December 31, 2023:

| | | | | | | | |

| (In millions of Canadian dollars, except ratios) | Mar 31, 2024 | Dec 31, 2023 |

| Current assets | 2,276.6 | | 2,272.5 | |

| Current liabilities | 1,696.4 | | 1,615.7 | |

Working capital (note) | 580.2 | | 656.8 | |

Current ratio (note) | 1.34 | | 1.41 | |

note: See the Definitions section of this MD&A for our discussion of supplementary financial measures used.

The carrying amounts of assets and liabilities for our US operations and other global subsidiaries on our consolidated statements of financial position increased marginally primarily due to the strengthening of the US dollar and British pound, relative to the Canadian dollar, partially offset by the weakening of the Australian dollar, relative to the Canadian dollar.

Current assets increased due to a collective increase of $150.6 million in trade and other receivables, unbilled receivables, and contract assets due to the acquisitions of ZETCON and Morrison Hershfield as well as organic growth. Prepaid expenses increased primarily due to higher subscription renewal fees paid for certain cloud-based software solutions. These increases were partly offset by decreases in cash and deposits of $153.4 million (explained in the Cash Flows section of this MD&A) and lower income taxes recoverable due to the timing of installment payments.

Our DSO, defined in the Definitions section of this MD&A, was 79 days at March 31, 2024, remaining within our stated internal guideline and increased two days from December 31, 2023.

The increase in current liabilities was largely the result of an increase in the current portion of long-term debt (explained in the Statement of Financial Position section of this MD&A) and an increase to deferred revenue from acquisitions. These increases were offset by lower trade and other payables due to the timing of the annual employee short-term incentive awards payment.

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-14 | Stantec Inc. | |

Cash Flows

Our cash flows from and used in operating, investing, and financing activities are reflected in the consolidated statements of cash flows and are summarized below:

| | | | | | | | | | | | | | |

| | Quarter Ended Mar 31, |

| (In millions of Canadian dollars) | | | | 2024 | 2023 | Change |

Cash flows from operating activities | | | | 56.9 | | 36.7 | | 20.2 | |

| Cash flows used in investing activities | | | | (408.1) | | (24.0) | | (384.1) | |

Cash flows from (used in) financing activities | | | | 194.2 | | (28.2) | | 222.4 | |

Cash Flows From Operating Activities

Cash flows from operating activities were $56.9 million, which increased $20.2 million compared to Q1 2023. Revenue growth and solid operational performance contributed to increased cash flow.

Cash Flows Used in Investing Activities

Cash flows used in investing activities were $408.1 million compared to $24.0 million in Q1 2023. This was primarily due to net cash used to fund our acquisitions of ZETCON and Morrison Hershfield in Q1 2024 for $431.3 million. Partly offsetting the increase was net proceeds of $41.5 million earned from the sale of investments held for self-insured liabilities compared to net purchases of $8.3 million in the comparative period.

Cash Flows From Financing Activities

Cash flows from financing activities were $194.2 million in Q1 2024, a $222.4 million increase in cash inflows compared to Q1 2023. The increase was driven by higher draws on our revolving credit facility of $214.0 million, primarily related to the acquisitions of ZETCON and Morrison Hershfield, and higher draws on our bank indebtedness.

Capital Management

Our objective in managing Stantec's capital is to provide sufficient capacity to cover normal operating and capital expenditures and to have flexibility for financing future growth. We focus our capital allocations on increasing shareholder value through funding accretive acquisitions in pursuit of our growth strategy while maintaining a strong balance sheet, repurchasing shares opportunistically, and managing dividend increases to our target payout ratio in a sustainable manner.

We manage our capital structure according to our internal guideline of maintaining a net debt to adjusted EBITDA ratio (actual trailing twelve months) of less than 2.0 to 1.0. There may be occasions when we exceed our target by completing acquisitions that increase our debt level for a period of time.

| | | | | | | | |

| (In millions of Canadian dollars, except ratios) | Mar 31, 2024 | Dec 31, 2023 |

| Current and non-current portion of long-term debt | 1,496.9 | | 1,129.0 | |

| Less: cash and cash equivalents | (199.5) | | (352.9) | |

| Bank indebtedness | 29.0 | | 23.6 | |

| Net debt | 1,326.4 | | 799.7 | |

| Shareholders' equity | 2,857.4 | | 2,756.6 | |

| Total capital managed | 4,183.8 | | 3,556.3 | |

| Trailing twelve months adjusted EBITDA from continuing operations (note) | 863.8 | | 831.0 | |

Net debt to adjusted EBITDA ratio (note) | 1.5 | | 1.0 | |

note: See the Definitions section of this MD&A for our discussion of non-IFRS measures used.

