Companies Struggling to Meet Expectations - Earnings Preview

17 Enero 2014 - 2:44AM

Zacks

Companies Struggling to Meet Expectations

The bulk of the 2013 Q4 earnings reports thus far have been from

the Finance sector, but the reporting cycle ramps up materially

this week, with almost 200 companies including 69 S&P 500

members reporting results. We will get results from a diverse group

of bellwethers from industries, ranging from IBM

(IBM) and Microsoft (MSFT) to

McDonald’s (MCD), Starbucks

(SBUX) and Proctor & Gamble (PG).

The Finance centric results thus far indicate that companies are

struggling to exceed the lowered earnings and expectations. The

beat ratios, both for earnings and revenues, are weaker relative to

what we would typically see at this stage of the reporting cycle.

The growth picture looks good on surface, but a lot of that is due

to easy comparisons.

It is hard to take a definitive feel for the guidance picture at

this stage as we haven’t seen that many earnings reports outside of

the Finance sector and banks typically don’t provide guidance. But

the overall trend among the few non-financial companies continues

to be towards negative guidance. The hope has been that the recent

uptrend economic fundamentals will start showing up in improved

management commentary that will stem the persistent downward

revision trend in earnings estimates. We will know more this week,

but recent results from the likes of Intel (INTC),

CSX Corp (CSX) and UPS don’t inspire much

confidence on that front.

Q3 Earnings Scorecard (as of Friday,

1/17/2013)

Total earnings for the 52 S&P 500 members that have reported

already are up +14.8% from the same period last year, with a ‘beat

ratio’ of 55.8% and a median surprise of +1.7%. Total revenues are

up +3.4%, with a revenue ‘beat ratio’ of 51.9% and a median

surprise of +0.9%. The earnings and revenue growth rates for these

52 companies are not materially different from what we have seen

from them in recent quarters. But the beat ratios are on the weak

side, as the chart below shows.

With results from almost 50% of the sector’s total market

capitalization already known, Finance has the most representative

sample of Q4 results of the major sectors. Total Finance sector are

earnings are up +14.2% from the same period last year, with strong

year-over-year gains at Bank of America (BAC)

driving most of the gain.

Excluding the $2.7 billion positive year-over-year swing in BAC’s

total earnings, growth for the sector would be down +3%. But even

including Bank of America’s hefty contribution, the Finance

sector’s growth rates and beat ratios at this stage don’t compare

favorably to what we have seen from this same group of companies in

recent quarters.

The insurance industry, the second largest in the Finance sector

accounting for almost a quarter of its total earnings, will start

reporting results this week as Travelers (TRV)

reports numbers. Total earnings for the insurance industry are

expected to be up +41.6%, as the year-earlier period was held down

by Sandy-related expenses.

The Composite Growth Picture

The ‘composite’ picture for Q4, where we combine the results from

the 52 companies that have reported already with the 448 still to

come, is for growth rate of +7.1%. This reflects +1.5% higher

revenues and net margin gains of about 50 basis points. Finance

remains a big growth driver in Q4 – total earnings growth for the

S&P 500 in Q4 drop to +3.4% once the sector is excluded.

Technology earnings are expected be flat in Q4, up only +1% after

the +5.9% gain in Q3. We will have to wait a bit longer to get

results from the sector’s growth leaders like

Google (GOOG) and Facebook (FB)

as the legacy players like IBM and Microsoft on the docket this

week are unlikely to move the needle much.

Lack of corporate capital spending has been an issue for the sector

for some time and the consensus view is that we will see a

turnaround on that front later this year. We haven’t heard anything

yet that will add to our confidence in that expectation. But this

optimistic view is a big contributor to the expected upturn in the

Tech sector’s growth estimate later this year. Total earnings for

the sector are expected to be up +9.4% this year and +10.9% in

2015, pronounced acceleration from the flat reading in 2013.

Will Guidance Finally Turn Around?

