Coach, Inc. (NYSE: COH), a leading marketer of modern classic

American accessories, today announced an increase of 19% in

earnings per diluted share to $0.46 for its third fiscal quarter

ended March 29, 2008, up from $0.39 per diluted share a year ago.

This substantial increase in earnings from the prior year�s third

quarter reflected a 19% gain in net sales. In the third quarter,

net sales were $745 million compared with the $625 million reported

in the same period of the prior year. Net income rose 10% to $162

million, or $0.46 per diluted share, compared with $147 million, or

$0.39 per diluted share in the prior year. For the quarter,

operating income totaled $257 million, up 13% from the $227 million

reported in the comparable year ago period, while operating margin

was 34.5% versus 36.2% reported for the prior year. During the

quarter, gross profit rose 15% to $558 million from $486 million a

year ago. Gross margin was 75.0% versus 77.8% a year ago, impacted

primarily by the sharp rise of the yen over the period, and, as

expected, by both the continued promotional environment and channel

mix. SG&A expenses as a percentage of net sales improved by 100

basis points to 40.5%, compared to the 41.5% reported in the

year-ago quarter, as the company was able to leverage expenses �

notably selling and distribution costs - on the higher sales base.

On a constant-exchange-rate basis, excluding the positive currency

effect from translating foreign-denominated sales in U.S. dollars,

net sales increased 16% in the third quarter. On the same basis,

operating income rose 17%. Lew Frankfort, Chairman and Chief

Executive Officer of Coach, Inc., said, �We were pleased to deliver

quarterly results which met our top and bottom-line expectations

despite the weakening retail climate in the U.S. Our strong overall

performance continues to reflect the critical balance provided by

our multi-channel and international business model.� For the nine

months ended March 29, 2008, net sales were $2.4 billion, up 22%

from the $2.0 billion reported in the first nine months of fiscal

2007. Net income rose to $570 million, up 19% from the $477 million

reported a year ago, while earnings per share rose 23% to $1.56

from $1.27. Third fiscal quarter sales results in each of Coach�s

primary channels of distribution grew as follows:

Direct-to-consumer sales increased 20% to $578 million from $481

million last year, including a 20% gain in sales from new and

existing Coach stores in North America. North American comparable

store sales for the quarter rose 9.0%. This compares to last year�s

third quarter in which North American comparable store sales rose

20.0% overall. In Japan, sales rose 12% on a constant-currency

basis, while dollar sales rose 25% adjusted for a stronger yen.

Indirect sales increased 15% to $166 million in the third quarter

from the $144 million reported for the prior year. Coach enjoyed

gains at retail for all indirect businesses, including

international locations as well as in U.S. department stores.

During the third quarter of fiscal 2008, the company opened five

retail stores and two factory stores in North America, bringing the

total to 287 retail stores and 101 factory stores as of March 29,

2008. In addition, one factory store was expanded. In Japan, Coach

opened two shop-in-shops while two retail locations closed, leaving

the total at 147 at the end of the quarter, while also expanding a

total of five locations. Mr. Frankfort continued, �Beginning this

quarter, we�re only providing aggregated comparable store sales for

our North American retail and factory stores. While less detailed,

this measure better aligns operational performance reporting with

operational flexibility to respond to changes in market dynamics.