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-15 | Stantec Inc. | |

At March 31, 2024, our net debt to adjusted EBITDA ratio was 1.5x, falling within our stated internal guideline, and higher compared to December 31, 2023 due to our recent acquisitions of ZETCON and Morrison Hershfield, which resulted in higher draws on our revolving credit facility.

Our credit facilities include:

•senior unsecured notes of $550 million

•syndicated senior credit facilities of $1.1 billion, structured as a sustainability-linked loan, consisting of a revolving credit facility in the maximum of $800 million and a term loan of $310 million (with access to additional funds of $600 million through an accordion feature), and an unsecured bilateral term credit facility of $100 million

•an uncommitted unsecured multicurrency credit facility of £20 million and an overdraft facility of AU$5 million

We are required to comply with certain covenants as part of our senior unsecured notes, syndicated senior credit facilities, and unsecured bilateral term credit facility. The key financial covenants include, but are not limited to, ratios that measure our debt relative to our profitability (as defined by the credit facilities agreement).

At March 31, 2024, $454.8 million was available in our credit facilities for future activities, and we were in compliance with the covenants related to our credit facilities as at and throughout the period ended March 31, 2024.

Shareholders’ Equity

Shareholders’ equity increased $100.8 million from December 31, 2023. The increase in shareholders' equity was mainly due to net income of $79.4 million earned in the first quarter of 2024 and comprehensive income of $45.3 million, primarily related to exchange differences on translation of our foreign subsidiaries. These increases were partly offset by dividends declared of $23.9 million.

Our Normal Course Issuer Bid (NCIB) on the TSX was renewed on December 11, 2023, enabling us to repurchase up to 2,281,339 of our common shares during the period of December 13, 2023 to December 12, 2024. We also have an Automatic Share Purchase Plan with a broker that allows the purchase of common shares for cancellation under the NCIB at any time during predetermined trading blackout periods within certain pre-established parameters.

Other

Outstanding Share Data

Common shares outstanding were 114,066,995 at March 31, 2024 and May 8, 2024. No shares were repurchased from April 1, 2024 to May 8, 2024 under our NCIB Automatic Share Purchase Plan.

Contractual Obligations

The nature and extent of our contractual obligations did not change materially from those described in the Contractual Obligations section of our 2023 Annual Report (incorporated here by reference). Management believes sufficient liquidity is available to meet our contractual obligations as at March 31, 2024.

Off-Balance Sheet Arrangements

The nature and extent of our off-balance sheet arrangements did not change materially from those described in the Off-Balance Sheet Arrangements section of our 2023 Annual Report (incorporated here by reference).

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-16 | Stantec Inc. | |

Financial Instruments and Market Risk

At March 31, 2024, the nature and extent of our use of financial instruments did not change materially from those described in the Financial Instruments and Market Risk section of our 2023 Annual Report (incorporated here by reference).

We continue to hold total return swap (TRS) agreements with a financial institution to manage a portion of our exposure to changes in the fair value of our shares for certain cash-settled share-based payment obligations. The TRS agreements fix the impact that our share price has on the payments required to settle the obligations for restricted share units and deferred share units.

Related-Party Transactions

Transactions with subsidiaries, structured entities, associated companies, joint ventures, and key management personnel are further described in note 33 of our audited consolidated financial statements for the year ended December 31, 2023 (included in our 2023 Annual Report and incorporated here by reference). At March 31, 2024, the nature and extent of these transactions were not materially different from those disclosed in the 2023 Annual Report.

Critical Accounting Estimates, Developments, and Measures

Critical Accounting Estimates

The preparation of consolidated financial statements in accordance with IFRS Accounting Standards requires us to make various estimates and assumptions. However, future events may result in significant differences between estimates and actual results.

There has been no significant change in our critical accounting estimates in Q1 2024 from those described in our 2023 Annual Report in the Critical Accounting Estimates, Developments, and Measures section and in note 5 of our December 31, 2023, audited consolidated financial statements (incorporated here by reference).