For obvious reasons, the market is very interested management

guidance for 2014. Companies typically provide guidance only for

the following quarter, but they do tend to discuss their outlook

their outlook for the coming year on the Q4 earnings calls. It will

be interesting to see if management teams see any material

improvement in the earnings picture this year along the lines of

current consensus earnings expectations for 2014.

Total earnings are expected to be up +9.3% in 2014, up from +4.6%

growth in 2013, with most of the growth coming in the back half of

the year.

Monday-1/20

- Nothing major on the economic or earnings calendars today

because of the Martin Luther King Jr. holiday.

Tuesday -1/21

- Nothing on the economic calendar, but a busy day on the

earnings front.

- Johnson & Johnson (JNJ),

Verizon (VZ), Travelers (TRV) and

Halliburton (HAL) are the key reports in the

morning, while IBM (IBM) and Texas

Instruments (TXN) will report after the close.

- Zacks Earnings ESP or Expected Earnings Surprise, our

proprietary leading indicator of earnings surprises, is showing JNJ

and TRV coming out with earnings beats.

- Stocks with positive Earnings ESP and Zacks Rank of 1, 2 or 3

are highly likely to come out with positive earnings surprises. JNJ

has a Zacks Rank #3 (Hold) and Earnings ESP of +0.8%, while TRV has

a Zacks Rank #2 (Buy) and positive ESP +0.5%.

- To get a better understanding of Zacks Earnings Surprise

Predictor, please click here.

Wednesday-1/22

- Another busy day on the earnings front and not much on the

economic calendar.

- Coach (COH), Abbott Labs

(ABT), Norfolk Southern (NSC) and United

Technology (UTX) are the key reports in the morning, while

eBay (EBAY) will report after the close.

- United Technology with Earnings ESP of +3.3% and Zacks Rank #3

is expected to come out with a positive earnings surprise, as is

Norfolk Southern.

Thursday -1/23

- A busy day on the economic calendar, with weekly Jobless

Claims, December Existing Home sales and Leading Indicators coming

out.

- McDonald’s (MCD), Union

Pacific (UNP) and Southwest Air (LUV) are

the key reports in the morning, while Microsoft

(MSFT) and Starbucks (SBUX) will report after the

close.

- Starbucks’ Zacks Rank #3 (Hold) and Earnings ESP of +2.9% show

that the company is highly likely to come out with a positive

earnings surprise.

Friday-1/24

- Nothing on the economic calendar.

- Proctor & Gamble (PG), Kimberly

Clark (KMB), WW Grainger (GWW), and

Kansas City Southern (KSU) are the key reports

today, all in the morning.

Here is a list of the 197 companies reporting this week,

including 69 S&P 500 members.