This metric fully reflects the brand�s overall retail performance

in North America while enabling our shareholders to gauge our

results against prior periods and other luxury retailers.� �As

noted, we�re pleased with our sales growth for the quarter and the

vitality of our North American businesses, where total revenues

grew 15%, including a 20% increase in sales at our stores driven by

both distribution growth and productivity gains. In addition, we

continue to be very pleased with our new retail store volumes as

they continue to surpass our initial projections both in existing

markets, such as the Las Vegas area, and in new markets, such as

Augusta, Georgia. Outside of North America, we are also excited

about our increased global brand recognition as we continue to

experience rapid growth internationally, most notably in East Asia

and Greater China.� Mr. Frankfort added, �The consumer continued to

embrace our new and innovative product this spring. As part of our

seasonal transition, we introduced our evolved Hamptons collection

in January, featuring the Madeline tote. Offered in multiple sizes,

this new silhouette performed quite well, particularly in bold

colors. In February, we launched our new Heritage Stripe

collection, a group of coated canvas totes and bags, and added an

updated group of Signature Stripe handbags and accessories later

that month. In March, we introduced the Francine satchel at $798,

which was the focus of our spring advertising campaign and was very

well received across all stores. And this month we brought back the

popular Soho collection, in softer, more feminine styles. Looking

ahead, we�re excited about pleated Ergo � arriving this week for

Mother�s Day." �As we briefly discussed last quarter, we have

embarked on a comprehensive review of all ways in which the brand

touches the consumer. These initiatives will be increasingly

evident as we move through the next year, most notably in our

product and in our store environments. In fact, we�re striving to

compress several years of product evolution into FY09 in order to

create a particularly compelling offering.� �These plans include

leveraging the early successes we have seen with our pinnacle

offering, creating a broader assortment of more sophisticated and

elevated product, to create a halo for the entire brand,

heightening Coach's aspirational appeal. At the same time, we will

maintain the balance that is key to our franchise, capitalizing on

our leadership position with our loyal core consumer and with the

aspirational consumer, who is often trading up to Coach.� �Due to

the continued uncertainty in the economic backdrop, we believe that

it�s prudent to wait until our fourth quarter report to offer

guidance for the upcoming fiscal year. That said, we believe that

the initiatives I�ve described, in combination with our diversified

model, will lessen the impact of a slowing consumer environment in

the U.S. through the remainder of this calendar year. It is also

important to note that given the compelling returns we�re

generating, we will continue to execute our existing distribution

growth plans in North America, including the opening of 40 new

retail stores, during the coming year,� concluded Mr. Frankfort.

For the fiscal year 2008 the company projected sales of about $3.18

billion, an increase of about 22% from the prior year, and

reiterated its earnings per diluted share guidance of $2.06, also

representing an increase of about 22%. Imbedded in this guidance is

a fourth quarter sales estimate of about $780 million, representing

a year over year increase of about 20%, and earnings per share of

$0.50, also up about 20%. The company also announced that during

the third fiscal quarter, it repurchased and retired 11,349,802

shares of its common stock at an average cost of $28.85, spending a

total of $327 million. At the end of the period, $333 million was

available under the company�s current repurchase authorization,

which was put into place in early November. Coach will host a

conference call to review third fiscal quarter results at 8:30 a.m.

(EDT) today, April 22, 2008. Interested parties may listen to the

webcast by accessing www.coach.com/investors on the Internet or

dialing into 1-888-405-2080 and asking for the Coach earnings call

led by Andrea Shaw Resnick, SVP of Investor Relations &

Corporate Communications. A telephone replay will be available

starting at 12:00 noon today, for a period of five business days.

The number to call is 1-866-352-7723. A webcast replay of this call

will be available for five business days on the Coach website.

Coach, with headquarters in New York, is a leading American

marketer of fine accessories and gifts for women and men, including

handbags, women�s and men�s small leathergoods, business cases,

weekend and travel accessories, footwear, watches, outerwear,

scarves, sunwear, fragrance, jewelry and related accessories. Coach

is sold worldwide through Coach stores, select department stores

and specialty stores, through the Coach catalog in the U.S. by

calling 1-800-223-8647 and through Coach�s website at

www.coach.com. Coach�s shares are traded on the New York Stock

Exchange under the symbol COH. This press release contains

forward-looking statements based on management's current

expectations. These statements can be identified by the use of

forward-looking terminology such as "may," "will," "should,"

"expect," "intend," "estimate," "are positioned to," "continue,"

"project," "guidance," �target,� "forecast," "anticipated," or

comparable terms. Future results may differ materially from

management's current expectations, based upon risks and

uncertainties such as expected economic trends, the ability to

anticipate consumer preferences, the ability to control costs, etc.