The conflicts in Ukraine and the Middle East, and higher inflationary environments have had adverse financial impacts on the global economy, but we have not seen an increase to our risk exposure. Stantec continues to closely monitor conflicts for potential impacts to our people and operations.

Recent Accounting Pronouncements

Certain amendments disclosed in note 3 of our unaudited interim consolidated financial statements for the quarter ended March 31, 2024 (incorporated here by reference) had an effective date of January 1, 2024, but did not have a material impact on the consolidated financial statements or accounting policies for the quarter ended March 31, 2024.

Future Adoptions

Standards, amendments, and interpretations that we reasonably expect to be applicable at a future date and intend to adopt when they become effective are described in note 6 of our 2023 audited consolidated financial statements and note 3 of our unaudited interim consolidated financial statements for the quarter ended March 31, 2024 (both incorporated here by reference). We are currently considering the impact of adopting these standards, amendments, and interpretations on our consolidated financial statements.

Definitions of Non-IFRS and Other Financial Measures

This MD&A includes references to and uses measures and terms that are not specifically defined in IFRS Accounting Standards and do not have any standardized meaning prescribed by IFRS Accounting Standards. These measures and terms are defined below. These non-IFRS and other financial measures may not be comparable to similar

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-17 | Stantec Inc. | |

measures presented by other companies. We believe that the measures defined here are useful for providing investors with additional information to assist them in understanding components of our financial results.

Non-IFRS Financial Measures and Ratios

Adjusted Measures

We use several adjusted financial measures because we believe they are useful for providing securities analysts, investors, and other interested parties with additional information to assist them in understanding components of our financial results (including a more complete understanding of factors and trends affecting our operating performance). These adjusted measures also provide supplemental measures of operating performance and improve comparability of operating results from one period to another, thus highlighting trends that may not otherwise be apparent when relying solely on IFRS Accounting Standards financial measures. Unless otherwise noted, a reconciliation of these adjusted measures to the most directly comparable IFRS Accounting Standards measure is included on page M-5.

Adjusted EBITDA represents net income from continuing operations before interest expense, income taxes, depreciation of property and equipment, depreciation of lease assets, amortization of intangible assets, impairment charges and reversals thereof, acquisition, integration and restructuring costs, and other adjustments for other specific items that are significant but are not reflective of our underlying operations. Specific items are subjective; however, we use our judgement and informed decision-making when identifying items to be excluded in calculating our adjusted measures. We use adjusted EBITDA as a measure of pre-tax operating cash flow. The most comparable IFRS Accounting Standards measure for adjusted EBITDA is net income.

Adjusted Net Income represents net income from continuing operations excluding the amortization of intangibles acquired through acquisitions, impairment charges and reversals thereof, acquisition, integration and restructuring costs, and adjustments for other specific items that are significant but are not reflective of our underlying operations, all on an after-tax basis. Specific items are subjective; however, we use our judgement and informed decision-making when identifying items to be excluded in calculating our adjusted measures. We use adjusted net income as a measure of overall profitability. The most comparable IFRS Accounting Standards measure for adjusted net income is net income.

Adjusted Earnings Per Share (EPS) is a non-IFRS ratio calculated by dividing adjusted net income (defined above) by the basic and diluted weighted average number of shares outstanding, respectively.

Adjusted Return on Invested Capital (ROIC) is a non-IFRS ratio that represents our full year adjusted net income (defined above) before tax-adjusted interest relative to our average aggregate net debt and adjusted shareholders’ equity, determined annually. Average net debt and adjusted shareholders’ equity are calculated using balances from past years. Adjusted shareholders’ equity includes the impact of adjusted net income from continuing operations (as defined above). We use adjusted ROIC to evaluate annual returns generated on our debt and equity capital. The most comparable IFRS Accounting Standards measure for adjusted net income before tax-adjusted interest is net income. The most comparable measure for adjusted shareholders’ equity is shareholders’ equity.

Net Debt to Adjusted EBITDA. As part of our assessment of our capital structure, we monitor net debt to adjusted EBITDA, a non-IFRS ratio. It is defined as the sum of (1) long-term debt, including current portion, and bank indebtedness, less cash and cash equivalents, divided by (2) adjusted EBITDA (as defined above). Net debt to adjusted EBITDA is quantified in the Liquidity and Capital Resources section on page M-15.