| Company |

Ticker |

Current Qtr |

Year-Ago Qtr |

Last EPS Surprise % |

Report Day |

Time |

| FIRST DEFIANCE |

FDEF |

0.51 |

0.52 |

3.85 |

Monday |

AMC |

| INTL BUS MACH |

IBM |

6.01 |

5.39 |

1.01 |

Tuesday |

AMC |

| JOHNSON & JOHNS |

JNJ |

1.2 |

1.19 |

3.82 |

Tuesday |

BTO |

| ROCKWELL COLLIN |

COL |

0.95 |

0.94 |

-2.29 |

Tuesday |

BTO |

| TRAVELERS COS |

TRV |

2.15 |

0.72 |

18.09 |

Tuesday |

BTO |

| HALLIBURTON CO |

HAL |

0.89 |

0.63 |

1.22 |

Tuesday |

BTO |

| BAKER-HUGHES |

BHI |

0.66 |

0.62 |

3.85 |

Tuesday |

BTO |

| CA INC |

CA |

0.68 |

0.61 |

22.06 |

Tuesday |

AMC |

| VERIZON COMM |

VZ |

0.65 |

0.38 |

2.67 |

Tuesday |

BTO |

| XILINX INC |

XLNX |

0.53 |

0.38 |

-5.77 |

Tuesday |

AMC |

| TEXAS INSTRS |

TXN |

0.47 |

0.36 |

-1.75 |

Tuesday |

AMC |

| DELTA AIR LINES |

DAL |

0.63 |

0.28 |

5.22 |

Tuesday |

BTO |

| REGIONS FINL CP |

RF |

0.2 |

0.22 |

-4.76 |

Tuesday |

BTO |

| FOREST LABS A |

FRX |

0.06 |

-0.21 |

157.14 |

Tuesday |

BTO |

| SAP AG ADR |

SAP |

1.59 |

1.23 |

2.04 |

Tuesday |

BTO |

| SIGNATURE BANK |

SBNY |

1.26 |

1.05 |

4.24 |

Tuesday |

BTO |

| WINTRUST FINL |

WTFC |

0.7 |

0.61 |

9.23 |

Tuesday |

AMC |

| COMMNTY BK SYS |

CBU |

0.53 |

0.52 |

3.85 |

Tuesday |

AMC |

| WOODWARD INC |

WWD |

0.41 |

0.39 |

8.57 |

Tuesday |

AMC |

| MERCANTILE BANK |

MBWM |

0.4 |

0.35 |

26.32 |

Tuesday |

BTO |

| PINNACLE FIN PT |

PNFP |

0.43 |

0.34 |

0 |

Tuesday |

AMC |

| RENASANT CORP |

RNST |

0.35 |

0.29 |

-31.43 |

Tuesday |

AMC |

| TD AMERITRADE |

AMTD |

0.32 |

0.27 |

5.88 |

Tuesday |

BTO |

| CREE INC |

CREE |

0.31 |

0.23 |

-6.25 |

Tuesday |

AMC |

| MARTEN TRANS |

MRTN |

0.25 |

0.23 |

4.35 |

Tuesday |

AMC |

| PETMED EXPRESS |

PETS |

0.23 |

0.23 |

-4.55 |

Tuesday |

BTO |

| FNB CORP |

FNB |

0.21 |

0.23 |

4.76 |

Tuesday |

AMC |

| FULTON FINL |

FULT |

0.2 |

0.2 |

5 |

Tuesday |

AMC |

| INTERACTIVE BRK |

IBKR |

0.15 |

0.19 |

0 |

Tuesday |

AMC |

| STILLWATER MNG |

SWC |

0.06 |

0.13 |

425 |

Tuesday |

BTO |

| SUPERTEX INC |

SUPX |

0.18 |

0.12 |

41.18 |

Tuesday |

AMC |

| SUPER MICRO COM |

SMCI |

0.22 |

0.11 |

0 |

Tuesday |

AMC |

| TRUSTCO BK -NY |

TRST |

0.1 |

0.1 |

10 |

Tuesday |

AMC |

| OMNOVA SOLUTION |

OMN |

0.12 |

0.07 |

-13.64 |

Tuesday |

BTO |

| SOUTHWEST BC-OK |

OKSB |

0.2 |

0.05 |

11.76 |

Tuesday |

AMC |

| COASTAL CONTACT |

