China Import Tax Cut Could Boost Profits For Swiss Watchmakers

12 Marzo 2012 - 3:52AM

Noticias Dow Jones

Moves by China to potentially reduce import taxes on consumer

and luxury goods have been welcomed by members of the Swiss watch

making industry, who say it could further boost sales in what is

their third biggest market.

China has been the main driver behind the increase in Swiss

watch exports, which reached a record 19.3 billion Swiss francs in

2011. Chinese English-language newspaper China Daily has cited Wei

Jianguo, a former deputy commerce minister and member of the

National Committee of the Chinese People's Political Consultative

Conference, as saying that there will be at least two rounds of

reductions on import taxes on consumer and luxury goods.

"This is good news," Francois Thiebaud, chief executive of

Swatch Group's Tissot brand and president of the Swiss exhibitors

at this year's Baselworld watch and jewellery show. He said a

reduction in import duties, which range from 10% to 25%, would

particularly help prestige brands like Swatch Group AG's (UHR.VX)

Omega.

According to the Beijing-based World Luxury Association, Chinese

tourists spent $7.2 billion on luxury merchandise outside the

country during the 2012 Chinese New Year holiday, up 29% from a

year ago.

Olivier Bernheim, chief executive of privately-held watchmaker

Raymond Weil, said the Chinese government had realized that if they

lift some of the customs barriers, more of this money would be

spent in China.

Eddie Lau, an analyst at Citi, said companies such as Prada SpA

(PRDSY) Coach Inc (COH), Hugo Boss AG (BOS.XE), LVMH (MC.FR),

Swatch and Richemont, could benefit

"They should either see better margins or stronger sales volume

if they decide to reduce the retail price," he said.

-By John Revill, Dow Jones Newswires; +41 43 443 8042 ;

john.revill@dowjones.com

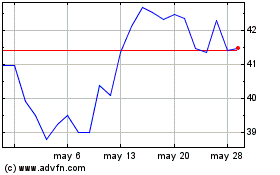

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

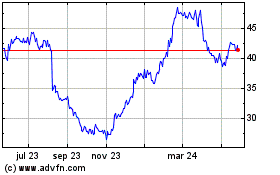

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024