Free Cash Flow is used to monitor the availability of discretionary cash as part of our capital management. It is defined as operating cash flows less capital expenditures and net lease payments. A reconciliation of free cash flow to its most comparable IFRS Accounting Standards measure, cash flows from operating activities, is included in the Additional Reconciliations of Non-IFRS Financial Measure on page M-20.

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-18 | Stantec Inc. | |

Margin. We calculate margin as a percentage of net revenue and monitor margin in comparison to our internal targets. Margin is a non-IFRS ratio when applied to non-IFRS financial measures.

Constant Currency Basis and Impact of Foreign Exchange. We monitor the impact of changing foreign exchange rates, quantify foreign exchange impacts, and, from time to time, prepare analyses on a constant currency basis (i.e., excluding the impact of foreign exchange) to better understand changes in activity. Amounts presented on a constant currency basis are non-IFRS financial measures; related fractions and percentages are non-IFRS ratios.

Compound Annual Growth Rate (CAGR) is a metric we use to evaluate the growth in our business. It represents the growth rate over a period of time on an annual compounded basis. CAGR is a non-IFRS ratio when applied to non-IFRS measures.

Supplementary Financial Measures

Days Sales Outstanding (DSO). DSO is a metric we use to evaluate the efficiency of our working capital. It represents the average number of days to convert our trade receivables, unbilled receivables, contract assets, and deferred revenue to cash. We calculate DSO by annualizing gross revenue for the quarter as reported under IFRS Accounting Standards.

Organic Growth (Retraction) and Acquisition Growth. To evaluate our performance, we quantify the change in revenue and backlog as either related to organic growth (retraction), acquisition growth, or the impact of foreign exchange. Revenue and backlog earned by acquired companies in the first 12 months following an acquisition is reported as growth from acquisitions and thereafter as organic growth (retraction). Organic growth (retraction) excludes the impact of foreign currency fluctuations. From time to time, we also quantify the impacts of certain unusual events to organic growth (retraction) to provide useful information to investors to help better understand our financial results.

Margin (defined above) is a supplementary financial measure when applied to IFRS Accounting Standard measures.

Compound Annual Growth Rate (CAGR) (defined above) is a supplementary financial measure when applied to IFRS Accounting Standard financial measures.

Current ratio is a supplementary financial measure calculated by dividing current assets by current liabilities that we use in assessing overall liquidity.

Working capital is a supplementary financial measure that we use as a measure for assessing overall liquidity. It is calculated by subtracting current liabilities from current assets.

Capital Management Measures

Net debt and total capital managed are categorized as capital management measures and quantified on page M-15.

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-19 | Stantec Inc. | |

Additional Reconciliation of Non-IFRS Financial Measure

Free Cash Flow

| | | | | | | | | | |

| Quarter Ended Mar 31, | |

| (In millions of Canadian dollars) | 2024 | 2023 | | |

| Net cash flows from operating activities | 56.9 | | 36.7 | | | |

| Less: capital expenditures (property and equipment and intangible assets) | (20.5) | | (21.8) | | | |

| Less: net lease payments | (21.2) | | (29.8) | | | |

Free cash flow (note) | 15.2 | | (14.9) | | | |

note: See the Definitions section of this MD&A for a discussion of free cash flow, a non-IFRS measure.

Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Our CEO and CFO evaluated our disclosure controls and procedures (defined in the US Securities Exchange Act Rules 13a–15(e) and 15d–15(e)) as of the end of the period covered by this quarterly report. Based on the evaluation, our CEO and CFO concluded that our disclosure controls and procedures were effective at such date.

Changes in Internal Control over Financial Reporting

There has been no change in our internal control over financial reporting identified in connection with the evaluation required by paragraph (d) of Rules 13a–15 or 15d–15 under the Securities Exchange Act of 1934 that occurred during our last fiscal quarter that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

Risk Factors

For the quarter ended March 31, 2024, there has been no significant change in our risk factors from those described in our 2023 Annual Report (incorporated here by reference). Notwithstanding the ongoing conflicts in the Middle East, our offices in the region, including in Bahrain, Qatar, Saudi Arabia, and the United Arab Emirates, have not been materially impacted by the increased geopolitical risk in the region and we do not have physical offices in the Israel-Gaza region where the Israel-Hamas conflict is ongoing. We continue to closely monitor conflicts for potential impacts to our people and operations.