COA |

-0.13 |

-0.09 |

50 |

Tuesday |

BTO |

| SYNOVUS FINL CP |

SNV |

0.05 |

-0.1 |

0 |

Tuesday |

BTO |

| NEW ORIENTAL ED |

EDU |

-0.01 |

-0.1 |

3.85 |

Tuesday |

BTO |

| ADV MICRO DEV |

AMD |

0.06 |

-0.14 |

100 |

Tuesday |

AMC |

| IRONWOOD PHARMA |

IRWD |

-0.5 |

-0.41 |

12.07 |

Tuesday |

BTO |

| WESTERN DIGITAL |

WDC |

2.08 |

2.09 |

3.92 |

Wednesday |

AMC |

| ABBOTT LABS |

ABT |

0.58 |

1.52 |

7.84 |

Wednesday |

BTO |

| GENL DYNAMICS |

GD |

1.76 |

1.39 |

9.52 |

Wednesday |

BTO |

| NORFOLK SOUTHRN |

NSC |

1.5 |

1.3 |

10.07 |

Wednesday |

BTO |

| UTD TECHS CORP |

UTX |

1.53 |

1.29 |

6.54 |

Wednesday |

BTO |

| COACH INC |

COH |

1.12 |

1.23 |

0 |

Wednesday |

BTO |

| PARKER HANNIFIN |

PH |

1.22 |

1.19 |

13.61 |

Wednesday |

BTO |

| STRYKER CORP |

SYK |

1.22 |

1.14 |

-1.01 |

Wednesday |

AMC |

| MOTOROLA SOLUTN |

MSI |

1.5 |

0.99 |

33.7 |

Wednesday |

BTO |

| SANDISK CORP |

SNDK |

1.47 |

0.99 |

23.77 |

Wednesday |

AMC |

| AMPHENOL CORP-A |

APH |

0.98 |

0.94 |

2.08 |

Wednesday |

BTO |

| ST JUDE MEDICAL |

STJ |

0.97 |

0.92 |

1.12 |

Wednesday |

BTO |

| VARIAN MEDICAL |

VAR |

0.9 |

0.89 |

-3.57 |

Wednesday |

AMC |

| F5 NETWORKS INC |

FFIV |

0.91 |

0.88 |

0 |

Wednesday |

AMC |

| FREEPT MC COP-B |

FCX |

0.81 |

0.78 |

38.1 |

Wednesday |

BTO |

| JACOBS ENGIN GR |

JEC |

0.73 |

0.76 |

-3.45 |

Wednesday |

AMC |

| US BANCORP |

USB |

0.75 |

0.75 |

0 |

Wednesday |

BTO |

| NORTHERN TRUST |

NTRS |

0.75 |

0.71 |

-2.56 |

Wednesday |

BTO |

| TE CONNECT-LTD |

TEL |

0.77 |

0.65 |

3.33 |

Wednesday |

BTO |

| EBAY INC |

EBAY |

0.71 |

0.64 |

1.89 |

Wednesday |

AMC |

| TEXTRON INC |

TXT |

0.61 |

0.56 |

-25.53 |

Wednesday |

BTO |

| NOBLE CORP PLC |

NE |

0.85 |

0.5 |

21.43 |

Wednesday |

AMC |

| PROGRESSIVE COR |

PGR |

0.42 |

0.34 |

0 |

Wednesday |

BTO |

| CROWN CASTLE |

CCI |

0.16 |

0.22 |

-5.88 |

Wednesday |

AMC |

| ALLEGHENY TECH |

ATI |

-0.19 |

0.18 |

3.57 |

Wednesday |

BTO |

| NETFLIX INC |

NFLX |

0.65 |

0.13 |

8.33 |

Wednesday |

AMC |

| UTD RENTALS INC |

URI |

1.45 |

1.27 |

3.16 |

Wednesday |

AMC |

| FLAGSTAR BANCP |

FBC |

0.1 |

1.12 |

-5.88 |

Wednesday |

AMC |

| ASML HOLDING NV |

ASML |

1.26 |

0.97 |

-15.94 |

Wednesday |

BTO |

| TEXAS CAP BCSHS |

TCBI |

0.79 |

0.82 |

-3.9 |

Wednesday |

AMC |

| FAIR ISAAC INC |

FICO |

0.59 |

0.77 |

6.25 |

Wednesday |

