Coach, Inc. (NYSE: COH), a leading marketer of modern classic

American accessories, today announced sales of $1.07 billion for

its second fiscal quarter ended December 26, 2009, compared with

$960 million reported in the same period of the prior year, an

increase of 11%. Net income for the quarter totaled $241 million,

with earnings per diluted share of $0.75. This compared to net

income of $217 million and earnings per diluted share of $0.67 in

the prior year’s second quarter.

Lew Frankfort, Chairman and Chief Executive Officer of Coach,

Inc., said, “We were very pleased with the strong sales and

earnings growth we generated this holiday, driven in part by a

return to positive North American comparable store sales. Our

performance reflected continued traction of the initiatives we have

put in place to adapt to the changed environment. Our customers

embraced our innovative and relevant products and collections while

our focus on digital and social media delivered a more engaging

brand experience for many consumers.”

For the second fiscal quarter, operating income totaled $381

million, up 9% from the $348 million reported in the comparable

year ago period, while the operating margin was 35.8% versus 36.3%

reported for the prior year. During the quarter, gross profit

increased 11% to $771 million from $692 million a year ago. Gross

margin was 72.4% versus 72.1% a year ago, reflecting the

re-engineering of key collections globally and margin improvement

in our North American factory business, offset in part by channel

mix. As expected, SG&A expenses as a percentage of net sales

increased to 36.6%, compared to the 35.8% reported in the year-ago

quarter as the company lapped certain significant and unusual

cost-saving items.

The company also announced that during the second fiscal

quarter, it repurchased and retired nearly 8.6 million shares of

its common stock at an average cost of $35.03, spending a total of

$300 million. At the end of the period, $410 million remained under

the company’s repurchase authorization.

For the six months ended December 26, 2009, net sales were $1.83

billion, up 7% from the $1.71 billion reported in the first six

months of fiscal 2009. Net income totaled $382 million, up 5% from

the $363 million reported a year ago, while earnings per share rose

8% to $1.19 from $1.10.

Second fiscal quarter sales results in each of Coach’s primary

channels of distribution were as follows:

- Direct-to-consumer sales

increased 14% to $934 million from $818 million last year. North

American comparable store sales for the quarter rose 3.2%. In

Japan, sales fell 2% on a constant-currency basis, while dollar

sales rose 7% driven by a stronger yen. China sales remained

robust, as POS sales continued to comp at a double-digit rate.

- Indirect sales decreased 8% to

$131 million in the second quarter from the $143 million reported

for the prior year. This decline was primarily due to reduced

shipments into U.S. department stores, as the company continues to

tightly manage inventories in that channel given sales levels at

POS. International POS sales rose during the period, notably in

locations focused on the domestic consumer.

During the second quarter of fiscal 2010, the company opened

three retail stores and two factory stores in North America,

bringing the total to 343 retail stores and 118 factory stores as

of December 26, 2009. In Japan, Coach opened one shop-in-shop,

taking the total to 163 at the end of the quarter. In China, four

net new locations were opened during the quarter, taking the total

to 37.

Mr. Frankfort continued, “Our pricing and product initiatives

have resonated with our consumer base, both here in North America

and internationally. The response to Madison and Poppy, our lead

collections for holiday, was strong, as was the reaction to our

holiday gifting and marketing campaigns which built on our

successes from the prior quarter. For early spring, we’re excited

about the new Peyton collection, which launched on December 26th,

and is off to a great start. And later this week, we’re

re-launching Poppy, featuring new styles and a fresh color

palette.”

“We were especially pleased by the strengthening of our North

America retail business during the holiday season, as revenues from

new and existing stores increased by 16% and comparable store sales

rose 3%. The trend in our domestic business built steadily over the

quarter, with December our strongest month, reflecting Coach’s

position as a gift resource. The most significant comp driver this

holiday was conversion, reflecting the vitality of the brand and

the strength of our product assortment.”

“Our holiday results bode well for the future. Despite the

challenging retail environment, we’re confident that we’ll continue

to deliver healthy sales and earnings growth over the balance of

the fiscal year. We’re well positioned for the ‘new normal’, and

expect to further expand our North American market share,

irrespective of category growth. We will leverage the abundant

growth opportunities available to us both domestically and

internationally, as we become an increasingly global brand,” Mr.

Frankfort concluded.

Coach will host a conference call to review second fiscal

quarter results at 8:30 a.m. (ET) today, January 20, 2010.