Subsequent Events

Acquisition

On April 30, 2024, we acquired all of the shares of Hydrock, a 950-person integrated engineering design firm headquartered in Bristol, England. Hydrock holds a nationwide presence with 22 locations in the UK and industry-renowned experience, bolstering our offering to the energy, buildings, and infrastructure markets. This addition further strengthens our Energy & Resources, Buildings, and Infrastructure operations in the Global group of Cash Generating Units.

Dividends

On May 8, 2024, our Board of Directors declared a dividend of $0.21 per share, payable on July 15, 2024, to shareholders of record on June 28, 2024.

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-20 | Stantec Inc. | |

Caution Regarding Forward-Looking Statements

Our public communications often include written or verbal forward-looking statements within the meaning of the US Private Securities Litigation Reform Act and Canadian securities laws. Forward-looking statements are disclosures regarding possible events, conditions, or results of operations that are based on assumptions about future economic conditions or courses of action and include financial outlooks or future-oriented financial information. Any financial outlook or future-oriented financial information in this Management’s Discussion and Analysis has been approved by management of Stantec. Such financial outlook or future-oriented financial information is provided for the purpose of providing information about management’s current expectations and plans relating to the future.

Forward-looking statements may involve but are not limited to comments with respect to our objectives for 2024 and beyond, our strategies or future actions, our targets, our expectations for our financial condition or share price, or the results of or outlook for our operations. Statements of this type may be contained in filings with securities regulators or in other communications and are contained in this report. Forward-looking statements in this report include but are not limited to the following:

•Our expectations in the Outlook section:

◦Net revenue growth will increase 11% to 15%, with organic net revenue growth in the mid- to high-single digits;

◦Organic growth in the US and Global regions is expected to be in the mid- to high- single digits to low double digits, and Canada in the mid-single digits;

◦Acquisition net revenue growth is expected to be in the mid-single digits from ESD, ZETCON, Morrison Hershfield, and Hydrock;

◦Adjusted EBITDA margin expected to be in the range of 16.2% to 17.2%, reflecting continued discipline in the management of administrative and marketing costs to drive operational efficiency. Adjusted EBITDA margin in Q1 and Q4 2024 is expected to be near or below the low end of this range because of the additional effects of regular seasonal factors in the northern hemisphere. We expect to move to the higher end of the range in Q2 and Q3 of 2024, when we typically achieve stronger organic net revenue growth and increased utilization in our operations;

◦Adjusted net income as a percentage of net revenue above 8%;

◦Adjusted diluted EPS growth expected to be in the range of 12% to 16%;

◦Adjusted ROIC expected to be above 11%;

◦Impact of LTIP remaining constant relative to Q1 2024, will be approximately $2.1 million (pre-tax) or $0.01 EPS for the remaining three quarters, and an annual impact of $7.9 million (pre-tax) or $0.05 EPS for 2023;

•Our belief that public infrastructure spending; private investment; increased project work in water security, transportation, and clean-energy infrastructure; the urgent challenges to tackle climate change and resource security; Smart(ER) cities; and buildings, including hospitals, data centers, and other mission critical facilities, to meet civic, healthcare, residential and industrial markets, are key growth drivers;

•Our ability to increase rates on certain projects to mitigate the impacts of wage inflation and increased selectivity in project pursuits;

•Our belief that through our innovative and collaborative approach to engineering and design, we are positioned to provide solutions to positively impact our clients, communities, and climate action;

•Our expectations regarding our sources of cash and our ability to meet our normal operating and capital expenditures in the Liquidity and Capital Resources section, based in part on the design of our business model; and

•Our expectations in the Critical Accounting Estimates, Developments and Measures section.

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-21 | Stantec Inc. | |

These describe the management expectations and targets by which we measure our success and assist our shareholders in understanding our financial position as at and for the periods ended on the dates presented in this report. Readers are cautioned that this information may not be appropriate for other purposes.

By their nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties. There is a significant risk that predictions, forecasts, conclusions, projections, and other forward-looking statements will not prove to be accurate. We caution readers of this report not to place undue reliance on our forward-looking statements since a number of factors could cause actual future results, conditions, actions, or events to differ materially from the targets, expectations, estimates, or intentions expressed in these forward-looking statements.