AMC |

| RAYMOND JAS FIN |

RJF |

0.73 |

0.69 |

47.62 |

Wednesday |

AMC |

| BANNER CORP |

BANR |

0.66 |

0.69 |

0 |

Wednesday |

AMC |

| TAYLOR CAP GRP |

TAYC |

0.34 |

0.66 |

-17.07 |

Wednesday |

AMC |

| NVE CORP |

NVEC |

0.63 |

0.6 |

17.86 |

Wednesday |

AMC |

| BRINKER INTL |

EAT |

0.58 |

0.5 |

-6.52 |

Wednesday |

BTO |

| EAST WEST BC |

EWBC |

0.54 |

0.49 |

-1.85 |

Wednesday |

AMC |

| COHEN&STRS INC |

CNS |

0.41 |

0.49 |

2.5 |

Wednesday |

AMC |

| RLI CORP |

RLI |

0.56 |

0.44 |

47.37 |

Wednesday |

AMC |

| PREFERRED BANK |

PFBC |

0.37 |

0.4 |

12.12 |

Wednesday |

N/A |

| EAGLE BCP INC |

EGBN |

0.43 |

0.39 |

2.33 |

Wednesday |

AMC |

| ETHAN ALLEN INT |

ETH |

0.42 |

0.39 |

6.45 |

Wednesday |

AMC |

| PAC PREMIER BCP |

PPBI |

0.22 |

0.32 |

-21.74 |

Wednesday |

BTO |

| PTC INC |

PTC |

0.37 |

0.26 |

13.04 |

Wednesday |

AMC |

| UMPQUA HLDGS CP |

UMPQ |

0.24 |

0.26 |

-7.69 |

Wednesday |

AMC |

| SUSQUEHANNA BSH |

SUSQ |

0.21 |

0.23 |

4.35 |

Wednesday |

AMC |

| CVB FINL |

CVBF |

0.22 |

0.21 |

9.52 |

Wednesday |

AMC |

| PACIFIC CONTL |

PCBK |

0.22 |

0.19 |

4.76 |

Wednesday |

AMC |

| BANCORPSOUTH |

BXS |

0.28 |

0.18 |

0 |

Wednesday |

AMC |

| FIRST MIDWST BK |

FMBI |

0.26 |

0.18 |

62.5 |

Wednesday |

BTO |

| LOGITECH INTL |

LOGI |

0.15 |

0.1 |

240 |

Wednesday |

AMC |

| ADTRAN INC |

ADTN |

0.14 |

0.08 |

31.82 |

Wednesday |

BTO |

| TAL EDUCATN-ADR |

XRS |

0.09 |

0.07 |

3.57 |

Wednesday |

BTO |

| TERADYNE INC |

TER |

0.04 |

0.07 |

4.55 |

Wednesday |

AMC |

| POLYCOM INC |

PLCM |

0.06 |

0.04 |

-50 |

Wednesday |

AMC |

| 8X8 INC |

EGHT |

0.03 |

0.04 |

-16.67 |

Wednesday |

AMC |

| FUSION-IO INC |

FIO |

-0.18 |

0.03 |

-10.53 |

Wednesday |

AMC |

| ZHONE TECH INC |

ZHNE |

0.05 |

0.02 |

50 |

Wednesday |

AMC |

| INTUITIVE SURG |

ISRG |

3.75 |

4.25 |

18.05 |

Thursday |

AMC |

| PRECISION CASTP |

PCP |

3.04 |

2.4 |

2.84 |

Thursday |

BTO |

| UNION PAC CORP |

UNP |

2.49 |

2.19 |

0.4 |

Thursday |

BTO |

| LOCKHEED MARTIN |

LMT |

2.02 |

1.78 |

13.72 |

Thursday |

BTO |

| MCDONALDS CORP |

MCD |

1.39 |

1.38 |

1.33 |

Thursday |

BTO |

| BAXTER INTL |

BAX |

1.25 |

1.26 |

0 |

Thursday |

BTO |

| DISCOVER FIN SV |

DFS |

1.18 |

1.07 |

0 |

Thursday |

AMC |

| MICROSOFT CORP |

MSFT |

0.67 |

0.81 |

14.81 |

Thursday |

AMC |

| AMERISOURCEBRGN |

ABC |

0.79 |

0.67 |

6.76 |