Please refer to Coach�s latest Annual Report on Form 10-K for a

complete list of risk factors. COACH, INC. CONDENSED CONSOLIDATED

STATEMENTS OF INCOME For the Quarters and Nine Months Ended March

29, 2008 and March 31, 2007 (in thousands, except per share data)

(unaudited) � � � � QUARTER ENDED NINE MONTHS ENDED March 29, March

31, March 29, March 31, 2008 2007 2008 2007 � Net sales $ 744,522 $

625,303 $ 2,399,257 $ 1,960,327 � Cost of sales � 186,204 � �

138,893 � 585,446 � 446,617 � Gross profit 558,318 486,410

1,813,811 1,513,710 � Selling, general and administrative expenses

� 301,626 � � 259,783 � 915,298 � 765,714 � Operating income

256,692 226,627 898,513 747,996 � Interest income, net � 9,547 � �

12,988 � 35,111 � 27,465 � Income before provision for income taxes

and discontinued operations 266,239 239,615 933,624 775,461 �

Provision for income taxes � 103,827 � � 92,225 � 364,109 � 298,335

� Income from continuing operations 162,412 147,390 569,515 477,126

� Income (loss) from discontinued operations, net of income taxes

(4 ) 2,574 16 25,927 � � � � Net income $ 162,408 � $ 149,964 $

569,531 $ 503,053 � � Net income per share � Basic � Continuing

operations $ 0.47 $ 0.40 $ 1.58 $ 1.29 � Discontinued operations �

(0.00 ) � 0.01 � 0.00 � 0.07 � Net income $ 0.47 � $ 0.41 $ 1.58 $

1.36 � � Diluted � Continuing operations $ 0.46 $ 0.39 $ 1.56 $

1.27 � Discontinued operations � (0.00 ) � 0.01 � 0.00 � 0.07 � Net

income $ 0.46 � $ 0.40 $ 1.56 $ 1.34 � Shares used in computing net

income per share � Basic � 348,125 � � 370,264 � 360,507 � 369,039

� Diluted � 351,593 � � 379,289 � 365,497 � 376,334 COACH, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS At March 29, 2008, June 30,

2007 and March 31, 2007 (in thousands) � � March 29, June 30, March

31, 2008 2007 2007 ASSETS (unaudited) (unaudited) � Cash, cash

equivalents and short term investments $ 616,202 $ 1,185,816 $

936,174 Receivables 148,074 107,814 124,858 Inventories 319,655

291,192 249,818 Other current assets � 187,022 � 155,374 � 155,414

� Total current assets 1,270,953 1,740,196 1,466,264 � Property and

equipment, net 420,943 368,461 344,659 Other noncurrent assets �

464,344 � 340,855 � 332,272 � Total assets $ 2,156,240 $ 2,449,512

$ 2,143,195 � LIABILITIES AND STOCKHOLDERS' EQUITY � Accounts

payable $ 63,676 $ 109,309 $ 62,113 Accrued liabilities 289,554

298,452 275,916 Subsidiary credit facilities 11,079 - - Current

portion of long-term debt � 285 � 235 � 235 � Total current

liabilities 364,594 407,996 338,264 � Long-term debt 2,580 2,865

2,865 Other liabilities 330,613 128,297 96,620 � Stockholders'

equity � 1,458,453 � 1,910,354 � 1,705,446 � Total liabilities and

stockholders' equity $ 2,156,240 $ 2,449,512 $ 2,143,195

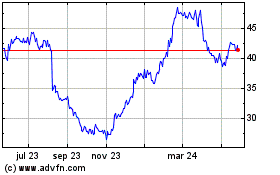

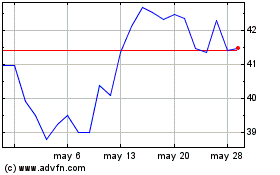

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024