Future outcomes relating to forward-looking statements may be influenced by many factors and material risks. For the quarter ended March 31, 2024, there has been no significant change in our risk factors from those described in our 2023 Annual Report (incorporated here by reference).

Assumptions

In determining our forward-looking statements, we consider material factors, including assumptions about the performance of Canadian, US, and various international economies and their effect on our business. The assumptions we made at the time of publishing our annual targets and outlook for 2024 are listed in the Cautionary Note Regarding Forward-Looking Statements section of our 2023 Annual Report (incorporated here by reference). The following information updates and therefore supersedes those assumptions.

•Our March 2024 outlook forecast assumed an average value for the US dollar of $1.35, for the British pound of $1.70, and for the Australian dollar of $0.90, which is consistent with the forecast provided in the 2023 Annual Report.

•As of March 2024 Canada's and Australia's 2024 GDP growth is projected to remain consistent with the rates forecasted in December of 0.9% and 1.4%, respectively. The US is projected to see a growth rate of 2.5% compared to 1.5% at December 2023 and the UK is expected to experience GDP growth of 0.8% compared to 0.7% at December 2023.

•In Canada, the number of total housing starts in 2024 was forecasted to decrease by 12% compared to 2023. As of March 2024, new housing construction in Canada decreased 13% over the first quarter of 2024. In the United States, the forecasted seasonally adjusted annual rate of total housing starts for 2024 was expected to be 1.37 million. This has since been revised to 1.39 million at March 2024.

•The American Institute of Architects ABI (architectural billing index) has decreased to 43.6 as of March 2024 from 45.3 at December 2023.

The preceding list of factors is not exhaustive. Investors and the public should carefully consider these factors, other uncertainties and potential events, and the inherent uncertainty of forward-looking statements when relying on these statements to make decisions with respect to our Company. The forward-looking statements contained herein represent our expectations as of May 8, 2024, and, accordingly, are subject to change after such date. Except as may be required by law, we do not undertake to update any forward-looking statement, whether written or verbal, that may be made from time to time. In the case of the ranges of expected performance for fiscal year 2024, it is our current practice to evaluate and, where we deem appropriate, to provide updates. However, subject to legal requirements, we may change this practice at any time at our sole discretion.

| | | | | | | | | | | |

Management’s Discussion and Analysis March 31, 2024 | M-22 | Stantec Inc. | |

Exhibit 99.2 - Stantec Inc.'s Unaudited Interim Condensed Consolidated Financial Statements

Interim Condensed Consolidated Statements of Financial Position

(Unaudited)

| | | | | | | | | | | |

| | March 31,

2024 | December 31,

2023 |

| (In millions of Canadian dollars) | Notes | $ | $ |

| ASSETS | | | |

| Current | | | |

| Cash and cash equivalents | | 199.5 | | 352.9 | |

| Trade and other receivables | 5 | 1,090.9 | | 1,063.5 | |

| Unbilled receivables | | 733.7 | | 623.8 | |

| Contract assets | | 102.1 | | 88.8 | |

| Income taxes recoverable | | 55.1 | | 72.6 | |

| Prepaid expenses | | 75.0 | | 53.8 | |

| Other assets | 6 | 20.3 | | 17.1 | |

| Total current assets | | 2,276.6 | | 2,272.5 | |

| Non-current | | | |

| Property and equipment | | 288.4 | | 267.5 | |

| Lease assets | 4 | 486.5 | | 442.9 | |

| Goodwill | 4 | 2,796.2 | | 2,384.0 | |

| Intangible assets | 4 | 429.9 | | 265.7 | |

| | | |

| Net employee defined benefit asset | | 73.9 | | 72.3 | |

| Deferred tax assets | | 96.3 | | 92.6 | |

| Other assets | 6 | 248.0 | | 279.2 | |

| Total assets | | 6,695.8 | | 6,076.7 | |

| LIABILITIES AND EQUITY | | | |

| Current | | | |

| Bank indebtedness | 7,12 | 29.0 | | 23.6 | |

| Trade and other payables | | 801.3 | | 818.5 | |

| Lease liabilities | | 113.3 | | 101.3 | |

| Deferred revenue | | 428.7 | | 397.5 | |

| Income taxes payable | | 20.7 | | 21.4 | |

| Long-term debt | 7,12 | 181.1 | | 146.7 | |

| Provisions | 8 | 57.6 | | 51.7 | |