Tapestry Provides 2020 Financial Targets

15 Agosto 2019 - 7:07AM

Noticias Dow Jones

By Kimberly Chin

Tapestry Inc. (TPR) said it expects fiscal 2020 revenue growth

to increase in the low-single digits compared with fiscal 2019,

largely due to more modest topline growth at Kate Spade in North

America.

This will affect the company's "ability to leverage its

strategic investments and fixed costs," the company said.

Shares of Tapestry fell 5% premarket.

For the year, the company projects about $30 million to $40

million of pretax charges associated with the company's enterprise

resource planning implementation efforts and another $20 million to

$30 million in pretax integration and acquisition-related

charges.

Tapestry anticipates an improvement to its top and bottom lines

at Coach and Stuart Weitzman in fiscal 2020.

For the first fiscal quarter, the company expects sales to be

slightly below the comparable quarter a year ago and per-share

earnings to decline from a year earlier.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

August 15, 2019 07:52 ET (11:52 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

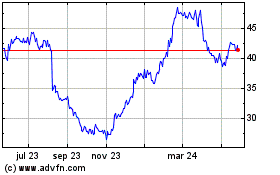

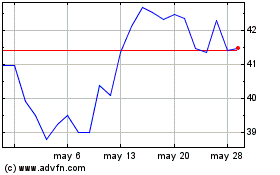

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024