Hart-Scott-Rodino Act waiting period has

expired

Company to be rebranded as Expand Energy and

trade on NASDAQ under “EXE” ticker symbol

Chesapeake Energy Corporation (NASDAQ: CHK) and

Southwestern Energy Company (NYSE: SWN) today announced the waiting

period in connection with the companies’ pending combination under

the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (“HSR

Act”) has expired. The companies expect the merger to close in the

first week of October.

Upon closing, the combined company will be the largest natural

gas producer in the U.S. and assume the name Expand Energy

Corporation. It will commence public trading on the NASDAQ under

the ticker symbol “EXE” at the open of trading the day after

closing.

“The world is short energy,” said Nick Dell’Osso, Chesapeake’s

President and Chief Executive Officer. “With a premium scaled

position across leading natural gas basins in the United States, a

peer-leading returns program and a resilient financial foundation,

Expand Energy is uniquely positioned to compete on an international

scale to expand America’s energy reach and deliver opportunity for

the world’s energy customers.”

About the Companies

Headquartered in Oklahoma City, Chesapeake Energy Corporation is

powered by dedicated and innovative employees who are focused on

discovering and responsibly developing leading positions in top

U.S. oil and gas plays. With a goal to achieve net zero GHG

emissions (Scope 1 and 2) by 2035, Chesapeake is committed to

safely answering the call for affordable, reliable, lower carbon

energy.

Southwestern Energy Company is a leading U.S. producer and

marketer of natural gas and natural gas liquids focused on

responsibly developing large-scale energy assets in the nation's

most prolific shale gas basins. SWN's returns-driven strategy

strives to create sustainable value for its stakeholders by

leveraging its scale, financial strength, and operational

execution.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the federal securities laws. Forward-looking

statements may be identified by words such as “anticipates,”

“believes,” “cause,” “continue,” “could,” “depend,” “develop,”

“estimates,” “expects,” “forecasts,” “goal,” “guidance,” “have,”

“impact,” “implement,” “increase,” “intends,” “lead,” “maintain,”

“may,” “might,” “plans,” “potential,” “possible,” “projected,”

“reduce,” “remain,” “result,” “scheduled,” “seek,” “should,”

“will,” “would” and other similar words or expressions. The absence

of such words or expressions does not necessarily mean the

statements are not forward-looking. Forward-looking statements are

not statements of historical fact and reflect the current views of

Chesapeake Energy Corporation (“Chesapeake”) and Southwestern

Energy Company (“Southwestern”) about future events. These

forward-looking statements include, but are not limited to,

statements regarding the proposed transaction between Chesapeake

and Southwestern, the expected closing of the proposed transaction

and the timing thereof and the proforma combined company and its

operations, strategies and plans, synergies and anticipated future

performance. Information adjusted for the proposed transaction

should not be considered a forecast of future results. Although we

believe our forward-looking statements are reasonable, statements

made regarding future results are not guarantees of future

performance and are subject to numerous assumptions, uncertainties

and risks that are difficult to predict. Forward-looking statements

are based on current expectations, estimates and assumptions that

involve a number of risks and uncertainties that could cause actual

results to differ materially from those projected.