Thursday |

BTO |

| KLA-TENCOR CORP |

KLAC |

0.79 |

0.63 |

3.03 |

Thursday |

AMC |

| STARBUCKS CORP |

SBUX |

0.69 |

0.57 |

0 |

Thursday |

AMC |

| JOHNSON CONTROL |

JCI |

0.69 |

0.52 |

1.06 |

Thursday |

BTO |

| FIFTH THIRD BK |

FITB |

0.42 |

0.46 |

-4.76 |

Thursday |

BTO |

| ALTERA CORP |

ALTR |

0.3 |

0.37 |

8.82 |

Thursday |

AMC |

| LEGGETT & PLATT |

LEG |

0.33 |

0.32 |

-2.27 |

Thursday |

AMC |

| INTL GAME TECH |

IGT |

0.3 |

0.28 |

-11.76 |

Thursday |

AMC |

| KEYCORP NEW |

KEY |

0.24 |

0.21 |

13.64 |

Thursday |

BTO |

| JUNIPER NETWRKS |

JNPR |

0.27 |

0.19 |

0 |

Thursday |

AMC |

| SOUTHWEST AIR |

LUV |

0.28 |

0.09 |

6.25 |

Thursday |

BTO |

| E TRADE FINL CP |

ETFC |

0.2 |

-0.65 |

0 |

Thursday |

AMC |

| OPEN TEXT CORP |

OTEX |

1.39 |

1.53 |

6.5 |

Thursday |

AMC |

| CASH AM INTL |

CSH |

0.99 |

1.34 |

4.94 |

Thursday |

BTO |

| ARCTIC CAT INC |

ACAT |

1.26 |

1.3 |

-12.82 |

Thursday |

BTO |

| TELEDYNE TECH |

TDY |

1.22 |

1.17 |

2.63 |

Thursday |

BTO |

| AVNET |

AVT |

1.11 |

1.01 |

2.27 |

Thursday |

BTO |

| DELUXE CORP |

DLX |

0.99 |

0.95 |

4.35 |

Thursday |

BTO |

| CITY NATIONAL |

CYN |

1.06 |

0.87 |

10 |

Thursday |

AMC |

| POPULAR INC |

BPOP |

0.67 |

0.81 |

-15.71 |

Thursday |

BTO |

| ALASKA AIR GRP |

ALK |

1.01 |

0.7 |

5.24 |

Thursday |

BTO |

| HUNT (JB) TRANS |

JBHT |

0.79 |

0.7 |

-3.85 |

Thursday |

BTO |

| CELANESE CP-A |

CE |

1.01 |

0.67 |

4.35 |

Thursday |

AMC |

| TESSCO TECH INC |

TESS |

0.58 |

0.65 |

12.24 |

Thursday |

AMC |

| INDEP BK MASS |

INDB |

0.62 |

0.61 |

5 |

Thursday |

AMC |

| BANKUNITED INC |

BKU |

0.46 |

0.61 |

13.04 |

Thursday |

BTO |

| GATX CORP |

GMT |

0.93 |

0.56 |

9 |

Thursday |

BTO |

| RESMED INC |

RMD |

0.63 |

0.53 |

-1.75 |

Thursday |

AMC |

| HANCOCK HLDG CO |

HBHC |

0.56 |

0.5 |

1.82 |

Thursday |

AMC |

| COLUMBUS MCKINN |

CMCO |

0.33 |

0.49 |

16.13 |

Thursday |

BTO |

| SIMMONS FIRST A |

SFNC |

0.5 |

0.48 |

9.76 |

Thursday |

BTO |

| CUBIST PHARM |

CBST |

0.31 |

0.48 |

-25.45 |

Thursday |

AMC |

| HILL-ROM HLDGS |

HRC |

0.51 |

0.47 |

8.33 |

Thursday |

BTO |

| DOLBY LAB INC-A |

DLB |

0.33 |

0.47 |

30.56 |

Thursday |

AMC |

| SILICOM LIMITED |

SILC |

0.63 |

0.46 |

12.24 |

Thursday |

BTO |

| FEDERATED INVST |

FII |

0.36 |

0.44 |

2.7 |

Thursday |

AMC |

| MAXIM INTG PDTS |

MXIM |

0.4 |

0.42 |

5.13 |