Interested parties may listen to the webcast by accessing

www.coach.com/investors on

the Internet or dialing into 1-888-405-2080 and asking for the

Coach earnings call led by Andrea Shaw Resnick, SVP of Investor

Relations & Corporate Communications. A telephone replay will

be available starting at 12:00 noon today, for a period of five

business days. The number to call is 1-866-352-7723. A webcast

replay of this call will be available for five business days on the

Coach website.

Coach, with headquarters in New York, is a leading American

marketer of fine accessories and gifts for women and men, including

handbags, women’s and men’s small leathergoods, business cases,

weekend and travel accessories, footwear, watches, outerwear,

scarves, sunwear, fragrance, jewelry and related accessories. Coach

is sold worldwide through Coach stores, select department stores

and specialty stores, through the Coach catalog in the U.S. by

calling 1-800-223-8647 and through Coach’s website at

www.coach.com. Coach’s shares are traded on the New York Stock

Exchange under the symbol COH.

This press release contains forward-looking statements based on

management's current expectations. These statements can be

identified by the use of forward-looking terminology such as "may,"

"will," "should," "expect," "intend," "estimate," "are positioned

to," "continue," "project," "guidance," “target,” "forecast,"

"anticipated," or comparable terms. Future results may differ

materially from management's current expectations, based upon risks

and uncertainties such as expected economic trends, the ability to

anticipate consumer preferences, the ability to control costs, etc.

Please refer to Coach’s latest Annual Report on Form 10-K for a

complete list of risk factors.

COACH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME

For the Quarters and Six

Months Ended December 26, 2009 and December 27, 2008

(in thousands, except per share

data)

(unaudited)

QUARTER

ENDED SIX MONTHS ENDED December 26, December

27, December 26, December 27, 2009

2008 2009 2008 Net sales $

1,065,005 $ 960,256 $ 1,826,442 $ 1,712,785 Cost of sales

294,066 268,220 505,325 462,556

Gross profit 770,939 692,036 1,321,117 1,250,229

Selling, general and administrative expenses 390,102

343,673 717,033 668,380 Operating

income 380,837 348,363 604,084 581,849 Interest income

(expense), net 112 532 (484 ) 3,178

Income before provision for income taxes 380,949 348,895

603,600 585,027 Provision for income taxes 139,999

131,989 221,823 222,310

Net income $ 240,950 $ 216,906 $ 381,777

$ 362,717 Net income per share Basic $

0.76 $ 0.67 $ 1.20 $ 1.11 Diluted $ 0.75 $ 0.67 $ 1.19 $

1.10 Shares used in computing net income per share

Basic 317,458 323,655 317,761

327,881 Diluted 321,381 325,168

321,137 329,716

COACH, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

At December 26, 2009, June 27, 2009 and

December 27, 2008

(in thousands)

(unaudited)

December

26, June 27, December 27, 2009 2009

2008 ASSETS Cash, cash equivalents and short

term investments $ 1,103,177 $ 800,362 $ 424,153 Receivables

178,849 108,707 192,024 Inventories 269,200 326,148 383,081 Other

current assets 165,166 161,192 221,579

Total current assets 1,716,392 1,396,409 1,220,837 Long term

investments 6,000 6,000 6,000 Property and equipment, net 564,483

592,982 600,437 Other noncurrent assets 582,255

568,945 510,687 Total assets $ 2,869,130 $ 2,564,336

$ 2,337,961

LIABILITIES AND STOCKHOLDERS' EQUITY

Accounts payable $ 120,167 $ 103,029 $ 125,650 Accrued

liabilities 457,557 348,619 391,260 Revolving credit facilities -

7,496 1,896 Current portion of long-term debt 737 508

503 Total current liabilities 578,461 459,652 519,309

Long-term debt 24,339 25,072 25,076 Other liabilities

400,764 383,570 327,565 Stockholders' equity

1,865,566 1,696,042 1,466,011 Total

liabilities and stockholders' equity $ 2,869,130 $ 2,564,336 $

2,337,961

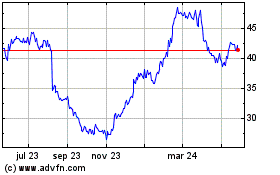

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

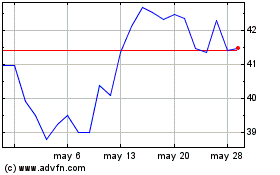

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024