Actual outcomes and results may differ materially from the

results stated or implied in the forward-looking statements

included in this press release due to a number of factors,

including, but not limited to: the occurrence of any event, change

or other circumstances that could give rise to the termination of

the definitive agreement; the risk that the parties may not be able

to satisfy the conditions to the proposed transaction in a timely

manner or at all; risks related to the disruption of management

time from ongoing business operations due to the proposed

transaction; the risk that any announcements relating to the

proposed transaction could have adverse effects on the market price

of Chesapeake’s common stock or Southwestern’s common stock; the

risk of any unexpected costs or expenses resulting from the

proposed transaction; the outcome of existing litigation and the

risk of any further litigation relating to the proposed

transaction; the risk that the proposed transaction and its

announcement could have an adverse effect on the ability of

Chesapeake and Southwestern to retain and hire key personnel, on

the ability of Chesapeake to attract third-party customers and

maintain its relationships with derivatives counterparties and on

Chesapeake’s operating results and businesses generally; the risk

that problems may arise in successfully integrating the businesses

of the companies, which may result in the combined company not

operating as effectively and efficiently as expected; the risk that

the combined company may be unable to achieve synergies or other

anticipated benefits of the proposed transaction or it may take

longer than expected to achieve those synergies or benefits and

other important factors that could cause actual results to differ

materially from those projected; the volatility in commodity prices

for crude oil and natural gas, the presence or recoverability of

estimated reserves; the ability to replace reserves; environmental

risks, drilling and operating risks, including the potential

liability for remedial actions or assessments under existing or

future environmental regulations and litigation; exploration and

development risks; the effect of future regulatory or legislative

actions on the companies or the industry in which they operate,

including the risk of new restrictions with respect to oil and

natural gas development activities; the risk that the credit

ratings of the combined business may be different from what the

companies expect; the ability of management to execute its plans to

meet its goals and other risks inherent in Chesapeake’s and

Southwestern’s businesses; public health crises, such as pandemics

and epidemics, and any related government policies and actions; the

potential disruption or interruption of Chesapeake’s or

Southwestern’s operations due to war, accidents, political events,

civil unrest, severe weather, cyber threats, terrorist acts, or

other natural or human causes beyond Chesapeake’s or Southwestern’s

control; and the combined company’s ability to identify and

mitigate the risks and hazards inherent in operating in the global

energy industry. Other unpredictable or unknown factors not

discussed in this press release could also have material adverse

effects on forward-looking statements. Such factors are difficult

to predict and may be beyond Chesapeake’s or Southwestern’s

control, and may also include other risks and uncertainties

including those detailed in Chesapeake’s annual reports on Form

10-K, quarterly reports on Form 10-Q and current reports on Form

8-K that are available on its website at http://investors.chk.com/

and on the SEC’s website at http://www.sec.gov, and those detailed

in Southwestern’s annual reports on Form 10-K, quarterly reports on

Form 10-Q and current reports on Form 8-K that are available on

Southwestern’s website at

https://ir.swn.com/CorporateProfile/default.aspx and on the SEC’s

website at http://www.sec.gov. Forward-looking statements are based

on the estimates and opinions of management at the time the

statements are made. Chesapeake and Southwestern undertake no

obligation to publicly correct or update the forward-looking

statements in this press release, in other documents, or on their

respective websites to reflect new information, future events or

otherwise, except as required by applicable law. All such

statements are expressly qualified by this cautionary statement.

Readers are cautioned not to place undue reliance on these

forward-looking statements that speak only as of the date

hereof.

IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the proposed transaction, Chesapeake filed a

Registration Statement on Form S-4 (the “Registration Statement”)

with the SEC that also constitutes a prospectus of Chesapeake

common stock. The Registration Statement was declared effective on

May 17, 2024, at which time Chesapeake filed a final prospectus and

Southwestern filed a definitive proxy statement. Chesapeake and

Southwestern commenced mailing of the definitive joint proxy

statement/prospectus (the “Proxy Statement/Prospectus”) to their

respective shareholders on or about May 17, 2024. Each party may

also file other relevant documents regarding the proposed

transaction with the SEC. This communication is not a substitute

for the Proxy Statement/Prospectus or for any other document that

Southwestern or Chesapeake has filed or may file in the future with

the SEC in connection with the proposed transaction. INVESTORS ARE

URGED TO CAREFULLY READ THE FORM S-4, THE PROXY

STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS THAT ARE

FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR

SUPPLEMENTS TO THOSE DOCUMENTS, AS THEY BECOME AVAILABLE BECAUSE

THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT

CHESAPEAKE, SOUTHWESTERN, THE PROPOSED TRANSACTION, THE RISKS

RELATED THERETO AND RELATED MATTERS.

Investors and security holders may obtain free copies of the

Form S-4 and the Proxy Statement/Prospectus, as well as other

filings containing important information about Chesapeake or

Southwestern, without charge at the SEC’s Internet website

(http://www.sec.gov). Copies of the documents filed with the SEC by

Chesapeake may be obtained free of charge on Chesapeake’s website

at http://investors.chk.com/. Copies of the documents filed with

the SEC by Southwestern may be obtained free of charge on

Southwestern’s website at

https://ir.swn.com/CorporateProfile/default.aspx.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240926900603/en/

CHK INVESTOR CONTACT: Chris Ayres (405) 935-8870

ir@chk.com

CHK MEDIA CONTACT: Brooke Coe (405) 935-8878

media@chk.com

SWN INVESTOR CONTACT: Brittany Raiford (832) 796-7906

brittany_raiford@swn.com

SWN MEDIA CONTACT: Andrew Siegel/Jed Repko Joele Frank

Wilkinson Brimmer Katcher (212) 355-4449

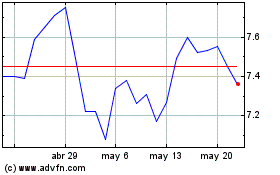

Southwestern Energy (NYSE:SWN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

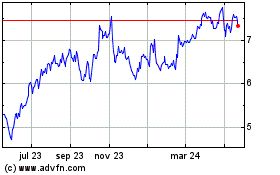

Southwestern Energy (NYSE:SWN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024