Thursday |

AMC |

| MATTHEWS INTL-A |

MATW |

0.39 |

0.42 |

0 |

Thursday |

AMC |

| CABOT MICROELEC |

CCMP |

0.61 |

0.41 |

20.69 |

Thursday |

BTO |

| MICROSEMI CORP |

MSCC |

0.35 |

0.41 |

0 |

Thursday |

AMC |

| SANDY SPRING |

SASR |

0.42 |

0.4 |

11.63 |

Thursday |

BTO |

| CUSTOMERS BANCP |

CUBI |

0.33 |

0.4 |

6.45 |

Thursday |

BTO |

| HEXCEL CORP |

HXL |

0.46 |

0.36 |

4.35 |

Thursday |

AMC |

| PEOPL BNCP-OHIO |

PEBO |

0.34 |

0.36 |

9.76 |

Thursday |

BTO |

| SYNAPTICS INC |

SYNA |

0.7 |

0.35 |

10.38 |

Thursday |

AMC |

| INFORMATICA CRP |

INFA |

0.39 |

0.34 |

-16.67 |

Thursday |

AMC |

| COLUMBIA BK SYS |

COLB |

0.35 |

0.34 |

0 |

Thursday |

BTO |

| CATHAY GENL BCP |

CATY |

0.4 |

0.31 |

2.7 |

Thursday |

AMC |

| NETSCOUT SYSTMS |

NTCT |

0.37 |

0.31 |

12 |

Thursday |

BTO |

| GLACIER BANCORP |

GBCI |

0.36 |

0.29 |

6.06 |

Thursday |

AMC |

| FIDELITY SOUTHN |

LION |

0.3 |

0.27 |

3.45 |

Thursday |

N/A |

| QUALITY SYS |

QSII |

0.18 |

0.26 |

-8.7 |

Thursday |

BTO |

| ENTERPRISE FINL |

EFSC |

0.41 |

0.23 |

18.92 |

Thursday |

N/A |

| BRIDGE CAP HLDG |

BBNK |

0.28 |

0.23 |

7.41 |

Thursday |

AMC |

| OCEANFIRST FINL |

OCFC |

0.21 |

0.23 |

3.57 |

Thursday |

AMC |

| WESTERN ALLIANC |

WAL |

0.33 |

0.22 |

0 |

Thursday |

AMC |

| JANUS CAP GRP |

JNS |

0.18 |

0.19 |

0 |

Thursday |

BTO |

| COBIZ FINL INC |

COBZ |

0.18 |

0.17 |

21.43 |

Thursday |

AMC |

| NATL PENN BCSHS |

NPBC |

0.17 |

0.17 |

0 |

Thursday |

BTO |

| CAPITALSOURCE |

CSE |

0.17 |

0.16 |

20 |

Thursday |

BTO |

| BANCORP BNK/THE |

TBBK |

0.13 |

0.15 |

-13.33 |

Thursday |

AMC |

| COMPUWARE CORP |

CPWR |

0.12 |

0.12 |

50 |

Thursday |

AMC |

| CAPITAL BNK FIN |

CBF |

0.21 |

0.1 |

10 |

Thursday |

BTO |

| FAIRCHILD SEMI |

FCS |

0.09 |

0.1 |

41.67 |

Thursday |

BTO |

| AMER RIVER BSH |

AMRB |

0.1 |

0.09 |

25 |

Thursday |

AMC |

| NOKIA CP-ADR A |

NOK |

0.05 |

0.08 |

100 |

Thursday |

BTO |

| BRIGGS & STRATT |

BGG |

0.1 |

0.07 |

-12.9 |

Thursday |

BTO |

| UTD CMNTY BK/GA |

UCBI |

0.22 |

0.04 |

10.53 |

Thursday |

BTO |

| DIGI INTL INC |

DGII |

0.05 |

0.04 |

28.57 |

Thursday |

AMC |

| DELTA APPAREL |

DLA |

-0.09 |

0.01 |

-76.67 |

Thursday |

AMC |

| CYPRESS SEMICON |

CY |

-0.01 |

-0.02 |

100 |

Thursday |

BTO |

| UROPLASTY INC |

UPI |

-0.05 |

-0.02 |

-50 |

Thursday |

AMC |

| UTD FINL BCP |

UBNK |

0.24 |

-0.05 |

-11.54 |

Thursday |

AMC |

| OLD REP INTL |

ORI |

0.18 |

-0.09 |

218.18 |

Thursday |

BTO |

| SHORETEL INC |

SHOR |

-0.05 |

-0.11 |

142.86 |

Thursday |

AMC |

| APPLD MICRO CIR |

AMCC |

0.02 |

-0.2 |

-200 |

Thursday |

AMC |

| MGIC INVSTMT CP |

MTG |

-0.02 |

-2.33 |

133.33 |

Thursday |

BTO |

| GRAINGER W W |

GWW |

2.63 |

2.42 |

-3.91 |

Friday |

BTO |

| KIMBERLY CLARK |

KMB |

1.4 |

1.37 |

2.86 |

Friday |

BTO |

| STANLEY B&D INC |

SWK |

1.3 |

1.37 |

0.72 |

Friday |

BTO |

| PROCTER & GAMBL |

PG |

1.2 |

1.22 |

0 |

Friday |

BTO |

| STATE ST CORP |

STT |

1.19 |

1.11 |

0 |

Friday |

BTO |

| HONEYWELL INTL |

HON |

1.22 |

1.1 |

0 |

Friday |

BTO |

| COVIDIEN PLC |

COV |

0.94 |

1.1 |

1.11 |

Friday |

BTO |

| KANSAS CITY SOU |

KSU |

1.1 |

0.91 |

-0.9 |

Friday |

BTO |

| BRISTOL-MYERS |

BMY |

0.43 |

0.47 |

4.55 |

Friday |

BTO |

| XEROX CORP |

XRX |

0.29 |

0.3 |

4 |

Friday |

BTO |

| PROSPERITY BCSH |

PB |

0.91 |

0.85 |

0 |

Friday |

BTO |

| WEST BANCORP |

WTBA |

0.24 |

0.22 |

3.85 |

Friday |

BTO |

| FIRST NIAGARA |

FNFG |

0.2 |

0.19 |

5.26 |

Friday |

BTO |

| IMMUNOGEN INC |

IMGN |

-0.18 |

-0.29 |

40.91 |

Friday |

BTO |

ABBOTT LABS (ABT): Free Stock Analysis Report

COACH INC (COH): Free Stock Analysis Report

EBAY INC (EBAY): Free Stock Analysis Report

FACEBOOK INC-A (FB): Free Stock Analysis Report

GOOGLE INC-CL A (GOOG): Free Stock Analysis Report

GRAINGER W W (GWW): Free Stock Analysis Report

HALLIBURTON CO (HAL): Free Stock Analysis Report

INTL BUS MACH (IBM): Free Stock Analysis Report

JOHNSON & JOHNS (JNJ): Free Stock Analysis Report

KIMBERLY CLARK (KMB): Free Stock Analysis Report

KANSAS CITY SOU (KSU): Free Stock Analysis Report

SOUTHWEST AIR (LUV): Free Stock Analysis Report

MCDONALDS CORP (MCD): Free Stock Analysis Report

MICROSOFT CORP (MSFT): Free Stock Analysis Report

NORFOLK SOUTHRN (NSC): Free Stock Analysis Report

PROCTER & GAMBL (PG): Free Stock Analysis Report

STARBUCKS CORP (SBUX): Free Stock Analysis Report

TRAVELERS COS (TRV): Free Stock Analysis Report

TEXAS INSTRS (TXN): Free Stock Analysis Report

UNION PAC CORP (UNP): Free Stock Analysis Report

UTD TECHS CORP (UTX): Free Stock Analysis Report

VERIZON COMM (VZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

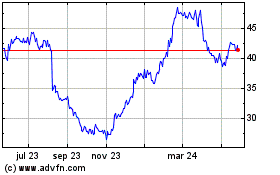

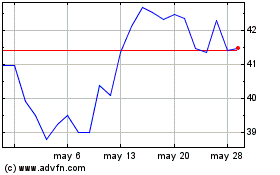

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024